444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South-East Asia oil and gas pipeline market represents a critical infrastructure segment driving regional energy security and economic development across the Association of Southeast Asian Nations (ASEAN) region. This dynamic market encompasses the construction, maintenance, and operation of extensive pipeline networks that transport crude oil, natural gas, and refined petroleum products throughout countries including Indonesia, Malaysia, Thailand, Singapore, Vietnam, Philippines, and Myanmar. Regional energy demand continues to surge, with pipeline infrastructure experiencing robust growth at approximately 8.2% CAGR as governments prioritize energy connectivity and supply chain resilience.

Infrastructure development across South-East Asia has accelerated significantly, driven by increasing industrialization, urbanization, and cross-border energy trade agreements. The region’s strategic position as a major energy transit hub between major oil and gas producing nations and consuming markets has positioned pipeline infrastructure as essential for regional energy security. Natural gas transportation particularly dominates the market, accounting for approximately 62% of total pipeline capacity as countries transition toward cleaner energy sources while maintaining economic growth trajectories.

Investment flows into pipeline infrastructure have intensified as regional governments recognize the critical importance of energy connectivity for economic development. Major pipeline projects spanning multiple countries have emerged as cornerstone initiatives, facilitating energy trade integration and reducing dependency on traditional shipping routes. Cross-border pipeline networks are expanding rapidly, with regional cooperation frameworks enabling seamless energy transportation across national boundaries.

The South-East Asia oil and gas pipeline market refers to the comprehensive ecosystem of pipeline infrastructure, technologies, services, and operations dedicated to transporting hydrocarbon resources throughout the Southeast Asian region. This market encompasses onshore and offshore pipeline systems, including transmission pipelines for long-distance transportation, distribution networks for local delivery, and gathering systems that collect production from multiple sources. Pipeline infrastructure serves as the backbone of regional energy security, enabling efficient, safe, and cost-effective transportation of oil, natural gas, and refined products across diverse geographical terrains and maritime boundaries.

Market participants include pipeline operators, construction companies, engineering firms, equipment manufacturers, maintenance service providers, and regulatory bodies that collectively ensure the development and operation of robust pipeline networks. The market encompasses various pipeline types, from high-pressure transmission lines spanning hundreds of kilometers to local distribution systems serving urban and industrial centers. Technological integration plays a crucial role, incorporating advanced monitoring systems, leak detection technologies, and automated control mechanisms that enhance operational efficiency and environmental safety.

Market dynamics in the South-East Asia oil and gas pipeline sector reflect the region’s rapid economic development and increasing energy consumption patterns. The market demonstrates exceptional growth potential, driven by substantial infrastructure investments, regional energy integration initiatives, and growing demand for reliable energy transportation solutions. Government support through favorable policies, regulatory frameworks, and international cooperation agreements has created an enabling environment for pipeline development across multiple countries.

Key growth drivers include rising energy consumption, industrial expansion, urbanization trends, and the need for energy security diversification. The market benefits from approximately 75% government backing for major infrastructure projects, reflecting the strategic importance of pipeline networks for national energy security. Regional integration efforts, particularly through ASEAN energy cooperation frameworks, have accelerated cross-border pipeline development and created opportunities for multinational energy transportation projects.

Technological advancement continues to reshape the market landscape, with smart pipeline technologies, advanced materials, and digital monitoring systems enhancing operational efficiency and safety standards. The integration of Internet of Things (IoT) technologies and artificial intelligence in pipeline operations has improved predictive maintenance capabilities and reduced operational costs. Environmental considerations increasingly influence project development, with emphasis on minimizing ecological impact and incorporating sustainable construction practices.

Strategic insights reveal several critical factors shaping the South-East Asia oil and gas pipeline market landscape:

Market maturation varies significantly across different countries, with Singapore and Malaysia leading in pipeline infrastructure density, while emerging markets like Vietnam and Myanmar present substantial growth opportunities. Investment priorities focus on connecting remote production areas with major consumption centers and establishing redundant transportation routes for enhanced energy security.

Economic growth across South-East Asia serves as the primary catalyst driving oil and gas pipeline market expansion. Rapid industrialization, particularly in manufacturing and petrochemical sectors, has created substantial demand for reliable energy transportation infrastructure. GDP growth rates averaging 5.8% annually across the region translate directly into increased energy consumption and corresponding pipeline capacity requirements.

Energy security concerns have prompted governments to diversify energy supply sources and transportation routes, reducing dependency on traditional shipping channels and single-source suppliers. The strategic importance of pipeline infrastructure for national energy security has resulted in significant government support and investment allocation. Regional cooperation initiatives, including the ASEAN Power Grid and Trans-ASEAN Gas Pipeline projects, demonstrate collective commitment to energy connectivity and supply chain resilience.

Urbanization trends continue to accelerate across the region, with urban populations growing at approximately 3.2% annually, creating concentrated demand centers that require extensive pipeline distribution networks. Industrial development in key sectors including petrochemicals, steel production, and power generation drives demand for large-volume, reliable energy transportation solutions that only pipeline infrastructure can efficiently provide.

Natural gas transition policies across multiple countries favor pipeline infrastructure development as governments seek cleaner energy alternatives while maintaining economic competitiveness. The shift from coal and oil toward natural gas for power generation and industrial applications has created substantial opportunities for gas pipeline expansion and modernization projects.

Capital intensity represents the most significant barrier to pipeline market expansion, with major projects requiring substantial upfront investments and long payback periods. Construction costs have increased due to challenging geographical conditions, including mountainous terrain, dense urban areas, and extensive maritime boundaries that complicate pipeline routing and installation.

Regulatory complexity across multiple jurisdictions creates challenges for cross-border pipeline projects, requiring coordination between different regulatory frameworks, environmental standards, and approval processes. Political risks associated with changing government policies, international relations, and regulatory modifications can impact project viability and investment decisions.

Environmental concerns increasingly influence project approval processes, with stricter environmental impact assessments and community consultation requirements extending project timelines and increasing development costs. Land acquisition challenges, particularly in densely populated areas, can significantly delay project implementation and increase overall costs.

Technical challenges related to pipeline construction in challenging environments, including seismic zones, corrosive soil conditions, and extreme weather patterns, require specialized engineering solutions and materials that increase project complexity and costs. Maintenance accessibility in remote or offshore locations presents ongoing operational challenges and cost considerations.

Cross-border integration presents exceptional opportunities for pipeline market expansion as regional energy trade continues to grow. The development of multinational pipeline networks connecting major production centers with diverse consumption markets creates opportunities for large-scale infrastructure projects with substantial economic impact. Energy hub development strategies in countries like Singapore and Malaysia position these nations as regional energy trading centers requiring extensive pipeline connectivity.

Renewable energy integration creates new opportunities for pipeline infrastructure, particularly for hydrogen transportation and carbon capture systems that support clean energy transition goals. Technological innovation in pipeline materials, monitoring systems, and construction methods offers opportunities for efficiency improvements and cost reductions that enhance project viability.

Public-private partnerships enable innovative financing structures that can accelerate pipeline development while sharing risks between government and private sector participants. Regional development banks and international financial institutions provide funding opportunities specifically targeted at infrastructure development projects that support regional economic integration.

Digitalization opportunities in pipeline operations, including smart monitoring systems, predictive maintenance technologies, and automated control systems, offer potential for operational efficiency improvements and cost reductions. Retrofit projects for existing pipeline infrastructure present opportunities for technology upgrades and capacity expansion without the full cost of new construction.

Supply and demand dynamics in the South-East Asia oil and gas pipeline market reflect the complex interplay between regional energy production, consumption patterns, and transportation infrastructure capacity. Demand growth consistently outpaces infrastructure development, creating opportunities for pipeline expansion and modernization projects across multiple countries.

Competitive dynamics involve both regional and international players, with local companies leveraging geographical knowledge and regulatory relationships while international firms contribute advanced technologies and financing capabilities. Market consolidation trends are emerging as larger players acquire smaller regional operators to achieve economies of scale and expand geographical coverage.

Price dynamics are influenced by construction costs, regulatory requirements, and financing conditions, with project economics varying significantly based on route complexity, environmental considerations, and political risk factors. Operational efficiency improvements through technology adoption have helped offset some cost pressures while enhancing service reliability and safety standards.

Innovation dynamics continue to reshape the market landscape, with advanced materials, digital monitoring systems, and automated control technologies improving pipeline performance and reducing operational costs. Sustainability considerations increasingly influence market dynamics, with environmental performance becoming a key differentiator in project selection and approval processes.

Comprehensive analysis of the South-East Asia oil and gas pipeline market employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, government officials, regulatory authorities, and technical experts across multiple countries to gather firsthand insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, regulatory filings, and technical documentation to establish baseline market data and validate primary research findings. Data triangulation methods ensure consistency and accuracy across multiple information sources while identifying potential discrepancies or data gaps that require additional investigation.

Market modeling techniques incorporate economic indicators, demographic trends, energy consumption patterns, and infrastructure development plans to project future market conditions and growth trajectories. Scenario analysis evaluates potential market outcomes under different economic, political, and technological conditions to provide comprehensive market outlook perspectives.

Expert validation processes involve review and verification of research findings by industry specialists and academic experts to ensure technical accuracy and market relevance. Continuous monitoring of market developments, regulatory changes, and industry announcements ensures research findings remain current and actionable for market participants.

Indonesia leads the regional market with extensive onshore and offshore pipeline networks supporting the country’s position as a major oil and gas producer. The country’s pipeline infrastructure spans approximately 35% of regional capacity, connecting production centers in Sumatra, Java, and Kalimantan with domestic and export markets. Government investment in pipeline infrastructure continues through state-owned enterprises and public-private partnerships targeting both capacity expansion and modernization projects.

Malaysia demonstrates sophisticated pipeline infrastructure development, particularly in natural gas transportation systems that support the country’s position as a regional energy hub. Cross-border connectivity with Thailand and Singapore positions Malaysia as a critical transit country for regional energy trade. The country’s pipeline network accounts for approximately 22% of regional capacity while serving both domestic consumption and international transit requirements.

Thailand focuses on pipeline infrastructure that supports industrial development and energy security objectives, with significant investments in natural gas distribution networks serving the Bangkok metropolitan area and industrial corridors. Regional integration projects connecting Thai infrastructure with neighboring countries create opportunities for energy trade expansion and supply diversification.

Singapore leverages its strategic location to develop sophisticated pipeline infrastructure supporting its role as a regional energy trading and refining center. Despite limited domestic production, Singapore’s pipeline networks facilitate substantial volumes of energy transit and storage operations. Technology leadership in pipeline monitoring and control systems positions Singapore as a regional center of excellence for pipeline operations.

Vietnam represents a rapidly growing market with substantial pipeline development projects supporting economic development and energy security objectives. Infrastructure investment focuses on connecting offshore production with onshore processing facilities and domestic distribution networks. The country’s pipeline capacity is expanding at approximately 12% annually to support industrial growth and urbanization trends.

Market leadership in the South-East Asia oil and gas pipeline sector involves both regional and international companies with diverse capabilities and market positioning strategies:

Strategic partnerships between regional and international companies have become increasingly common, combining local market knowledge with advanced technologies and financing capabilities. Joint ventures enable risk sharing for large-scale projects while facilitating technology transfer and capability development among regional players.

Competitive differentiation focuses on technical capabilities, safety performance, environmental compliance, and cost competitiveness. Innovation leadership in areas such as smart pipeline technologies, advanced materials, and digital monitoring systems provides competitive advantages in project selection and operational efficiency.

By Product Type:

By Application:

By Geography:

Natural Gas Pipeline Segment dominates the market with the highest growth rates and investment levels, driven by regional energy transition policies and industrial demand growth. Technology advancement in natural gas transportation, including high-pressure systems and advanced compression technologies, enables efficient long-distance transportation and cross-border connectivity. This segment benefits from approximately 68% of total pipeline investment across the region.

Crude Oil Pipeline Segment maintains steady growth supported by continued oil production and refining activities across the region. Infrastructure modernization projects focus on capacity expansion and safety improvements for existing pipeline networks. Strategic routing considerations increasingly emphasize connecting remote production areas with major refining centers and export terminals.

Refined Products Pipeline Segment experiences growth driven by increasing fuel consumption in transportation and industrial sectors. Urban distribution networks require sophisticated pipeline systems to serve dense population centers while maintaining safety and environmental standards. Product quality maintenance during transportation requires advanced pipeline technologies and monitoring systems.

Offshore Pipeline Segment presents unique technical challenges and opportunities, with specialized engineering requirements for subsea installations and maintenance operations. Environmental considerations are particularly critical for offshore projects, requiring advanced leak detection and environmental protection systems. Installation costs are significantly higher than onshore alternatives but provide access to offshore production resources.

Energy Security Enhancement represents the primary benefit for government stakeholders, with pipeline infrastructure providing reliable, efficient energy transportation that reduces dependency on alternative transportation methods. Supply chain resilience improves through diversified transportation routes and reduced vulnerability to shipping disruptions or geopolitical tensions affecting maritime transportation.

Economic Development benefits extend beyond the energy sector, with pipeline infrastructure supporting industrial development, job creation, and regional economic integration. Cost efficiency in energy transportation translates to lower energy costs for industrial consumers and improved economic competitiveness for regional manufacturing sectors.

Environmental Benefits include reduced emissions compared to alternative transportation methods, particularly for natural gas transportation that supports cleaner energy transition goals. Safety improvements through advanced pipeline technologies and monitoring systems reduce environmental risks and enhance community safety standards.

Investment Returns for private sector participants include stable, long-term revenue streams from pipeline operations and opportunities for portfolio diversification across multiple countries and energy products. Technology development opportunities enable companies to develop specialized capabilities and competitive advantages in regional markets.

Regional Integration benefits facilitate energy trade expansion, economic cooperation, and political stability through shared infrastructure investments and operational cooperation. Knowledge transfer and capability development opportunities enhance regional technical expertise and industry competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation continues to reshape pipeline operations through integration of Internet of Things (IoT) sensors, artificial intelligence, and machine learning technologies that enable predictive maintenance and operational optimization. Smart pipeline systems provide real-time monitoring capabilities and automated response systems that enhance safety and efficiency while reducing operational costs.

Environmental Sustainability increasingly influences pipeline design and construction practices, with emphasis on minimizing ecological impact and incorporating renewable energy sources for pipeline operations. Carbon footprint reduction initiatives drive adoption of more efficient compression technologies and renewable energy integration for pipeline facilities.

Cross-border Integration accelerates through regional cooperation frameworks and multilateral agreements that facilitate pipeline development spanning multiple countries. Regulatory harmonization efforts aim to standardize technical requirements and approval processes across different jurisdictions, reducing project complexity and development timelines.

Advanced Materials adoption improves pipeline durability and performance while reducing maintenance requirements and extending operational lifespans. Corrosion-resistant materials and advanced coating technologies enhance pipeline reliability in challenging environmental conditions common throughout the region.

Modular Construction approaches enable faster project implementation and cost reduction through standardized components and prefabrication techniques. Construction efficiency improvements reduce project timelines and minimize environmental disruption during installation phases.

Major infrastructure projects currently under development include the Trans-ASEAN Gas Pipeline expansion phases that will enhance regional energy connectivity and trade facilitation. Investment commitments from regional governments and international development banks support multiple large-scale pipeline projects across different countries and energy products.

Technology partnerships between regional operators and international technology companies are accelerating adoption of advanced pipeline monitoring and control systems. Digital infrastructure investments enable integration of smart technologies that improve operational efficiency and safety performance across existing and new pipeline networks.

Regulatory developments include harmonization of technical standards and safety requirements across ASEAN countries, facilitating cross-border project development and operational coordination. Environmental regulations continue to evolve, requiring enhanced environmental protection measures and community engagement processes for new projects.

Financing innovations include green bonds and sustainability-linked financing structures that support environmentally responsible pipeline development projects. Public-private partnerships are expanding to include innovative risk-sharing arrangements and performance-based contracting models that align stakeholder interests.

Capacity expansion projects across multiple countries focus on connecting remote production areas with major consumption centers and export facilities. Modernization initiatives for existing infrastructure incorporate advanced technologies and safety improvements while extending operational lifespans.

MarkWide Research analysis indicates that market participants should prioritize technology integration and digital transformation initiatives to maintain competitive positioning in an increasingly sophisticated market environment. Investment strategies should focus on projects with strong government support and clear regulatory pathways to minimize development risks and ensure project viability.

Strategic partnerships between regional and international companies offer optimal approaches for managing technical complexity, financing requirements, and regulatory challenges associated with large-scale pipeline projects. Risk management strategies should address political, environmental, and technical risks through comprehensive due diligence and appropriate insurance coverage.

Technology adoption should emphasize solutions that provide measurable improvements in operational efficiency, safety performance, and environmental compliance. Workforce development investments are essential for building regional technical capabilities and ensuring long-term operational success.

Market entry strategies for new participants should focus on niche segments or specific geographical areas where specialized capabilities can provide competitive advantages. Sustainability initiatives should be integrated into all aspects of project development and operations to meet evolving stakeholder expectations and regulatory requirements.

Financial planning should account for extended development timelines and potential cost escalation factors while maintaining flexibility to adapt to changing market conditions. Stakeholder engagement strategies should emphasize community benefits and environmental protection to facilitate project approval and implementation processes.

Market growth projections indicate continued expansion of pipeline infrastructure across South-East Asia, driven by sustained economic development and increasing energy consumption patterns. Investment levels are expected to maintain strong momentum, with government support and international financing enabling large-scale infrastructure development projects throughout the region.

Technology evolution will continue to enhance pipeline performance and operational efficiency, with artificial intelligence and machine learning applications becoming standard components of pipeline monitoring and control systems. Environmental performance improvements through advanced technologies and sustainable construction practices will become increasingly important for project approval and stakeholder acceptance.

Regional integration efforts will accelerate, creating opportunities for multinational pipeline projects that enhance energy security and economic cooperation across ASEAN countries. Cross-border connectivity is projected to expand at approximately 9.5% annually as regional energy trade continues to grow and diversify.

Market maturation will lead to increased focus on operational efficiency, safety performance, and environmental compliance rather than pure capacity expansion. Retrofit opportunities for existing infrastructure will become increasingly important as operators seek to extend asset lifespans and improve performance through technology upgrades.

Regulatory evolution will continue toward greater harmonization and standardization across the region, facilitating project development while maintaining high safety and environmental standards. MWR projections suggest that digital transformation initiatives will become essential for maintaining competitive positioning in an increasingly sophisticated market environment.

The South-East Asia oil and gas pipeline market represents a dynamic and rapidly evolving sector that plays a critical role in regional energy security and economic development. Strong fundamentals including sustained economic growth, government support, and increasing energy demand create favorable conditions for continued market expansion and infrastructure development across multiple countries.

Investment opportunities remain substantial, particularly in cross-border integration projects, technology modernization initiatives, and capacity expansion programs that support growing industrial and urban energy requirements. Regional cooperation through ASEAN frameworks provides a solid foundation for multinational projects that enhance energy connectivity and trade facilitation.

Technology advancement continues to reshape the market landscape, with digital transformation initiatives and smart pipeline technologies offering significant opportunities for operational efficiency improvements and competitive differentiation. Environmental sustainability considerations increasingly influence project development and operational practices, requiring integration of advanced environmental protection measures and community engagement strategies.

Market participants who successfully navigate regulatory complexity, manage technical challenges, and leverage strategic partnerships will be best positioned to capitalize on the substantial growth opportunities available throughout the region. Long-term success will depend on maintaining high safety and environmental standards while delivering cost-effective energy transportation solutions that support regional economic development objectives and energy security goals.

What is Oil And Gas Pipeline?

Oil and gas pipelines are systems of pipes used to transport oil and natural gas from production sites to refineries and distribution centers. They play a crucial role in the energy sector, facilitating the movement of these resources across regions.

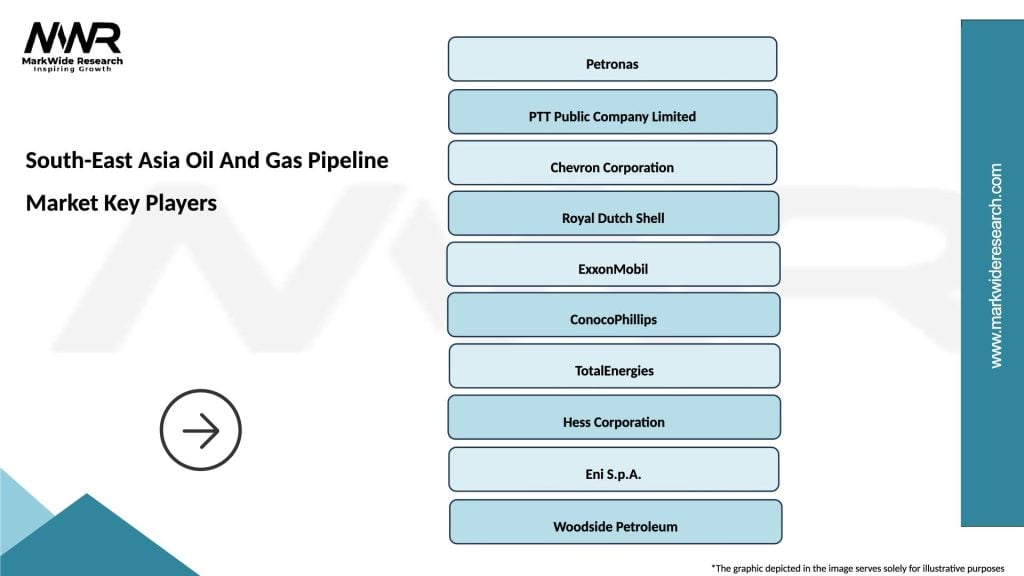

What are the key players in the South-East Asia Oil And Gas Pipeline Market?

Key players in the South-East Asia Oil And Gas Pipeline Market include companies like Petronas, PTT Public Company Limited, and Singapore Petroleum Company, among others. These companies are involved in the development, operation, and maintenance of pipeline infrastructure in the region.

What are the growth factors driving the South-East Asia Oil And Gas Pipeline Market?

The growth of the South-East Asia Oil And Gas Pipeline Market is driven by increasing energy demand, the expansion of natural gas infrastructure, and investments in pipeline projects. Additionally, regional economic growth and urbanization contribute to the rising need for efficient energy transportation.

What challenges does the South-East Asia Oil And Gas Pipeline Market face?

The South-East Asia Oil And Gas Pipeline Market faces challenges such as regulatory hurdles, environmental concerns, and geopolitical tensions. These factors can impact project timelines and investment decisions in the pipeline sector.

What opportunities exist in the South-East Asia Oil And Gas Pipeline Market?

Opportunities in the South-East Asia Oil And Gas Pipeline Market include the development of cross-border pipelines, advancements in pipeline technology, and the integration of renewable energy sources. These factors can enhance energy security and diversify supply routes.

What trends are shaping the South-East Asia Oil And Gas Pipeline Market?

Trends in the South-East Asia Oil And Gas Pipeline Market include the increasing adoption of digital technologies for pipeline monitoring, a focus on sustainability practices, and the shift towards cleaner energy sources. These trends are influencing how companies operate and invest in pipeline infrastructure.

South-East Asia Oil And Gas Pipeline Market

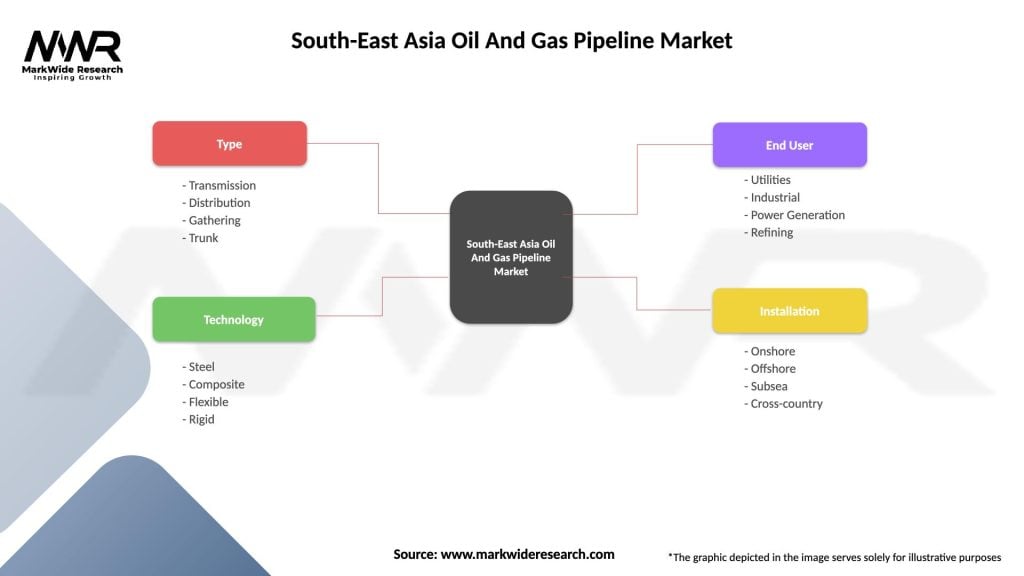

| Segmentation Details | Description |

|---|---|

| Type | Transmission, Distribution, Gathering, Trunk |

| Technology | Steel, Composite, Flexible, Rigid |

| End User | Utilities, Industrial, Power Generation, Refining |

| Installation | Onshore, Offshore, Subsea, Cross-country |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South-East Asia Oil And Gas Pipeline Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at