444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America deep water and ultra deep-water exploration & production market represents one of the most dynamic and rapidly evolving segments of the global offshore energy sector. This market encompasses drilling and production activities in water depths exceeding 500 meters for deep water operations and beyond 1,500 meters for ultra deep-water projects. South America’s continental shelf offers exceptional opportunities for hydrocarbon exploration, particularly along the coasts of Brazil, Argentina, Colombia, and Venezuela.

Regional market dynamics indicate substantial growth potential driven by technological advancements, favorable geological conditions, and increasing energy demand. The region’s offshore basins contain significant untapped reserves, with Brazil leading the market through its pre-salt discoveries and advanced production capabilities. Market expansion is supported by growing investments in subsea infrastructure, floating production systems, and enhanced drilling technologies that enable economic extraction from challenging deep-water environments.

Industry participants are experiencing robust growth opportunities as governments implement supportive regulatory frameworks and international oil companies increase their exploration commitments. The market demonstrates strong resilience despite global energy transitions, with deep water and ultra deep-water projects offering competitive production costs and substantial reserve potential that attracts continued investment from major energy corporations.

The South America deep water and ultra deep-water exploration & production market refers to the comprehensive ecosystem of activities, technologies, and investments focused on discovering, developing, and producing hydrocarbon resources from offshore locations where water depths exceed 500 meters for deep water and 1,500 meters for ultra deep-water operations across South American territorial waters.

This market encompasses multiple interconnected segments including seismic surveying, exploratory drilling, appraisal activities, field development planning, subsea infrastructure installation, floating production systems deployment, and ongoing production operations. Key market components include specialized drilling rigs, subsea equipment, pipeline systems, floating production storage and offloading vessels, and advanced reservoir management technologies specifically designed for challenging offshore environments.

Market participants range from international oil companies and national oil corporations to specialized service providers, equipment manufacturers, and technology developers. The market’s scope extends beyond traditional exploration and production to include environmental monitoring, decommissioning services, and emerging technologies for enhanced recovery and carbon capture applications in offshore settings.

South America’s deep water and ultra deep-water exploration & production market demonstrates exceptional growth momentum driven by technological innovations, favorable geological conditions, and increasing global energy demand. The region’s offshore basins, particularly Brazil’s pre-salt formations, represent some of the world’s most promising hydrocarbon provinces with substantial untapped potential for future development.

Market leadership is concentrated among major international oil companies partnering with national oil corporations to leverage local expertise and regulatory compliance. Brazil dominates regional market activity, accounting for approximately 75% of deep water production in South America, followed by emerging opportunities in Argentina, Colombia, and other coastal nations developing their offshore capabilities.

Technological advancement serves as a primary market driver, with innovations in subsea processing, enhanced drilling techniques, and floating production systems enabling economic development of previously inaccessible reserves. Investment flows continue expanding as companies recognize the long-term value proposition of deep water assets, despite higher initial capital requirements compared to conventional onshore or shallow water projects.

Future market prospects remain highly favorable, supported by ongoing exploration success, improving project economics, and growing regional energy security priorities. The market benefits from established infrastructure, skilled workforce development, and supportive government policies that encourage continued offshore investment and technological innovation across the region.

Strategic market analysis reveals several critical insights shaping the South America deep water and ultra deep-water exploration & production landscape. Primary market drivers include technological maturation, favorable regulatory environments, and substantial reserve potential that continues attracting international investment and expertise to the region.

Multiple factors drive robust growth in South America’s deep water and ultra deep-water exploration & production market, creating favorable conditions for sustained industry expansion and technological advancement. Primary market drivers include substantial untapped reserve potential, technological innovations, and supportive regulatory frameworks that encourage continued offshore investment.

Resource availability represents the fundamental driver, with South America’s continental shelf containing significant hydrocarbon reserves in deep water and ultra deep-water formations. Brazil’s pre-salt discoveries demonstrate the region’s exceptional potential, while ongoing exploration in Argentina, Colombia, and other nations reveals additional opportunities for major field developments and production growth.

Technological advancement enables economic development of previously inaccessible reserves through innovations in drilling techniques, subsea processing, and floating production systems. Enhanced drilling capabilities reduce operational risks and costs, while advanced reservoir management technologies optimize production efficiency and extend field life cycles across challenging offshore environments.

Government support through favorable fiscal regimes, streamlined permitting processes, and infrastructure development initiatives creates attractive investment conditions for international operators. Regulatory stability and transparent bidding processes encourage long-term commitments from major oil companies seeking to expand their deep water portfolios in the region.

Energy security priorities drive national policies supporting domestic production growth and reduced import dependence. Regional energy demand continues expanding, creating strong market fundamentals for sustained offshore development and production capacity expansion across multiple South American nations.

Several challenges constrain growth in South America’s deep water and ultra deep-water exploration & production market, requiring strategic solutions and continued industry adaptation. Primary market restraints include high capital requirements, technical complexities, and environmental considerations that impact project development timelines and investment decisions.

Capital intensity represents a significant barrier, with deep water and ultra deep-water projects requiring substantial upfront investments in specialized equipment, infrastructure, and technology. Project economics depend on sustained high commodity prices and long-term production commitments, making market participants sensitive to price volatility and economic uncertainty.

Technical challenges associated with extreme water depths, harsh environmental conditions, and complex geological formations increase operational risks and costs. Equipment reliability and maintenance requirements in remote offshore locations create logistical challenges that impact project schedules and operational efficiency across the region.

Environmental regulations and sustainability requirements impose additional compliance costs and operational constraints on offshore activities. Permitting processes can be lengthy and complex, particularly for ultra deep-water projects requiring comprehensive environmental impact assessments and stakeholder consultation procedures.

Workforce limitations and specialized skill requirements create bottlenecks in project execution and operational capacity. Infrastructure constraints in some regions limit support capabilities and increase logistical costs for deep water operations, particularly in emerging offshore markets beyond Brazil’s established production areas.

Substantial opportunities exist for growth and expansion in South America’s deep water and ultra deep-water exploration & production market, driven by untapped resources, technological innovations, and emerging market segments. Strategic opportunities span multiple areas including exploration expansion, technology deployment, and regional market development beyond established production centers.

Exploration expansion offers significant potential as vast areas of South America’s continental shelf remain underexplored, particularly in ultra deep-water formations and frontier basins. Argentina’s offshore potential represents a major opportunity, with recent discoveries indicating substantial hydrocarbon resources that could support large-scale development projects and production growth.

Technology integration creates opportunities for enhanced efficiency and reduced costs through digital transformation, artificial intelligence applications, and advanced automation systems. Subsea processing technologies enable development of remote fields and tie-back opportunities that expand production capacity while optimizing infrastructure investments.

Regional expansion beyond Brazil’s established operations presents opportunities in Colombia, Venezuela, Peru, and other coastal nations developing offshore capabilities. Infrastructure sharing and regional cooperation initiatives could reduce development costs and accelerate market growth across multiple jurisdictions.

Environmental technology development creates opportunities for carbon capture and storage applications, renewable energy integration, and enhanced environmental performance. Decommissioning services represent an emerging opportunity as older fields reach end-of-life, requiring specialized expertise and technology solutions for safe and environmentally responsible facility removal.

Complex market dynamics shape the South America deep water and ultra deep-water exploration & production landscape, influenced by technological evolution, regulatory changes, and global energy market conditions. Dynamic interactions between supply and demand factors, investment flows, and operational capabilities create a constantly evolving market environment requiring adaptive strategies from industry participants.

Supply-side dynamics are driven by production capacity expansion, new field developments, and enhanced recovery from existing assets. Brazil’s production growth continues leading regional supply increases, with pre-salt fields demonstrating exceptional productivity and reserve replacement rates that support sustained output expansion over the long term.

Demand dynamics reflect regional energy consumption patterns, export opportunities, and global market integration. Growing domestic demand in major South American economies creates strong fundamentals for continued offshore development, while export capabilities enable market participants to optimize revenue through global commodity markets.

Investment dynamics respond to commodity price cycles, project economics, and risk-return profiles of deep water opportunities. Capital allocation decisions increasingly favor projects with competitive breakeven costs, established infrastructure access, and proven geological potential that minimize development risks and maximize returns.

Competitive dynamics evolve as new entrants seek market access while established operators optimize their portfolios. Strategic partnerships and joint ventures enable risk sharing and capability combination, creating more resilient project structures and enhanced operational efficiency across challenging offshore environments.

Comprehensive research methodology underpins analysis of South America’s deep water and ultra deep-water exploration & production market, incorporating multiple data sources, analytical techniques, and validation procedures. Research approach combines quantitative analysis with qualitative insights to provide accurate market assessment and strategic recommendations for industry stakeholders.

Primary research involves extensive interviews with industry executives, technical experts, and government officials across major South American markets. Data collection encompasses operational statistics, investment trends, regulatory developments, and technological advancement indicators from leading market participants and industry organizations.

Secondary research utilizes published industry reports, government databases, company financial statements, and technical publications to validate primary findings and ensure comprehensive market coverage. Information sources include national oil companies, international operators, service providers, and regulatory agencies across the region.

Analytical methodology employs statistical modeling, trend analysis, and comparative assessment techniques to identify market patterns and growth drivers. Market segmentation analysis examines different operational categories, geographical regions, and technology applications to provide detailed insights into market structure and dynamics.

Validation procedures include cross-referencing multiple data sources, expert review processes, and sensitivity analysis to ensure accuracy and reliability. Quality assurance measures maintain consistency with established industry standards and analytical best practices throughout the research process.

Regional market analysis reveals significant variations in deep water and ultra deep-water exploration & production activities across South America, with distinct characteristics, opportunities, and challenges in different national markets. Brazil dominates regional activity, while other nations demonstrate varying levels of offshore development and market maturity.

Brazil represents approximately 85% of regional deep water production, driven by extensive pre-salt developments and established offshore infrastructure. Petrobras leads Brazilian operations in partnership with international majors, demonstrating world-class technical capabilities and operational efficiency in challenging ultra deep-water environments. Santos Basin and other prolific offshore areas continue attracting substantial investment and exploration activity.

Argentina’s offshore market shows emerging potential with recent discoveries in the Austral Basin and growing interest from international operators. Vaca Muerta offshore extensions and conventional deep water prospects offer significant opportunities for future development, supported by government initiatives to attract foreign investment and technology transfer.

Colombia’s Caribbean and Pacific offshore areas demonstrate moderate activity levels with established production from shallow water fields and growing exploration interest in deeper formations. Regulatory improvements and infrastructure development support expanded offshore operations and international operator participation in future licensing rounds.

Other regional markets including Venezuela, Peru, Ecuador, and Uruguay show varying levels of offshore potential and development activity. Market development in these areas depends on regulatory stability, infrastructure investment, and successful exploration results that demonstrate commercial viability for deep water projects.

The competitive landscape in South America’s deep water and ultra deep-water exploration & production market features a mix of national oil companies, international majors, and specialized service providers. Market leadership is established through operational excellence, technological capabilities, and strategic asset portfolios that enable sustained competitive advantage.

Competitive strategies focus on technological differentiation, operational efficiency, and strategic partnerships that optimize resource development and risk management. Market positioning depends on technical capabilities, financial strength, and local market knowledge that enable successful project execution in challenging offshore environments.

Market segmentation analysis reveals distinct categories within South America’s deep water and ultra deep-water exploration & production market, each characterized by specific operational requirements, technology applications, and economic drivers. Segmentation approach encompasses water depth classifications, operational phases, and geographical distributions that define market structure.

By Water Depth:

By Operational Phase:

By Technology Application:

Category-specific analysis provides detailed insights into different segments of South America’s deep water and ultra deep-water exploration & production market, revealing unique characteristics, growth drivers, and strategic considerations for each operational category.

Exploration Category: Seismic acquisition and exploratory drilling activities demonstrate robust growth as operators expand their search for new hydrocarbon discoveries. Advanced seismic technologies including 4D monitoring and high-resolution imaging enable more accurate prospect identification and reduced exploration risks. Success rates in deep water exploration show improvement through better geological understanding and enhanced drilling techniques.

Development Category: Field development projects require substantial capital investments in subsea infrastructure, floating production systems, and pipeline connections. Project execution benefits from standardized equipment designs and modular construction approaches that reduce costs and accelerate deployment schedules. Development strategies increasingly emphasize phased approaches and tie-back opportunities that optimize infrastructure utilization.

Production Category: Ongoing production operations focus on maximizing asset productivity through enhanced recovery techniques, artificial lift systems, and digital optimization technologies. Operational efficiency improvements through predictive maintenance, remote monitoring, and automated systems reduce costs and improve safety performance. Production optimization strategies extend field life cycles and maximize ultimate recovery from deep water assets.

Service Category: Specialized service providers support all phases of deep water operations through drilling services, subsea installation, maintenance activities, and logistics support. Service innovation drives efficiency improvements and cost reductions across the value chain, enabling more competitive project economics and expanded market opportunities.

Industry participants and stakeholders realize substantial benefits from South America’s deep water and ultra deep-water exploration & production market through multiple value creation mechanisms and strategic advantages. Benefit realization spans operational efficiency gains, technology advancement opportunities, and long-term asset value creation across the offshore energy value chain.

For Oil Companies: Deep water assets provide access to large, high-quality hydrocarbon reserves with competitive production costs and long-term cash flow generation potential. Portfolio diversification through offshore investments reduces geographical concentration risks while accessing some of the world’s most prolific petroleum provinces. Technology leadership in deep water operations creates competitive advantages and operational excellence capabilities applicable across global markets.

For Service Providers: Market expansion opportunities enable revenue growth through specialized equipment, technical services, and operational support capabilities. Technology innovation drives differentiation and premium pricing for advanced solutions that improve efficiency and reduce operational risks. Long-term contracts provide stable revenue streams and predictable business development opportunities.

For Governments: Offshore development generates substantial tax revenues, royalty payments, and economic activity supporting national development objectives. Energy security benefits include reduced import dependence and enhanced domestic production capacity. Technology transfer and local content requirements support industrial development and workforce capability building.

For Local Communities: Employment opportunities in offshore operations, support services, and related industries provide economic development benefits. Infrastructure development including ports, supply bases, and training facilities creates lasting economic assets and capabilities.

Comprehensive SWOT analysis evaluates the strategic position of South America’s deep water and ultra deep-water exploration & production market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shape the evolution of South America’s deep water and ultra deep-water exploration & production market, reflecting technological advancement, operational innovation, and strategic adaptation to changing industry conditions. Trend analysis reveals important developments that influence market growth and competitive positioning.

Digital Transformation: Advanced analytics, artificial intelligence, and machine learning applications optimize drilling operations, production management, and predictive maintenance activities. Digital twin technology enables virtual modeling and simulation of complex offshore systems, improving decision-making and operational efficiency. Remote monitoring and automated systems reduce personnel requirements and enhance safety performance in challenging environments.

Subsea Processing: Subsea separation and processing technologies enable development of remote fields and marginal discoveries that were previously uneconomic. Subsea boosting and compression systems extend production life and improve recovery rates from existing fields. All-electric subsea systems reduce maintenance requirements and improve reliability in deep water applications.

Environmental Focus: Carbon reduction initiatives drive adoption of cleaner technologies and operational practices throughout the offshore value chain. Circular economy principles influence equipment design, waste management, and decommissioning strategies. Biodiversity protection measures integrate environmental considerations into all phases of offshore operations.

Standardization: Equipment standardization reduces costs and improves interoperability across different projects and operators. Modular designs enable faster deployment and reduced fabrication costs for subsea systems and floating production units. Industry collaboration on standards development accelerates technology adoption and market growth.

Recent industry developments demonstrate the dynamic nature of South America’s deep water and ultra deep-water exploration & production market, with significant advances in technology, project execution, and market expansion. Development tracking reveals important milestones and strategic initiatives shaping market evolution.

Major Project Developments: Brazil’s pre-salt expansion continues with new field developments and production capacity additions reaching record levels. Petrobras achievements in ultra deep-water production demonstrate world-class operational capabilities and technology innovation. International partnerships accelerate development timelines and optimize resource allocation across multiple projects.

Technology Breakthroughs: Enhanced drilling systems achieve new depth records and improve operational efficiency in challenging geological formations. Subsea processing innovations enable economic development of previously marginal discoveries and remote field locations. Floating production advances increase capacity and reduce costs through improved design and construction techniques.

Regulatory Evolution: Government policy updates streamline permitting processes and enhance investment attractiveness across the region. Environmental standards evolution drives technology innovation and operational best practices. Local content requirements support industrial development and technology transfer initiatives.

Market Expansion: Argentina’s offshore licensing rounds attract international interest and investment commitments. Colombia’s regulatory improvements enhance market access and operational frameworks. Regional cooperation initiatives facilitate knowledge sharing and infrastructure development across national boundaries.

Strategic recommendations from MarkWide Research analysis provide actionable insights for industry participants seeking to optimize their position in South America’s deep water and ultra deep-water exploration & production market. Analyst guidance addresses key success factors, risk mitigation strategies, and growth opportunities across different market segments.

Investment Strategy: Focus on high-quality assets with established infrastructure access and proven geological potential to minimize development risks and maximize returns. Portfolio diversification across different water depths, operational phases, and geographical areas reduces concentration risks and enhances long-term value creation. Technology investment in digital capabilities and advanced subsea systems creates competitive advantages and operational efficiency gains.

Operational Excellence: Standardization initiatives reduce costs and improve project execution efficiency through common equipment designs and operational procedures. Partnership strategies enable risk sharing, capability combination, and access to specialized expertise and resources. Workforce development programs ensure adequate skilled personnel availability and technology transfer capabilities.

Risk Management: Comprehensive risk assessment procedures address technical, environmental, and commercial risks throughout project life cycles. Contingency planning for equipment failures, weather delays, and market volatility ensures project resilience and financial performance. Insurance strategies and financial hedging protect against operational and commodity price risks.

Market Positioning: Early entry strategies in emerging markets provide competitive advantages and preferred access to high-quality opportunities. Technology leadership positions enable premium pricing and preferred partner status with major operators. Sustainability focus addresses growing environmental requirements and stakeholder expectations.

Future market prospects for South America’s deep water and ultra deep-water exploration & production market remain highly favorable, supported by substantial resource potential, technological advancement, and growing regional energy demand. Long-term outlook indicates sustained growth opportunities despite global energy transition trends and evolving market conditions.

Production growth projections indicate continued expansion driven by new field developments, enhanced recovery from existing assets, and technology-enabled access to previously uneconomic resources. Brazil’s pre-salt production is expected to reach new record levels, while emerging markets in Argentina and other nations contribute additional growth capacity over the forecast period.

Technology evolution will continue driving operational efficiency improvements and cost reductions through digital transformation, automation, and advanced subsea processing capabilities. Innovation focus on environmental performance and carbon reduction will create new market opportunities while addressing sustainability requirements and regulatory expectations.

Investment outlook remains positive as project economics improve through technology advancement and operational optimization. Capital allocation is expected to favor high-return deep water projects with competitive breakeven costs and established infrastructure access. Market expansion into frontier areas will accelerate as exploration success demonstrates commercial viability and attracts additional investment.

Regional integration initiatives may enhance market efficiency through infrastructure sharing, regulatory harmonization, and technology transfer programs. Energy security priorities will continue supporting domestic production growth and offshore development across multiple South American nations, creating sustained demand for deep water exploration and production capabilities.

South America’s deep water and ultra deep-water exploration & production market represents one of the world’s most dynamic and promising offshore energy sectors, characterized by substantial resource potential, technological innovation, and strong growth fundamentals. Market leadership by Brazil’s pre-salt developments demonstrates the region’s world-class capabilities and competitive advantages in challenging offshore environments.

Strategic market drivers including favorable geology, supportive regulatory frameworks, and continued technology advancement create sustainable competitive advantages for regional operators and international investors. Growth opportunities extend beyond established production areas to emerging markets in Argentina, Colombia, and other nations developing their offshore capabilities and attracting international expertise.

Industry transformation through digital technologies, environmental innovation, and operational excellence initiatives positions the market for continued expansion despite global energy transition trends. Long-term prospects remain highly favorable as the region’s deep water and ultra deep-water resources provide essential energy supplies while supporting economic development and technological advancement across South America.

What is Deep Water and Ultra Deep-Water Exploration & Production?

Deep Water and Ultra Deep-Water Exploration & Production refers to the processes and technologies used to extract oil and gas from underwater reserves located at significant depths. This includes drilling, subsea engineering, and the use of specialized vessels and equipment to operate in challenging marine environments.

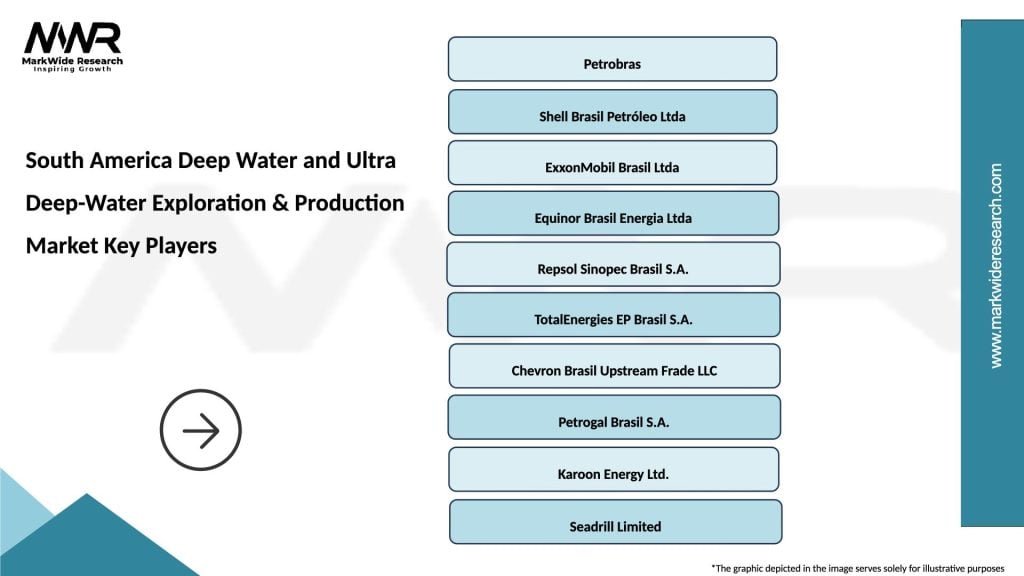

What are the key players in the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

Key players in the South America Deep Water and Ultra Deep-Water Exploration & Production Market include Petrobras, TotalEnergies, and Equinor, among others. These companies are involved in various stages of exploration, production, and technological innovation in deep water projects.

What are the main drivers of the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

The main drivers of the South America Deep Water and Ultra Deep-Water Exploration & Production Market include the increasing demand for energy, advancements in drilling technologies, and the discovery of new oil and gas reserves in deep water regions. Additionally, geopolitical factors and investment in infrastructure also play significant roles.

What challenges does the South America Deep Water and Ultra Deep-Water Exploration & Production Market face?

The South America Deep Water and Ultra Deep-Water Exploration & Production Market faces challenges such as high operational costs, environmental concerns, and regulatory hurdles. Additionally, technical difficulties associated with deep water drilling can impede project timelines and profitability.

What opportunities exist in the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

Opportunities in the South America Deep Water and Ultra Deep-Water Exploration & Production Market include the potential for new discoveries, partnerships with technology providers, and the development of sustainable practices. The shift towards cleaner energy sources also opens avenues for innovation in extraction methods.

What trends are shaping the South America Deep Water and Ultra Deep-Water Exploration & Production Market?

Trends shaping the South America Deep Water and Ultra Deep-Water Exploration & Production Market include the increasing use of digital technologies for monitoring and operations, a focus on reducing carbon emissions, and the integration of renewable energy sources into offshore operations. These trends are driving efficiency and sustainability in the sector.

South America Deep Water and Ultra Deep-Water Exploration & Production Market

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Development, Decommissioning |

| Technology | Subsea Systems, ROVs, Floating Platforms, Drilling Equipment |

| End User | Oil & Gas Companies, Government Agencies, Contractors, Service Providers |

| Application | Hydrocarbon Extraction, Environmental Monitoring, Seismic Surveys, Infrastructure Development |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Deep Water and Ultra Deep-Water Exploration & Production Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at