444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America pet nutraceuticals market represents a rapidly expanding segment within the region’s pet care industry, driven by increasing pet ownership rates and growing awareness of preventive healthcare for companion animals. Pet nutraceuticals encompass a wide range of dietary supplements, functional foods, and health-promoting products specifically formulated to enhance the wellbeing of dogs, cats, and other domestic animals across South American countries.

Market dynamics in South America reflect a significant shift toward premium pet care products, with pet owners increasingly viewing their animals as family members deserving specialized nutrition and healthcare solutions. The market demonstrates robust growth potential, with annual growth rates exceeding 8.5% in key segments such as joint health supplements and digestive wellness products.

Regional characteristics show Brazil leading market development, followed by Argentina, Chile, and Colombia, each contributing to the overall expansion through distinct consumer preferences and regulatory frameworks. The market encompasses various product categories including vitamins, minerals, probiotics, omega fatty acids, and specialized therapeutic formulations designed to address specific health conditions in pets.

Consumer behavior patterns indicate a growing willingness to invest in preventive healthcare solutions for pets, with premium product adoption rates reaching 42% among urban pet owners. This trend reflects broader socioeconomic developments and changing lifestyle patterns across South American metropolitan areas.

The South America pet nutraceuticals market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and retail of nutritional supplements and functional health products specifically designed for companion animals throughout South American countries. These products bridge the gap between traditional pet nutrition and pharmaceutical interventions, offering preventive and therapeutic benefits through scientifically formulated ingredients.

Nutraceuticals for pets combine nutritional and pharmaceutical properties, delivering health benefits beyond basic nutritional requirements. These products typically contain bioactive compounds such as glucosamine, chondroitin, probiotics, antioxidants, and essential fatty acids that support various physiological functions including joint health, digestive wellness, immune system strengthening, and cognitive function enhancement.

Market scope encompasses various delivery formats including soft chews, tablets, powders, liquids, and functional treats, catering to different pet preferences and owner convenience factors. The definition extends to both prescription-based therapeutic products and over-the-counter wellness supplements available through veterinary clinics, pet specialty stores, and online retail platforms.

Market performance in South America’s pet nutraceuticals sector demonstrates exceptional growth momentum, driven by fundamental shifts in pet ownership attitudes and increasing disposable income among middle-class households. The market benefits from expanding veterinary infrastructure and growing awareness of preventive healthcare approaches for companion animals.

Key growth drivers include rising pet humanization trends, increasing prevalence of age-related health conditions in pets, and growing acceptance of alternative healthcare solutions. Joint health supplements represent 35% of total market demand, followed by digestive health products and immune system boosters.

Regional distribution shows Brazil commanding the largest market share, accounting for approximately 45% of regional demand, while Argentina, Chile, and Colombia collectively represent significant growth opportunities. Urban markets demonstrate higher adoption rates compared to rural areas, reflecting income disparities and access to specialized veterinary services.

Competitive landscape features a mix of international brands and emerging local manufacturers, with distribution strategies focusing on veterinary channel partnerships and specialty retail expansion. E-commerce platforms increasingly serve as important sales channels, particularly following accelerated digital adoption during recent years.

Consumer demographics reveal that millennial and Generation X pet owners drive the majority of premium nutraceutical purchases, with household income levels above $25,000 annually showing significantly higher adoption rates. These consumers typically own multiple pets and demonstrate willingness to invest in preventive healthcare solutions.

Product preferences vary significantly across the region, with the following key insights emerging:

Seasonal patterns indicate higher sales volumes during winter months when joint health concerns peak, while digestive health products maintain consistent demand throughout the year.

Pet humanization trends serve as the primary catalyst for market expansion, with pet owners increasingly treating their animals as family members deserving premium healthcare solutions. This cultural shift drives demand for sophisticated nutraceutical products that mirror human supplement consumption patterns.

Aging pet populations across South America create substantial demand for age-related health management products. As veterinary care improves and pet lifespans extend, owners seek preventive solutions to maintain quality of life for senior pets, particularly focusing on joint mobility, cognitive function, and overall vitality.

Veterinary education initiatives play a crucial role in market development, with professional recommendations significantly influencing consumer purchasing decisions. Increased awareness among veterinary practitioners about nutraceutical benefits leads to higher prescription rates and consumer confidence in product efficacy.

Economic development in key South American markets enables higher discretionary spending on pet care products. Growing middle-class populations with increased disposable income demonstrate willingness to invest in premium pet health solutions, driving market expansion beyond basic nutritional needs.

Digital information access empowers pet owners with knowledge about preventive healthcare options, leading to proactive health management approaches. Online resources, social media communities, and digital veterinary consultations contribute to increased awareness and product adoption rates.

Economic volatility in several South American countries creates challenges for sustained market growth, as pet nutraceuticals often represent discretionary spending that may be reduced during economic downturns. Currency fluctuations and inflation impact both import costs and consumer purchasing power.

Regulatory complexities across different countries create barriers for market entry and product standardization. Varying approval processes, labeling requirements, and quality standards increase compliance costs and slow product launches, particularly for international manufacturers.

Limited veterinary infrastructure in rural and remote areas restricts market penetration, as professional recommendations remain crucial for consumer adoption. Uneven distribution of veterinary services creates geographic disparities in market development and product accessibility.

Consumer education gaps persist regarding the differences between nutraceuticals and traditional medications, leading to confusion about appropriate usage and expected outcomes. Misconceptions about product efficacy and safety may limit adoption rates among conservative pet owners.

Price sensitivity remains a significant constraint, particularly in price-conscious market segments where basic pet food and veterinary care compete for limited household budgets. Premium pricing of nutraceutical products may limit accessibility for lower-income pet owners.

E-commerce expansion presents substantial growth opportunities as digital retail platforms gain acceptance among South American consumers. Online sales channels offer improved product accessibility, competitive pricing, and convenient subscription services that enhance customer retention and market penetration.

Product innovation in delivery formats and formulations creates opportunities for market differentiation and premium positioning. Development of palatable, easy-to-administer products addresses key consumer pain points and expands market accessibility to previously reluctant pet owners.

Veterinary partnership programs offer significant potential for market expansion through professional channel development. Collaborative initiatives with veterinary clinics, including education programs and exclusive product lines, can drive recommendation rates and build consumer trust.

Regional manufacturing opportunities exist for local production facilities that can reduce import dependencies, lower costs, and improve supply chain reliability. Local manufacturing also enables better customization for regional preferences and regulatory requirements.

Preventive healthcare trends create opportunities for early intervention products that address health concerns before they become serious conditions. Wellness-focused formulations targeting young and adult pets represent untapped market potential beyond traditional senior pet segments.

Supply chain evolution reflects increasing sophistication in distribution networks, with specialized pet retail chains and veterinary distributors developing dedicated nutraceutical product lines. Distribution efficiency improvements of 25% have been achieved through strategic partnerships and logistics optimization.

Competitive intensity increases as both international brands and local manufacturers recognize market potential, leading to innovation acceleration and pricing pressures. Market consolidation trends emerge as larger companies acquire specialized nutraceutical brands to expand product portfolios.

Consumer behavior shifts toward online research and purchasing create new marketing dynamics, requiring companies to invest in digital presence and educational content. Social media influence and peer recommendations increasingly impact purchase decisions alongside traditional veterinary guidance.

Regulatory harmonization efforts across South American countries may simplify market entry and reduce compliance costs, potentially accelerating product launches and market expansion. Regional trade agreements facilitate cross-border commerce and supply chain optimization.

Technology integration in product development enables more precise formulations and quality control, while digital platforms improve customer engagement and product education. Innovation in packaging and preservation technologies extends product shelf life and maintains potency.

Primary research approaches employed comprehensive data collection through structured interviews with veterinary professionals, pet specialty retailers, and consumers across major South American markets. Survey methodologies captured quantitative insights regarding purchasing behaviors, product preferences, and market trends.

Secondary research analysis incorporated industry reports, regulatory filings, company financial statements, and trade association data to establish market baselines and validate primary research findings. Historical trend analysis provided context for growth projections and market dynamics assessment.

Market segmentation analysis utilized demographic, geographic, and psychographic variables to identify distinct consumer groups and their specific needs. Product category analysis examined sales data, pricing trends, and competitive positioning across different nutraceutical segments.

Expert consultation with veterinary nutritionists, industry executives, and regulatory specialists provided qualitative insights into market challenges, opportunities, and future development prospects. Professional perspectives enhanced understanding of clinical efficacy and market acceptance factors.

Data validation processes ensured accuracy and reliability through triangulation of multiple sources, cross-referencing of quantitative findings, and peer review of analytical conclusions. Statistical modeling techniques supported growth projections and market sizing estimates.

Brazil dominates the South American pet nutraceuticals market, representing the largest consumer base and most developed retail infrastructure. Brazilian market share reaches 48% of regional demand, driven by high pet ownership rates in urban areas and increasing disposable income among middle-class households.

Argentina demonstrates strong growth potential with sophisticated consumer preferences and established veterinary networks. The market benefits from cultural attitudes toward pet care and relatively high spending on premium pet products, particularly in Buenos Aires and other metropolitan areas.

Chile exhibits rapid market development with annual growth rates approaching 11% in premium segments, supported by economic stability and growing awareness of preventive pet healthcare. Chilean consumers show particular interest in natural and organic formulations.

Colombia represents an emerging market with significant expansion opportunities, driven by urbanization trends and increasing pet adoption rates. The market shows strong potential for basic nutraceutical products as consumer education and veterinary infrastructure develop.

Peru and Ecuador constitute smaller but growing markets with increasing interest in pet health products. These markets typically focus on essential supplements and show potential for future expansion as economic conditions improve and consumer awareness increases.

Regional trade dynamics facilitate cross-border distribution and enable economies of scale for manufacturers serving multiple markets. Harmonized regulations and trade agreements support market integration and supply chain optimization across the region.

Market leadership features a combination of established international brands and emerging regional players, each pursuing distinct competitive strategies and market positioning approaches.

Competitive strategies emphasize veterinary partnerships, product innovation, and educational marketing to build consumer trust and professional recommendations. Companies invest heavily in clinical research and regulatory compliance to support product efficacy claims.

Local manufacturers gain market share through competitive pricing, regional customization, and agile response to local market needs. These companies often focus on specific product categories or geographic regions to compete effectively against larger international brands.

By Product Type:

By Animal Type:

By Distribution Channel:

Joint Health Supplements dominate market demand, particularly for large dog breeds prone to hip dysplasia and arthritis. Glucosamine-based products account for 60% of joint health segment sales, with combination formulations including chondroitin and MSM gaining popularity among consumers seeking comprehensive solutions.

Digestive Health Products show rapid growth as pet owners recognize the importance of gut health for overall wellness. Probiotic supplements demonstrate particular strength in urban markets where pets experience dietary stress and environmental challenges affecting digestive function.

Immune System Boosters gain traction among health-conscious pet owners seeking preventive healthcare solutions. These products typically combine multiple ingredients including vitamins C and E, zinc, and specialized antioxidants to support natural immune responses.

Skin and Coat Supplements address common dermatological issues in South American climates, with omega-3 fatty acid formulations showing consistent demand. Products targeting specific conditions like allergies and dry skin command premium pricing and strong customer loyalty.

Cognitive Support Products represent an emerging category with significant growth potential as pet lifespans increase. These specialized formulations target senior pets experiencing age-related cognitive decline and memory issues.

Multivitamin Products serve as entry-level nutraceuticals for new consumers, often leading to purchases of more specialized supplements as pet owners become comfortable with the category and observe positive results.

Manufacturers benefit from expanding market opportunities and premium pricing potential in the growing South American pet nutraceuticals sector. The market offers attractive margins compared to traditional pet food products and enables brand differentiation through innovation and quality positioning.

Veterinary professionals gain additional revenue streams through product recommendations and retail sales, while enhancing patient care through preventive healthcare approaches. Professional partnerships with nutraceutical companies provide educational resources and clinical support for optimal patient outcomes.

Retailers experience increased customer loyalty and higher transaction values through nutraceutical product offerings. These products typically generate superior margins compared to basic pet supplies and create opportunities for customer education and relationship building.

Pet owners receive access to scientifically formulated products that support their animals’ health and longevity. Nutraceuticals offer convenient, palatable alternatives to traditional medications while providing preventive healthcare benefits that may reduce long-term veterinary costs.

Distributors capitalize on growing demand for specialized pet health products while building relationships with both manufacturers and retail partners. The category’s growth trajectory provides sustainable business opportunities and expansion potential across regional markets.

Regulatory bodies benefit from increased industry standards and quality control measures as companies invest in compliance and safety protocols. The market’s growth supports economic development and employment opportunities within the broader pet care industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic formulations gain significant traction among South American consumers seeking clean-label products for their pets. This trend mirrors human supplement preferences and drives premium pricing for products featuring organic ingredients, non-GMO formulations, and sustainable sourcing practices.

Personalized nutrition approaches emerge as companies develop breed-specific, age-appropriate, and condition-targeted formulations. Customized supplement programs show 18% higher customer retention rates compared to generic products, indicating strong consumer preference for tailored solutions.

Functional treat integration represents a growing trend where nutraceutical benefits are incorporated into palatable treat formats. This approach addresses administration challenges while providing convenient delivery methods that pets enjoy, improving compliance and customer satisfaction.

Subscription-based purchasing models gain popularity through e-commerce platforms, offering convenience and cost savings for regular supplement users. These programs provide predictable revenue streams for manufacturers while ensuring consistent product availability for consumers.

Veterinary-exclusive product lines expand as companies recognize the importance of professional channels for building credibility and consumer trust. These specialized formulations often feature higher potencies and therapeutic claims supported by clinical research.

Transparency and traceability become increasingly important as consumers demand information about ingredient sourcing, manufacturing processes, and quality control measures. Companies invest in supply chain transparency and third-party certifications to build consumer confidence.

Strategic acquisitions reshape the competitive landscape as larger companies acquire specialized nutraceutical brands to expand product portfolios and market reach. Recent transactions demonstrate industry consolidation trends and the strategic value placed on innovative formulations and established brands.

Research partnerships between manufacturers and veterinary schools advance clinical understanding of nutraceutical efficacy and safety. These collaborations support evidence-based product development and provide scientific validation for marketing claims and professional recommendations.

Regulatory harmonization initiatives across South American countries aim to simplify market entry and reduce compliance costs for manufacturers. These efforts support regional trade integration and may accelerate product launches and market expansion opportunities.

Digital marketing innovations leverage social media platforms and influencer partnerships to reach younger pet owners and build brand awareness. Companies invest in educational content and community building to establish thought leadership and consumer trust.

Sustainability initiatives gain prominence as companies adopt environmentally responsible packaging, sustainable ingredient sourcing, and carbon-neutral manufacturing processes. These efforts appeal to environmentally conscious consumers and support corporate social responsibility objectives.

Technology integration in manufacturing processes improves quality control, reduces costs, and enables more precise formulations. Advanced analytics and automation technologies enhance production efficiency and product consistency across different manufacturing facilities.

Market entry strategies should prioritize veterinary channel partnerships and professional education programs to build credibility and consumer trust. MarkWide Research analysis indicates that veterinary recommendations influence 78% of initial purchase decisions in the nutraceutical category.

Product development focus should emphasize palatability, ease of administration, and clear health benefits that pet owners can observe. Companies should invest in clinical research to support efficacy claims and differentiate products from competitors through scientific validation.

Distribution strategy optimization requires multi-channel approaches combining traditional retail, veterinary clinics, and e-commerce platforms. Online sales channels offer particular growth potential but require investment in digital marketing and customer education initiatives.

Regional customization becomes increasingly important as consumer preferences and regulatory requirements vary across South American countries. Companies should adapt product formulations, packaging, and marketing messages to local market conditions and cultural preferences.

Investment in consumer education remains critical for market development, particularly in emerging segments and geographic regions. Educational marketing programs should focus on preventive healthcare benefits and proper product usage to maximize customer satisfaction and retention.

Supply chain resilience requires diversification of sourcing and manufacturing capabilities to mitigate risks from economic volatility, regulatory changes, and logistical disruptions. Local manufacturing partnerships may provide strategic advantages in cost control and market responsiveness.

Market expansion prospects remain highly favorable as pet ownership rates continue growing across South America and consumer attitudes toward pet healthcare evolve. MWR projections indicate sustained growth rates exceeding 9% annually through the next five years, driven by urbanization trends and increasing disposable income.

Product innovation will likely focus on advanced delivery systems, combination formulations, and personalized nutrition approaches. Technology integration may enable customized supplement programs based on individual pet health profiles and genetic predispositions.

Market maturation in developed segments like joint health supplements may drive companies toward emerging categories such as cognitive support, anxiety management, and specialized therapeutic applications. These newer segments offer higher growth potential and less competitive intensity.

Regulatory evolution may establish more standardized requirements across the region, potentially reducing compliance costs and facilitating market entry for innovative products. Harmonized regulations could accelerate product launches and support regional distribution strategies.

Digital transformation will continue reshaping distribution channels and customer relationships, with e-commerce platforms gaining market share and subscription models becoming more prevalent. Companies must invest in digital capabilities to remain competitive in evolving retail landscapes.

Sustainability considerations will increasingly influence product development and marketing strategies as environmentally conscious consumers seek responsible brands. Companies that successfully integrate sustainability into their value propositions may gain competitive advantages in premium market segments.

The South America pet nutraceuticals market presents compelling growth opportunities driven by fundamental shifts in pet ownership attitudes, increasing disposable income, and growing awareness of preventive healthcare approaches. Market dynamics favor companies that can successfully navigate regulatory complexities while building strong veterinary partnerships and consumer education programs.

Strategic success factors include product innovation, quality assurance, professional channel development, and effective consumer communication. Companies must balance premium positioning with accessibility concerns while adapting to diverse regional preferences and regulatory requirements across South American markets.

Future market development will likely emphasize personalized nutrition approaches, advanced delivery systems, and expanded therapeutic applications. The integration of digital technologies and sustainable practices will become increasingly important for competitive differentiation and long-term market success.

Investment opportunities remain attractive for both established players and new entrants willing to commit resources to market education, product development, and distribution infrastructure. The market’s growth trajectory and premium pricing potential support continued expansion and innovation within the South American pet nutraceuticals sector.

What is Pet Nutraceuticals?

Pet nutraceuticals refer to products derived from food sources that provide health benefits beyond basic nutrition for pets. These products can include dietary supplements, functional foods, and herbal remedies aimed at improving pet health and well-being.

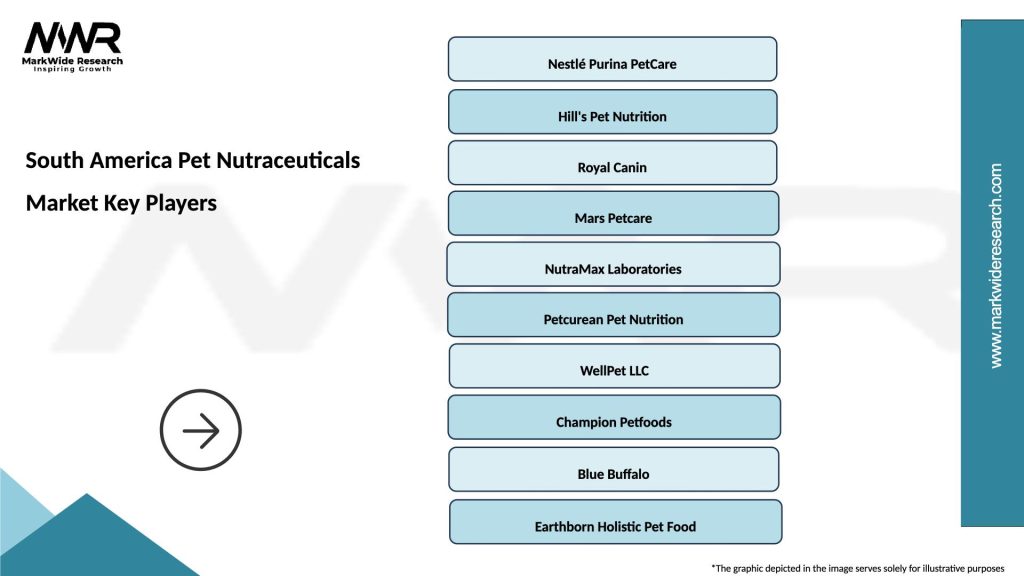

What are the key players in the South America Pet Nutraceuticals Market?

Key players in the South America Pet Nutraceuticals Market include companies like Nestlé Purina, Hill’s Pet Nutrition, and Bayer Animal Health, among others. These companies focus on developing innovative products that cater to the health needs of pets across the region.

What are the growth factors driving the South America Pet Nutraceuticals Market?

The growth of the South America Pet Nutraceuticals Market is driven by increasing pet ownership, rising awareness of pet health, and a growing demand for natural and organic pet products. Additionally, the trend towards preventive healthcare for pets is contributing to market expansion.

What challenges does the South America Pet Nutraceuticals Market face?

The South America Pet Nutraceuticals Market faces challenges such as regulatory hurdles, varying quality standards, and competition from traditional pet food products. These factors can hinder market growth and product acceptance among consumers.

What opportunities exist in the South America Pet Nutraceuticals Market?

Opportunities in the South America Pet Nutraceuticals Market include the potential for product innovation, expansion into emerging markets, and increasing consumer interest in pet wellness. Companies can capitalize on these trends by developing targeted products for specific health issues.

What trends are shaping the South America Pet Nutraceuticals Market?

Trends shaping the South America Pet Nutraceuticals Market include the rise of e-commerce for pet products, a focus on sustainability in sourcing ingredients, and the growing popularity of personalized pet nutrition. These trends reflect changing consumer preferences and the evolving landscape of pet care.

South America Pet Nutraceuticals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Probiotics, Omega Fatty Acids |

| End User | Pet Owners, Veterinary Clinics, Pet Retailers, Animal Shelters |

| Form | Powder, Chewable, Liquid, Capsule |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Veterinary Clinics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Pet Nutraceuticals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at