444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South American fats and oils market represents a dynamic and rapidly evolving sector that plays a crucial role in the region’s agricultural economy and global food supply chain. This market encompasses a diverse range of products including vegetable oils, animal fats, and specialty oils derived from various sources such as soybeans, palm, sunflower, corn, and other oilseeds. South America has established itself as a dominant force in global fats and oils production, with countries like Brazil, Argentina, and Colombia leading the charge in both production capacity and export capabilities.

Market dynamics in the South American region are characterized by favorable climatic conditions, extensive agricultural land availability, and significant investments in processing infrastructure. The region benefits from year-round growing seasons in many areas, allowing for multiple harvests and consistent supply chains. Current market trends indicate robust growth driven by increasing global demand for vegetable oils, rising health consciousness among consumers, and expanding applications in food processing, biodiesel production, and industrial applications.

Regional production has experienced substantial expansion over the past decade, with growth rates consistently outpacing global averages. The market demonstrates strong export orientation, with approximately 65% of production destined for international markets, making South America a critical supplier to regions including Asia, Europe, and North America. Technological advancements in extraction methods, refining processes, and sustainable farming practices continue to enhance productivity and quality standards across the region.

The South American fats and oils market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of edible and industrial fats and oils within the South American region. This market includes both crude and refined products derived from various plant and animal sources, serving multiple end-use applications ranging from food and beverage manufacturing to biodiesel production and industrial processing.

Market scope extends beyond traditional vegetable oils to include specialty products such as organic oils, cold-pressed variants, and value-added formulations designed for specific applications. The definition encompasses the entire value chain from oilseed cultivation and harvesting through extraction, refining, packaging, and final distribution to end consumers and industrial users. Geographic coverage includes all major South American countries, with particular emphasis on leading producers and exporters that drive regional market dynamics.

Product categories within this market span conventional oils like soybean, palm, and sunflower oils, as well as emerging segments including coconut oil, avocado oil, and other specialty oils gaining popularity due to health trends and culinary preferences. The market also encompasses animal fats used in food processing and industrial applications, creating a comprehensive landscape of fat and oil products serving diverse consumer and commercial needs.

South America’s fats and oils market continues to demonstrate exceptional growth momentum, driven by expanding global demand, favorable agricultural conditions, and strategic investments in processing infrastructure. The region maintains its position as a global leader in vegetable oil production and export, with soybean oil representing the largest segment followed by palm oil and sunflower oil. Market expansion is supported by increasing consumption in emerging economies, growing biodiesel demand, and rising health consciousness driving premium oil segment growth.

Key market drivers include population growth, urbanization trends, and changing dietary patterns that favor processed and convenience foods requiring various types of fats and oils. The region benefits from competitive production costs, advanced agricultural techniques, and established export infrastructure that positions South American producers favorably in global markets. Sustainability initiatives are becoming increasingly important, with producers investing in environmentally responsible farming practices and certification programs to meet evolving consumer and regulatory requirements.

Market challenges include price volatility driven by weather conditions, global commodity markets, and geopolitical factors affecting trade relationships. However, the region’s diversified production base and strong export capabilities provide resilience against market fluctuations. Innovation trends focus on product differentiation, value-added processing, and development of specialty oils catering to health-conscious consumers and specific industrial applications.

Strategic market positioning reveals several critical insights that define the South American fats and oils landscape. The region’s dominance in global markets stems from optimal growing conditions, large-scale production capabilities, and efficient supply chain infrastructure that enables competitive pricing and reliable delivery to international customers.

Population growth across South America and globally represents a fundamental driver of fats and oils demand, as larger populations require increased food production and processing capabilities. Urbanization trends contribute significantly to market expansion as urban consumers typically consume more processed foods that require various types of fats and oils in their production. The shift toward urban lifestyles also increases demand for convenience foods, restaurant meals, and packaged products that rely heavily on fats and oils for flavor, texture, and preservation.

Health consciousness among consumers is driving demand for premium and specialty oils perceived as healthier alternatives to traditional options. This trend supports market growth in segments such as olive oil, avocado oil, coconut oil, and other specialty products that command higher prices and margins. Dietary diversification in emerging markets is expanding consumption of fats and oils as populations adopt more varied and Western-influenced eating patterns that incorporate higher levels of processed foods and cooking oils.

Industrial applications continue expanding beyond traditional food uses, with biodiesel production representing a significant growth driver as governments implement renewable energy mandates and environmental regulations. Cosmetic and personal care industries are increasingly utilizing natural oils and fats in product formulations, creating new market opportunities for South American producers. Export market expansion driven by growing middle-class populations in Asia and Africa provides substantial growth opportunities for regional producers with established export capabilities.

Price volatility represents a significant challenge for the South American fats and oils market, as commodity prices fluctuate based on weather conditions, global supply and demand dynamics, and speculative trading activities. This volatility creates planning difficulties for both producers and consumers, potentially limiting long-term investment decisions and market expansion strategies. Weather dependency poses ongoing risks as droughts, floods, and other extreme weather events can significantly impact crop yields and production capacity.

Trade policy uncertainties and potential tariff changes create market instability and planning challenges for export-oriented producers. Environmental regulations are becoming increasingly stringent, requiring substantial investments in sustainable farming practices and processing technologies that may increase production costs. Competition from synthetic alternatives and other regions with lower production costs presents ongoing competitive pressures that can limit market share and pricing power.

Infrastructure limitations in some regions constrain market development, particularly in rural areas where transportation and storage facilities may be inadequate for efficient product movement. Currency fluctuations affect export competitiveness and profitability, as most international trade is conducted in US dollars while production costs are incurred in local currencies. Health concerns regarding certain types of fats and oils, particularly those high in saturated fats or trans fats, may limit demand growth in some market segments.

Specialty oil segments present substantial growth opportunities as consumers increasingly seek premium, organic, and health-focused products. The growing popularity of functional foods and nutraceuticals creates demand for oils with specific nutritional profiles and health benefits. Cold-pressed and minimally processed oils are gaining market traction among health-conscious consumers willing to pay premium prices for perceived quality and nutritional advantages.

Biodiesel expansion offers significant growth potential as governments worldwide implement renewable energy mandates and carbon reduction targets. Industrial applications beyond traditional uses continue expanding, including opportunities in cosmetics, pharmaceuticals, and specialty chemical production. Value-added processing capabilities can enhance profitability through product differentiation and direct consumer marketing rather than commodity-based sales.

Export market development in emerging economies provides substantial growth opportunities as rising incomes and changing dietary patterns increase fats and oils consumption. Sustainable and certified products command premium prices in developed markets where environmental consciousness drives purchasing decisions. Technology investments in extraction efficiency, quality improvement, and waste reduction can enhance competitiveness and profitability while meeting environmental requirements.

Supply chain dynamics in the South American fats and oils market are characterized by complex interactions between agricultural production, processing capacity, transportation infrastructure, and global demand patterns. Seasonal production cycles create natural supply fluctuations that influence pricing and inventory management strategies throughout the value chain. The region’s position as a major exporter means that global market conditions significantly impact local market dynamics and producer decision-making.

Competitive dynamics involve both large multinational corporations and smaller regional players, creating a diverse market structure with varying strategies and capabilities. Vertical integration trends are reshaping market dynamics as companies seek greater control over quality, costs, and supply chain reliability. Technology adoption rates vary significantly across the region, with leading producers investing heavily in advanced processing equipment while smaller operations may rely on traditional methods.

Regulatory dynamics continue evolving as governments implement new environmental standards, food safety requirements, and trade policies that affect market operations. Consumer preference shifts toward healthier and more sustainable products are driving product innovation and marketing strategies across the industry. Financial market dynamics influence commodity pricing, investment flows, and currency exchange rates that affect competitiveness and profitability throughout the sector.

Comprehensive market analysis for the South American fats and oils market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry stakeholders including producers, processors, distributors, and end-users through structured interviews, surveys, and focus groups. This approach provides firsthand insights into market trends, challenges, and opportunities from participants actively involved in market operations.

Secondary research encompasses extensive analysis of industry reports, government statistics, trade association data, and academic publications to establish market baselines and identify long-term trends. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth, segment performance, and regional dynamics based on historical data and identified trend patterns. Qualitative assessment incorporates expert opinions, industry knowledge, and market intelligence to provide context and interpretation for quantitative findings.

Data validation processes ensure information accuracy through cross-referencing multiple sources, triangulation of findings, and verification with industry experts. Market segmentation analysis examines various product categories, applications, and geographic regions to provide detailed insights into specific market components. Competitive intelligence gathering involves analysis of major market players, their strategies, capabilities, and market positioning to understand competitive dynamics and future market evolution.

Brazil dominates the South American fats and oils market, accounting for approximately 55% of regional production and serving as the continent’s largest exporter. The country’s vast agricultural land, favorable climate, and advanced processing infrastructure support large-scale soybean, palm, and sunflower oil production. Brazilian producers benefit from well-established export channels and strong relationships with major importing countries, particularly in Asia and Europe.

Argentina represents the second-largest market in the region, specializing primarily in soybean oil production and export. The country’s competitive advantage lies in efficient production systems and strategic geographic positioning for export to global markets. Colombian palm oil production has expanded significantly, with the country emerging as a major regional supplier and targeting increased export market penetration.

Other regional markets including Peru, Ecuador, and Venezuela contribute to overall production capacity while focusing on domestic market supply and niche export opportunities. Regional integration initiatives are facilitating increased trade flows between countries and supporting market development through improved infrastructure and reduced trade barriers. Investment patterns show continued expansion in processing capacity and agricultural productivity improvements across multiple countries, supporting sustained market growth throughout the region.

Market leadership in the South American fats and oils sector is characterized by a mix of large multinational corporations and significant regional players with strong local market presence. The competitive environment demonstrates ongoing consolidation trends as larger companies acquire smaller operations to achieve economies of scale and expand market reach.

Competitive strategies focus on vertical integration, sustainability initiatives, product differentiation, and geographic expansion to capture market share and improve profitability. Innovation investments are increasingly important as companies develop new products and improve processing efficiency to maintain competitive advantages.

Product segmentation in the South American fats and oils market reveals diverse categories serving different consumer needs and applications. By product type, the market encompasses vegetable oils, animal fats, and specialty oils with varying characteristics and end-use applications.

By Source:

By Application:

Vegetable oils category dominates the South American market with soybean oil leading in both production volume and export value. This category benefits from established supply chains, processing infrastructure, and strong global demand. Quality standards continue improving as producers invest in refining technology and implement quality control systems to meet international requirements.

Specialty oils segment is experiencing rapid growth driven by health consciousness and culinary trends. Organic and cold-pressed variants command premium prices and attract health-conscious consumers willing to pay higher prices for perceived quality benefits. Avocado oil and other specialty products are gaining market traction as producers diversify product portfolios to capture higher-value market segments.

Industrial applications represent a growing category as biodiesel demand expands and new industrial uses are developed. Cosmetic applications are particularly promising as natural and organic personal care products gain popularity. Animal fats category serves specific industrial and food processing applications while facing some consumer resistance due to health concerns and dietary preferences favoring plant-based alternatives.

Producers benefit from South America’s favorable agricultural conditions, competitive production costs, and established export infrastructure that enables profitable operations and market expansion opportunities. Scale advantages allow large producers to achieve cost efficiencies and invest in advanced processing technologies that improve product quality and operational efficiency.

Processors gain from access to abundant raw material supplies, skilled workforce, and supportive government policies that facilitate business operations and growth. Value-added processing opportunities enable companies to capture higher margins through product differentiation and direct consumer marketing rather than commodity-based sales strategies.

Exporters benefit from strong global demand, established trade relationships, and competitive pricing that supports market share growth in international markets. Distributors and retailers gain from diverse product portfolios, reliable supply chains, and growing consumer demand that supports business expansion and profitability. End consumers benefit from product availability, competitive pricing, and increasing variety of specialty and health-focused options that meet diverse dietary preferences and nutritional requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus is becoming increasingly important as consumers and regulators demand environmentally responsible production practices. Certification programs for sustainable palm oil, organic production, and carbon-neutral operations are gaining traction among producers seeking to differentiate their products and access premium market segments. Traceability systems are being implemented to provide transparency throughout the supply chain and meet consumer demands for product origin information.

Health and wellness trends continue driving demand for oils perceived as healthier alternatives to traditional options. Functional oils with specific nutritional benefits are gaining popularity as consumers seek products that support health and wellness goals. Plant-based alternatives are expanding beyond traditional vegetable oils to include innovative products derived from nuts, seeds, and other plant sources.

Technology integration is transforming production and processing operations through precision agriculture, automated processing systems, and digital supply chain management. Blockchain technology is being explored for supply chain transparency and product authentication. Biotechnology applications are enabling development of enhanced oil varieties with improved nutritional profiles and processing characteristics.

Recent industry developments demonstrate the dynamic nature of the South American fats and oils market with significant investments in capacity expansion, technology upgrades, and sustainability initiatives. Major producers are implementing comprehensive sustainability programs to meet evolving consumer and regulatory requirements while maintaining competitive positioning in global markets.

Infrastructure investments continue expanding throughout the region with new processing facilities, improved transportation networks, and enhanced storage capabilities supporting market growth and efficiency improvements. Research and development activities are intensifying as companies invest in product innovation, process optimization, and new application development to maintain competitive advantages and capture emerging market opportunities.

Strategic partnerships and joint ventures are becoming more common as companies seek to leverage complementary capabilities, share investment risks, and accelerate market expansion. Acquisition activities continue as larger players consolidate market position and smaller companies seek access to capital and distribution networks. Government initiatives supporting agricultural development, export promotion, and renewable energy adoption are creating favorable conditions for continued market expansion and modernization.

MarkWide Research analysis suggests that South American fats and oils market participants should prioritize sustainability initiatives and certification programs to maintain competitiveness in evolving global markets. Investment strategies should focus on technology upgrades, processing efficiency improvements, and product diversification to capture higher-value market segments and improve profitability.

Market positioning recommendations emphasize the importance of developing strong brand identities and direct consumer relationships rather than relying solely on commodity-based sales strategies. Export diversification should be pursued to reduce dependence on traditional markets and capture growth opportunities in emerging economies with expanding middle-class populations and changing dietary patterns.

Risk management strategies should address weather dependency, currency volatility, and trade policy uncertainties through diversification, hedging instruments, and flexible operational capabilities. Innovation investments in specialty products, functional oils, and value-added processing can provide competitive differentiation and access to premium market segments with higher margins and growth potential.

Long-term market prospects for the South American fats and oils market remain highly positive, supported by fundamental growth drivers including population expansion, rising incomes, and increasing global demand for vegetable oils. Regional production capacity is expected to continue expanding with projected growth rates of approximately 4-6% annually over the next decade, driven by agricultural productivity improvements and processing infrastructure development.

Export opportunities are expected to expand significantly as emerging markets in Asia and Africa experience continued economic growth and dietary transitions favoring increased fats and oils consumption. Biodiesel demand projections indicate substantial growth potential as renewable energy mandates expand globally and carbon reduction targets become more stringent. MWR forecasts indicate that specialty oil segments will experience above-average growth rates as health consciousness and premium product demand continue expanding.

Technology adoption is expected to accelerate throughout the region, with digital agriculture, precision processing, and supply chain optimization becoming standard practices among leading producers. Sustainability requirements will likely become more stringent, creating both challenges and opportunities for producers who invest early in environmentally responsible practices and certification programs. Market consolidation trends are expected to continue as scale advantages become increasingly important for competitiveness in global markets.

The South American fats and oils market represents a dynamic and strategically important sector with exceptional growth potential driven by favorable agricultural conditions, expanding global demand, and ongoing technological advancement. Regional advantages including competitive production costs, established export infrastructure, and diversified product portfolios position South American producers favorably for continued market expansion and international competitiveness.

Market evolution toward sustainability, health-focused products, and value-added processing creates both opportunities and challenges for industry participants. Companies that successfully adapt to changing consumer preferences, invest in technology and sustainability initiatives, and develop strong market positioning will be best positioned to capture growth opportunities and maintain competitive advantages in an increasingly complex global marketplace.

Future success in the South American fats and oils market will depend on strategic investments in innovation, sustainability, and market diversification while maintaining the fundamental competitive advantages that have established the region as a global leader in fats and oils production and export. The market’s strong fundamentals and growth trajectory make it an attractive sector for continued investment and development.

What is South American Fats and Oils?

South American Fats and Oils refer to the various edible and non-edible fats and oils produced and consumed in South America, including vegetable oils, animal fats, and specialty oils used in cooking, food processing, and industrial applications.

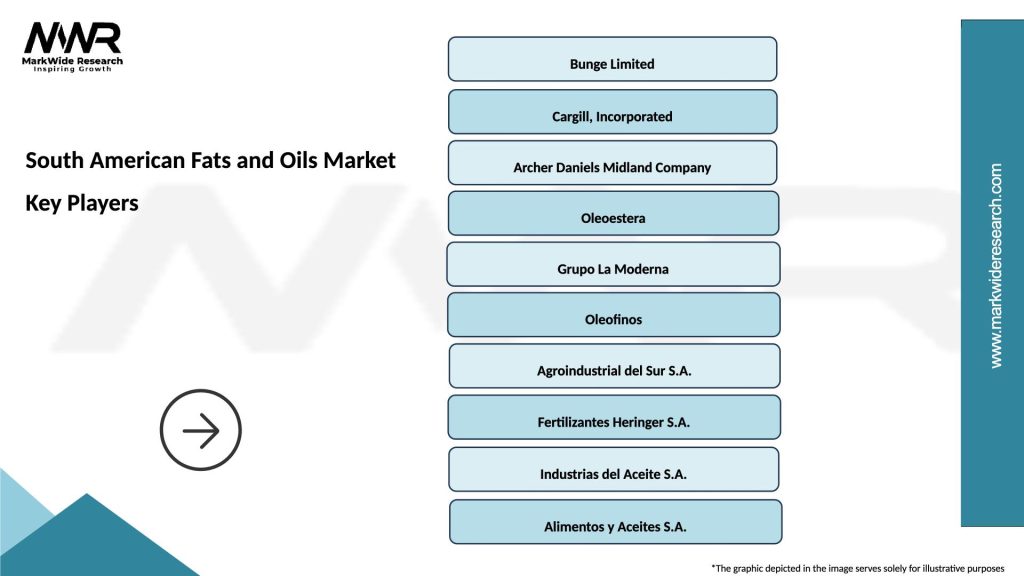

What are the key players in the South American Fats and Oils Market?

Key players in the South American Fats and Oils Market include Bunge Limited, Cargill, Archer Daniels Midland Company, and Oleaginosas Dreyfus, among others.

What are the growth factors driving the South American Fats and Oils Market?

The growth of the South American Fats and Oils Market is driven by increasing consumer demand for healthy cooking oils, the rise in food processing industries, and the expansion of the biofuels sector.

What challenges does the South American Fats and Oils Market face?

Challenges in the South American Fats and Oils Market include fluctuating raw material prices, regulatory hurdles related to food safety, and competition from alternative fat sources.

What opportunities exist in the South American Fats and Oils Market?

Opportunities in the South American Fats and Oils Market include the growing trend towards organic and sustainable oils, innovations in oil extraction technologies, and the increasing popularity of plant-based diets.

What trends are shaping the South American Fats and Oils Market?

Trends in the South American Fats and Oils Market include a shift towards healthier oil options, the rise of cold-pressed oils, and the increasing use of fats and oils in non-food applications such as cosmetics and personal care products.

South American Fats and Oils Market

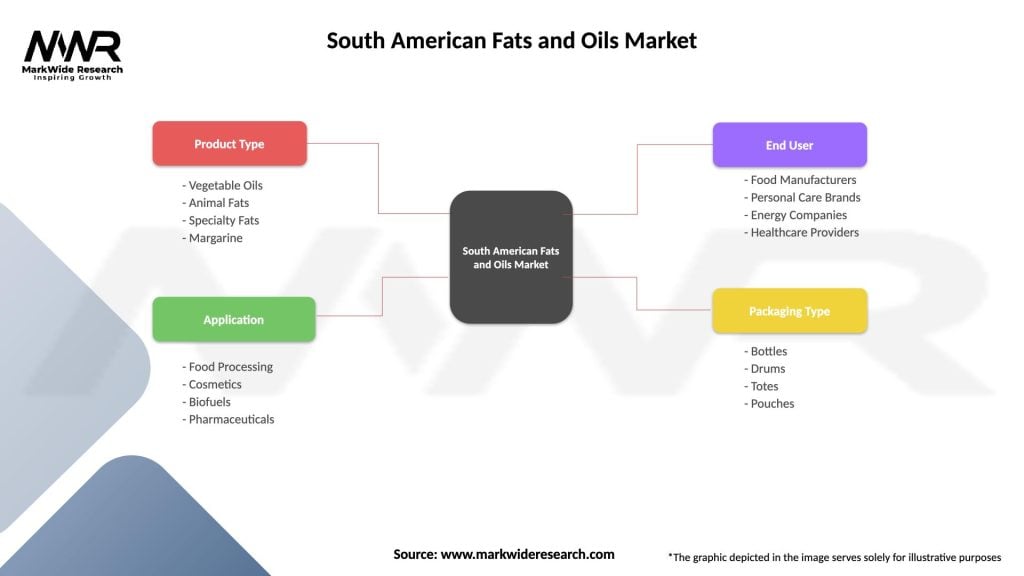

| Segmentation Details | Description |

|---|---|

| Product Type | Vegetable Oils, Animal Fats, Specialty Fats, Margarine |

| Application | Food Processing, Cosmetics, Biofuels, Pharmaceuticals |

| End User | Food Manufacturers, Personal Care Brands, Energy Companies, Healthcare Providers |

| Packaging Type | Bottles, Drums, Totes, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South American Fats and Oils Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at