444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America ETF market represents a dynamic and rapidly evolving segment of the regional financial landscape, offering investors diversified exposure to Latin American economies through exchange-traded funds. This market encompasses various investment vehicles that track indices, commodities, and sector-specific opportunities across countries including Brazil, Argentina, Chile, Colombia, and Peru. Market participants are witnessing increased institutional and retail investor interest as South American economies demonstrate resilience and growth potential despite global economic uncertainties.

Regional economic diversification has become a key driver for ETF adoption, with funds focusing on sectors ranging from natural resources and agriculture to technology and renewable energy. The market has experienced significant growth momentum with adoption rates increasing by approximately 12.5% annually as investors seek emerging market exposure. Investment flows into South American ETFs have shown remarkable consistency, supported by improved regulatory frameworks and enhanced market infrastructure across major regional exchanges.

Technological advancement and digital trading platforms have democratized access to South American ETFs, enabling both domestic and international investors to participate in regional growth stories. The market benefits from currency diversification opportunities and exposure to commodity cycles that traditionally drive South American economies, making these investment vehicles attractive for portfolio diversification strategies.

The South America ETF market refers to the comprehensive ecosystem of exchange-traded funds that provide investment exposure to South American securities, indices, commodities, and economic sectors. These financial instruments allow investors to gain diversified access to regional markets through a single tradeable security that combines the benefits of mutual fund diversification with stock-like trading flexibility.

ETF structures in South America include broad market index funds, sector-specific funds, commodity-focused vehicles, and country-specific offerings that track individual national markets. Market mechanisms enable these funds to trade on major exchanges while maintaining liquidity through authorized participant networks and market maker systems. The market encompasses both passive index-tracking funds and actively managed ETFs that seek to outperform regional benchmarks through strategic security selection.

Investment accessibility through South American ETFs extends beyond traditional equity exposure to include fixed income, real estate investment trusts, and alternative asset classes. This comprehensive approach allows investors to construct sophisticated portfolio allocations while benefiting from professional fund management and regulatory oversight that ensures transparency and investor protection.

Market dynamics in the South America ETF sector reflect broader regional economic trends, with increasing investor confidence driving substantial inflows and product innovation. The market has demonstrated robust performance across multiple asset classes, supported by improving macroeconomic fundamentals and enhanced regulatory environments that facilitate cross-border investment flows.

Key growth drivers include expanding middle-class wealth, institutional adoption of passive investment strategies, and increasing recognition of South America’s role in global supply chains. Technology integration has reduced transaction costs by approximately 18% while improving market access for retail investors through digital platforms and robo-advisory services.

Competitive landscape features both international asset management giants and regional specialists offering diverse ETF products tailored to local market conditions and investor preferences. Product innovation continues to expand investment options, with new launches focusing on ESG themes, smart beta strategies, and sector rotation opportunities that capitalize on regional economic cycles.

Future prospects remain positive as regulatory harmonization across South American markets facilitates greater integration and cross-listing opportunities. The market benefits from demographic trends supporting long-term savings and investment growth, positioning ETFs as preferred vehicles for retirement planning and wealth accumulation strategies.

Investment patterns reveal significant shifts toward passive investment strategies as South American investors increasingly recognize the benefits of low-cost, diversified market exposure. Institutional adoption has accelerated with pension funds and insurance companies allocating larger portions of their portfolios to ETF structures.

Market maturation is evident through expanding product ranges and increasing sophistication of investment strategies. Cross-border flows have intensified as international investors recognize South America’s potential for portfolio diversification and long-term growth opportunities.

Economic growth across South American countries continues to fuel investor interest in regional ETFs, with GDP expansion supporting corporate earnings and market valuations. Commodity price cycles create attractive entry points for investors seeking exposure to natural resource sectors that dominate many South American economies.

Demographic trends support long-term market growth as expanding middle classes increase savings rates and investment participation. Pension reform initiatives across the region have created substantial pools of capital seeking diversified investment vehicles, with ETFs positioned as preferred solutions for retirement planning strategies.

Regulatory improvements have enhanced market confidence through stronger investor protections and improved transparency requirements. Financial market integration initiatives facilitate cross-border investment flows and reduce regulatory barriers that previously limited ETF adoption.

Technology advancement has democratized investment access through digital platforms that reduce minimum investment requirements and transaction costs. Currency stability measures implemented by regional central banks have reduced volatility concerns that previously deterred international investment in South American ETFs.

Infrastructure development across the region creates investment opportunities in sectors ranging from transportation and energy to telecommunications and utilities. Trade agreement expansion enhances economic integration and creates new opportunities for sector-specific ETF strategies.

Political volatility remains a significant concern for international investors, with policy uncertainty affecting market sentiment and investment flows into South American ETFs. Currency fluctuations can create substantial volatility for unhedged international investors, particularly during periods of global risk aversion.

Liquidity constraints in smaller regional markets can impact ETF performance and create tracking errors relative to underlying indices. Regulatory fragmentation across different South American countries complicates cross-border investment strategies and increases compliance costs for fund managers.

Economic dependence on commodity exports makes many South American ETFs vulnerable to global commodity price cycles and external demand shocks. Infrastructure limitations in some markets can restrict trading efficiency and settlement processes, affecting overall market development.

Tax complexity surrounding cross-border ETF investments can deter some institutional investors and complicate portfolio management strategies. Limited local expertise in passive investment management may constrain product innovation and competitive dynamics in certain regional markets.

Market concentration in larger economies like Brazil can limit diversification benefits and create single-country risk exposures within regional ETF products. Information asymmetries between local and international investors can impact pricing efficiency and market development.

ESG investing trends create substantial opportunities for sustainable and socially responsible ETF products that align with growing investor consciousness about environmental and social impacts. Green energy transition across South America presents opportunities for renewable energy and clean technology focused ETFs.

Digital transformation initiatives across regional economies create investment opportunities in technology and fintech sectors through specialized ETF products. Agricultural innovation and sustainable farming practices offer opportunities for agribusiness and food security themed investment vehicles.

Infrastructure modernization programs across South American countries create opportunities for construction, materials, and engineering focused ETFs. Healthcare expansion driven by demographic changes and improved access creates opportunities for healthcare and pharmaceutical sector ETFs.

Financial inclusion initiatives expand the potential investor base for ETF products while creating opportunities for fintech and banking sector exposure. Regional trade integration through organizations like Mercosur creates opportunities for cross-border and regional integration themed ETFs.

Tourism recovery post-pandemic presents opportunities for hospitality and travel sector ETFs as international travel normalizes. Mining technology advancement creates opportunities for next-generation mining and metals processing ETFs that capitalize on technological innovation in traditional industries.

Supply and demand dynamics in the South America ETF market reflect broader investor sentiment toward emerging markets and regional economic prospects. Institutional demand has grown significantly as pension funds and insurance companies increase allocations to passive investment strategies, with institutional flows representing approximately 68% of total ETF inflows.

Competitive pressures have driven expense ratio reductions and product innovation as asset managers compete for market share in the growing ETF space. Market maker activity has improved liquidity conditions and reduced bid-ask spreads, enhancing the overall trading experience for investors.

Seasonal patterns influence ETF flows, with increased activity typically observed during pension contribution periods and year-end rebalancing activities. Correlation dynamics between South American markets and global indices affect investor allocation decisions and risk management strategies.

Interest rate environments significantly impact ETF performance, particularly for fixed income and dividend-focused products. MarkWide Research analysis indicates that rate-sensitive ETFs show 23% higher volatility during monetary policy transition periods compared to equity-focused funds.

Cross-asset relationships between commodity prices, currency movements, and equity market performance create complex dynamics that influence ETF strategy selection and portfolio construction decisions.

Comprehensive analysis of the South America ETF market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with fund managers, institutional investors, regulatory officials, and market participants across major South American financial centers.

Secondary research encompasses analysis of regulatory filings, fund prospectuses, performance data, and market statistics from exchanges and clearing organizations. Quantitative analysis examines historical performance patterns, correlation structures, and risk metrics across different ETF categories and investment strategies.

Market surveys capture investor sentiment, allocation preferences, and future investment intentions from both institutional and retail market participants. Expert consultations with regional economists, policy makers, and industry specialists provide contextual insights into market development trends and regulatory evolution.

Data validation processes ensure accuracy and consistency across multiple information sources, with cross-referencing and verification procedures applied to all quantitative and qualitative findings. Trend analysis employs statistical modeling techniques to identify patterns and project future market developments.

Regional focus groups provide insights into local market conditions, investor behavior patterns, and cultural factors that influence ETF adoption and usage patterns across different South American countries.

Brazil dominates the South American ETF landscape, accounting for approximately 52% of regional ETF assets under management due to its large economy and developed capital markets infrastructure. Brazilian ETFs offer exposure to diverse sectors including financial services, mining, energy, and consumer goods, benefiting from the country’s economic diversification efforts.

Argentina presents unique opportunities despite economic challenges, with ETFs focused on agricultural exports, natural resources, and recovery plays attracting international investor interest. Currency considerations remain paramount for Argentine ETF investments, with many funds offering hedged versions to mitigate peso volatility.

Chile’s market attracts investors through its stable regulatory environment and strong mining sector exposure, with copper and lithium focused ETFs gaining particular attention. Chilean pension reform discussions continue to influence domestic ETF adoption and product development strategies.

Colombia’s emerging ETF market benefits from economic diversification efforts and improved security conditions, with infrastructure and energy sector funds showing strong growth potential. Colombian peso stability has improved international investor confidence in local ETF products.

Peru’s mining-focused ETFs capitalize on the country’s position as a major global metals producer, while tourism and agricultural ETFs offer alternative exposure themes. Regional integration initiatives continue to enhance cross-border investment flows and market development opportunities.

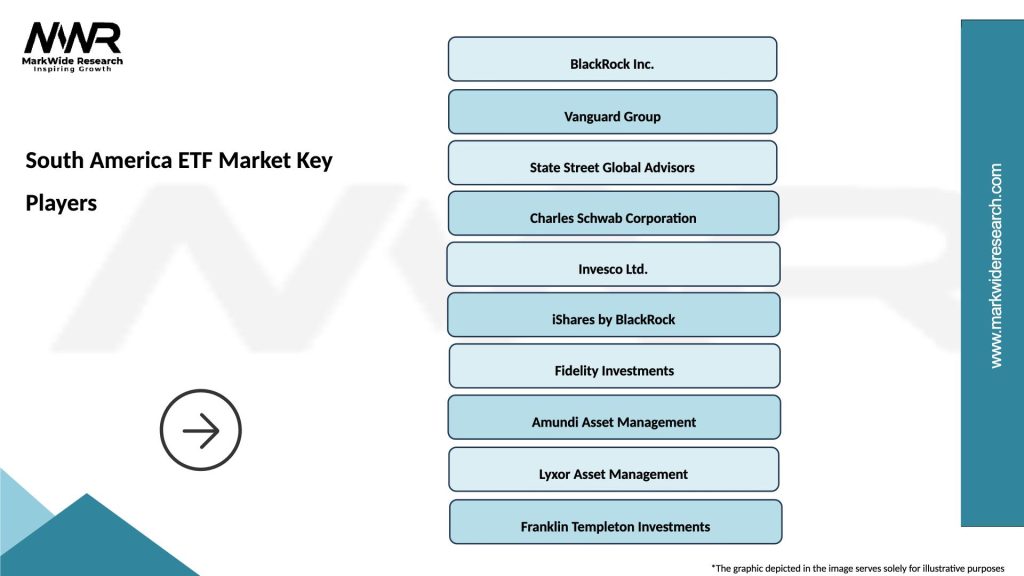

Market leadership in South American ETFs is shared among international asset management giants and regional specialists, each bringing unique strengths and market positioning strategies.

Competitive differentiation occurs through expense ratio competition, product innovation, and specialized market expertise. Distribution strategies vary significantly between firms, with some focusing on institutional channels while others emphasize retail investor access through digital platforms.

Product innovation continues to drive competitive dynamics, with firms launching ESG-focused funds, smart beta strategies, and alternative weighting methodologies to capture evolving investor preferences.

By Asset Class: The South American ETF market encompasses equity ETFs representing the largest segment, fixed income ETFs providing yield and diversification, commodity ETFs offering natural resource exposure, and alternative strategy ETFs including REITs and infrastructure funds.

By Geographic Focus: Country-specific ETFs target individual markets like Brazil, Argentina, and Chile, while regional ETFs provide broader South American exposure. Sector-specific funds focus on industries such as mining, agriculture, energy, and financial services that dominate regional economies.

By Investment Strategy: Passive index-tracking ETFs represent the majority of assets, while actively managed ETFs and smart beta strategies gain market share. Currency hedged and unhedged versions cater to different investor risk preferences and portfolio objectives.

By Investor Type: Institutional investors including pension funds and insurance companies represent the largest segment, while retail investors access ETFs through brokerage platforms and robo-advisors. High net worth individuals utilize ETFs for tactical allocation and portfolio diversification strategies.

By Distribution Channel: Traditional brokerage firms, digital investment platforms, bank wealth management divisions, and independent financial advisors each serve different investor segments with varying service levels and fee structures.

Equity ETFs dominate the South American market, with broad market index funds providing core exposure while sector-specific funds allow tactical positioning. Large-cap focused ETFs attract institutional investors seeking liquidity and stability, while small and mid-cap funds appeal to growth-oriented strategies.

Fixed Income ETFs serve important portfolio diversification roles, with government bond funds providing duration exposure and corporate bond ETFs offering yield enhancement. Local currency bonds attract domestic investors while hard currency denominated funds appeal to international participants.

Commodity ETFs capitalize on South America’s natural resource abundance, with precious metals, agricultural products, and energy funds reflecting regional economic strengths. Commodity producer ETFs provide equity exposure to mining and agricultural companies rather than direct commodity ownership.

Sector ETFs allow targeted exposure to key South American industries, with financial services, materials, and energy sectors representing the largest categories. Technology and healthcare sector ETFs are emerging as regional economies diversify beyond traditional commodity dependence.

Thematic ETFs capture long-term investment trends such as infrastructure development, renewable energy transition, and demographic changes affecting South American societies. ESG-focused funds address growing investor demand for sustainable investment options.

Investors benefit from diversified exposure to South American markets through single investment vehicles, reducing the complexity and costs associated with direct international investing. Risk management improves through professional portfolio construction and ongoing rebalancing that maintains target allocations.

Cost advantages include lower expense ratios compared to actively managed funds and reduced transaction costs through efficient trading mechanisms. Liquidity benefits provide intraday trading flexibility and transparent pricing that enhances portfolio management capabilities.

Asset managers benefit from scalable business models that allow efficient management of large asset pools while generating steady fee income. Product innovation opportunities enable differentiation and market share growth through specialized investment strategies.

Market makers profit from bid-ask spreads while providing essential liquidity services that support ETF market functioning. Authorized participants earn arbitrage profits while ensuring ETF prices remain aligned with underlying asset values.

Exchanges benefit from increased trading volumes and listing fees as ETF markets expand. Regulatory authorities gain improved market oversight capabilities through standardized ETF structures and reporting requirements.

Economic development benefits include increased capital market depth and improved price discovery mechanisms that support overall financial market development across South American countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Passive investing adoption continues accelerating as South American investors recognize the benefits of low-cost, diversified market exposure through ETF structures. Institutional allocation shifts toward passive strategies have increased ETF assets under management by approximately 15.2% annually over recent periods.

ESG integration represents a major trend as investors increasingly consider environmental, social, and governance factors in investment decisions. Sustainable investing themes are driving product innovation with new ETF launches focusing on clean energy, social impact, and governance excellence.

Technology disruption is transforming ETF access through robo-advisors, mobile trading platforms, and artificial intelligence-driven portfolio management tools. Digital distribution has reduced minimum investment requirements and democratized access to sophisticated investment strategies.

Smart beta strategies gain popularity as investors seek enhanced returns through factor-based investing approaches that target specific risk and return characteristics. Multi-factor ETFs combine value, momentum, quality, and low volatility factors in single investment vehicles.

Currency hedging options expand as investors seek to separate regional economic exposure from currency risk. Local currency ETFs appeal to domestic investors while hedged versions attract international participants concerned about exchange rate volatility.

Regulatory harmonization efforts across South American markets facilitate cross-border ETF listings and reduce compliance complexity for international asset managers. Tax treaty improvements enhance after-tax returns for international investors in regional ETF products.

Exchange consolidation and technology upgrades improve trading efficiency and reduce settlement risks across regional markets. Clearing and settlement infrastructure modernization supports increased ETF trading volumes and operational efficiency.

Product innovation accelerates with launches of thematic ETFs focused on infrastructure, renewable energy, and demographic trends specific to South American markets. MWR analysis indicates that thematic ETF launches have increased by 28% over the past two years.

Partnership agreements between international asset managers and local distributors expand ETF availability and investor education programs. Institutional adoption increases as pension funds and insurance companies modify investment policies to accommodate ETF strategies.

Technology integration includes blockchain applications for settlement processes and artificial intelligence for index construction and portfolio optimization. Mobile trading platforms enhance retail investor access and engagement with ETF products.

Diversification strategies should consider both geographic and sector allocation across South American ETF products to optimize risk-adjusted returns. Currency hedging decisions require careful analysis of investment objectives and risk tolerance levels for international investors.

Due diligence processes should examine underlying index methodology, fund management quality, and liquidity characteristics before making ETF investment decisions. Cost analysis should include expense ratios, trading costs, and tax implications to determine total investment costs.

Timing considerations suggest that systematic investment approaches may be more effective than tactical timing strategies given the volatility of emerging markets. Rebalancing disciplines help maintain target allocations and capture rebalancing premiums over time.

Risk management should incorporate position sizing, correlation analysis, and stress testing to ensure ETF allocations align with overall portfolio objectives. Liquidity assessment becomes particularly important for smaller or more specialized ETF products.

Long-term perspective remains essential given the development stage of many South American markets and the time required for economic and market maturation. Regular monitoring of political and economic developments helps inform ongoing investment decisions and allocation adjustments.

Growth prospects for the South America ETF market remain positive, supported by continued economic development, improving regulatory frameworks, and increasing investor sophistication. Market expansion is expected to continue at a compound annual growth rate of approximately 11.8% as both domestic and international investor participation increases.

Product innovation will likely focus on ESG themes, smart beta strategies, and sector-specific opportunities that capitalize on regional economic transformation. Technology integration will enhance market efficiency and investor access while reducing costs and improving transparency.

Institutional adoption is projected to accelerate as pension reform initiatives create larger pools of investment capital seeking diversified, cost-effective investment solutions. Retail investor participation will expand through improved financial education and enhanced digital distribution platforms.

Regional integration efforts may create opportunities for cross-border ETF products that provide exposure to integrated South American economic zones. Infrastructure development will create new investment themes and sector-specific opportunities for specialized ETF products.

MarkWide Research projects that sustainable and ESG-focused ETFs will represent approximately 35% of new product launches over the next five years, reflecting growing investor consciousness about environmental and social impacts. Market maturation will likely result in increased competition, lower costs, and improved product quality across the ETF ecosystem.

The South America ETF market represents a compelling investment opportunity characterized by significant growth potential, increasing product sophistication, and expanding investor adoption. Market fundamentals support continued development as regional economies diversify, regulatory frameworks improve, and investor education enhances market participation.

Investment opportunities span multiple asset classes, sectors, and investment strategies, providing diverse options for portfolio construction and risk management. Technological advancement continues to improve market access, reduce costs, and enhance the overall investor experience across ETF products.

Future success will depend on continued regulatory progress, political stability, and economic development across South American countries. Market participants who understand regional dynamics, maintain long-term perspectives, and employ appropriate risk management strategies are well-positioned to benefit from the ongoing development of South American ETF markets.

The South America ETF market stands at an important inflection point, with strong fundamentals supporting continued growth while evolving investor preferences drive product innovation and market sophistication. This dynamic environment creates opportunities for investors, asset managers, and other market participants who can navigate the complexities and capitalize on the long-term potential of South American financial markets.

What is South America ETF?

South America ETF refers to exchange-traded funds that invest in a diversified portfolio of assets from South American countries. These funds typically include stocks, bonds, and commodities, providing investors with exposure to the region’s economic performance.

What are the key players in the South America ETF Market?

Key players in the South America ETF Market include companies like BlackRock, Vanguard, and Invesco, which offer a range of ETFs focused on South American equities and fixed income. These firms are known for their extensive research and investment strategies tailored to the region, among others.

What are the growth factors driving the South America ETF Market?

The South America ETF Market is driven by factors such as increasing foreign investment, economic diversification in countries like Brazil and Chile, and growing interest in emerging markets among global investors. Additionally, the rise of digital trading platforms has made ETFs more accessible to retail investors.

What challenges does the South America ETF Market face?

The South America ETF Market faces challenges such as political instability in certain countries, currency volatility, and regulatory changes that can impact investment strategies. These factors can create uncertainty for investors looking to enter or expand in the market.

What opportunities exist in the South America ETF Market?

Opportunities in the South America ETF Market include the potential for high returns from emerging market investments, the growth of sustainable and ESG-focused ETFs, and the increasing demand for sector-specific funds that target industries like technology and renewable energy.

What trends are shaping the South America ETF Market?

Trends shaping the South America ETF Market include the rise of thematic investing, where funds focus on specific trends like green energy or technology, and the increasing use of artificial intelligence in fund management. Additionally, there is a growing emphasis on transparency and lower fees among ETF providers.

South America ETF Market

| Segmentation Details | Description |

|---|---|

| Product Type | Equity ETFs, Bond ETFs, Commodity ETFs, Currency ETFs |

| Customer Type | Institutional Investors, Retail Investors, Hedge Funds, Family Offices |

| Distribution Channel | Online Brokerage, Financial Advisors, Direct Sales, Institutional Sales |

| Investment Strategy | Passive Management, Active Management, Smart Beta, Thematic Investing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America ETF Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at