444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South America Anti-Caking Market refers to the industry that deals with the production and distribution of anti-caking agents used in various food and non-food applications. Anti-caking agents are substances that prevent the formation of lumps or clumps in powdered or granulated products. They help maintain the free-flowing properties of these products, ensuring their quality and usability.

Meaning

Anti-caking agents play a crucial role in the manufacturing and processing of a wide range of products, including food items like powdered spices, baking mixes, instant soup, and dairy products, as well as non-food items like fertilizers, detergents, and cosmetics. These agents prevent the particles in these products from sticking together, thereby improving their flowability, shelf life, and overall consumer experience.

Executive Summary

The South America Anti-Caking Market has been experiencing significant growth in recent years. The demand for anti-caking agents is driven by the growing food and beverage industry, increasing consumer awareness regarding product quality and safety, and the need for extended shelf life of powdered and granulated products. The market offers lucrative opportunities for manufacturers, suppliers, and distributors operating in this region.

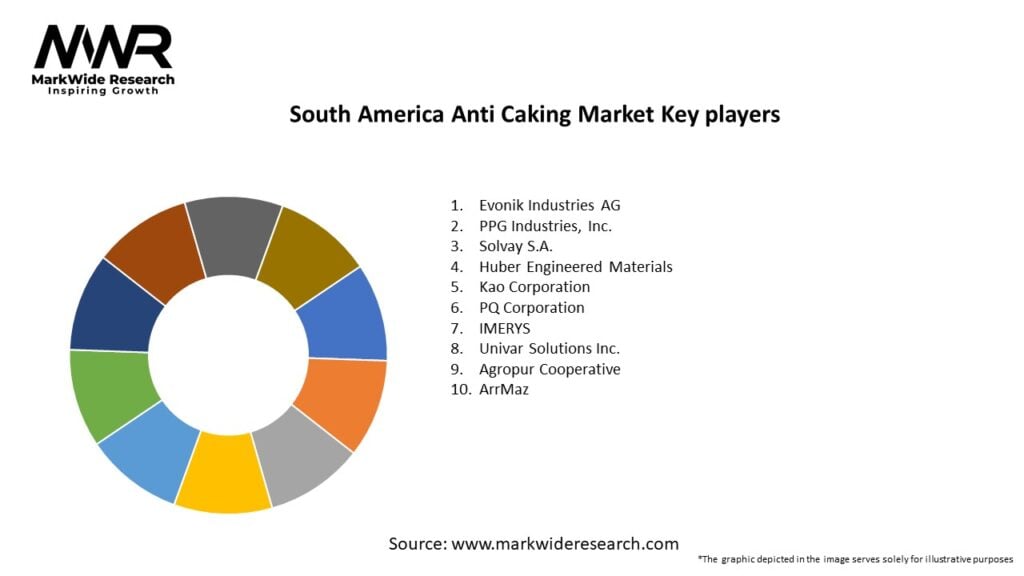

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The South America Anti-Caking Market is driven by several factors, including the growth of the food and beverage industry, changing consumer preferences, and the need for product innovation. The market dynamics are influenced by factors such as raw material availability, regulatory landscape, competitive rivalry, and technological advancements. Market players need to adapt to these dynamics to stay competitive and capitalize on emerging opportunities.

Regional Analysis

South America is a significant market for anti-caking agents, with Brazil and Argentina leading the region. Brazil, being the largest economy in South America, offers tremendous growth potential due to the increasing urbanization and demand for processed food products. Argentina is another prominent market, driven by its robust agricultural sector and the growing food processing industry. Other countries in the region, including Chile, Colombia, and Peru, also contribute to the overall market growth.

Competitive Landscape

Leading Companies in the South America Anti-Caking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The South America Anti-Caking Market can be segmented based on product type, application, and end-use industry. The product type segment includes natural and synthetic anti-caking agents. Application segments encompass food and non-food applications, while the end-use industry segments comprise food and beverage, pharmaceuticals, chemicals, animal feed, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the South America Anti-Caking Market. While the food and beverage industry witnessed disruptions in the initial phase, the demand for processed and packaged food products increased as consumers shifted towards home cooking and convenience foods. The non-food industries, on the other hand, faced challenges due to supply chain disruptions and reduced manufacturing activities. However, as the economies recover and consumer spending resumes, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The South America Anti-Caking Market is expected to witness steady growth in the coming years, driven by the rising demand for processed and convenience foods, increased awareness of product quality, and the adoption of natural and clean-label ingredients. As consumers become more health-conscious and seek products with extended shelf life, the demand for anti-caking agents is likely to surge across various industries.

Conclusion

The South America Anti-Caking Market presents lucrative opportunities for industry participants, driven by the growing food and beverage industry, increasing consumer demand for convenience products, and the need for product innovation. Manufacturers, suppliers, and distributors can capitalize on these opportunities by focusing on natural and clean-label solutions, expanding their product portfolios, and strengthening their distribution networks. The market’s future looks promising, provided industry players adapt to changing consumer preferences and evolving market dynamics to stay competitive and drive sustainable growth.

What is Anti Caking?

Anti caking refers to the process and methods used to prevent the formation of lumps in powdered or granulated materials. This is particularly important in industries such as food, pharmaceuticals, and chemicals, where product consistency and flowability are crucial.

What are the key players in the South America Anti Caking Market?

Key players in the South America Anti Caking Market include Evonik Industries, BASF, and Clariant, among others. These companies are known for their innovative solutions and extensive product portfolios in anti-caking agents.

What are the growth factors driving the South America Anti Caking Market?

The growth of the South America Anti Caking Market is driven by the increasing demand for processed food products, the expansion of the pharmaceutical industry, and the rising need for effective storage solutions in various sectors.

What challenges does the South America Anti Caking Market face?

Challenges in the South America Anti Caking Market include regulatory compliance issues, the high cost of raw materials, and competition from alternative products that may not require anti-caking agents.

What opportunities exist in the South America Anti Caking Market?

Opportunities in the South America Anti Caking Market include the development of natural and organic anti-caking agents, the growing trend of clean label products, and the expansion of e-commerce in the food and beverage sector.

What trends are shaping the South America Anti Caking Market?

Trends in the South America Anti Caking Market include the increasing use of biodegradable anti-caking agents, advancements in technology for better formulation, and a shift towards sustainable practices in manufacturing.

South America Anti Caking Market

| Segmentation Details | Description |

|---|---|

| Product Type | Silica, Calcium Carbonate, Starch, Talc |

| End User | Food & Beverage, Pharmaceuticals, Agriculture, Cosmetics |

| Application | Powdered Foods, Coatings, Adhesives, Fertilizers |

| Distribution Channel | Online, Direct Sales, Distributors, Retail |

Leading Companies in the South America Anti-Caking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at