444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America brewing enzymes market represents a dynamic and rapidly evolving sector within the regional food and beverage industry. This specialized market encompasses a comprehensive range of enzymatic solutions designed to optimize brewing processes, enhance product quality, and improve operational efficiency across the continent’s diverse brewing landscape. Market dynamics indicate substantial growth potential driven by increasing consumer demand for premium and craft beer products, technological advancements in enzyme applications, and the expanding brewery infrastructure throughout South America.

Regional brewing activities have experienced remarkable transformation over recent years, with countries like Brazil, Argentina, Colombia, and Chile leading the charge in adopting advanced brewing technologies. The market demonstrates robust growth momentum with projections indicating a compound annual growth rate of 8.2% CAGR through the forecast period. This growth trajectory reflects the region’s increasing focus on brewing innovation, quality enhancement, and production optimization.

Enzyme applications in South American breweries span multiple critical processes including mashing, fermentation, clarification, and flavor development. The market encompasses various enzyme categories such as amylases, proteases, glucanases, and specialty enzymes, each serving specific functions in the brewing value chain. Technology adoption rates have accelerated significantly, with approximately 72% of commercial breweries now incorporating some form of enzymatic processing in their operations.

The South America brewing enzymes market refers to the comprehensive ecosystem of specialized protein catalysts utilized throughout the beer production process across South American countries. These enzymes serve as biological accelerators that facilitate specific biochemical reactions essential for converting raw materials into high-quality beer products while optimizing production efficiency and consistency.

Brewing enzymes encompass a diverse portfolio of naturally occurring or engineered proteins that break down complex carbohydrates, proteins, and other organic compounds during various brewing stages. These specialized catalysts enable brewers to achieve precise control over fermentation processes, improve extract yields, enhance flavor profiles, and ensure product consistency across production batches.

Market significance extends beyond simple process optimization, as these enzymes enable breweries to adapt to varying raw material qualities, reduce production costs, minimize environmental impact, and meet evolving consumer preferences for diverse beer styles and characteristics throughout the South American region.

Strategic market analysis reveals that the South America brewing enzymes market is positioned for sustained expansion driven by multiple converging factors including rising craft beer popularity, technological innovation, and increasing quality standards across the brewing industry. The market demonstrates strong fundamentals with diversified applications spanning traditional and specialty brewing segments.

Key growth drivers include the region’s expanding middle class, urbanization trends, and growing appreciation for premium beer products. Approximately 65% of market growth is attributed to increased adoption of advanced brewing technologies and quality enhancement initiatives. The market benefits from favorable regulatory environments and increasing investment in brewery modernization projects across major South American economies.

Competitive dynamics showcase a mix of international enzyme manufacturers and regional suppliers, creating a balanced ecosystem that supports innovation while maintaining cost competitiveness. Market participants are increasingly focusing on developing specialized enzyme solutions tailored to local brewing traditions and raw material characteristics prevalent throughout South America.

Future prospects indicate continued market expansion with emerging opportunities in sustainable brewing practices, organic enzyme solutions, and specialized applications for craft and artisanal beer production. The market is expected to benefit from ongoing technological advancements and increasing consumer sophistication regarding beer quality and variety.

Market intelligence reveals several critical insights that define the South America brewing enzymes landscape and its growth trajectory. These insights provide valuable perspective on market dynamics, competitive positioning, and future development opportunities across the region.

Primary growth catalysts propelling the South America brewing enzymes market encompass a diverse range of economic, technological, and consumer-driven factors that collectively create a favorable environment for sustained market expansion and innovation.

Consumer preferences have evolved significantly toward premium and craft beer products, driving breweries to invest in advanced processing technologies including specialized enzyme applications. This trend reflects growing disposable income, urbanization, and increased exposure to international beer styles and quality standards throughout the region.

Technological advancement in enzyme development and application methodologies has made these solutions more accessible and cost-effective for breweries of all sizes. Modern enzyme formulations offer enhanced stability, specificity, and performance characteristics that enable brewers to achieve consistent results while optimizing production efficiency and reducing waste.

Regulatory support from regional governments promoting food and beverage industry development has created favorable conditions for brewery expansion and modernization. Investment incentives, reduced import duties on brewing equipment, and streamlined licensing procedures have accelerated the adoption of advanced brewing technologies including enzyme applications.

Raw material optimization needs drive enzyme adoption as breweries seek to maximize extract yields and maintain quality consistency despite variations in local grain characteristics. Enzymes enable brewers to work effectively with diverse raw material sources while achieving standardized product quality and production efficiency.

Operational challenges within the South America brewing enzymes market present certain limitations that may impact growth momentum and market penetration across different brewery segments and regional markets throughout the continent.

Cost considerations remain a significant factor for smaller breweries and emerging market participants who may find enzyme solutions financially challenging to implement. Initial investment requirements for enzyme integration, staff training, and process optimization can create barriers to adoption, particularly for craft breweries operating with limited capital resources.

Technical complexity associated with enzyme application and optimization requires specialized knowledge and expertise that may not be readily available in all regional markets. Proper enzyme selection, dosage determination, and process integration demand technical competency that can limit adoption rates among less experienced brewing operations.

Supply chain constraints in certain South American regions may affect enzyme availability and pricing stability. Import dependencies, logistics challenges, and currency fluctuations can impact the consistent supply of high-quality enzyme products, particularly for specialized or niche applications.

Regulatory variations across different South American countries create complexity for enzyme manufacturers and breweries operating in multiple markets. Differing approval processes, labeling requirements, and quality standards can slow market development and increase compliance costs for industry participants.

Emerging opportunities within the South America brewing enzymes market present substantial potential for growth, innovation, and market expansion across diverse brewery segments and regional markets throughout the continent.

Craft brewing expansion represents a significant opportunity as the artisanal beer movement continues gaining momentum across South America. Small and medium-sized breweries are increasingly recognizing the value of enzyme applications for achieving consistent quality, improving efficiency, and developing unique product characteristics that differentiate their offerings in competitive markets.

Sustainable brewing practices create opportunities for eco-friendly enzyme solutions that support environmental responsibility while maintaining production efficiency. Breweries are increasingly seeking enzyme products that reduce water consumption, minimize waste generation, and support overall sustainability objectives aligned with consumer environmental consciousness.

Export market development offers substantial growth potential as South American breweries increasingly target international markets. Enzyme applications that ensure consistent quality, extended shelf life, and standardized characteristics become essential for breweries seeking to compete effectively in global beer markets.

Specialty applications in areas such as gluten reduction, alcohol content optimization, and flavor enhancement present niche opportunities for specialized enzyme products. These applications address specific consumer needs and regulatory requirements while enabling breweries to develop innovative products that command premium pricing.

Complex interactions between supply and demand factors, technological developments, and competitive forces shape the South America brewing enzymes market dynamics, creating a multifaceted environment that influences growth patterns and strategic decision-making across the industry.

Supply-side dynamics reflect the interplay between international enzyme manufacturers and regional distributors who serve the diverse needs of South American breweries. Market supply is influenced by production capacity, raw material availability, technological innovation, and competitive pricing strategies that affect enzyme accessibility and adoption rates.

Demand patterns demonstrate seasonal variations aligned with beer consumption cycles, with peak demand periods corresponding to summer months and holiday seasons. Additionally, long-term demand trends reflect the growing sophistication of South American beer markets and increasing quality expectations among consumers and brewery operators.

Competitive intensity has increased as more players enter the market, driving innovation and service enhancement while creating pricing pressures. This competition benefits end users through improved product quality, expanded service offerings, and more competitive pricing structures across different enzyme categories and applications.

Technology evolution continues reshaping market dynamics through the development of more efficient, stable, and cost-effective enzyme solutions. Advanced formulations and application methodologies enable breweries to achieve better results with lower enzyme dosages, improving cost-effectiveness and operational efficiency.

Comprehensive research approach employed for analyzing the South America brewing enzymes market incorporates multiple data collection methodologies, analytical frameworks, and validation processes to ensure accuracy, reliability, and actionable insights for industry stakeholders and decision-makers.

Primary research activities include extensive interviews with brewery operators, enzyme manufacturers, distributors, and industry experts across major South American markets. These interactions provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the brewing enzymes landscape throughout the region.

Secondary research encompasses analysis of industry reports, trade publications, regulatory documents, and company financial statements to gather comprehensive market data and validate primary research findings. This approach ensures thorough coverage of market segments, geographic regions, and competitive dynamics.

Data triangulation methodologies cross-reference information from multiple sources to verify accuracy and eliminate potential biases or inconsistencies. This rigorous validation process enhances the reliability of market insights and projections presented in the analysis.

Analytical frameworks incorporate quantitative and qualitative assessment techniques to evaluate market size, growth patterns, competitive positioning, and future prospects. Statistical modeling and trend analysis support the development of accurate market projections and strategic recommendations.

Geographic distribution of the South America brewing enzymes market reveals distinct patterns of development, adoption, and growth potential across different countries and sub-regions, reflecting varying levels of brewery infrastructure, consumer preferences, and economic development.

Brazil dominates the regional market with approximately 45% market share, driven by its large brewing industry, established distribution networks, and growing craft beer segment. The country’s diverse brewery landscape, ranging from large multinational operations to emerging craft breweries, creates substantial demand for various enzyme applications and specialized solutions.

Argentina represents the second-largest market with strong growth momentum supported by increasing beer consumption, brewery modernization initiatives, and growing export activities. The country’s brewing industry has embraced enzyme technologies to improve product quality and production efficiency while maintaining cost competitiveness in regional and international markets.

Colombia and Chile demonstrate significant growth potential with expanding brewery sectors and increasing consumer sophistication regarding beer quality and variety. These markets benefit from favorable economic conditions, growing middle-class populations, and increasing investment in brewery infrastructure and technology adoption.

Emerging markets including Peru, Ecuador, and Uruguay show promising development prospects as their brewing industries mature and adopt advanced processing technologies. These markets represent opportunities for enzyme manufacturers seeking to expand their regional presence and serve growing brewery sectors.

Market competition in the South America brewing enzymes sector features a diverse mix of international manufacturers, regional suppliers, and specialized service providers who collectively serve the varied needs of the continent’s brewing industry through innovative products and comprehensive support services.

Strategic positioning varies among competitors, with some focusing on premium, high-performance solutions while others target cost-conscious brewery segments. Market leaders emphasize technical support, product innovation, and comprehensive service offerings to maintain competitive advantages in the evolving South American brewing enzymes market.

Market segmentation analysis reveals the diverse structure of the South America brewing enzymes market across multiple dimensions including enzyme type, application, brewery size, and end-use categories that collectively define market dynamics and growth opportunities.

By Enzyme Type:

By Application:

By Brewery Size:

Detailed analysis of specific enzyme categories reveals distinct market characteristics, growth patterns, and application trends that define competitive dynamics and development opportunities within the South America brewing enzymes market.

Amylase enzymes represent the largest and most established category, accounting for approximately 52% of total enzyme consumption across South American breweries. These enzymes are essential for converting starches into fermentable sugars during the mashing process, making them indispensable for beer production. Market demand for amylases remains stable with steady growth driven by brewery expansion and production volume increases.

Protease applications demonstrate strong growth potential as breweries increasingly focus on beer clarity, foam stability, and protein management. These enzymes help optimize protein levels, improve filtration efficiency, and enhance overall beer quality characteristics that are increasingly important for premium and export-oriented products.

Specialty enzyme categories including glucanases, lipases, and custom formulations show the highest growth rates as breweries seek to differentiate their products and optimize specific process parameters. These specialized solutions command premium pricing while enabling breweries to achieve unique product characteristics and operational advantages.

Emerging enzyme technologies focus on sustainability, efficiency, and novel applications that support brewing innovation and environmental responsibility. These developments create opportunities for market expansion and product differentiation in the competitive South American brewing landscape.

Comprehensive value proposition of brewing enzymes creates multiple benefits for various stakeholders throughout the South American brewing industry, from manufacturers and breweries to consumers and regulatory authorities.

For Breweries:

For Consumers:

For Enzyme Manufacturers:

Strategic assessment of the South America brewing enzymes market through comprehensive SWOT analysis reveals critical internal and external factors that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the South America brewing enzymes market reflect broader industry evolution, technological advancement, and changing consumer preferences that collectively influence market development and competitive dynamics.

Sustainability Integration has emerged as a dominant trend with breweries increasingly seeking enzyme solutions that support environmental responsibility. This includes enzymes that reduce water consumption, minimize waste generation, and improve energy efficiency throughout brewing processes. Environmental consciousness among consumers and regulatory pressure drive this trend’s continued expansion.

Craft Beer Sophistication continues accelerating across South America as consumers develop more refined tastes and appreciation for unique beer styles. This trend drives demand for specialized enzymes that enable craft breweries to achieve distinctive flavor profiles, improved clarity, and consistent quality that differentiates their products in competitive markets.

Digital Integration in brewing operations increasingly incorporates enzyme management and optimization through advanced monitoring and control systems. Smart brewing technologies enable precise enzyme dosing, real-time process monitoring, and data-driven optimization that improves efficiency and consistency while reducing waste and operational costs.

Premium Product Focus reflects growing consumer willingness to pay higher prices for superior beer quality and unique characteristics. This trend supports enzyme adoption for applications that enhance product quality, extend shelf life, and enable premium positioning in increasingly competitive beer markets throughout South America.

Significant developments within the South America brewing enzymes market demonstrate the dynamic nature of industry evolution, technological advancement, and strategic initiatives that shape competitive positioning and market growth opportunities.

Strategic partnerships between international enzyme manufacturers and regional distributors have expanded market access and technical support capabilities across South America. These collaborations enhance local service delivery, reduce supply chain complexity, and provide breweries with better access to specialized enzyme solutions and technical expertise.

Product innovation continues advancing with development of more stable, efficient, and cost-effective enzyme formulations specifically designed for South American brewing conditions and raw material characteristics. Recent innovations include temperature-stable enzymes, multi-functional formulations, and environmentally friendly solutions that address specific regional needs.

Capacity expansion initiatives by major enzyme manufacturers reflect growing confidence in South American market potential. New production facilities, distribution centers, and technical service capabilities enhance supply security and support market development across the region’s diverse brewing landscape.

Regulatory harmonization efforts across South American countries are gradually reducing barriers to enzyme trade and adoption. Standardized approval processes, mutual recognition agreements, and simplified regulatory frameworks support market development and reduce compliance complexity for industry participants.

Strategic recommendations for stakeholders in the South America brewing enzymes market focus on capitalizing on growth opportunities while addressing market challenges and competitive dynamics that influence long-term success and market positioning.

For Enzyme Manufacturers: Focus on developing specialized solutions for craft and artisanal breweries while maintaining cost-competitive offerings for large commercial operations. Invest in local technical support capabilities and establish strategic partnerships with regional distributors to enhance market penetration and customer service delivery. MarkWide Research analysis suggests that companies emphasizing sustainability and innovation will achieve superior market positioning.

For Breweries: Evaluate enzyme applications systematically to identify opportunities for quality improvement, cost reduction, and product differentiation. Start with proven applications in core processes before exploring specialized enzymes for unique product development. Invest in staff training and technical expertise to maximize enzyme benefits and optimize return on investment.

For Investors: Consider the brewing enzymes market as part of broader food technology and beverage industry investment strategies. Focus on companies with strong innovation capabilities, established market presence, and comprehensive service offerings that position them for sustained growth in the evolving South American market.

For Policymakers: Support industry development through favorable regulatory frameworks, investment incentives, and technical education programs that enhance brewing industry competitiveness and innovation adoption throughout the region.

Long-term prospects for the South America brewing enzymes market indicate sustained growth driven by continued brewery expansion, increasing quality standards, and evolving consumer preferences that collectively create favorable conditions for market development and innovation.

Growth projections suggest the market will maintain robust expansion with anticipated compound annual growth rates of 8.5% through 2030. This growth reflects increasing enzyme adoption across brewery segments, expanding applications in specialty brewing, and continued investment in brewery modernization and capacity expansion throughout the region.

Technology evolution will likely focus on developing more efficient, sustainable, and cost-effective enzyme solutions that address specific regional brewing challenges and opportunities. Advanced formulations, improved stability characteristics, and novel applications will drive continued market expansion and competitive differentiation.

Market maturation is expected to bring increased standardization, improved supply chain efficiency, and enhanced technical support capabilities that benefit all market participants. MWR projections indicate that market consolidation and strategic partnerships will create more integrated service offerings and comprehensive solutions for brewery customers.

Emerging opportunities in areas such as organic brewing, gluten-free products, and export-oriented production will create new demand segments for specialized enzyme applications. These developments will support continued market diversification and growth beyond traditional brewing applications.

The South America brewing enzymes market represents a dynamic and promising sector within the region’s evolving food and beverage industry landscape. Comprehensive analysis reveals strong fundamentals supporting sustained growth, driven by expanding brewery infrastructure, increasing quality consciousness, and growing consumer sophistication regarding beer products and characteristics.

Market dynamics demonstrate favorable conditions for continued expansion with multiple growth drivers including craft beer development, export market opportunities, and technological advancement creating substantial potential for enzyme manufacturers and brewery operators. The market benefits from improving economic conditions, supportive regulatory environments, and increasing investment in brewery modernization across major South American economies.

Strategic positioning opportunities exist for stakeholders who can effectively address market needs through innovative products, comprehensive service offerings, and strategic partnerships that enhance market access and customer value delivery. Success factors include technical expertise, cost competitiveness, and ability to adapt solutions to specific regional brewing requirements and characteristics.

Future development will likely emphasize sustainability, innovation, and specialization as key differentiating factors in an increasingly competitive market environment. The South America brewing enzymes market is well-positioned to capitalize on these trends while supporting the continued evolution and growth of the region’s diverse and dynamic brewing industry.

What is Brewing Enzymes?

Brewing enzymes are specialized proteins that facilitate various biochemical processes in the brewing of beer, including starch conversion, protein stabilization, and flavor enhancement. They play a crucial role in improving the efficiency and quality of the brewing process.

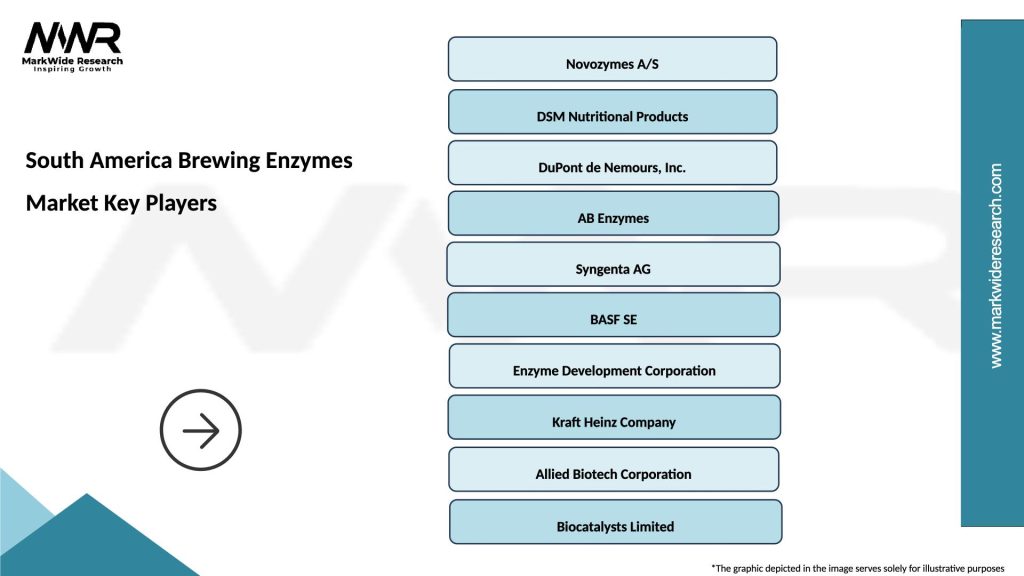

What are the key players in the South America Brewing Enzymes Market?

Key players in the South America Brewing Enzymes Market include Novozymes, DSM, and AB Enzymes, which provide a range of enzyme solutions tailored for brewing applications. These companies focus on innovation and sustainability in their product offerings, among others.

What are the growth factors driving the South America Brewing Enzymes Market?

The South America Brewing Enzymes Market is driven by the increasing demand for craft beers, the need for improved brewing efficiency, and the rising focus on sustainable brewing practices. Additionally, advancements in enzyme technology are enhancing product offerings.

What challenges does the South America Brewing Enzymes Market face?

Challenges in the South America Brewing Enzymes Market include the high cost of enzyme production and the need for regulatory compliance in food safety. Additionally, competition from traditional brewing methods can hinder the adoption of enzyme-based solutions.

What opportunities exist in the South America Brewing Enzymes Market?

Opportunities in the South America Brewing Enzymes Market include the growing trend of craft brewing and the potential for enzyme applications in non-alcoholic beverages. There is also an increasing interest in enzyme innovations that enhance flavor and reduce waste.

What trends are shaping the South America Brewing Enzymes Market?

Trends in the South America Brewing Enzymes Market include the rising popularity of enzyme formulations that cater to specific brewing styles and the integration of biotechnology in enzyme production. Additionally, sustainability initiatives are influencing product development and consumer preferences.

South America Brewing Enzymes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Amylase, Protease, Glucoamylase, Cellulase |

| Application | Beer Production, Distilled Spirits, Wine Making, Non-Alcoholic Beverages |

| End User | Brewery, Distillery, Beverage Manufacturer, Food Industry |

| Packaging Type | Bottles, Drums, Pouches, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Brewing Enzymes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at