444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa prefabricated buildings market represents a transformative sector within the country’s construction industry, experiencing remarkable growth driven by urbanization demands, housing shortages, and infrastructure development initiatives. Prefabricated construction has emerged as a viable solution to address South Africa’s pressing need for affordable housing, commercial spaces, and industrial facilities while reducing construction timelines and costs.

Market dynamics indicate that the South African prefabricated buildings sector is expanding at a robust CAGR of 8.2%, reflecting the growing acceptance of modular construction methods across residential, commercial, and industrial applications. The market encompasses various prefabricated solutions including modular homes, portable buildings, steel structures, and concrete panels that cater to diverse construction requirements.

Government initiatives supporting affordable housing programs and infrastructure development have significantly contributed to market expansion. The National Development Plan’s emphasis on sustainable construction practices and the need to address the housing backlog of approximately 2.3 million units has created substantial opportunities for prefabricated building solutions.

Regional distribution shows that Gauteng province leads the market with approximately 35% market share, followed by Western Cape and KwaZulu-Natal, driven by industrial development and urban population growth in these metropolitan areas.

The South Africa prefabricated buildings market refers to the comprehensive ecosystem of manufactured building components and complete structures that are produced off-site in controlled factory environments before being transported and assembled at their final destination. This market encompasses the design, manufacturing, distribution, and installation of various prefabricated construction solutions tailored to meet South Africa’s unique climatic, economic, and regulatory requirements.

Prefabricated buildings in the South African context include modular homes, portable classrooms, industrial warehouses, retail spaces, healthcare facilities, and temporary accommodation structures. These solutions utilize advanced manufacturing techniques, quality materials, and standardized processes to deliver construction projects with enhanced speed, cost-effectiveness, and quality control compared to traditional on-site construction methods.

Market expansion in South Africa’s prefabricated buildings sector is driven by compelling economic advantages, with construction time reductions of up to 60% compared to traditional methods. The sector addresses critical challenges including skilled labor shortages, material waste reduction, and the urgent need for affordable housing solutions across urban and rural communities.

Key market segments demonstrate varying growth patterns, with residential prefabricated buildings leading demand due to government housing initiatives and private sector developments. Commercial and industrial applications are gaining momentum as businesses recognize the benefits of faster project delivery and reduced operational disruption during construction phases.

Technology integration has become increasingly important, with manufacturers adopting advanced design software, automated production lines, and sustainable materials to enhance product quality and environmental performance. The incorporation of renewable energy systems and smart building technologies is becoming standard practice among leading market participants.

Competitive landscape features both international manufacturers establishing local operations and domestic companies expanding their capabilities to meet growing demand. Strategic partnerships between manufacturers, developers, and government agencies are facilitating market growth and innovation in prefabricated construction solutions.

Market penetration analysis reveals significant opportunities for growth across multiple sectors, with current adoption rates indicating substantial room for expansion in both urban and rural markets. The following insights highlight critical market dynamics:

Housing shortage crisis serves as the primary catalyst for prefabricated buildings market expansion in South Africa. The government’s commitment to delivering affordable housing solutions has created sustained demand for cost-effective construction methods that can accelerate project delivery while maintaining quality standards.

Urbanization trends continue to drive market growth as rural populations migrate to metropolitan areas, creating pressure on existing infrastructure and housing stock. Prefabricated buildings offer scalable solutions that can be rapidly deployed to accommodate growing urban populations while supporting planned development initiatives.

Skills shortage in traditional construction trades has made prefabricated solutions increasingly attractive to developers and contractors. The controlled factory environment reduces dependency on skilled on-site labor while ensuring consistent quality through standardized manufacturing processes and quality control systems.

Economic efficiency considerations motivate both public and private sector adoption of prefabricated construction methods. Reduced construction timelines translate to faster return on investment for commercial projects and accelerated delivery of essential infrastructure for government initiatives.

Environmental sustainability requirements are driving demand for prefabricated buildings that incorporate energy-efficient designs, sustainable materials, and reduced construction waste. The ability to optimize material usage and minimize environmental impact aligns with South Africa’s commitment to sustainable development goals.

Initial capital investment requirements for prefabricated building manufacturing facilities represent a significant barrier to entry for new market participants. The need for specialized equipment, skilled technicians, and quality control systems creates substantial upfront costs that may limit market expansion.

Regulatory challenges persist in some municipalities where building codes and approval processes have not been updated to accommodate prefabricated construction methods. Lengthy approval procedures and inconsistent standards across different regions can delay project implementation and increase costs.

Transportation limitations affect the delivery of large prefabricated components to remote locations, particularly in areas with inadequate road infrastructure. Size and weight restrictions on transportation routes can limit design options and increase logistics costs for certain projects.

Market perception challenges remain among some consumers and stakeholders who associate prefabricated buildings with lower quality or temporary structures. Overcoming these perceptions requires continued education and demonstration of superior quality and durability in modern prefabricated construction.

Financing constraints may limit access to prefabricated building solutions for smaller developers and individual homeowners who lack access to specialized construction financing products tailored to modular construction methods.

Government infrastructure programs present substantial opportunities for prefabricated building manufacturers to participate in large-scale development projects including schools, healthcare facilities, and social housing initiatives. The emphasis on rapid delivery and cost-effectiveness aligns perfectly with prefabricated construction capabilities.

Mining sector expansion creates demand for temporary and permanent accommodation facilities, office buildings, and industrial structures in remote locations where prefabricated solutions offer significant advantages over traditional construction methods.

Tourism infrastructure development offers opportunities for specialized prefabricated buildings including eco-lodges, visitor centers, and hospitality facilities that can be designed to minimize environmental impact while maximizing construction efficiency.

Disaster relief applications represent an emerging market opportunity as climate change increases the frequency of natural disasters requiring rapid deployment of emergency housing and community facilities.

Export potential exists for South African prefabricated building manufacturers to serve regional markets in sub-Saharan Africa where similar challenges exist regarding housing shortages, skills gaps, and infrastructure development needs.

Supply chain integration has become increasingly sophisticated as manufacturers develop strategic partnerships with material suppliers, transportation companies, and installation contractors to optimize project delivery timelines and cost structures.

Technology advancement continues to reshape market dynamics through the adoption of Building Information Modeling (BIM), automated manufacturing processes, and advanced materials that enhance structural performance and energy efficiency.

Competitive pressures are intensifying as international manufacturers establish local operations while domestic companies expand their capabilities and market reach. This competition drives innovation and cost optimization throughout the industry.

Customer expectations are evolving toward higher quality finishes, customization options, and integrated technology solutions that match or exceed traditional construction standards while maintaining the speed and cost advantages of prefabricated methods.

Regulatory evolution is gradually adapting to accommodate prefabricated construction methods, with progressive municipalities updating building codes and approval processes to streamline project approvals and encourage adoption of efficient construction technologies.

Comprehensive market analysis was conducted using a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability of market insights and projections for the South African prefabricated buildings sector.

Primary research activities included structured interviews with industry executives, manufacturers, developers, government officials, and end-users to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies captured quantitative data on market preferences, adoption rates, and growth projections.

Secondary research encompassed analysis of government statistics, industry reports, company financial statements, regulatory documents, and trade association publications to validate primary findings and establish comprehensive market context.

Data validation processes ensured accuracy through triangulation of multiple sources, expert review panels, and statistical analysis to confirm market sizing, growth rates, and competitive positioning assessments.

Market modeling utilized advanced analytical techniques to project future market scenarios based on economic indicators, demographic trends, policy developments, and technological advancement patterns affecting the prefabricated buildings industry.

Gauteng Province dominates the South African prefabricated buildings market with approximately 35% market share, driven by the concentration of industrial activity, urban development projects, and proximity to major transportation networks. The province’s economic hub status attracts significant investment in commercial and residential prefabricated construction projects.

Western Cape represents the second-largest regional market with 22% market share, supported by tourism infrastructure development, wine industry facilities, and progressive municipal policies that encourage sustainable construction methods. The region’s focus on environmental sustainability aligns well with prefabricated building advantages.

KwaZulu-Natal accounts for 18% of market activity, with strong demand from industrial developments around Durban port facilities, residential projects, and educational infrastructure. The province’s manufacturing base provides opportunities for local prefabricated building production.

Eastern Cape shows emerging growth potential with 12% market share, primarily driven by government housing programs and industrial development initiatives. The automotive manufacturing sector creates demand for specialized industrial prefabricated structures.

Remaining provinces collectively represent 13% of market activity, with growth opportunities in mining-related infrastructure, agricultural facilities, and rural development projects that benefit from prefabricated construction advantages.

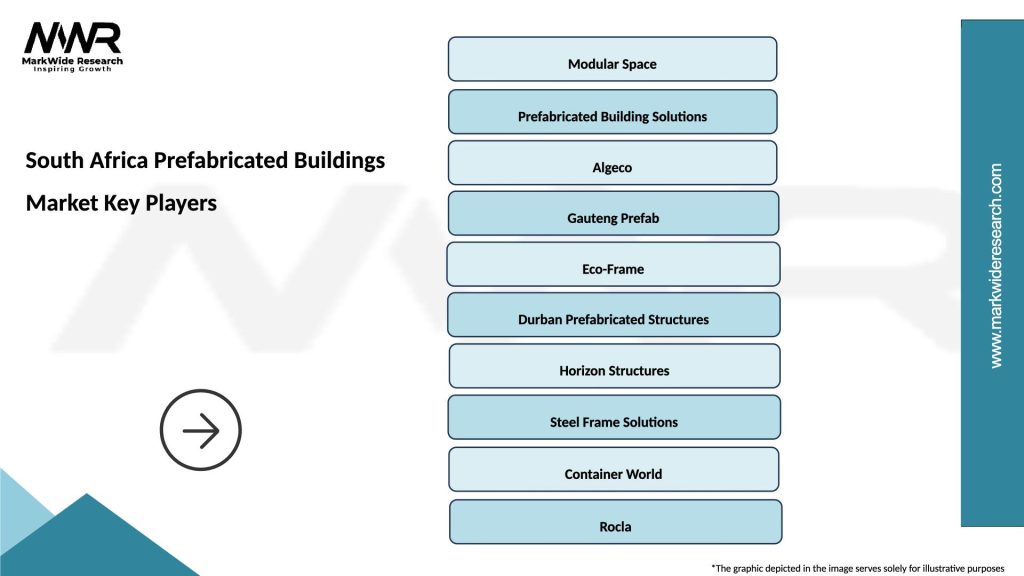

Market leadership is distributed among several key players who have established strong positions through technological innovation, strategic partnerships, and comprehensive service offerings across the prefabricated buildings value chain.

Strategic partnerships between manufacturers and construction companies are becoming increasingly common as the industry recognizes the benefits of integrated service delivery models that combine manufacturing expertise with construction experience.

By Building Type:

By Material Type:

By Application:

Residential Prefabricated Buildings dominate market demand with sustained growth driven by government affordable housing initiatives and private sector developments. The category benefits from standardized designs that reduce costs while maintaining quality standards suitable for South African climatic conditions.

Commercial Applications are experiencing rapid expansion as businesses recognize the advantages of faster project delivery and reduced operational disruption during construction. Retail chains and office developers are increasingly adopting prefabricated solutions for expansion projects.

Industrial Prefabricated Structures serve the manufacturing and logistics sectors with specialized designs that accommodate heavy equipment, large spans, and specific operational requirements. The mining industry represents a significant growth opportunity for industrial prefabricated buildings.

Institutional Buildings including schools and healthcare facilities benefit from prefabricated construction methods that enable faster delivery of essential community infrastructure while meeting stringent regulatory requirements for public buildings.

Sustainable Prefabricated Buildings represent a growing market segment as environmental consciousness increases among developers and end-users. Green building certifications and energy-efficient designs are becoming standard requirements for premium projects.

Manufacturers benefit from scalable production processes that enable efficient utilization of resources and consistent quality control. The factory environment allows for year-round production regardless of weather conditions, improving operational efficiency and delivery predictability.

Developers and Contractors gain competitive advantages through reduced construction timelines, predictable costs, and improved project management capabilities. The ability to overlap site preparation with manufacturing activities significantly accelerates project delivery schedules.

End Users receive high-quality buildings with superior energy efficiency, reduced maintenance requirements, and customization options that meet specific functional requirements. The controlled manufacturing environment ensures consistent quality and performance standards.

Government Agencies can accelerate infrastructure delivery programs while optimizing budget utilization through cost-effective construction methods. Prefabricated buildings support policy objectives for affordable housing and sustainable development.

Financial Institutions benefit from reduced project risk profiles due to predictable construction timelines and costs, enabling more favorable financing terms for prefabricated building projects compared to traditional construction methods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and Technology Integration are transforming the prefabricated buildings industry through advanced design software, automated manufacturing processes, and smart building technologies. Building Information Modeling (BIM) enables precise planning and coordination while reducing errors and waste.

Sustainability Focus continues to intensify with increasing demand for energy-efficient designs, renewable energy integration, and sustainable materials. Green building certifications are becoming standard requirements for commercial and institutional projects.

Customization Capabilities are expanding as manufacturers develop flexible production systems that accommodate customer-specific requirements while maintaining cost efficiency. Mass customization approaches enable personalized solutions without sacrificing manufacturing advantages.

Hybrid Construction Methods combining prefabricated components with traditional construction techniques are gaining popularity for complex projects requiring both efficiency and design flexibility. This approach optimizes the benefits of both construction methods.

Supply Chain Optimization through strategic partnerships and vertical integration is improving cost structures and delivery reliability. Just-in-time manufacturing and logistics coordination enhance overall project efficiency.

Manufacturing Capacity Expansion initiatives by leading companies are increasing production capabilities to meet growing market demand. New facilities incorporate advanced automation and quality control systems to enhance operational efficiency.

Strategic Partnerships between manufacturers, developers, and technology providers are creating integrated service offerings that streamline project delivery from design through installation and maintenance.

Government Policy Support through updated building codes, streamlined approval processes, and incentive programs is facilitating market growth and encouraging adoption of prefabricated construction methods.

Technology Investments in research and development are advancing material science, manufacturing processes, and building system integration to improve performance and reduce costs.

Market Consolidation activities including mergers and acquisitions are reshaping the competitive landscape as companies seek to achieve scale advantages and expand market coverage.

MarkWide Research analysis indicates that market participants should focus on developing comprehensive service capabilities that extend beyond manufacturing to include design, financing, and maintenance services. This integrated approach creates competitive differentiation and stronger customer relationships.

Investment in technology and automation will be critical for maintaining cost competitiveness and quality standards as market demand continues to grow. Companies should prioritize digital transformation initiatives that enhance operational efficiency and customer experience.

Strategic partnerships with government agencies, developers, and financial institutions will be essential for accessing large-scale project opportunities and developing sustainable business models that support long-term growth objectives.

Market education initiatives should be prioritized to address perception challenges and demonstrate the quality, durability, and value advantages of modern prefabricated buildings compared to traditional construction methods.

Sustainability leadership through environmental certifications, energy-efficient designs, and sustainable materials will become increasingly important for competitive positioning and regulatory compliance.

Market expansion is projected to continue at a robust pace of 8.2% CAGR over the next five years, driven by sustained demand from government infrastructure programs, private sector developments, and increasing acceptance of prefabricated construction methods across all building categories.

Technology advancement will accelerate the adoption of automated manufacturing processes, advanced materials, and integrated building systems that enhance performance while reducing costs. Smart building integration will become standard in commercial and institutional applications.

Regional expansion opportunities will emerge as infrastructure development spreads beyond major metropolitan areas to secondary cities and rural regions. MWR projections indicate that rural market penetration could reach 40% by 2028.

Export market development will provide growth opportunities for South African manufacturers to serve regional markets in sub-Saharan Africa where similar challenges exist regarding housing shortages and infrastructure development needs.

Regulatory harmonization across provinces and municipalities will streamline project approvals and reduce barriers to market expansion, supporting accelerated adoption of prefabricated construction methods throughout South Africa.

The South Africa prefabricated buildings market represents a dynamic and rapidly evolving sector that addresses critical national challenges including housing shortages, infrastructure development needs, and construction industry efficiency requirements. With sustained government support, technological advancement, and growing market acceptance, the industry is positioned for continued expansion and innovation.

Market fundamentals remain strong with compelling economic advantages, environmental benefits, and quality improvements that support long-term growth prospects. The combination of cost efficiency, speed of delivery, and sustainability advantages creates a compelling value proposition for diverse applications across residential, commercial, industrial, and institutional sectors.

Strategic opportunities exist for market participants who can successfully navigate regulatory challenges, invest in technology advancement, and develop comprehensive service capabilities that meet evolving customer expectations. The integration of digital technologies, sustainable practices, and customization capabilities will define competitive success in the evolving market landscape.

Future success will depend on continued collaboration between industry stakeholders, government agencies, and financial institutions to create an enabling environment that supports innovation, quality improvement, and market expansion. The South Africa prefabricated buildings market is well-positioned to contribute significantly to the country’s construction industry transformation and economic development objectives.

What is Prefabricated Buildings?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in standard sections that can be easily transported and assembled. They are commonly used in residential, commercial, and industrial applications due to their efficiency and cost-effectiveness.

What are the key players in the South Africa Prefabricated Buildings Market?

Key players in the South Africa Prefabricated Buildings Market include companies like AECOM, AFS International, and A-Frame, which specialize in various prefabrication techniques and materials. These companies are known for their innovative designs and sustainable building practices, among others.

What are the growth factors driving the South Africa Prefabricated Buildings Market?

The growth of the South Africa Prefabricated Buildings Market is driven by factors such as the increasing demand for affordable housing, rapid urbanization, and the need for sustainable construction solutions. Additionally, advancements in construction technology are enhancing the appeal of prefabricated buildings.

What challenges does the South Africa Prefabricated Buildings Market face?

The South Africa Prefabricated Buildings Market faces challenges such as regulatory hurdles, limited consumer awareness, and competition from traditional construction methods. These factors can hinder the adoption of prefabricated solutions in certain regions.

What opportunities exist in the South Africa Prefabricated Buildings Market?

Opportunities in the South Africa Prefabricated Buildings Market include the potential for modular construction in urban areas, the growing interest in eco-friendly building materials, and the expansion of infrastructure projects. These trends are likely to create new avenues for growth.

What trends are shaping the South Africa Prefabricated Buildings Market?

Trends shaping the South Africa Prefabricated Buildings Market include the rise of smart building technologies, increased focus on sustainability, and the integration of renewable energy solutions in prefabricated designs. These innovations are transforming how buildings are constructed and operated.

South Africa Prefabricated Buildings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Panelized Structures, Pre-Cast Concrete, Steel Frame |

| End User | Residential, Commercial, Educational, Industrial |

| Installation Type | On-Site, Off-Site, Hybrid, Temporary |

| Material | Wood, Steel, Concrete, Composite |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Prefabricated Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at