444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America gear market represents a dynamic and rapidly evolving industrial landscape that serves as a critical component across multiple sectors including automotive, manufacturing, mining, and renewable energy. This comprehensive market encompasses various gear types such as spur gears, helical gears, bevel gears, worm gears, and planetary gears, each serving specific applications within the region’s diverse industrial ecosystem. Market dynamics indicate substantial growth potential driven by increasing industrialization, infrastructure development, and technological advancement across South American countries.

Regional manufacturing capabilities have expanded significantly, with countries like Brazil, Argentina, and Chile leading the charge in gear production and consumption. The market demonstrates remarkable resilience and adaptability, particularly in response to evolving industrial demands and technological innovations. Growth trajectories show promising expansion at a 6.2% CAGR over the forecast period, reflecting the region’s commitment to industrial modernization and mechanical engineering excellence.

Industrial diversification across South America has created multiple demand centers for precision gears, ranging from traditional heavy industries to emerging renewable energy sectors. The market’s evolution reflects broader economic trends, including increased foreign investment, technological transfer, and the development of local manufacturing capabilities that reduce dependency on imports while enhancing regional competitiveness.

The South America gear market refers to the comprehensive ecosystem of gear manufacturing, distribution, and application across all South American countries, encompassing the production and supply of mechanical transmission components that transfer power and motion between machine elements. This market includes various gear configurations designed for specific industrial applications, from simple power transmission to complex motion control systems.

Gear systems serve as fundamental mechanical components that enable efficient power transmission, speed reduction or increase, and directional changes in rotational motion across diverse industrial applications. The South American market specifically addresses regional manufacturing needs, local supply chain requirements, and industry-specific demands that reflect the unique economic and industrial characteristics of the continent.

Market scope encompasses both standard and custom gear solutions, including precision-engineered components for high-performance applications and cost-effective solutions for general industrial use. This comprehensive approach ensures that South American industries have access to appropriate gear technologies that support their operational efficiency and competitive positioning in global markets.

Strategic analysis of the South America gear market reveals a robust and expanding industrial sector characterized by increasing demand for precision mechanical components across multiple industries. The market demonstrates strong fundamentals driven by ongoing industrialization, infrastructure development, and the modernization of existing manufacturing facilities throughout the region.

Key growth drivers include the expansion of automotive manufacturing, increased mining activities, renewable energy development, and general industrial modernization efforts. The market benefits from technological advancement in gear manufacturing processes, improved material sciences, and enhanced precision engineering capabilities that enable local manufacturers to compete effectively with international suppliers.

Regional competitiveness has improved significantly through strategic investments in manufacturing infrastructure, workforce development, and technology transfer initiatives. Local manufacturers now capture approximately 58% market share in standard gear applications, while specialized and high-precision segments continue to rely on international suppliers for advanced technological solutions.

Future prospects indicate continued market expansion supported by government initiatives promoting industrial development, foreign direct investment in manufacturing sectors, and the growing emphasis on local content requirements in major industrial projects across South America.

Market intelligence reveals several critical insights that define the current state and future trajectory of the South America gear market. These insights reflect comprehensive analysis of industry trends, technological developments, and economic factors influencing market dynamics.

Primary market drivers propelling the South America gear market forward include a combination of economic, technological, and industrial factors that create sustained demand for mechanical transmission components. These drivers reflect both immediate market needs and long-term strategic developments across the region.

Industrial expansion represents the most significant driver, with countries across South America investing heavily in manufacturing infrastructure, mining operations, and energy production facilities. This expansion creates direct demand for various gear types and configurations, from heavy-duty industrial gears to precision components for automated manufacturing systems.

Automotive sector growth continues to drive substantial demand, particularly in Brazil and Argentina where major automotive manufacturers have established production facilities. The sector’s evolution toward electric vehicles and hybrid technologies creates new opportunities for specialized gear applications, including reduction gears for electric drivetrains and precision components for advanced transmission systems.

Mining industry modernization across South America generates significant demand for heavy-duty gear systems capable of operating in challenging environments. Countries rich in mineral resources, including Chile, Peru, and Brazil, continue to invest in advanced mining equipment that requires sophisticated gear solutions for optimal performance and reliability.

Renewable energy development emerges as a crucial driver, with wind power installations requiring specialized gearboxes and hydroelectric projects demanding precision gear systems. The region’s commitment to sustainable energy sources creates growing demand for gear technologies specifically designed for renewable energy applications.

Market constraints affecting the South America gear market include several challenging factors that limit growth potential and create operational difficulties for manufacturers and suppliers. Understanding these restraints is essential for developing effective market strategies and addressing industry limitations.

Economic volatility across South American countries creates uncertainty in capital investment decisions, affecting demand for industrial equipment and gear systems. Currency fluctuations, inflation pressures, and political instability in some regions contribute to market unpredictability that challenges long-term planning and investment commitments.

Technology gaps persist in certain high-precision gear applications where local manufacturing capabilities have not yet reached international standards. This limitation forces reliance on imported components for critical applications, increasing costs and extending delivery times while limiting the development of local technological expertise.

Skills shortages in advanced manufacturing techniques and precision engineering limit the ability of regional manufacturers to compete effectively in high-value market segments. The lack of specialized technical education and training programs creates workforce constraints that affect quality, productivity, and innovation capabilities.

Infrastructure limitations in some areas restrict manufacturing efficiency and supply chain effectiveness. Inadequate transportation networks, unreliable power supply, and limited access to advanced manufacturing equipment create operational challenges that increase costs and reduce competitiveness compared to international suppliers.

Strategic opportunities within the South America gear market present significant potential for growth and development across multiple dimensions. These opportunities reflect emerging trends, technological advances, and evolving industrial requirements that create new market segments and expansion possibilities.

Export market development represents a substantial opportunity as South American gear manufacturers improve quality standards and competitive positioning. Regional manufacturers can leverage cost advantages and growing technical capabilities to compete in international markets, particularly in neighboring regions and developing economies with similar industrial requirements.

Technology partnerships with international gear manufacturers offer opportunities for knowledge transfer, advanced manufacturing techniques, and access to cutting-edge production technologies. These collaborations can accelerate local capability development while providing international partners with cost-effective manufacturing bases and regional market access.

Renewable energy expansion creates substantial opportunities for specialized gear applications, including wind turbine gearboxes, hydroelectric generator systems, and solar tracking mechanisms. The region’s abundant renewable energy resources and government support for sustainable development drive demand for specialized gear solutions.

Digital transformation in manufacturing presents opportunities for implementing Industry 4.0 technologies, including smart manufacturing systems, predictive maintenance solutions, and automated quality control processes. These advances can significantly improve productivity, quality, and competitiveness while reducing operational costs.

Regional integration initiatives create opportunities for expanded market access and supply chain optimization across South American countries. Trade agreements and economic cooperation programs facilitate cross-border business development and create larger, more integrated markets for gear manufacturers and suppliers.

Market dynamics in the South America gear market reflect complex interactions between supply and demand factors, technological developments, and economic conditions that shape industry evolution and competitive positioning. These dynamics create both challenges and opportunities for market participants.

Supply chain evolution demonstrates increasing localization as regional manufacturers develop capabilities to serve domestic markets more effectively. This trend reduces import dependency while improving delivery times and customer service, though it also intensifies competition among local suppliers and requires continuous investment in capability development.

Demand patterns show increasing sophistication as South American industries adopt more advanced technologies and require higher-precision gear solutions. This evolution drives market segmentation between standard commodity gears and specialized high-performance applications, creating different competitive dynamics and value propositions.

Competitive intensity varies significantly across market segments, with commodity gear applications experiencing price-based competition while specialized applications focus on technical capabilities and service quality. Market participants must navigate these different competitive environments while building sustainable competitive advantages.

Innovation cycles in gear technology create opportunities for differentiation and market leadership, particularly in applications related to renewable energy, electric vehicles, and advanced manufacturing systems. Companies that successfully develop and commercialize innovative gear solutions can achieve significant competitive advantages and market share gains.

Comprehensive research methodology employed in analyzing the South America gear market combines multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of market insights. The methodology incorporates both primary and secondary research approaches to develop a complete understanding of market dynamics and trends.

Primary research includes extensive interviews with industry executives, manufacturing managers, technical specialists, and key decision-makers across the gear value chain. These interviews provide firsthand insights into market conditions, technological trends, competitive dynamics, and future outlook from industry participants with direct market experience.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements to gather quantitative data and validate primary research findings. This approach ensures comprehensive coverage of market segments, geographic regions, and application areas.

Market modeling techniques include statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify key growth drivers. The modeling process considers multiple variables including economic indicators, industrial production data, and technology adoption rates to ensure robust analytical foundations.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure accuracy and reliability of research findings. This rigorous approach provides confidence in market analysis and strategic recommendations for industry participants.

Regional market analysis reveals significant variations in gear market development across South American countries, reflecting different industrial structures, economic conditions, and technological capabilities. Understanding these regional differences is crucial for developing effective market strategies and identifying growth opportunities.

Brazil dominates the South American gear market with approximately 45% regional market share, driven by its large automotive industry, extensive manufacturing base, and significant mining operations. The country’s advanced industrial infrastructure and skilled workforce support both domestic production and export activities, making it the regional leader in gear manufacturing and consumption.

Argentina represents the second-largest market with 22% market share, primarily driven by automotive manufacturing, agricultural equipment production, and industrial machinery applications. The country’s strong engineering tradition and technical education system support advanced gear manufacturing capabilities, particularly in precision applications.

Chile contributes approximately 15% market share, with demand primarily driven by mining operations and renewable energy projects. The country’s focus on copper mining and growing wind energy sector create specific demand patterns for heavy-duty and specialized gear applications.

Colombia and Peru together account for 12% market share, with growing industrial sectors and increasing foreign investment driving demand for gear systems. These markets show strong growth potential as industrial development accelerates and infrastructure projects expand.

Other South American countries collectively represent the remaining 6% market share, including Venezuela, Ecuador, Uruguay, and smaller markets with specific industrial requirements and growth opportunities in niche applications.

Competitive dynamics in the South America gear market feature a mix of international corporations, regional manufacturers, and specialized local suppliers competing across different market segments and application areas. The competitive landscape reflects varying strategies, capabilities, and market positioning approaches.

Market positioning strategies vary significantly, with international companies emphasizing technological leadership and comprehensive service capabilities, while regional manufacturers focus on cost competitiveness, local market knowledge, and rapid response to customer requirements.

Market segmentation analysis reveals distinct categories within the South America gear market, each characterized by specific requirements, applications, and competitive dynamics. Understanding these segments is essential for targeted market strategies and product development initiatives.

By Gear Type:

By Application:

Automotive segment represents the largest application category, driven by significant vehicle production in Brazil and Argentina. This segment demands high-precision gears with strict quality requirements and cost competitiveness. Electric vehicle development creates new opportunities for specialized reduction gears and precision components, though this market remains in early development stages across South America.

Industrial manufacturing applications show steady growth as regional industries modernize equipment and adopt automated production systems. This segment values reliability, standardization, and local technical support, creating opportunities for regional manufacturers to compete effectively against international suppliers through superior service and faster delivery times.

Mining equipment segment requires heavy-duty gear systems capable of operating in harsh environments with minimal maintenance requirements. Copper mining in Chile and iron ore extraction in Brazil drive substantial demand for specialized gear applications, often requiring custom engineering solutions and extensive technical support.

Renewable energy applications represent the fastest-growing segment, with wind power development creating demand for large gearboxes and hydroelectric projects requiring precision gear systems. This segment offers opportunities for technology partnerships and specialized manufacturing capabilities that can serve both regional and export markets.

Agricultural machinery segment reflects South America’s significant agricultural production, requiring reliable and cost-effective gear solutions for various farming equipment. This market emphasizes durability, ease of maintenance, and availability of replacement parts through extensive distribution networks.

Strategic advantages available to industry participants in the South America gear market include multiple opportunities for growth, profitability, and competitive positioning. These benefits reflect the market’s evolution and the potential for value creation across the gear industry value chain.

Manufacturers benefit from growing regional demand that supports capacity utilization and economies of scale in production operations. Local manufacturing capabilities provide competitive advantages through reduced transportation costs, shorter delivery times, and enhanced customer service capabilities that international suppliers cannot easily match.

Technology providers find opportunities to establish partnerships with regional manufacturers, facilitating technology transfer while gaining access to cost-effective manufacturing capabilities and regional market knowledge. These collaborations can accelerate market penetration while reducing investment risks and operational complexities.

End-user industries benefit from improved supplier diversity, enhanced service levels, and competitive pricing as local gear manufacturing capabilities expand. Regional suppliers offer advantages in technical support, customization capabilities, and rapid response to changing requirements that support operational efficiency and competitiveness.

Supply chain participants including distributors and service providers benefit from market growth and increasing sophistication of gear applications. Opportunities exist for value-added services including technical consulting, maintenance support, and specialized logistics solutions that enhance customer relationships and profitability.

Investment community recognizes the South America gear market as an attractive opportunity for industrial investment, particularly in manufacturing infrastructure, technology development, and market expansion initiatives that can generate sustainable returns while supporting regional economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological advancement represents the most significant trend shaping the South America gear market, with manufacturers increasingly adopting advanced production technologies including CNC machining, automated assembly systems, and digital quality control processes. These improvements enable higher precision, improved consistency, and enhanced productivity that support competitive positioning against international suppliers.

Sustainability focus drives demand for environmentally responsible manufacturing processes and recyclable gear materials. Companies are investing in energy-efficient production methods, waste reduction initiatives, and sustainable material sourcing to meet evolving customer requirements and regulatory standards while reducing operational costs.

Customization capabilities become increasingly important as regional industries require application-specific gear solutions tailored to unique operational requirements. This trend favors manufacturers with engineering expertise and flexible production capabilities over standardized mass production approaches.

Digital integration transforms gear manufacturing through implementation of smart manufacturing systems, predictive maintenance technologies, and data-driven quality control processes. MarkWide Research indicates that companies adopting digital technologies achieve 25% efficiency improvements compared to traditional manufacturing approaches.

Supply chain localization continues as companies seek to reduce import dependency and improve supply chain resilience. This trend supports regional manufacturing development while creating opportunities for local suppliers to expand market share through enhanced service capabilities and competitive positioning.

Recent industry developments in the South America gear market reflect ongoing transformation and modernization efforts across the regional manufacturing landscape. These developments indicate growing sophistication and competitive capabilities among regional market participants.

Manufacturing facility expansions by both international and regional companies demonstrate confidence in market growth potential and commitment to serving regional demand more effectively. Several major gear manufacturers have announced significant capacity investments in Brazil and Argentina to support automotive and industrial applications.

Technology partnerships between international gear manufacturers and regional companies facilitate knowledge transfer while providing cost-effective manufacturing capabilities. These collaborations accelerate capability development and enable regional companies to compete in higher-value market segments.

Quality certification achievements by regional manufacturers demonstrate improving standards and international competitiveness. Several South American gear producers have achieved ISO 9001, TS 16949, and other international quality certifications that enable participation in global supply chains.

Research and development investments by regional companies and universities support innovation in gear design, materials science, and manufacturing processes. These initiatives contribute to technological advancement and competitive differentiation in specialized applications.

Export market development initiatives by regional manufacturers demonstrate growing confidence in international competitiveness. Several companies have successfully established export relationships with customers in North America, Europe, and Asia, validating quality and cost competitiveness.

Strategic recommendations for South America gear market participants focus on leveraging regional advantages while addressing competitive challenges and market opportunities. These suggestions reflect comprehensive analysis of market dynamics and industry best practices.

Technology investment should prioritize advanced manufacturing capabilities that enable competition in high-precision applications while maintaining cost competitiveness. Companies should focus on CNC machining, automated quality control, and digital manufacturing systems that improve productivity and quality consistency.

Workforce development initiatives are essential for building technical capabilities required for advanced gear manufacturing. Companies should invest in training programs, technical education partnerships, and knowledge transfer initiatives that develop specialized skills and engineering expertise.

Market diversification strategies should explore opportunities in renewable energy, electric vehicles, and export markets to reduce dependency on traditional industrial applications. This approach provides growth opportunities while spreading risk across multiple market segments.

Partnership development with international technology providers can accelerate capability development while providing access to advanced manufacturing techniques and global market opportunities. Strategic alliances should focus on mutual benefit and long-term relationship building.

Quality improvement programs should emphasize international standards and certifications that enable participation in global supply chains and premium market segments. Investment in quality systems provides competitive differentiation and supports premium pricing strategies.

Future prospects for the South America gear market indicate continued growth and development driven by industrial expansion, technological advancement, and increasing regional manufacturing capabilities. The market is positioned for sustained expansion across multiple application areas and geographic regions.

Growth projections suggest the market will maintain robust expansion at approximately 6.2% CAGR through the forecast period, supported by ongoing industrialization, infrastructure development, and modernization of existing manufacturing facilities. This growth rate reflects both organic market expansion and increasing market share capture by regional manufacturers.

Technology evolution will continue transforming the gear manufacturing landscape through adoption of Industry 4.0 technologies, advanced materials, and precision manufacturing techniques. Companies that successfully implement these technologies will achieve significant competitive advantages and market leadership positions.

Market maturation will result in increased specialization and segmentation as regional manufacturers develop expertise in specific applications and customer segments. This evolution supports value creation and competitive differentiation while reducing direct price competition.

Export development represents significant future opportunity as regional manufacturers achieve international quality standards and competitive positioning. MWR analysis suggests that South American gear exports could achieve 15% annual growth over the next five years as companies establish international market presence.

Sustainability requirements will increasingly influence market development as customers demand environmentally responsible manufacturing processes and recyclable products. Companies that proactively address sustainability requirements will achieve competitive advantages and access to premium market segments.

The South America gear market presents a compelling opportunity for growth and development across multiple dimensions, reflecting the region’s industrial evolution and increasing technological sophistication. Market fundamentals remain strong, supported by diverse industrial demand, improving manufacturing capabilities, and strategic investments in technology and infrastructure development.

Regional manufacturers have demonstrated remarkable progress in developing competitive capabilities while international companies continue to invest in local presence and partnerships. This dynamic creates a healthy competitive environment that benefits end-users through improved product quality, competitive pricing, and enhanced service capabilities.

Future success in the South America gear market will depend on continued investment in technology, workforce development, and quality improvement initiatives that enable competition in high-value applications while maintaining cost competitiveness. Companies that successfully navigate these requirements while building sustainable competitive advantages will achieve market leadership and profitable growth in this expanding market opportunity.

What is Gear?

Gear refers to mechanical components used to transmit power and motion in various applications, including automotive, industrial machinery, and consumer electronics. They play a crucial role in enhancing efficiency and performance in these systems.

What are the key players in the South America Gear Market?

Key players in the South America Gear Market include companies like Siemens, Bosch, and SKF, which are known for their innovative gear solutions in automotive and industrial applications, among others.

What are the main drivers of growth in the South America Gear Market?

The main drivers of growth in the South America Gear Market include the increasing demand for automation in manufacturing, the expansion of the automotive sector, and advancements in gear technology that enhance performance and durability.

What challenges does the South America Gear Market face?

Challenges in the South America Gear Market include fluctuating raw material prices, competition from low-cost imports, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the South America Gear Market?

Opportunities in the South America Gear Market include the growing trend towards electric vehicles, which require specialized gear systems, and the increasing focus on renewable energy technologies that utilize advanced gear solutions.

What trends are shaping the South America Gear Market?

Trends shaping the South America Gear Market include the integration of smart technologies in gear systems, the shift towards lightweight materials for improved efficiency, and the rising demand for customized gear solutions across various industries.

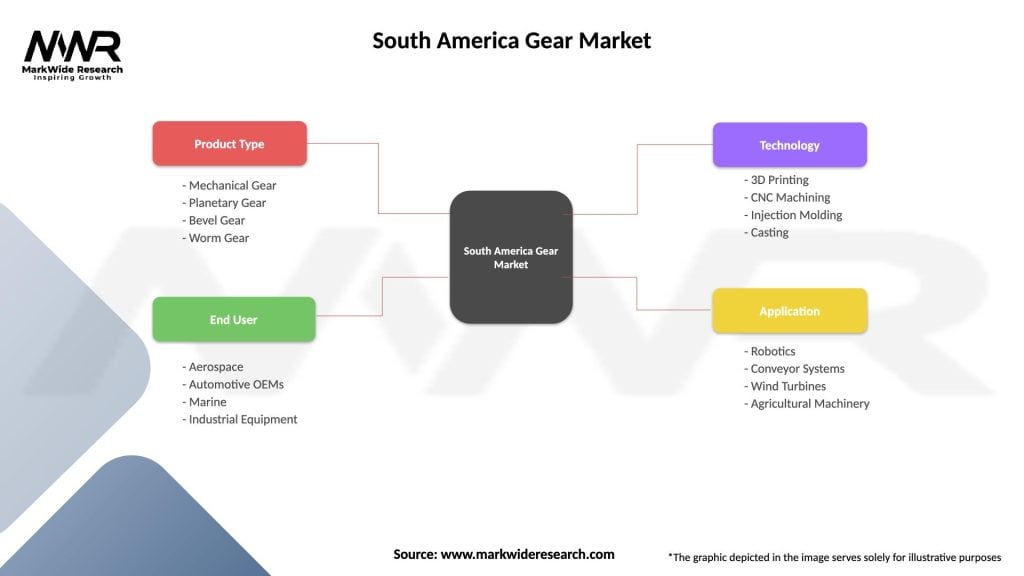

South America Gear Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mechanical Gear, Planetary Gear, Bevel Gear, Worm Gear |

| End User | Aerospace, Automotive OEMs, Marine, Industrial Equipment |

| Technology | 3D Printing, CNC Machining, Injection Molding, Casting |

| Application | Robotics, Conveyor Systems, Wind Turbines, Agricultural Machinery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Gear Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at