444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America e-commerce apparel market represents one of the most dynamic and rapidly evolving segments within the region’s digital commerce landscape. This market encompasses online sales of clothing, footwear, accessories, and fashion-related products across countries including Brazil, Argentina, Chile, Colombia, Peru, and other South American nations. The region has experienced remarkable transformation in consumer shopping behaviors, driven by increasing internet penetration, smartphone adoption, and changing lifestyle preferences among younger demographics.

Digital transformation has fundamentally reshaped how South American consumers approach fashion purchases, with online platforms becoming increasingly preferred channels for discovering and acquiring apparel products. The market demonstrates significant growth potential, expanding at a robust CAGR of 12.8% as traditional retail boundaries continue to blur and omnichannel strategies gain prominence. This growth trajectory reflects the region’s evolving retail infrastructure, improved logistics networks, and growing consumer confidence in online shopping experiences.

Market dynamics indicate that Brazil dominates the regional landscape, accounting for approximately 65% of total market activity, followed by Argentina and Chile as secondary growth markets. The sector benefits from increasing urbanization, rising disposable incomes among middle-class consumers, and the proliferation of mobile commerce platforms that cater specifically to local preferences and payment methods.

The South America e-commerce apparel market refers to the comprehensive ecosystem of online retail platforms, digital marketplaces, and mobile applications that facilitate the sale and distribution of fashion and clothing products across South American countries. This market encompasses various business models including business-to-consumer (B2C) platforms, marketplace operations, direct-to-consumer brand channels, and social commerce initiatives that leverage digital technologies to connect fashion retailers with end consumers.

E-commerce apparel in this context includes all categories of clothing and fashion accessories sold through digital channels, ranging from everyday casual wear and formal attire to specialized sportswear, luxury fashion items, and footwear. The market also incorporates emerging segments such as sustainable fashion, plus-size clothing, and culturally-specific apparel that resonates with diverse South American consumer preferences and cultural traditions.

South America’s e-commerce apparel sector stands at a pivotal transformation point, characterized by accelerating digital adoption and evolving consumer expectations. The market demonstrates exceptional resilience and growth potential, supported by improving technological infrastructure and increasing consumer comfort with online shopping experiences. Key growth drivers include expanding internet connectivity, rising smartphone penetration rates reaching 78% across major urban centers, and the emergence of innovative payment solutions tailored to regional preferences.

Market leaders are successfully implementing omnichannel strategies that integrate online and offline experiences, while emerging players focus on niche segments and specialized offerings. The competitive landscape features a mix of international e-commerce giants, regional marketplace platforms, and local fashion brands that have successfully transitioned to digital-first business models. Consumer behavior analysis reveals increasing preference for mobile shopping, with mobile commerce representing 58% of total online apparel purchases.

Future prospects remain highly optimistic, with analysts projecting continued expansion driven by generational shifts in shopping preferences, improved logistics infrastructure, and the ongoing development of cross-border e-commerce capabilities that connect South American consumers with global fashion brands and trends.

Consumer demographics reveal that millennials and Generation Z consumers drive the majority of online apparel purchases, with these age groups demonstrating higher digital engagement and willingness to experiment with new brands and shopping platforms. The market exhibits strong seasonal variations, with peak activity occurring during traditional shopping periods and cultural celebrations unique to South American countries.

Digital infrastructure development serves as the primary catalyst for market expansion, with governments and private sector investments significantly improving internet connectivity and mobile network coverage across urban and rural areas. This technological foundation enables broader market participation and supports the growth of sophisticated e-commerce platforms that can handle complex fashion retail requirements including visual merchandising, size variations, and customer service integration.

Demographic shifts play a crucial role in driving market growth, as younger consumers who grew up with digital technologies become primary fashion purchasers. These consumers demonstrate higher comfort levels with online shopping, greater willingness to try new brands, and increased expectations for seamless digital experiences. Their shopping behaviors influence broader market trends and drive innovation in areas such as personalization, social shopping, and mobile-optimized experiences.

Economic factors including rising disposable incomes, expanding middle-class populations, and increased urbanization create favorable conditions for e-commerce apparel growth. Additionally, the cost advantages of online shopping, including access to promotional offers, price comparison capabilities, and elimination of traditional retail markups, make digital channels increasingly attractive to price-conscious consumers.

Pandemic acceleration has permanently altered consumer shopping behaviors, with many traditional in-store shoppers transitioning to online channels and discovering the convenience and variety benefits of e-commerce apparel shopping. This behavioral shift has created lasting changes in market dynamics and consumer expectations.

Logistics challenges remain significant barriers to market growth, particularly in remote areas and smaller cities where delivery infrastructure may be limited or unreliable. High shipping costs, extended delivery times, and concerns about product damage during transit can discourage online apparel purchases and limit market expansion into underserved regions.

Size and fit concerns represent persistent obstacles for online apparel shopping, as consumers cannot physically try on items before purchase. This challenge is particularly acute for fashion categories where fit is critical, leading to higher return rates and customer dissatisfaction when sizing expectations are not met. The lack of standardized sizing across brands further complicates this issue.

Payment security and fraud concerns continue to influence consumer behavior, with some segments remaining hesitant to provide payment information online or preferring cash-on-delivery options that can complicate fulfillment processes. Limited access to traditional banking services in certain demographics also restricts market participation.

Cultural preferences for tactile shopping experiences and personal interaction with sales staff can slow adoption rates, particularly among older consumer segments who value the traditional retail experience and may be skeptical of online shopping benefits.

Emerging technologies present substantial opportunities for market expansion and innovation, including augmented reality try-on experiences, artificial intelligence-powered styling recommendations, and advanced personalization engines that can improve customer satisfaction and reduce return rates. These technologies can address key barriers to online apparel shopping while creating differentiated customer experiences.

Untapped demographics represent significant growth potential, particularly in rural areas and among older consumer segments who have not yet fully embraced e-commerce shopping. Targeted education campaigns, simplified user interfaces, and culturally-relevant marketing approaches can help expand market reach into these underserved segments.

Cross-border e-commerce offers opportunities to connect South American consumers with global fashion brands and trends while also enabling local brands to expand into international markets. Improved customs processes, international shipping partnerships, and currency exchange solutions can facilitate this growth.

Sustainable fashion represents an emerging opportunity as environmental consciousness grows among consumers. Brands that can effectively communicate sustainability credentials and offer eco-friendly options may capture significant market share among environmentally-aware consumer segments.

Competitive intensity continues to escalate as both international e-commerce giants and local players vie for market share through aggressive pricing strategies, expanded product offerings, and enhanced customer service capabilities. This competition drives innovation and improves overall market conditions for consumers while challenging businesses to differentiate their value propositions.

Supply chain evolution reflects the growing sophistication of e-commerce operations, with companies investing in advanced inventory management systems, predictive analytics, and automated fulfillment capabilities. These improvements enable faster delivery times, better product availability, and more efficient operations that can support market growth and customer satisfaction.

Consumer expectations continue to rise, driven by experiences with leading global e-commerce platforms and increasing familiarity with digital shopping capabilities. Customers now expect features such as same-day delivery, easy returns, personalized recommendations, and seamless omnichannel experiences that integrate online and offline touchpoints.

Regulatory developments influence market dynamics through consumer protection laws, data privacy regulations, and cross-border trade policies that can either facilitate or complicate e-commerce operations. Companies must navigate these regulatory requirements while maintaining competitive operations and customer service standards.

Primary research methodologies employed in analyzing the South America e-commerce apparel market include comprehensive consumer surveys, in-depth interviews with industry executives, and focus group discussions with target demographic segments. These approaches provide direct insights into consumer preferences, shopping behaviors, and market trends that quantitative data alone cannot capture.

Secondary research incorporates analysis of industry reports, government statistics, company financial disclosures, and academic studies that provide broader market context and historical trend analysis. This research foundation enables comprehensive understanding of market dynamics and competitive positioning across different countries and consumer segments.

Data validation processes ensure accuracy and reliability through triangulation of multiple data sources, expert review panels, and statistical verification methods. Market sizing and growth projections undergo rigorous validation to ensure they reflect realistic market conditions and growth potential.

Regional analysis methodology accounts for significant variations in market conditions, consumer behaviors, and competitive landscapes across different South American countries, ensuring that insights accurately reflect local market dynamics rather than applying broad generalizations across the diverse regional market.

Brazil dominates the South American e-commerce apparel landscape, representing the largest and most mature market with well-developed logistics infrastructure, established payment systems, and high consumer adoption rates. The Brazilian market benefits from a large urban population, relatively high internet penetration rates, and the presence of major international and domestic e-commerce platforms that have invested significantly in local operations.

Argentina represents the second-largest market opportunity, characterized by sophisticated consumer preferences and strong fashion culture. However, economic volatility and currency fluctuations create unique challenges for e-commerce operations, requiring adaptive pricing strategies and flexible payment options. The market shows strong growth potential with 15.2% annual expansion in online apparel purchases.

Chile and Colombia emerge as high-growth markets with improving digital infrastructure and increasing consumer confidence in online shopping. These markets benefit from stable economic conditions and growing middle-class populations that drive demand for fashion and lifestyle products. Chile particularly demonstrates strong adoption of mobile commerce platforms.

Smaller markets including Peru, Ecuador, and Uruguay present niche opportunities for specialized products and services, though they may require different approaches to logistics, payment processing, and customer service to achieve sustainable growth and profitability.

Market leadership is contested among several categories of players, each bringing different strengths and strategic approaches to the South American e-commerce apparel market. The competitive environment features intense rivalry and continuous innovation as companies seek to capture and retain customer loyalty in this rapidly growing sector.

By Product Category: The market segments into distinct product categories, each with unique characteristics and growth patterns. Women’s apparel represents the largest segment, followed by men’s clothing and children’s wear. Footwear and accessories constitute rapidly growing categories with strong consumer demand and repeat purchase patterns.

By Consumer Demographics: Age-based segmentation reveals distinct shopping behaviors and preferences, with millennials and Generation Z driving the majority of online purchases. Income-based segmentation shows growing participation from middle-income consumers who value the convenience and variety of online shopping options.

By Price Range: The market spans from budget-conscious value segments to premium and luxury categories, with mid-range products representing the largest volume segment. Premium segments show strong growth as consumers become more comfortable with higher-value online purchases.

By Shopping Channel: Mobile commerce dominates with 62% of total transactions, followed by desktop/laptop purchases and emerging social commerce channels. Cross-platform shopping behaviors are increasingly common as consumers research on one device and purchase on another.

Women’s Apparel leads market activity with diverse subcategories including casual wear, formal attire, activewear, and seasonal fashion items. This segment benefits from higher purchase frequency, greater variety seeking behavior, and strong influence from social media and fashion trends. Size inclusivity and sustainable options are becoming increasingly important differentiators.

Men’s Fashion demonstrates steady growth with particular strength in casual wear, sportswear, and professional attire. Male consumers show higher brand loyalty but are increasingly willing to experiment with online-exclusive brands and direct-to-consumer offerings. Convenience and time-saving aspects of online shopping particularly appeal to this demographic.

Children’s Clothing represents a high-frequency purchase category driven by rapid growth and seasonal needs. Parents appreciate the convenience of online shopping for children’s items, though size and quality concerns remain important considerations. Educational and character-themed apparel shows strong performance.

Footwear faces unique challenges related to fit and comfort but benefits from strong brand recognition and customer loyalty. Athletic and casual footwear categories perform particularly well online, while formal and specialized footwear may require more sophisticated sizing and return policies.

Retailers and Brands benefit from expanded market reach, reduced operational costs compared to traditional retail, and access to detailed consumer data that enables personalized marketing and inventory optimization. E-commerce platforms provide opportunities to test new products, enter new markets, and build direct relationships with consumers without significant upfront investment in physical infrastructure.

Consumers gain access to broader product selections, competitive pricing, convenient shopping experiences, and the ability to compare options across multiple brands and retailers. Online shopping eliminates geographical constraints and provides access to international brands and trends that may not be available through traditional retail channels.

Logistics Providers experience increased demand for delivery services, warehousing solutions, and specialized handling of fashion items. The growth of e-commerce apparel creates opportunities for innovation in last-mile delivery, reverse logistics for returns, and technology-enabled tracking and customer communication.

Payment Processors benefit from increased transaction volumes and opportunities to develop specialized solutions for e-commerce, including installment payment options, fraud prevention systems, and cross-border payment capabilities that facilitate international shopping.

Strengths:

Weaknesses:

Opportunities:

Threats:

Social Commerce Integration represents a transformative trend as fashion brands increasingly leverage social media platforms for product discovery, customer engagement, and direct sales. Instagram Shopping, Facebook Marketplace, and emerging platforms like TikTok Shop are becoming essential channels for reaching younger consumers who discover and purchase fashion items through social media interactions.

Personalization and AI technologies are revolutionizing the online shopping experience through sophisticated recommendation engines, personalized styling services, and predictive analytics that anticipate consumer preferences. These technologies help address the challenge of product discovery in vast online catalogs while improving customer satisfaction and conversion rates.

Sustainable Fashion Focus reflects growing consumer awareness of environmental and social issues, driving demand for eco-friendly materials, ethical production practices, and transparent supply chains. Brands that successfully communicate sustainability credentials and offer environmentally responsible options are gaining competitive advantages and customer loyalty.

Omnichannel Experiences blur the lines between online and offline shopping through services like buy-online-pickup-in-store, virtual styling consultations, and integrated loyalty programs. According to MarkWide Research analysis, consumers increasingly expect seamless experiences across all touchpoints, with 73% preferring brands that offer integrated online and offline services.

Technology Partnerships are reshaping the competitive landscape as traditional retailers collaborate with technology companies to enhance their e-commerce capabilities. These partnerships focus on areas such as artificial intelligence, augmented reality, and advanced analytics that can improve customer experiences and operational efficiency.

Logistics Innovations include the development of micro-fulfillment centers, same-day delivery services, and automated sorting facilities that can handle the unique requirements of fashion e-commerce including size variations, seasonal inventory, and high return rates. These investments improve customer satisfaction while reducing operational costs.

Payment Evolution encompasses the introduction of buy-now-pay-later services, cryptocurrency payment options, and improved mobile payment solutions that cater to diverse consumer preferences and financial situations. These innovations expand market accessibility and can increase average order values.

Sustainability Initiatives include the development of circular fashion programs, carbon-neutral shipping options, and partnerships with sustainable material suppliers. These initiatives respond to consumer demand while potentially reducing long-term operational costs and regulatory risks.

Investment Priorities should focus on technology infrastructure, particularly mobile optimization and personalization capabilities that can differentiate brands in an increasingly competitive market. Companies should prioritize investments in sizing technology, virtual try-on solutions, and customer service automation that can address key barriers to online apparel purchases.

Market Entry Strategies for new players should emphasize niche positioning, exceptional customer service, and innovative approaches to common industry challenges. Success requires understanding local consumer preferences, payment methods, and cultural factors that influence shopping behaviors across different South American markets.

Partnership Opportunities exist in logistics, technology, and payment processing where collaboration can provide competitive advantages without requiring massive capital investments. Strategic partnerships with local influencers, fashion bloggers, and cultural figures can also enhance brand credibility and market penetration.

Risk Management strategies should address currency volatility, supply chain disruptions, and changing regulatory environments that can impact operations. Diversification across multiple markets and product categories can help mitigate these risks while providing growth opportunities.

Growth Projections indicate continued robust expansion of the South American e-commerce apparel market, driven by ongoing digital transformation, improving infrastructure, and evolving consumer preferences. MWR forecasts suggest the market will maintain strong momentum with particular acceleration in mobile commerce and cross-border shopping segments.

Technology Integration will become increasingly sophisticated, with artificial intelligence, augmented reality, and machine learning technologies becoming standard features rather than competitive differentiators. These technologies will enable more personalized shopping experiences, better inventory management, and improved customer service capabilities.

Market Consolidation may occur as successful players acquire smaller competitors or struggling retailers, leading to more concentrated market leadership while creating opportunities for innovative new entrants that can identify and serve underserved market segments.

Regulatory Evolution will likely bring more comprehensive consumer protection laws, data privacy regulations, and international trade agreements that could either facilitate or complicate cross-border e-commerce operations. Companies that proactively adapt to regulatory changes will be better positioned for long-term success.

The South America e-commerce apparel market represents a compelling growth opportunity characterized by strong fundamentals, evolving consumer behaviors, and improving technological infrastructure. Despite challenges related to logistics, sizing, and economic volatility, the market demonstrates resilience and significant potential for continued expansion across multiple dimensions including geographic reach, product categories, and consumer demographics.

Success factors for market participants include deep understanding of local consumer preferences, investment in technology solutions that address key shopping barriers, and development of flexible business models that can adapt to changing market conditions. Companies that can effectively combine global best practices with local market insights will be best positioned to capture the substantial opportunities available in this dynamic and rapidly evolving market.

Future growth will be driven by continued digital adoption, infrastructure improvements, and the emergence of new technologies that enhance the online shopping experience. The South America e-commerce apparel market is poised to become an increasingly important component of the global fashion retail landscape, offering significant opportunities for both established players and innovative new entrants who can successfully navigate its unique challenges and capitalize on its substantial growth potential.

What is E-Commerce Apparel?

E-Commerce Apparel refers to the online retailing of clothing and fashion items, encompassing various segments such as casual wear, formal wear, and activewear. This sector has seen significant growth due to the increasing adoption of online shopping and changing consumer preferences.

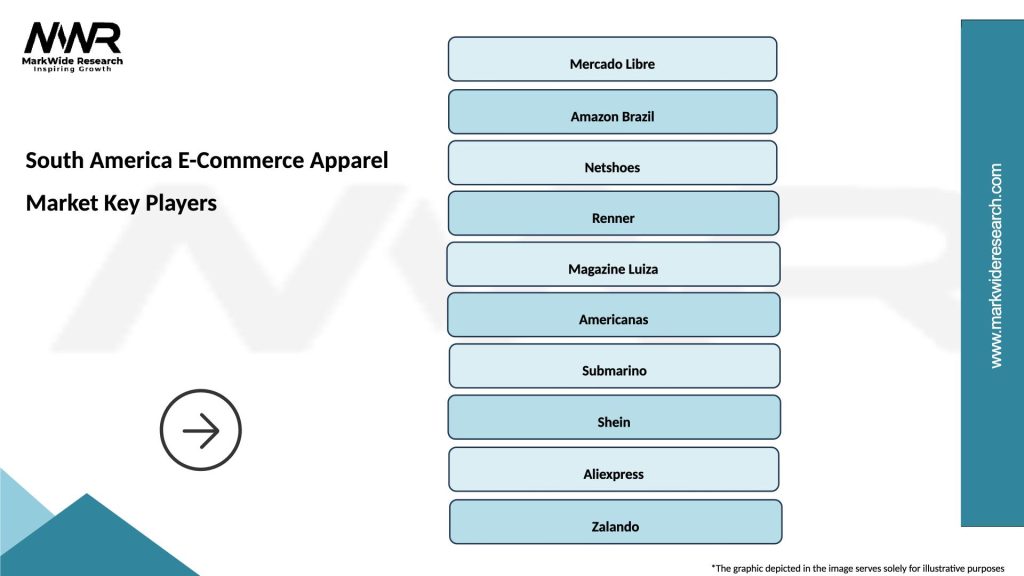

What are the key players in the South America E-Commerce Apparel Market?

Key players in the South America E-Commerce Apparel Market include companies like Dafiti, Zattini, and Mercado Livre. These companies are known for their extensive product ranges and strong online presence, catering to diverse consumer needs, among others.

What are the main drivers of the South America E-Commerce Apparel Market?

The main drivers of the South America E-Commerce Apparel Market include the growing internet penetration, increasing smartphone usage, and a shift in consumer behavior towards online shopping. Additionally, the rise of social media marketing has significantly influenced consumer purchasing decisions.

What challenges does the South America E-Commerce Apparel Market face?

The South America E-Commerce Apparel Market faces challenges such as logistical issues, high return rates, and intense competition among online retailers. Additionally, varying regulations across countries can complicate operations for e-commerce businesses.

What opportunities exist in the South America E-Commerce Apparel Market?

Opportunities in the South America E-Commerce Apparel Market include the potential for growth in niche segments like sustainable fashion and plus-size apparel. Furthermore, advancements in technology, such as augmented reality for virtual fitting, can enhance the online shopping experience.

What trends are shaping the South America E-Commerce Apparel Market?

Trends shaping the South America E-Commerce Apparel Market include the rise of influencer marketing, increased focus on sustainability, and the integration of AI for personalized shopping experiences. Additionally, the demand for fast fashion continues to influence consumer choices.

South America E-Commerce Apparel Market

| Segmentation Details | Description |

|---|---|

| Product Type | T-Shirts, Dresses, Jeans, Activewear |

| Customer Type | Men, Women, Children, Unisex |

| Distribution Channel | Online Retailers, Brand Websites, Marketplaces, Social Media |

| Price Tier | Luxury, Mid-Range, Budget, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America E-Commerce Apparel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at