444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America electric vehicle battery electrolyte market represents a rapidly evolving sector within the broader automotive electrification landscape. As countries across the region embrace sustainable transportation solutions, the demand for advanced battery technologies has surged dramatically. Battery electrolytes serve as the critical medium that enables ion transport between electrodes, making them essential components for electric vehicle performance and efficiency.

Regional dynamics indicate that South America is experiencing unprecedented growth in electric vehicle adoption, driven by government incentives, environmental regulations, and increasing consumer awareness. The market encompasses various electrolyte types, including liquid, solid, and gel-based solutions, each offering distinct advantages for different vehicle applications. Growth projections suggest the market is expanding at a robust 12.5% CAGR, reflecting the region’s commitment to sustainable mobility solutions.

Key market participants are establishing manufacturing facilities and research centers across major South American countries, particularly in Brazil, Argentina, and Chile. The region’s abundant lithium reserves provide a strategic advantage for electrolyte production, positioning South America as a potential global hub for battery component manufacturing. Market penetration rates currently stand at 8.3% of total vehicle sales, with significant room for expansion as infrastructure development accelerates.

The South America electric vehicle battery electrolyte market refers to the regional industry focused on producing, distributing, and supplying electrolyte solutions specifically designed for electric vehicle battery systems. These electrolytes facilitate the movement of ions between battery electrodes, enabling energy storage and discharge processes essential for vehicle operation.

Battery electrolytes in this context encompass various chemical compositions, including lithium-ion electrolytes, solid-state electrolytes, and emerging alternative formulations. The market includes both domestic production capabilities and import activities to meet growing regional demand. Electrolyte performance directly impacts battery efficiency, charging speed, temperature tolerance, and overall vehicle range, making quality and innovation critical market factors.

Market scope extends beyond traditional passenger vehicles to include commercial electric vehicles, electric buses, and emerging applications in electric motorcycles and specialized industrial vehicles. The definition encompasses the entire value chain from raw material sourcing through final product delivery to battery manufacturers and automotive assembly plants throughout South America.

Market transformation across South America’s electric vehicle battery electrolyte sector reflects broader regional shifts toward sustainable transportation and energy independence. The market demonstrates strong fundamentals driven by supportive government policies, increasing environmental consciousness, and strategic investments in local production capabilities.

Key growth drivers include expanding electric vehicle manufacturing capacity, improving charging infrastructure, and favorable regulatory frameworks promoting clean transportation. Technology advancement in electrolyte formulations has enhanced battery performance metrics, with energy density improvements reaching 15-20% annually across leading product categories.

Regional advantages position South America uniquely within the global battery supply chain, particularly through access to critical raw materials and emerging manufacturing expertise. Investment flows from international battery manufacturers and automotive companies have accelerated local capacity development, creating new opportunities for regional suppliers and technology partners.

Market challenges include infrastructure limitations, skilled workforce development needs, and competition from established global suppliers. However, strategic initiatives by governments and private sector participants are addressing these constraints through targeted investments and collaborative partnerships.

Strategic market positioning reveals several critical insights shaping the South America electric vehicle battery electrolyte landscape:

Market intelligence indicates that liquid electrolytes currently dominate regional demand, accounting for 78% of market share, while solid-state alternatives are gaining traction in premium vehicle segments. Production capacity is expanding rapidly, with new facilities planned across multiple countries to meet projected demand growth.

Government initiatives across South America are providing substantial momentum for electric vehicle battery electrolyte market expansion. Policy frameworks including tax incentives, import duty reductions, and direct subsidies are encouraging both vehicle adoption and local component manufacturing. Countries like Brazil and Chile have implemented comprehensive electrification strategies that prioritize domestic battery supply chain development.

Environmental regulations are becoming increasingly stringent, pushing automotive manufacturers toward electric vehicle production and creating sustained demand for battery components. Emission standards and urban air quality requirements are accelerating the transition away from internal combustion engines, particularly in major metropolitan areas across the region.

Raw material advantages provide South America with unique competitive positioning in the global battery supply chain. The region’s substantial lithium reserves, particularly in the “Lithium Triangle” spanning Argentina, Bolivia, and Chile, offer strategic advantages for electrolyte production. Resource availability reduces input costs and enhances supply chain security for regional manufacturers.

Technology transfer from established global battery manufacturers is accelerating local capability development. Joint ventures and licensing agreements are bringing advanced electrolyte formulations and production techniques to South American facilities, improving product quality and manufacturing efficiency.

Consumer awareness regarding environmental sustainability and energy costs is driving increased interest in electric vehicles. Total cost of ownership advantages, combined with improving vehicle performance and charging convenience, are expanding the addressable market for electric vehicle batteries and associated components.

Infrastructure limitations present significant challenges for electric vehicle adoption and, consequently, battery electrolyte demand growth. Charging network development lags behind vehicle availability in many regions, creating range anxiety among potential consumers and limiting market expansion potential.

High initial costs associated with electric vehicle purchases continue to constrain market penetration, particularly in price-sensitive segments. Battery costs represent a substantial portion of vehicle pricing, and electrolyte expenses contribute to overall system costs that may limit accessibility for many consumers.

Technical expertise shortages in advanced battery technologies pose challenges for local production development. Skilled workforce requirements for electrolyte manufacturing and quality control exceed current regional capabilities, necessitating extensive training programs and technology transfer initiatives.

Supply chain complexity for specialized chemicals and materials used in electrolyte production can create bottlenecks and cost pressures. Import dependencies for certain critical components expose regional manufacturers to currency fluctuations and international trade disruptions.

Quality standards and certification requirements for automotive applications demand significant investments in testing equipment and process validation. Regulatory compliance costs can be particularly challenging for smaller regional manufacturers seeking to enter the market.

Emerging applications beyond traditional passenger vehicles present substantial growth opportunities for battery electrolyte suppliers. Commercial vehicle electrification, including buses, delivery trucks, and industrial equipment, offers new market segments with different performance requirements and potentially higher margins.

Export potential to other regions could significantly expand market opportunities for South American electrolyte manufacturers. Competitive advantages in raw material access and production costs may enable regional suppliers to compete effectively in global markets, particularly as demand outpaces supply in established markets.

Technology innovation in solid-state and advanced electrolyte formulations represents a significant opportunity for regional companies to establish competitive differentiation. Research partnerships with universities and international technology companies could accelerate development of next-generation products.

Circular economy initiatives focused on battery recycling and electrolyte recovery present new business model opportunities. Sustainability requirements are driving interest in closed-loop systems that could create additional revenue streams for electrolyte manufacturers.

Regional integration through trade agreements and collaborative frameworks could enhance market access and reduce barriers to cross-border business development. Economic cooperation initiatives may facilitate technology sharing and joint investment projects that benefit the entire regional market.

Competitive dynamics within the South America electric vehicle battery electrolyte market are evolving rapidly as both international and regional players establish market positions. Market consolidation trends are emerging as larger companies acquire specialized electrolyte manufacturers to secure supply chains and access proprietary technologies.

Price pressures from automotive manufacturers seeking to reduce battery costs are driving efficiency improvements and innovation in electrolyte production processes. Cost optimization initiatives are leading to economies of scale and improved manufacturing techniques that benefit the entire supply chain.

Technology evolution is creating both opportunities and challenges as new electrolyte formulations emerge with superior performance characteristics. Product lifecycle management becomes critical as manufacturers must balance investment in current technologies with preparation for next-generation solutions.

Supply chain resilience has become a priority following global disruptions, leading to increased focus on regional sourcing and production capabilities. Risk mitigation strategies are driving diversification of supplier bases and investment in local manufacturing capacity.

Regulatory evolution continues to shape market dynamics as governments refine policies supporting electric vehicle adoption and domestic manufacturing. Policy uncertainty in some areas creates challenges for long-term planning while also presenting opportunities for companies that can adapt quickly to changing requirements.

Comprehensive market analysis for the South America electric vehicle battery electrolyte market employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included extensive interviews with industry executives, battery manufacturers, automotive companies, and government officials across key regional markets.

Secondary research incorporated analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and identify market trends. Data triangulation techniques ensured consistency across multiple information sources and enhanced the reliability of market projections.

Market modeling utilized advanced statistical techniques to project future market development based on historical trends, regulatory changes, and technology adoption patterns. Scenario analysis considered various potential outcomes based on different assumptions regarding policy support, technology advancement, and economic conditions.

Expert validation processes involved review of findings by industry specialists and academic researchers with expertise in battery technologies and South American automotive markets. Peer review procedures ensured analytical rigor and identified potential biases or methodological limitations.

Continuous monitoring of market developments throughout the research period enabled real-time updates to analysis and incorporation of emerging trends that could impact market projections and strategic recommendations.

Brazil dominates the South America electric vehicle battery electrolyte market, accounting for approximately 45% of regional demand. The country’s large automotive manufacturing base, supportive government policies, and growing consumer acceptance of electric vehicles drive substantial electrolyte requirements. São Paulo and Rio de Janeiro serve as primary consumption centers, while manufacturing facilities are expanding in industrial regions.

Argentina represents the second-largest market, contributing 22% of regional demand. The country’s significant lithium reserves provide strategic advantages for electrolyte production, and government initiatives promoting electric vehicle adoption are creating new market opportunities. Buenos Aires leads in vehicle adoption, while northern provinces focus on raw material production.

Chile’s market share stands at 18% of regional total, driven by strong government commitment to electrification and substantial mining industry interest in electric vehicle applications. The country’s copper mining operations are increasingly adopting electric vehicles, creating specialized demand for high-performance electrolytes designed for harsh operating conditions.

Colombia and Peru together account for 12% of market demand, with both countries implementing policies to encourage electric vehicle adoption in urban areas. Infrastructure development in major cities is supporting market growth, while mining operations provide additional demand for specialized applications.

Remaining countries including Uruguay, Ecuador, and Venezuela contribute the final 3% of market share. These markets are in early development stages but show potential for future growth as regional integration initiatives and technology transfer programs expand access to electric vehicle technologies.

Market leadership in the South America electric vehicle battery electrolyte sector is distributed among both international corporations and emerging regional players. The competitive environment reflects the market’s developmental stage, with opportunities for new entrants alongside established global suppliers.

Regional players are emerging as significant competitors, leveraging local advantages in raw material access and market knowledge. Strategic partnerships between international technology leaders and regional manufacturers are creating new competitive dynamics and accelerating market development.

By Electrolyte Type: The market segments into distinct categories based on chemical composition and physical properties. Liquid electrolytes currently dominate with the largest market share, offering proven performance and cost-effectiveness for most applications. Solid-state electrolytes represent an emerging segment with superior safety characteristics and potential for higher energy density applications.

By Vehicle Type: Market segmentation reflects diverse application requirements across vehicle categories. Passenger vehicles constitute the primary segment, driven by consumer adoption and government incentives. Commercial vehicles including buses and delivery trucks represent a rapidly growing segment with specialized performance requirements.

By Battery Chemistry: Different battery technologies require specific electrolyte formulations. Lithium-ion batteries account for the majority of current demand, while lithium iron phosphate and other alternative chemistries serve specialized applications with specific performance or cost requirements.

By End-User: The market serves various customer categories with distinct needs and procurement patterns. Original equipment manufacturers represent the primary customer base, while aftermarket applications and battery recycling operations constitute smaller but growing segments.

By Distribution Channel: Market access varies by customer type and geographic location. Direct sales to major manufacturers dominate volume, while distributor networks serve smaller customers and provide regional market coverage.

Liquid Electrolyte Segment: This category maintains market leadership through proven reliability and cost-effectiveness. Carbonate-based electrolytes dominate current applications, offering good performance characteristics for most vehicle types. Innovation focus centers on improving thermal stability and extending operating temperature ranges to enhance vehicle performance in diverse climatic conditions.

Solid-State Electrolyte Segment: Representing the technology frontier, this category shows promise for next-generation applications. Safety advantages including reduced fire risk and improved thermal stability make solid-state solutions attractive for premium vehicle segments. Development challenges include manufacturing scalability and cost reduction to achieve broader market adoption.

Gel Electrolyte Segment: This intermediate category combines advantages of liquid and solid technologies. Performance characteristics include improved safety compared to liquid electrolytes while maintaining easier manufacturing than solid-state alternatives. Market applications focus on specialized uses where standard liquid electrolytes may not provide adequate safety margins.

Polymer Electrolyte Segment: An emerging category with potential for flexible battery designs and improved safety characteristics. Technology development focuses on enhancing ionic conductivity while maintaining mechanical properties. Commercial applications remain limited but show potential for specialized vehicle designs and applications.

Ionic Liquid Segment: A specialized category offering unique properties for extreme operating conditions. Performance advantages include wide temperature ranges and excellent thermal stability. Market adoption is limited by higher costs but growing interest in specialized applications drives continued development.

Battery Manufacturers benefit from improved electrolyte technologies that enhance overall battery performance and reduce production costs. Supply chain advantages from regional sourcing reduce logistics costs and improve delivery reliability. Technology partnerships with electrolyte suppliers enable collaborative development of optimized solutions for specific applications.

Automotive Companies gain access to advanced battery technologies that improve vehicle performance and reduce costs. Local sourcing opportunities reduce supply chain risks and support regional manufacturing strategies. Sustainability benefits from regional production align with corporate environmental goals and consumer expectations.

Government Stakeholders achieve policy objectives including reduced emissions, energy independence, and industrial development. Economic benefits include job creation, technology transfer, and reduced import dependencies. Environmental improvements support climate change mitigation and urban air quality objectives.

Investors access growing market opportunities with strong fundamentals and government support. Technology advancement creates potential for significant returns on innovation investments. Regional advantages in raw materials and manufacturing costs provide competitive positioning for portfolio companies.

Research Institutions benefit from increased industry collaboration and funding for battery technology development. Knowledge transfer opportunities enhance academic programs and create career paths for graduates. Innovation ecosystems develop around battery technology clusters, attracting additional investment and talent.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration is becoming a dominant trend as environmental considerations influence product development and manufacturing processes. Eco-friendly electrolyte formulations using renewable materials and reduced environmental impact production methods are gaining market traction. Circular economy principles are driving development of recyclable electrolyte systems and closed-loop manufacturing processes.

Technology Convergence between different electrolyte types is creating hybrid solutions that combine advantages of multiple approaches. Advanced formulations incorporating nanotechnology and specialized additives are improving performance characteristics while maintaining cost competitiveness. Smart electrolytes with self-healing properties and adaptive performance characteristics represent emerging technological frontiers.

Regional Localization of production and supply chains is accelerating as companies seek to reduce risks and improve responsiveness. Manufacturing clusters are developing around key automotive production centers, creating economies of scale and specialized expertise. Technology transfer initiatives are building local capabilities and reducing dependence on imported solutions.

Performance Enhancement continues to drive product development as vehicle manufacturers demand improved battery characteristics. Fast-charging compatibility requires electrolytes that can handle high current densities without degradation. Temperature tolerance improvements enable vehicle operation in diverse climatic conditions across South America.

Cost Optimization remains a critical trend as market participants work to reduce battery costs and improve electric vehicle affordability. Manufacturing efficiency improvements and economies of scale are reducing production costs while maintaining quality standards. Raw material optimization focuses on reducing dependence on expensive or scarce materials.

Manufacturing Expansion across the region reflects growing confidence in market potential and supportive policy environments. New production facilities are being established in Brazil, Argentina, and Chile to serve regional demand and potentially export to other markets. Capacity investments by both international and regional companies demonstrate commitment to long-term market development.

Technology Partnerships between international electrolyte manufacturers and regional companies are accelerating knowledge transfer and capability development. Joint ventures and licensing agreements provide access to advanced technologies while building local expertise. Research collaborations with universities are advancing fundamental understanding of electrolyte chemistry and performance optimization.

Regulatory Framework development continues to evolve as governments refine policies supporting electric vehicle adoption and domestic manufacturing. Quality standards and certification requirements are being established to ensure product safety and performance. Trade policies are being adjusted to support regional integration and technology transfer.

Infrastructure Investment in charging networks and supporting systems is creating favorable conditions for electric vehicle adoption. Grid integration projects are addressing power supply requirements for widespread vehicle electrification. Logistics networks are being developed to support efficient distribution of battery components and finished products.

Innovation Initiatives including research grants, technology incubators, and innovation centers are fostering development of next-generation electrolyte technologies. Startup ecosystem development is creating new companies focused on specialized applications and novel approaches to electrolyte design and manufacturing.

Strategic positioning recommendations for market participants emphasize the importance of building local capabilities while maintaining access to global technology developments. MarkWide Research analysis suggests that companies should focus on developing regional partnerships and establishing manufacturing presence to capitalize on growing market opportunities.

Technology investment priorities should balance current market needs with preparation for next-generation solutions. Solid-state electrolyte development represents a critical area for long-term competitive positioning, while improvements to liquid electrolyte performance address immediate market requirements. Research and development spending should target applications specific to regional operating conditions and vehicle requirements.

Market entry strategies should consider the diverse regulatory and economic environments across South American countries. Phased expansion starting with larger markets like Brazil and Argentina allows for learning and capability development before entering smaller markets. Local partnerships provide market knowledge and regulatory navigation capabilities essential for success.

Supply chain optimization should prioritize regional sourcing where possible while maintaining quality and cost competitiveness. Vertical integration opportunities in raw material processing could provide competitive advantages given regional resource availability. Risk management strategies should address currency fluctuations, political stability, and international trade disruptions.

Sustainability integration should be incorporated into all aspects of business strategy as environmental considerations become increasingly important to customers and regulators. Circular economy business models present opportunities for differentiation and additional revenue streams through recycling and recovery operations.

Market trajectory for the South America electric vehicle battery electrolyte market appears strongly positive, supported by favorable policy environments, improving technology, and growing consumer acceptance. Growth acceleration is expected as charging infrastructure expands and vehicle costs continue to decline through technological advancement and economies of scale.

Technology evolution will likely see continued improvement in liquid electrolyte performance alongside gradual introduction of solid-state alternatives in premium applications. Performance enhancements including faster charging capabilities and extended temperature ranges will expand vehicle applications and consumer appeal. Cost reduction through manufacturing optimization and raw material efficiency will improve market accessibility.

Regional integration is expected to accelerate as trade agreements and cooperation initiatives reduce barriers to cross-border business development. Supply chain regionalization will likely continue as companies seek to reduce risks and improve responsiveness to local market needs. Technology clusters around major automotive centers will create specialized expertise and competitive advantages.

Market expansion beyond passenger vehicles into commercial applications will create new growth opportunities with different performance requirements and potentially higher margins. Export potential may develop as regional manufacturers achieve competitive positioning in global markets through raw material advantages and cost optimization.

Sustainability requirements will become increasingly important as environmental regulations strengthen and consumer awareness grows. Circular economy initiatives including battery recycling and electrolyte recovery will create new business opportunities and support long-term market sustainability. Innovation ecosystems will continue developing around battery technology, attracting investment and talent to support continued market growth.

The South America electric vehicle battery electrolyte market represents a compelling growth opportunity within the broader regional transition toward sustainable transportation. Market fundamentals including supportive government policies, abundant raw material resources, and growing consumer acceptance create favorable conditions for sustained expansion and development.

Strategic advantages inherent to the region, particularly access to lithium reserves and emerging manufacturing capabilities, position South America as a potentially significant player in the global battery supply chain. Technology development initiatives and international partnerships are building local expertise while providing access to advanced electrolyte formulations and production techniques.

Market challenges including infrastructure limitations, technical expertise requirements, and competitive pressures from established global suppliers require strategic responses and continued investment. However, collaborative approaches involving government support, private sector investment, and international partnerships are addressing these constraints and creating pathways for market development.

Future prospects appear favorable as electric vehicle adoption accelerates and supporting infrastructure develops across the region. Innovation opportunities in specialized applications, sustainability initiatives, and export markets provide multiple avenues for growth and competitive differentiation. The South America electric vehicle battery electrolyte market is positioned to play an increasingly important role in the global transition to sustainable transportation, offering significant opportunities for stakeholders across the value chain.

What is Electric Vehicle Battery Electrolyte?

Electric Vehicle Battery Electrolyte refers to the medium that allows the flow of electric charge between the anode and cathode in a battery. It plays a crucial role in the performance, safety, and efficiency of electric vehicle batteries.

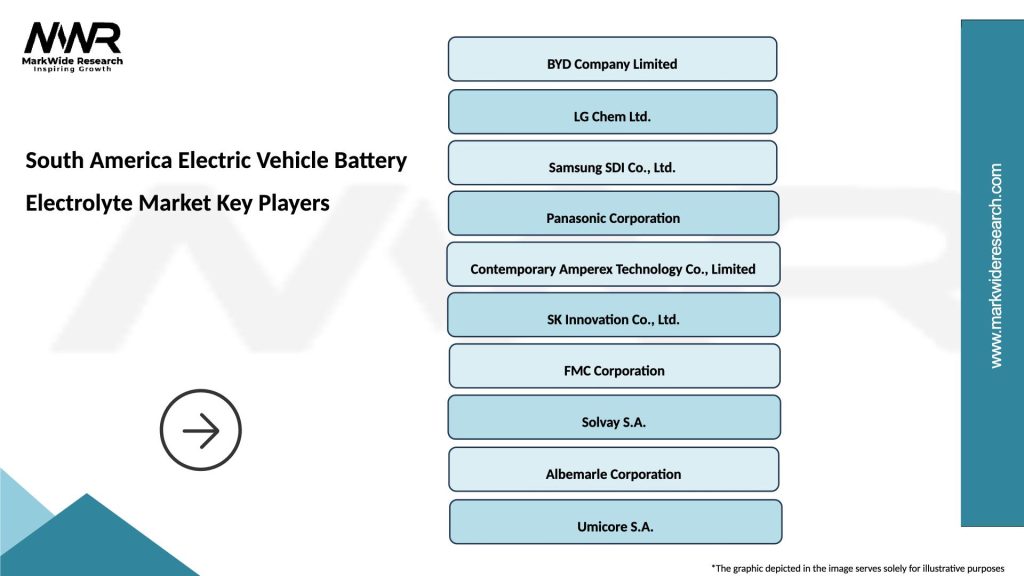

What are the key players in the South America Electric Vehicle Battery Electrolyte Market?

Key players in the South America Electric Vehicle Battery Electrolyte Market include companies like BASF, LG Chem, and Samsung SDI, which are known for their innovations in battery materials and technologies, among others.

What are the growth factors driving the South America Electric Vehicle Battery Electrolyte Market?

The growth of the South America Electric Vehicle Battery Electrolyte Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation.

What challenges does the South America Electric Vehicle Battery Electrolyte Market face?

Challenges in the South America Electric Vehicle Battery Electrolyte Market include the high cost of raw materials, limited recycling infrastructure, and regulatory hurdles that can impact production and distribution.

What opportunities exist in the South America Electric Vehicle Battery Electrolyte Market?

Opportunities in the South America Electric Vehicle Battery Electrolyte Market include the potential for innovation in solid-state electrolytes, increased investment in renewable energy sources, and the expansion of electric vehicle infrastructure.

What trends are shaping the South America Electric Vehicle Battery Electrolyte Market?

Trends in the South America Electric Vehicle Battery Electrolyte Market include the shift towards sustainable and eco-friendly materials, the development of high-performance electrolytes, and the growing interest in battery recycling technologies.

South America Electric Vehicle Battery Electrolyte Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Electrolyte, Solid Electrolyte, Gel Electrolyte, Polymer Electrolyte |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Charging Infrastructure |

| Technology | Lithium-Ion, Solid-State, Flow Battery, Sodium-Ion |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Electric Vehicle Battery Electrolyte Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at