444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America data center power market represents a rapidly evolving landscape driven by increasing digitalization, cloud adoption, and expanding internet infrastructure across the region. This dynamic market encompasses power distribution units, uninterruptible power supply systems, generators, and energy management solutions specifically designed for data center operations. Regional growth has accelerated significantly as enterprises migrate to digital platforms and governments invest in smart city initiatives.

Market expansion is particularly pronounced in countries like Brazil, Argentina, Chile, and Colombia, where telecommunications infrastructure development and foreign investment in technology sectors are creating substantial demand for reliable data center power solutions. The market is experiencing a compound annual growth rate of 8.2%, reflecting the region’s commitment to digital transformation and modernization of IT infrastructure.

Key market characteristics include increasing adoption of renewable energy sources, growing emphasis on energy efficiency, and rising demand for modular power solutions that can scale with business requirements. The integration of artificial intelligence and Internet of Things technologies is further driving the need for sophisticated power management systems that ensure optimal performance and minimal downtime.

The South America data center power market refers to the comprehensive ecosystem of electrical infrastructure, power management systems, and energy solutions specifically designed to support data center operations across South American countries. This market encompasses all power-related components essential for maintaining continuous, reliable operation of data processing facilities, including primary power distribution, backup power systems, cooling infrastructure power, and intelligent monitoring solutions.

Data center power systems in this context include uninterruptible power supplies (UPS), power distribution units (PDUs), emergency generators, battery backup systems, and advanced power monitoring software. These solutions ensure that critical IT equipment receives clean, consistent electrical power while providing redundancy and failover capabilities to prevent service interruptions that could result in significant business losses.

Strategic market positioning reveals that South America’s data center power market is experiencing unprecedented growth driven by digital transformation initiatives, increasing cloud service adoption, and expanding e-commerce activities. The market demonstrates strong fundamentals with Brazil accounting for approximately 45% of regional demand, followed by significant contributions from Argentina, Chile, and Colombia.

Technology advancement is reshaping market dynamics as organizations prioritize energy efficiency, sustainability, and intelligent power management capabilities. The adoption of lithium-ion battery systems has increased by 35% over the past two years, reflecting the industry’s shift toward more efficient and environmentally friendly power storage solutions.

Investment trends indicate substantial capital allocation toward modernizing existing facilities and constructing new data centers to meet growing demand for digital services. Hyperscale data center developments are particularly driving demand for high-capacity power solutions, while edge computing requirements are creating opportunities for distributed power architectures.

Market intelligence reveals several critical insights shaping the South American data center power landscape:

Digital transformation initiatives across South American enterprises are creating unprecedented demand for robust data center infrastructure. Organizations are investing heavily in modernizing their IT capabilities to remain competitive in an increasingly digital economy, driving substantial growth in power infrastructure requirements.

Cloud service adoption continues accelerating as businesses recognize the benefits of scalable, flexible computing resources. This trend is particularly strong in the financial services, healthcare, and retail sectors, where organizations require reliable power systems to support mission-critical applications and ensure business continuity.

Government digitalization programs are significantly contributing to market expansion as public sector organizations modernize their technology infrastructure. Smart city initiatives, digital government services, and e-governance platforms require sophisticated data center facilities with advanced power management capabilities.

E-commerce growth throughout the region is creating substantial demand for data processing capabilities, driving investment in both large-scale and distributed data center facilities. The surge in online retail activity requires robust backend infrastructure supported by reliable power systems.

Economic volatility in several South American countries creates challenges for long-term infrastructure investment planning. Currency fluctuations, inflation concerns, and political uncertainty can impact capital allocation decisions and delay data center development projects.

Skilled workforce limitations present ongoing challenges for market growth as the specialized nature of data center power systems requires experienced technicians and engineers. The shortage of qualified personnel can impact project timelines and operational efficiency.

Grid infrastructure limitations in certain regions constrain data center development and require significant investment in power conditioning and backup systems. Unreliable utility power in some areas necessitates more robust and expensive power infrastructure solutions.

High initial capital requirements for advanced power systems can be prohibitive for smaller organizations, potentially limiting market penetration in the small and medium enterprise segment. The complexity and cost of implementing enterprise-grade power solutions may delay adoption among cost-sensitive customers.

Renewable energy integration presents significant opportunities for innovative power solutions that combine traditional backup systems with sustainable energy sources. Solar and wind power integration capabilities are becoming increasingly important differentiators in the market.

Edge computing expansion creates substantial opportunities for distributed power architectures and smaller-scale power solutions. As organizations deploy computing resources closer to end users, demand for efficient, compact power systems is growing rapidly.

Artificial intelligence integration in power management systems offers opportunities for advanced monitoring, predictive maintenance, and optimization capabilities. AI-powered solutions can significantly improve system efficiency and reduce operational costs.

Modular data center growth is driving demand for prefabricated power solutions that can be rapidly deployed and easily scaled. This trend offers opportunities for manufacturers to develop standardized, cost-effective power modules.

Competitive dynamics in the South American data center power market are intensifying as both international and regional players compete for market share. MarkWide Research analysis indicates that market consolidation is occurring as larger companies acquire specialized regional providers to expand their geographic presence and technical capabilities.

Technology evolution is reshaping market dynamics with the introduction of more efficient power conversion technologies, advanced battery chemistries, and intelligent monitoring systems. Organizations are increasingly prioritizing solutions that offer energy efficiency improvements of 15-20% compared to traditional systems.

Customer expectations are evolving toward comprehensive power management solutions that integrate seamlessly with existing infrastructure while providing advanced monitoring and control capabilities. The demand for turnkey solutions that combine hardware, software, and services is growing significantly.

Regulatory influences are becoming more prominent as governments implement energy efficiency standards and environmental regulations that impact data center operations. Compliance requirements are driving adoption of more sophisticated power management and monitoring systems.

Primary research methodology employed comprehensive interviews with industry stakeholders including data center operators, power system manufacturers, technology integrators, and end-user organizations across major South American markets. This approach provided direct insights into market trends, challenges, and opportunities from multiple perspectives.

Secondary research analysis incorporated extensive review of industry publications, government reports, regulatory documents, and company financial statements to establish market context and validate primary research findings. This methodology ensured comprehensive coverage of market dynamics and competitive landscape factors.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to ensure accuracy and reliability of market insights. Quantitative data was verified through multiple independent sources to maintain research integrity.

Market modeling techniques utilized advanced analytical frameworks to project market trends, assess competitive positioning, and evaluate growth opportunities. The methodology incorporated both bottom-up and top-down approaches to provide comprehensive market perspective.

Brazil dominates the South American data center power market with approximately 45% market share, driven by its large economy, advanced telecommunications infrastructure, and significant foreign investment in technology sectors. The country’s major metropolitan areas, particularly São Paulo and Rio de Janeiro, concentrate the majority of data center development activity.

Argentina represents the second-largest market with 22% regional share, benefiting from government digitalization initiatives and growing cloud service adoption among enterprises. Buenos Aires serves as the primary hub for data center activity, with expanding development in secondary markets.

Chile accounts for approximately 18% of the regional market, distinguished by its stable political environment, reliable power grid, and strategic location for serving both Pacific and Atlantic markets. The country’s commitment to renewable energy makes it attractive for sustainable data center development.

Colombia captures roughly 10% of market share, with growth driven by expanding telecommunications infrastructure and increasing digital service adoption. The government’s digital transformation agenda is creating substantial opportunities for data center power solutions.

Other markets including Peru, Ecuador, and Uruguay collectively represent the remaining 5% market share, with emerging opportunities driven by improving economic conditions and increasing technology adoption rates.

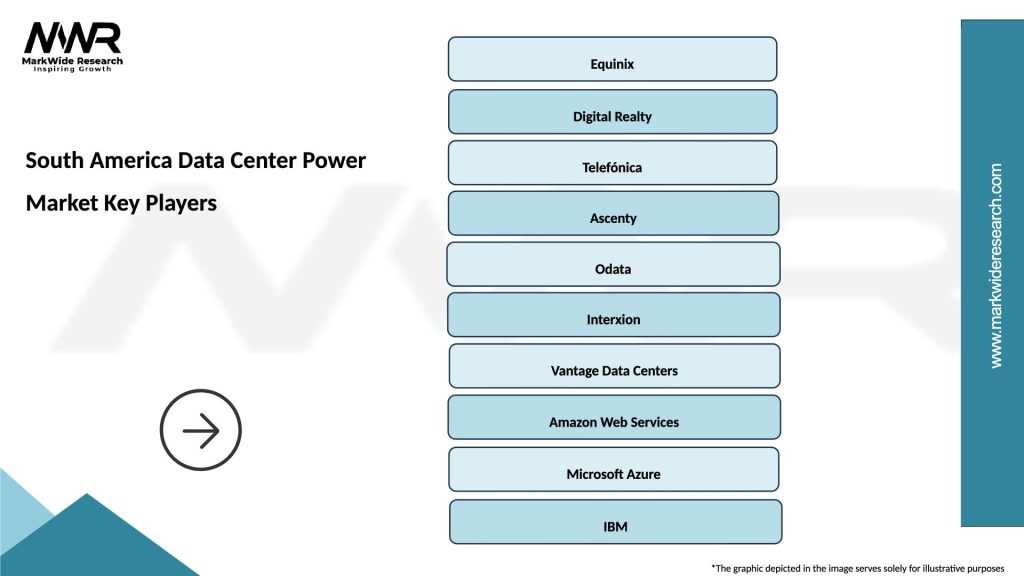

Market leadership is distributed among several key players offering comprehensive power solutions for data center applications:

Competitive strategies focus on technological innovation, regional partnership development, and comprehensive service offerings that address the complete data center power ecosystem. Companies are investing heavily in research and development to create more efficient, sustainable, and intelligent power solutions.

By Solution Type:

By Data Center Type:

By Power Rating:

UPS Systems Category represents the largest market segment, driven by critical requirements for uninterrupted power supply in data center operations. Modern UPS systems incorporate advanced battery technologies, improved efficiency ratings, and intelligent monitoring capabilities that enable predictive maintenance and optimal performance.

Power Distribution Units are experiencing significant innovation with intelligent PDUs gaining market share due to their advanced monitoring and control capabilities. These solutions provide real-time power consumption data, remote management capabilities, and integration with data center infrastructure management systems.

Generator Systems remain essential for long-term backup power requirements, with diesel generators maintaining dominance while natural gas and hybrid renewable solutions gain traction. The trend toward more environmentally friendly generator technologies is driving innovation in this category.

Power Monitoring Software is emerging as a critical category as organizations seek to optimize energy consumption, reduce operational costs, and ensure compliance with efficiency standards. AI-powered analytics and predictive maintenance capabilities are key differentiators in this segment.

Data Center Operators benefit from improved operational efficiency, reduced energy costs, and enhanced system reliability through advanced power management solutions. Modern power systems provide comprehensive monitoring capabilities that enable proactive maintenance and optimization strategies.

Enterprise Customers gain access to more reliable, scalable, and cost-effective data center services supported by robust power infrastructure. Advanced power systems ensure business continuity and support digital transformation initiatives with minimal risk of service interruptions.

Technology Vendors can differentiate their offerings through innovative power solutions that address evolving customer requirements for efficiency, sustainability, and intelligent management capabilities. The growing market provides substantial opportunities for revenue growth and market expansion.

Government Stakeholders benefit from improved digital infrastructure that supports economic development, smart city initiatives, and digital government services. Reliable data center power infrastructure enables the delivery of critical public services and supports national competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus is becoming a dominant trend as organizations prioritize environmental responsibility and energy efficiency in their data center operations. The integration of renewable energy sources and implementation of green building standards are driving demand for innovative power solutions.

Edge Computing Expansion is creating new requirements for distributed power architectures that can support smaller-scale data centers located closer to end users. This trend is driving innovation in compact, efficient power solutions designed for edge deployment scenarios.

Artificial Intelligence Integration in power management systems is enabling predictive maintenance, automated optimization, and intelligent load balancing capabilities. AI-powered solutions can reduce operational costs by 12-18% while improving system reliability and performance.

Modular Design Adoption is gaining momentum as organizations seek flexible, scalable power solutions that can adapt to changing requirements. Prefabricated power modules reduce deployment time and enable rapid capacity expansion as business needs evolve.

Hybrid Power Systems combining traditional backup power with renewable energy sources are becoming increasingly popular as organizations seek to reduce operational costs and environmental impact while maintaining reliability standards.

Strategic partnerships between international power system manufacturers and regional system integrators are expanding market reach and improving local service capabilities. These collaborations enable global companies to leverage local expertise while providing regional partners access to advanced technologies.

Technology acquisitions are reshaping the competitive landscape as companies seek to expand their solution portfolios and geographic presence. Recent acquisitions have focused on software capabilities, renewable energy integration, and edge computing solutions.

Product innovations continue advancing power system efficiency, reliability, and intelligence. Recent developments include next-generation lithium-ion battery systems, AI-powered monitoring platforms, and modular power distribution architectures designed for rapid deployment.

Market expansion initiatives by major players include establishing local manufacturing facilities, expanding service networks, and developing region-specific solutions that address unique market requirements and regulatory standards.

Investment prioritization should focus on solutions that combine reliability, efficiency, and sustainability to address evolving customer requirements. MWR analysis suggests that companies investing in AI-powered management capabilities and renewable energy integration will achieve competitive advantages in the growing market.

Geographic expansion strategies should prioritize markets with stable political environments, reliable infrastructure, and growing technology adoption rates. Brazil, Chile, and Colombia represent the most attractive opportunities for near-term market entry and expansion.

Technology development should emphasize modular, scalable solutions that can address diverse customer requirements from small edge deployments to large hyperscale facilities. Flexibility and adaptability will be key differentiators in the evolving market landscape.

Partnership strategies should focus on developing strong relationships with local system integrators, service providers, and technology partners to ensure effective market penetration and customer support capabilities throughout the region.

Market trajectory indicates continued strong growth driven by accelerating digital transformation, expanding cloud adoption, and increasing government investment in digital infrastructure. The market is projected to maintain robust growth rates exceeding 8% annually through the next five years.

Technology evolution will continue advancing power system efficiency, intelligence, and sustainability. Next-generation solutions will incorporate advanced AI capabilities, improved energy storage technologies, and seamless integration with renewable energy sources.

Regional development patterns suggest that secondary markets will experience accelerated growth as digital infrastructure expands beyond major metropolitan areas. Edge computing requirements will drive distributed power solution deployment across diverse geographic locations.

Industry consolidation is expected to continue as companies seek to achieve scale advantages and expand their solution portfolios. Strategic acquisitions and partnerships will reshape the competitive landscape while driving innovation and market development.

The South America data center power market represents a dynamic and rapidly expanding opportunity driven by digital transformation, cloud adoption, and infrastructure modernization across the region. With strong growth fundamentals and increasing investment in technology infrastructure, the market offers substantial opportunities for both established players and new entrants.

Key success factors include developing comprehensive solutions that address reliability, efficiency, and sustainability requirements while providing the flexibility to scale with evolving business needs. Companies that can effectively combine advanced technology with local market expertise and strong service capabilities will be best positioned to capitalize on the growing market opportunity.

Strategic priorities for market participants should focus on innovation, partnership development, and geographic expansion to capture the significant growth potential across South American markets. The integration of AI, renewable energy, and edge computing capabilities will be critical for long-term competitive success in this evolving market landscape.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, which house computer systems and associated components. This includes power distribution, backup systems, and energy efficiency measures.

What are the key players in the South America Data Center Power Market?

Key players in the South America Data Center Power Market include companies like Schneider Electric, Vertiv, and Eaton, which provide power management solutions and infrastructure for data centers, among others.

What are the main drivers of the South America Data Center Power Market?

The main drivers of the South America Data Center Power Market include the increasing demand for cloud computing services, the growth of big data analytics, and the rising need for energy-efficient power solutions in data centers.

What challenges does the South America Data Center Power Market face?

Challenges in the South America Data Center Power Market include high energy costs, regulatory compliance issues, and the need for advanced infrastructure to support growing data demands.

What opportunities exist in the South America Data Center Power Market?

Opportunities in the South America Data Center Power Market include the expansion of renewable energy sources, advancements in energy storage technologies, and the increasing adoption of green data center practices.

What trends are shaping the South America Data Center Power Market?

Trends shaping the South America Data Center Power Market include the shift towards modular data center designs, the integration of artificial intelligence for power management, and the focus on sustainability and energy efficiency in data center operations.

South America Data Center Power Market

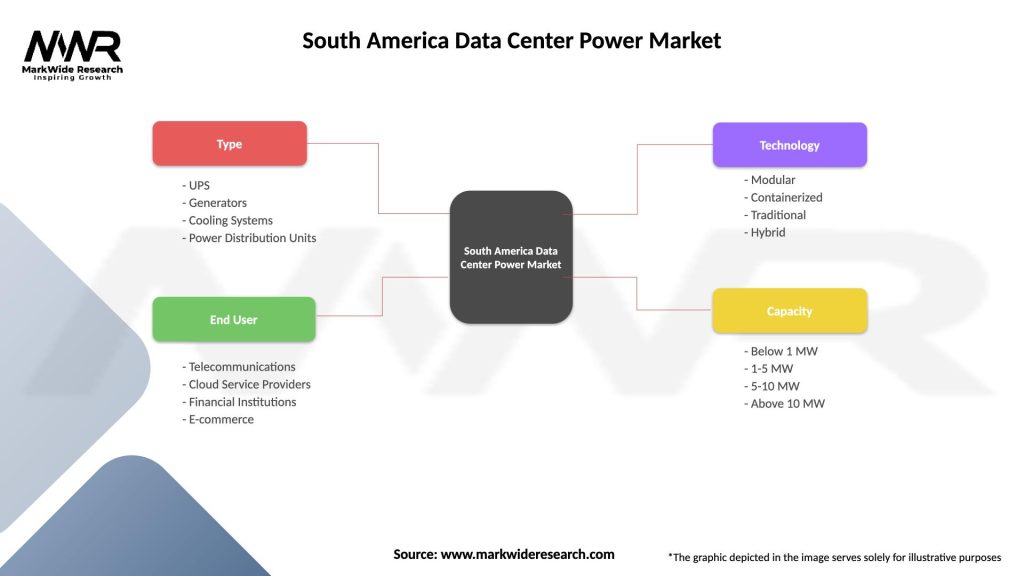

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Cooling Systems, Power Distribution Units |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, E-commerce |

| Technology | Modular, Containerized, Traditional, Hybrid |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at