444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America electric vehicle battery manufacturing market represents a rapidly evolving sector within the region’s automotive and energy storage ecosystem. This emerging market encompasses the production, assembly, and distribution of lithium-ion batteries, solid-state batteries, and other advanced energy storage solutions specifically designed for electric vehicles across South American countries including Brazil, Argentina, Chile, Colombia, and Peru.

Market dynamics indicate substantial growth potential driven by increasing government incentives for electric mobility, rising environmental consciousness among consumers, and significant investments in lithium mining operations throughout the region. The market benefits from South America’s abundant natural resources, particularly lithium reserves in the “Lithium Triangle” spanning Argentina, Bolivia, and Chile, which collectively hold approximately 58% of global lithium reserves.

Regional manufacturing capabilities are expanding rapidly as international automotive manufacturers establish local production facilities to serve both domestic and export markets. The market encompasses various battery technologies including nickel-manganese-cobalt (NMC), lithium iron phosphate (LFP), and emerging solid-state technologies, with growing emphasis on sustainable manufacturing practices and circular economy principles.

Investment flows into the sector have accelerated significantly, with both domestic and international companies recognizing the strategic importance of establishing battery manufacturing capabilities in proximity to raw material sources. This positioning offers competitive advantages in terms of supply chain efficiency, cost optimization, and reduced transportation emissions for battery components.

The South America electric vehicle battery manufacturing market refers to the comprehensive ecosystem of companies, facilities, and supply chains engaged in producing energy storage systems specifically designed for electric vehicles within South American territories. This market encompasses the entire value chain from raw material processing and cell manufacturing to battery pack assembly and integration with electric vehicle platforms.

Manufacturing activities include lithium extraction and processing, cathode and anode material production, electrolyte formulation, cell assembly, battery management system integration, and final battery pack configuration. The market serves various electric vehicle segments including passenger cars, commercial vehicles, buses, and two-wheelers, with increasing focus on energy density optimization and charging speed enhancement.

Technological scope covers multiple battery chemistries and form factors, ranging from traditional cylindrical and prismatic cells to advanced pouch cells and next-generation solid-state technologies. The market also encompasses recycling and second-life applications for electric vehicle batteries, supporting circular economy initiatives and sustainable resource utilization throughout the region.

South America’s electric vehicle battery manufacturing sector is experiencing unprecedented growth momentum, driven by the convergence of abundant lithium resources, supportive government policies, and increasing electric vehicle adoption rates across the region. The market represents a strategic opportunity for both regional economic development and global supply chain diversification in the electric mobility transition.

Key growth drivers include substantial government investments in electric mobility infrastructure, international automotive manufacturers establishing local production facilities, and growing consumer acceptance of electric vehicles driven by environmental concerns and total cost of ownership advantages. The region’s competitive position is further strengthened by preferential access to critical raw materials and emerging trade agreements facilitating battery exports.

Market participants range from established international battery manufacturers and automotive OEMs to emerging regional players and specialized technology providers. Strategic partnerships between mining companies, battery manufacturers, and automotive brands are becoming increasingly common, creating integrated value chains that leverage South America’s natural resource advantages while building local manufacturing capabilities.

Future prospects indicate continued expansion with projected growth rates exceeding 25% annually through the next decade, supported by increasing electric vehicle penetration, expanding charging infrastructure, and technological advances in battery performance and manufacturing efficiency.

Strategic positioning within the global battery supply chain represents South America’s primary competitive advantage, with the region’s lithium resources providing cost-effective access to critical raw materials for battery manufacturing. This positioning enables local manufacturers to achieve competitive pricing while reducing supply chain risks associated with long-distance material transportation.

Government policy support serves as the primary catalyst for electric vehicle battery manufacturing growth across South America, with multiple countries implementing comprehensive electric mobility strategies that include domestic content requirements, tax incentives, and infrastructure development programs. These policies create favorable conditions for battery manufacturing investments while ensuring long-term market demand.

Resource availability provides fundamental competitive advantages for South American battery manufacturers, with the region’s extensive lithium, nickel, and cobalt reserves enabling cost-effective production and reduced supply chain dependencies. The proximity to raw materials significantly reduces transportation costs and environmental impact while ensuring supply security for manufacturing operations.

International investment flows are accelerating as global automotive and battery companies recognize South America’s strategic importance in the electric vehicle supply chain. Major manufacturers are establishing regional production facilities to serve both local markets and export opportunities, bringing advanced technologies and manufacturing expertise to the region.

Environmental regulations and sustainability commitments are driving demand for locally produced batteries that reduce transportation emissions and support circular economy principles. Consumers and businesses increasingly prefer products with lower carbon footprints, creating market advantages for regionally manufactured battery solutions.

Technological advancement in battery performance, manufacturing efficiency, and cost reduction is enabling broader electric vehicle adoption while creating opportunities for South American manufacturers to participate in cutting-edge technology development and production.

Infrastructure limitations present significant challenges for battery manufacturing expansion, including inadequate transportation networks, limited port facilities, and insufficient electrical grid capacity in some regions. These constraints can increase operational costs and limit production scalability for battery manufacturing facilities.

Technical workforce shortages constrain rapid industry expansion as battery manufacturing requires specialized skills in electrochemistry, materials science, and advanced manufacturing processes. The limited availability of qualified personnel can delay project implementation and increase labor costs for manufacturers.

Capital intensity of battery manufacturing operations requires substantial upfront investments in specialized equipment, clean room facilities, and quality control systems. These high capital requirements can limit market entry for smaller companies and extend payback periods for new facilities.

Regulatory complexity across different South American countries creates challenges for manufacturers seeking to establish regional operations or export products across borders. Varying environmental standards, safety requirements, and certification processes can increase compliance costs and operational complexity.

Technology dependence on international suppliers for critical manufacturing equipment and advanced materials can create supply chain vulnerabilities and limit local value addition in battery production processes.

Export market development represents substantial growth opportunities as South American battery manufacturers can leverage competitive production costs and resource advantages to serve international markets, particularly in North America and Europe where supply chain diversification is increasingly prioritized.

Technology partnerships with international research institutions and manufacturers offer opportunities to access advanced battery technologies while developing local innovation capabilities. These collaborations can accelerate technology transfer and enable South American companies to participate in next-generation battery development.

Circular economy initiatives create new business opportunities in battery recycling, second-life applications, and material recovery systems. As electric vehicle adoption increases, the volume of end-of-life batteries will create substantial value opportunities for companies developing comprehensive recycling capabilities.

Regional integration through trade agreements and economic partnerships can facilitate cross-border investment, technology sharing, and market access expansion. Enhanced regional cooperation can create larger addressable markets and enable economies of scale in battery manufacturing operations.

Sustainable manufacturing practices and environmental certifications can differentiate South American battery manufacturers in global markets where sustainability credentials are increasingly important for procurement decisions and brand positioning.

Supply chain evolution is fundamentally reshaping the South American electric vehicle battery manufacturing landscape as companies seek to establish more resilient and geographically diversified supply networks. This transformation is driven by lessons learned from recent global supply chain disruptions and strategic desires to reduce dependencies on single-source suppliers.

Competitive positioning within the market is increasingly determined by companies’ ability to integrate vertically across the value chain, from raw material processing through final battery assembly. Manufacturers that can control multiple stages of production achieve better cost structures and supply security while offering customers more reliable delivery schedules.

Technology convergence is accelerating as battery manufacturers collaborate with automotive OEMs, charging infrastructure providers, and energy storage system integrators to develop comprehensive electric mobility solutions. These partnerships create synergies that enhance product performance while reducing overall system costs for end users.

Investment patterns show increasing focus on sustainable manufacturing practices and environmental compliance, with new facilities incorporating renewable energy systems, water recycling technologies, and waste minimization processes. According to MarkWide Research analysis, sustainability investments account for approximately 22% of total capital expenditure in new battery manufacturing projects.

Market consolidation trends indicate that successful companies are those that can achieve scale economies while maintaining technological innovation capabilities, leading to strategic mergers and partnerships that combine complementary strengths and market positions.

Primary research activities encompassed comprehensive interviews with industry executives, government officials, technology providers, and end-users across major South American markets. These interviews provided insights into market dynamics, competitive strategies, regulatory developments, and future growth prospects from multiple stakeholder perspectives.

Secondary research involved extensive analysis of industry reports, government publications, patent filings, investment announcements, and academic research papers related to electric vehicle battery manufacturing in South America. This research provided quantitative data on market trends, technology developments, and competitive positioning.

Market modeling utilized advanced analytical frameworks to project market growth scenarios based on various factors including electric vehicle adoption rates, government policy implementations, raw material availability, and international trade developments. Multiple scenarios were developed to account for different growth trajectories and market conditions.

Data validation processes included cross-referencing information from multiple sources, conducting follow-up interviews with key stakeholders, and utilizing proprietary databases to ensure accuracy and reliability of market insights and projections.

Expert consultation with battery technology specialists, automotive industry analysts, and regional economic development experts provided additional validation and context for market findings and future outlook assessments.

Brazil leads the South American electric vehicle battery manufacturing market with the largest automotive industry and most developed manufacturing infrastructure. The country benefits from established automotive supply chains, skilled workforce availability, and government incentives for electric vehicle production. Brazilian manufacturers are focusing on serving both domestic demand and export opportunities to neighboring countries.

Argentina leverages its position within the Lithium Triangle to develop integrated battery manufacturing capabilities that capitalize on direct access to lithium resources. The country is attracting international investment in battery-grade lithium processing facilities and downstream manufacturing operations, with particular strength in industrial and commercial vehicle battery applications.

Chile combines abundant lithium resources with strong institutional frameworks and international trade relationships to position itself as a premium battery manufacturing hub. Chilean companies are developing advanced lithium processing capabilities while attracting international partners for battery cell and pack assembly operations targeting export markets.

Colombia is emerging as a strategic location for battery manufacturing serving northern South American and Central American markets. The country offers competitive labor costs, improving infrastructure, and government support for electric mobility initiatives, with particular focus on urban transportation and logistics applications.

Peru and other regional markets are developing niche capabilities in specialized battery applications and components, contributing to the overall regional ecosystem while focusing on specific market segments where they can achieve competitive advantages.

International manufacturers are establishing significant presence in the South American electric vehicle battery market through direct investment, joint ventures, and strategic partnerships with local companies. These companies bring advanced technologies and global market access while benefiting from regional resource advantages and cost competitiveness.

Regional players are emerging as significant competitors by leveraging local market knowledge, government relationships, and resource access to develop competitive battery manufacturing operations that serve both domestic and international markets.

Strategic partnerships between international technology providers and regional manufacturers are becoming increasingly common, combining global expertise with local advantages to create competitive battery manufacturing operations throughout South America.

By Battery Type: The market encompasses various battery technologies optimized for different electric vehicle applications and performance requirements. Lithium-ion batteries dominate current production with multiple chemistry variations, while emerging technologies are gaining market share in premium applications.

By Application: Different electric vehicle segments require customized battery solutions optimized for specific performance, cost, and durability requirements.

By Manufacturing Stage: The value chain encompasses multiple manufacturing stages from raw material processing to final battery pack assembly and integration.

Passenger vehicle batteries represent the largest and fastest-growing segment within the South American market, driven by increasing consumer adoption of electric vehicles and expanding model availability from international and domestic manufacturers. This segment emphasizes balanced performance characteristics including energy density, charging speed, and cost competitiveness.

Commercial vehicle applications are experiencing rapid growth as logistics companies and fleet operators recognize the total cost of ownership advantages of electric vehicles. Battery requirements for this segment prioritize durability, fast charging capabilities, and predictable performance over extended operational periods.

Public transportation batteries focus on reliability and longevity for bus and rail applications where consistent performance and minimal maintenance requirements are critical. This segment often involves larger battery systems with specialized thermal management and safety features.

Two-wheeler batteries represent an emerging opportunity as electric motorcycles and scooters gain popularity in urban areas. These applications require compact, lightweight battery solutions that balance performance with affordability for cost-sensitive consumer segments.

Stationary storage applications are creating additional market opportunities for battery manufacturers as electric vehicle batteries reach end-of-life and can be repurposed for grid storage and renewable energy integration applications.

Manufacturers benefit from South America’s abundant raw material resources, competitive labor costs, and growing domestic market demand. The region offers opportunities to establish cost-effective production facilities while accessing international export markets through established trade relationships and logistics networks.

Automotive OEMs gain access to reliable battery supply chains with competitive pricing and reduced transportation costs for regional vehicle production. Local battery manufacturing enables faster response times to market demands and customization opportunities for regional vehicle requirements.

Government stakeholders achieve economic development objectives through job creation, technology transfer, and export revenue generation. Battery manufacturing investments contribute to industrial diversification and value-added processing of natural resources.

Consumers benefit from improved electric vehicle affordability, reduced import dependencies, and enhanced service support for battery systems. Local manufacturing can enable faster warranty service and replacement part availability.

Environmental stakeholders gain from reduced transportation emissions associated with battery imports, improved recycling infrastructure development, and enhanced circular economy practices in battery lifecycle management.

Investors access growth opportunities in a rapidly expanding market with strong fundamentals including resource advantages, government support, and increasing demand from multiple application segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Vertical integration strategies are becoming increasingly prevalent as battery manufacturers seek to control critical supply chain elements from raw material processing through final product assembly. This trend enables better cost control, quality assurance, and supply security while creating competitive advantages in rapidly evolving markets.

Sustainability focus is driving significant changes in manufacturing processes, with companies implementing renewable energy systems, water recycling technologies, and waste minimization practices. Environmental certifications and carbon footprint reduction are becoming important differentiators in customer procurement decisions.

Technology advancement continues at rapid pace with developments in solid-state batteries, silicon anodes, and advanced battery management systems. South American manufacturers are investing in research and development capabilities to participate in next-generation technology development and commercialization.

Export orientation is increasing as regional manufacturers recognize opportunities to serve international markets with competitive products. Trade agreements and logistics infrastructure improvements are facilitating access to North American and European markets where supply chain diversification is prioritized.

Circular economy implementation is gaining momentum with companies developing comprehensive battery lifecycle management capabilities including recycling, second-life applications, and material recovery systems. These initiatives create additional revenue streams while addressing environmental concerns.

Major investment announcements continue to reshape the competitive landscape as international battery manufacturers establish regional production facilities. Recent developments include multi-billion dollar commitments from leading global companies to build integrated manufacturing complexes throughout South America.

Technology partnerships between international companies and regional manufacturers are accelerating technology transfer and capability development. These collaborations combine global expertise with local advantages to create competitive manufacturing operations and innovation centers.

Government policy initiatives are expanding across the region with new incentive programs, domestic content requirements, and infrastructure investments supporting electric vehicle battery manufacturing. These policies create favorable investment conditions while ensuring long-term market development.

Supply chain agreements between mining companies and battery manufacturers are securing long-term raw material access while enabling integrated value chain development. These partnerships ensure supply security while optimizing costs and environmental impact.

Research and development investments are increasing as companies establish innovation centers and collaborate with universities to develop next-generation battery technologies. MWR data indicates that R&D spending in the sector has grown by 45% annually over the past three years.

Strategic positioning recommendations emphasize the importance of leveraging South America’s natural resource advantages while building advanced manufacturing capabilities that can compete globally. Companies should focus on developing integrated value chains that maximize local content while accessing international markets.

Technology investment priorities should balance current market demands with future technology trends, ensuring that manufacturing facilities can adapt to evolving battery technologies while maintaining competitive cost structures. Flexibility in production systems will be critical for long-term success.

Partnership strategies should emphasize collaborations that combine complementary strengths, including technology access, market knowledge, and resource availability. Strategic alliances can accelerate market entry while reducing investment risks and operational complexity.

Sustainability integration should be prioritized from project inception rather than retrofitted later, as environmental credentials become increasingly important for market access and customer acceptance. Early adoption of sustainable practices can create competitive advantages and regulatory compliance benefits.

Workforce development investments are essential for supporting rapid industry growth and ensuring availability of qualified personnel for advanced manufacturing operations. Companies should collaborate with educational institutions and government agencies to develop specialized training programs.

Market expansion is projected to continue at accelerated pace driven by increasing electric vehicle adoption, supportive government policies, and growing international recognition of South America’s strategic importance in global battery supply chains. The region is positioned to become a major global supplier of electric vehicle batteries within the next decade.

Technology evolution will continue to drive market dynamics as next-generation battery technologies achieve commercial viability. South American manufacturers that invest in innovation capabilities and maintain technological flexibility will be best positioned to capitalize on emerging opportunities.

Export growth represents the most significant opportunity for market expansion as international customers seek supply chain diversification and South American manufacturers achieve competitive cost and quality positions. Export revenues are projected to grow at 40% annually through 2030.

Sustainability requirements will become increasingly important for market access and competitive positioning. Companies that establish leadership in environmental performance and circular economy practices will achieve advantages in customer relationships and regulatory compliance.

Regional integration through enhanced trade agreements and economic partnerships will facilitate market expansion and investment flows, creating larger addressable markets and enabling economies of scale in manufacturing operations. According to MarkWide Research projections, regional trade in battery products will increase by 50% over the next five years.

South America’s electric vehicle battery manufacturing market represents one of the most promising growth opportunities in the global clean energy transition, combining abundant natural resources with increasing market demand and supportive policy environments. The region’s strategic advantages in raw material access, competitive manufacturing costs, and growing domestic markets create favorable conditions for sustained industry expansion.

Success factors for market participants include leveraging regional resource advantages while building world-class manufacturing capabilities, developing strategic partnerships that combine complementary strengths, and maintaining focus on sustainability and innovation to achieve competitive differentiation in global markets.

Long-term prospects remain highly positive as electric vehicle adoption accelerates globally and supply chain diversification becomes increasingly important for automotive manufacturers and battery companies. South America is well-positioned to capture significant market share in this growing industry while contributing to regional economic development and environmental sustainability objectives.

The South America electric vehicle battery manufacturing market will continue evolving rapidly as technology advances, market demand grows, and competitive dynamics shift. Companies that can successfully navigate these changes while building sustainable competitive advantages will achieve significant success in this transformative industry sector.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the production processes involved in creating batteries specifically designed for electric vehicles, including lithium-ion and solid-state batteries. This sector is crucial for the growth of electric mobility and sustainable transportation solutions.

What are the key players in the South America Electric Vehicle Battery Manufacturing Market?

Key players in the South America Electric Vehicle Battery Manufacturing Market include companies like BYD, LG Chem, and A123 Systems, which are involved in the production and supply of electric vehicle batteries. These companies are focusing on innovation and expanding their manufacturing capabilities to meet rising demand, among others.

What are the growth factors driving the South America Electric Vehicle Battery Manufacturing Market?

The growth of the South America Electric Vehicle Battery Manufacturing Market is driven by increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology. Additionally, the rising awareness of environmental issues is pushing consumers towards electric mobility solutions.

What challenges does the South America Electric Vehicle Battery Manufacturing Market face?

The South America Electric Vehicle Battery Manufacturing Market faces challenges such as high production costs, supply chain disruptions, and the need for skilled labor. Additionally, competition from established markets can hinder the growth of local manufacturers.

What opportunities exist in the South America Electric Vehicle Battery Manufacturing Market?

Opportunities in the South America Electric Vehicle Battery Manufacturing Market include the potential for partnerships with automotive manufacturers, investments in research and development for advanced battery technologies, and the growing trend of renewable energy integration. These factors can enhance the market’s growth trajectory.

What trends are shaping the South America Electric Vehicle Battery Manufacturing Market?

Trends shaping the South America Electric Vehicle Battery Manufacturing Market include the shift towards sustainable materials, the development of faster charging technologies, and the increasing focus on recycling and battery lifecycle management. These trends are essential for meeting future energy demands and environmental standards.

South America Electric Vehicle Battery Manufacturing Market

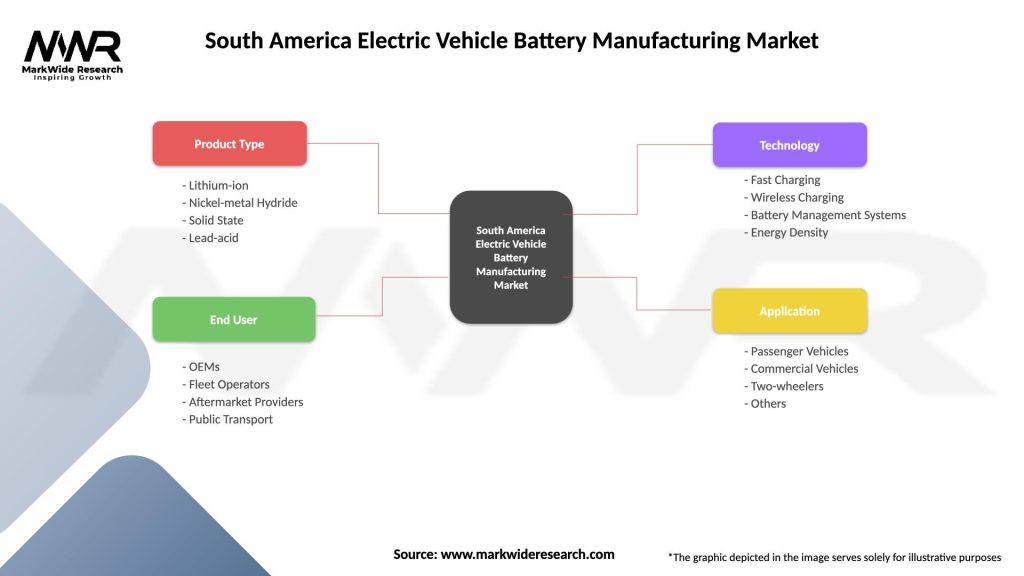

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid State, Lead-acid |

| End User | OEMs, Fleet Operators, Aftermarket Providers, Public Transport |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Energy Density |

| Application | Passenger Vehicles, Commercial Vehicles, Two-wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Electric Vehicle Battery Manufacturing Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at