444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America compressed natural gas and liquified natural gas vehicles market represents a rapidly evolving sector within the region’s transportation ecosystem. This market encompasses vehicles powered by both compressed natural gas (CNG) and liquified natural gas (LNG) technologies, serving diverse applications from public transportation to commercial freight operations. Market dynamics indicate substantial growth potential driven by environmental regulations, fuel cost advantages, and government incentives promoting cleaner transportation alternatives.

Regional adoption of natural gas vehicles varies significantly across South American countries, with Argentina, Brazil, and Colombia leading the transition. The market demonstrates robust expansion with growth rates exceeding 8.5% CAGR in key segments, particularly in urban bus fleets and commercial vehicle applications. Infrastructure development continues to accelerate, with refueling station networks expanding to support increased vehicle adoption.

Technology advancement in natural gas vehicle systems has enhanced performance characteristics, making these alternatives increasingly competitive with traditional diesel and gasoline vehicles. The market benefits from favorable economics, with natural gas fuel costs typically 30-40% lower than conventional fuels, creating compelling value propositions for fleet operators and individual consumers.

The South America compressed natural gas and liquified natural gas vehicles market refers to the comprehensive ecosystem of vehicles, infrastructure, and supporting services that utilize natural gas as a primary fuel source across South American countries. This market encompasses both CNG vehicles, which store natural gas at high pressure in gaseous form, and LNG vehicles, which utilize natural gas in its liquified state for extended range applications.

CNG technology involves compressing natural gas to approximately 200-250 bar pressure, making it suitable for light-duty vehicles, buses, and medium-duty commercial applications. LNG technology requires cooling natural gas to approximately -162°C, creating a dense liquid fuel ideal for heavy-duty trucks and long-haul transportation where extended range is critical.

Market scope includes vehicle manufacturing, conversion services, refueling infrastructure, maintenance services, and regulatory frameworks supporting natural gas vehicle adoption. The sector represents a strategic transition toward cleaner transportation alternatives while maintaining economic viability for operators across various vehicle categories and applications.

Strategic positioning of the South America natural gas vehicles market reflects strong momentum driven by environmental concerns, economic advantages, and supportive government policies. The market demonstrates accelerating adoption across multiple vehicle segments, with public transportation leading the transition followed by commercial freight applications.

Key growth drivers include stringent emission regulations, substantial fuel cost savings, and expanding refueling infrastructure networks. Argentina and Brazil maintain market leadership positions, collectively representing over 70% market share in regional natural gas vehicle adoption. Technology improvements continue enhancing vehicle performance, reliability, and operational efficiency.

Market challenges primarily involve infrastructure development costs, vehicle conversion expenses, and range limitations in certain applications. However, government incentives and private sector investments are addressing these barriers through targeted programs and infrastructure expansion initiatives.

Future prospects indicate sustained growth momentum with projected expansion rates of 9.2% CAGR through the forecast period. Innovation focus on advanced natural gas engine technologies, improved storage systems, and integrated digital solutions positions the market for continued evolution and broader adoption across South American transportation sectors.

Market penetration analysis reveals significant opportunities for natural gas vehicle expansion across South America’s diverse transportation landscape. Current adoption rates vary considerably by country and application, creating targeted growth opportunities for market participants.

Environmental regulations serve as primary catalysts driving natural gas vehicle adoption across South America. Government mandates for emission reductions in urban areas create compelling requirements for cleaner transportation alternatives, with natural gas vehicles offering immediate solutions for compliance.

Economic incentives provide substantial motivation for natural gas vehicle adoption. Fuel cost advantages typically range from 25-45% savings compared to conventional fuels, creating attractive return on investment scenarios for fleet operators. Government subsidies and tax incentives further enhance economic attractiveness through reduced acquisition costs and operational expenses.

Infrastructure development momentum accelerates market growth through expanded refueling accessibility. Public-private partnerships facilitate strategic refueling station placement, reducing range anxiety and supporting broader vehicle adoption. Technology improvements in refueling systems enhance convenience and operational efficiency.

Energy security considerations drive strategic interest in domestic natural gas resources. Regional production capabilities reduce dependence on imported petroleum products while supporting local economic development. Supply chain advantages create stable fuel pricing and availability for natural gas vehicle operators.

Infrastructure limitations present significant challenges for natural gas vehicle market expansion. Refueling station availability remains concentrated in major urban areas, limiting adoption in rural and remote regions. Capital requirements for infrastructure development create barriers for smaller operators and emerging markets.

Vehicle conversion costs represent substantial upfront investments for fleet operators. Retrofit expenses and specialized maintenance requirements can offset fuel savings in certain applications. Technology complexity requires specialized technician training and service capabilities.

Range limitations particularly affect CNG vehicles in long-haul applications. Storage capacity constraints reduce cargo space and operational flexibility compared to conventional fuel systems. Refueling frequency requirements impact operational efficiency in certain use cases.

Regulatory uncertainties create hesitation among potential adopters. Policy changes and evolving emission standards may affect long-term viability of natural gas vehicle investments. Standardization challenges across different countries complicate regional expansion strategies.

Public transportation modernization creates substantial opportunities for natural gas vehicle deployment. Urban bus fleet renewals provide ideal platforms for CNG adoption, with supportive government policies and centralized refueling capabilities. Bus rapid transit systems increasingly specify natural gas vehicles for environmental and economic benefits.

Commercial freight applications offer significant growth potential, particularly for medium and heavy-duty vehicles. Last-mile delivery services benefit from natural gas vehicles’ urban operation advantages and emission reduction capabilities. Regional freight corridors present opportunities for LNG vehicle deployment with strategic refueling infrastructure.

Mining and industrial applications represent emerging opportunities for specialized natural gas vehicles. Off-road equipment and industrial vehicles can benefit from natural gas power systems’ environmental and economic advantages. Port operations increasingly adopt natural gas vehicles for cargo handling and transportation activities.

Technology partnerships enable market expansion through collaborative development initiatives. International cooperation facilitates technology transfer and best practice sharing across South American countries. Innovation programs support advanced natural gas vehicle development and deployment strategies.

Supply chain evolution reflects increasing sophistication in natural gas vehicle ecosystem development. Manufacturing capabilities expand across the region, reducing import dependence and supporting local economic development. Component suppliers establish regional presence to serve growing market demand.

Competitive landscape intensifies as traditional automotive manufacturers integrate natural gas technologies into their product portfolios. Conversion specialists expand service capabilities to address diverse vehicle applications and customer requirements. Technology providers develop advanced solutions for improved performance and efficiency.

Market consolidation trends emerge as successful operators expand their geographic presence and service offerings. Strategic partnerships between vehicle manufacturers, fuel suppliers, and infrastructure developers create integrated solutions for customers. Investment flows increase from both domestic and international sources.

Regulatory harmonization efforts across South American countries facilitate regional market development. Technical standards alignment reduces complexity and costs for multi-country operations. Policy coordination enhances market predictability and investment confidence.

Comprehensive analysis of the South America natural gas vehicles market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes extensive interviews with industry stakeholders, government officials, and market participants across key South American countries.

Secondary research encompasses analysis of government publications, industry reports, and regulatory documents from relevant authorities. Market data collection focuses on vehicle registration statistics, infrastructure development projects, and policy implementation timelines. Statistical analysis validates trends and projections through multiple data sources.

Regional coverage includes detailed analysis of major South American markets including Argentina, Brazil, Colombia, Chile, and Peru. Segmentation analysis examines vehicle types, applications, and fuel technologies to provide comprehensive market understanding. Competitive intelligence evaluates key market participants and their strategic positioning.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review. Market modeling incorporates economic indicators, policy impacts, and technology trends to develop realistic growth projections. Quality assurance protocols maintain research integrity and reliability throughout the analysis process.

Argentina maintains the largest natural gas vehicle market in South America, with over 2.5 million vehicles currently in operation. Government support through subsidies and regulatory frameworks has created favorable conditions for market development. Infrastructure maturity provides extensive refueling networks supporting widespread adoption across vehicle categories.

Brazil represents the second-largest market with significant growth momentum in commercial vehicle applications. São Paulo and Rio de Janeiro lead urban adoption initiatives, particularly in public transportation fleets. Federal programs promote natural gas vehicle adoption through tax incentives and infrastructure development support.

Colombia demonstrates rapid market expansion with government initiatives targeting emission reductions in major cities. Bogotá’s bus rapid transit system increasingly incorporates natural gas vehicles. Natural gas production capabilities support domestic market development and fuel supply security.

Chile focuses on mining and industrial applications for natural gas vehicles, leveraging the country’s mining sector expertise. Santiago’s public transportation system explores natural gas alternatives for emission reduction. Port operations increasingly adopt natural gas vehicles for cargo handling activities.

Peru emerges as a growing market with Lima’s transportation initiatives driving initial adoption. Natural gas availability from domestic production supports market development potential. Government policies increasingly recognize natural gas vehicles as viable emission reduction solutions.

Market leadership reflects diverse participation from vehicle manufacturers, conversion specialists, and technology providers. Competition intensity increases as traditional automotive companies expand natural gas vehicle offerings alongside specialized market participants.

Strategic positioning varies among competitors, with some focusing on original equipment manufacturing while others emphasize conversion services and aftermarket support. Technology differentiation centers on engine efficiency, storage systems, and integrated vehicle solutions.

Vehicle type segmentation reveals distinct adoption patterns and growth opportunities across different categories. Market distribution reflects varying economic and operational considerations for each vehicle segment.

By Fuel Type:

By Vehicle Type:

By Application:

Light-duty vehicle category demonstrates mature adoption in Argentina with over 2 million vehicles currently operating on natural gas. Conversion market remains active with specialized service providers offering retrofit solutions for existing gasoline vehicles. OEM offerings expand as manufacturers recognize market demand and regulatory drivers.

Bus category shows strongest growth momentum across the region, with municipal fleets leading adoption initiatives. Bus rapid transit systems increasingly specify natural gas vehicles for environmental and operational benefits. Intercity bus operators explore natural gas alternatives for route efficiency and cost reduction.

Commercial vehicle category presents significant opportunities as businesses seek operational cost reductions. Last-mile delivery services particularly benefit from natural gas vehicles’ urban operation advantages. Fleet operators increasingly recognize total cost of ownership benefits despite higher initial investments.

Heavy-duty category emerges as a growth segment with LNG technology enabling long-haul applications. Mining operations explore natural gas vehicles for specialized equipment and transportation needs. Port operations adopt natural gas vehicles for cargo handling and environmental compliance.

Fleet operators realize substantial operational cost reductions through natural gas vehicle adoption. Fuel savings typically range from 30-45% compared to conventional fuels, creating attractive return on investment scenarios. Maintenance advantages include reduced engine wear and extended service intervals due to cleaner combustion characteristics.

Government entities achieve environmental objectives through natural gas vehicle promotion. Emission reductions support urban air quality improvement initiatives and climate change commitments. Energy security benefits reduce dependence on imported petroleum products while supporting domestic natural gas industries.

Vehicle manufacturers access growing market opportunities through natural gas technology integration. Product differentiation enables competitive positioning in environmentally conscious markets. Technology development creates intellectual property assets and manufacturing capabilities for regional and global markets.

Infrastructure developers benefit from expanding refueling station networks and service opportunities. Investment returns improve as vehicle adoption increases and utilization rates rise. Technology partnerships enable advanced refueling solutions and operational efficiency improvements.

Environmental stakeholders advance sustainability objectives through cleaner transportation alternatives. Emission reduction achievements contribute to air quality improvements and climate change mitigation efforts. Public health benefits result from reduced particulate matter and toxic emissions in urban areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration drives significant improvements in natural gas vehicle performance and efficiency. Advanced engine management systems optimize fuel consumption and emission characteristics. Digital connectivity enables fleet management optimization and predictive maintenance capabilities.

Infrastructure modernization focuses on fast-fill refueling capabilities and strategic station placement. Mobile refueling solutions address infrastructure gaps in underserved areas. Renewable natural gas integration enhances environmental benefits and sustainability credentials.

Market consolidation trends emerge as successful operators expand their geographic presence and service offerings. Vertical integration strategies combine vehicle manufacturing, fuel supply, and infrastructure development. Strategic partnerships create comprehensive solutions for large fleet customers.

Regulatory evolution toward stricter emission standards accelerates natural gas vehicle adoption. Carbon pricing mechanisms improve economic competitiveness of cleaner fuel alternatives. Public procurement policies increasingly favor natural gas vehicles for government fleet applications.

Customer sophistication increases as operators develop expertise in natural gas vehicle operations and maintenance. Total cost of ownership analysis becomes standard practice for fleet acquisition decisions. Performance monitoring systems enable continuous optimization of vehicle operations.

Manufacturing expansion initiatives establish local production capabilities across South America. Marcopolo’s natural gas bus production increases to meet growing demand from public transportation operators. International partnerships facilitate technology transfer and manufacturing expertise development.

Infrastructure investments accelerate refueling station deployment in key markets. Public-private partnerships fund strategic refueling corridor development connecting major cities. Technology upgrades improve refueling speed and operational efficiency at existing stations.

Policy developments create supportive frameworks for natural gas vehicle adoption. Colombia’s national natural gas vehicle program establishes targets and incentives for market growth. Regional cooperation initiatives promote harmonized standards and cross-border operations.

Technology breakthroughs enhance natural gas vehicle capabilities and market appeal. Advanced storage systems increase range and reduce weight penalties. Engine efficiency improvements deliver better performance and lower emissions.

Market entries by new participants intensify competition and innovation. International manufacturers establish South American operations to serve growing market demand. Technology startups develop innovative solutions for natural gas vehicle applications.

Strategic focus on infrastructure development remains critical for sustained market growth. MarkWide Research analysis indicates that refueling station availability directly correlates with vehicle adoption rates across South American markets. Investment priorities should emphasize strategic corridor development and urban area coverage.

Technology advancement initiatives should prioritize range extension and operational efficiency improvements. LNG vehicle development offers particular opportunities for heavy-duty and long-haul applications. Digital integration capabilities enhance fleet management and operational optimization potential.

Market expansion strategies should leverage successful models from mature markets like Argentina. Government engagement remains essential for policy support and regulatory framework development. Public-private partnerships provide effective mechanisms for infrastructure development and market acceleration.

Competitive positioning requires comprehensive solutions combining vehicles, infrastructure, and services. Customer education programs address knowledge gaps and operational concerns. Service network development ensures adequate maintenance and support capabilities for growing vehicle populations.

Regional coordination efforts should focus on standards harmonization and cross-border operations. Technology sharing initiatives accelerate market development across multiple countries. Investment attraction strategies should emphasize long-term growth potential and government support frameworks.

Market trajectory indicates sustained growth momentum with projected expansion rates of 9.2% CAGR through the forecast period. Public transportation sector continues driving adoption with major cities implementing comprehensive natural gas bus programs. Commercial vehicle applications expand as businesses recognize operational cost advantages and environmental benefits.

Technology evolution enhances natural gas vehicle competitiveness across multiple applications. Advanced engine technologies improve performance characteristics and fuel efficiency. Storage system innovations address range limitations while reducing weight and space penalties.

Infrastructure expansion accelerates with strategic refueling station deployment supporting broader vehicle adoption. MWR projections indicate refueling station networks will grow by 15% annually across key South American markets. Technology improvements in refueling systems enhance convenience and operational efficiency.

Regional integration efforts facilitate cross-border operations and market harmonization. Policy coordination creates consistent regulatory frameworks supporting regional market development. Investment flows increase from both domestic and international sources attracted by growth potential.

Competitive landscape evolution reflects increasing participation from traditional automotive manufacturers alongside specialized market participants. Innovation focus on integrated solutions combining vehicles, fuel supply, and digital services. Market maturation creates opportunities for consolidation and strategic partnerships.

The South America compressed natural gas and liquified natural gas vehicles market demonstrates compelling growth potential driven by environmental regulations, economic advantages, and supportive government policies. Market leadership by Argentina and Brazil provides proven models for regional expansion, while emerging markets offer significant opportunities for strategic development.

Technology advancement continues enhancing natural gas vehicle competitiveness across diverse applications, from urban buses to heavy-duty commercial vehicles. Infrastructure development momentum accelerates market accessibility and adoption rates, supported by public-private partnerships and strategic investments.

Future success depends on continued collaboration between government entities, private sector participants, and technology providers. Strategic focus on comprehensive solutions addressing vehicles, infrastructure, and services will drive sustainable market growth and broader adoption across South America’s transportation sector.

What is Compressed Natural Gas and Liquified Natural Gas Vehicles?

Compressed Natural Gas (CNG) and Liquified Natural Gas (LNG) vehicles are types of vehicles that utilize natural gas as a fuel source. These vehicles are designed to operate on compressed or liquefied forms of natural gas, which are considered cleaner alternatives to traditional gasoline and diesel fuels.

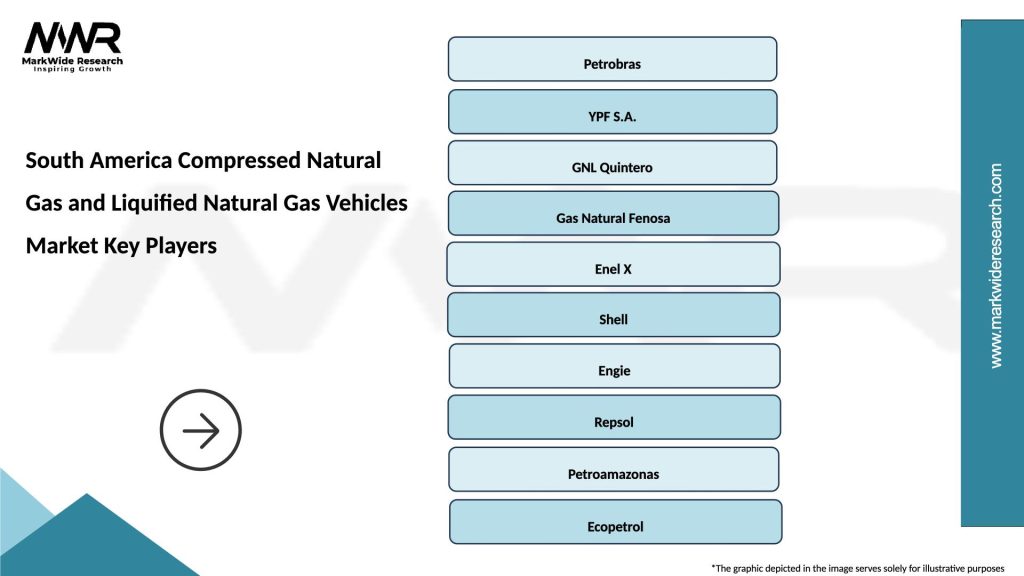

What are the key players in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market?

Key players in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market include companies like Scania, Volvo, and Iveco, which manufacture vehicles that run on natural gas. These companies are focusing on expanding their product lines to include more environmentally friendly options, among others.

What are the growth factors driving the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market?

The growth of the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market is driven by increasing environmental regulations, rising fuel prices, and the need for cleaner transportation solutions. Additionally, government incentives for adopting alternative fuel vehicles are also contributing to market growth.

What challenges does the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market face?

The South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market faces challenges such as limited refueling infrastructure and higher initial costs compared to conventional vehicles. Additionally, fluctuations in natural gas prices can impact the market’s stability.

What opportunities exist in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market?

Opportunities in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market include the potential for technological advancements in fuel efficiency and emissions reduction. There is also a growing interest in public transportation systems adopting CNG and LNG vehicles to reduce urban pollution.

What trends are shaping the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market?

Trends in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market include the increasing adoption of hybrid models that combine natural gas with electric power. Additionally, there is a rising focus on sustainability and reducing carbon footprints in the transportation sector.

South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market

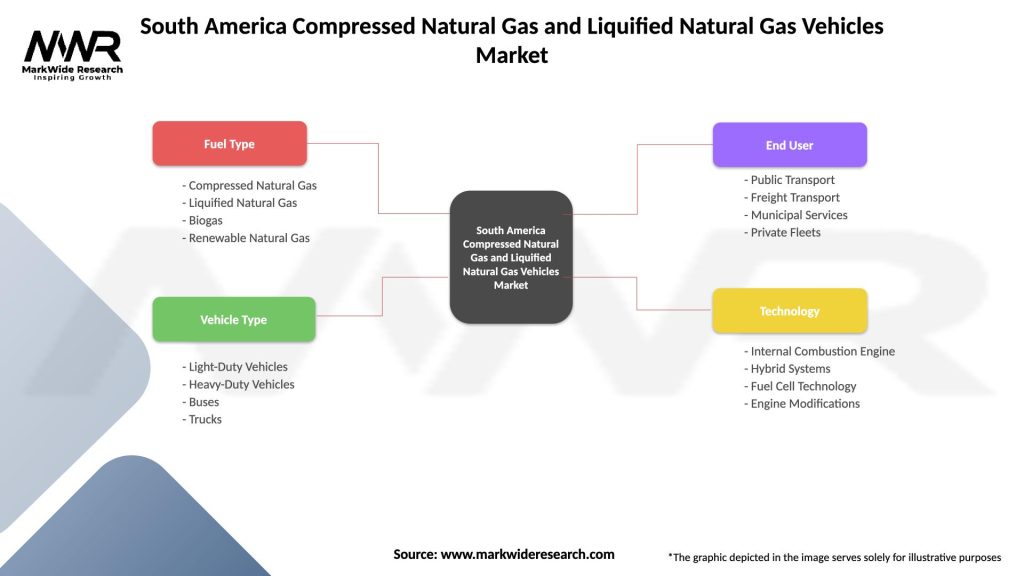

| Segmentation Details | Description |

|---|---|

| Fuel Type | Compressed Natural Gas, Liquified Natural Gas, Biogas, Renewable Natural Gas |

| Vehicle Type | Light-Duty Vehicles, Heavy-Duty Vehicles, Buses, Trucks |

| End User | Public Transport, Freight Transport, Municipal Services, Private Fleets |

| Technology | Internal Combustion Engine, Hybrid Systems, Fuel Cell Technology, Engine Modifications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Compressed Natural Gas and Liquified Natural Gas Vehicles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at