444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa plastic bottles market represents a dynamic and rapidly evolving sector within the country’s packaging industry, driven by increasing consumer demand for convenient beverage packaging, growing urbanization, and expanding retail infrastructure. Market dynamics indicate significant growth potential as manufacturers adapt to changing consumer preferences and environmental considerations. The sector encompasses various plastic bottle types including PET bottles, HDPE containers, and specialized packaging solutions for beverages, personal care products, and household chemicals.

Industry transformation is evident through technological advancements in blow molding processes, lightweight bottle designs, and enhanced barrier properties that extend product shelf life. The market demonstrates robust growth patterns with increasing adoption of sustainable packaging solutions and recycling initiatives. Regional distribution shows concentrated activity in major metropolitan areas including Johannesburg, Cape Town, and Durban, where manufacturing facilities and consumer markets converge.

Manufacturing capabilities have expanded significantly with local producers investing in advanced production technologies and international companies establishing regional operations. The market benefits from growing beverage consumption patterns, particularly in carbonated soft drinks, bottled water, and fruit juices, driving demand for high-quality plastic bottle solutions.

The South Africa plastic bottles market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of plastic bottle packaging solutions within South African borders, encompassing various polymer types, production technologies, and end-use applications across multiple industry sectors.

Market scope includes polyethylene terephthalate (PET) bottles for beverages, high-density polyethylene (HDPE) containers for dairy and household products, polypropylene bottles for pharmaceutical applications, and specialized barrier bottles for sensitive products. The sector integrates upstream raw material suppliers, bottle manufacturers, filling companies, and recycling operations to create a comprehensive value chain.

Technological components encompass injection stretch blow molding, extrusion blow molding, and thermoforming processes that enable production of bottles with varying specifications, barrier properties, and aesthetic features. The market includes both primary packaging for direct product contact and secondary packaging applications for retail presentation and consumer convenience.

Strategic positioning of the South Africa plastic bottles market reflects strong fundamentals driven by expanding consumer markets, technological innovation, and increasing focus on sustainable packaging solutions. The sector demonstrates resilient growth characteristics with diversified applications across beverage, personal care, pharmaceutical, and household chemical industries.

Key performance indicators highlight the market’s evolution toward lightweight designs, improved recyclability, and enhanced functionality through advanced polymer technologies. Manufacturing efficiency improvements have enabled cost-effective production while maintaining quality standards that meet international specifications and regulatory requirements.

Competitive dynamics show increasing consolidation among major players while creating opportunities for specialized manufacturers focusing on niche applications and innovative packaging solutions. The market benefits from favorable demographic trends including urbanization rates of approximately 67% of the population and growing middle-class consumer spending on packaged goods.

Investment patterns indicate strong capital allocation toward production capacity expansion, technology upgrades, and sustainability initiatives that align with global environmental standards and consumer preferences for eco-friendly packaging options.

Market intelligence reveals several critical insights that define the South Africa plastic bottles market landscape and future trajectory:

Consumer behavior analysis indicates increasing preference for convenient packaging formats, premium bottle designs, and environmentally responsible packaging options that influence manufacturer product development strategies.

Primary growth drivers propelling the South Africa plastic bottles market include expanding urbanization, rising disposable incomes, and changing lifestyle patterns that favor convenient packaged products over traditional bulk purchasing habits.

Beverage industry expansion serves as a fundamental market driver with increasing consumption of bottled water, soft drinks, and functional beverages. The growing health consciousness among consumers has particularly boosted demand for bottled water and sports drinks, requiring specialized bottle designs with enhanced barrier properties and aesthetic appeal.

Retail infrastructure development across urban and rural areas has improved product accessibility and created new distribution channels for packaged goods. Modern retail formats including supermarkets, convenience stores, and online platforms have increased consumer exposure to bottled products and driven packaging innovation.

Manufacturing cost advantages compared to alternative packaging materials make plastic bottles an attractive option for producers seeking cost-effective packaging solutions without compromising product protection or shelf appeal. Advanced production technologies have further reduced manufacturing costs while improving quality consistency.

Export opportunities to neighboring African countries provide additional growth momentum as South African manufacturers leverage competitive advantages in production capabilities, quality standards, and logistics infrastructure to serve regional markets effectively.

Environmental concerns represent the most significant market restraint as increasing awareness of plastic pollution and waste management challenges creates regulatory pressure and consumer resistance to single-use plastic packaging solutions.

Raw material price volatility affects production costs and profit margins, particularly for PET resin and other petroleum-based polymers that experience price fluctuations based on global oil markets and supply chain disruptions.

Regulatory compliance costs continue to increase as government agencies implement stricter environmental standards, recycling requirements, and extended producer responsibility programs that require significant investment in compliance systems and reporting mechanisms.

Competition from alternative packaging materials including glass, aluminum, and biodegradable materials challenges market share as consumers and brands explore more sustainable packaging options that align with environmental objectives.

Infrastructure limitations in recycling and waste management systems create negative publicity for plastic packaging and limit the development of circular economy solutions that could address environmental concerns while maintaining market growth.

Sustainability innovation presents substantial opportunities for manufacturers developing recyclable, biodegradable, and bio-based plastic bottle solutions that address environmental concerns while maintaining functional performance characteristics.

Premium packaging segments offer higher margin opportunities as brands seek distinctive bottle designs, advanced barrier properties, and specialized features that enhance product differentiation and consumer appeal in competitive markets.

Regional export expansion to Sub-Saharan African markets provides growth potential as neighboring countries develop their consumer markets and require reliable packaging suppliers with proven quality standards and production capabilities.

Technology partnerships with international equipment manufacturers and material suppliers can accelerate innovation in production processes, material formulations, and bottle designs that meet evolving market requirements and regulatory standards.

Circular economy initiatives create opportunities for companies investing in bottle-to-bottle recycling technologies, collection systems, and closed-loop supply chains that address sustainability concerns while creating new revenue streams.

Supply chain dynamics in the South Africa plastic bottles market reflect complex interactions between raw material suppliers, manufacturers, brand owners, and recycling operators that influence pricing, availability, and innovation patterns across the value chain.

Demand fluctuations correlate strongly with seasonal beverage consumption patterns, economic conditions, and consumer confidence levels that affect discretionary spending on packaged goods and premium product categories.

Competitive pressures drive continuous improvement in production efficiency, quality standards, and customer service capabilities as manufacturers compete for market share in both domestic and export markets.

Technological evolution accelerates through industry collaboration, research partnerships, and investment in advanced manufacturing equipment that enables production of lighter, stronger, and more sustainable bottle designs.

Regulatory dynamics create both challenges and opportunities as government policies on environmental protection, recycling targets, and extended producer responsibility shape industry practices and investment priorities.

Comprehensive market analysis employs multiple research methodologies including primary data collection through industry interviews, manufacturer surveys, and stakeholder consultations to gather firsthand insights into market conditions, challenges, and opportunities.

Secondary research integration incorporates government statistics, industry association reports, trade publications, and academic studies to validate primary findings and provide historical context for market trends and development patterns.

Quantitative analysis techniques utilize statistical modeling, trend analysis, and forecasting methods to project market growth, segment performance, and competitive dynamics based on historical data and identified market drivers.

Qualitative assessment methods include expert interviews, focus group discussions, and case study analysis to understand market nuances, consumer preferences, and industry best practices that influence strategic decision-making.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, peer review procedures, and continuous monitoring of market developments that may affect research conclusions and recommendations.

Gauteng Province dominates the South Africa plastic bottles market with approximately 45% of total production capacity concentrated in the Johannesburg-Pretoria metropolitan area, benefiting from proximity to major consumer markets, transportation infrastructure, and skilled workforce availability.

Western Cape region represents the second-largest market segment, accounting for 28% of manufacturing activity with strong presence in beverage bottling, wine industry packaging, and export-oriented production facilities serving African markets through Cape Town port facilities.

KwaZulu-Natal province contributes 18% of market capacity with manufacturing clusters around Durban and Pietermaritzburg, focusing on beverage packaging, personal care products, and household chemical containers for both domestic consumption and regional export.

Eastern Cape and other provinces collectively represent 9% of production capacity with smaller-scale operations serving local markets and specialized applications including pharmaceutical packaging, industrial containers, and niche product categories.

Regional development patterns show increasing investment in secondary cities and rural areas as manufacturers seek cost advantages, government incentives, and access to emerging consumer markets outside major metropolitan areas.

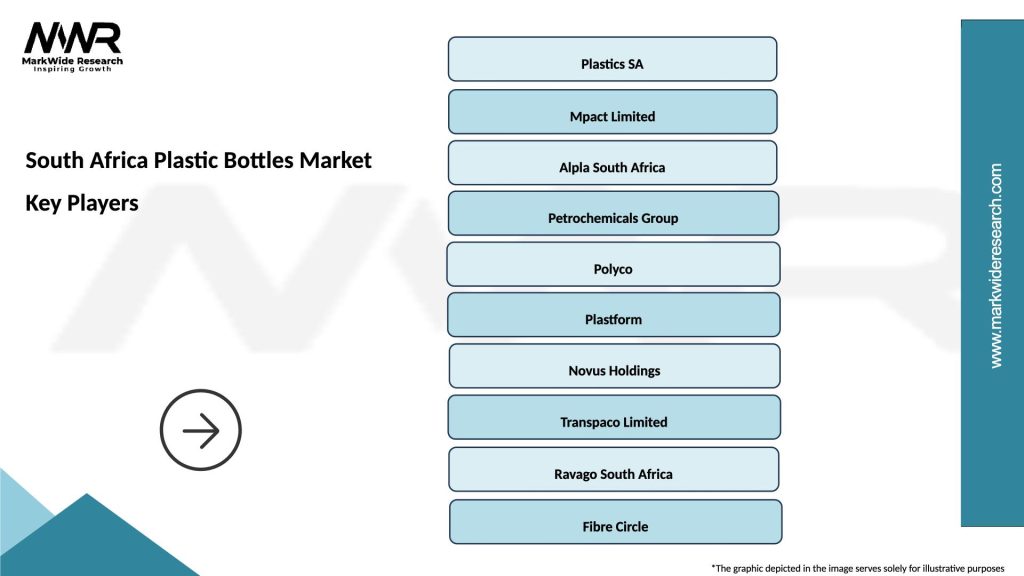

Market leadership is distributed among several key players with varying strengths in production capabilities, market reach, and technological innovation:

Competitive strategies emphasize technological innovation, operational efficiency, customer service excellence, and sustainability initiatives that differentiate companies in increasingly competitive market conditions.

Market consolidation trends show ongoing merger and acquisition activity as companies seek scale advantages, expanded capabilities, and improved market positioning through strategic combinations and partnerships.

By Material Type:

By Application:

By Production Technology:

Beverage Bottles Category demonstrates the strongest growth momentum with increasing consumer preference for convenient, portable packaging formats. Innovation trends focus on lightweight designs, improved barrier properties, and enhanced visual appeal through advanced labeling and decoration technologies.

Personal Care Packaging shows premium positioning trends with emphasis on aesthetic appeal, functional dispensing features, and sustainable material options that align with brand values and consumer environmental consciousness.

Household Chemical Containers prioritize safety features, chemical compatibility, and child-resistant closures that meet regulatory requirements while providing cost-effective packaging solutions for manufacturers.

Pharmaceutical Bottles require the highest quality standards with strict regulatory compliance, sterile production environments, and specialized barrier properties that protect sensitive products from contamination and degradation.

Industrial Applications focus on durability, chemical resistance, and cost-effectiveness for bulk packaging of industrial chemicals, lubricants, and specialty products requiring robust container performance.

Manufacturers benefit from growing market demand, technological advancement opportunities, and export potential that provide multiple revenue streams and business expansion possibilities in domestic and regional markets.

Brand owners gain access to innovative packaging solutions, cost-effective production capabilities, and sustainable packaging options that enhance product differentiation and consumer appeal while meeting environmental objectives.

Consumers enjoy improved product convenience, enhanced safety features, and increasing availability of environmentally responsible packaging options that align with personal values and lifestyle preferences.

Investors find attractive opportunities in a growing market with strong fundamentals, technological innovation potential, and increasing focus on sustainability that creates long-term value creation prospects.

Government stakeholders benefit from job creation, export revenue generation, and industrial development that contributes to economic growth while advancing environmental protection through improved recycling and waste management systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Lightweighting initiatives continue driving innovation as manufacturers develop bottles with reduced material usage while maintaining structural integrity and performance characteristics. This trend addresses both cost reduction objectives and environmental concerns about plastic consumption.

Sustainable packaging adoption accelerates through increased use of recycled content, bio-based materials, and design for recyclability principles that enable circular economy approaches to plastic bottle production and consumption.

Smart packaging integration emerges through incorporation of digital technologies, QR codes, and interactive features that enhance consumer engagement and provide product authentication, traceability, and marketing opportunities.

Customization capabilities expand as manufacturers invest in flexible production systems that enable small-batch production, personalized packaging, and rapid response to changing customer requirements and market trends.

Premium positioning strategies focus on distinctive bottle designs, advanced decoration techniques, and functional features that justify higher pricing and improve profit margins in competitive market segments.

Technology investments by major manufacturers include installation of advanced injection stretch blow molding equipment, automated quality control systems, and energy-efficient production processes that improve competitiveness and environmental performance.

Sustainability partnerships between bottle manufacturers, brand owners, and recycling companies create integrated solutions for plastic waste management, recycled content sourcing, and closed-loop packaging systems.

Regulatory compliance initiatives address new environmental standards, extended producer responsibility requirements, and recycling targets through industry collaboration and investment in compliance systems.

Market expansion projects include new production facilities, capacity upgrades, and geographic expansion into neighboring African countries to capture growing regional demand for packaged products.

Innovation collaborations with international technology providers, material suppliers, and research institutions accelerate development of next-generation packaging solutions that meet evolving market requirements.

MarkWide Research recommends that industry participants prioritize sustainability initiatives through investment in recycling technologies, bio-based materials, and circular economy business models that address environmental concerns while maintaining market competitiveness.

Strategic focus should emphasize premium market segments, customization capabilities, and value-added services that differentiate companies from low-cost competitors and improve profit margins in challenging market conditions.

Technology advancement remains critical for maintaining competitiveness through continuous investment in production efficiency, quality improvement, and innovation capabilities that enable rapid response to changing market requirements.

Regional expansion strategies should leverage South Africa’s competitive advantages in production capabilities, quality standards, and logistics infrastructure to capture growing opportunities in African markets.

Partnership development with key stakeholders including brand owners, recycling companies, and technology providers can create synergies that accelerate innovation, improve sustainability performance, and enhance market positioning.

Market trajectory indicates continued growth driven by expanding consumer markets, technological innovation, and increasing focus on sustainable packaging solutions that balance environmental concerns with functional performance requirements.

Sustainability transformation will accelerate through regulatory pressure, consumer demand, and industry innovation that creates new opportunities for companies investing in environmentally responsible packaging solutions and circular economy approaches.

Technology evolution will enable more efficient production processes, advanced material formulations, and smart packaging features that enhance product differentiation and consumer value while reducing environmental impact.

Regional integration with African markets will provide growth opportunities as neighboring countries develop their consumer markets and require reliable packaging suppliers with proven capabilities and quality standards.

MWR analysis projects that successful companies will be those that effectively balance growth objectives with sustainability commitments, invest in innovation capabilities, and develop strong partnerships across the value chain to capture emerging opportunities in evolving market conditions.

The South Africa plastic bottles market presents a dynamic landscape characterized by strong growth fundamentals, technological innovation opportunities, and increasing emphasis on sustainable packaging solutions. Market evolution reflects changing consumer preferences, regulatory developments, and industry transformation toward more environmentally responsible practices while maintaining functional performance and cost competitiveness.

Strategic positioning for market participants requires balancing traditional growth drivers with emerging sustainability requirements through investment in innovation, technology advancement, and circular economy initiatives. The sector’s future success depends on industry collaboration, regulatory compliance, and continuous adaptation to evolving market conditions and consumer expectations.

Long-term prospects remain positive as the market benefits from expanding consumer demand, regional export opportunities, and technological capabilities that enable production of high-quality, sustainable packaging solutions. Companies that successfully navigate environmental challenges while capitalizing on growth opportunities will be well-positioned to capture value in this evolving market landscape.

What is Plastic Bottles?

Plastic bottles are containers made from various types of plastic, commonly used for packaging liquids such as beverages, cleaning products, and personal care items. They are lightweight, durable, and can be produced in various shapes and sizes to meet consumer needs.

What are the key players in the South Africa Plastic Bottles Market?

Key players in the South Africa Plastic Bottles Market include companies like Nampak, Plastics SA, and Astrapak, which are involved in the production and distribution of plastic bottles for various applications, including food and beverage packaging, personal care, and household products, among others.

What are the growth factors driving the South Africa Plastic Bottles Market?

The South Africa Plastic Bottles Market is driven by increasing consumer demand for packaged beverages, the growth of the food and beverage industry, and rising awareness of convenience packaging. Additionally, the shift towards lightweight and recyclable materials is contributing to market growth.

What challenges does the South Africa Plastic Bottles Market face?

The South Africa Plastic Bottles Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging, and competition from alternative materials like glass and metal. These factors can impact production and consumer preferences.

What opportunities exist in the South Africa Plastic Bottles Market?

Opportunities in the South Africa Plastic Bottles Market include the development of biodegradable and recyclable plastic options, innovations in bottle design for enhanced functionality, and the expansion of e-commerce, which increases demand for efficient packaging solutions.

What trends are shaping the South Africa Plastic Bottles Market?

Trends in the South Africa Plastic Bottles Market include a growing emphasis on sustainability, with companies focusing on reducing plastic usage and increasing recycling rates. Additionally, advancements in manufacturing technology are enabling the production of lighter and more efficient bottles.

South Africa Plastic Bottles Market

| Segmentation Details | Description |

|---|---|

| Product Type | PET, HDPE, LDPE, PVC |

| End User | Food & Beverage, Personal Care, Household, Pharmaceuticals |

| Packaging Type | Single-Serve, Multi-Pack, Bulk, Custom Shapes |

| Application | Carbonated Drinks, Water, Juices, Cleaning Products |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Plastic Bottles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at