444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

South Africa’s data center water consumption market represents a critical intersection of technological advancement and environmental sustainability. The region’s growing digital infrastructure demands are driving unprecedented focus on water usage optimization within data center operations. As cloud computing adoption accelerates across the continent, South African data centers are experiencing significant growth in cooling system requirements, making water consumption studies increasingly vital for operational efficiency.

Market dynamics indicate that South Africa’s data center sector is witnessing substantial expansion, with water consumption analysis becoming a cornerstone of sustainable operations. The country’s unique climate conditions and water scarcity challenges create a compelling need for comprehensive water usage monitoring and optimization strategies. Data centers in major metropolitan areas including Johannesburg, Cape Town, and Durban are implementing advanced water management systems to address both operational efficiency and environmental compliance requirements.

Industry stakeholders are increasingly recognizing that effective water consumption management directly impacts operational costs and environmental sustainability. The market encompasses various technologies including evaporative cooling systems, closed-loop cooling solutions, and advanced monitoring platforms. With data center operators facing growing pressure to reduce their environmental footprint, water consumption studies are becoming integral to strategic planning and regulatory compliance initiatives across South Africa’s expanding digital infrastructure landscape.

The South Africa study of data center water consumption market refers to the comprehensive analysis and monitoring of water usage patterns, optimization technologies, and management solutions specifically designed for data center cooling and operational systems within the South African market. This specialized sector encompasses the tools, technologies, and services that enable data center operators to measure, analyze, and optimize their water consumption for enhanced operational efficiency and environmental sustainability.

Water consumption studies in this context involve detailed assessment of cooling system efficiency, evaporation rates, water recycling capabilities, and overall resource utilization patterns. The market includes various stakeholders such as data center operators, cooling system manufacturers, environmental monitoring solution providers, and regulatory compliance specialists who work together to develop comprehensive water management strategies.

Key components of this market include advanced metering infrastructure, real-time monitoring systems, predictive analytics platforms, and water treatment technologies. These solutions enable data centers to achieve optimal power usage effectiveness while minimizing their water footprint through innovative cooling approaches and resource management practices.

South Africa’s data center water consumption market is experiencing transformative growth driven by increasing digitalization and environmental awareness. The market encompasses comprehensive solutions for monitoring, analyzing, and optimizing water usage across the country’s expanding data center infrastructure. Key market drivers include stringent environmental regulations, rising operational costs, and growing demand for sustainable data center operations.

Market participants are focusing on innovative cooling technologies and advanced monitoring systems to address water scarcity challenges while maintaining optimal operational performance. The sector benefits from strong government support for sustainable technology adoption and increasing private sector investment in green data center initiatives. Major metropolitan areas are witnessing significant deployment of water-efficient cooling systems and comprehensive consumption monitoring platforms.

Technological advancement remains a primary growth catalyst, with artificial intelligence and machine learning integration enabling predictive water management and automated optimization processes. The market demonstrates strong potential for continued expansion as data center operators increasingly prioritize environmental sustainability alongside operational efficiency. Industry collaboration between technology providers and data center operators is fostering innovative solutions that address both immediate operational needs and long-term sustainability objectives.

Critical market insights reveal several fundamental trends shaping South Africa’s data center water consumption landscape:

Primary market drivers propelling South Africa’s data center water consumption market include escalating environmental regulations and growing awareness of sustainable operations. Government initiatives promoting water conservation are creating mandatory requirements for comprehensive consumption monitoring and reporting across all industrial sectors, including data centers.

Operational cost pressures represent another significant driver as data center operators seek to optimize their resource utilization and reduce overall operational expenses. Water consumption studies enable facilities to identify inefficiencies and implement targeted improvements that deliver measurable cost savings while enhancing system performance.

Technological advancement continues driving market growth through the development of sophisticated monitoring and optimization platforms. Integration of artificial intelligence and machine learning capabilities enables predictive maintenance and automated optimization processes that significantly improve cooling system efficiency and reduce water waste.

Climate change concerns and increasing frequency of drought conditions in South Africa are intensifying focus on water conservation across all industries. Data center operators are proactively implementing comprehensive water management strategies to ensure operational continuity while demonstrating environmental responsibility to stakeholders and regulatory authorities.

Significant market restraints include high initial implementation costs associated with advanced water monitoring and optimization systems. Many data center operators, particularly smaller facilities, face budget constraints that limit their ability to invest in comprehensive water consumption analysis platforms and associated infrastructure upgrades.

Technical complexity presents another challenge as implementing sophisticated water management systems requires specialized expertise and ongoing maintenance support. The shortage of qualified technicians and engineers familiar with advanced cooling system optimization creates implementation barriers and increases operational complexity for many facilities.

Infrastructure limitations in certain regions of South Africa constrain market growth, particularly in areas with limited access to reliable water supplies or inadequate utility infrastructure. These constraints affect the feasibility of implementing certain water-intensive cooling technologies and limit optimization opportunities.

Regulatory uncertainty regarding future water usage restrictions and compliance requirements creates hesitation among some market participants. Data center operators may delay investment decisions while awaiting clearer guidance on long-term environmental regulations and potential changes to water allocation policies.

Substantial market opportunities exist in developing integrated solutions that combine water consumption monitoring with broader energy management platforms. The convergence of sustainability initiatives creates demand for comprehensive environmental monitoring systems that address multiple resource optimization objectives simultaneously.

Government incentive programs supporting sustainable technology adoption present significant opportunities for market expansion. Various provincial and national initiatives offer financial support for data centers implementing water conservation technologies, creating favorable conditions for increased market penetration.

International expansion opportunities are emerging as South African companies develop expertise in water-scarce environment solutions. This knowledge can be leveraged to serve similar markets across Africa and other regions facing comparable water availability challenges.

Innovation partnerships between local universities, research institutions, and private companies are creating opportunities for breakthrough technology development. These collaborations focus on developing climate-specific solutions that address unique South African environmental conditions while advancing global best practices in data center water management.

Market dynamics in South Africa’s data center water consumption sector are characterized by rapid technological evolution and increasing regulatory pressure. The interplay between environmental sustainability requirements and operational efficiency demands is driving continuous innovation in monitoring and optimization technologies.

Competitive dynamics are intensifying as both local and international technology providers compete to deliver comprehensive water management solutions. Market participants are differentiating through specialized expertise in climate-specific applications and integrated platform capabilities that address multiple operational requirements.

Supply chain dynamics are evolving to support increased demand for sophisticated monitoring equipment and cooling system components. Local manufacturing capabilities are expanding to reduce import dependencies and provide more responsive support for customized solution requirements.

Customer dynamics reflect growing sophistication in water management requirements and increasing emphasis on measurable sustainability outcomes. Data center operators are demanding comprehensive reporting capabilities and predictive analytics that enable proactive resource optimization and regulatory compliance management.

Comprehensive research methodology employed in analyzing South Africa’s data center water consumption market incorporates multiple data collection and analysis approaches. Primary research involves direct engagement with industry stakeholders including data center operators, technology providers, regulatory authorities, and environmental consultants to gather firsthand insights into market trends and challenges.

Secondary research encompasses detailed analysis of government publications, industry reports, academic studies, and regulatory documentation to establish comprehensive understanding of market dynamics and regulatory frameworks. This approach ensures thorough coverage of both technical specifications and policy implications affecting market development.

Quantitative analysis involves statistical examination of water consumption patterns, efficiency metrics, and cost-benefit relationships across different data center configurations and cooling technologies. This analysis provides measurable insights into performance optimization opportunities and return on investment calculations.

Qualitative assessment includes expert interviews, case study development, and trend analysis to identify emerging opportunities and potential market disruptions. According to MarkWide Research analysis, this multi-faceted approach ensures comprehensive understanding of both current market conditions and future development trajectories.

Gauteng Province dominates South Africa’s data center water consumption market, accounting for approximately 45% of total market activity. The region’s concentration of major data centers in Johannesburg and Pretoria drives significant demand for advanced water management solutions. Local facilities are implementing sophisticated monitoring systems to address both operational efficiency and environmental compliance requirements.

Western Cape represents the second-largest regional market, with Cape Town serving as a major hub for data center operations. The province’s recent water crisis has intensified focus on consumption optimization and alternative cooling technologies. Regional market share stands at approximately 28% of national activity, with strong emphasis on drought-resistant cooling solutions.

KwaZulu-Natal is experiencing rapid growth in data center water consumption studies, particularly in the Durban metropolitan area. The region benefits from favorable climate conditions and growing technology sector presence, contributing approximately 18% of market activity. Local facilities are pioneering innovative seawater cooling applications and hybrid cooling system implementations.

Other provinces collectively represent the remaining market share, with emerging opportunities in Eastern Cape and Free State regions. These areas are witnessing increased data center development driven by cost advantages and government incentives for technology infrastructure investment.

Market leadership in South Africa’s data center water consumption sector is distributed among several key categories of providers, each offering specialized expertise and comprehensive solution portfolios.

Technology segmentation within South Africa’s data center water consumption market encompasses several distinct categories:

By Cooling Technology:

By Monitoring Solution:

By Facility Size:

Evaporative cooling systems represent the largest category within South Africa’s data center water consumption market, driven by the technology’s effectiveness in the country’s climate conditions. These systems demonstrate exceptional energy efficiency but require comprehensive water management to optimize consumption and maintain performance standards.

Real-time monitoring solutions are experiencing rapid adoption as data center operators seek immediate visibility into their water consumption patterns. These platforms enable proactive optimization and rapid response to efficiency degradation or system anomalies, contributing to overall operational excellence.

Hybrid cooling approaches are gaining traction as facilities seek to balance water consumption with energy efficiency across varying operational conditions. These systems adapt to seasonal variations and load fluctuations while maintaining optimal resource utilization throughout different operating scenarios.

Compliance reporting tools represent a growing category as regulatory requirements become more stringent and comprehensive. Data centers require sophisticated platforms that automate documentation processes while providing detailed analytics for continuous improvement initiatives and stakeholder reporting requirements.

Data center operators benefit significantly from comprehensive water consumption studies through reduced operational costs and enhanced environmental compliance. Advanced monitoring systems enable predictive maintenance scheduling and optimization of cooling system performance, resulting in measurable efficiency improvements and extended equipment lifecycles.

Technology providers gain competitive advantages through specialized expertise in water management solutions and comprehensive platform capabilities. Market participation enables development of innovative technologies specifically designed for South African climate conditions while building valuable customer relationships and market presence.

Environmental consultants benefit from growing demand for specialized expertise in data center sustainability and regulatory compliance. The market provides opportunities for value-added services including efficiency audits, optimization recommendations, and ongoing monitoring support for facility operators.

Government stakeholders achieve environmental policy objectives through improved industrial water conservation and enhanced regulatory compliance across the data center sector. Comprehensive consumption studies support evidence-based policy development and effective resource allocation for water conservation initiatives.

Utility companies benefit from improved demand forecasting and more efficient resource allocation through detailed consumption data and predictive analytics. Enhanced visibility into data center water usage patterns enables infrastructure planning optimization and improved service delivery across industrial customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming South Africa’s data center water consumption market. Advanced machine learning algorithms enable predictive optimization and automated system adjustments that significantly improve efficiency while reducing manual intervention requirements.

Sustainability reporting automation is gaining momentum as data centers face increasing pressure for transparent environmental performance documentation. Automated platforms provide comprehensive analytics and standardized reporting formats that streamline compliance processes and stakeholder communication.

Edge computing expansion is driving demand for distributed water management solutions that can operate effectively in smaller, unmanned facilities. These applications require simplified monitoring approaches while maintaining comprehensive visibility and optimization capabilities.

Circular water economy principles are influencing solution development with increased focus on water recycling and reuse applications. Data centers are implementing closed-loop systems that minimize fresh water consumption while maintaining optimal cooling performance through advanced treatment and recycling technologies.

MWR data indicates that integration of renewable energy sources with water management systems is creating opportunities for comprehensive sustainability solutions that address multiple environmental objectives simultaneously.

Recent industry developments highlight accelerating innovation and market maturation within South Africa’s data center water consumption sector. Major technology providers are establishing local partnerships to deliver customized solutions that address specific regional climate and infrastructure challenges.

Government policy initiatives are creating new requirements for comprehensive water consumption monitoring and reporting across industrial facilities. These regulations are driving increased adoption of advanced monitoring platforms and creating standardized approaches to consumption optimization and environmental compliance.

Research and development investments are yielding breakthrough technologies in water-efficient cooling systems and predictive optimization platforms. Local universities and research institutions are collaborating with industry partners to develop climate-specific solutions that maximize efficiency in South African operating conditions.

Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to expand their solution portfolios and market presence. These developments are creating more comprehensive integrated platforms that address multiple aspects of data center environmental management and operational optimization.

Market participants should prioritize development of integrated solutions that combine water consumption monitoring with broader environmental management capabilities. This approach addresses growing demand for comprehensive sustainability platforms while creating competitive differentiation through expanded value propositions.

Investment focus should emphasize artificial intelligence and machine learning capabilities that enable predictive optimization and automated system management. These technologies provide measurable operational improvements while reducing the complexity and cost of ongoing system management for data center operators.

Partnership strategies should include collaboration with local system integrators and service providers to ensure effective solution deployment and ongoing support. Strong local partnerships enable responsive customer service and customization capabilities that address specific regional requirements and operating conditions.

Regulatory engagement is essential for staying ahead of evolving compliance requirements and contributing to policy development processes. Active participation in industry associations and regulatory discussions enables companies to influence standards development while ensuring their solutions meet emerging requirements.

MarkWide Research recommends focusing on scalable solutions that can adapt to varying facility sizes and operational requirements, enabling broader market penetration across different data center categories and customer segments.

Future market prospects for South Africa’s data center water consumption sector remain highly positive, driven by continued digital infrastructure expansion and intensifying environmental regulations. The market is projected to experience sustained growth as data center operators increasingly prioritize sustainability alongside operational efficiency.

Technological advancement will continue driving market evolution through development of more sophisticated monitoring and optimization platforms. Integration of artificial intelligence, machine learning, and IoT technologies will enable autonomous optimization capabilities that significantly reduce operational complexity while maximizing resource efficiency.

Regulatory development is expected to create additional market opportunities through expanded monitoring requirements and stricter environmental compliance standards. These changes will drive increased adoption of comprehensive management platforms that automate compliance processes while providing detailed performance analytics.

Market expansion opportunities will emerge through development of solutions applicable to other industrial sectors facing similar water management challenges. The expertise developed in data center applications can be leveraged to serve broader industrial markets while creating additional revenue streams and market diversification opportunities.

International growth potential remains significant as South African companies develop specialized expertise in water-scarce environment solutions that can be applied to similar markets across Africa and other regions facing comparable environmental challenges and infrastructure constraints.

South Africa’s data center water consumption market represents a dynamic and rapidly evolving sector driven by the intersection of technological advancement and environmental sustainability requirements. The market demonstrates strong growth potential supported by increasing digitalization, stringent environmental regulations, and growing awareness of resource optimization opportunities among data center operators.

Key success factors include technological innovation, comprehensive solution integration, and strong local partnerships that enable effective deployment and ongoing support. Market participants who focus on developing climate-specific solutions while maintaining scalability across different facility types and operational requirements will be best positioned for long-term success.

Future market development will be characterized by continued technological advancement, expanding regulatory requirements, and growing emphasis on measurable sustainability outcomes. The convergence of artificial intelligence, IoT technologies, and environmental management platforms will create comprehensive solutions that address multiple operational objectives while delivering measurable value to data center operators and environmental stakeholders alike.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and equipment.

What are the key players in the South Africa Study Of Data Center Water Consumption Market?

Key players in the South Africa Study Of Data Center Water Consumption Market include companies like Teraco, Dimension Data, and Vodacom, which are involved in data center operations and management, among others.

What are the growth factors driving the South Africa Study Of Data Center Water Consumption Market?

The growth of the South Africa Study Of Data Center Water Consumption Market is driven by the increasing demand for cloud services, the expansion of digital infrastructure, and the need for efficient cooling solutions in data centers.

What challenges does the South Africa Study Of Data Center Water Consumption Market face?

Challenges in the South Africa Study Of Data Center Water Consumption Market include water scarcity issues, regulatory pressures regarding water usage, and the high costs associated with implementing sustainable water management practices.

What opportunities exist in the South Africa Study Of Data Center Water Consumption Market?

Opportunities in the South Africa Study Of Data Center Water Consumption Market include the adoption of innovative cooling technologies, investment in water recycling systems, and the potential for partnerships with local governments to enhance sustainability efforts.

What trends are shaping the South Africa Study Of Data Center Water Consumption Market?

Trends in the South Africa Study Of Data Center Water Consumption Market include the increasing focus on sustainability, the integration of AI for optimizing water usage, and the shift towards hybrid cooling solutions that combine traditional and innovative methods.

South Africa Study Of Data Center Water Consumption Market

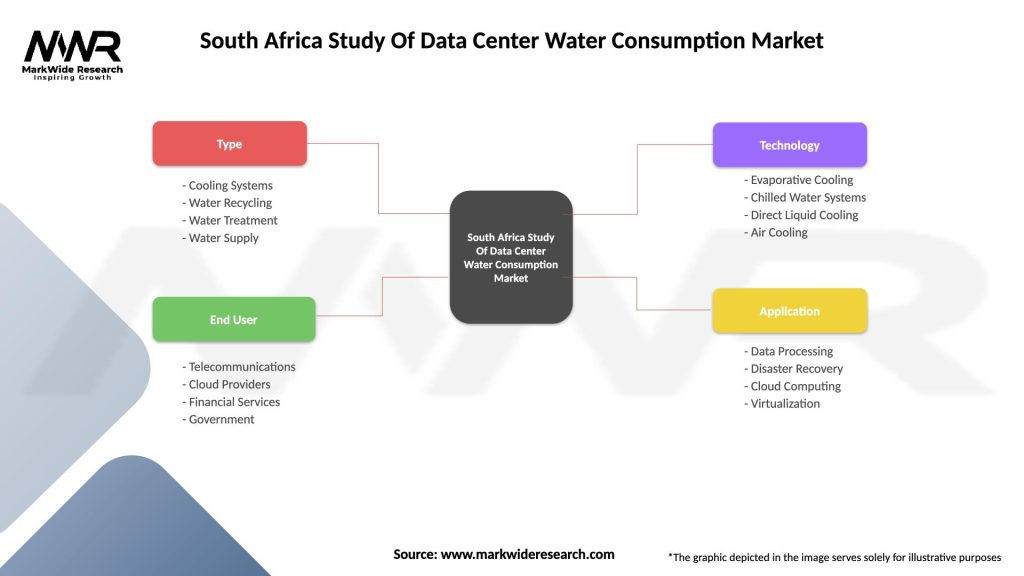

| Segmentation Details | Description |

|---|---|

| Type | Cooling Systems, Water Recycling, Water Treatment, Water Supply |

| End User | Telecommunications, Cloud Providers, Financial Services, Government |

| Technology | Evaporative Cooling, Chilled Water Systems, Direct Liquid Cooling, Air Cooling |

| Application | Data Processing, Disaster Recovery, Cloud Computing, Virtualization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at