444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa rail freight transport market represents a critical component of the nation’s logistics infrastructure, serving as the backbone for moving bulk commodities, manufactured goods, and raw materials across the country. Rail freight transport in South Africa has evolved significantly over the past decade, driven by government initiatives to revitalize the railway network and increasing demand from mining, agricultural, and manufacturing sectors.

Market dynamics indicate substantial growth potential, with the sector experiencing a 6.2% annual growth rate in freight volumes over recent years. The market encompasses various freight categories including coal, iron ore, agricultural products, containers, and general freight, with coal transportation accounting for approximately 68% of total rail freight volumes. This dominance reflects South Africa’s position as a major coal exporter and the railway system’s historical development around mining operations.

Infrastructure modernization efforts have gained momentum, with significant investments in track rehabilitation, locomotive procurement, and digital technologies. The market benefits from South Africa’s strategic geographic position, connecting landlocked neighboring countries to major ports including Durban, Cape Town, and Port Elizabeth. Cross-border freight movements contribute approximately 15% of total rail freight revenue, highlighting the international dimension of the market.

Transnet Freight Rail dominates the market as the primary rail freight operator, managing the vast majority of the country’s rail freight infrastructure and operations. However, recent policy developments have opened opportunities for private sector participation, creating new competitive dynamics and investment prospects in the rail freight transport sector.

The South Africa rail freight transport market refers to the comprehensive ecosystem of railway-based cargo transportation services, infrastructure, and related logistics operations within South African borders and extending to neighboring countries. This market encompasses the movement of various commodities including bulk materials, containerized goods, and specialized freight using dedicated freight rail networks, locomotives, and rolling stock.

Rail freight transport involves the systematic movement of goods via railway systems, utilizing specialized freight cars, locomotives, and supporting infrastructure such as terminals, marshalling yards, and maintenance facilities. The market includes both domestic freight movements within South Africa and international transit cargo destined for regional markets in Southern Africa.

Key components of this market include freight rail operators, infrastructure owners, locomotive and rolling stock manufacturers, maintenance service providers, and logistics companies that integrate rail transport into broader supply chain solutions. The market also encompasses supporting services such as cargo handling, warehousing, and intermodal transfer facilities that connect rail networks with road, sea, and air transport modes.

South Africa’s rail freight transport market stands at a pivotal juncture, characterized by significant infrastructure challenges and substantial modernization opportunities. The market has demonstrated resilience despite operational difficulties, maintaining its position as a crucial component of the national logistics network. Government initiatives to revitalize the rail sector have created renewed optimism and attracted both domestic and international investment interest.

Market performance has been influenced by various factors including infrastructure constraints, operational efficiency challenges, and competition from road transport. However, recent policy reforms allowing private sector participation have introduced new dynamics, with several companies expressing interest in operating specific rail corridors and providing specialized freight services.

Commodity transportation remains the market’s primary driver, with mining-related freight accounting for the largest volume share. The agricultural sector represents a growing opportunity, particularly for grain and other bulk agricultural products requiring efficient long-distance transportation. Container freight has shown promising growth, supported by increasing trade volumes and port connectivity improvements.

Future prospects appear positive, with projected growth rates of 8.5% annually over the next five years, driven by infrastructure investments, operational improvements, and expanding regional trade relationships. The market is expected to benefit from increased private sector involvement and technological modernization initiatives.

Strategic insights reveal several critical factors shaping the South Africa rail freight transport market landscape:

Market intelligence indicates that operational reliability improvements have resulted in 23% better on-time performance compared to previous years. This enhancement has contributed to increased customer confidence and freight volume growth across multiple commodity categories.

Primary market drivers propelling the South Africa rail freight transport sector include robust demand from key industries and supportive government policies. The mining sector continues to generate substantial freight volumes, with coal, iron ore, and other mineral exports requiring efficient rail transportation to reach port facilities. This demand provides a stable foundation for rail freight operations and justifies continued infrastructure investments.

Government initiatives have emerged as significant catalysts for market growth. The National Development Plan emphasizes rail transport development as crucial for economic growth and job creation. Infrastructure investment programs totaling substantial amounts have been allocated for rail network rehabilitation and expansion, creating opportunities for both domestic and international companies.

Environmental considerations increasingly favor rail transport over road alternatives. Rail freight generates significantly lower carbon emissions per ton-kilometer compared to trucking, aligning with South Africa’s climate commitments and corporate sustainability goals. This environmental advantage has prompted several large shippers to shift freight volumes from road to rail transport.

Regional trade expansion within the Southern African Development Community creates additional demand for cross-border rail freight services. Countries like Botswana, Zimbabwe, and Zambia rely on South African rail networks to access seaports, generating consistent transit freight volumes and revenue streams for rail operators.

Cost competitiveness for long-distance bulk freight transportation makes rail an attractive option for shippers seeking to reduce logistics costs. Rail transport typically offers 30-40% cost savings compared to road transport for distances exceeding 500 kilometers, particularly for bulk commodities and containerized goods.

Infrastructure constraints represent the most significant challenge facing the South Africa rail freight transport market. Years of underinvestment have resulted in deteriorated track conditions, aging signaling systems, and insufficient maintenance facilities. These issues contribute to reduced operational speeds, increased derailments, and service reliability problems that discourage potential customers from choosing rail transport.

Operational inefficiencies within the dominant rail operator have created service quality concerns among freight customers. Issues including locomotive availability, crew scheduling problems, and maintenance backlogs have resulted in delayed deliveries and reduced customer satisfaction. These operational challenges have prompted some shippers to shift freight volumes to road transport alternatives.

Limited network flexibility constrains the market’s ability to serve diverse customer needs. The rail network’s design, primarily focused on mining corridors, limits access to certain industrial areas and agricultural regions. This geographic limitation reduces the market’s potential customer base and freight volume opportunities.

High capital requirements for infrastructure development and locomotive procurement create barriers for new market entrants. The substantial investments needed for rail operations, combined with long payback periods, limit private sector participation and slow market development. Regulatory complexities surrounding rail operations and safety requirements add additional barriers for potential operators.

Competition from road transport remains intense, particularly for shorter distances and time-sensitive freight. Road transport offers greater flexibility, door-to-door service, and faster transit times for many freight categories, making it challenging for rail operators to compete effectively in certain market segments.

Private sector participation presents the most significant opportunity for market transformation and growth. Recent policy changes allowing private operators to access rail infrastructure have attracted interest from both domestic and international companies. This development could introduce competition, improve service quality, and accelerate infrastructure modernization through private investment.

Agricultural freight expansion offers substantial growth potential as South Africa’s agricultural sector modernizes and export volumes increase. Rail transport is particularly well-suited for bulk agricultural products including grains, sugar, and citrus fruits. Dedicated agricultural corridors could capture freight currently moving by road, generating new revenue streams and improving farmer logistics costs.

Container freight growth represents another promising opportunity, driven by increasing international trade and e-commerce expansion. Enhanced rail-port connectivity and improved container handling facilities could attract freight currently using road transport for port access. Intermodal terminals development could facilitate seamless transfers between rail and other transport modes.

Regional integration initiatives within Southern Africa create opportunities for expanded cross-border freight services. Infrastructure development projects connecting South African rail networks with neighboring countries could generate substantial transit freight volumes and position South Africa as a regional logistics hub.

Technology integration offers opportunities to improve operational efficiency and customer service. Digital platforms for freight booking, real-time tracking systems, and predictive maintenance technologies could enhance competitiveness against road transport alternatives. Automation technologies in terminals and yards could reduce operational costs and improve service reliability.

Market dynamics in the South Africa rail freight transport sector reflect complex interactions between infrastructure capabilities, regulatory frameworks, and competitive pressures. The market operates within a challenging environment where operational constraints limit growth potential while policy reforms create new opportunities for development and investment.

Supply-side dynamics are characterized by infrastructure limitations and capacity constraints that restrict the market’s ability to meet growing freight demand. Track capacity bottlenecks, locomotive shortages, and maintenance backlogs create operational challenges that impact service reliability and customer satisfaction. However, ongoing infrastructure investment programs are gradually addressing these constraints.

Demand-side factors include strong underlying freight generation from mining, agriculture, and manufacturing sectors. The market benefits from South Africa’s position as a major commodity exporter and regional trade hub. Seasonal variations in agricultural freight and cyclical patterns in mining exports influence demand patterns and operational planning requirements.

Competitive dynamics have evolved with the introduction of private sector participation opportunities. Traditional monopolistic market structure is gradually transitioning toward a more competitive environment, potentially improving service quality and operational efficiency. Modal competition from road transport remains intense, particularly for shorter distances and time-sensitive freight.

Regulatory dynamics continue to shape market development through policy reforms and infrastructure investment decisions. Government initiatives to revitalize the rail sector have created optimism and attracted investment interest. Safety regulations and environmental standards increasingly influence operational practices and investment priorities.

Research methodology for analyzing the South Africa rail freight transport market employs a comprehensive approach combining primary and secondary research techniques. The methodology ensures accurate data collection, thorough market analysis, and reliable insights into market trends, opportunities, and challenges.

Primary research involves direct engagement with key market participants including rail operators, freight customers, government officials, and industry experts. Structured interviews and surveys provide firsthand insights into operational challenges, market trends, and future expectations. Site visits to rail facilities, ports, and customer locations offer practical understanding of market dynamics and operational realities.

Secondary research encompasses analysis of government publications, industry reports, financial statements, and regulatory documents. This research provides historical data, policy information, and market context essential for comprehensive market understanding. Statistical analysis of freight volumes, operational performance metrics, and economic indicators supports quantitative market assessment.

Data validation processes ensure information accuracy and reliability through cross-referencing multiple sources and expert verification. Market projections and trend analysis utilize established forecasting methodologies adapted to the unique characteristics of the South African rail freight market. Stakeholder feedback sessions validate findings and ensure practical relevance of research conclusions.

Analytical frameworks include competitive analysis, SWOT assessment, and market segmentation studies that provide structured insights into market dynamics and strategic opportunities. The methodology incorporates both quantitative and qualitative analysis techniques to deliver comprehensive market intelligence.

Regional analysis reveals distinct patterns in rail freight transport demand and infrastructure development across South Africa’s provinces. The market demonstrates significant geographic concentration in key industrial and mining regions, with specific corridors dominating freight volumes and revenue generation.

Gauteng Province serves as the primary freight hub, accounting for approximately 35% of total rail freight volumes due to its concentration of manufacturing industries, distribution centers, and intermodal terminals. The province benefits from extensive rail connectivity to major ports and neighboring countries, making it crucial for both domestic and transit freight movements.

KwaZulu-Natal represents another critical region, particularly for port-related freight through Durban harbor. The province handles substantial volumes of coal exports, container freight, and agricultural products. Coal export corridors from Mpumalanga through KwaZulu-Natal to Durban port represent some of the highest-volume rail freight routes in the country.

Mpumalanga Province dominates coal freight generation, with extensive mining operations requiring efficient rail transport to export terminals. The province’s rail infrastructure focuses primarily on coal transportation, though opportunities exist for diversification into other freight categories including agricultural products and general cargo.

Western Cape serves important agricultural and manufacturing freight markets, with rail connections to Cape Town port facilitating exports of wine, fruit, and manufactured goods. The region has shown 12% growth in container rail freight over recent years, reflecting increasing trade volumes and improved port connectivity.

Cross-border corridors connecting South Africa with Botswana, Zimbabwe, and Mozambique generate significant transit freight revenues. These routes handle diverse commodities including copper, chrome, and agricultural products, contributing approximately 18% of total rail freight revenue.

Competitive landscape in the South Africa rail freight transport market has traditionally been dominated by a single major operator, though recent policy changes are introducing new competitive dynamics and market participants.

Market concentration remains high, with the primary operator handling over 85% of total rail freight volumes. However, policy reforms allowing private sector access to rail infrastructure are expected to increase competition and improve service quality. New entrants are focusing on specific corridors, specialized freight services, and niche market segments.

Competitive strategies include infrastructure investment, operational efficiency improvements, technology adoption, and customer service enhancement. Companies are also exploring partnerships and joint ventures to access rail infrastructure and develop integrated logistics solutions.

Service differentiation is becoming increasingly important as competition intensifies. Operators are focusing on reliability, transit times, cargo tracking capabilities, and value-added services to attract and retain customers in an evolving market environment.

Market segmentation analysis reveals distinct freight categories and service types within the South Africa rail freight transport market, each with unique characteristics, growth patterns, and operational requirements.

By Commodity Type:

By Service Type:

By Geographic Route:

Coal transportation dominates the rail freight market, benefiting from South Africa’s position as a major coal exporter. This category requires specialized rolling stock, dedicated corridors, and efficient port interfaces. Operational efficiency in coal transport has improved by 15% through infrastructure upgrades and operational optimization programs.

Container freight represents the fastest-growing segment, driven by increasing international trade and e-commerce expansion. This category requires intermodal terminals, specialized container handling equipment, and integrated logistics services. Container volumes have shown consistent growth, with rail modal share increasing in key corridors.

Agricultural freight offers significant expansion opportunities, particularly for grain transportation from farming regions to ports and domestic markets. This category is seasonal in nature and requires flexible capacity allocation and specialized rolling stock for different agricultural products.

General freight includes manufactured goods, automotive products, and consumer goods requiring reliable service and competitive transit times. This category faces intense competition from road transport and requires service quality improvements to capture market share.

Cross-border freight serves regional trade relationships and transit cargo movements. This category requires coordination with neighboring countries’ rail systems and customs procedures, offering stable revenue streams from established trade relationships.

Intermodal services combine rail transport with road and sea modes, providing comprehensive logistics solutions. This category is growing as customers seek integrated transport services and supply chain optimization.

Industry participants in the South Africa rail freight transport market enjoy several strategic advantages and benefits that support business growth and operational efficiency.

For Rail Operators:

For Freight Customers:

For Government and Society:

Investment opportunities in infrastructure, technology, and operations provide attractive returns for both domestic and international investors seeking exposure to South Africa’s logistics sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping the South Africa rail freight transport market through implementation of advanced technologies for fleet management, cargo tracking, and predictive maintenance. Internet of Things sensors and data analytics are improving operational efficiency and reducing maintenance costs, while digital platforms enhance customer service and freight booking processes.

Sustainability initiatives are gaining prominence as environmental regulations tighten and corporate sustainability commitments increase. Rail operators are investing in energy-efficient locomotives, renewable energy systems, and carbon reduction programs. Green logistics trends favor rail transport over road alternatives, creating market opportunities for environmentally conscious freight services.

Intermodal integration is becoming increasingly important as customers seek seamless transport solutions combining rail, road, and maritime modes. Development of intermodal terminals and integrated logistics services addresses customer demands for comprehensive supply chain solutions and door-to-door freight services.

Private sector participation is transforming market dynamics through introduction of competition and private investment in infrastructure and operations. This trend is expected to improve service quality, operational efficiency, and customer satisfaction while accelerating infrastructure modernization programs.

Regional integration within Southern Africa is creating opportunities for expanded cross-border freight services and transit cargo movements. Infrastructure development projects and trade facilitation initiatives support this trend, positioning South Africa as a regional logistics hub.

Automation technologies are being implemented in terminals, yards, and maintenance facilities to improve operational efficiency and reduce labor costs. Automated systems for cargo handling, train scheduling, and equipment maintenance are enhancing productivity and service reliability.

Infrastructure modernization programs have accelerated with substantial government investment in track rehabilitation, signaling upgrades, and terminal improvements. These developments address capacity constraints and operational efficiency challenges that have limited market growth in recent years.

Policy reforms allowing private sector access to rail infrastructure represent a fundamental shift in market structure. MarkWide Research analysis indicates these changes could attract significant private investment and introduce competitive dynamics that improve service quality and operational efficiency.

Locomotive procurement programs are addressing fleet shortages and aging equipment issues that have constrained operational capacity. New locomotive acquisitions and refurbishment programs are improving service reliability and reducing maintenance costs.

Technology implementations include deployment of modern signaling systems, digital communication networks, and automated cargo handling equipment. These technological advances enhance operational safety, efficiency, and customer service capabilities.

Partnership agreements between rail operators and private companies are creating new service offerings and market opportunities. These collaborations combine public infrastructure with private sector expertise and investment to improve freight services.

Regional connectivity projects are enhancing cross-border rail links and facilitating increased trade with neighboring countries. These developments support South Africa’s position as a regional logistics hub and create new revenue opportunities for rail freight operators.

Environmental initiatives include adoption of cleaner technologies, energy efficiency programs, and carbon reduction strategies that align with sustainability goals and regulatory requirements.

Infrastructure investment should remain the top priority for market development, with focus on track rehabilitation, signaling modernization, and terminal capacity expansion. Strategic investments in bottleneck sections and high-traffic corridors could deliver immediate operational improvements and customer service enhancements.

Private sector engagement should be accelerated through clear regulatory frameworks and attractive investment terms. Creating transparent processes for private operators to access rail infrastructure could stimulate competition and improve service quality while reducing government investment burdens.

Technology adoption requires coordinated implementation across operations, maintenance, and customer service functions. Digital platforms for freight booking, tracking, and customer communication could significantly improve competitiveness against road transport alternatives.

Service diversification beyond traditional bulk commodities could capture new market segments and reduce dependence on cyclical mining freight. Developing capabilities in container transport, agricultural freight, and general cargo could provide more stable revenue streams.

Regional integration initiatives should be pursued to capitalize on Southern Africa’s trade growth and transit freight opportunities. Coordinating with neighboring countries on infrastructure development and operational procedures could generate substantial cross-border freight volumes.

Skills development programs are essential to address technical expertise gaps and support sector modernization. Training programs for locomotive operators, maintenance technicians, and logistics professionals could improve operational efficiency and safety performance.

Customer relationship management should be enhanced through improved service reliability, communication, and value-added services. Building stronger customer partnerships could increase freight volumes and reduce modal competition from road transport.

Future prospects for the South Africa rail freight transport market appear increasingly positive, driven by infrastructure investments, policy reforms, and growing freight demand from key sectors. Market projections indicate sustained growth over the next decade, with annual freight volume increases of 7.2% expected as operational improvements and capacity expansions take effect.

Infrastructure development will continue as a primary focus, with ongoing rehabilitation programs addressing capacity constraints and service reliability issues. Completion of major infrastructure projects is expected to significantly improve operational efficiency and customer satisfaction, supporting market growth and competitiveness.

Private sector participation is anticipated to increase substantially as regulatory frameworks mature and investment opportunities become clearer. MWR analysis suggests that private operators could capture 25% market share within five years, introducing competition and innovation that benefits the entire sector.

Technology integration will accelerate as digital solutions prove their value in improving operations and customer service. Advanced analytics, automation, and digital platforms are expected to become standard features of rail freight operations, enhancing efficiency and competitiveness.

Regional trade expansion within Southern Africa will create additional growth opportunities for cross-border freight services. Infrastructure connectivity projects and trade facilitation initiatives support this trend, positioning South Africa as the region’s primary logistics hub.

Sustainability requirements will increasingly favor rail transport over road alternatives, as environmental regulations tighten and corporate sustainability commitments expand. This trend could accelerate modal shift and support long-term market growth.

Market diversification beyond traditional bulk commodities is expected to reduce cyclical volatility and create more stable revenue streams. Growth in container freight, agricultural products, and general cargo will broaden the market base and improve resilience.

The South Africa rail freight transport market stands at a transformational juncture, with significant opportunities emerging from infrastructure modernization, policy reforms, and growing freight demand. Despite historical challenges including infrastructure constraints and operational inefficiencies, recent developments indicate a positive trajectory for market growth and development.

Key success factors for market participants include strategic infrastructure investments, technology adoption, and customer service improvements that enhance competitiveness against road transport alternatives. The introduction of private sector participation creates new competitive dynamics that could accelerate innovation and operational efficiency improvements.

Market fundamentals remain strong, supported by robust freight demand from mining, agricultural, and manufacturing sectors, combined with South Africa’s strategic position as a regional trade hub. Government commitment to rail sector development and substantial infrastructure investment programs provide a supportive policy environment for sustained growth.

Future success will depend on effective execution of modernization programs, successful integration of private sector capabilities, and continued focus on operational excellence and customer satisfaction. The market’s evolution toward greater competition and technological sophistication positions it well for capturing emerging opportunities in regional trade and sustainable logistics solutions.

What is Rail Freight Transport?

Rail freight transport refers to the movement of goods and cargo via trains across rail networks. It plays a crucial role in logistics, offering efficient transportation for bulk commodities, manufactured goods, and raw materials.

What are the key players in the South Africa Rail Freight Transport Market?

Key players in the South Africa Rail Freight Transport Market include Transnet Freight Rail, Spoornet, and Grindrod Limited, among others. These companies are involved in various aspects of rail logistics, including freight handling and infrastructure development.

What are the main drivers of the South Africa Rail Freight Transport Market?

The main drivers of the South Africa Rail Freight Transport Market include the growing demand for efficient logistics solutions, increased industrial activity, and the need for sustainable transport options. Additionally, government initiatives to improve rail infrastructure are also contributing to market growth.

What challenges does the South Africa Rail Freight Transport Market face?

The South Africa Rail Freight Transport Market faces challenges such as aging infrastructure, competition from road transport, and regulatory hurdles. These factors can impact the efficiency and reliability of rail freight services.

What opportunities exist in the South Africa Rail Freight Transport Market?

Opportunities in the South Africa Rail Freight Transport Market include the potential for technological advancements in rail operations, expansion of intermodal transport solutions, and increased investment in rail infrastructure. These factors can enhance service offerings and operational efficiency.

What trends are shaping the South Africa Rail Freight Transport Market?

Trends shaping the South Africa Rail Freight Transport Market include the adoption of digital technologies for tracking and managing freight, a focus on sustainability through reduced carbon emissions, and the integration of rail with other transport modes. These trends are driving innovation and improving service delivery.

South Africa Rail Freight Transport Market

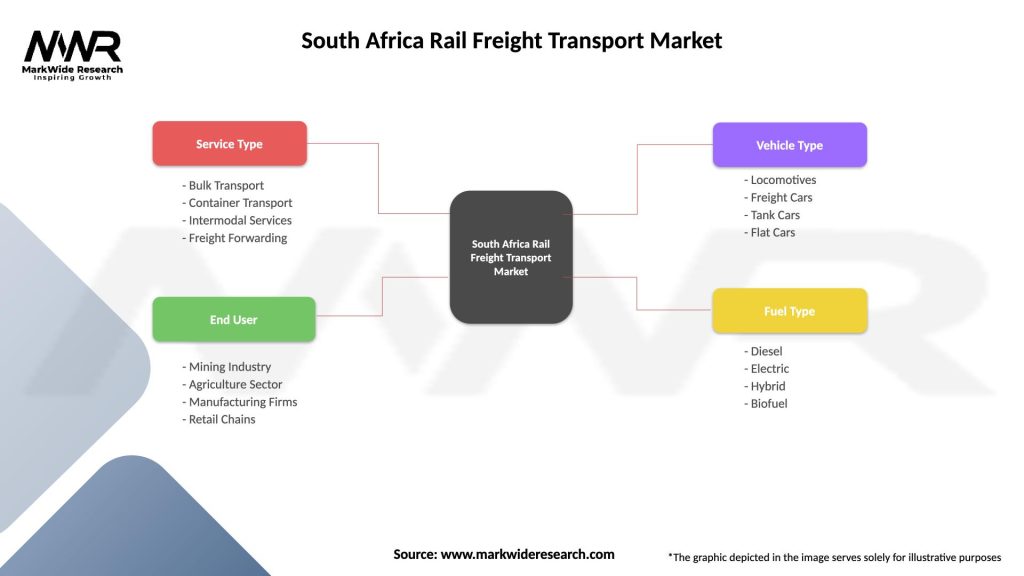

| Segmentation Details | Description |

|---|---|

| Service Type | Bulk Transport, Container Transport, Intermodal Services, Freight Forwarding |

| End User | Mining Industry, Agriculture Sector, Manufacturing Firms, Retail Chains |

| Vehicle Type | Locomotives, Freight Cars, Tank Cars, Flat Cars |

| Fuel Type | Diesel, Electric, Hybrid, Biofuel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Rail Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at