444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The aerial work platform (AWP) rental market in South Korea has experienced significant growth in recent years due to the increasing demand for construction and maintenance work. AWPs, also known as elevated work platforms (EWPs), are used to lift workers and equipment to elevated heights, allowing them to work safely and efficiently in difficult-to-reach areas.

The South Korean AWP rental market is characterized by a high level of competition, with numerous rental companies vying for market share. These companies offer a variety of AWPs, including boom lifts, scissor lifts, and other types of aerial platforms.

AWP rental services in South Korea have gained significant importance due to the increasing demand for construction and maintenance work. The rental of AWPs is a cost-effective and efficient way for companies to access the equipment they need without having to invest in it themselves. This is especially true for small and medium-sized companies that may not have the financial resources to purchase their own equipment.

Executive Summary:

The South Korean AWP rental market is expected to experience significant growth in the coming years, driven by the increasing demand for construction and maintenance work. Key market drivers include a growing construction industry, increased infrastructure spending, and the cost-effectiveness of rental services.

However, there are also several market restraints to consider, including high initial costs, maintenance and repair costs, and the potential for equipment downtime. To capitalize on the opportunities in this market, rental companies will need to stay up-to-date on the latest technology and trends, and offer a range of services to meet the needs of their customers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

The South Korean AWP rental market is projected to grow at a CAGR of XX% during the forecast period. The market is driven by a number of factors, including:

However, there are also several challenges to consider, including:

To succeed in this market, rental companies will need to stay up-to-date on the latest trends and technology, and offer a range of services to meet the needs of their customers.

Market Drivers:

The South Korean AWP rental market is driven by a number of key factors, including:

The construction industry in South Korea has experienced significant growth in recent years, driven by increased demand for new infrastructure and housing. As a result, there is a growing need for AWPs to assist with construction and maintenance work.

The South Korean government has increased its infrastructure spending in recent years, with a focus on improving transportation and other key infrastructure projects. This has created additional demand for AWPs, particularly in urban areas.

Renting AWPs is often more cost-effective than purchasing the equipment outright, particularly for small and medium-sized companies that may not have the financial resources to invest in their own equipment. This has led to increased demand for rental services in the South Korean market.

Market Restraints:

Despite the many opportunities in the South Korean AWP rental market, there are also several key restraints to consider, including:

The cost of purchasing AWP equipment can be prohibitively expensive for many companies, particularly smaller ones. This can make it difficult for rental companies to expand their offerings and meet the needs of their customers.

AWP equipment requires regular maintenance and repair to keep it in good working order. These costs can add up quickly, particularly for rental companies that have a large fleet of equipment.

AWP equipment downtime can be costly for rental companies, as it can lead to lost rental revenue and increased repair costs. It can also cause delays in construction projects, which can negatively impact a company’s reputation and bottom line.

Market Opportunities:

Despite the challenges facing the South Korean AWP rental market, there are also several key opportunities to consider, including:

Advancements in AWP technology, such as the use of electric and hybrid power systems, can help to reduce operating costs and increase efficiency. Rental companies that stay up-to-date on these advancements can gain a competitive edge in the market.

South Korea’s growing construction industry is not limited to urban areas. There is also significant demand for construction and maintenance work in rural areas, particularly in the energy and agriculture sectors. Rental companies that expand their offerings to these markets can capitalize on this opportunity.

Rental companies that offer a range of services, such as training and maintenance, can differentiate themselves from their competitors and provide added value to their customers. This can lead to increased customer loyalty and repeat business.

Market Dynamics:

The South Korean AWP rental market is a dynamic and competitive industry that is constantly evolving. Key dynamics to consider include:

As the market grows, so too does the level of competition. Rental companies that are able to differentiate themselves from their competitors and offer added value to their customers will be better positioned to succeed.

Advancements in AWP technology are driving innovation in the market, and rental companies that stay up-to-date on these advancements will be better positioned to meet the changing needs of their customers.

As the construction industry evolves, so too do the demands of customers. Rental companies that are able to adapt to these changing demands and provide customized solutions to their customers will be more successful in the long run.

Regional Analysis:

The South Korean AWP rental market is divided into several key regions, including Seoul, Busan, Daegu, and Incheon. Each of these regions has its own unique characteristics and challenges, and rental companies that are able to tailor their offerings to meet the needs of each region will be better positioned to succeed.

Competitive Landscape:

Leading companies in the South Korea Aerial Work Platform (AWP) Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

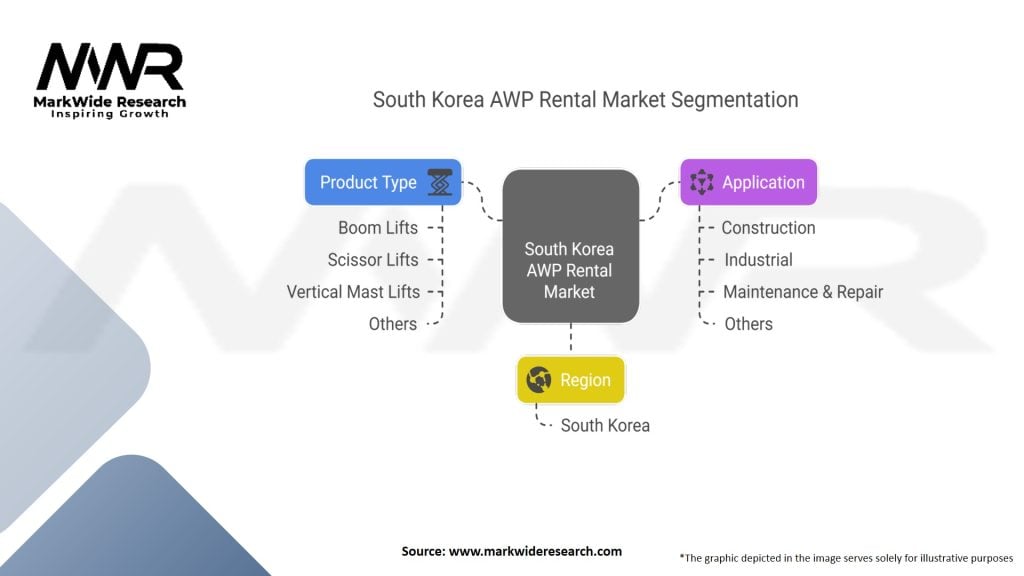

Segmentation:

The South Korean AWP rental market can be segmented by equipment type, end-user industry, and region. Equipment types include boom lifts, scissor lifts, and other types of aerial platforms. End-user industries include construction, energy, agriculture, and others.

Category-wise Insights:

Category-wise insights into the South Korean AWP rental market include:

Boom lifts are the most commonly rented type of AWP in South Korea, due to their versatility and ability to reach high elevations.

Scissor lifts are often used for indoor applications and are ideal for use in tight spaces.

Other types of aerial platforms, such as truck-mounted lifts and telehandlers, are also available for rent in the South Korean market.

Key Benefits for Industry Participants and Stakeholders:

Industry participants and stakeholders in the South Korean AWP rental market can benefit from:

Renting AWPs is a cost-effective way for companies to access the equipment they need without having to invest in it themselves. This can help to reduce upfront costs and improve cash flow.

AWPs can help to improve efficiency and productivity on construction and maintenance projects by allowing workers to access difficult-to-reach areas quickly and safely.

Renting AWPs provides companies with flexibility, as they can rent the equipment they need for specific projects without having to worry about storage or maintenance costs.

SWOT Analysis:

A SWOT analysis of the South Korean AWP rental market reveals the following:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Key trends in the South Korean AWP rental market include:

Advancements in electric and hybrid power systems are driving innovation in the market, with rental companies increasingly offering these types of AWPs to their customers.

Safety is a top priority in the South Korean AWP rental market, with rental companies providing training and safety equipment to their customers to ensure that workers can operate the equipment safely.

Sustainability is becoming increasingly important in the South Korean construction industry, and rental companies that are able to provide environmentally friendly equipment and services will be better positioned to succeed.

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the South Korean AWP rental market. The pandemic led to a slowdown in construction activity in 2020, which negatively impacted rental companies. However, with the easing of restrictions and a rebound in construction activity in 2021, the market is expected to recover.

Key Industry Developments:

Key industry developments in the South Korean AWP rental market include:

In 2020, Lotte Rental acquired Hanjin Rental, one of the largest rental companies in South Korea. This acquisition has strengthened Lotte Rental’s position in the market and expanded its offerings to customers.

Rental companies are placing a greater emphasis on safety and training, with many offering training courses and safety equipment to their customers to ensure that workers can operate the equipment safely.

Analyst Suggestions:

To succeed in the South Korean AWP rental market, rental companies should:

Advancements in AWP technology are driving innovation in the market, and rental companies that stay up-to-date on these advancements will be better positioned to meet the changing needs of their customers.

Rental companies that offer a range of services, such as training and maintenance, can differentiate themselves from their competitors and provide added value to their customers.

Safety is a top priority in the South Korean AWP rental market, and rental companies that provide training and safety equipment to their customers will be better positioned to succeed.

Future Outlook:

The future outlook for the South Korean AWP rental market is positive, with the market expected to experience significant growth in the coming years. Key drivers of this growth include the growing construction industry, increasing infrastructure spending, and the cost-effectiveness of rental services.

Conclusion:

In conclusion, the South Korean AWP rental market is a dynamic and competitive industry that is poised for significant growth in the coming years. Rental companies that stay up-to-date on the latest trends and technology, provide a range of services to their customers, and emphasize safety will be better positioned to succeed in this market. While there are challenges to consider, including high initial costs and maintenance and repair costs, there are also significant opportunities to capitalize on, such as technological advancements, expansion into new markets, and offering a range of services.

What is the South Korea Aerial Work Platform (AWP) rental?

The South Korea Aerial Work Platform (AWP) rental refers to the leasing of equipment designed to provide temporary access to elevated areas for various applications, including construction, maintenance, and industrial tasks.

Who are the key players in the South Korea Aerial Work Platform (AWP) rental market?

Key players in the South Korea Aerial Work Platform (AWP) rental market include companies like Hyundai Construction Equipment, Doosan Infracore, and JLG Industries, among others.

What are the growth factors driving the South Korea Aerial Work Platform (AWP) rental market?

The growth of the South Korea Aerial Work Platform (AWP) rental market is driven by increasing construction activities, a rise in infrastructure projects, and the growing demand for safety and efficiency in elevated work environments.

What challenges does the South Korea Aerial Work Platform (AWP) rental market face?

Challenges in the South Korea Aerial Work Platform (AWP) rental market include high maintenance costs, regulatory compliance issues, and competition from alternative access solutions.

What opportunities exist in the South Korea Aerial Work Platform (AWP) rental market?

Opportunities in the South Korea Aerial Work Platform (AWP) rental market include the expansion of smart technology in equipment, increasing demand for rental services in urban development, and the potential for growth in the renewable energy sector.

What trends are shaping the South Korea Aerial Work Platform (AWP) rental market?

Trends in the South Korea Aerial Work Platform (AWP) rental market include the adoption of electric and hybrid models, advancements in telematics for equipment monitoring, and a shift towards more sustainable practices in equipment usage.

South Korea Aerial Work Platform (AWP) Rental Market

| Segmentation | Details |

|---|---|

| Product Type | Boom Lifts, Scissor Lifts, Vertical Mast Lifts, Others |

| Application | Construction, Industrial, Maintenance & Repair, Others |

| Region | South Korea |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Aerial Work Platform (AWP) Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at