444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa pouch packaging market represents a dynamic and rapidly evolving segment within the country’s broader packaging industry. This market encompasses a diverse range of flexible packaging solutions designed to meet the growing demands of various sectors including food and beverages, pharmaceuticals, personal care, and industrial applications. Pouch packaging has gained significant traction in South Africa due to its versatility, cost-effectiveness, and superior barrier properties that extend product shelf life while reducing material usage.

Market dynamics in South Africa reflect a strong preference for sustainable and convenient packaging solutions. The pouch packaging sector is experiencing robust growth driven by increasing consumer demand for portable, lightweight, and environmentally conscious packaging alternatives. With urbanization accelerating and consumer lifestyles becoming more fast-paced, the demand for flexible packaging solutions continues to expand at a remarkable 8.2% annual growth rate.

Regional market characteristics demonstrate significant potential for expansion, particularly in the food and beverage sector where pouch packaging accounts for approximately 35% market penetration. The pharmaceutical industry has also embraced pouch packaging solutions, with adoption rates reaching 28% across major therapeutic categories. These statistics underscore the growing acceptance and integration of pouch packaging technologies across diverse industrial applications throughout South Africa.

The South Africa pouch packaging market refers to the comprehensive ecosystem of flexible packaging solutions that utilize various materials and technologies to create sealed pouches for product containment, protection, and distribution across multiple industries within the South African economy.

Pouch packaging encompasses a wide range of flexible packaging formats including stand-up pouches, flat pouches, spouted pouches, retort pouches, and specialty pouches designed for specific applications. These packaging solutions are manufactured using advanced materials such as polyethylene, polypropylene, polyester, aluminum foil, and various barrier films that provide optimal protection against moisture, oxygen, light, and other environmental factors that could compromise product quality.

Market scope extends beyond traditional packaging applications to include innovative solutions such as smart packaging with integrated sensors, biodegradable pouches made from sustainable materials, and high-barrier pouches designed for extended shelf life applications. The definition also encompasses the entire value chain from raw material suppliers and converting equipment manufacturers to brand owners and end consumers who benefit from the convenience and functionality of pouch packaging solutions.

Strategic market positioning reveals that South Africa’s pouch packaging industry has emerged as a critical component of the country’s manufacturing sector, driven by increasing demand for flexible, sustainable, and cost-effective packaging solutions. The market demonstrates strong growth momentum across multiple application segments, with particularly robust expansion in food and beverage packaging where convenience and shelf life extension are paramount considerations.

Key market drivers include rising consumer awareness of environmental sustainability, increasing demand for convenient packaging formats, and growing adoption of advanced barrier technologies that enhance product protection. The market benefits from South Africa’s strategic position as a manufacturing hub for the broader African continent, enabling local producers to serve both domestic and export markets effectively.

Competitive landscape analysis indicates a healthy mix of international players and local manufacturers, creating a dynamic environment that fosters innovation and competitive pricing. Major market participants are investing heavily in advanced converting technologies and sustainable material solutions to meet evolving customer requirements and regulatory standards.

Future growth prospects remain highly favorable, with industry experts projecting continued expansion driven by increasing urbanization, changing consumer preferences, and ongoing technological advancements in flexible packaging materials and manufacturing processes. The market is expected to maintain its growth trajectory while adapting to emerging trends such as e-commerce packaging requirements and circular economy principles.

Market intelligence reveals several critical insights that define the current state and future direction of South Africa’s pouch packaging industry:

Market maturity indicators suggest that while the industry has established strong foundations, significant growth opportunities remain in emerging applications and advanced technology segments. The convergence of sustainability requirements and performance demands is creating new market niches for innovative packaging solutions.

Primary growth drivers propelling the South Africa pouch packaging market forward include several interconnected factors that reflect broader economic and social trends. The increasing urbanization rate, which has reached 67% of the population, is creating greater demand for convenient, portable packaging solutions that align with busy urban lifestyles.

Consumer behavior shifts toward healthier eating habits and premium product categories are driving demand for high-performance pouch packaging that can maintain product freshness and nutritional value over extended periods. The growing middle class in South Africa is willing to pay premium prices for products that offer superior convenience and quality, creating opportunities for advanced pouch packaging solutions.

Sustainability imperatives represent another crucial driver, as both consumers and regulatory bodies increasingly prioritize environmentally responsible packaging choices. Pouch packaging typically requires less material than rigid alternatives and offers better space utilization during transportation, resulting in reduced carbon footprint throughout the supply chain.

Technological advancements in barrier films, printing technologies, and converting equipment are enabling manufacturers to offer increasingly sophisticated packaging solutions that meet specific performance requirements while maintaining cost competitiveness. These innovations are opening new application areas and expanding the addressable market for pouch packaging solutions.

Economic factors including currency fluctuations and raw material costs are encouraging local production and import substitution, creating opportunities for domestic manufacturers to capture market share from international suppliers while offering more responsive customer service and shorter lead times.

Significant challenges facing the South Africa pouch packaging market include several structural and operational constraints that impact growth potential and profitability. High capital investment requirements for advanced converting equipment and quality control systems can create barriers to entry for smaller manufacturers and limit expansion capabilities for existing players.

Raw material dependencies on imported polymers and specialty films expose manufacturers to currency volatility and supply chain disruptions. These dependencies can result in unpredictable cost structures and pricing pressures that affect competitiveness in price-sensitive market segments.

Technical limitations in certain applications where pouch packaging may not provide adequate protection or functionality compared to rigid packaging alternatives can restrict market penetration. Some products require specific barrier properties or structural integrity that current pouch technologies cannot economically deliver.

Regulatory complexities surrounding food contact materials and pharmaceutical packaging requirements can create compliance costs and development delays for new product introductions. Navigating multiple regulatory frameworks while maintaining cost competitiveness presents ongoing challenges for market participants.

Infrastructure constraints including power supply reliability and transportation networks can impact manufacturing efficiency and distribution capabilities, particularly for companies serving rural markets or export destinations. These operational challenges can limit growth potential and increase operating costs.

Skills shortages in specialized technical areas such as flexible packaging engineering and quality assurance can constrain innovation capabilities and operational excellence, potentially limiting the industry’s ability to compete with international suppliers offering advanced solutions.

Emerging opportunities within the South Africa pouch packaging market present significant potential for growth and innovation across multiple dimensions. The expanding e-commerce sector is creating new requirements for protective packaging that can withstand shipping stresses while providing attractive presentation for direct-to-consumer deliveries.

Pharmaceutical applications represent a high-growth opportunity segment, particularly for unit-dose packaging and clinical trial supplies where pouch packaging offers advantages in terms of patient compliance, product protection, and cost efficiency. The aging population and increasing healthcare awareness are driving demand for pharmaceutical packaging innovations.

Agricultural sector integration offers substantial opportunities for specialized pouch packaging solutions designed for seeds, fertilizers, and crop protection products. These applications require specific barrier properties and durability characteristics that align well with advanced pouch packaging technologies.

Export market expansion into neighboring African countries presents opportunities for South African manufacturers to leverage their technological capabilities and geographic advantages. Many regional markets lack local pouch packaging production capacity, creating export opportunities for established South African companies.

Sustainable packaging innovations including biodegradable materials, recyclable structures, and reduced material usage designs are creating new market segments where environmentally conscious brands are willing to pay premium prices for responsible packaging solutions.

Smart packaging integration incorporating sensors, indicators, and digital connectivity features represents a frontier opportunity for high-value applications where product authentication, freshness monitoring, and consumer engagement are critical success factors.

Complex market dynamics shape the competitive landscape and growth trajectory of South Africa’s pouch packaging industry through the interaction of supply-side capabilities, demand-side requirements, and external environmental factors. The market demonstrates cyclical patterns influenced by seasonal demand variations, particularly in food and agricultural applications.

Supply chain dynamics reflect the industry’s dependence on imported raw materials balanced against local converting and distribution capabilities. Manufacturers are increasingly implementing vertical integration strategies to gain better control over costs and quality while reducing supply chain risks.

Competitive dynamics feature intense price competition in commodity segments balanced by differentiation opportunities in specialized applications. Companies are pursuing various strategies including technology leadership, customer intimacy, and operational excellence to establish sustainable competitive advantages.

Innovation dynamics are accelerating as companies invest in research and development to address emerging customer requirements and regulatory changes. The pace of new product introductions has increased significantly, with 23% of current product offerings introduced within the past three years.

Customer dynamics show increasing sophistication in packaging requirements, with buyers demanding comprehensive solutions that address multiple performance criteria simultaneously. This trend is driving convergence between packaging suppliers and their customers through collaborative development programs and long-term partnerships.

Regulatory dynamics continue to evolve, with new standards for food safety, environmental impact, and product labeling creating both challenges and opportunities for market participants who can adapt quickly to changing requirements.

Comprehensive research approach employed for analyzing the South Africa pouch packaging market combines multiple data collection and analysis methodologies to ensure accuracy, completeness, and reliability of findings. The research framework integrates primary research through industry interviews and surveys with secondary research utilizing published reports, industry databases, and regulatory filings.

Primary research activities included structured interviews with key industry stakeholders including manufacturers, suppliers, distributors, and end-users across various application segments. These interviews provided insights into market trends, competitive dynamics, technology developments, and future growth prospects from multiple perspectives throughout the value chain.

Secondary research sources encompassed industry publications, government statistics, trade association reports, and company financial statements to establish market sizing, growth rates, and competitive positioning. This data was cross-referenced and validated through multiple sources to ensure consistency and accuracy.

Market segmentation analysis utilized both top-down and bottom-up approaches to validate market size estimates and growth projections across different application areas, material types, and customer segments. This dual approach helps identify potential gaps or inconsistencies in market data.

Competitive intelligence gathering involved analysis of company websites, product catalogs, press releases, and industry conference presentations to understand competitive positioning, technology capabilities, and strategic directions of major market participants.

Data validation processes included triangulation of findings across multiple sources, expert review of preliminary results, and sensitivity analysis of key assumptions to ensure robust and reliable market insights that can support strategic decision-making.

Geographic market distribution across South Africa reveals distinct regional patterns influenced by industrial concentration, population density, and economic development levels. The Gauteng province dominates market activity with approximately 42% of total demand, driven by its position as the country’s economic hub and manufacturing center.

Western Cape region represents the second-largest market segment, accounting for roughly 28% of market share, supported by strong food and beverage industries, wine production, and export-oriented manufacturing activities. The region’s proximity to major ports facilitates both import of raw materials and export of finished products.

KwaZulu-Natal province contributes significantly to market demand through its diverse industrial base including automotive, chemicals, and food processing industries. The region’s strategic location provides access to both domestic and regional African markets, supporting growth in packaging applications.

Eastern Cape market shows growing potential driven by automotive manufacturing and agricultural processing activities. Government incentives for industrial development in this region are attracting new investments in packaging and related industries.

Rural market penetration remains limited but presents opportunities for growth as infrastructure development and economic activity expand into previously underserved areas. Mobile and flexible packaging solutions are particularly well-suited for reaching these emerging markets.

Cross-border trade dynamics with neighboring countries create additional demand for packaging solutions designed for export applications, requiring enhanced barrier properties and durability to withstand extended transportation and storage conditions.

Market competition in South Africa’s pouch packaging industry features a diverse mix of international corporations, regional players, and specialized local manufacturers, each bringing distinct capabilities and market positioning strategies.

Competitive strategies vary significantly among market participants, with larger companies leveraging economies of scale and technological capabilities while smaller players focus on niche markets and specialized applications. Innovation in sustainable materials and smart packaging features is becoming increasingly important for competitive differentiation.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand capabilities, access new markets, and achieve operational synergies. This consolidation is creating opportunities for remaining independent players to serve specialized market niches.

Technology leadership has emerged as a key competitive factor, with companies investing heavily in advanced converting equipment, quality control systems, and research and development capabilities to maintain market position and serve evolving customer requirements.

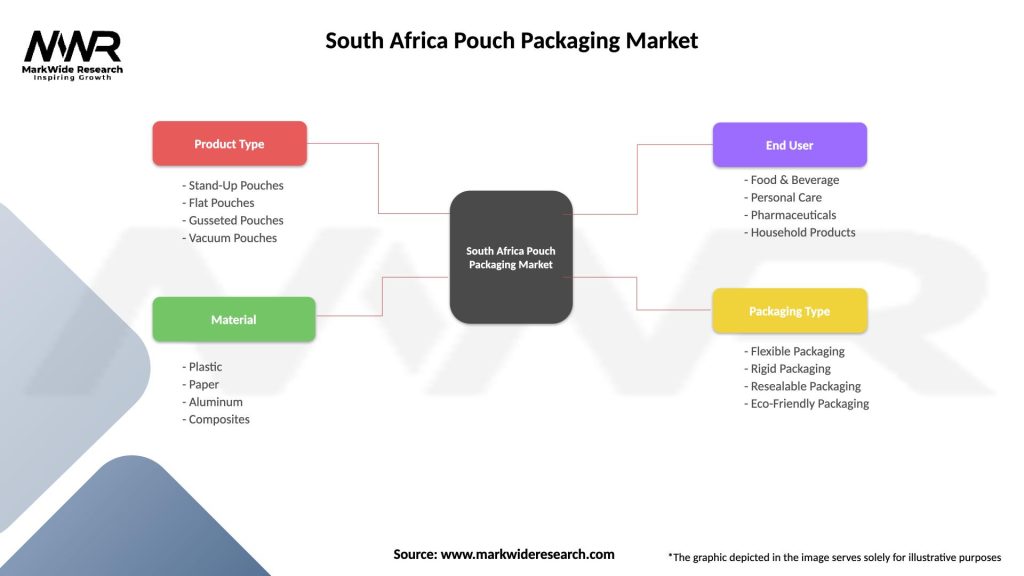

Market segmentation analysis reveals distinct categories within the South Africa pouch packaging market, each characterized by specific requirements, growth patterns, and competitive dynamics.

By Material Type:

By Application Sector:

By Pouch Type:

Food and beverage applications dominate the South African pouch packaging market, driven by consumer demand for convenient, portable packaging formats that maintain product freshness and quality. This category benefits from ongoing innovation in barrier technologies and easy-open features that enhance user experience.

Snack food packaging represents a particularly dynamic subcategory where pouch packaging has achieved near-universal adoption due to its ability to protect product crispness while providing attractive shelf presentation. Modified atmosphere packaging capabilities are increasingly important for premium snack products.

Beverage pouches are gaining traction in juice and dairy applications where lightweight packaging and portion control are valued by consumers. Spouted pouches have become particularly popular for children’s beverages and on-the-go consumption occasions.

Pharmaceutical packaging represents a high-value category where pouch packaging offers advantages in unit-dose applications, clinical trials, and over-the-counter medications. Regulatory compliance and tamper-evidence features are critical requirements in this segment.

Personal care applications are expanding rapidly as brands seek differentiated packaging that communicates premium positioning while offering functional benefits such as dispensing control and product protection. Sustainable materials are becoming increasingly important in this category.

Industrial packaging serves diverse applications including chemicals, adhesives, and automotive fluids where chemical resistance and durability are primary considerations. Custom solutions are often required to meet specific performance requirements.

Manufacturers benefit significantly from pouch packaging adoption through reduced material costs, improved production efficiency, and enhanced product differentiation capabilities. The lightweight nature of pouches reduces transportation costs while flexible manufacturing processes enable rapid response to market demands and seasonal variations.

Brand owners gain competitive advantages through improved shelf appeal, extended product shelf life, and enhanced consumer convenience features. Pouch packaging enables premium positioning while supporting sustainability initiatives that resonate with environmentally conscious consumers.

Retailers appreciate the space efficiency and handling convenience of pouch packaging, which maximizes shelf utilization and reduces inventory management complexity. The reduced weight and improved stackability of pouches optimize logistics and storage operations.

Consumers benefit from enhanced product freshness, portion control options, and convenient packaging features such as resealability and easy-open designs. The lightweight and compact nature of pouches supports active lifestyles and on-the-go consumption patterns.

Environmental stakeholders recognize the sustainability advantages of pouch packaging, including reduced material usage, lower transportation emissions, and increasing availability of recyclable and biodegradable options that support circular economy principles.

Supply chain participants benefit from improved efficiency throughout the distribution network, with reduced handling costs, optimized transportation utilization, and minimized product damage during transit and storage operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the South Africa pouch packaging market, with companies increasingly adopting recyclable materials, biodegradable options, and circular economy principles. This trend is driven by both regulatory requirements and consumer preferences for environmentally responsible packaging solutions.

Smart packaging integration is gaining momentum as brands seek to enhance consumer engagement and product authentication through digital connectivity, freshness indicators, and interactive features. These technologies are particularly relevant for premium products and pharmaceutical applications where product integrity is critical.

Customization and personalization trends are driving demand for shorter production runs and more flexible manufacturing capabilities. Digital printing technologies are enabling cost-effective customization that supports brand differentiation and targeted marketing campaigns.

Convenience enhancement continues to drive innovation in opening mechanisms, dispensing features, and resealability options. Consumer research indicates that 78% of purchase decisions are influenced by packaging convenience factors, particularly in food and personal care categories.

Barrier technology advancement is enabling pouch packaging to compete in applications previously dominated by rigid packaging. New material combinations and coating technologies are extending shelf life capabilities while maintaining cost competitiveness.

E-commerce adaptation is creating new requirements for packaging that can withstand shipping stresses while providing attractive unboxing experiences for direct-to-consumer deliveries. This trend is driving innovation in protective packaging designs and sustainable shipping solutions.

Recent industry developments highlight the dynamic nature of South Africa’s pouch packaging market and the ongoing evolution of technologies, capabilities, and market strategies among key participants.

Technology investments by major manufacturers have focused on advanced converting equipment and quality control systems that enable production of high-performance pouches for demanding applications. These investments are enhancing competitiveness and opening new market opportunities.

Sustainability initiatives have accelerated across the industry, with multiple companies launching recyclable pouch programs and investing in biodegradable material development. According to MarkWide Research analysis, sustainability-focused product launches have increased by 45% over the past two years.

Strategic partnerships between packaging manufacturers and material suppliers are driving innovation in barrier technologies and sustainable materials. These collaborations are essential for developing next-generation packaging solutions that meet evolving market requirements.

Market expansion activities include new facility investments and capacity additions to serve growing demand in key application segments. Several companies have announced plans to expand production capabilities to support both domestic growth and export opportunities.

Regulatory compliance initiatives have intensified as companies adapt to evolving food safety and environmental regulations. These efforts include investment in testing capabilities, quality systems, and documentation processes required for regulated applications.

Digital transformation projects are improving operational efficiency and customer service capabilities through implementation of advanced planning systems, quality monitoring technologies, and customer portal solutions that enhance supply chain integration.

Strategic recommendations for market participants focus on positioning for long-term success in an evolving competitive landscape while addressing immediate operational challenges and market opportunities.

Investment priorities should emphasize sustainable material technologies and advanced converting capabilities that enable differentiation in high-value market segments. Companies should also consider vertical integration opportunities that provide better control over costs and quality while reducing supply chain risks.

Market development strategies should focus on expanding into underserved application areas and geographic regions where pouch packaging adoption remains limited. Export market development represents a particularly attractive opportunity for companies with established domestic operations.

Innovation focus areas should include smart packaging technologies, sustainable materials, and enhanced barrier properties that address emerging customer requirements. Collaboration with research institutions and technology partners can accelerate development timelines and reduce investment risks.

Operational excellence initiatives should target cost reduction, quality improvement, and customer service enhancement through process optimization, automation, and supply chain integration. These improvements are essential for maintaining competitiveness in price-sensitive market segments.

Risk management strategies should address raw material price volatility, currency exposure, and regulatory compliance requirements through diversified sourcing, hedging programs, and proactive regulatory monitoring. These measures help ensure business continuity and financial stability.

Long-term growth prospects for the South Africa pouch packaging market remain highly favorable, supported by fundamental trends including urbanization, changing consumer preferences, and increasing focus on sustainability. MWR projections indicate continued market expansion with growth rates expected to maintain momentum at approximately 7.5% annually over the next five years.

Technology evolution will continue driving market development through advances in barrier materials, smart packaging features, and sustainable solutions. The convergence of digital technologies with traditional packaging is expected to create new value propositions and market opportunities.

Market maturation in traditional segments will be balanced by growth in emerging applications such as e-commerce packaging, pharmaceutical unit doses, and industrial specialty applications. This diversification will provide stability and reduce dependence on any single market segment.

Sustainability requirements will become increasingly important competitive factors, with companies that successfully develop and commercialize environmentally responsible solutions gaining significant market advantages. Regulatory support for circular economy initiatives will accelerate this trend.

Regional market integration is expected to increase as South African manufacturers expand into neighboring African countries, leveraging their technological capabilities and geographic advantages to serve broader regional markets.

Innovation acceleration will continue as companies invest in research and development to address evolving customer requirements and competitive pressures. The pace of new product introductions is expected to increase, with 30% of market offerings likely to be new or significantly modified products within the next three years.

The South Africa pouch packaging market represents a dynamic and rapidly evolving industry segment with strong growth prospects driven by fundamental shifts in consumer behavior, technological advancement, and sustainability requirements. The market has demonstrated resilience and adaptability while maintaining its position as a critical component of the country’s manufacturing sector.

Key success factors for market participants include technological innovation, operational excellence, sustainability leadership, and customer-centric solutions that address evolving market requirements. Companies that successfully balance these priorities while maintaining cost competitiveness will be best positioned for long-term success.

Market opportunities remain substantial across multiple dimensions including application expansion, geographic growth, and technology advancement. The convergence of sustainability trends with performance requirements is creating new market niches where innovative companies can establish competitive advantages.

Strategic positioning for the future requires careful attention to emerging trends, regulatory developments, and competitive dynamics while maintaining focus on operational excellence and customer satisfaction. The South Africa pouch packaging market will continue to evolve, offering significant opportunities for companies that can adapt to changing requirements while delivering superior value to customers and stakeholders.

What is Pouch Packaging?

Pouch packaging refers to flexible packaging solutions that are made from various materials, typically used for food, beverages, and consumer goods. This type of packaging is designed to be lightweight, portable, and often resealable, making it popular among manufacturers and consumers alike.

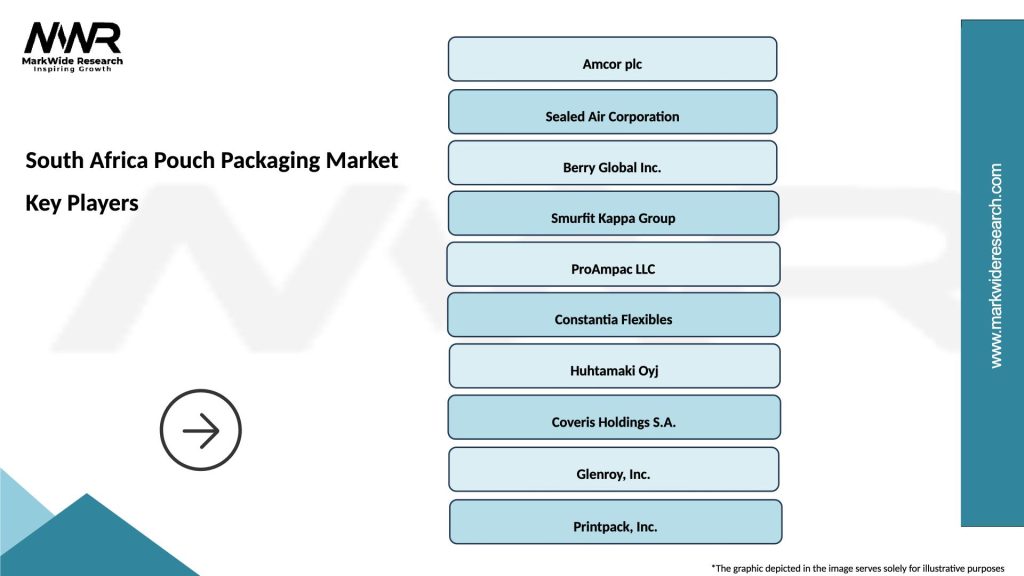

What are the key players in the South Africa Pouch Packaging Market?

Key players in the South Africa Pouch Packaging Market include Amcor, Mondi Group, and Nampak, which are known for their innovative packaging solutions and extensive product ranges. These companies focus on sustainability and meeting consumer demands for convenience, among others.

What are the growth factors driving the South Africa Pouch Packaging Market?

The South Africa Pouch Packaging Market is driven by factors such as the increasing demand for convenient packaging solutions, the growth of the food and beverage industry, and rising consumer preferences for sustainable packaging options. Additionally, the trend towards on-the-go consumption is boosting market growth.

What challenges does the South Africa Pouch Packaging Market face?

Challenges in the South Africa Pouch Packaging Market include competition from alternative packaging solutions, regulatory pressures regarding plastic use, and the need for continuous innovation to meet changing consumer preferences. These factors can impact market dynamics and growth.

What opportunities exist in the South Africa Pouch Packaging Market?

Opportunities in the South Africa Pouch Packaging Market include the potential for growth in e-commerce packaging, advancements in biodegradable materials, and the increasing demand for customized packaging solutions. These trends present avenues for companies to expand their offerings.

What trends are shaping the South Africa Pouch Packaging Market?

Trends in the South Africa Pouch Packaging Market include the rise of eco-friendly materials, the adoption of smart packaging technologies, and the growing popularity of stand-up pouches. These innovations are influencing consumer choices and driving market evolution.

South Africa Pouch Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Flat Pouches, Gusseted Pouches, Vacuum Pouches |

| Material | Plastic, Paper, Aluminum, Composites |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Resealable Packaging, Eco-Friendly Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Pouch Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at