444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America refining catalyst market represents a critical component of the region’s petroleum refining industry, encompassing specialized chemical compounds that accelerate and optimize various refining processes. This dynamic market serves as the backbone for transforming crude oil into valuable petroleum products including gasoline, diesel, jet fuel, and petrochemicals across major South American economies including Brazil, Argentina, Colombia, and Venezuela.

Market dynamics in South America reflect the region’s substantial crude oil reserves and growing domestic energy demands. The refining catalyst sector has experienced robust expansion, driven by increasing refinery capacity utilization and modernization initiatives across the continent. Brazil dominates the regional market, accounting for approximately 45% of total catalyst consumption, followed by Argentina and Colombia as significant contributors to market growth.

Technological advancement has become a defining characteristic of the South American refining catalyst landscape. Modern catalysts demonstrate enhanced selectivity, improved thermal stability, and extended operational lifespans, enabling refineries to achieve higher conversion rates and product quality standards. The market encompasses various catalyst types including fluid catalytic cracking (FCC) catalysts, hydroprocessing catalysts, reforming catalysts, and alkylation catalysts, each serving specific refining applications.

Regional integration efforts have facilitated increased collaboration between South American countries in refining technology development and catalyst procurement strategies. This cooperation has led to improved economies of scale and enhanced technical expertise sharing across the region’s refining infrastructure.

The South America refining catalyst market refers to the comprehensive ecosystem of specialized chemical compounds, technologies, and services designed to enhance petroleum refining processes across South American countries. These catalysts function as essential enablers that accelerate chemical reactions, improve product yields, and optimize operational efficiency within oil refineries throughout the region.

Refining catalysts serve multiple critical functions including breaking down heavy hydrocarbon molecules, removing impurities such as sulfur and nitrogen compounds, and facilitating the conversion of crude oil fractions into high-value petroleum products. The market encompasses both the physical catalyst materials and the associated technical services including catalyst management, regeneration, and performance optimization.

Geographic scope includes all major oil-refining nations within South America, with particular emphasis on countries with significant refining capacity such as Brazil, Argentina, Colombia, Venezuela, Ecuador, and Peru. The market addresses diverse refining configurations ranging from simple distillation units to complex integrated refineries capable of producing a wide spectrum of petroleum derivatives.

Strategic positioning of the South America refining catalyst market reflects the region’s evolving energy landscape and increasing focus on refining efficiency optimization. The market has demonstrated resilience despite global economic uncertainties, supported by consistent domestic fuel demand and export opportunities to international markets.

Growth trajectory indicates sustained expansion driven by refinery modernization projects, environmental compliance requirements, and increasing demand for cleaner fuel specifications. The market benefits from South America’s abundant crude oil resources and strategic geographic position for serving both domestic and export markets.

Technology adoption has accelerated across the region, with refineries increasingly implementing advanced catalyst systems to improve operational performance and environmental compliance. Modern catalyst technologies enable refineries to process heavier crude oil feedstocks while producing higher-quality products that meet stringent international specifications.

Competitive landscape features a combination of global catalyst suppliers and regional service providers, creating a dynamic market environment that promotes innovation and competitive pricing. Leading market participants have established strong local presence through strategic partnerships and technical service capabilities.

Future prospects remain positive, supported by ongoing infrastructure investments, regulatory developments favoring cleaner fuels, and increasing integration with global energy markets. The market is expected to benefit from continued economic growth across major South American economies and expanding petrochemical production capacity.

Market segmentation reveals distinct patterns across different catalyst categories and applications within South American refineries:

Application diversity spans multiple refining processes, with each catalyst type serving specific operational requirements and product quality objectives. The market demonstrates strong correlation with refinery throughput capacity and product slate optimization strategies implemented by regional operators.

Technology trends emphasize enhanced catalyst performance, extended operational cycles, and improved environmental compliance capabilities. Advanced catalyst formulations enable refineries to achieve higher conversion rates while reducing energy consumption and emissions.

Domestic energy demand serves as a primary market driver, with South American countries experiencing steady growth in transportation fuel consumption and industrial energy requirements. Population growth, urbanization trends, and economic development contribute to sustained demand for refined petroleum products across the region.

Refinery modernization initiatives represent a significant growth catalyst, as aging refining infrastructure requires upgrading to meet contemporary efficiency and environmental standards. Many South American refineries are implementing comprehensive modernization programs that include advanced catalyst systems and process optimization technologies.

Environmental regulations increasingly influence catalyst selection and implementation strategies. Stricter sulfur content limits, emissions standards, and fuel quality specifications drive demand for specialized catalysts capable of producing cleaner fuels while maintaining operational efficiency.

Heavy crude oil processing requirements create substantial opportunities for advanced catalyst technologies. South America’s significant heavy and extra-heavy crude oil reserves necessitate sophisticated catalyst systems capable of upgrading these challenging feedstocks into valuable products.

Export market opportunities provide additional demand drivers, as South American refineries seek to optimize product quality for international markets. Advanced catalyst technologies enable production of export-grade fuels that meet stringent international specifications and command premium pricing.

Petrochemical integration trends drive demand for specialized catalysts that support integrated refining and petrochemical operations. This integration enables refineries to maximize value creation through optimized product slate management and feedstock utilization.

Economic volatility poses challenges for market growth, as fluctuating crude oil prices and currency instability can impact refinery investment decisions and catalyst procurement strategies. Economic uncertainties may delay planned modernization projects and affect overall market expansion.

High capital requirements for catalyst implementation and refinery upgrades can limit market penetration, particularly for smaller regional refineries with constrained financial resources. The substantial investment required for advanced catalyst systems may deter some operators from pursuing optimization initiatives.

Technical complexity associated with modern catalyst systems requires specialized expertise and training, which may not be readily available in all regional markets. The need for skilled personnel and technical support capabilities can constrain adoption rates for advanced catalyst technologies.

Supply chain challenges including logistics constraints and import dependencies can impact catalyst availability and pricing stability. Remote refinery locations and infrastructure limitations may complicate catalyst delivery and technical service provision.

Regulatory uncertainties regarding future environmental standards and fuel specifications can create hesitation in catalyst investment decisions. Refineries may delay catalyst upgrades pending clarity on long-term regulatory requirements and compliance timelines.

Biofuel integration presents emerging opportunities for specialized catalysts that support renewable fuel production and blending operations. As South American countries implement biofuel mandates and sustainability initiatives, demand for compatible catalyst technologies is expected to increase significantly.

Digital transformation initiatives create opportunities for smart catalyst management systems that optimize performance through real-time monitoring and predictive analytics. Advanced digital technologies can enhance catalyst utilization efficiency and extend operational lifecycles.

Regional collaboration efforts may facilitate shared catalyst procurement strategies and technical expertise development. Increased cooperation between South American countries could lead to improved economies of scale and enhanced market access for catalyst suppliers.

Circular economy principles drive opportunities for catalyst recycling and regeneration services. Sustainable catalyst management practices can reduce operational costs while supporting environmental objectives and resource conservation initiatives.

Specialty product markets offer growth potential for catalysts that enable production of high-value petrochemical feedstocks and specialty chemicals. Diversification into specialty applications can provide additional revenue streams and market differentiation opportunities.

Supply-demand balance in the South America refining catalyst market reflects the interplay between refinery capacity utilization, maintenance schedules, and catalyst replacement cycles. Market dynamics are influenced by seasonal demand variations, planned maintenance activities, and unexpected operational disruptions that may accelerate catalyst consumption.

Competitive intensity has increased as global catalyst suppliers expand their regional presence while local service providers enhance their technical capabilities. This competition drives innovation in catalyst formulations, service delivery models, and pricing strategies that benefit end-user refineries.

Technology evolution continues to reshape market dynamics through the introduction of next-generation catalyst systems with enhanced performance characteristics. MarkWide Research analysis indicates that advanced catalyst technologies can improve refinery margins by 8-12% through optimized conversion rates and extended operational cycles.

Regulatory influence on market dynamics intensifies as environmental standards become more stringent and fuel quality specifications evolve. Catalyst suppliers must continuously adapt their product portfolios to address changing regulatory requirements while maintaining cost-effectiveness for refinery operators.

Economic cycles significantly impact market dynamics through their influence on refinery investment decisions, capacity utilization rates, and catalyst procurement strategies. Market participants must navigate economic uncertainties while maintaining operational readiness for growth opportunities.

Primary research methodologies employed in analyzing the South America refining catalyst market include comprehensive interviews with industry executives, refinery operators, catalyst suppliers, and technical service providers. Direct engagement with market participants provides valuable insights into operational challenges, technology preferences, and future investment plans.

Secondary research encompasses extensive analysis of industry publications, regulatory documents, company financial reports, and technical literature related to refining catalyst technologies. This research foundation ensures comprehensive understanding of market trends, competitive dynamics, and technological developments.

Data validation processes involve cross-referencing multiple information sources and conducting follow-up interviews to verify key findings and market assessments. Rigorous validation procedures ensure accuracy and reliability of market intelligence and forecasting models.

Quantitative analysis techniques include statistical modeling, trend analysis, and correlation studies to identify market patterns and growth drivers. Advanced analytical methods enable precise market sizing, segmentation analysis, and performance benchmarking across different catalyst categories and regional markets.

Expert consultation with industry specialists, technical consultants, and regulatory authorities provides additional validation and context for market findings. Expert insights enhance understanding of complex technical issues and regulatory implications affecting market development.

Brazil maintains its position as the dominant market within South America, driven by the country’s extensive refining infrastructure and substantial domestic fuel demand. Brazilian refineries operate sophisticated catalyst management programs and demonstrate strong adoption rates for advanced catalyst technologies. The market benefits from Petrobras’ comprehensive refining network and ongoing modernization initiatives.

Argentina represents the second-largest regional market, supported by significant refining capacity and growing domestic energy consumption. Argentine refineries focus on optimizing operations for both domestic supply and export opportunities, driving demand for high-performance catalyst systems. The market demonstrates 25% growth potential through planned capacity expansions and technology upgrades.

Colombia has emerged as a dynamic market driven by refinery modernization projects and increasing integration with international markets. Colombian refineries emphasize product quality optimization and environmental compliance, creating opportunities for advanced catalyst technologies. The market benefits from strategic geographic positioning and export-oriented refining strategies.

Venezuela possesses substantial market potential despite current economic challenges, supported by the country’s vast crude oil reserves and refining infrastructure. Market recovery depends on economic stabilization and infrastructure investment, which could unlock significant catalyst demand growth.

Other regional markets including Ecuador, Peru, and Chile contribute to overall market growth through specialized refining operations and niche applications. These markets demonstrate increasing sophistication in catalyst selection and management practices.

Market leadership is characterized by a combination of global catalyst suppliers and regional service providers, each bringing distinct competitive advantages to the South American market:

Competitive strategies emphasize local presence, technical service excellence, and customized solutions that address specific regional requirements. Market leaders invest significantly in research and development to maintain technological advantages and respond to evolving market needs.

Strategic partnerships between global suppliers and local service providers create comprehensive market coverage and enhanced customer support capabilities. These collaborations enable effective market penetration and sustainable competitive positioning.

By Catalyst Type:

By Application:

By End-User:

FCC Catalysts dominate the South American market due to their critical role in maximizing gasoline yields from heavy crude oil feedstocks. These catalysts demonstrate continuous innovation in zeolite technology, matrix formulations, and additive systems that enhance selectivity and stability. Regional refineries particularly value FCC catalysts that can process challenging feedstocks while maintaining high conversion rates.

Hydroprocessing Catalysts represent the fastest-growing category, driven by increasing environmental regulations and heavy oil upgrading requirements. Advanced formulations incorporating novel active metals and support materials enable superior performance in sulfur removal, nitrogen removal, and aromatic saturation applications. Market growth reflects 15% annual expansion in hydroprocessing catalyst consumption.

Reforming Catalysts maintain steady market presence through their essential role in octane enhancement and aromatics production. Platinum-based catalyst systems continue to evolve with improved dispersion technologies and enhanced regeneration capabilities that extend operational lifecycles and reduce operating costs.

Alkylation Catalysts serve specialized applications in high-octane gasoline production, with increasing focus on solid acid catalyst technologies that offer environmental and operational advantages over traditional liquid acid systems. Market adoption reflects growing emphasis on sustainable refining practices.

Specialty Catalysts including isomerization, polymerization, and selective hydrogenation catalysts address niche applications that support product quality optimization and process efficiency enhancement. These categories demonstrate strong growth potential as refineries pursue operational excellence and product differentiation strategies.

Refinery Operators benefit from advanced catalyst technologies through improved operational efficiency, enhanced product yields, and reduced environmental compliance costs. Modern catalyst systems enable refineries to process diverse feedstocks while maintaining consistent product quality and meeting stringent environmental standards.

Catalyst Suppliers gain access to growing regional markets with substantial long-term potential. The South American market offers opportunities for technology differentiation, service expansion, and strategic partnerships that support sustainable business growth and market leadership.

Technology Providers benefit from increasing demand for advanced refining solutions and digital optimization tools. Market growth creates opportunities for innovative technologies that enhance catalyst performance, extend operational lifecycles, and improve overall refining economics.

Service Companies experience expanding opportunities for catalyst management, regeneration, and technical support services. Comprehensive service offerings create additional value streams and strengthen customer relationships through enhanced operational support.

Government Stakeholders benefit from improved energy security, enhanced export capabilities, and reduced environmental impact through advanced refining technologies. Modern catalyst systems support national energy objectives while promoting sustainable industrial development.

Environmental Organizations gain from cleaner fuel production and reduced refinery emissions enabled by advanced catalyst technologies. Improved environmental performance supports sustainability objectives and regulatory compliance across the regional refining sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has emerged as a dominant trend, with refineries increasingly adopting catalyst technologies that support environmental objectives and circular economy principles. This trend encompasses catalyst recycling, regeneration optimization, and development of bio-compatible catalyst systems that enable renewable fuel production.

Digital Optimization represents a transformative trend affecting catalyst management practices across South American refineries. Advanced analytics, machine learning algorithms, and real-time monitoring systems enable predictive maintenance, performance optimization, and extended catalyst lifecycles that improve overall refining economics.

Process Intensification trends focus on maximizing catalyst efficiency through innovative reactor designs, enhanced mass transfer, and optimized operating conditions. These developments enable refineries to achieve higher throughput and improved product quality while reducing energy consumption and environmental impact.

Feedstock Flexibility has become increasingly important as refineries seek to process diverse crude oil types and alternative feedstocks. Catalyst technologies that enable flexible operations and rapid feedstock transitions provide competitive advantages in volatile market conditions.

Integrated Operations trend toward combining refining and petrochemical production creates demand for specialized catalyst systems that optimize overall facility economics. This integration requires sophisticated catalyst management strategies that balance multiple product objectives and market requirements.

Technology Innovations continue to reshape the catalyst landscape through breakthrough developments in catalyst design, manufacturing processes, and performance optimization. Recent innovations include advanced zeolite synthesis techniques, novel metal dispersion technologies, and enhanced catalyst regeneration methods that extend operational lifecycles.

Strategic Partnerships between global catalyst suppliers and regional refineries have intensified, creating collaborative relationships that support technology transfer, local capability development, and customized solution development. These partnerships enable more effective market penetration and sustainable competitive positioning.

Regulatory Developments across South American countries continue to influence catalyst selection and implementation strategies. Recent regulatory changes emphasize sulfur reduction, emissions control, and fuel quality enhancement, driving demand for specialized catalyst technologies that address these requirements.

Investment Initiatives in refinery modernization and capacity expansion create substantial opportunities for catalyst suppliers. MWR analysis indicates that planned refinery investments across South America could drive 20-25% growth in catalyst demand over the next five years.

Market Consolidation trends include strategic acquisitions, joint ventures, and technology licensing agreements that reshape competitive dynamics and market structure. These developments create opportunities for enhanced market access and improved service delivery capabilities.

Market Entry Strategies should emphasize local presence, technical service excellence, and customized solutions that address specific regional requirements. Successful market participants must invest in local capabilities, strategic partnerships, and comprehensive customer support infrastructure to achieve sustainable competitive advantages.

Technology Investment priorities should focus on catalyst systems that address environmental compliance, feedstock flexibility, and operational efficiency objectives. Companies should prioritize research and development initiatives that create differentiated value propositions and support long-term market leadership.

Service Expansion opportunities exist for comprehensive catalyst management services that optimize performance, extend lifecycles, and reduce total cost of ownership. Integrated service offerings create additional revenue streams and strengthen customer relationships through enhanced operational support.

Regional Collaboration initiatives can facilitate market access, technology transfer, and capability development across South American countries. Strategic partnerships with local organizations enable more effective market penetration and sustainable business development.

Sustainability Focus should guide product development and market positioning strategies, as environmental considerations increasingly influence catalyst selection decisions. Companies that demonstrate strong environmental credentials and sustainable practices will achieve competitive advantages in evolving market conditions.

Market expansion prospects remain positive for the South America refining catalyst market, supported by continued economic growth, increasing energy demand, and ongoing refinery modernization initiatives. The market is expected to benefit from sustained investment in refining infrastructure and technology advancement across the region.

Technology evolution will continue to drive market development through innovations in catalyst design, manufacturing processes, and application technologies. Advanced catalyst systems that offer superior performance, extended lifecycles, and enhanced environmental compliance will capture increasing market share.

Regulatory influence on market development is expected to intensify as environmental standards become more stringent and fuel quality specifications evolve. Catalyst suppliers that proactively address regulatory requirements will achieve competitive advantages and market leadership positions.

Integration trends toward combined refining and petrochemical operations will create new opportunities for specialized catalyst technologies that optimize integrated facility economics. This trend supports market diversification and value creation through enhanced product portfolios.

Digital transformation initiatives will reshape catalyst management practices through advanced analytics, predictive maintenance, and real-time optimization systems. MarkWide Research projects that digital catalyst management systems could improve operational efficiency by 12-18% while reducing maintenance costs and extending catalyst lifecycles.

The South America refining catalyst market presents substantial opportunities for growth and development, driven by the region’s abundant petroleum resources, increasing energy demand, and ongoing modernization initiatives. Market participants that successfully navigate economic volatility, regulatory requirements, and competitive dynamics will achieve sustainable success in this evolving landscape.

Strategic positioning requires comprehensive understanding of regional market dynamics, customer requirements, and technology trends that shape catalyst selection and implementation decisions. Companies that invest in local presence, technical capabilities, and customer relationships will establish competitive advantages and market leadership positions.

Future success depends on continuous innovation, sustainability focus, and adaptability to changing market conditions. The South America refining catalyst market offers significant potential for companies that demonstrate commitment to regional development, environmental stewardship, and operational excellence in serving this dynamic and growing market.

What is Refining Catalyst?

Refining catalysts are substances used in the petroleum refining process to enhance the efficiency of chemical reactions, particularly in the conversion of crude oil into valuable products like gasoline, diesel, and jet fuel.

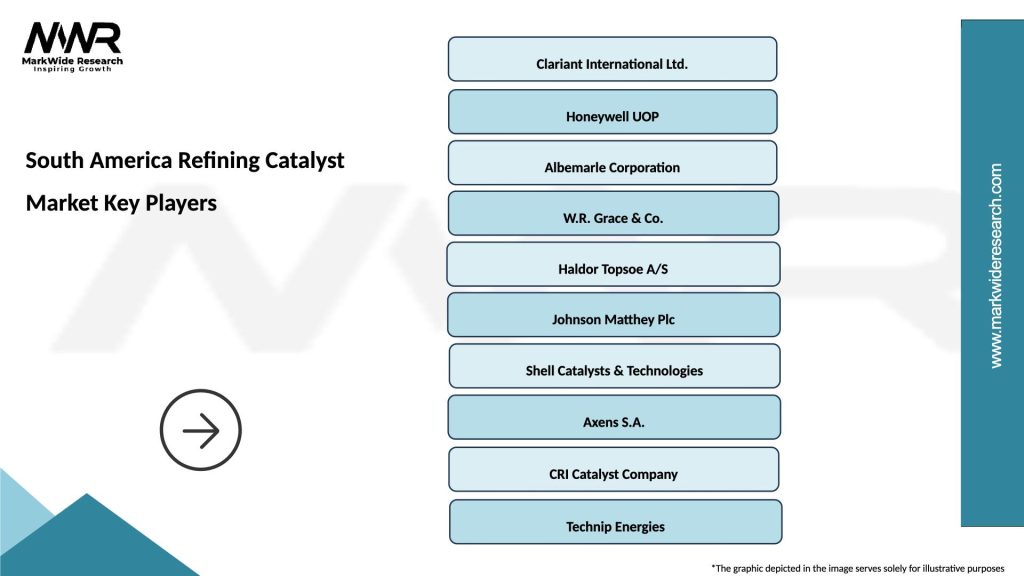

What are the key players in the South America Refining Catalyst Market?

Key players in the South America Refining Catalyst Market include companies such as BASF, Honeywell UOP, and Clariant, which are known for their innovative catalyst solutions and extensive market presence, among others.

What are the growth factors driving the South America Refining Catalyst Market?

The growth of the South America Refining Catalyst Market is driven by increasing demand for cleaner fuels, advancements in refining technologies, and the need for efficient processing of heavy crude oils.

What challenges does the South America Refining Catalyst Market face?

Challenges in the South America Refining Catalyst Market include regulatory pressures for environmental compliance, fluctuating crude oil prices, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the South America Refining Catalyst Market?

Opportunities in the South America Refining Catalyst Market include the expansion of refining capacities, the shift towards sustainable refining practices, and the development of advanced catalysts for biofuels and renewable energy applications.

What trends are shaping the South America Refining Catalyst Market?

Trends in the South America Refining Catalyst Market include the increasing adoption of hydrocracking and hydrotreating processes, the focus on reducing emissions, and the integration of digital technologies for process optimization.

South America Refining Catalyst Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydrocracking Catalysts, Reforming Catalysts, Hydrotreating Catalysts, FCC Catalysts |

| End User | Refineries, Petrochemical Plants, Oil & Gas Companies, Chemical Manufacturers |

| Technology | Fixed Bed, Fluidized Bed, Moving Bed, Slurry Phase |

| Application | Gasoline Production, Diesel Production, Jet Fuel Production, Lubricants |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Refining Catalyst Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at