444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America temperature monitoring market represents a rapidly expanding sector driven by increasing industrial automation, stringent regulatory requirements, and growing awareness of quality control across multiple industries. This comprehensive market encompasses advanced temperature sensing technologies, wireless monitoring systems, and sophisticated data analytics platforms that enable real-time temperature tracking and control across diverse applications.

Market dynamics in South America reflect a significant transformation toward digitalization and Industry 4.0 adoption, with countries like Brazil, Argentina, and Chile leading the regional growth trajectory. The market demonstrates robust expansion potential, with analysts projecting a compound annual growth rate (CAGR) of 8.2% through the forecast period, driven by increasing demand from pharmaceutical, food and beverage, healthcare, and manufacturing sectors.

Regional characteristics include diverse industrial landscapes ranging from agricultural processing facilities in Brazil to mining operations in Chile and Peru. This diversity creates unique temperature monitoring requirements, fostering innovation in sensor technologies, wireless communication protocols, and cloud-based monitoring platforms. The market benefits from increasing foreign investment, technology transfer initiatives, and growing emphasis on operational efficiency and regulatory compliance.

Technology adoption patterns across South America show accelerating integration of Internet of Things (IoT) enabled temperature monitoring solutions, with wireless sensor networks achieving 65% market penetration in industrial applications. This technological evolution supports enhanced data collection capabilities, predictive maintenance strategies, and improved operational decision-making across various industry verticals.

The South America temperature monitoring market refers to the comprehensive ecosystem of technologies, devices, and services designed to measure, track, and control temperature conditions across various industrial, commercial, and institutional applications throughout the South American region. This market encompasses hardware components including sensors, data loggers, and wireless transmitters, alongside software platforms for data analysis, reporting, and system integration.

Temperature monitoring systems serve critical functions in maintaining product quality, ensuring regulatory compliance, protecting sensitive equipment, and optimizing operational processes. These solutions range from simple standalone devices to complex networked systems capable of monitoring thousands of temperature points simultaneously across multiple locations and facilities.

Market scope includes various technology categories such as wired and wireless temperature sensors, cloud-based monitoring platforms, mobile applications for remote access, and integrated building management systems. The solutions address diverse requirements including cold chain management, pharmaceutical storage, food safety compliance, HVAC optimization, and industrial process control throughout South American markets.

Market performance in South America’s temperature monitoring sector demonstrates exceptional growth momentum, supported by increasing industrialization, regulatory modernization, and technological advancement across key regional economies. The market benefits from substantial investments in infrastructure development, digital transformation initiatives, and quality assurance programs that drive demand for sophisticated temperature monitoring solutions.

Key growth drivers include expanding pharmaceutical manufacturing capabilities, modernization of food processing facilities, and increasing adoption of cold chain logistics systems. The healthcare sector particularly contributes to market expansion, with 42% of new installations occurring in hospitals, clinics, and pharmaceutical storage facilities across major South American cities.

Technology trends reveal significant migration toward wireless and IoT-enabled monitoring systems, with traditional wired solutions representing declining market share. Cloud-based platforms demonstrate rapid adoption rates, offering scalability, remote accessibility, and advanced analytics capabilities that appeal to both large enterprises and small-to-medium businesses throughout the region.

Competitive landscape features a mix of international technology providers and emerging regional players, creating dynamic market conditions that foster innovation and competitive pricing. This environment benefits end-users through improved product offerings, enhanced service capabilities, and more accessible pricing structures across various market segments.

Primary market insights reveal several critical trends shaping the South America temperature monitoring landscape:

Market maturity varies significantly across South American countries, with Brazil and Argentina demonstrating advanced adoption patterns while emerging markets in the region present substantial growth opportunities for temperature monitoring technology providers.

Regulatory compliance requirements serve as the primary market driver, with South American governments implementing increasingly stringent regulations for food safety, pharmaceutical storage, and environmental monitoring. These regulatory frameworks mandate continuous temperature monitoring and documentation, creating sustained demand for certified monitoring solutions across multiple industry sectors.

Industrial modernization initiatives throughout South America drive significant investments in advanced monitoring technologies. Manufacturing facilities, processing plants, and distribution centers prioritize automation and digitalization projects that include comprehensive temperature monitoring capabilities as essential components of operational efficiency strategies.

Healthcare sector expansion creates substantial demand for temperature monitoring solutions, particularly in pharmaceutical manufacturing, vaccine storage, and hospital facility management. The growing emphasis on healthcare quality and patient safety drives adoption of sophisticated monitoring systems that ensure optimal storage conditions for temperature-sensitive medical products and supplies.

Cold chain logistics growth reflects increasing consumer demand for fresh and frozen products, pharmaceutical distribution, and e-commerce fulfillment services. This expansion requires comprehensive temperature monitoring throughout the supply chain, from production facilities to final delivery points, creating opportunities for integrated monitoring solutions.

Energy management priorities motivate organizations to implement smart monitoring systems that optimize HVAC and refrigeration operations. Rising energy costs and environmental sustainability goals drive adoption of monitoring technologies that enable precise temperature control and energy consumption optimization across various facility types.

High implementation costs present significant barriers for small and medium-sized enterprises across South America, particularly in emerging markets where capital constraints limit technology adoption. Initial investments in comprehensive monitoring systems, including sensors, infrastructure, and software platforms, can represent substantial financial commitments that challenge budget-conscious organizations.

Technical complexity associated with advanced monitoring systems creates implementation challenges, particularly in organizations with limited technical expertise or IT infrastructure. Integration requirements, system configuration, and ongoing maintenance needs can overwhelm internal capabilities, necessitating external support services that increase total ownership costs.

Infrastructure limitations in certain South American regions constrain deployment of sophisticated monitoring solutions. Unreliable power supply, limited internet connectivity, and inadequate telecommunications infrastructure can compromise system performance and reliability, particularly in remote or rural locations.

Skills shortage affects market growth as organizations struggle to find qualified personnel capable of implementing, maintaining, and optimizing temperature monitoring systems. This challenge is particularly acute in emerging markets where technical education and training programs may not adequately address evolving technology requirements.

Economic volatility in certain South American markets creates uncertainty that affects capital investment decisions. Currency fluctuations, inflation concerns, and changing economic conditions can delay or reduce technology investments, impacting market growth potential across various industry sectors.

Digital transformation acceleration across South America creates substantial opportunities for temperature monitoring technology providers. Organizations increasingly recognize the value of data-driven decision making and operational optimization, driving demand for advanced monitoring solutions that integrate with broader digital infrastructure initiatives.

Emerging market penetration offers significant growth potential as smaller economies in South America develop industrial capabilities and regulatory frameworks. Countries like Paraguay, Uruguay, and Ecuador present opportunities for technology providers to establish market presence and build long-term customer relationships in developing markets.

Industry 4.0 adoption creates demand for sophisticated monitoring solutions that support smart manufacturing, predictive maintenance, and automated quality control processes. This technological evolution enables temperature monitoring providers to offer value-added services including analytics, consulting, and system integration capabilities.

Sustainability initiatives drive demand for monitoring solutions that support environmental compliance, energy efficiency, and waste reduction objectives. Organizations seek technologies that demonstrate measurable environmental benefits while improving operational performance and regulatory compliance.

Public-private partnerships in infrastructure development create opportunities for large-scale monitoring system deployments in healthcare facilities, educational institutions, and government buildings. These partnerships can accelerate market adoption while providing stable revenue streams for technology providers.

Supply chain evolution significantly influences market dynamics as South American businesses adapt to changing consumer expectations, regulatory requirements, and competitive pressures. Temperature monitoring becomes increasingly critical for maintaining product quality, ensuring compliance, and optimizing operational efficiency throughout complex supply networks.

Technology convergence creates dynamic market conditions as traditional temperature monitoring solutions integrate with IoT platforms, cloud computing services, and artificial intelligence capabilities. This convergence enables new business models, service offerings, and value propositions that reshape competitive landscapes and customer expectations.

Customer sophistication increases as South American organizations develop greater understanding of temperature monitoring technologies and their potential benefits. This evolution drives demand for more advanced features, better integration capabilities, and comprehensive support services that challenge providers to continuously innovate and improve their offerings.

Competitive intensity escalates as international technology companies expand their South American presence while regional players develop specialized solutions for local market requirements. This competition benefits customers through improved products, competitive pricing, and enhanced service capabilities across various market segments.

Regulatory evolution continues to shape market dynamics as governments update standards, introduce new requirements, and enhance enforcement capabilities. These changes create both opportunities and challenges for market participants, requiring continuous adaptation and compliance investment to maintain market position.

Comprehensive research approach employed for analyzing the South America temperature monitoring market incorporates multiple data collection methodologies, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technology providers, end-users, and regulatory officials across major South American markets. These interactions provide firsthand insights into market trends, customer requirements, competitive dynamics, and technology adoption patterns that inform market analysis and forecasting.

Secondary research components encompass analysis of industry reports, government publications, regulatory documents, and company financial statements to establish comprehensive market context and validate primary research findings. This approach ensures thorough coverage of market factors and influences that shape industry development.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and applying statistical analysis techniques to ensure data accuracy and reliability. Market projections undergo rigorous review and validation to provide stakeholders with dependable insights for strategic decision-making.

Analytical frameworks incorporate quantitative and qualitative assessment methodologies that evaluate market size, growth potential, competitive positioning, and technology trends. These frameworks enable comprehensive market understanding that supports strategic planning and investment decision-making across various stakeholder categories.

Brazil dominates the South America temperature monitoring market, accounting for approximately 45% of regional market share due to its large industrial base, advanced healthcare infrastructure, and comprehensive regulatory framework. The country’s pharmaceutical manufacturing sector, food processing industry, and expanding cold chain logistics network drive substantial demand for sophisticated monitoring solutions.

Argentina represents the second-largest regional market, with strong growth in pharmaceutical manufacturing, agricultural processing, and healthcare facility modernization. The country’s emphasis on export quality standards and regulatory compliance creates sustained demand for certified temperature monitoring systems across multiple industry sectors.

Chile demonstrates significant market potential driven by mining industry requirements, wine production facilities, and growing pharmaceutical sector. The country’s stable economic environment and advanced telecommunications infrastructure support adoption of sophisticated wireless and IoT-enabled monitoring solutions.

Colombia and Peru exhibit rapid market growth as industrial development accelerates and regulatory frameworks modernize. These markets present opportunities for technology providers to establish presence in emerging economies with substantial long-term growth potential.

Smaller regional markets including Uruguay, Paraguay, and Ecuador show increasing adoption of temperature monitoring technologies, particularly in agricultural processing, healthcare facilities, and cold storage applications. These markets benefit from technology transfer and investment from larger regional economies.

Market leadership in South America’s temperature monitoring sector features a diverse mix of international technology companies and regional specialists that compete across various market segments and application areas:

Competitive strategies focus on technology innovation, local market presence, customer service excellence, and strategic partnerships with regional distributors and system integrators. Companies invest in research and development, market education, and technical support capabilities to maintain competitive advantage.

Regional players complement international providers by offering specialized solutions, local support services, and competitive pricing for specific market segments. These companies often focus on niche applications or provide customized solutions that address unique regional requirements.

By Technology:

By Application:

By End-User:

Healthcare and pharmaceutical applications demonstrate the highest growth potential within the South America temperature monitoring market, driven by increasing regulatory requirements, expanding pharmaceutical manufacturing, and growing emphasis on patient safety. This segment requires the most sophisticated monitoring capabilities, including continuous data logging, alarm systems, and comprehensive documentation features.

Food and beverage sector represents the largest application category by volume, encompassing diverse requirements from large-scale processing facilities to small retail establishments. This segment benefits from increasing consumer awareness of food safety, export quality requirements, and regulatory compliance mandates that drive systematic adoption of monitoring technologies.

Industrial manufacturing applications show steady growth as South American manufacturers modernize facilities and implement Industry 4.0 technologies. Temperature monitoring becomes integral to process optimization, equipment protection, and quality assurance programs that improve operational efficiency and product quality.

HVAC and building management applications expand rapidly as commercial real estate development accelerates and energy efficiency becomes a priority. This segment benefits from integration opportunities with building automation systems and smart building technologies that optimize facility operations.

Transportation and logistics category experiences significant growth driven by e-commerce expansion, pharmaceutical distribution requirements, and cold chain modernization initiatives. This segment requires robust, portable monitoring solutions capable of maintaining data integrity throughout complex supply chains.

Technology providers benefit from expanding market opportunities across diverse industry sectors and geographic regions throughout South America. The growing emphasis on digitalization, regulatory compliance, and operational efficiency creates sustained demand for innovative monitoring solutions and related services.

End-user organizations realize significant operational benefits including improved product quality, enhanced regulatory compliance, reduced waste, and optimized energy consumption. Advanced monitoring systems enable data-driven decision making, predictive maintenance strategies, and automated quality control processes that improve overall business performance.

System integrators and distributors capitalize on growing demand for comprehensive monitoring solutions by offering value-added services including system design, installation, training, and ongoing support. These partners play crucial roles in market development and customer success across various application areas.

Regulatory agencies benefit from improved compliance monitoring, enhanced data transparency, and more effective enforcement capabilities enabled by advanced monitoring technologies. Digital documentation and automated reporting features support regulatory oversight while reducing administrative burden on both agencies and regulated organizations.

Consumers and society ultimately benefit from improved product safety, quality assurance, and environmental protection enabled by comprehensive temperature monitoring throughout supply chains and facility operations. These benefits contribute to public health, consumer confidence, and environmental sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless technology dominance represents the most significant trend shaping the South America temperature monitoring market, with wireless solutions achieving 78% adoption rate in new installations. This trend reflects customer preferences for flexible deployment, reduced installation costs, and enhanced scalability compared to traditional wired systems.

Cloud-based platforms demonstrate rapid adoption as organizations seek scalable, accessible monitoring solutions that support remote management and advanced analytics capabilities. Cloud deployment eliminates local server requirements while providing enhanced data security, automatic updates, and improved system reliability.

Mobile accessibility becomes increasingly important as facility managers and quality assurance personnel require real-time access to monitoring data from smartphones and tablets. Mobile applications enable immediate response to alarm conditions, remote system management, and improved operational flexibility.

Artificial intelligence integration emerges as organizations seek predictive analytics, automated anomaly detection, and intelligent alarm management capabilities. AI-powered monitoring systems can identify patterns, predict equipment failures, and optimize operational parameters to improve efficiency and reduce costs.

Integration requirements drive demand for monitoring solutions that seamlessly connect with existing enterprise resource planning, building management, and quality management systems. This integration enables comprehensive data analysis, automated reporting, and streamlined operational workflows.

Sustainability focus influences purchasing decisions as organizations prioritize energy-efficient monitoring solutions that support environmental objectives while reducing operational costs. Green technology features become important differentiators in competitive evaluations.

Regulatory modernization across South America continues to drive market development as governments update temperature monitoring requirements for various industries. Recent regulatory changes in Brazil and Argentina mandate continuous monitoring and digital documentation for pharmaceutical and food processing facilities, creating immediate demand for compliant monitoring solutions.

Technology partnerships between international monitoring system providers and regional distributors accelerate market penetration and customer support capabilities. These partnerships enable technology transfer, local manufacturing opportunities, and enhanced service delivery throughout South American markets.

Investment initiatives in healthcare infrastructure modernization create substantial opportunities for temperature monitoring technology providers. Government and private sector investments in hospital facilities, pharmaceutical manufacturing, and medical device production drive demand for sophisticated monitoring capabilities.

Digital transformation programs implemented by major South American corporations include comprehensive monitoring system upgrades as essential components of operational modernization. These programs typically involve integration of monitoring systems with broader enterprise technology platforms and analytics capabilities.

Research and development activities focus on developing monitoring solutions specifically adapted to South American market requirements, including harsh environmental conditions, infrastructure limitations, and cost constraints. These efforts result in more robust, affordable solutions that address regional market needs.

MarkWide Research recommends that temperature monitoring technology providers prioritize wireless and IoT-enabled solutions to capitalize on strong market demand for flexible, scalable monitoring capabilities. Organizations should invest in cloud-based platforms and mobile applications that address evolving customer requirements for remote accessibility and advanced analytics.

Market entry strategies should emphasize partnerships with established regional distributors and system integrators who possess local market knowledge, customer relationships, and technical support capabilities. These partnerships accelerate market penetration while reducing investment requirements and operational risks.

Product development initiatives should focus on cost-effective solutions that address the needs of small and medium-sized enterprises throughout South America. Simplified installation procedures, intuitive user interfaces, and flexible pricing models can expand market accessibility and drive volume growth.

Service capabilities become increasingly important as customers seek comprehensive support including system design, installation, training, and ongoing maintenance. Technology providers should develop local service capabilities or partner with qualified service organizations to ensure customer success and satisfaction.

Regulatory compliance requires continuous attention as South American governments update standards and enforcement procedures. Companies should maintain current knowledge of regulatory requirements and ensure their solutions meet or exceed applicable standards across various market segments.

Market trajectory for South America’s temperature monitoring sector indicates sustained growth driven by industrial modernization, regulatory evolution, and technology advancement. The market is projected to maintain robust expansion with compound annual growth rates exceeding 8% through the next five years, supported by increasing adoption across multiple industry sectors.

Technology evolution will continue toward more sophisticated, integrated monitoring solutions that combine temperature sensing with other environmental parameters, predictive analytics, and automated control capabilities. These advanced systems will enable more comprehensive facility management and operational optimization.

Market maturation in developed South American economies will drive demand for premium monitoring solutions with advanced features, while emerging markets will focus on cost-effective basic systems that provide essential monitoring capabilities. This bifurcation creates opportunities for providers across various market segments.

Industry consolidation may occur as larger technology companies acquire regional specialists and smaller providers to expand market presence and capabilities. This consolidation could accelerate technology development and improve customer service capabilities throughout the region.

Regulatory harmonization across South American countries may simplify compliance requirements and create opportunities for standardized monitoring solutions that serve multiple markets. This development would reduce complexity and costs for both technology providers and end-users operating across regional boundaries.

The South America temperature monitoring market presents exceptional growth opportunities driven by industrial modernization, regulatory advancement, and increasing emphasis on quality control and operational efficiency. Market dynamics favor technology providers who can deliver innovative, cost-effective solutions that address diverse customer requirements across various industry sectors and geographic regions.

Competitive success requires understanding of local market conditions, regulatory requirements, and customer preferences that vary significantly across South American countries. Technology providers must balance advanced capabilities with affordability while ensuring reliable performance in challenging environmental conditions and infrastructure constraints.

Future market development will be shaped by continued technology evolution, regulatory modernization, and economic growth throughout the region. Organizations that invest in wireless technologies, cloud-based platforms, and comprehensive service capabilities will be best positioned to capitalize on expanding market opportunities and achieve sustainable competitive advantage in this dynamic and growing market.

What is Temperature Monitoring?

Temperature monitoring refers to the process of measuring and recording temperature levels in various environments, such as industrial, agricultural, and healthcare settings. It is essential for ensuring safety, compliance, and efficiency in operations.

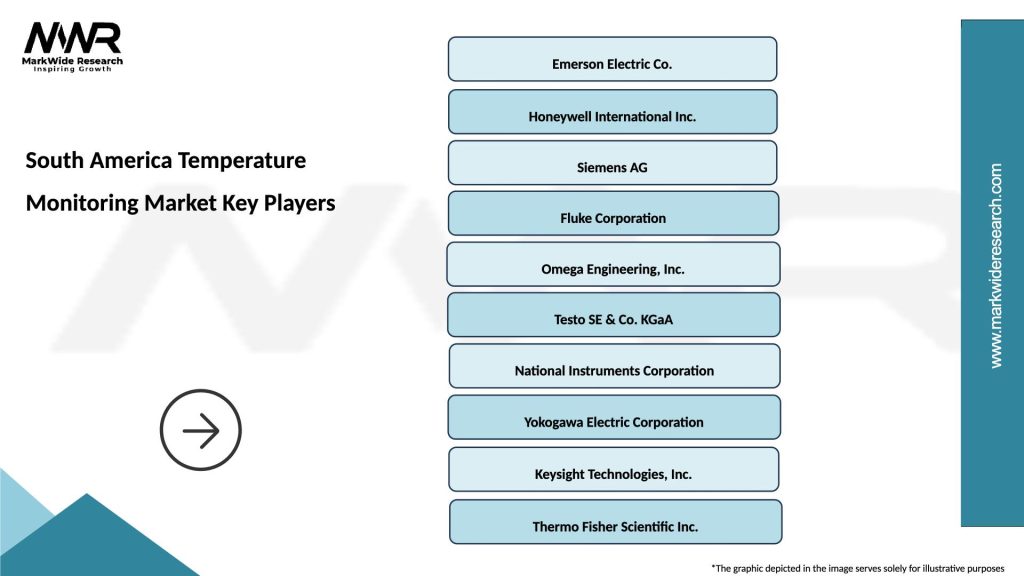

What are the key players in the South America Temperature Monitoring Market?

Key players in the South America Temperature Monitoring Market include companies like Omega Engineering, Fluke Corporation, and Testo SE & Co. KGaA, which provide a range of temperature monitoring solutions for different applications, among others.

What are the growth factors driving the South America Temperature Monitoring Market?

The South America Temperature Monitoring Market is driven by increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with the growing need for compliance with safety regulations. Additionally, advancements in IoT technology are enhancing monitoring capabilities.

What challenges does the South America Temperature Monitoring Market face?

Challenges in the South America Temperature Monitoring Market include the high costs associated with advanced monitoring systems and the need for skilled personnel to operate and maintain these technologies. Additionally, varying regulatory standards across countries can complicate compliance.

What opportunities exist in the South America Temperature Monitoring Market?

Opportunities in the South America Temperature Monitoring Market include the expansion of smart agriculture practices and the increasing adoption of automated monitoring systems in industries. The rise of e-commerce also presents a growing need for effective temperature control during logistics.

What trends are shaping the South America Temperature Monitoring Market?

Trends in the South America Temperature Monitoring Market include the integration of wireless technology for real-time monitoring and the development of advanced data analytics tools. Additionally, there is a growing focus on sustainability and energy efficiency in temperature monitoring solutions.

South America Temperature Monitoring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Thermometers, Data Loggers, Infrared Sensors, Wireless Sensors |

| Technology | Analog, Digital, IoT-enabled, Wireless |

| End User | Agriculture, Food & Beverage, Pharmaceuticals, Laboratories |

| Installation | Fixed, Portable, Wall-mounted, Handheld |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Temperature Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at