444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America sodium reduction ingredient market represents a rapidly evolving sector within the regional food and beverage industry, driven by increasing health consciousness and regulatory pressures to reduce sodium consumption. Food manufacturers across Argentina, Brazil, Chile, Colombia, and other South American nations are increasingly adopting innovative sodium reduction solutions to meet consumer demands for healthier products while maintaining taste profiles and food safety standards.

Market dynamics indicate that the region is experiencing significant growth in demand for sodium reduction ingredients, with the market expanding at a compound annual growth rate of 6.2% over the forecast period. This growth trajectory reflects the increasing awareness of sodium-related health issues, including hypertension and cardiovascular diseases, which affect a substantial portion of the South American population.

Regional manufacturers are investing heavily in research and development to create effective sodium reduction solutions that cater to local taste preferences and traditional food preparations. The market encompasses various ingredient categories, including potassium-based alternatives, yeast extracts, mineral salts, and flavor enhancers that enable food producers to reduce sodium content by up to 50% without compromising product quality or consumer acceptance.

Brazil dominates the South American sodium reduction ingredient market, accounting for approximately 42% of regional demand, followed by Argentina and Chile as significant contributors to market growth. The increasing prevalence of processed food consumption and growing health awareness among consumers are primary factors driving market expansion across the region.

The South America sodium reduction ingredient market refers to the commercial sector encompassing the production, distribution, and application of specialized food ingredients designed to reduce sodium content in processed foods and beverages while maintaining taste, texture, and preservation properties. These ingredients serve as alternatives or supplements to traditional sodium chloride, enabling food manufacturers to create healthier product formulations that align with dietary guidelines and consumer preferences for reduced-sodium options.

Sodium reduction ingredients include a diverse range of compounds such as potassium chloride, calcium chloride, magnesium sulfate, yeast extracts, hydrolyzed vegetable proteins, and various flavor enhancers that can partially or completely replace conventional salt in food applications. The market encompasses both natural and synthetic alternatives that help manufacturers achieve significant sodium reductions while preserving the sensory characteristics that consumers expect from their favorite food products.

Market growth in the South American sodium reduction ingredient sector is being propelled by a confluence of factors including rising health consciousness, government initiatives to reduce population sodium intake, and increasing prevalence of lifestyle-related diseases. The market is characterized by strong demand from the processed food industry, particularly in the bakery, dairy, meat processing, and snack food segments.

Key market drivers include the implementation of sodium reduction regulations in several South American countries, with governments mandating gradual sodium reductions of 10-25% across various food categories over the next five years. Consumer awareness campaigns about the health risks associated with excessive sodium consumption have resulted in 68% of South American consumers actively seeking lower-sodium food options when making purchasing decisions.

Technological advancements in ingredient formulation and processing techniques are enabling manufacturers to develop more effective sodium reduction solutions that maintain product quality and shelf life. The market is witnessing increased investment in research and development, with companies focusing on creating region-specific solutions that cater to traditional South American cuisine preferences and cooking methods.

Competitive landscape features both international ingredient suppliers and regional manufacturers working to establish strong market positions through strategic partnerships, product innovation, and distribution network expansion. The market is expected to continue its upward trajectory, supported by favorable regulatory environments and growing consumer demand for healthier food options.

Market penetration of sodium reduction ingredients varies significantly across South American countries, with more developed economies showing higher adoption rates among food manufacturers. The following key insights highlight the current market landscape:

Health awareness initiatives represent the primary driver of growth in the South American sodium reduction ingredient market. Government health agencies across the region have launched comprehensive campaigns highlighting the connection between excessive sodium consumption and cardiovascular diseases, hypertension, and stroke. These initiatives have successfully increased consumer awareness, with surveys indicating that 72% of South American consumers now actively read nutrition labels and seek products with reduced sodium content.

Regulatory frameworks implemented by national governments are creating mandatory requirements for food manufacturers to reduce sodium levels in processed foods. Countries like Brazil, Argentina, and Chile have established progressive sodium reduction targets, requiring manufacturers to achieve specific reduction percentages within defined timeframes. These regulations are compelling food companies to invest in sodium reduction ingredients and reformulation technologies.

Rising healthcare costs associated with diet-related diseases are motivating both governments and consumers to prioritize preventive health measures. The economic burden of treating hypertension and cardiovascular conditions has reached critical levels in several South American countries, prompting policy makers to implement proactive measures to reduce population sodium intake through food industry regulations.

Consumer lifestyle changes and increasing urbanization are contributing to higher consumption of processed and convenience foods, creating opportunities for manufacturers to differentiate their products through healthier formulations. The growing middle class in South America is demonstrating increased willingness to pay premium prices for products that offer health benefits, including reduced sodium content.

Technical challenges in maintaining product quality while reducing sodium content represent significant obstacles for food manufacturers. Sodium plays crucial roles in food preservation, texture development, and flavor enhancement, making it difficult to achieve substantial reductions without affecting product characteristics. Many sodium reduction ingredients require complex formulation adjustments and may alter taste profiles in ways that consumers find unacceptable.

Cost considerations pose substantial barriers to widespread adoption of sodium reduction ingredients, particularly for small and medium-sized food manufacturers operating on tight profit margins. Alternative ingredients often cost significantly more than traditional sodium chloride, and the reformulation process requires additional research and development investments that may strain company resources.

Consumer acceptance remains a critical challenge, as taste preferences developed over generations are difficult to change. Many South American consumers associate reduced-sodium products with inferior taste quality, creating resistance to purchasing these items even when health benefits are clearly communicated. Cultural attachment to traditional flavors and cooking methods can impede market acceptance of reformulated products.

Supply chain limitations in certain South American regions restrict access to advanced sodium reduction ingredients, particularly in rural areas and smaller markets. Limited distribution networks and inadequate cold storage facilities can affect ingredient quality and availability, creating barriers to market expansion in underserved regions.

Emerging market segments present substantial opportunities for sodium reduction ingredient suppliers, particularly in the rapidly growing plant-based food sector and functional food categories. As South American consumers increasingly embrace vegetarian and vegan diets, manufacturers are seeking innovative ingredients that can enhance flavor profiles while maintaining low sodium content in plant-based products.

Technology partnerships between international ingredient companies and regional food manufacturers offer opportunities to develop customized solutions that address specific local market needs. These collaborations can accelerate product development timelines and create competitive advantages through specialized formulations tailored to South American taste preferences and regulatory requirements.

Export market potential exists for South American food manufacturers who successfully develop reduced-sodium products that meet international standards. Global demand for healthier food options creates opportunities to expand beyond domestic markets, particularly to North American and European markets where sodium reduction regulations are well-established.

Digital marketing channels provide new avenues for educating consumers about the benefits of reduced-sodium products and building brand loyalty around health-focused positioning. Social media platforms and e-commerce channels enable targeted marketing campaigns that can effectively reach health-conscious consumers and drive demand for products containing sodium reduction ingredients.

Supply and demand dynamics in the South American sodium reduction ingredient market are influenced by complex interactions between regulatory pressures, consumer preferences, and technological capabilities. MarkWide Research analysis indicates that demand is currently outpacing supply in several key ingredient categories, creating opportunities for new market entrants and capacity expansion by existing suppliers.

Price volatility affects market dynamics as raw material costs for sodium reduction ingredients fluctuate based on global commodity markets and regional supply chain disruptions. Manufacturers must balance cost considerations with performance requirements, leading to ongoing evaluation of ingredient alternatives and optimization of formulation strategies.

Innovation cycles are accelerating as companies invest in research and development to create next-generation sodium reduction solutions. The market is witnessing the emergence of novel ingredient combinations and processing technologies that enable greater sodium reductions while maintaining or improving product quality characteristics.

Competitive pressures are intensifying as more companies enter the sodium reduction ingredient market, leading to increased focus on product differentiation, customer service, and technical support capabilities. Market leaders are establishing competitive advantages through proprietary technologies, exclusive distribution agreements, and comprehensive application support services.

Primary research for the South American sodium reduction ingredient market analysis involved comprehensive surveys and interviews with key stakeholders across the food industry value chain. Data collection included responses from food manufacturers, ingredient suppliers, regulatory officials, and industry associations representing major South American markets including Brazil, Argentina, Chile, Colombia, and Peru.

Secondary research encompassed analysis of government publications, industry reports, trade association data, and academic studies related to sodium reduction initiatives and ingredient technologies. Market sizing and forecasting models incorporated historical consumption data, regulatory timeline analysis, and demographic trends affecting food consumption patterns across the region.

Market validation processes included cross-referencing data from multiple sources and conducting expert interviews with industry professionals possessing extensive experience in food ingredient markets. Quality assurance measures ensured data accuracy and reliability through systematic verification procedures and peer review processes.

Analytical frameworks applied advanced statistical modeling techniques to identify market trends, growth drivers, and competitive dynamics. Forecasting models incorporated multiple scenarios based on different regulatory implementation timelines and consumer adoption rates to provide comprehensive market projections.

Brazil dominates the South American sodium reduction ingredient market, representing approximately 42% of regional demand due to its large population, advanced food processing industry, and progressive regulatory environment. The Brazilian government has implemented comprehensive sodium reduction guidelines that require food manufacturers to achieve specific reduction targets across multiple product categories, driving substantial demand for alternative ingredients.

Argentina constitutes the second-largest market, accounting for roughly 23% of regional consumption, with strong growth driven by increasing health awareness and government initiatives to address rising rates of hypertension and cardiovascular disease. The Argentine food industry is actively reformulating products to meet consumer demands for healthier options while maintaining traditional flavor profiles.

Chile represents a rapidly growing market segment, contributing approximately 15% of regional demand, with particularly strong adoption in the processed meat and bakery sectors. Chilean consumers demonstrate high awareness of sodium-related health risks, creating favorable market conditions for reduced-sodium product launches and ingredient adoption.

Colombia and Peru together account for about 12% of market share, with emerging opportunities driven by urbanization trends and increasing processed food consumption. These markets show significant potential for growth as regulatory frameworks develop and consumer education initiatives expand awareness of sodium reduction benefits.

Smaller markets including Uruguay, Ecuador, and Bolivia represent the remaining 8% of regional demand, with growth potential limited by market size and distribution challenges but offering opportunities for specialized ingredient applications and niche product development.

Market leadership in the South American sodium reduction ingredient sector is characterized by a mix of international ingredient companies and regional specialists who have developed strong positions through strategic partnerships and localized product development. The competitive environment features both established multinational corporations and emerging regional players competing for market share.

Key market participants include:

Competitive strategies focus on product innovation, technical support services, and development of region-specific solutions that address local taste preferences and regulatory requirements. Companies are investing in application laboratories and customer support capabilities to help food manufacturers successfully implement sodium reduction strategies.

Market consolidation trends are emerging as larger companies acquire specialized ingredient suppliers and regional players to expand their product portfolios and geographic reach. Strategic partnerships between international suppliers and local distributors are becoming increasingly common to enhance market penetration and customer service capabilities.

By ingredient type, the South American sodium reduction ingredient market encompasses several distinct categories, each serving specific applications and performance requirements in food manufacturing processes:

By application segment, the market serves diverse food industry sectors with varying requirements and adoption rates:

Potassium-based ingredients represent the largest category within the South American sodium reduction ingredient market, accounting for approximately 35% of total consumption. These ingredients offer direct sodium replacement capabilities and are widely accepted by food manufacturers due to their proven effectiveness and regulatory approval status across the region.

Yeast extract products constitute a rapidly growing category, with demand increasing by 22% annually as manufacturers seek natural flavor enhancement solutions. These ingredients are particularly popular in the processed meat and snack food sectors, where they provide umami taste characteristics that help maintain consumer acceptance of reduced-sodium formulations.

Flavor enhancer compounds are gaining traction in applications where minimal formulation changes are desired. These specialized ingredients can amplify existing flavors, allowing manufacturers to reduce sodium content while maintaining taste intensity. The category is experiencing strong growth in the bakery and dairy sectors.

Mineral salt alternatives serve niche applications where specific functional properties are required beyond taste enhancement. Calcium and magnesium-based ingredients provide additional nutritional benefits while contributing to sodium reduction goals, making them attractive for functional food applications.

Hydrolyzed protein ingredients offer comprehensive solutions for manufacturers seeking to improve both taste and nutritional profiles. These ingredients are particularly effective in soup, sauce, and ready meal applications where complex flavor development is essential for consumer acceptance.

Food manufacturers benefit from sodium reduction ingredients through improved product positioning in health-conscious market segments and compliance with regulatory requirements. These ingredients enable companies to differentiate their products while maintaining quality standards and consumer acceptance levels that support market share growth and premium pricing opportunities.

Consumers gain access to healthier food options that support dietary goals for reduced sodium intake without sacrificing taste preferences. The availability of effectively reformulated products enables consumers to make healthier choices while continuing to enjoy familiar foods and flavors, contributing to improved public health outcomes.

Healthcare systems experience reduced burden from diet-related diseases as population sodium intake decreases through widespread adoption of sodium reduction ingredients. Lower rates of hypertension and cardiovascular disease translate to reduced healthcare costs and improved quality of life for South American populations.

Ingredient suppliers benefit from growing market demand and opportunities to develop innovative solutions that address specific regional needs. The expanding market creates revenue growth opportunities and incentives for continued research and development investment in advanced ingredient technologies.

Regulatory authorities achieve public health objectives through industry cooperation in implementing sodium reduction initiatives. The availability of effective ingredient solutions facilitates successful policy implementation and demonstrates the feasibility of achieving population health goals through industry collaboration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient preference is driving significant growth in plant-based sodium reduction solutions, with consumers increasingly seeking clean label products that avoid synthetic additives. This trend is particularly strong in the organic and premium food segments, where manufacturers are investing in natural yeast extracts, sea salt alternatives, and botanical flavor enhancers.

Customization and personalization trends are leading to development of application-specific ingredient solutions that address unique formulation challenges in different food categories. Suppliers are working closely with manufacturers to create tailored ingredient blends that optimize performance for specific products and production processes.

Sustainability focus is influencing ingredient sourcing and production methods, with companies prioritizing environmentally responsible supply chains and manufacturing processes. This trend is creating opportunities for suppliers who can demonstrate sustainable practices and reduced environmental impact in their operations.

Digital technology integration is transforming how ingredient suppliers support their customers through virtual application laboratories, online formulation tools, and digital technical support services. These technologies are improving efficiency and reducing time-to-market for new product development projects.

Functional food convergence is creating opportunities to combine sodium reduction with other health benefits such as protein fortification, vitamin enhancement, and probiotic integration. This trend enables manufacturers to create products that address multiple consumer health concerns simultaneously.

Regulatory milestone achievements include the successful implementation of phase one sodium reduction targets in Brazil and Argentina, demonstrating the feasibility of industry-wide reformulation efforts. These achievements have provided valuable data on consumer acceptance and technical implementation strategies that inform future policy development.

Technology breakthrough announcements from leading ingredient suppliers include the development of next-generation flavor enhancement systems that enable sodium reductions of up to 60% while maintaining taste quality. These innovations represent significant advances in ingredient technology and create new possibilities for product reformulation.

Strategic partnership formations between international ingredient companies and regional food manufacturers are accelerating market development and technology transfer. These collaborations are facilitating knowledge sharing and creating competitive advantages for participating companies.

Investment expansion projects by major ingredient suppliers include new production facilities and research centers in South America, demonstrating long-term commitment to the regional market. These investments are improving local supply chain capabilities and reducing ingredient costs for regional manufacturers.

Consumer education initiatives launched by industry associations and government agencies are improving awareness of sodium reduction benefits and building support for reformulated products. These programs are contributing to improved consumer acceptance rates and market growth.

Market entry strategies for new participants should focus on developing strong technical support capabilities and building relationships with key food manufacturers. Success in this market requires deep understanding of local taste preferences and regulatory requirements, making partnerships with regional players essential for effective market penetration.

Investment priorities should emphasize research and development capabilities that enable customized solution development for specific applications and customer needs. Companies that can provide comprehensive technical support and application expertise will achieve competitive advantages in this complex market environment.

Product development focus should prioritize natural ingredient solutions and clean label formulations that align with consumer preferences for minimally processed foods. MWR analysis suggests that companies investing in natural ingredient technologies will capture disproportionate market share growth.

Geographic expansion strategies should consider the varying regulatory environments and market maturity levels across South American countries. Companies should prioritize markets with established regulatory frameworks and strong consumer awareness while building capabilities for emerging markets.

Partnership opportunities exist throughout the value chain, from raw material suppliers to end-user manufacturers. Strategic alliances can accelerate market development, reduce investment requirements, and provide access to specialized expertise and distribution networks.

Market growth projections indicate continued expansion of the South American sodium reduction ingredient market, with compound annual growth rates expected to maintain strong momentum through the forecast period. Regulatory implementation timelines and increasing consumer health awareness will continue driving demand for innovative ingredient solutions.

Technology evolution will focus on developing more effective and cost-efficient sodium reduction solutions that address current limitations in taste, functionality, and economic viability. Advances in biotechnology and food science are expected to create breakthrough ingredients that enable greater sodium reductions with improved consumer acceptance.

Regulatory landscape development will likely include expansion of sodium reduction mandates to additional food categories and countries, creating new market opportunities and driving continued industry investment in reformulation technologies. Harmonization of standards across South American countries may facilitate regional trade and market development.

Consumer behavior trends suggest continued growth in demand for healthier food options, with younger generations showing particularly strong preferences for products with reduced sodium content. This demographic shift will support long-term market growth and create opportunities for premium product positioning.

Industry consolidation may accelerate as companies seek to achieve economies of scale and expand their technological capabilities through mergers and acquisitions. This trend could lead to increased competition and innovation while potentially improving ingredient availability and cost-effectiveness for food manufacturers.

The South America sodium reduction ingredient market represents a dynamic and rapidly evolving sector with substantial growth potential driven by health awareness, regulatory initiatives, and technological advancement. Market participants who can successfully navigate the complex requirements of taste maintenance, cost management, and regulatory compliance will capture significant opportunities in this expanding market.

Success factors include deep understanding of local market conditions, strong technical support capabilities, and commitment to continuous innovation in ingredient development. Companies that invest in building comprehensive solutions and partnerships throughout the value chain will achieve sustainable competitive advantages and market leadership positions.

Long-term market prospects remain highly favorable, supported by demographic trends, regulatory momentum, and continued technological progress in ingredient science. The market will continue evolving toward more sophisticated solutions that address multiple consumer needs while enabling food manufacturers to create healthier products without compromising quality or profitability.

What is Sodium Reduction Ingredient?

Sodium Reduction Ingredient refers to various substances used to lower sodium content in food products while maintaining flavor and quality. These ingredients are essential in addressing health concerns related to high sodium intake, particularly in processed foods.

What are the key players in the South America Sodium Reduction Ingredient Market?

Key players in the South America Sodium Reduction Ingredient Market include companies like Kerry Group, DSM, and Cargill, which are known for their innovative solutions in sodium reduction. These companies focus on developing ingredients that enhance flavor while reducing sodium levels, among others.

What are the growth factors driving the South America Sodium Reduction Ingredient Market?

The South America Sodium Reduction Ingredient Market is driven by increasing health awareness among consumers and a rising demand for low-sodium food products. Additionally, regulatory pressures to reduce sodium in processed foods are contributing to market growth.

What challenges does the South America Sodium Reduction Ingredient Market face?

Challenges in the South America Sodium Reduction Ingredient Market include consumer resistance to new flavors and the technical difficulties in formulating low-sodium products without compromising taste. Additionally, the cost of developing these ingredients can be a barrier for some manufacturers.

What opportunities exist in the South America Sodium Reduction Ingredient Market?

Opportunities in the South America Sodium Reduction Ingredient Market include the growing trend of clean label products and the increasing demand for healthier food options. Companies can capitalize on these trends by innovating new sodium reduction solutions tailored to local tastes.

What trends are shaping the South America Sodium Reduction Ingredient Market?

Trends in the South America Sodium Reduction Ingredient Market include the rise of plant-based ingredients and the use of natural flavor enhancers to reduce sodium. Additionally, there is a growing focus on sustainability and health-conscious formulations among food manufacturers.

South America Sodium Reduction Ingredient Market

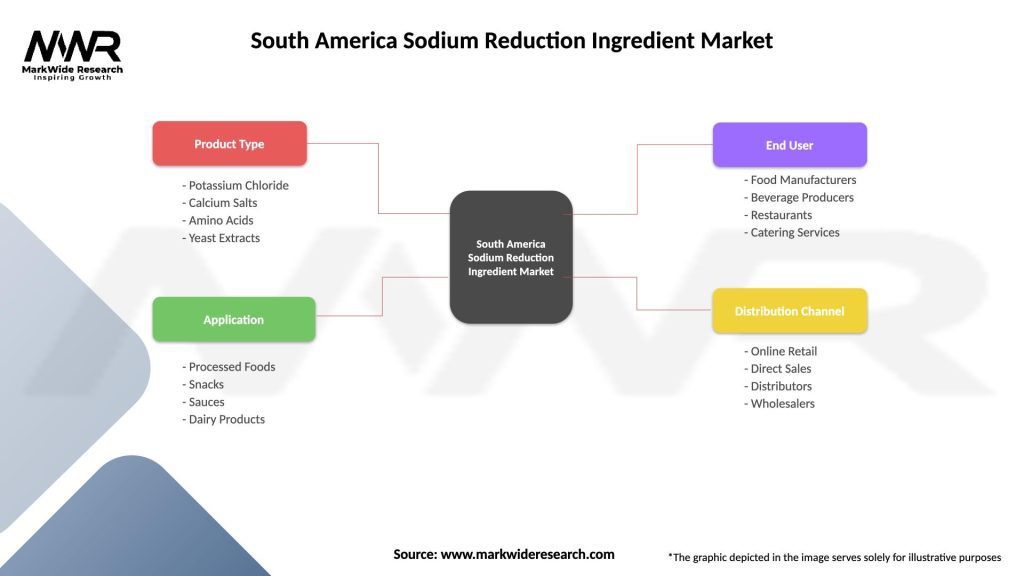

| Segmentation Details | Description |

|---|---|

| Product Type | Potassium Chloride, Calcium Salts, Amino Acids, Yeast Extracts |

| Application | Processed Foods, Snacks, Sauces, Dairy Products |

| End User | Food Manufacturers, Beverage Producers, Restaurants, Catering Services |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Sodium Reduction Ingredient Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at