444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America electric vehicle battery manufacturing equipment market represents a rapidly evolving sector driven by the region’s growing commitment to sustainable transportation and clean energy initiatives. Regional governments across South America are implementing progressive policies to support electric vehicle adoption, creating substantial demand for advanced battery manufacturing capabilities. The market encompasses sophisticated equipment used in lithium-ion battery production, including cell assembly systems, electrode coating machines, formation and testing equipment, and automated handling solutions.

Manufacturing infrastructure development in countries like Brazil, Argentina, and Chile has accelerated significantly, with local and international companies establishing production facilities to serve both domestic and export markets. The region’s abundant lithium reserves, particularly in the lithium triangle encompassing parts of Argentina, Bolivia, and Chile, provide strategic advantages for battery manufacturing operations. Market growth is projected at a robust 12.3% CAGR through the forecast period, reflecting strong investment momentum and technological advancement.

Industry dynamics indicate increasing collaboration between South American governments, international technology providers, and local manufacturers to establish comprehensive battery production ecosystems. The market benefits from growing automotive industry presence, renewable energy storage requirements, and supportive regulatory frameworks promoting electric mobility solutions.

The South America electric vehicle battery manufacturing equipment market refers to the comprehensive ecosystem of specialized machinery, systems, and technologies used to produce lithium-ion batteries and other energy storage solutions for electric vehicles within the South American region. This market encompasses all equipment categories required for complete battery cell production, from raw material processing through final assembly and quality testing.

Core equipment categories include electrode preparation systems, cell assembly machinery, formation and aging equipment, pack assembly systems, and quality control instrumentation. The market also covers supporting infrastructure such as clean room environments, material handling systems, and process automation solutions essential for high-volume battery production operations.

Regional significance extends beyond domestic electric vehicle supply, as South America’s strategic position in global lithium supply chains creates opportunities for export-oriented battery manufacturing. The market represents the intersection of advanced manufacturing technology, sustainable energy solutions, and regional economic development initiatives focused on value-added mineral processing and clean technology adoption.

Market momentum in South America’s electric vehicle battery manufacturing equipment sector reflects accelerating regional transformation toward sustainable mobility solutions. The market demonstrates strong growth potential driven by government incentives, international investment, and strategic advantages in raw material access. Key market drivers include expanding electric vehicle adoption rates, which have increased by 38% annually across major South American markets, and growing energy storage requirements for renewable power integration.

Technology advancement remains central to market development, with manufacturers increasingly adopting automated production systems and advanced quality control solutions. The region’s focus on developing local manufacturing capabilities has attracted significant investment from global battery equipment suppliers seeking to establish regional production and service networks. Market segmentation reveals strong demand across multiple application areas, including automotive batteries, stationary energy storage, and specialized industrial applications.

Competitive landscape features both international technology leaders and emerging regional players, creating dynamic market conditions that support innovation and cost optimization. The market benefits from increasing collaboration between equipment manufacturers, battery producers, and automotive companies to develop integrated production solutions tailored to regional requirements and market conditions.

Strategic insights reveal several critical factors shaping the South America electric vehicle battery manufacturing equipment market:

Market dynamics indicate increasing sophistication in equipment requirements as manufacturers pursue higher production volumes and improved quality standards. The integration of Industry 4.0 technologies including IoT sensors, artificial intelligence, and predictive maintenance systems represents a growing trend across regional battery manufacturing operations.

Primary market drivers propelling growth in South America’s electric vehicle battery manufacturing equipment market include accelerating electric vehicle adoption supported by government incentives and environmental regulations. Regional governments have implemented comprehensive policy frameworks promoting clean transportation, with electric vehicle sales growth reaching 45% year-over-year in key markets including Brazil and Argentina.

Resource availability represents a fundamental driver, as South America’s abundant lithium reserves provide cost advantages and supply security for battery manufacturing operations. The region produces approximately 58% of global lithium supply, creating strategic opportunities for value-added processing and battery production. Infrastructure development initiatives across multiple countries support manufacturing capability expansion and technology adoption.

Investment momentum from both domestic and international sources drives market expansion, with major automotive and technology companies establishing regional operations. Energy transition requirements for renewable power integration create additional demand for battery storage solutions, expanding market opportunities beyond automotive applications. Technology advancement in battery chemistry and manufacturing processes enables higher performance and cost-effective production solutions.

Supply chain integration initiatives aim to develop comprehensive regional battery production ecosystems, reducing dependence on imported components and creating competitive advantages in global markets. Workforce development programs and technical education initiatives support skilled labor availability for advanced manufacturing operations.

Capital intensity represents a significant market restraint, as battery manufacturing equipment requires substantial upfront investment and sophisticated technical expertise. High implementation costs for advanced production systems can limit market entry for smaller manufacturers and slow overall capacity expansion. Technical complexity associated with battery manufacturing processes requires specialized knowledge and skilled workforce availability that may be limited in certain regional markets.

Supply chain challenges including component availability and logistics infrastructure can impact equipment delivery and installation timelines. Regulatory complexity across different South American countries creates compliance challenges for equipment manufacturers and battery producers operating in multiple markets. Technology evolution rapid pace means equipment investments may face obsolescence risks as battery chemistry and manufacturing processes continue advancing.

Market maturity limitations in some regional markets result in smaller production volumes that may not justify advanced equipment investments. Currency volatility and economic uncertainty in certain countries can impact investment decisions and project financing availability. Skills shortage in specialized technical areas may limit operational efficiency and equipment utilization rates.

Environmental compliance requirements for battery manufacturing operations necessitate additional equipment and process investments that increase overall project costs. Quality standards alignment with international automotive industry requirements demands sophisticated testing and validation equipment that adds complexity and cost to manufacturing operations.

Significant opportunities exist in South America’s electric vehicle battery manufacturing equipment market through strategic partnerships and technology localization initiatives. Government incentives and support programs create favorable conditions for equipment manufacturers to establish regional operations and develop local supply chains. Export potential to other emerging markets provides additional growth opportunities beyond domestic demand.

Technology adaptation opportunities include developing equipment solutions specifically designed for regional operating conditions and market requirements. Service expansion in maintenance, training, and technical support creates recurring revenue opportunities for equipment suppliers. Financing solutions development can help address capital intensity challenges and accelerate market adoption.

Integration opportunities with renewable energy systems and smart grid infrastructure expand market applications beyond traditional automotive battery production. Circular economy initiatives including battery recycling and material recovery create demand for specialized processing equipment. Research collaboration with regional universities and technology institutes supports innovation and capability development.

Market consolidation opportunities may emerge as the industry matures, creating potential for strategic acquisitions and partnerships. Vertical integration possibilities allow equipment manufacturers to expand into related areas such as materials processing and quality assurance systems. Digital transformation initiatives including remote monitoring and predictive maintenance services represent growing opportunity areas.

Dynamic market forces shaping the South America electric vehicle battery manufacturing equipment sector include rapidly evolving technology requirements and changing competitive landscapes. Innovation cycles in battery chemistry and cell design drive continuous equipment upgrades and capability enhancements. Market consolidation trends among battery manufacturers influence equipment demand patterns and specification requirements.

Supply chain evolution toward regional integration creates opportunities for local equipment suppliers while challenging traditional import-dependent models. Quality standards alignment with international automotive requirements drives demand for advanced testing and validation equipment. Production scaling requirements as manufacturers move from pilot to commercial operations necessitate flexible and expandable equipment solutions.

Technology convergence between battery manufacturing and other advanced manufacturing sectors enables knowledge transfer and cost optimization opportunities. Regulatory harmonization efforts across South American countries may simplify compliance requirements and facilitate regional market integration. Investment patterns show increasing focus on sustainable and environmentally responsible manufacturing processes.

Market maturation processes include development of local technical expertise, service networks, and supply chain capabilities. Competitive dynamics reflect balance between international technology leaders and emerging regional players seeking market share through cost advantages and specialized solutions.

Comprehensive research methodology employed for analyzing the South America electric vehicle battery manufacturing equipment market combines primary and secondary research approaches to ensure data accuracy and market insight depth. Primary research includes structured interviews with key industry stakeholders, including equipment manufacturers, battery producers, automotive companies, and government officials across major South American markets.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baseline information and trend identification. Market sizing methodologies utilize bottom-up and top-down approaches to validate findings and ensure analytical consistency. Data triangulation processes cross-reference multiple information sources to enhance reliability and accuracy.

Regional analysis methodology includes country-specific market assessment covering Brazil, Argentina, Chile, Colombia, and other significant markets within the region. Technology assessment evaluates current and emerging equipment technologies, manufacturing processes, and industry best practices. Competitive analysis examines market positioning, strategic initiatives, and capability development among key market participants.

Trend analysis incorporates historical data review, current market conditions assessment, and future projection modeling based on identified drivers and market dynamics. Validation processes include expert review panels and industry feedback sessions to ensure research findings accuracy and practical relevance for market participants and stakeholders.

Brazil dominates the South America electric vehicle battery manufacturing equipment market with approximately 42% regional market share, driven by its large automotive industry and government support for electric mobility initiatives. Brazilian market benefits from established manufacturing infrastructure, skilled workforce availability, and strong domestic demand for electric vehicles. Major equipment installations include automated cell assembly systems and formation equipment for lithium-ion battery production.

Argentina represents the second-largest regional market with 28% market share, leveraging its strategic position in lithium production and growing automotive sector. Argentine operations focus on integrated battery manufacturing solutions that utilize domestic lithium resources for value-added processing. The country’s investment incentives and trade agreements support equipment imports and technology transfer initiatives.

Chile maintains significant market presence with 18% regional share, capitalizing on its leadership in lithium mining and renewable energy development. Chilean market emphasizes sustainable manufacturing processes and integration with solar power systems for battery production operations. The country’s stable regulatory environment and strong mining sector expertise support advanced equipment adoption.

Colombia and other markets collectively represent 12% regional share, with growing interest in electric vehicle adoption and battery manufacturing capabilities. Emerging markets focus on establishing basic production capabilities and developing local technical expertise through partnerships with international equipment suppliers. MarkWide Research analysis indicates increasing investment momentum across smaller regional markets as electric vehicle adoption accelerates.

Competitive environment in the South America electric vehicle battery manufacturing equipment market features a mix of international technology leaders and emerging regional players. Market leadership positions are held by established global equipment manufacturers who bring advanced technology and extensive experience to regional operations.

Strategic initiatives among competitors include establishing regional service centers, developing local partnerships, and adapting equipment designs for South American market requirements. Innovation focus areas include automation enhancement, energy efficiency improvement, and integration with renewable energy systems. Market positioning strategies emphasize technology leadership, cost competitiveness, and comprehensive service support capabilities.

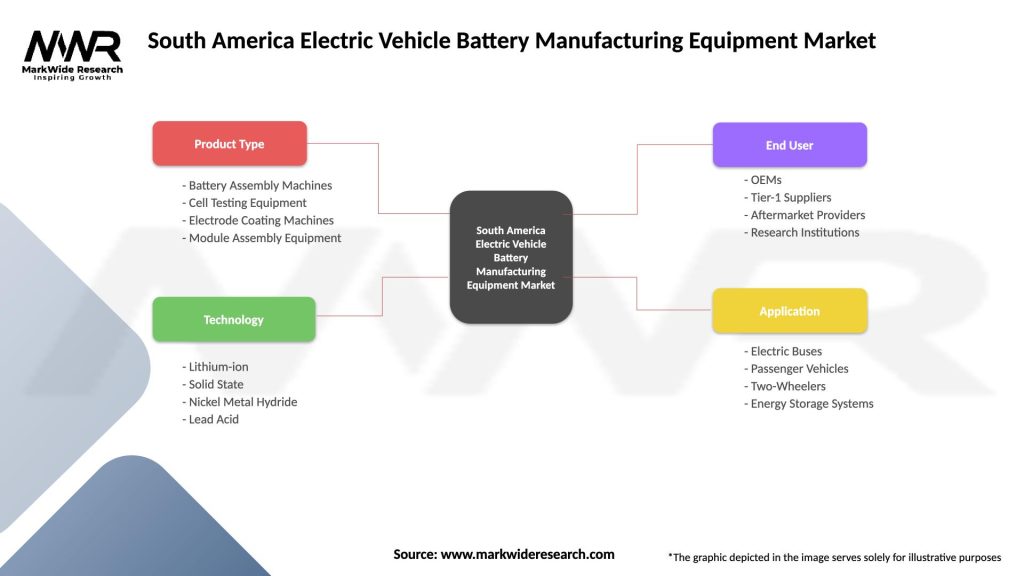

Market segmentation analysis reveals diverse equipment categories and application areas within the South America electric vehicle battery manufacturing equipment market. Technology segmentation includes multiple equipment types serving different stages of the battery production process.

By Equipment Type:

By Application:

By Technology:

Electrode preparation equipment represents the largest market segment, accounting for approximately 35% of total equipment demand in South America. Coating systems and calendering equipment are particularly important as they directly impact battery performance and quality characteristics. Advanced coating technologies enable precise material application and improved energy density in finished battery cells.

Cell assembly systems constitute 28% of market demand, reflecting the critical importance of automated assembly processes in high-volume battery production. Winding and stacking equipment requires sophisticated precision control and quality monitoring capabilities to ensure consistent cell performance. Integration with vision systems and quality control measures enhances production reliability and reduces defect rates.

Formation and testing equipment accounts for 22% of market share, serving essential quality assurance functions in battery manufacturing operations. Formation systems perform initial charging cycles that activate battery cells and establish performance characteristics. Advanced testing equipment enables comprehensive quality validation and performance verification before final assembly.

Pack assembly equipment represents 15% of market demand, focusing on integration of individual cells into complete battery systems. Thermal management integration and electrical connection systems require specialized equipment designed for automotive and energy storage applications. Safety testing and validation equipment ensures compliance with industry standards and regulatory requirements.

Material handling systems comprise the remaining market segment, providing essential support functions for clean room operations and automated production workflows. Clean room equipment maintains environmental conditions necessary for high-quality battery production, while automated storage and retrieval systems optimize material flow and inventory management.

Equipment manufacturers benefit from expanding market opportunities in South America through growing demand for battery production capabilities and government support for clean technology adoption. Technology transfer opportunities enable global suppliers to establish regional operations while contributing to local capability development. Service revenue potential includes ongoing maintenance, training, and upgrade services that provide recurring income streams.

Battery producers gain access to advanced manufacturing technologies that improve production efficiency, quality consistency, and cost competitiveness. Automation benefits include reduced labor requirements, improved safety conditions, and enhanced production scalability. Quality improvements through advanced equipment enable better battery performance and longer service life, supporting market competitiveness.

Automotive manufacturers benefit from local battery supply chain development that reduces costs, improves supply security, and supports electric vehicle market expansion. Regional production capabilities enable faster response to market demands and reduced transportation costs. Quality assurance through advanced manufacturing equipment supports vehicle performance and safety requirements.

Government stakeholders achieve economic development objectives through job creation, technology transfer, and value-added manufacturing development. Environmental benefits include reduced transportation emissions and support for clean energy transition initiatives. Strategic advantages in global battery supply chains enhance regional competitiveness and export potential.

Research institutions gain opportunities for collaboration with industry partners on technology development and workforce training programs. Innovation ecosystems benefit from knowledge transfer and practical application of research findings in commercial operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation advancement represents a dominant trend in South America’s electric vehicle battery manufacturing equipment market, with manufacturers increasingly adopting Industry 4.0 technologies to improve efficiency and quality. Artificial intelligence integration enables predictive maintenance, quality optimization, and process automation that reduces operational costs and improves production reliability. IoT connectivity allows real-time monitoring and remote diagnostics capabilities.

Sustainability focus drives demand for energy-efficient equipment and environmentally responsible manufacturing processes. Renewable energy integration with battery production facilities creates synergies between clean energy generation and storage manufacturing. Circular economy principles influence equipment design to support material recycling and waste reduction initiatives.

Localization trends include development of regional supply chains and adaptation of equipment designs for South American market conditions. Technology transfer initiatives facilitate knowledge sharing between international suppliers and local manufacturers. Service localization includes establishment of regional service centers and training programs for technical support.

Quality enhancement trends focus on advanced testing and validation equipment that ensures compliance with international automotive standards. Process optimization through data analytics and machine learning improves production efficiency and reduces defect rates. Flexibility requirements drive demand for modular and reconfigurable equipment systems that can adapt to changing production requirements.

Integration trends include comprehensive production line solutions that combine multiple equipment types into coordinated manufacturing systems. Digital twin technology enables virtual production optimization and equipment performance modeling.

Recent industry developments highlight accelerating momentum in South America’s electric vehicle battery manufacturing equipment market. Major investments by international automotive and technology companies have established new production facilities across the region, creating substantial equipment demand. Government initiatives including tax incentives and infrastructure development programs support market expansion and technology adoption.

Technology partnerships between global equipment suppliers and regional manufacturers facilitate knowledge transfer and capability development. Research collaborations with universities and technology institutes advance innovation in battery manufacturing processes and equipment design. Pilot projects demonstrate advanced manufacturing technologies and validate commercial viability for regional applications.

Regulatory developments include harmonization of safety standards and quality requirements across South American countries. Trade agreements facilitate equipment imports and technology transfer while supporting regional market integration. Environmental regulations drive adoption of cleaner manufacturing processes and energy-efficient equipment solutions.

Market consolidation activities include strategic acquisitions and partnerships among equipment suppliers seeking to strengthen regional market positions. Service expansion initiatives establish local technical support capabilities and training programs. Innovation investments focus on developing next-generation equipment technologies and manufacturing processes tailored to regional requirements and market conditions.

Strategic recommendations for success in the South America electric vehicle battery manufacturing equipment market emphasize the importance of regional adaptation and local partnership development. MarkWide Research analysis suggests that equipment manufacturers should prioritize establishing regional service capabilities and technical support networks to compete effectively in this growing market.

Investment priorities should focus on automation technologies and quality control systems that address regional manufacturing requirements while meeting international automotive standards. Partnership strategies with local manufacturers and research institutions can accelerate market entry and technology adaptation. Financing solutions development helps address capital intensity challenges and supports market adoption among smaller manufacturers.

Technology development should emphasize energy efficiency, sustainability, and integration with renewable energy systems to align with regional environmental priorities. Workforce development initiatives including training programs and technical education partnerships support long-term market growth and operational success. Supply chain localization reduces costs and improves service responsiveness while supporting regional economic development objectives.

Market entry strategies should consider country-specific regulatory requirements and market conditions while leveraging regional integration opportunities. Service differentiation through comprehensive support offerings and local expertise development creates competitive advantages in this emerging market. Innovation focus on cost-effective solutions adapted to regional operating conditions supports market penetration and growth.

Future market prospects for South America’s electric vehicle battery manufacturing equipment sector appear highly favorable, with continued growth expected across multiple market segments and geographic regions. Market expansion will be driven by accelerating electric vehicle adoption, government support policies, and increasing investment in regional manufacturing capabilities. Technology advancement will continue enhancing equipment capabilities and production efficiency.

Growth projections indicate sustained market expansion at 12.3% CAGR through the forecast period, supported by strong fundamentals and favorable market conditions. Regional integration initiatives will create larger addressable markets and economies of scale for equipment manufacturers and battery producers. Export opportunities to other emerging markets will provide additional growth drivers beyond domestic demand.

Technology evolution toward next-generation battery chemistries and manufacturing processes will create new equipment requirements and market opportunities. Sustainability trends will drive demand for environmentally responsible manufacturing solutions and circular economy integration. Automation advancement will continue improving production efficiency and quality while reducing operational costs.

Market maturation processes will include development of comprehensive regional supply chains, technical expertise, and service capabilities. Innovation ecosystems will strengthen through increased collaboration between industry, government, and research institutions. Competitive dynamics will evolve as regional players develop capabilities and international suppliers establish stronger local presence.

Long-term outlook suggests South America will become an increasingly important region in global battery manufacturing, supported by resource advantages, growing market demand, and strategic government policies promoting clean technology development and adoption.

The South America electric vehicle battery manufacturing equipment market represents a dynamic and rapidly expanding sector with substantial growth potential driven by favorable market fundamentals and strategic regional advantages. Strong government support, abundant lithium resources, and accelerating electric vehicle adoption create compelling conditions for sustained market expansion and technology development.

Market opportunities extend across multiple equipment categories and application areas, with particular strength in automotive battery production and energy storage systems. Regional integration initiatives and international investment momentum support comprehensive supply chain development and manufacturing capability expansion. Technology advancement continues enhancing equipment performance while addressing sustainability and efficiency requirements.

Success factors for market participants include regional adaptation, local partnership development, and comprehensive service capability establishment. Innovation focus on cost-effective, environmentally responsible solutions aligned with regional requirements will drive competitive advantage and market growth. The market’s strategic importance in global battery supply chains positions South America as an increasingly significant player in the clean energy transition and sustainable transportation development.

What is Electric Vehicle Battery Manufacturing Equipment?

Electric Vehicle Battery Manufacturing Equipment refers to the machinery and tools used in the production of batteries specifically designed for electric vehicles. This includes equipment for cell assembly, battery pack formation, and quality testing.

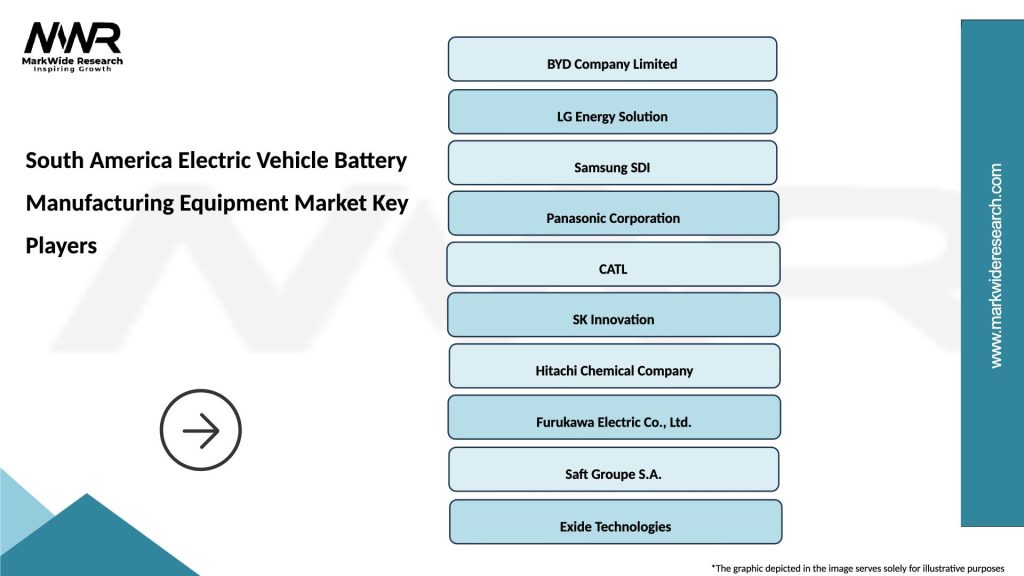

What are the key players in the South America Electric Vehicle Battery Manufacturing Equipment Market?

Key players in the South America Electric Vehicle Battery Manufacturing Equipment Market include companies like CATL, LG Chem, and Panasonic, which are known for their advanced battery technologies and manufacturing capabilities, among others.

What are the growth factors driving the South America Electric Vehicle Battery Manufacturing Equipment Market?

The growth of the South America Electric Vehicle Battery Manufacturing Equipment Market is driven by the increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the South America Electric Vehicle Battery Manufacturing Equipment Market face?

Challenges in the South America Electric Vehicle Battery Manufacturing Equipment Market include high initial investment costs, supply chain disruptions for raw materials, and the need for skilled labor to operate advanced manufacturing technologies.

What opportunities exist in the South America Electric Vehicle Battery Manufacturing Equipment Market?

Opportunities in the South America Electric Vehicle Battery Manufacturing Equipment Market include the potential for local manufacturing to reduce import dependency, partnerships with automotive companies for tailored solutions, and the growing focus on sustainable battery technologies.

What trends are shaping the South America Electric Vehicle Battery Manufacturing Equipment Market?

Trends in the South America Electric Vehicle Battery Manufacturing Equipment Market include the shift towards solid-state batteries, increased automation in manufacturing processes, and the integration of renewable energy sources in production facilities.

South America Electric Vehicle Battery Manufacturing Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Battery Assembly Machines, Cell Testing Equipment, Electrode Coating Machines, Module Assembly Equipment |

| Technology | Lithium-ion, Solid State, Nickel Metal Hydride, Lead Acid |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Research Institutions |

| Application | Electric Buses, Passenger Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Electric Vehicle Battery Manufacturing Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at