444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America electric bus battery pack market represents a transformative segment within the region’s sustainable transportation ecosystem. This rapidly evolving market encompasses the design, manufacturing, and deployment of advanced battery systems specifically engineered for electric public transit vehicles across South American countries. Market dynamics indicate substantial growth potential driven by increasing environmental consciousness, government initiatives promoting clean transportation, and technological advancements in battery chemistry and energy density.

Regional adoption of electric bus battery packs has accelerated significantly, with countries like Brazil, Chile, and Colombia leading the transition toward electrified public transportation systems. The market encompasses various battery technologies including lithium-ion, lithium iron phosphate, and emerging solid-state solutions, each offering distinct advantages in terms of energy density, safety, and operational longevity. Growth projections suggest the market will expand at a compound annual growth rate of 12.8% through the forecast period, reflecting strong institutional commitment to sustainable mobility solutions.

Infrastructure development across major South American metropolitan areas has created favorable conditions for electric bus adoption, with cities implementing comprehensive charging networks and maintenance facilities. The market benefits from increasing collaboration between international battery manufacturers and local automotive companies, fostering technology transfer and regional manufacturing capabilities. Investment patterns show growing private sector participation alongside government funding, creating a robust foundation for sustained market expansion.

The South America electric bus battery pack market refers to the comprehensive ecosystem encompassing the development, production, and deployment of energy storage systems specifically designed for electric public transportation vehicles operating throughout South American countries. This market includes various stakeholders from battery cell manufacturers and pack assemblers to bus manufacturers and transit authorities, all working collaboratively to advance sustainable urban mobility solutions.

Battery pack systems in this context represent sophisticated energy storage solutions that integrate multiple battery cells, thermal management systems, battery management systems (BMS), and safety components into unified packages capable of powering electric buses for extended operational periods. These systems must meet stringent requirements for reliability, safety, and performance while operating in diverse climatic conditions ranging from tropical coastal regions to high-altitude Andean environments.

Market scope encompasses both original equipment manufacturer (OEM) applications for new electric bus production and retrofit solutions for converting existing diesel bus fleets to electric propulsion. The definition extends to include associated services such as battery leasing programs, maintenance contracts, and end-of-life recycling services that support the complete lifecycle management of electric bus battery systems.

Strategic analysis of the South America electric bus battery pack market reveals a sector positioned for substantial expansion driven by convergent factors including environmental regulations, technological advancement, and economic incentives. The market demonstrates strong fundamentals with increasing adoption rates across major urban centers and growing investment in supporting infrastructure. Key performance indicators show consistent improvement in battery energy density, charging speed, and operational reliability, making electric buses increasingly competitive with traditional diesel alternatives.

Regional leadership has emerged from countries implementing comprehensive electrification strategies, with Brazil commanding approximately 45% market share followed by Chile and Colombia with significant adoption programs. The market benefits from favorable government policies including tax incentives, import duty reductions, and direct subsidies for electric vehicle adoption. Technology trends indicate rapid advancement in lithium iron phosphate chemistry, offering improved safety characteristics and longer cycle life particularly suited to intensive public transit applications.

Competitive dynamics feature a mix of international battery manufacturers establishing regional operations and emerging local players developing specialized solutions for South American market conditions. The market structure supports both centralized manufacturing for economies of scale and distributed assembly operations to reduce logistics costs and improve service responsiveness. Future projections indicate sustained growth momentum with expanding applications beyond urban transit to include intercity bus services and specialized transportation applications.

Market intelligence reveals several critical insights shaping the South America electric bus battery pack landscape. The following key insights provide strategic understanding of market dynamics and growth drivers:

Environmental imperatives serve as the primary catalyst driving South America electric bus battery pack market expansion. Increasing awareness of air quality issues in major metropolitan areas has prompted governments to implement stringent emission standards and transition timelines for public transportation fleets. Regulatory frameworks across the region mandate gradual replacement of diesel buses with electric alternatives, creating predictable demand patterns for battery pack systems.

Economic incentives significantly influence market adoption through comprehensive support programs including purchase subsidies, tax exemptions, and preferential financing terms for electric bus acquisitions. These programs reduce the total cost of ownership gap between electric and conventional buses, making electrification economically attractive for transit operators. Operational cost advantages of electric buses, including reduced fuel and maintenance expenses, provide compelling long-term value propositions that drive sustained market growth.

Technological advancement in battery chemistry and manufacturing processes continues to improve performance characteristics while reducing costs. Enhanced energy density enables longer operational ranges, while improved charging speeds reduce downtime and increase fleet utilization efficiency. Infrastructure development programs across major cities provide comprehensive charging networks that eliminate range anxiety and operational constraints previously associated with electric bus deployment.

International cooperation and technology transfer initiatives facilitate access to advanced battery technologies and manufacturing expertise, accelerating market development. Strategic partnerships between global battery manufacturers and regional companies create local production capabilities while ensuring access to cutting-edge technology. Climate commitments made by South American countries under international agreements create long-term policy stability that supports sustained investment in electric transportation infrastructure.

Capital investment requirements represent a significant barrier to widespread electric bus adoption, as initial acquisition costs remain substantially higher than conventional diesel alternatives despite improving economics. Many transit operators face budget constraints that limit their ability to make large upfront investments in electric bus fleets and associated charging infrastructure. Financial limitations are particularly challenging for smaller municipalities and private bus operators who lack access to government subsidies or preferential financing programs.

Infrastructure gaps in certain regions limit the practical deployment of electric bus systems, particularly in areas lacking reliable electrical grid capacity or adequate maintenance facilities. The requirement for specialized charging equipment and trained maintenance personnel creates additional operational complexities that some operators find challenging to manage. Grid stability concerns in some areas raise questions about the reliability of electric bus operations during peak demand periods or electrical system disruptions.

Technical challenges related to battery performance in extreme weather conditions and high-altitude environments present operational concerns for some applications. Battery degradation over time and the eventual need for replacement create long-term cost considerations that operators must factor into their financial planning. Supply chain dependencies on imported battery cells and components create vulnerability to international trade disruptions and currency fluctuations that can impact project economics.

Skills and knowledge gaps within the regional workforce limit the availability of qualified technicians capable of maintaining and servicing advanced battery systems. This constraint can lead to increased maintenance costs and reduced system reliability if not adequately addressed through training and development programs. Regulatory uncertainty in some jurisdictions creates hesitation among potential investors and operators who prefer stable policy environments for long-term capital commitments.

Expanding applications beyond urban transit present significant growth opportunities for electric bus battery pack systems, including intercity transportation, school bus services, and specialized vehicle applications. The growing recognition of electric propulsion benefits in various transportation segments creates multiple market entry points for battery pack manufacturers. Technology diversification opportunities include development of specialized battery solutions optimized for specific operational requirements such as high-altitude performance or extreme temperature resilience.

Regional manufacturing expansion offers substantial opportunities for establishing local production capabilities that reduce costs, improve supply chain resilience, and create employment opportunities. Strategic partnerships between international technology providers and regional manufacturers can accelerate market development while ensuring technology transfer and knowledge building. Service sector development including battery leasing, maintenance, and recycling services presents attractive business models that provide recurring revenue streams while supporting customer adoption.

Government procurement programs across South American countries create substantial market opportunities through large-scale electric bus deployment initiatives. These programs often include long-term contracts that provide revenue stability and growth predictability for battery pack suppliers. Export potential to other emerging markets leveraging South American manufacturing capabilities and regional expertise in tropical and high-altitude applications presents additional growth avenues.

Innovation opportunities in battery chemistry, thermal management, and system integration can create competitive advantages and market leadership positions. Development of solutions specifically optimized for South American operating conditions and requirements can establish strong market positions. Circular economy initiatives including battery recycling and second-life applications create new revenue streams while addressing environmental sustainability concerns and resource conservation objectives.

Supply chain evolution within the South America electric bus battery pack market reflects increasing regionalization and vertical integration as manufacturers seek to reduce costs and improve responsiveness. The market demonstrates growing maturity with established players expanding production capacity while new entrants focus on specialized applications and innovative technologies. Competitive intensity has increased as market growth attracts additional participants, driving innovation and cost reduction while improving product quality and service offerings.

Technology convergence between battery systems, charging infrastructure, and fleet management solutions creates integrated value propositions that address comprehensive customer needs. This convergence enables more sophisticated business models including performance-based contracts and comprehensive service packages. Market consolidation trends indicate strategic acquisitions and partnerships as companies seek to strengthen their market positions and expand their technological capabilities.

Customer sophistication has increased significantly as transit operators develop deeper understanding of electric bus technology and operational requirements. This evolution has led to more demanding performance specifications and comprehensive evaluation criteria that drive continuous improvement in battery pack design and manufacturing. Regulatory harmonization across South American countries facilitates market development by creating consistent standards and requirements that enable economies of scale in product development and manufacturing.

Investment patterns show increasing participation from private equity and venture capital firms attracted by the market’s growth potential and strategic importance. This financial support accelerates technology development and market expansion while providing resources for infrastructure development and market penetration activities. International collaboration continues to strengthen through technology transfer agreements, joint ventures, and strategic partnerships that combine global expertise with regional market knowledge.

Comprehensive market analysis for the South America electric bus battery pack market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include extensive interviews with industry stakeholders including battery manufacturers, bus operators, government officials, and technology providers to gather firsthand insights into market conditions and trends. Survey methodologies capture quantitative data on market size, growth rates, and competitive positioning while qualitative interviews provide deeper understanding of market dynamics and strategic considerations.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and regulatory documents to establish comprehensive market context and validate primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources while identifying potential discrepancies or gaps in available information. Market modeling employs sophisticated analytical frameworks to project future market conditions and assess the impact of various scenarios on market development.

Regional analysis methodology includes country-specific research to understand local market conditions, regulatory environments, and competitive landscapes. This approach recognizes the diversity within South American markets and ensures that regional variations are properly captured and analyzed. Technology assessment includes evaluation of current and emerging battery technologies, manufacturing processes, and system integration approaches to provide comprehensive understanding of technological trends and their market implications.

Validation processes include expert review panels and stakeholder feedback sessions to ensure research findings accurately reflect market realities and provide actionable insights for decision-making. Continuous monitoring and updating procedures maintain research currency and relevance as market conditions evolve. Quality assurance protocols ensure data accuracy, analytical rigor, and objective presentation of findings while maintaining confidentiality of proprietary information provided by research participants.

Brazil dominates the South America electric bus battery pack market with approximately 45% regional market share, driven by comprehensive government support programs and large-scale urban transit systems in major cities including São Paulo, Rio de Janeiro, and Brasília. The country benefits from established automotive manufacturing infrastructure and growing local battery pack assembly capabilities. Brazilian market characteristics include strong government procurement programs, favorable financing terms, and increasing private sector participation in electric bus deployment initiatives.

Chile represents the second-largest market with approximately 22% regional share, distinguished by aggressive electrification targets and comprehensive policy support for sustainable transportation. Santiago’s ambitious electric bus program serves as a regional model for large-scale transit electrification, demonstrating the feasibility and benefits of comprehensive fleet conversion. Chilean market dynamics feature strong international partnerships, advanced charging infrastructure, and innovative financing mechanisms that support rapid market expansion.

Colombia accounts for approximately 18% of regional market activity, with Bogotá and Medellín leading electric bus adoption through integrated urban mobility programs. The country’s focus on improving air quality and reducing transportation emissions drives sustained government support for electric bus deployment. Colombian initiatives include comprehensive driver training programs, maintenance facility development, and strategic partnerships with international technology providers.

Argentina and Peru collectively represent approximately 15% of regional market share, with growing interest in electric bus technology driven by environmental concerns and economic incentives. Both countries are developing regulatory frameworks and incentive programs to support electric transportation adoption while building local technical capabilities. Emerging markets including Ecuador, Uruguay, and Bolivia show increasing interest in electric bus technology, creating additional growth opportunities for battery pack suppliers and system integrators.

Market leadership in the South America electric bus battery pack sector features a diverse mix of international manufacturers and emerging regional players, each bringing distinct capabilities and strategic approaches to market development. The competitive environment demonstrates increasing sophistication as companies develop comprehensive value propositions that extend beyond basic battery supply to include integrated solutions and services.

Competitive strategies increasingly focus on localization, technology transfer, and comprehensive service offerings that address the complete lifecycle of electric bus battery systems. Strategic partnerships between international technology providers and regional manufacturers create competitive advantages through combined global expertise and local market knowledge.

Technology segmentation within the South America electric bus battery pack market reveals distinct categories based on battery chemistry, system architecture, and performance characteristics. Each segment addresses specific operational requirements and cost considerations that influence customer selection criteria and market development patterns.

By Battery Chemistry:

By Application:

By Capacity Range:

Urban transit applications represent the largest market segment, accounting for approximately 65% of total demand for electric bus battery packs in South America. This category benefits from predictable route patterns, established charging infrastructure, and strong government support for public transportation electrification. Performance requirements emphasize reliability, safety, and cost-effectiveness rather than maximum energy density, making lithium iron phosphate chemistry particularly attractive for these applications.

Bus Rapid Transit systems constitute a rapidly growing segment with specialized requirements for high-power charging and intensive operational schedules. These applications demand robust battery systems capable of frequent charging cycles while maintaining consistent performance throughout extended service life. Technical specifications for BRT applications often include advanced thermal management systems and sophisticated battery management systems to ensure optimal performance under demanding operational conditions.

Intercity transportation represents an emerging opportunity segment with unique requirements for maximum range and energy density. These applications often require custom battery pack configurations optimized for specific route characteristics and operational patterns. Market development in this segment depends on continued improvement in battery energy density and the establishment of charging infrastructure along major transportation corridors.

School transportation applications present specialized requirements emphasizing safety, reliability, and moderate performance characteristics. This segment benefits from predictable operational patterns and growing environmental awareness among educational institutions and communities. Regulatory considerations for school bus applications often include enhanced safety requirements and specialized certification processes that influence battery pack design and manufacturing approaches.

Transit operators realize substantial operational benefits from electric bus battery pack adoption including reduced fuel costs, lower maintenance requirements, and improved vehicle reliability. Electric buses typically demonstrate 60-70% lower operating costs compared to diesel alternatives when considering fuel, maintenance, and lifecycle expenses. Operational advantages include quieter operation, instant torque delivery, and reduced driver fatigue through improved vehicle dynamics and reduced vibration.

Environmental benefits provide significant value for communities and government stakeholders through improved air quality, reduced noise pollution, and decreased greenhouse gas emissions. Electric buses eliminate local emissions entirely while reducing overall carbon footprint when powered by clean electricity sources. Public health improvements result from reduced exposure to diesel particulates and other harmful emissions, particularly benefiting vulnerable populations in urban areas.

Economic development opportunities emerge through local manufacturing, employment creation, and technology transfer initiatives associated with electric bus battery pack production. Regional manufacturing capabilities reduce import dependencies while creating skilled employment opportunities in advanced manufacturing sectors. Supply chain benefits include reduced exposure to volatile fuel prices and improved energy security through domestic electricity sources.

Technology advancement drives innovation in battery chemistry, manufacturing processes, and system integration approaches that benefit broader electric vehicle markets. Knowledge and capabilities developed in electric bus applications often transfer to other transportation segments and energy storage applications. Investment attraction in electric transportation infrastructure creates broader economic benefits through job creation, technology development, and industrial capacity building.

Strengths:

Weaknesses:

Opportunities:

Threats:

Battery chemistry evolution represents a fundamental trend driving market development, with increasing adoption of lithium iron phosphate technology due to its superior safety characteristics and cost-effectiveness for public transit applications. This trend reflects growing operator sophistication and emphasis on total cost of ownership rather than initial purchase price. Performance improvements in LFP chemistry continue to narrow the energy density gap with other technologies while maintaining safety and cost advantages.

Integrated solutions are becoming increasingly prevalent as customers seek comprehensive packages that include batteries, charging infrastructure, maintenance services, and performance guarantees. This trend reflects market maturation and customer desire for simplified procurement and operation. Service integration enables battery manufacturers to capture additional value while providing customers with optimized system performance and reduced operational complexity.

Localization strategies continue to accelerate as international manufacturers establish regional production capabilities to reduce costs, improve supply chain resilience, and access government incentives. This trend creates employment opportunities while building regional technical capabilities and reducing import dependencies. Technology transfer associated with localization initiatives strengthens regional innovation capabilities and competitive positioning.

Circular economy principles are gaining importance as stakeholders focus on battery lifecycle management, recycling, and second-life applications. This trend addresses environmental sustainability concerns while creating new revenue opportunities and reducing material costs. Regulatory developments increasingly emphasize end-of-life responsibility and resource recovery, driving innovation in recycling technologies and business models.

Strategic partnerships between international battery manufacturers and regional bus producers have accelerated market development through combined technological expertise and local market knowledge. Recent collaborations have resulted in optimized battery solutions specifically designed for South American operating conditions and customer requirements. Technology transfer initiatives associated with these partnerships strengthen regional manufacturing capabilities while ensuring access to advanced battery technologies.

Government procurement programs across major South American cities have created substantial market opportunities through large-scale electric bus deployment initiatives. Recent announcements include comprehensive fleet electrification programs in São Paulo, Santiago, and Bogotá that will require thousands of battery packs over the next several years. Policy developments continue to strengthen support for electric transportation through enhanced incentives and regulatory requirements.

Infrastructure investments in charging networks and maintenance facilities have eliminated key barriers to electric bus adoption while creating favorable conditions for market expansion. Recent developments include rapid charging corridors along major transportation routes and specialized maintenance centers equipped for battery service and replacement. Grid integration initiatives ensure adequate electrical capacity to support large-scale electric bus operations.

Innovation breakthroughs in battery chemistry and manufacturing processes continue to improve performance while reducing costs. Recent developments include enhanced thermal management systems optimized for tropical climates and high-altitude operations common in South America. Manufacturing automation initiatives improve quality consistency while reducing production costs and enabling competitive pricing for regional markets.

Market entry strategies should emphasize localization and partnership development to establish sustainable competitive positions in South American markets. MarkWide Research analysis indicates that successful market participants typically combine international technological expertise with strong regional partnerships and local manufacturing capabilities. Companies should prioritize understanding of local regulatory requirements, customer preferences, and operational conditions that influence product design and market approach.

Technology focus should emphasize lithium iron phosphate chemistry for mainstream applications while developing specialized solutions for niche markets requiring high energy density or extreme performance characteristics. Investment in thermal management and battery management system technologies specifically optimized for South American operating conditions can create competitive advantages. Product development should consider modular designs that enable cost-effective customization for different applications and customer requirements.

Service development represents a critical success factor as customers increasingly seek comprehensive solutions rather than standalone products. Battery leasing programs, performance guarantees, and lifecycle management services can differentiate offerings while creating recurring revenue streams. Customer education initiatives help build market acceptance and ensure optimal system utilization while reducing operational risks and customer concerns.

Supply chain optimization should balance cost reduction with resilience and responsiveness requirements. Regional manufacturing capabilities reduce logistics costs and improve customer service while creating local employment and accessing government incentives. Strategic sourcing of critical materials and components should consider both cost and supply security factors while building relationships with reliable suppliers.

Market expansion is projected to accelerate significantly over the next decade as battery costs continue declining and performance characteristics improve. Growth projections indicate the market will expand at a compound annual growth rate exceeding 12% through 2030, driven by comprehensive government support programs and increasing operator acceptance of electric bus technology. Technology advancement will enable new applications and market segments while improving the economic attractiveness of electric bus adoption.

Regional manufacturing capabilities are expected to expand substantially as international companies establish local production facilities and regional players develop advanced manufacturing capabilities. This development will reduce costs, improve supply chain resilience, and create employment opportunities while strengthening regional competitiveness. Innovation ecosystems will emerge around major manufacturing centers, fostering technology development and supporting market growth.

Application diversification beyond urban transit will create additional market opportunities in intercity transportation, school bus services, and specialized vehicle applications. Each segment will require optimized battery solutions that address specific operational requirements and performance characteristics. Market segmentation will become increasingly sophisticated as customers develop deeper understanding of their specific needs and available technology options.

Sustainability initiatives will drive development of comprehensive circular economy approaches including battery recycling, second-life applications, and sustainable manufacturing processes. These developments will address environmental concerns while creating new business opportunities and reducing material costs. MWR projections suggest that circular economy principles will become integral to business models and competitive positioning within the next five years.

The South America electric bus battery pack market represents a dynamic and rapidly evolving sector positioned for substantial growth driven by environmental imperatives, government support, and technological advancement. Market analysis reveals strong fundamentals including comprehensive policy support, improving technology performance, and growing customer acceptance that create favorable conditions for sustained expansion. Regional leadership from countries like Brazil, Chile, and Colombia demonstrates the feasibility and benefits of large-scale electric bus deployment while creating models for broader regional adoption.

Competitive dynamics feature increasing sophistication as market participants develop comprehensive value propositions that extend beyond basic battery supply to include integrated solutions and services. The market benefits from growing localization of manufacturing capabilities that reduce costs while building regional technical expertise and employment opportunities. Technology trends indicate continued improvement in battery performance and cost-effectiveness that will further accelerate market adoption and expand application opportunities.

Future prospects remain highly positive with projected growth rates exceeding 12% annually supported by expanding government programs, improving technology economics, and growing environmental awareness. The market is well-positioned to benefit from broader trends toward sustainable transportation and urban mobility solutions while creating substantial economic and environmental benefits for South American communities. Strategic opportunities exist for companies that can effectively combine technological expertise with regional market knowledge and comprehensive customer solutions, positioning the South America electric bus battery pack market as a key driver of sustainable transportation transformation across the region.

What is Electric Bus Battery Pack?

Electric Bus Battery Pack refers to the collection of batteries used to power electric buses, providing the necessary energy for propulsion and onboard systems. These battery packs are crucial for the performance, range, and efficiency of electric buses in urban transportation.

What are the key players in the South America Electric Bus Battery Pack Market?

Key players in the South America Electric Bus Battery Pack Market include BYD, Siemens, and A123 Systems, which are known for their innovative battery technologies and contributions to electric mobility solutions, among others.

What are the main drivers of the South America Electric Bus Battery Pack Market?

The main drivers of the South America Electric Bus Battery Pack Market include the increasing demand for sustainable public transportation, government initiatives promoting electric vehicles, and advancements in battery technology that enhance energy density and reduce costs.

What challenges does the South America Electric Bus Battery Pack Market face?

Challenges in the South America Electric Bus Battery Pack Market include high initial investment costs, limited charging infrastructure, and concerns regarding battery lifespan and recycling, which can hinder widespread adoption.

What opportunities exist in the South America Electric Bus Battery Pack Market?

Opportunities in the South America Electric Bus Battery Pack Market include the potential for partnerships between public transport authorities and battery manufacturers, the growth of renewable energy integration for charging, and the expansion of electric bus fleets in urban areas.

What trends are shaping the South America Electric Bus Battery Pack Market?

Trends shaping the South America Electric Bus Battery Pack Market include the shift towards lithium-ion and solid-state batteries, increased focus on energy efficiency, and the development of smart charging solutions that optimize battery usage and reduce downtime.

South America Electric Bus Battery Pack Market

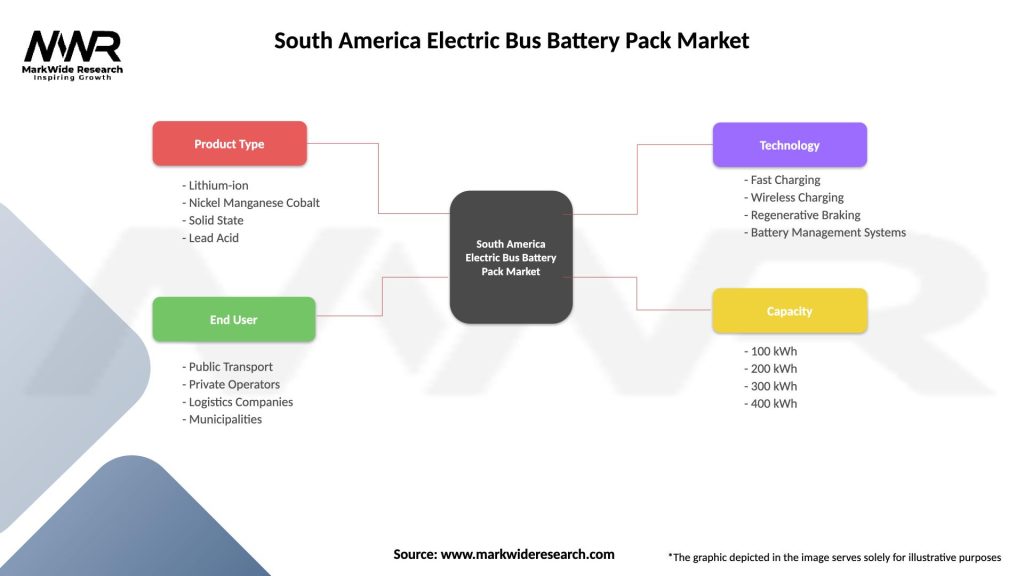

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel Manganese Cobalt, Solid State, Lead Acid |

| End User | Public Transport, Private Operators, Logistics Companies, Municipalities |

| Technology | Fast Charging, Wireless Charging, Regenerative Braking, Battery Management Systems |

| Capacity | 100 kWh, 200 kWh, 300 kWh, 400 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Electric Bus Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at