444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America e-commerce skin care products market represents one of the fastest-growing segments within the region’s digital commerce landscape. This dynamic marketplace encompasses a wide range of skincare solutions sold through online platforms, including cleansers, moisturizers, serums, anti-aging treatments, and specialized dermatological products. The market has experienced remarkable transformation driven by increasing internet penetration, changing consumer preferences, and the growing influence of social media beauty trends across countries like Brazil, Argentina, Colombia, Chile, and Peru.

Digital transformation has fundamentally reshaped how South American consumers discover, research, and purchase skincare products. The market benefits from a young, tech-savvy population that increasingly relies on online reviews, influencer recommendations, and digital platforms for beauty product selection. With smartphone adoption rates exceeding 75% across major urban centers, mobile commerce has become a primary driver of market expansion.

Regional diversity characterizes the South American e-commerce skincare landscape, with Brazil dominating market share at approximately 65% of total regional sales, followed by Argentina, Colombia, and Chile. The market encompasses both international beauty brands and emerging local companies that leverage e-commerce platforms to reach broader audiences. Growing awareness of skincare routines, particularly among millennials and Generation Z consumers, continues to fuel demand for specialized products and personalized beauty solutions.

The South America e-commerce skin care products market refers to the comprehensive ecosystem of online retail channels, digital platforms, and electronic commerce infrastructure dedicated to the sale and distribution of skincare products across South American countries. This market encompasses all forms of digital transactions involving skincare products, from traditional e-commerce websites and mobile applications to social commerce platforms and subscription-based beauty services.

Market scope includes various product categories such as facial cleansers, moisturizers, sunscreens, anti-aging treatments, acne solutions, and specialized dermatological products sold through online channels. The definition extends beyond simple product sales to include digital marketing strategies, customer engagement platforms, virtual consultations, and omnichannel retail experiences that bridge online and offline beauty shopping.

Geographic coverage spans the entire South American continent, with particular emphasis on major markets including Brazil, Argentina, Colombia, Chile, Peru, Ecuador, Uruguay, and Paraguay. The market definition encompasses both business-to-consumer (B2C) transactions and emerging business-to-business (B2B) platforms serving beauty retailers, salons, and professional skincare practitioners throughout the region.

Market momentum in the South America e-commerce skin care products sector reflects a convergence of technological advancement, changing consumer behavior, and increased beauty consciousness across the region. The market demonstrates robust growth potential driven by expanding internet infrastructure, rising disposable incomes in urban areas, and growing acceptance of online shopping for personal care products.

Key growth drivers include the proliferation of social media beauty influencers, increased awareness of skincare routines, and the convenience factor associated with online shopping. The COVID-19 pandemic accelerated digital adoption, with online skincare sales experiencing growth rates of 40-60% during peak lockdown periods. This digital shift has proven sustainable, with many consumers maintaining their online purchasing habits post-pandemic.

Competitive dynamics feature a mix of established international beauty brands, emerging direct-to-consumer companies, and local South American skincare manufacturers leveraging e-commerce platforms for market expansion. The market benefits from increasing investment in logistics infrastructure, payment solutions, and last-mile delivery capabilities that enhance the overall online shopping experience for beauty consumers.

Future prospects indicate continued expansion driven by technological innovations such as augmented reality try-on experiences, artificial intelligence-powered product recommendations, and personalized skincare solutions. The market is expected to maintain strong growth momentum as digital natives become the primary consumer demographic and e-commerce infrastructure continues to mature across the region.

Consumer behavior analysis reveals significant shifts in how South American consumers approach skincare purchasing decisions. The following insights highlight critical market dynamics:

Digital infrastructure expansion serves as a fundamental driver of market growth across South America. Improved internet connectivity, enhanced mobile networks, and expanding broadband access have created favorable conditions for e-commerce adoption. Government initiatives promoting digital inclusion and private sector investments in telecommunications infrastructure continue to reduce barriers to online shopping participation.

Changing consumer preferences reflect a generational shift toward digital-first shopping experiences. Younger consumers, particularly millennials and Generation Z, demonstrate strong preferences for online research, comparison shopping, and digital purchase processes. This demographic values convenience, product variety, and access to international brands that may not be readily available through traditional retail channels.

Social media integration has transformed skincare product discovery and purchase behavior. Beauty influencers, skincare specialists, and user-generated content drive product awareness and credibility. Platforms like Instagram, TikTok, and YouTube serve as powerful marketing channels that directly influence purchasing decisions and brand preferences among South American consumers.

Urbanization trends contribute to market expansion as growing urban populations gain access to improved internet infrastructure and develop higher disposable incomes. Urban consumers demonstrate greater willingness to experiment with new skincare products and embrace online shopping for personal care items. The concentration of young professionals in major cities creates ideal conditions for e-commerce market development.

Pandemic-driven behavioral changes accelerated the adoption of online shopping for personal care products. Lockdown measures, social distancing requirements, and health concerns prompted consumers to explore digital alternatives to traditional beauty retail. Many of these behavioral changes have proven permanent, creating sustained demand for e-commerce skincare solutions.

Logistics challenges present significant obstacles to market expansion across South America’s diverse geographic landscape. Complex terrain, inadequate transportation infrastructure, and limited last-mile delivery capabilities in rural and remote areas restrict market accessibility. High shipping costs and extended delivery times can discourage online purchases, particularly for lower-value skincare products.

Payment system limitations continue to constrain market growth in certain regions and demographic segments. Limited credit card penetration, concerns about online payment security, and preference for cash transactions among older consumers create barriers to e-commerce adoption. Complex currency fluctuations and international payment processing challenges further complicate cross-border skincare purchases.

Regulatory complexities surrounding cosmetic imports, product registration, and online retail operations create compliance challenges for e-commerce platforms and international brands. Varying regulations across South American countries complicate market entry strategies and increase operational costs for companies seeking regional expansion.

Digital divide issues persist in rural areas and among lower-income populations, limiting market accessibility. Uneven internet infrastructure development, limited smartphone adoption in certain demographics, and digital literacy gaps prevent universal market participation. These disparities create uneven market development patterns across the region.

Product authenticity concerns affect consumer confidence in online skincare purchases. Counterfeit products, unauthorized sellers, and quality control issues can undermine trust in e-commerce platforms. Consumers often express preferences for physical product inspection before purchase, particularly for premium skincare items.

Emerging market penetration offers substantial growth opportunities as internet infrastructure expands into previously underserved areas. Secondary cities and rural regions with improving connectivity represent untapped consumer segments with growing purchasing power and increasing interest in skincare products. E-commerce platforms that successfully address logistics and payment challenges in these markets can achieve significant competitive advantages.

Personalization technologies present opportunities for differentiation and customer engagement enhancement. Artificial intelligence, machine learning, and data analytics enable customized product recommendations, virtual skincare consultations, and personalized beauty routines. Companies that invest in these technologies can create superior customer experiences and build stronger brand loyalty.

Sustainable beauty trends create opportunities for eco-conscious skincare brands and platforms. Growing environmental awareness among South American consumers drives demand for sustainable packaging, natural ingredients, and ethical beauty practices. E-commerce platforms that emphasize sustainability credentials can attract environmentally conscious consumers and differentiate their offerings.

Cross-border e-commerce expansion enables access to international skincare brands and specialized products not available through local retailers. Improved international shipping options, simplified customs procedures, and currency hedging solutions create opportunities for global beauty brands to enter South American markets through e-commerce channels.

Social commerce integration represents a significant growth opportunity as social media platforms develop native shopping capabilities. Instagram Shopping, Facebook Marketplace, and emerging social commerce features enable seamless transitions from product discovery to purchase, creating new revenue streams and customer acquisition channels for skincare brands.

Supply chain evolution continues to reshape the South American e-commerce skincare landscape. Traditional distribution models are being disrupted by direct-to-consumer brands, dropshipping arrangements, and integrated logistics solutions. Companies are investing in regional fulfillment centers, automated warehousing, and advanced inventory management systems to improve delivery speed and reduce operational costs.

Competitive intensity has increased significantly as both established beauty retailers and new digital-native brands compete for market share. Price competition, promotional strategies, and customer acquisition costs have intensified, forcing companies to focus on differentiation through product quality, customer service, and unique value propositions.

Technology integration drives continuous market evolution through innovations in augmented reality, virtual try-on experiences, and AI-powered skincare analysis. These technologies enhance the online shopping experience by addressing traditional limitations of digital beauty retail, such as inability to test products before purchase.

Consumer education initiatives play an increasingly important role in market development. Skincare brands and e-commerce platforms invest in educational content, virtual consultations, and expert advice to help consumers make informed purchasing decisions. This educational approach builds trust and encourages trial of new products and brands.

Regulatory adaptation continues as governments across South America develop frameworks for e-commerce regulation, consumer protection, and digital taxation. These evolving regulatory environments create both challenges and opportunities for market participants, requiring ongoing compliance monitoring and strategic adaptation.

Comprehensive data collection methodologies underpin accurate market analysis of the South America e-commerce skin care products sector. Primary research involves extensive surveys of online consumers, interviews with e-commerce platform executives, and discussions with beauty brand representatives operating in the region. This primary data collection provides insights into consumer behavior, purchasing patterns, and market trends that quantitative data alone cannot capture.

Secondary research integration combines industry reports, government statistics, e-commerce platform data, and academic studies to create a comprehensive market picture. Analysis of online search trends, social media engagement metrics, and digital advertising spending patterns provides additional context for market dynamics and consumer preferences.

Market segmentation analysis employs both demographic and psychographic segmentation approaches to understand diverse consumer groups across South American markets. Geographic analysis considers country-specific factors, urban-rural differences, and regional economic variations that influence e-commerce adoption and skincare purchasing behavior.

Competitive intelligence gathering involves monitoring e-commerce platform performance, analyzing pricing strategies, and tracking promotional activities across major market participants. This competitive analysis provides insights into market positioning, strategic initiatives, and emerging trends that shape industry development.

Trend forecasting methodologies combine historical data analysis with forward-looking indicators such as technology adoption rates, demographic shifts, and economic projections. This approach enables accurate prediction of market evolution and identification of emerging opportunities and challenges.

Brazil dominates the South American e-commerce skincare market, accounting for approximately 65% of regional sales volume. The Brazilian market benefits from advanced e-commerce infrastructure, high internet penetration rates, and a large urban population with significant purchasing power. Major cities like São Paulo, Rio de Janeiro, and Brasília serve as primary growth centers, while secondary markets show increasing adoption rates.

Argentina represents the second-largest market, contributing roughly 15% of regional market share. Despite economic challenges and currency volatility, Argentine consumers demonstrate strong interest in skincare products and online shopping. Buenos Aires leads market development, with growing adoption in cities like Córdoba and Rosario. Cross-border shopping for international beauty brands remains popular among affluent consumers.

Colombia emerges as a rapidly growing market with approximately 8% market share and strong growth momentum. Bogotá, Medellín, and Cali drive market expansion, supported by improving internet infrastructure and growing middle-class purchasing power. The Colombian market shows particular strength in natural and organic skincare products, reflecting cultural preferences for traditional beauty ingredients.

Chile maintains a mature e-commerce environment with 6% of regional market share. Santiago dominates the Chilean market, with high internet penetration and sophisticated consumer preferences. Chilean consumers demonstrate willingness to pay premium prices for quality skincare products and show strong adoption of subscription-based beauty services.

Peru and Ecuador together account for approximately 4% of market share but show significant growth potential. Lima and Quito serve as primary market centers, with expanding internet infrastructure and growing urban populations creating favorable conditions for e-commerce development. These markets show particular interest in affordable skincare solutions and local beauty brands.

Smaller markets including Uruguay, Paraguay, and Bolivia collectively represent the remaining 2% of market share but offer niche opportunities for specialized products and services. These markets benefit from spillover effects from larger neighboring countries and show gradual adoption of e-commerce skincare shopping.

Market leadership in the South America e-commerce skin care products sector involves a diverse mix of international beauty conglomerates, regional e-commerce platforms, and emerging direct-to-consumer brands. The competitive environment continues to evolve as traditional retailers expand their digital presence and new market entrants leverage innovative business models.

Emerging competitors include direct-to-consumer skincare brands, subscription beauty services, and specialized platforms focusing on natural or organic products. These companies leverage social media marketing, influencer partnerships, and personalized customer experiences to compete with established players.

Strategic partnerships between international beauty brands and local e-commerce platforms continue to reshape competitive dynamics. These collaborations enable global brands to access South American markets while providing local platforms with premium product offerings and enhanced credibility.

Product category segmentation reveals diverse consumer preferences and market opportunities across the South American e-commerce skincare landscape:

Price point segmentation reflects diverse economic conditions and consumer preferences across the region:

Distribution channel segmentation encompasses various e-commerce models and platforms:

Facial cleansers dominate the e-commerce skincare market due to their essential role in daily skincare routines and frequent repurchase cycles. This category benefits from strong brand loyalty while also showing openness to new product trials. Gel cleansers, foam cleansers, and micellar waters show particularly strong online sales performance, with consumers appreciating the ability to read detailed ingredient lists and user reviews before purchasing.

Anti-aging products represent the highest-value category within the e-commerce skincare market, attracting consumers willing to invest in premium formulations and established brands. This segment shows strong growth potential as South American populations age and become more conscious of preventive skincare. Retinol products, peptide creams, and vitamin C serums demonstrate particularly strong online performance.

Acne treatment products show consistent demand driven by younger demographics who are comfortable with online shopping and research. This category benefits from detailed product information, before-and-after photos, and user testimonials that help consumers make informed decisions. Salicylic acid products, benzoyl peroxide treatments, and natural acne solutions perform well in e-commerce channels.

Sunscreen products maintain steady demand across all South American markets due to high UV exposure levels and growing awareness of sun protection importance. This category shows seasonal variations but maintains baseline demand throughout the year. Broad-spectrum sunscreens, tinted sunscreens, and sport-specific formulations demonstrate strong online sales performance.

Natural and organic skincare represents a rapidly growing category driven by increasing consumer awareness of ingredient safety and environmental concerns. This segment benefits from detailed product descriptions, certification information, and brand storytelling that resonates with conscious consumers. Local South American ingredients and traditional beauty formulations show particular appeal in this category.

Brand manufacturers benefit from direct access to South American consumers without requiring extensive physical retail infrastructure. E-commerce platforms enable brands to test market demand, gather consumer feedback, and build brand awareness cost-effectively. Digital channels provide valuable consumer data and insights that inform product development and marketing strategies.

E-commerce platforms gain from the high-margin beauty category that drives frequent purchases and customer engagement. Skincare products generate strong customer lifetime value and provide opportunities for cross-selling and upselling. The category’s visual nature makes it well-suited for social commerce integration and influencer marketing partnerships.

Consumers enjoy unprecedented access to product variety, competitive pricing, and detailed product information. Online shopping enables comparison shopping, access to international brands, and convenience of home delivery. Digital platforms provide educational content, reviews, and expert advice that enhance purchasing confidence and product satisfaction.

Logistics providers benefit from consistent demand for skincare product delivery services, creating stable revenue streams and opportunities for specialized beauty fulfillment services. The category’s relatively small package sizes and moderate value make it suitable for various delivery options and pricing models.

Payment processors gain from the growing volume of online beauty transactions and the category’s appeal to digitally-savvy consumers comfortable with electronic payments. Skincare purchases often involve repeat customers, creating predictable transaction volumes and opportunities for loyalty program integration.

Digital marketing agencies benefit from the visual nature of skincare products and the category’s strong social media presence. Beauty brands typically invest heavily in digital marketing, creating opportunities for content creation, influencer partnerships, and performance marketing services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution transforms how consumers interact with skincare brands online. Advanced algorithms analyze skin types, concerns, and preferences to provide customized product recommendations. Virtual skin analysis tools, AI-powered chatbots, and personalized skincare routines create more engaging and effective shopping experiences that drive customer loyalty and satisfaction.

Social commerce integration blurs the lines between social media engagement and e-commerce transactions. Instagram Shopping, TikTok partnerships, and influencer collaborations enable seamless transitions from content consumption to product purchase. Live streaming beauty demonstrations and real-time product launches create urgency and excitement around new skincare releases.

Subscription model adoption gains momentum as consumers seek convenience and personalized product discovery. Monthly beauty boxes, customized skincare regimens, and automatic replenishment services provide predictable revenue for brands while offering value and convenience for consumers. These models enable brands to build stronger customer relationships and gather valuable usage data.

Sustainability emphasis influences product development, packaging choices, and brand messaging across the e-commerce skincare market. Consumers increasingly prioritize eco-friendly packaging, natural ingredients, and ethical sourcing practices. Brands that successfully communicate their sustainability credentials gain competitive advantages and appeal to environmentally conscious consumers.

Mobile-first experiences drive platform design and user interface optimization as smartphone usage dominates e-commerce interactions. Mobile apps, one-click purchasing, and mobile payment integration create seamless shopping experiences. Augmented reality features, voice search capabilities, and mobile-optimized content enhance the mobile shopping experience for skincare products.

Cross-border shopping expansion enables access to international skincare brands and specialized products not available through local retailers. Improved international shipping options, simplified customs procedures, and currency hedging solutions facilitate cross-border transactions. This trend particularly benefits premium and niche skincare brands seeking to enter South American markets.

Platform expansion initiatives have accelerated across major South American markets as e-commerce companies invest in infrastructure and service capabilities. MercadoLibre has significantly expanded its beauty category offerings and introduced specialized beauty fulfillment centers in Brazil and Argentina. These investments improve delivery speed and product availability for skincare consumers across the region.

International brand entries continue to reshape the competitive landscape as global beauty companies establish direct-to-consumer operations in South America. Sephora’s expansion into Brazil and Ulta Beauty’s partnership discussions with regional platforms demonstrate growing international interest in South American e-commerce opportunities.

Technology partnerships between beauty brands and technology companies have introduced innovative shopping experiences. Augmented reality try-on features, virtual skin consultations, and AI-powered product matching tools enhance the online skincare shopping experience. These technological advances address traditional limitations of digital beauty retail.

Logistics infrastructure investments by major e-commerce platforms and third-party logistics providers improve delivery capabilities across South America. New fulfillment centers, last-mile delivery partnerships, and same-day delivery services in major cities enhance customer satisfaction and enable competitive differentiation.

Payment solution innovations address traditional barriers to e-commerce adoption in South America. Buy-now-pay-later options, digital wallet integration, and cryptocurrency payment acceptance expand payment accessibility. These innovations particularly benefit younger consumers and those without traditional credit access.

Regulatory framework developments across South American countries create more favorable conditions for e-commerce growth. Simplified customs procedures, digital taxation frameworks, and consumer protection regulations provide greater certainty for businesses and consumers participating in online skincare commerce.

Market entry strategies should prioritize mobile-first approaches given the dominance of smartphone-based shopping in South America. Companies entering the market should invest in responsive mobile platforms, mobile payment integration, and mobile-optimized content. MarkWide Research analysis indicates that mobile commerce represents the primary growth opportunity for new market entrants.

Localization efforts prove critical for success in diverse South American markets. Companies should adapt product offerings, pricing strategies, and marketing messages to local preferences and economic conditions. Understanding cultural beauty standards, ingredient preferences, and shopping behaviors enables more effective market penetration strategies.

Partnership development with established e-commerce platforms, logistics providers, and payment processors accelerates market entry and reduces operational complexity. Strategic partnerships enable companies to leverage existing infrastructure while focusing on core competencies in product development and brand building.

Content marketing investments should emphasize educational content, user-generated reviews, and influencer partnerships that build trust and credibility. South American consumers rely heavily on peer recommendations and expert advice when making skincare purchasing decisions. Comprehensive content strategies that address consumer questions and concerns drive conversion rates and customer satisfaction.

Technology adoption in areas such as personalization, virtual consultations, and augmented reality creates competitive advantages and enhances customer experiences. Companies that successfully integrate these technologies into their e-commerce operations can differentiate their offerings and build stronger customer relationships.

Sustainability initiatives should be integrated into product development, packaging design, and brand messaging to appeal to environmentally conscious consumers. Transparent communication about ingredient sourcing, manufacturing processes, and environmental impact resonates with South American consumers increasingly concerned about sustainability.

Market expansion is expected to continue at robust rates as internet infrastructure improvements and smartphone adoption reach previously underserved areas. Secondary cities and rural regions with growing connectivity represent significant untapped opportunities for e-commerce skincare sales. MWR projections indicate that market penetration in these emerging areas could drive substantial growth over the next five years.

Technology integration will increasingly define competitive advantages as artificial intelligence, machine learning, and augmented reality become standard features of e-commerce platforms. Virtual skin analysis, personalized product recommendations, and immersive shopping experiences will become consumer expectations rather than differentiating features.

Cross-border commerce expansion will provide South American consumers with unprecedented access to international skincare brands and specialized products. Improved logistics networks, simplified customs procedures, and enhanced payment solutions will facilitate international transactions and create new opportunities for global beauty brands.

Sustainability focus will intensify as environmental consciousness grows among South American consumers. Brands that successfully integrate sustainable practices into their operations and communicate these efforts effectively will gain competitive advantages. Natural ingredients, eco-friendly packaging, and ethical sourcing will become increasingly important purchase criteria.

Social commerce evolution will blur traditional boundaries between social media engagement and e-commerce transactions. Live streaming shopping events, influencer-driven sales, and social media-integrated purchasing will create new customer acquisition channels and engagement opportunities for skincare brands.

Market consolidation may occur as successful platforms and brands acquire smaller competitors or form strategic partnerships. This consolidation could lead to improved operational efficiency, enhanced customer experiences, and stronger competitive positions for surviving market participants.

The South America e-commerce skin care products market represents a dynamic and rapidly evolving sector with substantial growth potential across the region. Driven by increasing internet penetration, changing consumer preferences, and growing beauty consciousness, the market demonstrates strong momentum despite facing challenges related to logistics infrastructure, payment systems, and regulatory complexity.

Key success factors for market participants include mobile-first strategies, localization efforts, strategic partnerships, and technology integration. Companies that successfully navigate the diverse South American landscape while addressing local consumer needs and preferences are positioned to capture significant market opportunities. The importance of social media integration, personalization capabilities, and sustainability initiatives continues to grow as consumer expectations evolve.

Future prospects remain highly positive as infrastructure improvements, technology adoption, and demographic trends create favorable conditions for continued market expansion. The convergence of e-commerce capabilities, social media influence, and beauty consciousness among South American consumers creates a unique and compelling market opportunity for skincare brands and platforms willing to invest in long-term market development strategies.

What is E-Commerce Skin Care Products?

E-Commerce Skin Care Products refer to beauty and personal care items sold online, including moisturizers, serums, and cleansers. This market has seen significant growth due to the increasing preference for online shopping and the rising awareness of skincare among consumers.

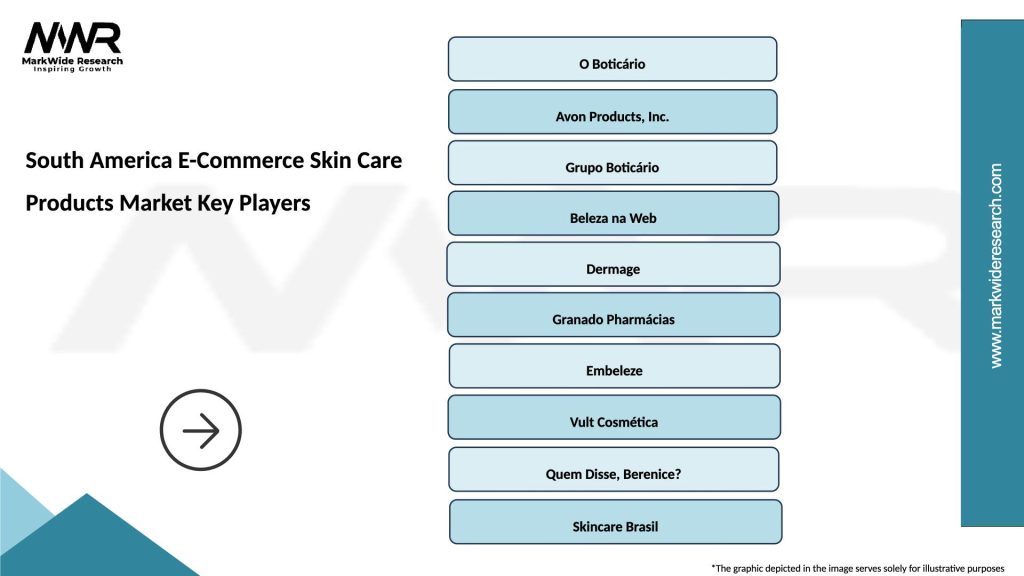

What are the key players in the South America E-Commerce Skin Care Products Market?

Key players in the South America E-Commerce Skin Care Products Market include Natura & Co, O Boticário, and Sephora, among others. These companies are known for their diverse product offerings and strong online presence.

What are the growth factors driving the South America E-Commerce Skin Care Products Market?

The growth of the South America E-Commerce Skin Care Products Market is driven by factors such as increasing internet penetration, a growing middle-class population, and rising consumer awareness about skincare benefits. Additionally, the convenience of online shopping contributes to market expansion.

What challenges does the South America E-Commerce Skin Care Products Market face?

Challenges in the South America E-Commerce Skin Care Products Market include intense competition, regulatory hurdles, and issues related to product authenticity. These factors can hinder market growth and affect consumer trust.

What opportunities exist in the South America E-Commerce Skin Care Products Market?

Opportunities in the South America E-Commerce Skin Care Products Market include the potential for growth in organic and natural skincare products, as well as the expansion of online platforms catering to niche markets. Additionally, increasing social media influence can drive consumer engagement.

What trends are shaping the South America E-Commerce Skin Care Products Market?

Trends in the South America E-Commerce Skin Care Products Market include the rise of personalized skincare solutions, the popularity of clean beauty products, and the integration of augmented reality for virtual try-ons. These trends reflect changing consumer preferences and technological advancements.

South America E-Commerce Skin Care Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Moisturizers, Cleansers, Serums, Sunscreens |

| Distribution Channel | Online Retailers, Brand Websites, Marketplaces, Social Media |

| Customer Type | Women, Men, Teens, Seniors |

| Packaging Type | Tubes, Jars, Pumps, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America E-Commerce Skin Care Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at