444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America mammography devices market represents a critical segment of the region’s healthcare infrastructure, focusing on advanced breast cancer screening and diagnostic technologies. This market encompasses digital mammography systems, 3D tomosynthesis equipment, and complementary imaging solutions designed to enhance early detection capabilities across the continent. Market dynamics indicate substantial growth potential driven by increasing awareness of breast cancer prevention, government healthcare initiatives, and technological advancements in medical imaging.

Regional healthcare systems are experiencing significant transformation as countries like Brazil, Argentina, Chile, and Colombia invest heavily in modernizing their diagnostic capabilities. The market demonstrates robust expansion with growing adoption rates of digital mammography systems reaching approximately 68% penetration across major urban centers. Healthcare infrastructure development continues to accelerate, particularly in metropolitan areas where specialized cancer centers and diagnostic facilities are implementing state-of-the-art mammography technologies.

Technological evolution within the South American mammography landscape reflects global trends toward enhanced imaging quality, reduced radiation exposure, and improved patient comfort. The integration of artificial intelligence and computer-aided detection systems is gaining momentum, with adoption rates increasing by 12% annually across the region. Public-private partnerships are playing an increasingly important role in expanding access to advanced mammography services, particularly in underserved rural and semi-urban areas.

The South America mammography devices market refers to the comprehensive ecosystem of breast imaging equipment, technologies, and related services utilized for breast cancer screening, diagnosis, and monitoring across South American countries. This market encompasses various mammography modalities including digital mammography, 3D breast tomosynthesis, contrast-enhanced mammography, and mobile mammography units designed to serve diverse healthcare settings from large metropolitan hospitals to remote rural clinics.

Market scope extends beyond hardware to include software solutions, maintenance services, training programs, and quality assurance systems that ensure optimal performance of mammography equipment. The definition encompasses both public and private healthcare sectors, covering government-funded screening programs, private diagnostic centers, and specialized breast imaging facilities. Technological components include X-ray generators, digital detectors, image processing systems, and integrated workflow solutions that streamline the entire mammography process from patient scheduling to report generation.

Market leadership in the South America mammography devices sector is characterized by strong growth momentum driven by increasing breast cancer awareness and expanding healthcare access. The region demonstrates significant potential for market expansion, with annual growth rates consistently outpacing global averages due to infrastructure modernization and government health initiatives. Digital transformation remains a key theme, as healthcare facilities transition from analog to digital mammography systems at an accelerated pace.

Key market drivers include rising breast cancer incidence rates, aging population demographics, and improved healthcare funding across major South American economies. The market benefits from technological advancements that enhance diagnostic accuracy while reducing examination time and patient discomfort. Regulatory frameworks are evolving to support quality standards and ensure patient safety, creating a more structured environment for market growth.

Investment trends show increasing focus on comprehensive breast health programs that integrate screening, diagnosis, and treatment planning. The market is witnessing strategic partnerships between international medical device manufacturers and local healthcare providers, facilitating technology transfer and capacity building. Future prospects remain highly positive, with projected growth rates indicating sustained expansion through the next decade.

Primary market insights reveal several critical factors shaping the South America mammography devices landscape:

Demographic transitions across South America are creating substantial demand for mammography services as population aging accelerates and breast cancer awareness increases. The region experiences rising incidence rates of breast cancer, with early detection programs becoming increasingly critical for improving patient outcomes. Healthcare policy reforms in major economies are prioritizing preventive care and cancer screening, leading to increased government funding for mammography equipment procurement.

Technological advancement serves as a powerful market driver, with next-generation mammography systems offering superior image quality, reduced radiation exposure, and enhanced patient comfort. The integration of artificial intelligence and machine learning algorithms is revolutionizing diagnostic accuracy, enabling earlier detection of subtle abnormalities that might be missed by traditional screening methods. Digital workflow solutions are streamlining operations and improving efficiency in busy healthcare facilities.

Economic development across the region is expanding healthcare budgets and enabling infrastructure investments in advanced medical imaging equipment. Private sector growth in healthcare services is creating additional demand for high-quality mammography systems as diagnostic centers compete to offer premium services. International partnerships and technology transfer agreements are facilitating access to cutting-edge mammography technologies previously unavailable in the region.

Economic constraints represent significant challenges for mammography market expansion, particularly in countries experiencing currency volatility and fiscal limitations. The high capital costs associated with advanced mammography systems can strain healthcare budgets, especially for smaller facilities and rural hospitals. Import dependencies create additional cost pressures due to currency fluctuations and trade regulations affecting medical device procurement.

Infrastructure limitations in certain regions pose obstacles to mammography deployment, including inadequate electrical power supply, limited technical support networks, and insufficient physical space for equipment installation. Skilled workforce shortages present ongoing challenges, with limited numbers of trained radiologists and mammography technologists available to operate sophisticated equipment effectively. Maintenance and service capabilities remain underdeveloped in remote areas, potentially affecting equipment uptime and diagnostic quality.

Regulatory complexities can slow market entry for new technologies, with varying approval processes across different countries creating barriers for manufacturers. Cultural factors and patient awareness levels may limit screening program participation rates, particularly in rural communities where breast cancer education remains limited. Healthcare system fragmentation can impede coordinated screening programs and standardized quality protocols across different providers.

Emerging market segments present substantial growth opportunities, particularly in the development of cost-effective mammography solutions tailored to resource-constrained environments. The growing emphasis on preventive healthcare creates opportunities for comprehensive breast health programs that integrate screening, education, and follow-up care. Telemedicine integration offers potential for remote diagnostic services, enabling expert consultation and second opinions across geographic boundaries.

Public-private partnerships represent significant opportunities for market expansion, allowing for innovative financing models and shared risk arrangements that can accelerate equipment deployment. The development of mobile mammography services presents opportunities to reach underserved populations and expand screening coverage to remote areas. Technology localization initiatives could create opportunities for regional manufacturing and service capabilities, reducing costs and improving accessibility.

Educational program development offers opportunities to build market demand through increased awareness and professional training initiatives. The integration of digital health platforms creates opportunities for comprehensive breast health management systems that combine screening, tracking, and patient engagement tools. Regional standardization efforts present opportunities for harmonized quality protocols and cross-border collaboration in mammography services.

Competitive dynamics in the South America mammography devices market reflect a complex interplay between established international manufacturers and emerging regional players. Market consolidation trends are evident as larger companies acquire local distributors and service providers to strengthen their regional presence. The competitive landscape is characterized by innovation cycles that continuously introduce enhanced imaging technologies and improved patient experience features.

Supply chain dynamics play a crucial role in market development, with manufacturers establishing regional distribution networks and service centers to support growing demand. Pricing strategies are evolving to address diverse market segments, from premium facilities seeking cutting-edge technology to cost-conscious providers requiring reliable basic systems. Service model innovation is becoming increasingly important, with comprehensive maintenance and support packages influencing purchasing decisions.

Regulatory dynamics continue to shape market evolution, with harmonization efforts across South American countries creating more predictable approval processes. Technology adoption patterns vary significantly across the region, with urban centers leading digital transformation while rural areas maintain mixed technology environments. Market maturation is occurring at different rates across countries, creating diverse opportunities for various technology levels and service models.

Comprehensive market analysis for the South America mammography devices market employs multi-faceted research methodologies combining primary and secondary data sources. Primary research includes structured interviews with healthcare administrators, radiologists, medical device distributors, and government health officials across major South American countries. Secondary research encompasses analysis of healthcare statistics, government health reports, medical device registration data, and industry publications.

Data collection strategies utilize both quantitative and qualitative approaches to ensure comprehensive market understanding. Quantitative analysis focuses on market sizing, growth projections, and statistical trends derived from healthcare databases and industry reports. Qualitative insights are gathered through expert interviews, focus groups, and observational studies of mammography facilities across different market segments.

Market validation processes include cross-referencing multiple data sources and conducting expert panel reviews to ensure accuracy and reliability. MarkWide Research methodology incorporates advanced analytical frameworks to identify market patterns, competitive dynamics, and emerging trends. Regional analysis considers country-specific factors including healthcare policies, economic conditions, and demographic trends that influence mammography market development.

Brazil dominates the South America mammography devices market, accounting for approximately 45% of regional market share due to its large population, advanced healthcare infrastructure, and comprehensive cancer screening programs. Brazilian market dynamics are characterized by strong government support for breast cancer prevention, significant private healthcare sector investment, and growing adoption of advanced mammography technologies. The country’s regulatory environment supports innovation while maintaining strict quality standards for medical devices.

Argentina represents the second-largest market segment with approximately 22% regional market share, driven by well-established healthcare systems and increasing focus on preventive care. Argentine healthcare facilities are modernizing rapidly, with significant investments in digital mammography systems and quality improvement programs. The country benefits from strong medical education systems that produce skilled radiologists and technologists capable of operating advanced equipment.

Chile and Colombia collectively account for approximately 18% of market share, with both countries implementing national breast cancer screening programs and investing in healthcare infrastructure modernization. Chilean market development is supported by stable economic conditions and progressive healthcare policies, while Colombian growth is driven by expanding healthcare coverage and increasing private sector participation. Smaller markets including Peru, Ecuador, and Uruguay show promising growth potential with combined market share of approximately 15%, supported by improving economic conditions and healthcare system development.

Market leadership in the South America mammography devices sector is characterized by the presence of established international manufacturers alongside emerging regional players. The competitive environment demonstrates strategic positioning across different market segments, from premium technology providers to cost-effective solution specialists.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and adoption patterns across South America:

By Technology:

By End User:

By Application:

Digital mammography systems represent the fastest-growing category, with adoption rates accelerating across all market segments. These systems offer superior image quality, reduced radiation exposure, and enhanced workflow efficiency compared to traditional analog systems. Technology integration capabilities allow for seamless connection with hospital information systems and picture archiving systems, improving overall operational efficiency.

3D tomosynthesis technology is gaining significant traction among premium healthcare facilities, offering enhanced diagnostic accuracy and reduced false-positive rates. This category demonstrates particular strength in private healthcare sectors where advanced technology adoption is prioritized. Clinical benefits include improved visualization of dense breast tissue and better detection of small lesions that might be obscured in traditional 2D imaging.

Mobile mammography solutions represent an emerging category with substantial growth potential, particularly for addressing geographic accessibility challenges in rural and remote areas. These systems enable healthcare providers to extend screening services beyond traditional facility boundaries, supporting population health initiatives and preventive care programs. Operational flexibility makes mobile units attractive for both government screening programs and private healthcare organizations seeking to expand their service reach.

Healthcare providers benefit from advanced mammography technologies through improved diagnostic capabilities, enhanced workflow efficiency, and better patient outcomes. Operational advantages include reduced examination times, lower radiation exposure, and integrated digital workflows that streamline the entire screening process. Quality improvements result from enhanced image resolution, computer-aided detection capabilities, and standardized protocols that ensure consistent diagnostic quality.

Patients experience significant benefits including more comfortable examinations, reduced radiation exposure, and faster result delivery. Diagnostic accuracy improvements lead to earlier cancer detection, reduced false-positive rates, and more precise treatment planning. Accessibility enhancements through mobile mammography services and expanded screening programs ensure broader population coverage and improved health outcomes.

Government stakeholders benefit from cost-effective screening programs that support public health objectives and cancer prevention initiatives. Healthcare system efficiency improvements result from standardized protocols, quality assurance programs, and integrated data management systems. Economic benefits include reduced long-term healthcare costs through early detection and prevention, supporting sustainable healthcare system development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the South America mammography devices market. AI-powered diagnostic tools are enhancing screening accuracy, reducing interpretation time, and supporting radiologists in identifying subtle abnormalities. The adoption rate of AI-enhanced systems is increasing by approximately 15% annually across major healthcare facilities, driven by proven improvements in diagnostic performance.

Digital transformation continues to reshape mammography workflows, with comprehensive digital solutions replacing traditional film-based systems. Cloud-based platforms are enabling remote access to images and reports, supporting telemedicine initiatives and specialist consultations. Workflow optimization through integrated digital systems is reducing examination times and improving patient throughput in busy facilities.

Mobile mammography expansion is addressing geographic accessibility challenges, with deployment rates increasing significantly across rural and underserved areas. Government screening programs are increasingly incorporating mobile units to achieve population coverage targets and improve preventive care access. Technology miniaturization is enabling more compact and efficient mobile mammography systems suitable for diverse deployment scenarios.

Recent technological innovations have introduced next-generation mammography systems with enhanced imaging capabilities and improved patient experience features. Major manufacturers are launching AI-integrated platforms that provide real-time diagnostic support and automated quality assurance functions. Regulatory approvals for advanced mammography technologies are accelerating across South American countries, facilitating faster market entry for innovative solutions.

Strategic partnerships between international manufacturers and regional healthcare providers are expanding market access and technology transfer capabilities. Government initiatives including national breast cancer screening programs are driving systematic equipment procurement and deployment strategies. MarkWide Research analysis indicates that these developments are creating a more structured and sustainable market environment for mammography devices across the region.

Investment announcements from major healthcare organizations signal continued market expansion and infrastructure development. Training program launches are addressing workforce development needs and supporting technology adoption initiatives. Quality certification programs are establishing standardized protocols and ensuring consistent diagnostic quality across different providers and regions.

Market entry strategies should prioritize partnerships with established regional distributors and service providers to navigate complex regulatory environments and build local market presence. Technology positioning should emphasize cost-effectiveness and reliability while maintaining advanced diagnostic capabilities suitable for diverse healthcare settings. Service model development should include comprehensive training and support programs to address workforce limitations and ensure successful technology adoption.

Investment priorities should focus on digital mammography systems with AI integration capabilities, as these technologies demonstrate the strongest growth potential and clinical value proposition. Geographic expansion should target major metropolitan areas initially, followed by strategic deployment in secondary cities and rural regions through mobile solutions. Partnership development with government health agencies and private healthcare networks can accelerate market penetration and establish sustainable business models.

Product development should emphasize solutions tailored to resource-constrained environments while maintaining high diagnostic quality standards. Financing solutions including leasing programs and public-private partnerships can address capital constraints and expand market accessibility. MWR recommends focusing on comprehensive value propositions that combine advanced technology with extensive support services and training programs to differentiate in competitive markets.

Long-term market prospects for South America mammography devices remain highly positive, with sustained growth expected through the next decade driven by demographic trends, healthcare infrastructure development, and technology advancement. Digital transformation will continue accelerating, with analog systems being phased out in favor of advanced digital and AI-enhanced platforms. Market maturation is expected to occur at different rates across countries, creating diverse opportunities for various technology levels and service models.

Technology evolution will focus on enhanced diagnostic accuracy, improved patient experience, and integrated workflow solutions that optimize healthcare delivery efficiency. AI integration will become standard across mammography systems, with adoption rates projected to reach 75% penetration in major healthcare facilities within five years. Mobile mammography deployment will expand significantly, supporting population health initiatives and addressing geographic accessibility challenges.

Market consolidation trends may accelerate as larger companies acquire regional players and establish comprehensive service networks. Regulatory harmonization across South American countries will create more predictable market conditions and facilitate technology adoption. Investment flows into healthcare infrastructure will continue supporting market expansion, with particular emphasis on preventive care and early detection programs that rely heavily on advanced mammography capabilities.

The South America mammography devices market presents substantial opportunities for growth and development, driven by increasing healthcare investment, demographic transitions, and advancing technology capabilities. Market dynamics indicate strong potential for sustained expansion, with digital transformation and AI integration leading technological advancement across the region. Regional diversity creates multiple market segments with varying needs and adoption patterns, requiring tailored strategies for successful market participation.

Strategic success in this market requires comprehensive understanding of local healthcare systems, regulatory environments, and economic conditions that influence purchasing decisions and technology adoption. Partnership development with regional stakeholders, investment in training and support programs, and focus on cost-effective solutions will be critical for long-term market success. Technology innovation combined with accessible service models will drive continued market evolution and expansion across South America’s diverse healthcare landscape.

What is Mammography Devices?

Mammography devices are specialized imaging equipment used to conduct mammograms, which are X-ray examinations of the breast. These devices play a crucial role in the early detection and diagnosis of breast cancer, helping to improve patient outcomes.

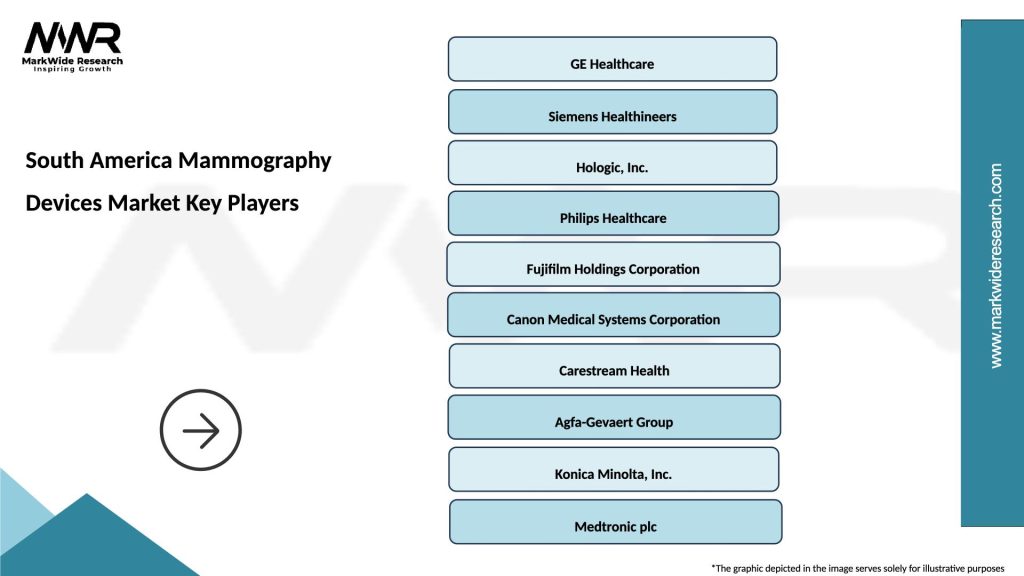

What are the key players in the South America Mammography Devices Market?

Key players in the South America Mammography Devices Market include Hologic, Siemens Healthineers, GE Healthcare, and Fujifilm, among others. These companies are known for their innovative technologies and comprehensive product offerings in breast imaging.

What are the growth factors driving the South America Mammography Devices Market?

The growth of the South America Mammography Devices Market is driven by increasing awareness about breast cancer, advancements in imaging technology, and government initiatives promoting early detection. Additionally, rising healthcare expenditure and improved access to diagnostic services contribute to market expansion.

What challenges does the South America Mammography Devices Market face?

The South America Mammography Devices Market faces challenges such as high costs of advanced imaging systems and a lack of trained professionals to operate these devices. Furthermore, disparities in healthcare access across different regions can hinder widespread adoption.

What opportunities exist in the South America Mammography Devices Market?

Opportunities in the South America Mammography Devices Market include the introduction of portable and digital mammography systems, which can enhance accessibility in remote areas. Additionally, increasing partnerships between public and private sectors can foster innovation and improve service delivery.

What trends are shaping the South America Mammography Devices Market?

Trends shaping the South America Mammography Devices Market include the integration of artificial intelligence in mammography for improved accuracy and efficiency. There is also a growing focus on personalized medicine and patient-centered care, which is influencing device development and usage.

South America Mammography Devices Market

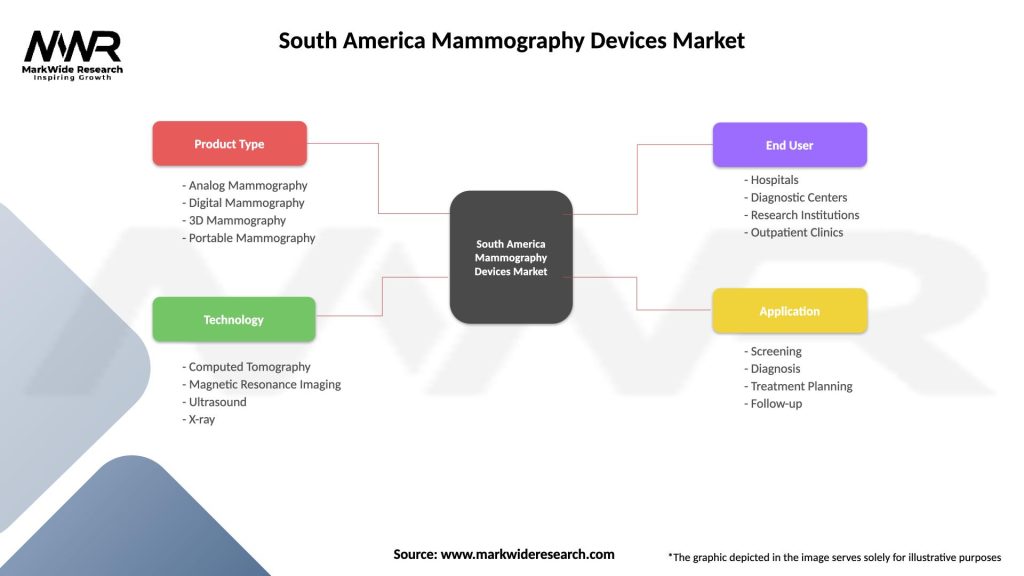

| Segmentation Details | Description |

|---|---|

| Product Type | Analog Mammography, Digital Mammography, 3D Mammography, Portable Mammography |

| Technology | Computed Tomography, Magnetic Resonance Imaging, Ultrasound, X-ray |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Application | Screening, Diagnosis, Treatment Planning, Follow-up |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Mammography Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at