444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The South America automotive high performance electric vehicle market represents a rapidly evolving segment within the region’s automotive industry, characterized by increasing consumer demand for sustainable transportation solutions combined with superior performance capabilities. Market dynamics indicate substantial growth potential driven by government incentives, environmental consciousness, and technological advancements in battery systems and electric powertrains.

Regional adoption of high performance electric vehicles has accelerated significantly, with Brazil and Argentina leading the transformation. The market encompasses luxury electric sports cars, high-performance SUVs, and premium electric sedans that deliver exceptional acceleration, advanced connectivity features, and extended range capabilities. Growth projections suggest the market will expand at a robust CAGR of 18.5% through the forecast period, reflecting strong consumer interest and supportive regulatory frameworks.

Infrastructure development across major South American cities has created favorable conditions for electric vehicle adoption, with charging networks expanding rapidly in urban centers. The convergence of performance-oriented design, environmental sustainability, and technological innovation has positioned high performance electric vehicles as a premium segment attracting affluent consumers seeking cutting-edge automotive experiences.

The South America automotive high performance electric vehicle market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and sales of premium electric vehicles that combine zero-emission propulsion with superior performance characteristics across South American countries. This market segment focuses specifically on electric vehicles designed to deliver exceptional acceleration, handling, and technological sophistication while maintaining environmental sustainability.

High performance electric vehicles in this context are defined as battery-powered automobiles capable of achieving acceleration from zero to 100 kilometers per hour in under six seconds, featuring advanced battery management systems, regenerative braking technology, and sophisticated electronic control units. These vehicles typically incorporate premium materials, cutting-edge infotainment systems, and autonomous driving capabilities that distinguish them from conventional electric vehicles.

Market scope encompasses various vehicle categories including electric sports cars, performance-oriented SUVs, luxury electric sedans, and high-end electric crossovers. The definition extends beyond mere performance metrics to include vehicles that represent technological innovation, design excellence, and brand prestige within the South American automotive landscape.

Market transformation in South America’s automotive high performance electric vehicle sector reflects a fundamental shift toward sustainable mobility solutions without compromising driving excitement and luxury experiences. The region has witnessed unprecedented growth in electric vehicle adoption, with high performance segments capturing significant market share of 23% among premium vehicle categories.

Key market drivers include stringent emission regulations, government incentives for electric vehicle purchases, declining battery costs, and increasing consumer awareness of environmental sustainability. Brazil leads regional adoption with comprehensive charging infrastructure development, while Argentina and Chile demonstrate strong growth potential through supportive policy frameworks and urban electrification initiatives.

Technological advancements in battery chemistry, electric motor efficiency, and vehicle connectivity have enhanced the appeal of high performance electric vehicles among South American consumers. Major automotive manufacturers have established local assembly operations and partnerships with regional distributors to capitalize on growing demand for premium electric mobility solutions.

Market challenges include high initial purchase prices, limited charging infrastructure in rural areas, and consumer concerns regarding battery longevity and replacement costs. However, these obstacles are gradually being addressed through technological improvements, infrastructure investments, and innovative financing solutions that make high performance electric vehicles more accessible to target demographics.

Strategic market insights reveal several critical factors shaping the South America automotive high performance electric vehicle landscape:

Environmental regulations across South American countries have become increasingly stringent, compelling automotive manufacturers to prioritize electric vehicle development and consumers to consider sustainable transportation alternatives. Government mandates for emission reductions and air quality improvements in major cities have created strong regulatory drivers for high performance electric vehicle adoption.

Technological advancement in battery technology has significantly improved energy density, charging speeds, and overall vehicle performance while reducing costs. Modern lithium-ion battery systems deliver exceptional power output enabling high performance electric vehicles to achieve acceleration and handling characteristics that exceed traditional sports cars, attracting performance-oriented consumers.

Economic incentives provided by South American governments include substantial tax credits, reduced import duties, and preferential financing terms for electric vehicle purchases. These financial benefits have made high performance electric vehicles more competitive with conventional luxury vehicles, expanding the addressable market and accelerating adoption rates.

Infrastructure development has reached critical mass in major South American cities, with comprehensive charging networks providing convenient access to fast-charging stations. The availability of reliable charging infrastructure has eliminated range anxiety concerns and made electric vehicle ownership practical for daily commuting and long-distance travel.

Consumer awareness of environmental sustainability and climate change impacts has increased dramatically, particularly among affluent demographics who represent the primary target market for high performance electric vehicles. This heightened environmental consciousness has translated into purchasing decisions that prioritize sustainable transportation solutions.

High acquisition costs remain a significant barrier to widespread adoption of high performance electric vehicles in South America, where premium electric vehicles command substantial price premiums compared to conventional alternatives. The initial investment required for cutting-edge battery technology, advanced electronics, and performance-oriented components limits market accessibility to affluent consumer segments.

Infrastructure limitations persist in rural and remote areas of South America, where charging station availability remains inadequate for supporting electric vehicle adoption. The uneven distribution of charging infrastructure creates geographic constraints on electric vehicle utility and limits market expansion beyond major metropolitan areas.

Battery concerns including degradation over time, replacement costs, and disposal considerations continue to influence consumer purchasing decisions. Despite technological improvements, concerns about long-term battery performance and the substantial cost of battery replacement remain significant factors affecting market growth.

Technical complexity associated with high performance electric vehicles requires specialized maintenance capabilities and trained technicians, which may not be readily available across all South American markets. The need for specialized service infrastructure and technical expertise creates additional ownership considerations for potential buyers.

Import dependencies for critical components including advanced battery systems, electric motors, and electronic control units expose the market to supply chain disruptions and currency fluctuation impacts. These dependencies can affect vehicle availability and pricing stability in South American markets.

Government initiatives across South America present substantial opportunities for market expansion through continued policy support, infrastructure investments, and incentive programs. Emerging policies focused on urban air quality improvement and carbon emission reduction create favorable conditions for high performance electric vehicle adoption.

Technology partnerships between global automotive manufacturers and South American companies offer opportunities for local production, technology transfer, and market customization. These collaborations can reduce costs, improve supply chain efficiency, and create vehicles specifically designed for South American consumer preferences and operating conditions.

Charging infrastructure expansion represents a significant opportunity for private investment and public-private partnerships. The development of comprehensive fast-charging networks along major transportation corridors and in commercial centers can accelerate market adoption and improve electric vehicle practicality.

Fleet electrification initiatives by corporate customers, ride-sharing services, and government agencies create substantial volume opportunities for high performance electric vehicles. Fleet adoption can drive economies of scale, reduce costs, and demonstrate electric vehicle capabilities to broader consumer audiences.

Energy integration opportunities exist through connections with renewable energy systems, smart grid technologies, and energy storage applications. High performance electric vehicles can serve as mobile energy storage units, providing grid services and creating additional value propositions for consumers and utilities.

Competitive intensity in the South America automotive high performance electric vehicle market has increased significantly as global manufacturers recognize the region’s growth potential. Market competition has driven rapid innovation in battery technology, vehicle design, and performance capabilities while simultaneously reducing prices and improving value propositions for consumers.

Supply chain evolution reflects the transition from import-dependent models to regional manufacturing and assembly operations. Local production capabilities have improved cost competitiveness and reduced delivery times while creating employment opportunities and technology transfer benefits for South American economies.

Consumer behavior patterns indicate growing acceptance of electric vehicle technology among performance-oriented buyers, with adoption rates increasing by 34% annually in key metropolitan markets. Early adopters have demonstrated satisfaction with electric vehicle performance, reliability, and ownership experience, creating positive word-of-mouth marketing effects.

Regulatory dynamics continue evolving with increasingly stringent emission standards, urban access restrictions for conventional vehicles, and expanded incentive programs for electric vehicle adoption. These regulatory changes create both opportunities and challenges for market participants while accelerating the transition toward electric mobility.

Technology convergence between automotive, energy, and digital sectors has created new business models and value creation opportunities. The integration of electric vehicles with smart home systems, renewable energy installations, and digital services platforms represents emerging market dynamics that extend beyond traditional automotive boundaries.

Comprehensive market analysis for the South America automotive high performance electric vehicle market employed multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combined primary data collection through industry interviews, surveys, and expert consultations with extensive secondary research utilizing industry reports, government publications, and company financial statements.

Primary research activities included structured interviews with automotive industry executives, electric vehicle manufacturers, dealership networks, and technology suppliers across major South American markets. Consumer surveys captured purchasing intentions, preference patterns, and adoption barriers among target demographics in Brazil, Argentina, Chile, and Colombia.

Secondary research sources encompassed government statistical databases, automotive industry associations, trade publications, and academic research institutions. Market data validation involved cross-referencing multiple sources and conducting triangulation analysis to ensure consistency and accuracy of findings.

Market modeling techniques utilized statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. The methodology incorporated economic indicators, regulatory changes, and technology adoption curves to create comprehensive market outlook assessments.

Data quality assurance processes included peer review, expert validation, and sensitivity analysis to identify potential biases and ensure research reliability. The methodology adhered to international market research standards and best practices for automotive industry analysis.

Brazil dominates the South America automotive high performance electric vehicle market with approximately 45% market share, driven by the largest economy, most developed automotive industry, and comprehensive government support for electric vehicle adoption. Major cities including São Paulo, Rio de Janeiro, and Brasília have established extensive charging infrastructure networks supporting premium electric vehicle ownership.

Argentina represents the second-largest market with growing market share of 28%, benefiting from government incentives, urban air quality initiatives, and increasing consumer environmental awareness. Buenos Aires has emerged as a key market for luxury electric vehicles, with expanding charging infrastructure and dealer networks supporting market growth.

Chile demonstrates exceptional growth potential despite its smaller market size, with rapid adoption rates of 41% annually in the high performance electric vehicle segment. The country’s commitment to renewable energy and environmental sustainability has created favorable conditions for electric vehicle adoption, particularly in Santiago and other major urban centers.

Colombia and Peru represent emerging markets with increasing interest in high performance electric vehicles, though adoption remains limited by infrastructure constraints and economic factors. These markets show promise for future growth as charging infrastructure develops and government policies become more supportive of electric vehicle adoption.

Regional cooperation initiatives including cross-border charging networks and harmonized technical standards are facilitating market integration and improving electric vehicle practicality for regional travel. These collaborative efforts support market expansion and create economies of scale for infrastructure development and vehicle distribution.

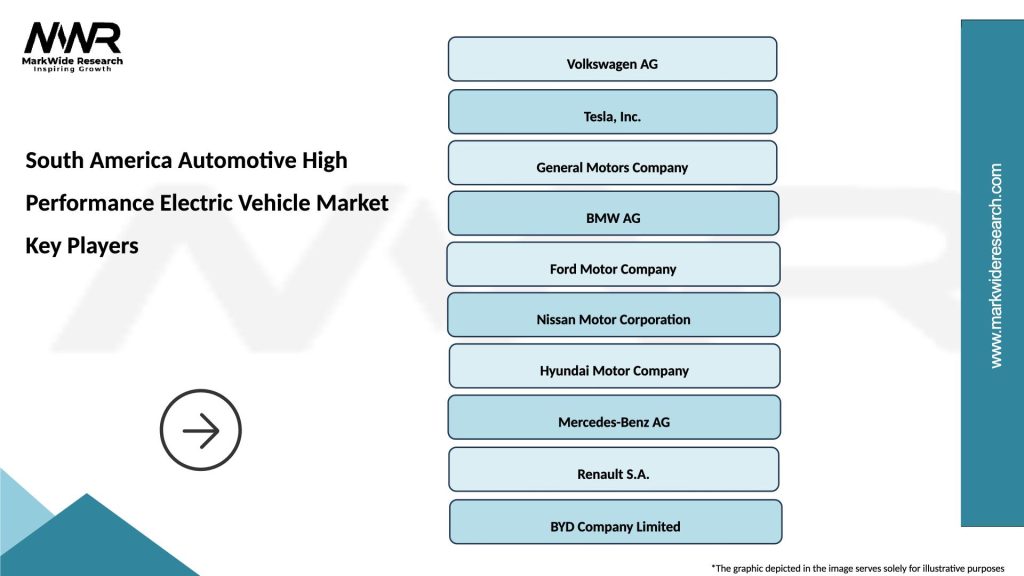

Market leadership in the South America automotive high performance electric vehicle sector is contested among several global automotive manufacturers who have established strong regional presence through local partnerships and distribution networks.

Competitive strategies focus on technology differentiation, charging infrastructure development, local partnerships, and customer experience enhancement. Market leaders invest heavily in research and development, regional manufacturing capabilities, and comprehensive service networks to maintain competitive advantages.

By Vehicle Type:

By Price Range:

By Technology:

By End User:

Electric Sports Cars represent the premium segment of the South America market, attracting enthusiasts and collectors who prioritize performance and exclusivity. These vehicles demonstrate the capabilities of electric powertrains while maintaining the emotional appeal and driving excitement traditionally associated with high-performance sports cars. Market penetration in this category reaches 15% of luxury sports car sales, indicating strong consumer acceptance.

Performance SUVs have emerged as the fastest-growing category, combining the practicality required by South American consumers with the performance capabilities demanded by luxury buyers. These vehicles address family transportation needs while delivering exceptional acceleration and advanced technology features that justify premium pricing.

Luxury Electric Sedans serve the executive market segment, offering sophisticated transportation solutions for business leaders and affluent consumers who prioritize comfort, technology, and environmental responsibility. The category benefits from established luxury car buyer preferences and growing corporate sustainability initiatives.

Electric Crossovers represent the most accessible entry point into high performance electric vehicles, offering versatility and performance at relatively moderate premium pricing. This category has the potential for broader market adoption as infrastructure develops and consumer acceptance increases.

Technology integration across all categories includes advanced driver assistance systems, over-the-air software updates, and comprehensive connectivity features that enhance the ownership experience and differentiate electric vehicles from conventional alternatives.

Automotive Manufacturers benefit from expanding into high-growth electric vehicle segments while building brand reputation for innovation and environmental responsibility. The transition to electric powertrains enables manufacturers to differentiate products, command premium pricing, and access new customer segments interested in sustainable luxury transportation.

Consumers gain access to cutting-edge transportation technology that delivers superior performance while reducing environmental impact and operating costs. High performance electric vehicles offer instant torque delivery, quiet operation, and advanced connectivity features that enhance the driving experience beyond conventional vehicles.

Government Agencies achieve environmental policy objectives through reduced emissions, improved urban air quality, and decreased dependence on imported petroleum products. Electric vehicle adoption supports renewable energy integration and creates opportunities for smart grid development and energy storage applications.

Infrastructure Providers capitalize on growing demand for charging services and energy management solutions. The expansion of electric vehicle adoption creates business opportunities for charging network operators, energy companies, and technology service providers.

Economic Development benefits include job creation in manufacturing, service, and technology sectors, along with opportunities for foreign investment and technology transfer. The electric vehicle industry supports development of advanced manufacturing capabilities and high-skill employment opportunities.

Environmental Stakeholders see measurable progress toward emission reduction goals and air quality improvement in urban areas. Electric vehicle adoption contributes to broader sustainability objectives and climate change mitigation efforts across South America.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous driving integration has become a defining trend in high performance electric vehicles, with manufacturers incorporating advanced driver assistance systems and preparing for fully autonomous capabilities. MarkWide Research indicates that autonomous features adoption has reached 67% penetration in premium electric vehicle segments across South America.

Over-the-air updates enable continuous vehicle improvement and feature enhancement throughout the ownership lifecycle, creating ongoing value for consumers and new revenue opportunities for manufacturers. This trend transforms vehicles from static products into continuously evolving technology platforms.

Sustainable manufacturing practices have become increasingly important, with manufacturers implementing carbon-neutral production processes, recycled materials, and circular economy principles. Consumers increasingly consider the entire lifecycle environmental impact when making purchasing decisions.

Charging speed improvements continue advancing with ultra-fast charging capabilities reducing charging times to minutes rather than hours. These technological improvements address key consumer concerns and make electric vehicles more practical for long-distance travel and daily use.

Vehicle-to-everything connectivity enables electric vehicles to communicate with infrastructure, other vehicles, and energy systems, creating new functionality and value propositions. This trend supports smart city development and integrated transportation systems.

Subscription and mobility services are emerging as alternatives to traditional vehicle ownership, particularly appealing to urban consumers who value access over ownership. These business models reduce barriers to electric vehicle adoption and create new market opportunities.

Manufacturing investments by global automotive companies have accelerated across South America, with several manufacturers announcing local assembly facilities and component production capabilities. These investments reduce costs, improve supply chain resilience, and demonstrate long-term commitment to regional markets.

Charging infrastructure partnerships between automotive manufacturers, energy companies, and government agencies have created comprehensive charging networks in major metropolitan areas. These collaborative efforts address infrastructure barriers and improve electric vehicle practicality for consumers.

Battery technology breakthroughs including solid-state batteries, improved energy density, and faster charging capabilities continue advancing electric vehicle performance and reducing costs. These technological developments enhance the competitive position of electric vehicles relative to conventional alternatives.

Government policy evolution has included expanded incentive programs, emission standards, and urban access restrictions that favor electric vehicles. Policy developments create market certainty and encourage both consumer adoption and industry investment.

Strategic partnerships between traditional automotive manufacturers and technology companies have accelerated innovation in autonomous driving, connectivity, and energy management systems. These collaborations combine automotive expertise with cutting-edge technology capabilities.

Market entry by new electric vehicle manufacturers and mobility service providers has intensified competition and driven innovation across the industry. New entrants bring fresh perspectives and disruptive business models that challenge traditional automotive approaches.

Infrastructure investment should remain a top priority for industry stakeholders and government agencies, with particular focus on fast-charging networks along major transportation corridors and in commercial centers. MWR analysis suggests that comprehensive charging infrastructure could accelerate adoption rates by additional 25% annually.

Local manufacturing capabilities should be developed through strategic partnerships and technology transfer agreements to reduce costs, improve supply chain resilience, and create employment opportunities. Regional production can significantly improve cost competitiveness and market accessibility.

Consumer education programs should address misconceptions about electric vehicle performance, reliability, and ownership costs while highlighting environmental and economic benefits. Effective communication strategies can accelerate market adoption and reduce purchase barriers.

Technology differentiation should focus on features that provide clear value to South American consumers, including connectivity, performance, and integration with local energy systems. Manufacturers should avoid over-engineering and focus on practical benefits that justify premium pricing.

Service network development requires investment in technician training, diagnostic equipment, and parts availability to support growing electric vehicle populations. Comprehensive service capabilities are essential for maintaining customer satisfaction and brand reputation.

Financial innovation including leasing programs, battery-as-a-service models, and innovative financing solutions can address affordability concerns and expand market accessibility. Creative financing approaches can overcome initial cost barriers and accelerate adoption.

Market expansion is expected to accelerate significantly over the next decade, with high performance electric vehicles becoming mainstream options in South American luxury automotive markets. Growth projections indicate the market will achieve sustained CAGR of 22.3% through 2030, driven by technology improvements, infrastructure development, and supportive government policies.

Technology evolution will continue advancing battery performance, charging speeds, and autonomous capabilities while reducing costs and improving reliability. Next-generation electric vehicles will offer superior performance, extended range, and enhanced connectivity features that exceed consumer expectations.

Infrastructure maturation will eliminate range anxiety and make electric vehicles practical for all transportation needs across South America. Comprehensive charging networks, including ultra-fast charging stations and wireless charging technology, will support widespread adoption.

Market democratization will occur as costs decline and technology improves, making high performance electric vehicles accessible to broader consumer segments. Mass market adoption will drive economies of scale and further cost reductions.

Integration opportunities with renewable energy systems, smart grids, and urban mobility platforms will create additional value propositions and business models. Electric vehicles will become integral components of sustainable transportation ecosystems.

Regional leadership potential exists for South American countries that successfully develop electric vehicle industries, charging infrastructure, and supportive policy frameworks. Early movers can establish competitive advantages and attract international investment in the growing electric mobility sector.

The South America automotive high performance electric vehicle market represents a transformational opportunity that combines environmental sustainability with superior performance capabilities, creating compelling value propositions for consumers, manufacturers, and society. Market dynamics indicate strong growth potential driven by supportive government policies, advancing technology, and increasing consumer environmental awareness.

Strategic success in this market requires comprehensive approaches that address infrastructure development, technology advancement, consumer education, and financial accessibility. Industry participants who invest in local capabilities, strategic partnerships, and customer-focused solutions will be best positioned to capitalize on emerging opportunities.

Future prospects remain highly positive, with technological improvements, infrastructure expansion, and policy support creating favorable conditions for sustained market growth. The convergence of performance, sustainability, and innovation positions high performance electric vehicles as the future of premium transportation in South America, offering significant opportunities for stakeholders across the automotive ecosystem.

What is Automotive High Performance Electric Vehicle?

Automotive High Performance Electric Vehicles are advanced electric cars designed for superior speed, handling, and efficiency. They often incorporate cutting-edge technology and materials to enhance performance and sustainability.

What are the key players in the South America Automotive High Performance Electric Vehicle Market?

Key players in the South America Automotive High Performance Electric Vehicle Market include Tesla, Porsche, and BMW, among others. These companies are known for their innovative electric vehicle technologies and high-performance models.

What are the main drivers of growth in the South America Automotive High Performance Electric Vehicle Market?

The main drivers of growth in this market include increasing consumer demand for sustainable transportation, advancements in battery technology, and government incentives for electric vehicle adoption. Additionally, the rising awareness of environmental issues is propelling market expansion.

What challenges does the South America Automotive High Performance Electric Vehicle Market face?

Challenges in the South America Automotive High Performance Electric Vehicle Market include limited charging infrastructure, high initial costs of electric vehicles, and competition from traditional internal combustion engine vehicles. These factors can hinder widespread adoption.

What opportunities exist in the South America Automotive High Performance Electric Vehicle Market?

Opportunities in the South America Automotive High Performance Electric Vehicle Market include the potential for partnerships with local governments to expand charging networks, the development of new battery technologies, and the growing interest in electric motorsports. These factors can enhance market growth.

What trends are shaping the South America Automotive High Performance Electric Vehicle Market?

Trends shaping the South America Automotive High Performance Electric Vehicle Market include the rise of autonomous driving technology, increased focus on vehicle connectivity, and the integration of renewable energy sources for charging. These innovations are transforming the automotive landscape.

South America Automotive High Performance Electric Vehicle Market

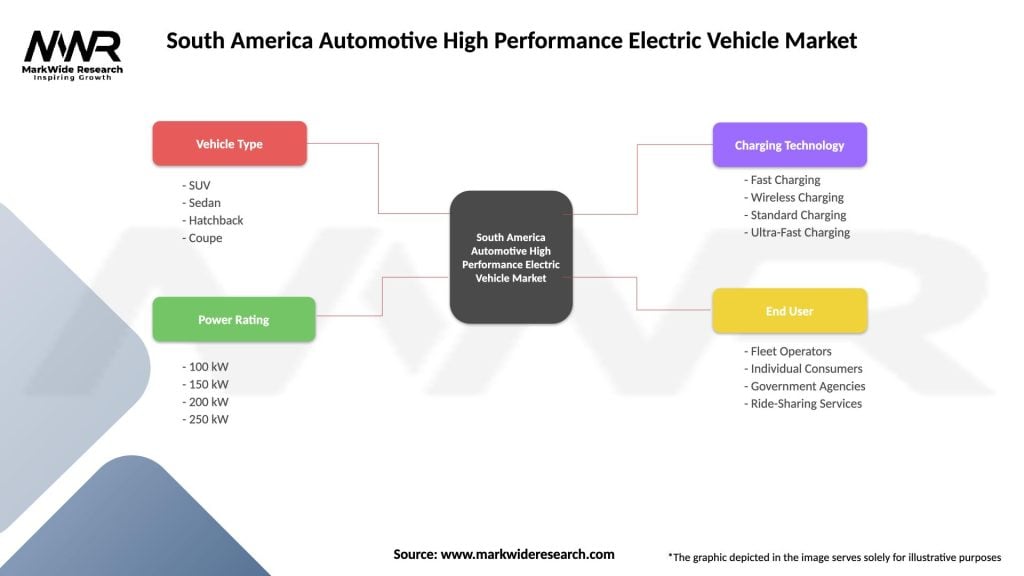

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Coupe |

| Power Rating | 100 kW, 150 kW, 200 kW, 250 kW |

| Charging Technology | Fast Charging, Wireless Charging, Standard Charging, Ultra-Fast Charging |

| End User | Fleet Operators, Individual Consumers, Government Agencies, Ride-Sharing Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South America Automotive High Performance Electric Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at