444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America transformer market represents a critical component of the region’s electrical infrastructure development, encompassing power transformers, distribution transformers, and specialty transformers across multiple voltage levels. This dynamic market serves diverse applications including power generation, transmission, distribution, and industrial operations throughout countries like Brazil, Argentina, Chile, Colombia, and Peru. The regional market demonstrates robust growth potential driven by expanding urbanization, industrial development, and renewable energy integration initiatives.

Market dynamics in South America reflect the region’s ongoing infrastructure modernization efforts and increasing electricity demand. The transformer market benefits from substantial investments in grid modernization, renewable energy projects, and industrial expansion across key economies. With growing emphasis on energy efficiency and smart grid technologies, the market experiences significant transformation in product offerings and technological capabilities.

Regional growth patterns indicate strong momentum with the market expanding at approximately 6.2% CAGR over the forecast period. Brazil dominates the regional landscape, accounting for nearly 45% market share, followed by Argentina and Chile as significant contributors. The market’s evolution reflects broader economic development trends and increasing electrification rates across urban and rural areas.

The South America transformer market refers to the comprehensive ecosystem of electrical transformer manufacturing, distribution, and services across South American countries, encompassing all voltage levels from low-voltage distribution transformers to extra-high-voltage power transformers used in transmission networks.

Transformers serve as essential electrical devices that transfer electrical energy between circuits through electromagnetic induction, enabling voltage level adjustments necessary for efficient power transmission and distribution. In the South American context, these devices support the region’s growing electrical infrastructure needs, facilitating reliable power delivery from generation sources to end consumers across residential, commercial, and industrial sectors.

Market scope includes various transformer types such as power transformers, distribution transformers, instrument transformers, and specialty transformers designed for specific applications. The regional market encompasses both domestic manufacturing capabilities and international imports, reflecting the diverse technological requirements and economic conditions across different South American countries.

South America’s transformer market demonstrates compelling growth prospects driven by infrastructure development, renewable energy expansion, and industrial modernization across the region. The market benefits from increasing electricity demand, grid modernization initiatives, and substantial investments in power generation and transmission infrastructure.

Key market drivers include rapid urbanization with approximately 82% urban population growth projected by 2030, expanding renewable energy capacity, and government initiatives supporting electrical infrastructure development. Brazil leads regional demand, while countries like Colombia and Chile show significant growth potential in renewable energy integration and grid modernization projects.

Technology trends favor smart transformers, eco-friendly designs, and digital monitoring capabilities. The market experiences increasing adoption of amorphous core transformers, offering improved energy efficiency, and growing demand for transformers compatible with renewable energy sources including solar and wind power installations.

Competitive landscape features both international manufacturers and regional players, with companies focusing on local manufacturing capabilities, technical support services, and customized solutions for South American market requirements. Strategic partnerships and technology transfer agreements play crucial roles in market development and capacity building across the region.

Strategic market insights reveal several critical factors shaping the South America transformer market landscape:

Primary market drivers propelling the South America transformer market include robust infrastructure development initiatives across the region. Government investments in electrical grid expansion and modernization create substantial demand for transformers across all voltage levels. These investments support economic development objectives and improve electricity access in underserved areas.

Renewable energy expansion serves as a significant growth catalyst, with South American countries pursuing ambitious clean energy targets. Solar and wind power projects require specialized transformers for grid integration, while hydroelectric developments demand high-capacity power transformers. The renewable energy sector’s growth rate of approximately 8.5% annually directly translates to increased transformer demand.

Industrial development across manufacturing, mining, and petrochemical sectors drives demand for industrial transformers and specialized electrical equipment. Brazil’s manufacturing sector expansion and Chile’s mining industry growth create substantial opportunities for transformer suppliers. Industrial automation trends further increase demand for precision transformers and power quality solutions.

Urbanization trends accelerate distribution transformer requirements as cities expand and new residential developments emerge. The region’s urban population growth necessitates extensive electrical infrastructure development, including substations, distribution networks, and commercial building electrical systems. Smart city initiatives additionally promote advanced transformer technologies with monitoring capabilities.

Economic volatility across South American countries poses significant challenges for transformer market growth. Currency fluctuations, inflation pressures, and political uncertainties affect infrastructure investment decisions and project financing. These economic factors can delay major electrical projects and impact transformer procurement timelines.

High capital requirements for transformer manufacturing facilities and advanced technology development create barriers for regional market players. The substantial investment needed for modern production capabilities and quality certification processes limits the number of domestic manufacturers and increases dependence on imports for certain transformer categories.

Technical skill shortages in transformer design, manufacturing, and maintenance present ongoing challenges. The specialized knowledge required for modern transformer technologies, particularly smart transformers and renewable energy applications, remains limited in some regional markets. This skills gap affects both manufacturing capabilities and after-sales service quality.

Regulatory complexities across different South American countries create compliance challenges for transformer manufacturers and suppliers. Varying technical standards, certification requirements, and import regulations increase operational complexity and costs. Harmonization efforts remain incomplete, affecting cross-border trade and regional market integration.

Smart grid development presents substantial opportunities for advanced transformer technologies across South America. Countries investing in grid modernization require intelligent transformers with monitoring, control, and communication capabilities. These smart grid initiatives offer premium pricing opportunities for technology providers and create long-term service revenue streams.

Renewable energy integration creates specialized market segments for transformers designed for solar, wind, and hydroelectric applications. The growing renewable energy capacity, projected to reach 35% of total generation by 2030, requires customized transformer solutions for grid connection and power conditioning. This trend favors manufacturers with renewable energy expertise.

Regional manufacturing expansion opportunities exist for companies establishing local production facilities. Government policies promoting domestic manufacturing, combined with growing market demand, create favorable conditions for investment in transformer production capabilities. Local manufacturing reduces logistics costs and improves market responsiveness.

Digital transformation in the electrical sector opens opportunities for transformer manufacturers to develop IoT-enabled products and digital services. Predictive maintenance, remote monitoring, and data analytics services represent growing revenue opportunities beyond traditional transformer sales. These digital capabilities enhance customer value propositions and create competitive advantages.

Supply chain dynamics in the South America transformer market reflect both regional manufacturing capabilities and international dependencies. Key raw materials including electrical steel, copper, and insulating materials are sourced through global supply chains, while some countries develop local component manufacturing to reduce import reliance and improve cost competitiveness.

Technology evolution drives market dynamics as manufacturers adapt to changing customer requirements and regulatory standards. The shift toward energy-efficient designs, smart monitoring capabilities, and renewable energy compatibility influences product development strategies. Companies investing in research and development gain competitive advantages in emerging market segments.

Competitive intensity varies across different transformer categories and regional markets. Power transformer segments experience intense competition from international manufacturers, while distribution transformer markets show stronger regional player presence. Price competition remains significant, balanced by quality requirements and technical support capabilities.

Customer preferences evolve toward comprehensive solutions including transformers, installation services, and long-term maintenance contracts. End users increasingly value total cost of ownership over initial purchase price, creating opportunities for service-oriented business models. This trend benefits companies offering integrated electrical solutions and technical expertise.

Comprehensive market research methodology employed for analyzing the South America transformer market incorporates multiple data collection and analysis approaches. Primary research includes structured interviews with industry executives, technical experts, and key stakeholders across transformer manufacturing, utility companies, and industrial end users throughout the region.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. Market sizing and forecasting utilize bottom-up and top-down approaches, incorporating economic indicators, infrastructure investment data, and electricity demand projections for accurate market assessment.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review panels. Industry consultations and technical advisory inputs provide market insights and validate research findings. MarkWide Research employs rigorous quality control measures to ensure data reliability and analytical precision.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning studies. Market segmentation analysis covers product types, voltage levels, applications, and geographical regions. Forecasting models incorporate economic scenarios, policy impacts, and technology adoption curves for comprehensive market projections.

Brazil dominates the South America transformer market with approximately 45% regional market share, driven by its large economy, extensive electrical infrastructure, and significant industrial base. The country’s power sector modernization initiatives, renewable energy expansion, and urban development projects create substantial transformer demand across all categories. Brazilian manufacturers also serve regional export markets.

Argentina represents the second-largest regional market with strong demand for power transformers and distribution equipment. The country’s electrical grid modernization efforts and industrial development drive market growth. Argentina’s focus on renewable energy development, particularly wind power, creates opportunities for specialized transformer applications.

Chile demonstrates robust market growth potential with approximately 12% regional market share, supported by mining industry expansion and renewable energy development. The country’s solar energy projects and grid interconnection initiatives require specialized transformers. Chile’s stable economic environment attracts international transformer manufacturers and technology providers.

Colombia and Peru show emerging market characteristics with growing electricity demand and infrastructure development needs. These countries benefit from economic growth, urbanization trends, and government investments in electrical infrastructure. Regional integration projects and cross-border electrical connections create additional transformer demand opportunities.

International manufacturers maintain strong positions in the South America transformer market through established distribution networks and technical capabilities:

Regional manufacturers compete effectively in specific market segments through cost advantages, local market knowledge, and customer relationships. These companies often focus on distribution transformers and standard applications while partnering with international firms for advanced technologies.

By Product Type:

By Voltage Level:

By Application:

Power transformers represent the highest-value market segment, driven by transmission network expansion and power generation projects. These large transformers require sophisticated manufacturing capabilities and extensive testing facilities. The segment benefits from renewable energy development and grid interconnection projects across South America.

Distribution transformers constitute the largest volume segment with steady demand from urbanization and electrification projects. This category shows strong growth in residential and commercial developments, with increasing adoption of energy-efficient designs. Regional manufacturers compete effectively in standard distribution transformer applications.

Smart transformers emerge as a growing category with approximately 15% annual growth rate in adoption. These advanced units incorporate monitoring, communication, and control capabilities for smart grid applications. The segment attracts premium pricing and creates opportunities for technology-focused manufacturers.

Renewable energy transformers show specialized growth driven by solar, wind, and hydroelectric projects. These applications require transformers designed for variable power generation and grid integration challenges. The category benefits from South America’s renewable energy expansion and environmental sustainability initiatives.

Manufacturers benefit from growing market demand and opportunities for local production expansion. The regional market offers attractive growth prospects with less saturated conditions compared to mature markets. Companies establishing manufacturing presence gain cost advantages and improved market access while supporting local economic development.

Utility companies access improved transformer technologies and competitive pricing through market competition. The expanding supplier base provides better procurement options and technical support capabilities. Utilities benefit from energy-efficient transformers that reduce operational costs and support sustainability objectives.

Industrial end users gain access to specialized transformer solutions and comprehensive technical support. The competitive market environment drives innovation and cost optimization, benefiting industrial customers through improved product offerings and service quality. Custom solutions address specific industrial requirements and operational challenges.

Government stakeholders benefit from infrastructure development support and technology transfer opportunities. Local transformer manufacturing creates employment opportunities and reduces import dependence. The market development supports broader economic objectives including energy security and industrial capability building.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with transformers incorporating IoT sensors, communication capabilities, and predictive analytics. These smart transformers enable remote monitoring, condition assessment, and predictive maintenance, reducing operational costs and improving reliability. The trend toward digitalization creates new business models and service opportunities.

Energy efficiency focus drives adoption of amorphous core transformers and advanced insulation materials. Regulatory requirements and utility cost reduction objectives promote high-efficiency transformer designs. This trend benefits manufacturers with energy-efficient product portfolios and creates differentiation opportunities in competitive markets.

Renewable energy integration influences transformer design requirements and market demand patterns. Solar and wind power installations require transformers capable of handling variable power generation and grid integration challenges. This trend creates specialized market segments and technical requirements for transformer manufacturers.

Modular design approaches gain popularity for improved manufacturing efficiency and reduced installation time. Modular transformers offer flexibility in capacity expansion and simplified maintenance procedures. This trend particularly benefits distribution transformer applications and supports rapid deployment requirements.

Manufacturing capacity expansion continues across the region with several international companies establishing or expanding production facilities. These investments support growing market demand while reducing logistics costs and improving delivery times. Local manufacturing also creates employment opportunities and technology transfer benefits.

Technology partnerships between international manufacturers and regional companies facilitate knowledge transfer and market development. These collaborations combine global technical expertise with local market knowledge, creating competitive advantages for participating companies. Joint ventures and licensing agreements become common market entry strategies.

Grid modernization projects across major South American countries drive demand for advanced transformer technologies. These initiatives incorporate smart grid capabilities, renewable energy integration, and improved system reliability. MarkWide Research analysis indicates that grid modernization investments will accelerate transformer market growth over the forecast period.

Sustainability initiatives influence product development and manufacturing processes throughout the industry. Companies focus on eco-friendly transformer designs, recyclable materials, and reduced environmental impact. These developments align with regional environmental objectives and create market differentiation opportunities.

Market entry strategies should prioritize local partnerships and manufacturing capabilities to compete effectively in the South America transformer market. Companies entering the region benefit from collaborating with established distributors and technical service providers. Local manufacturing presence becomes increasingly important for cost competitiveness and market responsiveness.

Technology investment in smart transformer capabilities and renewable energy applications positions companies for future growth opportunities. The market evolution toward intelligent electrical infrastructure creates premium pricing opportunities for advanced products. Companies should balance technology advancement with cost competitiveness for different market segments.

Service expansion represents a significant opportunity for revenue growth and customer relationship strengthening. Comprehensive service offerings including installation, commissioning, maintenance, and monitoring services create competitive advantages and recurring revenue streams. Digital service capabilities become particularly valuable for customer retention.

Regional specialization allows companies to develop expertise in specific South American market requirements and applications. Understanding local regulations, customer preferences, and technical requirements enables better product positioning and customer service. Regional specialization creates barriers for competitors and improves market penetration.

Market growth prospects remain positive with the South America transformer market expected to maintain robust expansion driven by infrastructure development and renewable energy growth. The market benefits from favorable long-term trends including urbanization, industrial development, and electrical grid modernization across the region.

Technology evolution will accelerate with increasing adoption of smart transformers and digital monitoring capabilities. The integration of artificial intelligence, machine learning, and IoT technologies will transform transformer functionality and create new value propositions. These technological advances support the development of more efficient and reliable electrical infrastructure.

Renewable energy integration will continue driving specialized transformer demand with the regional renewable capacity expected to reach 40% of total generation by 2035. This growth creates sustained demand for transformers designed for solar, wind, and hydroelectric applications. The renewable energy trend also promotes distributed generation and microgrid applications.

Regional manufacturing capabilities will expand as companies invest in local production facilities and technology transfer initiatives. This development reduces import dependence, creates employment opportunities, and improves market competitiveness. MWR projects that regional manufacturing capacity will increase significantly over the forecast period, supporting market growth and economic development objectives.

The South America transformer market presents compelling growth opportunities driven by infrastructure development, renewable energy expansion, and technological advancement across the region. Market dynamics favor companies with local manufacturing capabilities, advanced technology offerings, and comprehensive service portfolios. The regional market benefits from favorable long-term trends including urbanization, industrial development, and electrical grid modernization.

Success factors in this dynamic market include strategic partnerships, technology innovation, and customer-focused service offerings. Companies that establish strong regional presence while maintaining technological competitiveness will capture the most significant market opportunities. The evolution toward smart grid technologies and renewable energy integration creates premium market segments for advanced transformer solutions.

Future market development will be characterized by continued growth, technological advancement, and increasing regional manufacturing capabilities. The South America transformer market represents an attractive opportunity for both international manufacturers and regional players willing to invest in technology, manufacturing, and market development initiatives that support the region’s electrical infrastructure advancement and economic growth objectives.

What is Transformer?

Transformers are electrical devices that transfer electrical energy between two or more circuits through electromagnetic induction. They are essential in power distribution and voltage regulation in various applications, including industrial, commercial, and residential sectors.

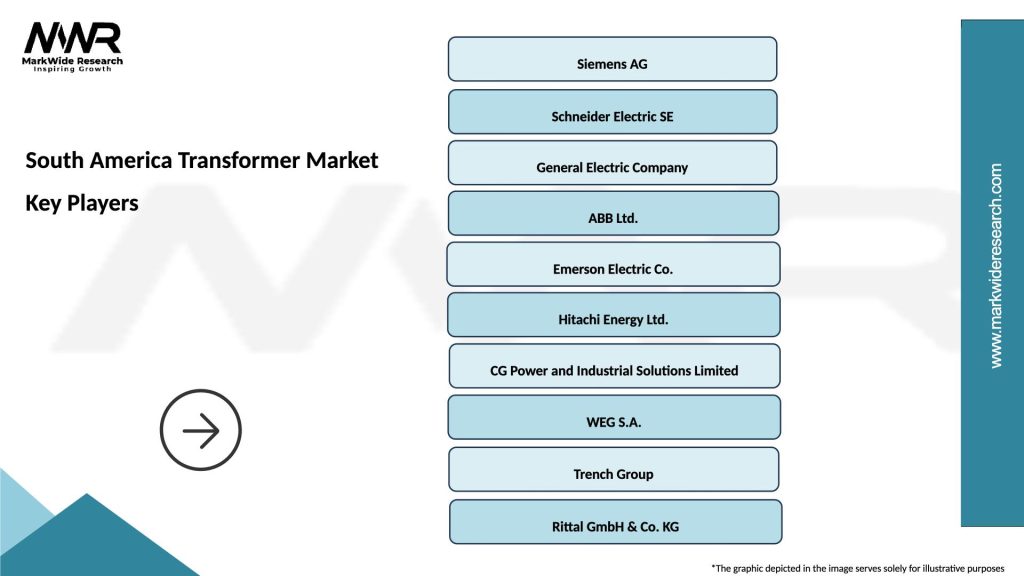

What are the key players in the South America Transformer Market?

Key players in the South America Transformer Market include Siemens, Schneider Electric, and ABB, among others. These companies are involved in manufacturing and supplying a range of transformers for various applications, including renewable energy and industrial use.

What are the growth factors driving the South America Transformer Market?

The South America Transformer Market is driven by increasing demand for electricity, expansion of renewable energy projects, and modernization of power infrastructure. Additionally, urbanization and industrial growth contribute to the rising need for efficient power distribution systems.

What challenges does the South America Transformer Market face?

The South America Transformer Market faces challenges such as regulatory hurdles, fluctuating raw material prices, and the need for skilled labor. These factors can impact production costs and the timely delivery of transformer solutions.

What opportunities exist in the South America Transformer Market?

Opportunities in the South America Transformer Market include the increasing investment in smart grid technologies and the growing focus on energy efficiency. Additionally, the rise of electric vehicles presents new avenues for transformer applications in charging infrastructure.

What trends are shaping the South America Transformer Market?

Trends in the South America Transformer Market include the adoption of digital technologies for monitoring and maintenance, as well as the integration of renewable energy sources. There is also a growing emphasis on sustainable practices and reducing the environmental impact of transformer production.

South America Transformer Market

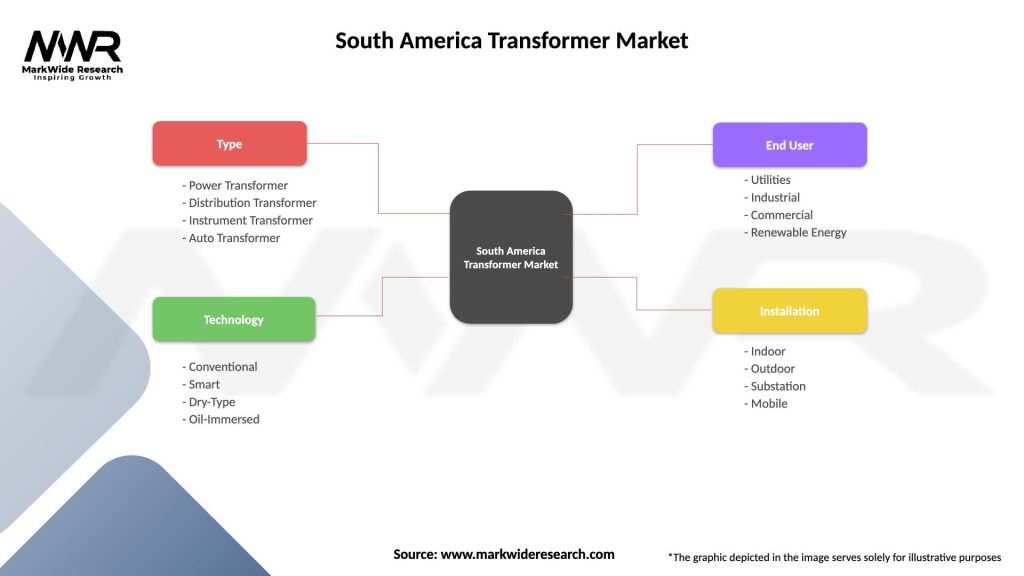

| Segmentation Details | Description |

|---|---|

| Type | Power Transformer, Distribution Transformer, Instrument Transformer, Auto Transformer |

| Technology | Conventional, Smart, Dry-Type, Oil-Immersed |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Installation | Indoor, Outdoor, Substation, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Transformer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at