444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South Africa Third-Party Logistics (3PL) market is witnessing significant growth due to the increasing demand for efficient supply chain management and logistics services. 3PL providers offer a range of services such as transportation, warehousing, inventory management, freight forwarding, and value-added services to businesses across various industries. These services enable businesses to outsource their logistics operations and focus on their core competencies, leading to improved operational efficiency and cost savings.

Meaning

Third-Party Logistics (3PL) refers to the outsourcing of logistics activities to specialized service providers. These providers have the expertise and infrastructure to handle various aspects of the supply chain, including transportation, warehousing, packaging, and distribution. By partnering with 3PL providers, businesses can leverage their industry knowledge, network, and technology to streamline their logistics operations and meet customer demands effectively.

Executive Summary

The South Africa Third-Party Logistics (3PL) market has experienced steady growth in recent years, driven by the increasing complexity of supply chains and the need for efficient logistics solutions. The market is highly competitive, with both domestic and international players offering a wide range of services. The COVID-19 pandemic has also had a significant impact on the market, highlighting the importance of resilient and adaptable logistics systems.

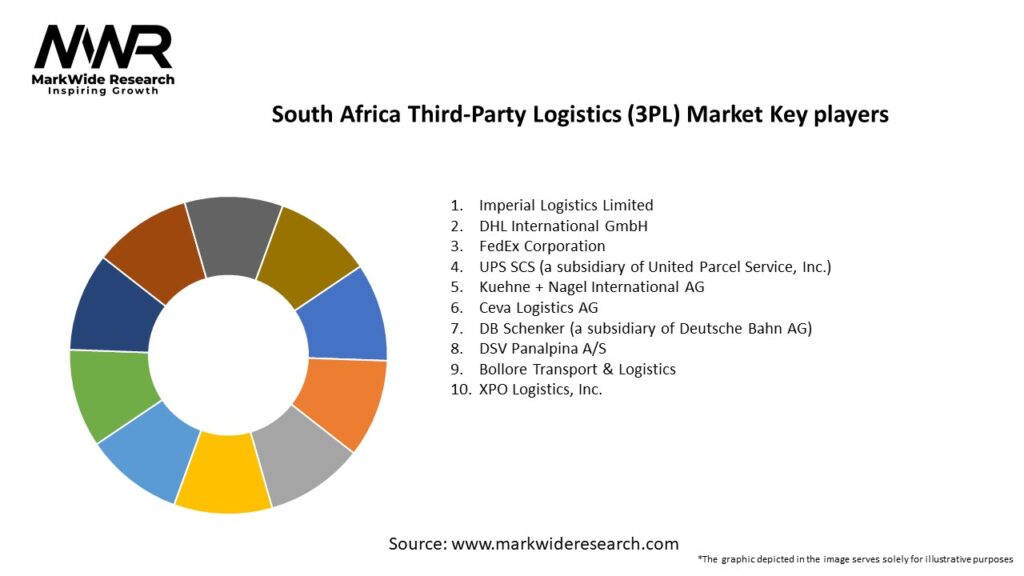

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The South Africa Third-Party Logistics (3PL) market is dynamic and influenced by various factors. Rapid technological advancements, evolving customer expectations, and changing market dynamics continually shape the industry. 3PL providers must stay abreast of these trends and adapt their strategies to remain competitive and meet the evolving needs of their clients.

Regional Analysis

The South African market for 3PL services is regionally diverse, with key logistics hubs located in major cities such as Johannesburg, Cape Town, and Durban. These regions serve as key nodes for transportation and warehousing activities, facilitating efficient supply chain operations. Johannesburg, as the economic hub of the country, witnesses significant logistics activity due to its central location and connectivity to major transport networks.

Competitive Landscape

Leading Companies in the South Africa Third-Party Logistics (3PL) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The South Africa Third-Party Logistics (3PL) market can be segmented based on service type, end-user industry, and mode of transportation. The service types include transportation, warehousing, value-added services, and others. The end-user industries encompass retail, manufacturing, healthcare, automotive, and others. The modes of transportation include road, rail, air, and sea.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the South Africa Third-Party Logistics (3PL) market. The lockdown restrictions, supply chain disruptions, and changing consumer behavior significantly affected logistics operations. The pandemic highlighted the need for agile and resilient supply chains, driving companies to reevaluate their logistics strategies and invest in technologies that enable real-time visibility and flexibility.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the South Africa Third-Party Logistics (3PL) market looks promising, driven by factors such as the growing e-commerce sector, advancements in technology, and the increasing focus on sustainable logistics practices. As businesses recognize the benefits of outsourcing logistics functions, the demand for 3PL services is expected to continue to rise. To stay competitive, 3PL providers should adapt to changing market dynamics, invest in technology, and offer innovative solutions that cater to the evolving needs of their clients.

Conclusion

The South Africa Third-Party Logistics (3PL) market is experiencing significant growth, driven by the need for efficient and cost-effective logistics solutions. The market is characterized by intense competition, technological advancements, and a focus on sustainability. As businesses continue to outsource logistics functions and demand specialized expertise, 3PL providers must adapt to emerging trends, leverage advanced technologies, and offer comprehensive solutions to remain competitive in the evolving market landscape. With the right strategies, partnerships, and investments, the South Africa 3PL market holds immense potential for growth and success in the coming years.

What is Third-Party Logistics?

Third-Party Logistics (3PL) refers to the outsourcing of logistics and supply chain management functions to a specialized service provider. This can include transportation, warehousing, and distribution services, allowing businesses to focus on their core operations.

Who are the key players in the South Africa Third-Party Logistics (3PL) Market?

Key players in the South Africa Third-Party Logistics (3PL) Market include Imperial Logistics, Bidvest Panalpina Logistics, and DHL Supply Chain, among others. These companies provide a range of services including freight forwarding, warehousing, and supply chain management.

What are the growth factors driving the South Africa Third-Party Logistics (3PL) Market?

The growth of the South Africa Third-Party Logistics (3PL) Market is driven by increasing e-commerce activities, the need for cost-effective supply chain solutions, and the demand for improved logistics efficiency. Additionally, the rise in consumer expectations for faster delivery times is also a significant factor.

What challenges does the South Africa Third-Party Logistics (3PL) Market face?

The South Africa Third-Party Logistics (3PL) Market faces challenges such as infrastructure limitations, regulatory hurdles, and fluctuating fuel prices. These factors can impact operational efficiency and service delivery in the logistics sector.

What opportunities exist in the South Africa Third-Party Logistics (3PL) Market?

Opportunities in the South Africa Third-Party Logistics (3PL) Market include the expansion of e-commerce, advancements in technology such as automation and AI, and the growing demand for sustainable logistics solutions. These trends can lead to innovative service offerings and improved customer satisfaction.

What trends are shaping the South Africa Third-Party Logistics (3PL) Market?

Trends shaping the South Africa Third-Party Logistics (3PL) Market include the increasing adoption of digital technologies, the focus on sustainability, and the integration of advanced analytics for better decision-making. These trends are transforming how logistics services are delivered and managed.

South Africa Third-Party Logistics (3PL) Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Value-Added Services |

| End User | Retail, Manufacturing, E-commerce, Automotive |

| Delivery Model | Direct Delivery, Cross-Docking, Just-In-Time, Drop Shipping |

| Technology | Warehouse Management Systems, Transportation Management Systems, IoT Solutions, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the South Africa Third-Party Logistics (3PL) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at