444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America bath and shower products market represents a dynamic and rapidly evolving segment within the region’s personal care industry. This comprehensive market encompasses a diverse range of products including body washes, shower gels, bar soaps, bath salts, scrubs, and specialized cleansing formulations designed for daily hygiene and wellness routines. The market has experienced substantial growth driven by increasing consumer awareness of personal hygiene, rising disposable incomes, and evolving lifestyle preferences across major South American economies.

Market dynamics in South America reflect a unique blend of traditional bathing practices and modern product innovations. Countries such as Brazil, Argentina, Colombia, and Chile lead the regional demand, with urban populations showing particularly strong adoption rates for premium and specialized bath products. The market demonstrates robust expansion with a projected compound annual growth rate of 6.2% CAGR through the forecast period, indicating sustained consumer interest and market maturation.

Consumer preferences have shifted significantly toward natural and organic formulations, with approximately 58% of consumers expressing preference for products containing botanical ingredients and eco-friendly packaging. This trend has prompted manufacturers to develop innovative product lines that combine traditional South American ingredients with modern cosmetic science, creating unique value propositions for regional consumers.

Distribution channels have diversified considerably, with traditional retail maintaining strong presence while e-commerce platforms experience rapid growth, particularly following accelerated digital adoption patterns. The market benefits from increasing penetration of international brands alongside strong regional manufacturers who understand local preferences and cultural nuances in bathing and personal care routines.

The South America bath and shower products market refers to the comprehensive commercial ecosystem encompassing the manufacturing, distribution, and retail of personal cleansing products specifically designed for bathing and showering applications across South American countries. This market includes both mass-market and premium product categories, ranging from basic cleansing formulations to luxury spa-inspired treatments and therapeutic wellness products.

Product scope within this market definition includes liquid body washes, moisturizing shower gels, traditional and artisanal bar soaps, exfoliating scrubs, bath oils, bubble baths, and specialized products for sensitive skin conditions. The market also encompasses complementary products such as loofahs, bath accessories, and aromatherapy-infused cleansing solutions that enhance the overall bathing experience.

Geographic coverage spans the entire South American continent, with particular focus on major economies including Brazil, Argentina, Colombia, Peru, Chile, Venezuela, Ecuador, Uruguay, Paraguay, Bolivia, Guyana, Suriname, and French Guiana. Each market demonstrates unique characteristics influenced by local climate conditions, cultural preferences, economic development levels, and regulatory environments affecting product formulations and marketing approaches.

Market performance in South America’s bath and shower products sector demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior and increasing emphasis on personal wellness. The market has successfully navigated economic challenges while maintaining steady expansion across multiple product categories and distribution channels.

Key growth drivers include urbanization trends affecting 72% of the regional population, rising middle-class purchasing power, and increased awareness of personal hygiene importance. Premium product segments show particularly strong performance, with natural and organic formulations capturing significant market share as consumers prioritize health-conscious choices in their daily routines.

Competitive landscape features a balanced mix of multinational corporations and regional specialists, creating dynamic market conditions that benefit consumers through product innovation and competitive pricing. Local manufacturers leverage indigenous ingredients and traditional knowledge to create differentiated products that resonate with cultural preferences while meeting modern quality standards.

Future prospects remain highly favorable, with digital transformation accelerating market access and consumer education. E-commerce penetration continues expanding, while sustainability initiatives drive product development toward environmentally responsible formulations and packaging solutions that align with growing environmental consciousness among South American consumers.

Consumer behavior analysis reveals significant insights into South American bathing preferences and purchasing decisions. The following key insights shape market development and strategic planning:

Market maturation indicators suggest continued evolution toward more sophisticated consumer preferences and increased willingness to invest in premium personal care experiences. These insights guide manufacturers in product development and marketing strategy formulation.

Economic development across South America serves as a fundamental driver for bath and shower products market expansion. Rising disposable incomes enable consumers to upgrade from basic cleansing products to premium formulations that offer enhanced benefits and improved user experiences. This economic progression particularly impacts urban areas where lifestyle changes create demand for sophisticated personal care solutions.

Urbanization trends significantly influence market growth as city dwellers adopt more complex daily routines that incorporate multiple personal care products. Urban consumers demonstrate higher awareness of international beauty standards and show greater willingness to experiment with new product categories and brands, driving market diversification and innovation.

Health and wellness consciousness has emerged as a powerful market driver, with consumers increasingly viewing bathing routines as essential components of overall well-being. This trend supports demand for therapeutic and aromatherapy-infused products that provide stress relief and skin health benefits beyond basic cleansing functions.

Climate considerations across South America’s diverse geographic regions create specific product needs that drive market segmentation. Humid tropical climates increase demand for antibacterial and refreshing formulations, while cooler regions favor moisturizing and nourishing products, creating opportunities for specialized product development.

Cultural evolution toward modern lifestyle adoption, particularly among younger demographics, drives acceptance of international product categories and bathing practices. This cultural shift supports market expansion for premium and specialty products that were previously considered luxury items.

Economic volatility in several South American countries creates challenges for consistent market growth, as currency fluctuations and inflation impact consumer purchasing power and import costs for international brands. These economic pressures can force consumers to prioritize basic necessities over premium personal care products, affecting market expansion rates.

Infrastructure limitations in rural and remote areas restrict market penetration and distribution efficiency. Limited access to modern retail channels and reliable logistics networks prevents many consumers from accessing diverse product options, constraining overall market development potential.

Regulatory complexities across different countries create barriers for manufacturers seeking regional expansion. Varying product registration requirements, labeling standards, and ingredient restrictions increase compliance costs and slow product launch timelines, particularly affecting smaller manufacturers and new market entrants.

Cultural resistance to certain product categories or formulations may limit adoption rates in traditional communities. Some consumers maintain strong preferences for conventional soap products and may be hesitant to adopt modern liquid formulations or specialized products, creating market segmentation challenges.

Import dependency for certain ingredients and packaging materials exposes the market to supply chain disruptions and cost fluctuations. This dependency can affect product availability and pricing stability, particularly for premium products that rely on imported specialty ingredients.

Digital commerce expansion presents significant opportunities for market growth as internet penetration increases across South America. E-commerce platforms enable manufacturers to reach previously inaccessible consumer segments while providing detailed product information and customer reviews that support informed purchasing decisions.

Natural ingredient innovation offers substantial opportunities for product differentiation using South America’s rich biodiversity. Manufacturers can develop unique formulations featuring indigenous plants and traditional ingredients, creating competitive advantages while supporting local communities and sustainable sourcing practices.

Subscription services and direct-to-consumer models present opportunities for building customer loyalty and predictable revenue streams. These business models allow for personalized product recommendations and convenient replenishment systems that enhance customer satisfaction and retention rates.

Men’s grooming segment represents an underexplored opportunity with significant growth potential as male consumers become more interested in personal care routines. Targeted product development and marketing strategies can capture this expanding demographic and drive category growth.

Sustainability initiatives create opportunities for brands to differentiate through environmentally responsible practices. Consumers increasingly value eco-friendly packaging, biodegradable formulations, and ethical sourcing, creating competitive advantages for companies that prioritize sustainability.

Private label development offers opportunities for retailers to capture higher margins while providing consumers with value-oriented alternatives to branded products. This trend supports market democratization and increased product accessibility across different income segments.

Supply chain evolution demonstrates increasing sophistication as manufacturers optimize distribution networks to serve diverse South American markets efficiently. Modern logistics capabilities enable better inventory management and faster product delivery, supporting market expansion and customer satisfaction improvements.

Innovation cycles have accelerated significantly, with manufacturers introducing new products and formulations at unprecedented rates to meet evolving consumer preferences. This dynamic environment rewards companies that can quickly identify trends and translate them into marketable products that resonate with target audiences.

Competitive intensity continues increasing as both international and regional players vie for market share through product differentiation, pricing strategies, and marketing innovations. This competition benefits consumers through improved product quality, expanded choice options, and competitive pricing across all market segments.

Consumer education plays an increasingly important role in market dynamics as manufacturers invest in awareness campaigns that highlight product benefits and proper usage techniques. Educational initiatives help consumers understand value propositions and make informed choices that support market growth and customer satisfaction.

Seasonal fluctuations create dynamic demand patterns that require sophisticated inventory management and marketing strategies. Manufacturers must balance production schedules and promotional activities to optimize performance across different climate zones and seasonal preferences throughout the region.

Primary research methodologies employed in analyzing the South America bath and shower products market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions across major urban centers. These qualitative and quantitative research approaches provide detailed insights into consumer preferences, purchasing behaviors, and market trends that shape strategic decision-making.

Secondary research encompasses extensive analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and identify growth patterns. This research foundation supports accurate market sizing and forecasting while validating primary research findings through multiple data sources.

Market segmentation analysis utilizes advanced statistical techniques to identify distinct consumer groups and product categories within the broader market. Segmentation research helps manufacturers understand target audience characteristics and develop appropriate marketing strategies for different demographic and geographic segments.

Competitive intelligence gathering involves systematic monitoring of competitor activities, product launches, pricing strategies, and marketing campaigns across the region. This intelligence supports strategic planning and helps identify market opportunities and potential threats that may impact business performance.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert verification of findings. Quality control measures include peer review, statistical validation, and ongoing monitoring of market developments to maintain research relevance and reliability.

Brazil dominates the South American bath and shower products market, accounting for approximately 45% of regional demand due to its large population, developed retail infrastructure, and strong consumer culture around personal care. Brazilian consumers demonstrate sophisticated preferences for premium products and show high adoption rates for international brands alongside strong support for domestic manufacturers.

Argentina represents the second-largest market with significant growth potential despite economic challenges. Argentine consumers show strong brand loyalty and preference for quality products, creating opportunities for both premium and value-oriented offerings. The market benefits from well-developed urban retail networks and increasing e-commerce adoption.

Colombia demonstrates rapid market expansion driven by economic growth and increasing consumer sophistication. The Colombian market shows particular strength in natural and organic product segments, with consumers expressing strong interest in products featuring local ingredients and sustainable packaging solutions.

Chile and Peru represent emerging opportunities with growing middle-class populations and increasing urbanization rates. These markets show strong potential for premium product adoption as consumer purchasing power increases and awareness of international beauty standards expands through digital media exposure.

Smaller markets including Uruguay, Ecuador, and Paraguay demonstrate niche opportunities for specialized products and targeted marketing strategies. These markets often show strong preferences for value-oriented products while maintaining interest in natural and traditional formulations that reflect local cultural preferences.

Market leadership in South America’s bath and shower products sector features a diverse mix of international corporations and regional specialists, each leveraging unique strengths to capture market share and build customer loyalty. The competitive environment encourages continuous innovation and strategic positioning across multiple market segments.

Competitive strategies focus on product differentiation through natural ingredients, sustainable packaging, and targeted marketing campaigns that resonate with local cultural values. Companies invest heavily in research and development to create formulations that address specific regional climate and skin care needs.

Product type segmentation reveals distinct market categories with varying growth rates and consumer preferences across South America:

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Premium segment performance demonstrates exceptional growth as consumers increasingly view bath and shower products as essential components of personal wellness routines. Premium products featuring natural ingredients, therapeutic benefits, and luxury packaging command higher margins while building strong brand loyalty among affluent consumer segments.

Natural and organic categories show remarkable expansion with approximately 34% annual growth as consumers prioritize health-conscious choices and environmental responsibility. These products often feature indigenous South American ingredients such as açaí, quinoa, and various botanical extracts that provide unique benefits while supporting local communities.

Men’s grooming products represent the fastest-growing category segment as traditional gender barriers in personal care continue dissolving. Male consumers increasingly adopt comprehensive grooming routines that include specialized body washes, exfoliating products, and moisturizing formulations designed for masculine preferences and skin characteristics.

Therapeutic and medicated products gain traction among consumers with specific skin conditions or sensitivities. These specialized formulations address concerns such as dry skin, eczema, and dermatitis while maintaining gentle cleansing properties that support daily use without irritation.

Eco-friendly packaging becomes increasingly important across all categories as environmental consciousness influences purchasing decisions. Manufacturers respond with biodegradable containers, refillable systems, and concentrated formulations that reduce environmental impact while appealing to sustainability-minded consumers.

Manufacturers benefit from expanding market opportunities that support revenue growth and brand development across diverse South American markets. The growing consumer base provides sustainable demand for both existing products and innovative formulations that address evolving preferences and lifestyle changes.

Retailers gain from increased category performance and higher margin opportunities, particularly in premium and specialty product segments. Bath and shower products generate consistent traffic and repeat purchases while offering cross-selling opportunities with complementary personal care items.

Distributors enjoy stable demand patterns and expanding market reach as urbanization and economic development create new consumer segments. The market’s resilience during economic fluctuations provides reliable revenue streams while growth trends support business expansion opportunities.

Consumers receive enhanced product choices, improved formulations, and competitive pricing through market competition and innovation. Access to international brands and specialized products improves personal care options while educational initiatives help consumers make informed purchasing decisions.

Suppliers of raw materials benefit from increased demand for natural ingredients, packaging materials, and specialty chemicals used in product formulations. The market’s growth supports supply chain development and creates opportunities for local ingredient sourcing and processing.

Investors find attractive opportunities in a market demonstrating consistent growth potential and resilience to economic challenges. The personal care sector’s defensive characteristics combined with growth trends create favorable investment conditions for both established companies and emerging brands.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends drive market evolution as consumers seek products tailored to their specific skin types, preferences, and lifestyle needs. According to MarkWide Research analysis, personalized product offerings show 28% higher customer satisfaction rates compared to standard formulations, encouraging manufacturers to develop customizable solutions and targeted marketing approaches.

Sustainability integration becomes increasingly central to product development and brand positioning as environmental consciousness influences consumer choices. Manufacturers adopt eco-friendly packaging, sustainable sourcing practices, and biodegradable formulations that align with growing environmental awareness while maintaining product performance standards.

Multi-functional formulations gain popularity as consumers seek efficiency and value in their personal care routines. Products combining cleansing, moisturizing, and aromatherapy benefits in single formulations appeal to time-conscious consumers while providing enhanced user experiences that justify premium pricing.

Indigenous ingredient incorporation reflects growing appreciation for traditional South American botanicals and their therapeutic properties. Manufacturers leverage ingredients such as açaí, guaraná, and various Amazonian plants to create unique product propositions that celebrate regional heritage while delivering proven benefits.

Digital engagement strategies transform how brands connect with consumers through social media, influencer partnerships, and interactive marketing campaigns. These digital approaches enable targeted messaging, community building, and direct consumer feedback that inform product development and marketing strategies.

Subscription commerce models emerge as convenient solutions for regular product replenishment while building customer loyalty and predictable revenue streams. These services often include personalized recommendations and exclusive products that enhance customer relationships and lifetime value.

Product innovation accelerates across the industry as manufacturers introduce advanced formulations featuring cutting-edge ingredients and delivery systems. Recent developments include probiotic-infused body washes, vitamin-enriched shower gels, and pH-balanced formulations that support skin health while providing superior cleansing performance.

Manufacturing expansion occurs throughout South America as companies establish local production facilities to reduce costs and improve supply chain efficiency. These investments support job creation, technology transfer, and reduced dependence on imported products while enabling faster response to local market preferences.

Strategic partnerships between international brands and regional distributors facilitate market entry and expansion while leveraging local expertise and established distribution networks. These collaborations often result in co-developed products that combine global innovation with regional market knowledge.

Sustainability initiatives gain momentum as companies implement comprehensive environmental programs covering ingredient sourcing, manufacturing processes, and packaging solutions. Industry leaders establish ambitious sustainability targets and invest in renewable energy, waste reduction, and circular economy principles.

Digital transformation reshapes industry operations through advanced analytics, artificial intelligence, and automation technologies that improve efficiency and customer insights. Companies leverage data analytics to optimize product development, inventory management, and marketing effectiveness while enhancing customer experiences.

Regulatory harmonization efforts progress across South American countries to streamline product registration and safety standards. These initiatives reduce compliance complexity and costs while facilitating regional trade and market access for manufacturers of all sizes.

Market entry strategies should prioritize understanding local consumer preferences and cultural nuances that influence product acceptance and brand loyalty. Companies entering South American markets benefit from partnering with regional experts and conducting extensive consumer research to develop appropriate product formulations and marketing approaches.

Investment priorities should focus on sustainable product development and digital capabilities that support long-term growth and competitive advantage. Companies that invest early in eco-friendly formulations and e-commerce infrastructure position themselves favorably for future market evolution and consumer preference shifts.

Distribution optimization requires multi-channel approaches that combine traditional retail with emerging digital platforms to maximize market reach and customer convenience. Successful companies develop integrated distribution strategies that serve diverse consumer segments while maintaining cost efficiency and service quality.

Innovation focus should emphasize natural ingredients, multi-functional benefits, and personalized solutions that address specific regional needs and preferences. Companies that leverage South America’s biodiversity while incorporating modern cosmetic science create compelling value propositions that differentiate their products in competitive markets.

Brand positioning strategies should balance international appeal with local relevance to build strong emotional connections with target consumers. Successful brands communicate authentic stories that resonate with cultural values while demonstrating clear product benefits and quality standards.

Sustainability integration should become central to business strategy rather than peripheral marketing initiatives. Companies that embed environmental responsibility throughout their operations create competitive advantages while meeting growing consumer expectations for ethical business practices.

Market trajectory indicates sustained growth potential driven by demographic trends, economic development, and evolving consumer preferences across South America. The market is projected to maintain robust expansion with increasing sophistication in product offerings and distribution channels that serve diverse consumer segments effectively.

Technology integration will reshape product development and customer engagement through advanced formulation techniques, personalization capabilities, and digital marketing innovations. Companies that embrace technological advancement while maintaining focus on consumer needs will capture disproportionate market share and customer loyalty.

Sustainability imperatives will intensify as environmental consciousness becomes mainstream among South American consumers. Future market leaders will be those companies that successfully balance performance, affordability, and environmental responsibility while communicating authentic sustainability commitments to their customers.

Regional integration trends suggest increasing harmonization of consumer preferences and regulatory standards across South American countries. This convergence creates opportunities for regional brand strategies and streamlined operations while maintaining sensitivity to local cultural preferences and market conditions.

Premium segment expansion will continue as rising affluence enables more consumers to upgrade from basic products to sophisticated formulations offering enhanced benefits and experiences. MWR projections indicate premium products will represent 42% of market value within the next five years, reflecting sustained consumer willingness to invest in quality personal care solutions.

Innovation acceleration will drive continuous product development cycles as manufacturers compete to meet evolving consumer expectations and capture emerging market opportunities. Future success will depend on companies’ ability to balance innovation with operational efficiency while maintaining strong customer relationships and brand equity.

The South America bath and shower products market presents compelling opportunities for sustained growth and profitability driven by favorable demographic trends, increasing consumer sophistication, and expanding distribution capabilities. Market dynamics support both established players and new entrants who can effectively address regional preferences while maintaining competitive positioning through innovation and operational excellence.

Strategic success factors include deep understanding of local consumer needs, commitment to sustainable practices, and investment in digital capabilities that enhance customer engagement and operational efficiency. Companies that balance global expertise with regional market knowledge while prioritizing product quality and customer satisfaction will capture disproportionate market share and build lasting competitive advantages.

Future market evolution will favor companies that embrace sustainability, leverage technology for personalization and efficiency, and maintain agility in responding to changing consumer preferences and market conditions. The market’s resilience and growth potential make it an attractive investment opportunity for companies seeking exposure to South America’s expanding consumer economy and evolving personal care landscape.

What is Bath & Shower Products?

Bath & Shower Products refer to a range of items designed for personal hygiene and cleansing during bathing or showering. This includes soaps, body washes, shampoos, conditioners, and other related products that enhance the bathing experience.

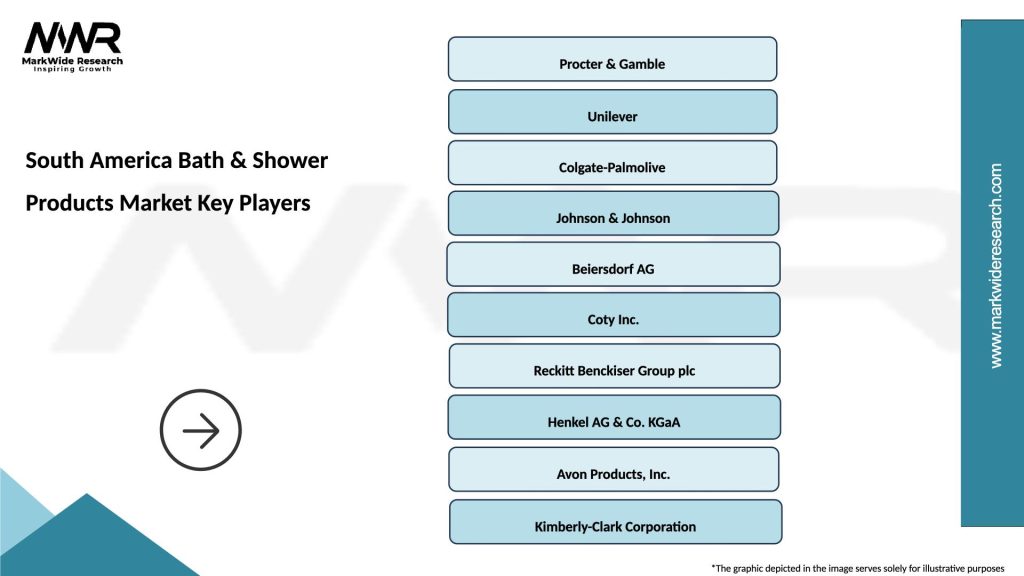

What are the key players in the South America Bath & Shower Products Market?

Key players in the South America Bath & Shower Products Market include Procter & Gamble, Unilever, Colgate-Palmolive, and Natura & Co, among others. These companies are known for their diverse product offerings and strong market presence in the region.

What are the main drivers of growth in the South America Bath & Shower Products Market?

The main drivers of growth in the South America Bath & Shower Products Market include increasing consumer awareness of personal hygiene, rising disposable incomes, and a growing trend towards premium and natural products. Additionally, the influence of social media on beauty and wellness trends plays a significant role.

What challenges does the South America Bath & Shower Products Market face?

The South America Bath & Shower Products Market faces challenges such as intense competition among brands, fluctuating raw material prices, and regulatory hurdles regarding product safety and environmental impact. These factors can affect pricing strategies and market entry for new players.

What opportunities exist in the South America Bath & Shower Products Market?

Opportunities in the South America Bath & Shower Products Market include the rising demand for organic and eco-friendly products, the expansion of e-commerce platforms, and the potential for innovative product formulations. Brands that can adapt to changing consumer preferences are likely to succeed.

What trends are shaping the South America Bath & Shower Products Market?

Trends shaping the South America Bath & Shower Products Market include the growing popularity of multi-functional products, increased focus on sustainability, and the rise of personalized skincare solutions. Consumers are increasingly seeking products that cater to their specific needs and values.

South America Bath & Shower Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shower Gels, Bath Oils, Body Washes, Shower Creams |

| End User | Households, Hotels, Spas, Gyms |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Form | Liquid, Gel, Foam, Bar |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Bath & Shower Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at