444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America water consumption market represents a critical component of the region’s infrastructure and economic development landscape. This dynamic sector encompasses residential, industrial, agricultural, and commercial water usage patterns across twelve diverse countries, each facing unique challenges related to water availability, distribution, and consumption management. South America contains approximately 12% of the world’s population but holds nearly 26% of global freshwater resources, creating a paradoxical situation where abundance coexists with accessibility challenges.

Regional water consumption patterns vary significantly across the continent, with countries like Brazil and Argentina leading in total consumption volumes, while nations such as Chile and Peru face acute water scarcity issues despite their coastal locations. The market is experiencing substantial transformation driven by urbanization trends, industrial expansion, climate change impacts, and evolving regulatory frameworks focused on sustainable water management practices.

Infrastructure development remains a primary catalyst for market evolution, with governments and private entities investing heavily in water treatment facilities, distribution networks, and conservation technologies. The agricultural sector dominates regional water consumption, accounting for approximately 70% of total usage, followed by industrial applications and domestic consumption. This distribution pattern reflects the continent’s strong agricultural economy and growing industrial base.

The South America water consumption market refers to the comprehensive ecosystem of water usage, distribution, treatment, and management services across the South American continent. This market encompasses all aspects of water utilization from source extraction through end-user consumption, including municipal water supply systems, industrial water processing, agricultural irrigation networks, and residential consumption patterns.

Market participants include government water utilities, private water companies, industrial consumers, agricultural producers, and residential users. The sector involves complex interactions between water resource management, infrastructure development, regulatory compliance, and technological innovation. Water consumption in this context extends beyond simple usage to include water quality management, conservation initiatives, recycling programs, and sustainable consumption practices.

Geographic scope covers all twelve South American countries, each contributing unique consumption patterns, regulatory environments, and infrastructure challenges. The market reflects diverse economic conditions, from developed urban centers with sophisticated water management systems to rural areas relying on traditional water sources and distribution methods.

South America’s water consumption market demonstrates robust growth potential despite facing significant infrastructure and environmental challenges. The region’s abundant freshwater resources provide a strong foundation for sustainable market development, while increasing urbanization and industrial expansion drive growing demand for reliable water supply systems. Market dynamics are shaped by the interplay between resource availability, infrastructure investment, regulatory evolution, and technological advancement.

Key growth drivers include rapid urban population expansion, industrial sector development, agricultural modernization, and increasing awareness of water conservation importance. The market benefits from substantial government investment in water infrastructure projects, private sector participation in utility operations, and international development funding for water access improvement initiatives.

Regional disparities create both challenges and opportunities, with water-rich countries like Brazil and Colombia positioned to become regional water security leaders, while arid nations focus on efficiency improvements and alternative water source development. Technology adoption accelerates across the region, with smart water management systems, advanced treatment technologies, and conservation solutions gaining traction among utilities and large consumers.

Strategic market insights reveal several critical trends shaping the South American water consumption landscape:

Population growth serves as a fundamental driver for South America’s water consumption market expansion. The region’s population continues growing at approximately 1.1% annually, with urban areas experiencing even higher growth rates. This demographic trend directly translates to increased demand for municipal water services, residential consumption, and supporting infrastructure development.

Economic development across South American countries drives industrial water consumption growth. Manufacturing expansion, mining operations, energy production, and service sector development all require substantial water resources. Industrial water demand grows proportionally with economic activity, creating sustained market expansion opportunities for water suppliers and treatment service providers.

Agricultural modernization initiatives promote efficient irrigation systems and precision farming techniques that, while improving water use efficiency, often increase overall agricultural water consumption due to expanded cultivation areas. Food security concerns and export market opportunities encourage agricultural expansion, particularly in countries like Brazil, Argentina, and Uruguay.

Climate change impacts paradoxically drive market growth by necessitating adaptive water management strategies. Extreme weather events, changing precipitation patterns, and temperature variations require more sophisticated water storage, treatment, and distribution systems. Resilience building becomes a critical market driver as communities and industries seek reliable water supply security.

Infrastructure limitations represent the most significant constraint on South America’s water consumption market development. Many regions lack adequate water treatment facilities, distribution networks, and storage systems necessary to meet growing demand. Capital investment requirements for infrastructure development often exceed available public funding, creating bottlenecks in market expansion.

Regulatory complexity across different countries creates challenges for regional market participants. Varying water quality standards, pricing mechanisms, and operational requirements complicate cross-border operations and technology standardization efforts. Policy inconsistencies between national and local governments further compound regulatory navigation difficulties.

Environmental concerns increasingly constrain water consumption growth, particularly in ecologically sensitive areas. Water resource protection regulations limit extraction rates from natural sources, while environmental impact assessments slow infrastructure development projects. Competing demands between economic development and environmental preservation create ongoing market tensions.

Economic volatility in several South American countries affects water infrastructure investment capacity and consumer purchasing power. Currency fluctuations impact imported technology costs, while economic downturns reduce government spending on water system improvements and maintenance programs.

Technology innovation presents substantial opportunities for market transformation and growth. Advanced water treatment technologies, smart distribution systems, and conservation solutions offer potential for significant efficiency improvements and service quality enhancements. Digital water management platforms enable real-time monitoring, predictive maintenance, and optimized resource allocation across water systems.

Public-private partnerships create opportunities for accelerated infrastructure development and operational efficiency improvements. Private sector expertise in project management, technology implementation, and operational optimization can complement public sector resources and regulatory authority. Concession agreements and management contracts offer sustainable financing models for water system expansion and modernization.

Regional integration opportunities exist for water resource sharing and infrastructure coordination between neighboring countries. Cross-border projects can optimize water resource utilization while reducing individual country investment requirements. Shared technology platforms and operational standards can improve overall regional water security and market efficiency.

Sustainable development initiatives supported by international organizations and development banks provide funding opportunities for water access improvement projects. Green financing mechanisms increasingly support environmentally sustainable water infrastructure development, creating new market segments focused on conservation and efficiency.

Supply and demand dynamics in South America’s water consumption market reflect the complex interplay between abundant natural resources and infrastructure limitations. While the region possesses substantial freshwater reserves, uneven geographic distribution and inadequate distribution systems create localized scarcity conditions. Demand growth consistently outpaces infrastructure development in many areas, creating ongoing supply-demand imbalances.

Pricing mechanisms vary significantly across the region, with some countries maintaining subsidized water rates while others implement market-based pricing structures. Tariff reforms increasingly reflect true water costs, including infrastructure maintenance and environmental protection expenses. These pricing dynamics influence consumption patterns and investment decisions throughout the market.

Competitive dynamics evolve as private sector participation increases in traditionally government-dominated water utilities. Market liberalization in several countries creates opportunities for competitive service provision while maintaining regulatory oversight for essential services. Competition drives innovation and efficiency improvements across the sector.

Technological disruption transforms traditional water management approaches through digitalization, automation, and advanced treatment technologies. Innovation adoption accelerates as utilities and large consumers recognize efficiency and cost benefits of modern water management solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into South America’s water consumption market. Primary research includes extensive interviews with water utility executives, government officials, industrial water users, and technology providers across all major South American markets. These stakeholder consultations provide firsthand insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government statistical databases, utility company reports, industry publications, and academic research papers. Data triangulation methods verify information accuracy by cross-referencing multiple sources and identifying consistent trends and patterns across different data sets.

Quantitative analysis utilizes statistical modeling techniques to project market trends, consumption patterns, and growth trajectories. Regression analysis identifies key variables influencing water consumption levels, while time series analysis reveals seasonal and cyclical patterns in market behavior.

Qualitative assessment incorporates expert opinions, industry insights, and stakeholder perspectives to provide context for quantitative findings. Market intelligence gathering includes monitoring regulatory developments, technology innovations, and competitive landscape changes that impact market dynamics.

Brazil dominates the South American water consumption market, accounting for approximately 45% of regional consumption due to its large population, extensive industrial base, and significant agricultural sector. The country’s diverse geography creates varied water availability conditions, from abundant resources in the Amazon region to scarcity challenges in the northeast. Brazilian water utilities increasingly adopt advanced technologies and private sector partnerships to improve service delivery and infrastructure development.

Argentina represents the second-largest market segment, with substantial agricultural water consumption supporting its position as a major food exporter. The country faces unique challenges related to groundwater depletion in some regions while maintaining abundant surface water resources in others. Buenos Aires metropolitan area concentrates significant municipal and industrial water demand, driving infrastructure investment priorities.

Colombia and Chile demonstrate contrasting market characteristics, with Colombia benefiting from abundant rainfall and river systems while Chile confronts severe water scarcity in its northern regions. Chilean water markets feature more advanced privatization and market-based allocation mechanisms compared to other regional countries. Colombia’s water sector focuses on expanding access to underserved populations and improving service quality.

Peru, Ecuador, and Venezuela face distinct challenges related to geographic diversity, economic conditions, and infrastructure development needs. Andean countries particularly struggle with water distribution from highland sources to coastal population centers, requiring substantial infrastructure investment and technical expertise.

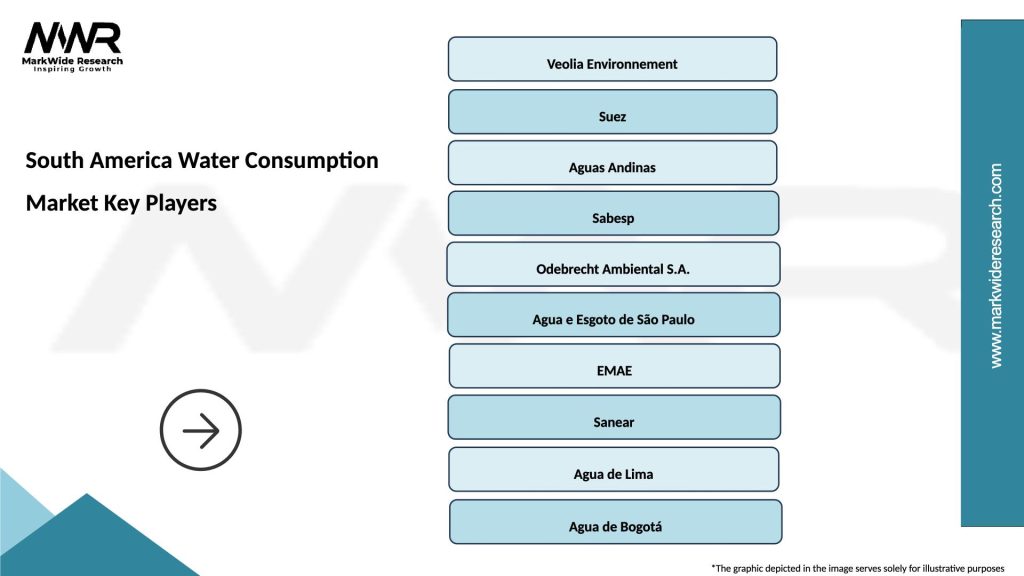

Market leadership in South America’s water consumption sector includes a mix of government utilities, private water companies, and international operators. Key market participants demonstrate varying approaches to service delivery, technology adoption, and market expansion strategies:

Competitive strategies focus on operational efficiency improvements, technology integration, customer service enhancement, and sustainable development practices. Market consolidation trends emerge as larger utilities acquire smaller operations to achieve economies of scale and improve service delivery capabilities.

By End-User Application:

By Water Source:

By Treatment Level:

Agricultural water consumption demonstrates the highest volume usage but lowest revenue generation per unit, creating unique market dynamics focused on efficiency and cost optimization. Irrigation modernization programs increasingly adopt drip irrigation, precision agriculture, and smart water management systems to improve crop yields while reducing water consumption. This segment shows growing adoption of water recycling and alternative source utilization.

Municipal water supply generates the highest revenue per unit consumed while serving the most diverse customer base. Urban water systems require sophisticated treatment, distribution, and quality monitoring infrastructure to meet regulatory standards and customer expectations. This segment drives most technology innovation and infrastructure investment in the regional market.

Industrial water consumption varies significantly by sector, with mining, manufacturing, and energy production representing the largest industrial users. Industrial water management increasingly focuses on closed-loop systems, water recycling, and zero liquid discharge technologies to minimize environmental impact and reduce operational costs.

Energy sector water usage grows with regional energy production expansion, particularly in hydroelectric power generation and oil and gas operations. Power plant cooling and hydraulic fracturing operations create substantial water demand in specific geographic areas, requiring specialized supply and treatment solutions.

Water utilities benefit from growing market demand, technology advancement opportunities, and increasing private sector investment in infrastructure development. Operational efficiency improvements through smart water management systems reduce costs while improving service quality and customer satisfaction. Regulatory support for utility modernization creates favorable conditions for long-term investment and growth.

Technology providers find expanding opportunities for water treatment, distribution, and management solution deployment across the region. Innovation demand drives market growth for companies offering advanced filtration, monitoring, and automation technologies. Local partnerships and technology transfer agreements create sustainable market entry strategies.

Industrial consumers gain access to more reliable water supplies and advanced treatment services supporting operational efficiency and environmental compliance. Water security improvements reduce business risks while enabling expansion and modernization initiatives. Cost optimization through efficient water management directly impacts profitability and competitiveness.

Government stakeholders achieve improved public health outcomes, economic development support, and environmental protection through enhanced water management systems. Infrastructure investment creates employment opportunities while building essential services for economic growth and social development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping South America’s water consumption market through smart meter deployment, real-time monitoring systems, and predictive analytics applications. IoT integration enables utilities to optimize distribution networks, detect leaks quickly, and improve customer service delivery. Data analytics platforms provide insights for demand forecasting and infrastructure planning.

Sustainability focus drives adoption of circular economy principles in water management, emphasizing recycling, reuse, and resource recovery. Green infrastructure solutions gain traction for stormwater management and natural treatment systems. Environmental, social, and governance (ESG) considerations increasingly influence investment decisions and operational practices.

Decentralized treatment systems grow in popularity for remote communities and industrial facilities seeking independence from centralized utilities. Modular treatment technologies offer scalable solutions for varying demand levels and geographic constraints. On-site treatment and recycling systems reduce transportation costs and improve supply reliability.

Water-energy nexus optimization becomes increasingly important as utilities seek to reduce energy consumption in water treatment and distribution processes. Energy recovery from wastewater treatment and renewable energy integration in water facilities demonstrate growing market sophistication and environmental awareness.

Infrastructure investment accelerates across the region with major projects including water treatment plant construction, distribution network expansion, and storage facility development. MarkWide Research analysis indicates substantial government commitments to water infrastructure improvement programs spanning multiple countries and involving billions in investment commitments.

Technology partnerships between international companies and regional utilities increase, facilitating knowledge transfer and advanced solution deployment. Digital platform implementations demonstrate significant efficiency improvements and customer satisfaction enhancements in pilot programs across major metropolitan areas.

Regulatory reforms in several countries modernize water sector governance, pricing mechanisms, and quality standards. Market liberalization initiatives create opportunities for private sector participation while maintaining public oversight of essential services. Cross-border cooperation agreements facilitate regional water security initiatives.

Climate adaptation projects receive increased funding and priority as governments recognize water security importance for economic stability and social development. Resilience building initiatives include drought management systems, flood control infrastructure, and emergency response capabilities.

Strategic recommendations for market participants emphasize the importance of technology integration, partnership development, and sustainability focus in capturing growth opportunities. Utilities should prioritize smart water management system implementation to improve operational efficiency and customer service while reducing operational costs and environmental impact.

Private sector participants should consider public-private partnership opportunities as preferred market entry and expansion strategies. Risk mitigation through diversified geographic presence and multiple revenue streams helps navigate economic volatility and regulatory uncertainty common in regional markets.

Technology providers should focus on developing solutions specifically adapted to South American market conditions, including affordability constraints, infrastructure limitations, and regulatory requirements. Local partnerships and technology transfer agreements create sustainable competitive advantages and market access.

Investment strategies should emphasize long-term infrastructure development opportunities while maintaining flexibility to adapt to changing market conditions. ESG compliance becomes increasingly important for accessing international funding and meeting stakeholder expectations.

Market growth prospects remain positive despite infrastructure and economic challenges, with increasing demand from population growth, economic development, and climate adaptation needs driving sustained expansion. Technology advancement continues accelerating efficiency improvements and service quality enhancements across all market segments.

Infrastructure development will likely accelerate through increased public-private partnerships and international development funding. MWR projections indicate substantial investment requirements over the next decade to meet growing demand and replace aging infrastructure in major metropolitan areas.

Regulatory evolution toward more sophisticated water management frameworks will create both challenges and opportunities for market participants. Sustainability requirements will increasingly influence operational practices and investment decisions throughout the sector.

Regional integration initiatives may create larger, more efficient markets while improving overall water security across South America. Technology standardization and operational best practice sharing will likely improve sector performance and reduce costs for consumers and utilities alike.

South America’s water consumption market presents a complex landscape of abundant resources, growing demand, and significant infrastructure challenges that create both opportunities and obstacles for market participants. The region’s substantial freshwater reserves provide a strong foundation for sustainable development, while increasing urbanization, industrial expansion, and agricultural modernization drive consistent demand growth across all market segments.

Market dynamics reflect the ongoing transformation from traditional government-dominated utilities toward more sophisticated, technology-enabled, and privately-participated water management systems. Digital innovation, sustainability focus, and operational efficiency improvements emerge as key differentiators for successful market participants navigating this evolving landscape.

Future success in South America’s water consumption market will depend on stakeholders’ ability to balance economic development needs with environmental sustainability requirements while building resilient infrastructure capable of adapting to climate change impacts. Collaborative approaches involving government, private sector, and international partners offer the most promising path toward achieving universal water access and sustainable resource management across the region.

What is Water Consumption?

Water consumption refers to the total volume of water used by individuals, industries, and agriculture in a specific region. In South America, this includes domestic use, agricultural irrigation, and industrial processes.

What are the key players in the South America Water Consumption Market?

Key players in the South America Water Consumption Market include companies like Veolia, Suez, and Aguas Andinas, which provide water management and treatment solutions, among others.

What are the main drivers of the South America Water Consumption Market?

The main drivers of the South America Water Consumption Market include increasing population growth, urbanization leading to higher domestic water use, and the expansion of agricultural activities requiring irrigation.

What challenges does the South America Water Consumption Market face?

Challenges in the South America Water Consumption Market include water scarcity due to climate change, pollution of water sources, and inadequate infrastructure for water distribution and treatment.

What opportunities exist in the South America Water Consumption Market?

Opportunities in the South America Water Consumption Market include investments in water recycling technologies, the development of sustainable water management practices, and the implementation of smart water systems to enhance efficiency.

What trends are shaping the South America Water Consumption Market?

Trends shaping the South America Water Consumption Market include the increasing adoption of water-efficient technologies, a focus on sustainable practices in agriculture, and the rise of public-private partnerships to improve water infrastructure.

South America Water Consumption Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottled Water, Tap Water, Purified Water, Mineral Water |

| End User | Residential, Commercial, Industrial, Agricultural |

| Distribution Channel | Retail, Online, Wholesale, Direct Sales |

| Application | Drinking, Irrigation, Industrial Processes, Recreational |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Water Consumption Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at