444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America AUV & ROV market represents a rapidly expanding sector within the region’s maritime and offshore industries. Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs) have become essential tools for underwater exploration, research, and commercial operations across South American waters. The market demonstrates significant growth potential, driven by increasing offshore oil and gas activities, marine research initiatives, and environmental monitoring requirements.

Regional dynamics indicate that countries like Brazil, Argentina, and Chile are leading the adoption of advanced underwater vehicle technologies. The market is experiencing robust expansion with a projected CAGR of 8.2% over the forecast period, reflecting the growing demand for sophisticated underwater exploration capabilities. Offshore energy exploration remains the primary driver, accounting for approximately 45% of market applications across the region.

Technological advancements in battery life, navigation systems, and sensor capabilities are enhancing the operational efficiency of both AUVs and ROVs. The integration of artificial intelligence and machine learning technologies is revolutionizing underwater data collection and analysis, making these vehicles more autonomous and cost-effective for various applications.

The South America AUV & ROV market refers to the comprehensive ecosystem of autonomous and remotely operated underwater vehicles designed for various subsea applications across South American waters. AUVs operate independently using pre-programmed instructions and onboard sensors, while ROVs are controlled remotely by operators on surface vessels through tethered connections.

Market scope encompasses the manufacturing, deployment, maintenance, and support services for these underwater vehicles across multiple industries including oil and gas, marine research, defense, aquaculture, and environmental monitoring. The market includes various vehicle types ranging from small inspection-class ROVs to large work-class systems capable of heavy-duty operations at significant depths.

Geographic coverage spans the entire South American continent, with particular emphasis on countries with extensive coastlines and offshore activities. The market encompasses both Atlantic and Pacific coastal regions, addressing diverse underwater environments from shallow coastal waters to deep-sea exploration sites.

Market momentum in South America’s AUV & ROV sector is accelerating due to increased offshore exploration activities and growing environmental awareness. The region’s vast continental shelf and rich marine resources create substantial opportunities for underwater vehicle deployment across multiple sectors. Brazil dominates the regional market, contributing approximately 52% of total demand, followed by Argentina and Chile as significant growth markets.

Technology integration trends show increasing adoption of hybrid AUV/ROV systems that combine autonomous operation capabilities with remote control functionality. These advanced systems offer enhanced operational flexibility and cost-effectiveness for complex underwater missions. The market is witnessing a shift toward more sophisticated sensor packages and improved data processing capabilities.

Investment patterns indicate strong government and private sector commitment to marine technology development. Several South American countries are establishing marine technology centers and research facilities to support local AUV & ROV capabilities. MarkWide Research analysis suggests that the market will continue expanding as regional economies prioritize sustainable marine resource utilization and environmental protection.

Strategic insights reveal several critical factors shaping the South America AUV & ROV market landscape:

Primary drivers propelling the South America AUV & ROV market include the region’s expanding offshore energy sector, which requires sophisticated underwater vehicles for exploration, drilling support, and pipeline maintenance. Deepwater exploration activities in Brazilian waters, particularly in the pre-salt layer, are creating substantial demand for high-performance ROVs capable of operating at depths exceeding 2,000 meters.

Environmental regulations are increasingly mandating comprehensive underwater monitoring and assessment programs, driving adoption of AUVs equipped with advanced sensor packages. The need for continuous environmental monitoring in sensitive marine ecosystems is creating sustained demand for autonomous underwater vehicles that can operate for extended periods without human intervention.

Technological advancement in battery technology and energy management systems is extending operational duration and reducing operational costs, making AUV & ROV deployment more economically viable for a broader range of applications. Infrastructure development projects, including submarine cable installations and port construction, are generating consistent demand for specialized underwater vehicles.

Research initiatives focused on marine biodiversity, climate change impacts, and oceanographic studies are expanding the scientific application market for AUVs. Government funding for marine research programs is supporting the acquisition of advanced underwater vehicle systems across multiple South American countries.

High capital costs associated with AUV & ROV acquisition and maintenance represent a significant barrier for many potential users, particularly smaller research institutions and commercial operators. The substantial investment required for advanced underwater vehicle systems, including support equipment and trained personnel, limits market accessibility for budget-constrained organizations.

Technical complexity of modern AUV & ROV systems requires specialized expertise for operation and maintenance, creating challenges in regions with limited technical infrastructure. The shortage of qualified technicians and operators capable of managing sophisticated underwater vehicle systems constrains market growth potential.

Regulatory challenges across different South American countries create compliance complexities for international operators and equipment manufacturers. Varying import regulations, certification requirements, and operational permits can delay project implementation and increase operational costs.

Economic volatility in some South American markets affects long-term investment planning for expensive underwater vehicle systems. Currency fluctuations and political instability can impact project financing and equipment procurement decisions, particularly for large-scale offshore operations.

Emerging opportunities in the South America AUV & ROV market include the growing renewable energy sector, particularly offshore wind farm development and tidal energy projects. These applications require specialized underwater vehicles for site assessment, installation support, and ongoing maintenance operations, creating new market segments with substantial growth potential.

Marine mining exploration for critical minerals and rare earth elements presents significant opportunities for advanced AUV deployment. The region’s extensive continental shelf contains valuable mineral deposits that require sophisticated underwater survey and sampling capabilities.

Aquaculture expansion across South American coastal regions is driving demand for AUVs equipped with monitoring and management capabilities. The growing fish farming industry requires continuous water quality monitoring, fish health assessment, and facility inspection services that can be efficiently provided by autonomous underwater vehicles.

Tourism applications are emerging as underwater vehicles become more accessible for marine tourism and archaeological exploration. The development of underwater tourism sites and shipwreck exploration programs creates opportunities for specialized ROV services and equipment rental markets.

Market dynamics in the South America AUV & ROV sector are characterized by increasing integration between different underwater vehicle technologies and expanding application diversity. The traditional boundaries between AUVs and ROVs are blurring as hybrid systems offer combined autonomous and remotely operated capabilities, providing enhanced operational flexibility.

Competitive dynamics show a trend toward regional partnerships and technology transfer agreements between international manufacturers and local service providers. This collaboration model is facilitating technology localization while reducing operational costs and improving service availability across the region.

Innovation cycles are accelerating as manufacturers focus on developing more efficient, reliable, and cost-effective underwater vehicle systems. The integration of artificial intelligence, machine learning, and advanced sensor technologies is creating new capabilities and applications that were previously technically or economically unfeasible.

Supply chain dynamics are evolving to support regional market growth, with several countries establishing local assembly and service facilities. This localization trend is improving equipment availability, reducing lead times, and creating local employment opportunities in the marine technology sector.

Research approach for analyzing the South America AUV & ROV market employed a comprehensive mixed-method methodology combining quantitative market analysis with qualitative industry insights. Primary research included extensive interviews with industry stakeholders, equipment manufacturers, service providers, and end-users across major South American markets.

Data collection processes incorporated multiple sources including industry surveys, government statistics, trade association reports, and company financial disclosures. Market sizing methodologies utilized bottom-up and top-down approaches to ensure accuracy and reliability of market assessments and growth projections.

Validation procedures included cross-referencing data from multiple sources and conducting expert interviews to verify market trends and forecasts. Regional analysis was conducted through country-specific research teams with local market expertise and industry connections.

Forecasting models incorporated economic indicators, industry growth drivers, and technological advancement timelines to project market development scenarios. The research methodology ensured comprehensive coverage of all market segments and geographic regions within South America.

Brazil dominates the South America AUV & ROV market, accounting for approximately 52% of regional demand, driven by extensive offshore oil and gas operations and significant marine research activities. The country’s pre-salt oil discoveries have created substantial demand for deepwater ROV capabilities, while environmental monitoring requirements support AUV market growth.

Argentina represents the second-largest market, contributing approximately 18% of regional demand, with growing offshore exploration activities and expanding aquaculture operations driving market development. The country’s extensive coastline and continental shelf provide substantial opportunities for underwater vehicle deployment across multiple applications.

Chile’s market share of approximately 15% is supported by strong mining industry demand for underwater survey capabilities and growing marine research initiatives. The country’s unique geography, including extensive fjord systems and deep coastal waters, creates specialized requirements for advanced underwater vehicle technologies.

Other regional markets including Colombia, Peru, and Uruguay collectively represent 15% of market demand, with growing recognition of underwater vehicle capabilities for various marine applications. These emerging markets show significant growth potential as offshore activities expand and environmental awareness increases.

Market leadership in the South America AUV & ROV sector is characterized by a mix of international technology providers and emerging regional service companies. The competitive landscape shows increasing collaboration between global manufacturers and local partners to address regional market requirements.

Key market participants include:

Competitive strategies focus on technology localization, service network expansion, and partnership development with regional operators. Companies are investing in local facilities and training programs to build regional capabilities and reduce operational costs.

By Vehicle Type:

By Application:

By Depth Rating:

AUV segment demonstrates strong growth in marine research and environmental monitoring applications, with increasing adoption of long-endurance vehicles capable of multi-day autonomous operations. Survey-class AUVs are particularly popular for bathymetric mapping and habitat assessment projects across South American waters.

ROV applications remain dominant in offshore energy sector operations, with work-class vehicles representing the largest revenue segment. Inspection-class ROVs are experiencing growing demand for aquaculture and infrastructure applications, offering cost-effective solutions for routine monitoring tasks.

Hybrid systems are emerging as a significant growth category, combining autonomous survey capabilities with remote intervention functions. These versatile platforms are particularly attractive for complex projects requiring both data collection and physical interaction capabilities.

Service segments including equipment rental, maintenance, and operator training are expanding rapidly as the market matures. Regional service centers are being established to provide local support and reduce operational downtime for underwater vehicle operations.

Operational efficiency improvements through AUV & ROV deployment enable more cost-effective underwater operations compared to traditional diving or surface vessel methods. Enhanced safety benefits eliminate human exposure to hazardous underwater environments while maintaining operational capability in challenging conditions.

Data quality advantages include consistent, repeatable measurements and comprehensive coverage of underwater areas that would be difficult or impossible to access through conventional methods. Advanced sensor integration provides multi-parameter data collection capabilities in single deployments.

Cost reduction benefits emerge through reduced vessel time, eliminated diving operations, and improved operational efficiency. 24/7 operational capability of AUVs enables continuous monitoring and data collection without weather-related interruptions.

Environmental benefits include reduced surface vessel emissions, minimal ecosystem disturbance, and improved environmental monitoring capabilities. Stakeholder advantages extend to regulatory compliance, risk mitigation, and enhanced project execution capabilities across multiple marine applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous operation trends show increasing sophistication in AUV navigation and decision-making capabilities, with artificial intelligence enabling more complex mission execution without human intervention. Swarm technology development allows multiple AUVs to operate cooperatively, dramatically expanding survey coverage and data collection efficiency.

Miniaturization trends are making underwater vehicles more accessible and cost-effective for smaller-scale applications. Micro-AUVs and compact ROVs are opening new market segments in aquaculture, environmental monitoring, and research applications previously considered economically unfeasible.

Sensor integration advances are creating multi-purpose platforms capable of simultaneous data collection across multiple parameters. Real-time data transmission capabilities are enabling immediate analysis and decision-making during underwater operations.

Sustainability focus is driving development of more energy-efficient systems and environmentally friendly operational practices. Green technology integration includes solar charging capabilities, biodegradable components, and reduced environmental impact operational procedures.

Recent developments in the South America AUV & ROV market include establishment of regional manufacturing facilities by international companies seeking to reduce costs and improve service delivery. Technology transfer agreements between global manufacturers and local partners are facilitating knowledge sharing and capability development.

Research collaborations between universities, government agencies, and private companies are advancing underwater vehicle technology development and application innovation. MWR analysis indicates that these partnerships are accelerating market growth and technology adoption across the region.

Infrastructure investments in port facilities and service centers are improving operational support for underwater vehicle operations. Training programs established by equipment manufacturers and service providers are addressing the skilled personnel shortage in the market.

Regulatory developments include updated safety standards and operational guidelines for underwater vehicle operations, providing clearer frameworks for market participants while ensuring operational safety and environmental protection.

Market entry strategies should focus on partnership development with established regional operators to leverage local market knowledge and regulatory expertise. Technology localization investments can provide competitive advantages through reduced costs and improved service delivery capabilities.

Application diversification beyond traditional oil and gas markets can provide more stable revenue streams and reduced market volatility exposure. Service-based business models may offer more attractive returns than equipment sales in emerging markets with limited capital availability.

Investment priorities should emphasize training and capability development to address the skilled personnel shortage limiting market growth. Regional service networks are essential for successful market penetration and customer retention in the South American market.

Technology development should focus on cost-effective solutions suitable for regional market conditions and budget constraints. Modular system designs can provide flexibility and upgrade paths that appeal to cost-conscious customers while enabling future technology adoption.

Market projections indicate continued strong growth in the South America AUV & ROV market, with expanding applications driving demand across multiple sectors. Technology advancement will continue reducing operational costs while improving capabilities, making underwater vehicles accessible to broader market segments.

Regional development trends suggest increasing technology localization and capability building, reducing dependence on imported systems and services. Government initiatives supporting marine technology development are expected to accelerate market growth and innovation.

Application expansion into renewable energy, marine mining, and environmental monitoring will diversify the market beyond traditional oil and gas applications. Efficiency improvements of approximately 25-30% are projected over the next five years through technological advancement and operational optimization.

MarkWide Research forecasts that the market will maintain robust growth momentum, supported by increasing offshore activities, environmental monitoring requirements, and technological innovation. Investment opportunities remain attractive for companies willing to commit to long-term regional market development and capability building.

The South America AUV & ROV market presents significant opportunities for growth and development across multiple application sectors. Strong fundamentals including extensive offshore resources, growing environmental awareness, and increasing technology adoption support positive market outlook for the forecast period.

Success factors for market participants include strategic partnerships, technology localization, and comprehensive service network development. Regional market dynamics favor companies that can provide cost-effective solutions while maintaining high operational standards and safety requirements.

Future growth will be driven by application diversification, technological advancement, and increasing recognition of underwater vehicle benefits across traditional and emerging market segments. The market’s evolution toward more autonomous, efficient, and cost-effective systems positions it for sustained expansion throughout South America’s diverse marine environments.

What is AUV & ROV?

AUV & ROV refers to Autonomous Underwater Vehicles and Remotely Operated Vehicles, which are used for various underwater applications such as exploration, inspection, and data collection in marine environments.

What are the key players in the South America AUV & ROV Market?

Key players in the South America AUV & ROV Market include Ocean Infinity, Teledyne Technologies, and Kongsberg Gruppen, among others.

What are the main drivers of growth in the South America AUV & ROV Market?

The main drivers of growth in the South America AUV & ROV Market include increasing demand for underwater exploration, advancements in technology, and the rising need for marine data collection in sectors like oil and gas and environmental monitoring.

What challenges does the South America AUV & ROV Market face?

Challenges in the South America AUV & ROV Market include high operational costs, technical limitations of existing technologies, and regulatory hurdles that can impede deployment in certain regions.

What opportunities exist in the South America AUV & ROV Market?

Opportunities in the South America AUV & ROV Market include the expansion of offshore renewable energy projects, increased investment in marine research, and the growing interest in underwater tourism and exploration.

What trends are shaping the South America AUV & ROV Market?

Trends shaping the South America AUV & ROV Market include the integration of artificial intelligence for data analysis, the development of hybrid vehicles, and a focus on sustainability in underwater operations.

South America AUV & ROV Market

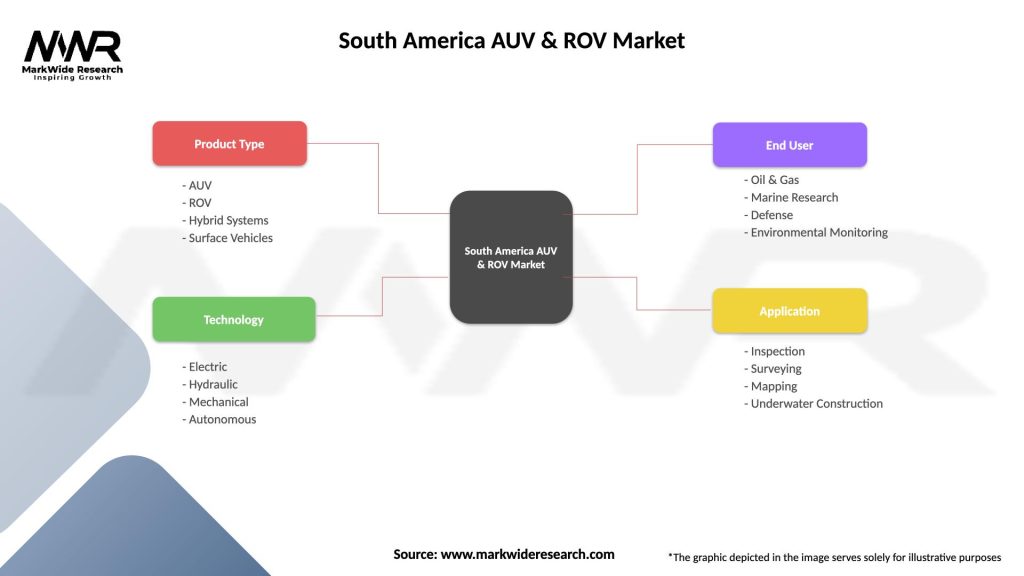

| Segmentation Details | Description |

|---|---|

| Product Type | AUV, ROV, Hybrid Systems, Surface Vehicles |

| Technology | Electric, Hydraulic, Mechanical, Autonomous |

| End User | Oil & Gas, Marine Research, Defense, Environmental Monitoring |

| Application | Inspection, Surveying, Mapping, Underwater Construction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America AUV & ROV Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at