444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa petroleum market represents a critical component of the nation’s energy infrastructure, serving as the backbone for transportation, industrial operations, and economic development across the region. South Africa’s petroleum sector encompasses crude oil refining, fuel distribution, petrochemical production, and strategic energy storage facilities that support both domestic consumption and regional export activities.

Market dynamics in South Africa’s petroleum industry are characterized by significant government involvement, strategic partnerships with international oil companies, and ongoing infrastructure modernization initiatives. The country’s position as Africa’s most industrialized economy drives substantial petroleum demand, with the sector experiencing steady growth at approximately 4.2% CAGR over recent years.

Key market drivers include expanding transportation networks, industrial growth, mining sector expansion, and increasing energy security initiatives. The market benefits from South Africa’s strategic location, advanced refining capabilities, and well-established distribution infrastructure that serves both local and regional markets throughout Southern Africa.

Regulatory frameworks governing the petroleum sector emphasize energy security, environmental compliance, and economic transformation objectives. The market operates under comprehensive oversight from government agencies, ensuring sustainable development while promoting competitive market conditions and foreign investment opportunities.

The South Africa petroleum market refers to the comprehensive ecosystem of activities involving the exploration, refining, distribution, and retail of petroleum products within South Africa’s borders and its influence on regional energy supply chains. This market encompasses upstream operations, midstream processing facilities, and downstream retail networks that collectively serve the nation’s energy requirements.

Petroleum products within this market include gasoline, diesel fuel, jet fuel, heating oil, lubricants, and various petrochemical derivatives used across multiple industrial applications. The market structure integrates both state-owned enterprises and private sector participants, creating a diverse competitive landscape that supports energy security objectives while promoting economic growth.

Strategic importance of the petroleum market extends beyond domestic energy needs, positioning South Africa as a regional energy hub serving neighboring countries through cross-border fuel supply agreements and infrastructure sharing arrangements. This regional integration enhances market stability and creates additional revenue streams for local petroleum companies.

South Africa’s petroleum market demonstrates robust growth potential driven by industrial expansion, transportation sector development, and regional energy integration initiatives. The market benefits from established refining infrastructure, strategic geographic positioning, and comprehensive distribution networks that support both domestic and export activities.

Key growth factors include government infrastructure investment programs, mining sector expansion, and increasing regional energy cooperation agreements. The market shows particular strength in diesel fuel demand, driven by commercial transportation growth and industrial applications, with diesel representing approximately 42% of total petroleum consumption.

Investment opportunities are emerging in renewable energy integration, biofuel development, and advanced refining technologies that enhance operational efficiency and environmental compliance. The market attracts significant foreign direct investment, particularly in downstream operations and retail network expansion projects.

Competitive dynamics feature both established international oil companies and emerging local players, creating a balanced market structure that promotes innovation and competitive pricing. Strategic partnerships between global petroleum companies and local enterprises drive technology transfer and capacity building initiatives.

Market segmentation reveals diverse demand patterns across different petroleum product categories, with transportation fuels dominating consumption patterns and industrial applications showing steady growth trajectories. The following insights characterize current market conditions:

Economic growth serves as the primary driver for South Africa’s petroleum market expansion, with industrial development, mining activities, and transportation sector growth creating sustained demand for various petroleum products. The country’s position as Africa’s second-largest economy generates substantial energy requirements across multiple sectors.

Infrastructure development initiatives, including highway construction, port expansion, and industrial zone development, drive increased petroleum consumption through construction activities and enhanced transportation networks. Government investment in infrastructure projects creates long-term demand growth opportunities for petroleum suppliers.

Regional integration programs establish South Africa as a petroleum hub for Southern Africa, with cross-border supply agreements and shared infrastructure projects expanding market reach beyond domestic boundaries. This regional role enhances market stability and creates additional revenue streams for local petroleum companies.

Mining sector expansion contributes significantly to petroleum demand through heavy machinery operations, transportation requirements, and processing facility energy needs. South Africa’s mineral wealth drives continuous mining activity, creating consistent petroleum consumption patterns that support market growth.

Urbanization trends increase transportation fuel demand as more people migrate to cities and urban centers, driving private vehicle ownership and public transportation system expansion. Urban growth patterns create concentrated demand centers that support retail network development and distribution efficiency improvements.

Environmental regulations impose increasing compliance costs on petroleum companies, requiring investments in cleaner technologies, emission control systems, and environmental monitoring programs. These regulatory requirements create operational challenges while driving industry transformation toward more sustainable practices.

Price volatility in global crude oil markets creates uncertainty for both suppliers and consumers, affecting investment decisions and long-term planning initiatives. Currency fluctuations and international market dynamics add complexity to pricing strategies and profit margin management.

Infrastructure constraints in certain regions limit market expansion opportunities, particularly in rural areas where distribution networks require significant investment to establish viable supply chains. Transportation bottlenecks and storage capacity limitations affect market efficiency and growth potential.

Alternative energy adoption presents long-term challenges to petroleum demand growth, as renewable energy technologies and electric vehicle adoption gradually reduce dependence on traditional petroleum products. This transition requires industry adaptation and diversification strategies.

Regulatory complexity creates operational challenges for petroleum companies navigating multiple government agencies, licensing requirements, and compliance obligations. Administrative processes and regulatory uncertainty can delay project implementation and increase operational costs.

Biofuel development presents significant opportunities for petroleum companies to diversify product portfolios and meet environmental compliance requirements. South Africa’s agricultural sector provides feedstock opportunities for biodiesel and ethanol production, creating new market segments and revenue streams.

Regional expansion opportunities exist throughout Southern Africa, where South African petroleum companies can leverage established expertise and infrastructure to serve growing markets in neighboring countries. Cross-border partnerships and joint ventures create pathways for market expansion and risk diversification.

Technology integration offers opportunities to improve operational efficiency, reduce costs, and enhance customer service through digital transformation initiatives. Advanced analytics, automation systems, and mobile technologies create competitive advantages and operational improvements.

Petrochemical development provides opportunities to add value to petroleum products through downstream processing and chemical production. South Africa’s industrial base creates demand for petrochemical products, supporting vertical integration and margin enhancement strategies.

Strategic partnerships with international oil companies offer opportunities for technology transfer, capital investment, and market access expansion. Collaborative arrangements enable local companies to access global expertise while maintaining market presence and operational control.

Supply chain integration characterizes South Africa’s petroleum market dynamics, with vertical integration strategies enabling companies to control multiple stages of the value chain from refining to retail distribution. This integration enhances operational efficiency and provides better margin control across market segments.

Competitive positioning involves both price competition and service differentiation, as petroleum companies seek to maintain market share while developing unique value propositions for different customer segments. Brand loyalty programs and service quality improvements drive customer retention and market expansion.

Regulatory compliance shapes market dynamics through environmental standards, safety requirements, and economic transformation policies that influence operational practices and investment decisions. Companies must balance compliance costs with competitive positioning and profitability objectives.

Technology adoption drives operational improvements and customer service enhancements, with digital platforms enabling better supply chain management, inventory optimization, and customer engagement. According to MarkWide Research analysis, technology investments improve operational efficiency by approximately 18% annually.

Market consolidation trends create opportunities for strategic acquisitions and partnerships, as companies seek to achieve economies of scale and expand market presence. Consolidation activities reshape competitive dynamics and create new market leaders with enhanced capabilities.

Primary research methodologies employed in analyzing South Africa’s petroleum market include comprehensive surveys of industry participants, structured interviews with key stakeholders, and detailed analysis of operational data from petroleum companies, government agencies, and industry associations.

Secondary research incorporates analysis of government publications, industry reports, financial statements, and regulatory filings to develop comprehensive market understanding. Data sources include energy ministry publications, statistical office reports, and petroleum industry association data.

Market modeling techniques utilize econometric analysis, trend extrapolation, and scenario planning to project future market conditions and identify growth opportunities. Statistical analysis of historical data provides foundation for forecasting and strategic planning recommendations.

Stakeholder engagement involves consultation with petroleum companies, government officials, industry experts, and end-users to validate research findings and ensure comprehensive market understanding. Expert interviews provide qualitative insights that complement quantitative analysis.

Data validation processes ensure research accuracy through cross-referencing multiple sources, peer review procedures, and continuous monitoring of market developments. Quality assurance measures maintain research integrity and reliability for strategic decision-making purposes.

Gauteng Province dominates South Africa’s petroleum consumption, accounting for approximately 35% of national demand due to its concentration of industrial activities, transportation hubs, and urban population centers. The province’s economic significance drives substantial petroleum requirements across multiple sectors.

Western Cape represents the second-largest regional market, with 22% market share, supported by port activities, tourism, agriculture, and manufacturing sectors. Cape Town’s position as a major port city creates significant demand for marine fuels and transportation petroleum products.

KwaZulu-Natal contributes 18% of petroleum consumption, driven by Durban’s port operations, industrial activities, and agricultural sector requirements. The province’s coastal location and industrial base create diverse petroleum demand patterns across multiple applications.

Eastern regions including Mpumalanga and Limpopo show growing petroleum demand driven by mining activities, with coal mining operations and mineral processing facilities creating substantial fuel and lubricant requirements. These regions represent emerging growth opportunities for petroleum suppliers.

Rural markets present development opportunities despite infrastructure challenges, as agricultural activities, small-scale mining, and transportation services create distributed demand for petroleum products. Market penetration strategies focus on mobile distribution and strategic partnerships with local retailers.

Market leadership in South Africa’s petroleum sector features a combination of international oil companies and domestic enterprises, creating a competitive environment that promotes innovation and service excellence. The competitive landscape includes the following key participants:

Competitive strategies emphasize service differentiation, network expansion, and technology adoption to maintain market position and drive customer loyalty. Companies invest in brand development, customer service improvements, and operational efficiency enhancements to compete effectively in the market.

Product segmentation of South Africa’s petroleum market reveals diverse demand patterns across different fuel types and applications, with each segment demonstrating unique growth characteristics and market dynamics.

By Product Type:

By Application:

By Distribution Channel:

Transportation fuels dominate the petroleum market, with diesel fuel showing particularly strong growth due to commercial vehicle expansion and industrial applications. The transportation segment benefits from economic growth, infrastructure development, and increasing vehicle ownership rates across urban and rural areas.

Industrial petroleum products demonstrate steady demand growth driven by manufacturing expansion, mining activities, and power generation requirements. This category includes specialized fuels, lubricants, and petrochemical feedstocks that support South Africa’s industrial base and export-oriented manufacturing sectors.

Aviation fuels represent a specialized but important market segment, with demand driven by domestic and international air travel, cargo operations, and military requirements. Airport infrastructure development and airline industry growth support sustained demand in this category.

Marine fuels benefit from South Africa’s strategic coastal location and major port operations, with demand from international shipping, fishing fleets, and offshore activities. Port expansion projects and increased maritime trade create growth opportunities in this specialized segment.

Specialty products including lubricants, greases, and petrochemicals serve niche markets with higher margins and specialized applications. These products require technical expertise and customer service capabilities that create competitive advantages for suppliers with appropriate capabilities.

Petroleum companies benefit from South Africa’s stable regulatory environment, established infrastructure, and growing regional market opportunities that support business expansion and profitability. The market provides diverse revenue streams and strategic positioning for regional operations.

Government stakeholders gain economic benefits through tax revenues, employment creation, and energy security enhancement that supports national development objectives. The petroleum sector contributes significantly to government finances and economic stability.

Industrial customers benefit from reliable fuel supply, competitive pricing, and comprehensive service offerings that support operational efficiency and cost management. Established distribution networks ensure consistent product availability and supply chain reliability.

Consumers enjoy access to quality petroleum products through extensive retail networks, competitive pricing, and service innovations that enhance convenience and value. Brand competition drives service improvements and customer benefit programs.

Regional economies benefit from South Africa’s role as a petroleum hub, with cross-border trade, infrastructure sharing, and technical expertise transfer supporting regional energy security and economic development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend in South Africa’s petroleum market, with companies investing in advanced analytics, mobile applications, and automated systems to improve operational efficiency and customer service delivery. MWR data indicates that digital initiatives improve customer satisfaction rates by approximately 25% annually.

Environmental sustainability initiatives drive market transformation through cleaner fuel standards, emission reduction technologies, and renewable energy integration programs. Companies invest in environmental compliance and sustainability programs to meet regulatory requirements and customer expectations.

Regional integration accelerates through cross-border partnerships, shared infrastructure projects, and harmonized regulatory frameworks that facilitate petroleum trade throughout Southern Africa. This integration creates economies of scale and market expansion opportunities for South African companies.

Customer experience enhancement becomes increasingly important as petroleum companies differentiate through service quality, convenience offerings, and loyalty programs. Retail innovation includes mobile payment systems, customer apps, and value-added services that improve customer engagement.

Supply chain optimization focuses on efficiency improvements, cost reduction, and reliability enhancement through advanced logistics systems, inventory management, and distribution network optimization. These improvements support competitive positioning and profitability enhancement.

Infrastructure modernization projects include refinery upgrades, pipeline expansion, and storage facility development that enhance market capacity and operational efficiency. These investments support long-term market growth and improve supply chain reliability.

Strategic partnerships between international oil companies and local enterprises create opportunities for technology transfer, capital investment, and market expansion. Joint ventures and collaboration agreements strengthen competitive positioning and operational capabilities.

Regulatory reforms streamline licensing processes, enhance market competition, and promote foreign investment in the petroleum sector. Government initiatives support market development while maintaining energy security and environmental protection objectives.

Technology adoption accelerates across the petroleum value chain, with companies implementing advanced systems for exploration, refining, distribution, and retail operations. Innovation investments improve operational efficiency and competitive advantages.

Market consolidation activities include mergers, acquisitions, and strategic alliances that reshape competitive dynamics and create larger, more efficient market participants with enhanced capabilities and market reach.

Investment prioritization should focus on infrastructure modernization, technology adoption, and regional expansion opportunities that support long-term competitive positioning. Companies should balance growth investments with operational efficiency improvements and risk management strategies.

Regulatory compliance requires proactive engagement with government agencies, environmental standards implementation, and safety protocol enhancement. Companies should invest in compliance systems and stakeholder relationships to manage regulatory risks effectively.

Market diversification strategies should include biofuel development, petrochemical expansion, and specialty product offerings that reduce dependence on traditional petroleum products and create new revenue streams with higher margins.

Regional expansion opportunities require careful market analysis, partnership development, and risk assessment to successfully enter neighboring markets. Companies should leverage South Africa’s infrastructure and expertise advantages while adapting to local market conditions.

Sustainability initiatives should integrate environmental compliance with business strategy, creating competitive advantages through cleaner technologies and responsible business practices that appeal to environmentally conscious customers and stakeholders.

Market growth projections indicate continued expansion of South Africa’s petroleum market, driven by economic development, infrastructure investment, and regional integration initiatives. The market is expected to maintain steady growth rates of approximately 3.8% CAGR over the next five years, supported by diverse demand drivers and strategic positioning advantages.

Technology integration will accelerate across all market segments, with digital transformation initiatives improving operational efficiency, customer service, and competitive positioning. Advanced analytics, automation systems, and mobile technologies will become standard operational tools throughout the industry.

Environmental compliance requirements will continue expanding, driving investment in cleaner technologies, emission reduction systems, and sustainable business practices. Companies that proactively address environmental challenges will gain competitive advantages and regulatory compliance benefits.

Regional market integration will deepen through infrastructure sharing, regulatory harmonization, and cross-border partnership development. South Africa’s role as a regional petroleum hub will strengthen, creating additional growth opportunities and market expansion possibilities.

Product diversification trends will accelerate as companies develop biofuel capabilities, specialty petroleum products, and petrochemical operations that reduce market risks and create higher-margin revenue streams. Innovation and product development will become increasingly important for competitive success.

South Africa’s petroleum market demonstrates strong fundamentals and promising growth prospects, supported by established infrastructure, strategic geographic positioning, and diverse demand drivers across transportation, industrial, and commercial sectors. The market benefits from stable regulatory frameworks, competitive dynamics, and regional integration opportunities that create sustainable competitive advantages.

Key success factors for market participants include infrastructure investment, technology adoption, regulatory compliance, and strategic positioning for regional expansion opportunities. Companies that effectively balance growth investments with operational efficiency improvements will achieve sustainable competitive advantages in this dynamic market environment.

Future market development will be shaped by environmental sustainability requirements, digital transformation initiatives, and regional integration programs that create both challenges and opportunities for petroleum companies. Strategic planning and adaptive management approaches will be essential for navigating market evolution and capitalizing on emerging opportunities while managing associated risks effectively.

What is Petroleum?

Petroleum is a naturally occurring liquid found beneath the Earth’s surface, primarily composed of hydrocarbons. It is a crucial energy source used in various applications, including fuel for vehicles, heating, and the production of petrochemicals.

What are the key players in the South Africa Petroleum Market?

Key players in the South Africa Petroleum Market include Sasol, TotalEnergies, and PetroSA, which are involved in exploration, refining, and distribution of petroleum products, among others.

What are the growth factors driving the South Africa Petroleum Market?

The South Africa Petroleum Market is driven by increasing energy demand, urbanization, and industrial growth. Additionally, government initiatives to enhance energy security and reduce reliance on imports contribute to market expansion.

What challenges does the South Africa Petroleum Market face?

The South Africa Petroleum Market faces challenges such as fluctuating global oil prices, regulatory hurdles, and environmental concerns. These factors can impact investment and operational stability within the sector.

What opportunities exist in the South Africa Petroleum Market?

Opportunities in the South Africa Petroleum Market include the development of renewable energy projects, advancements in extraction technologies, and potential offshore discoveries. These factors may enhance the country’s energy mix and sustainability efforts.

What trends are shaping the South Africa Petroleum Market?

Trends in the South Africa Petroleum Market include a shift towards cleaner energy sources, increased investment in refining capacity, and the adoption of digital technologies for operational efficiency. These trends reflect a broader global movement towards sustainability and innovation.

South Africa Petroleum Market

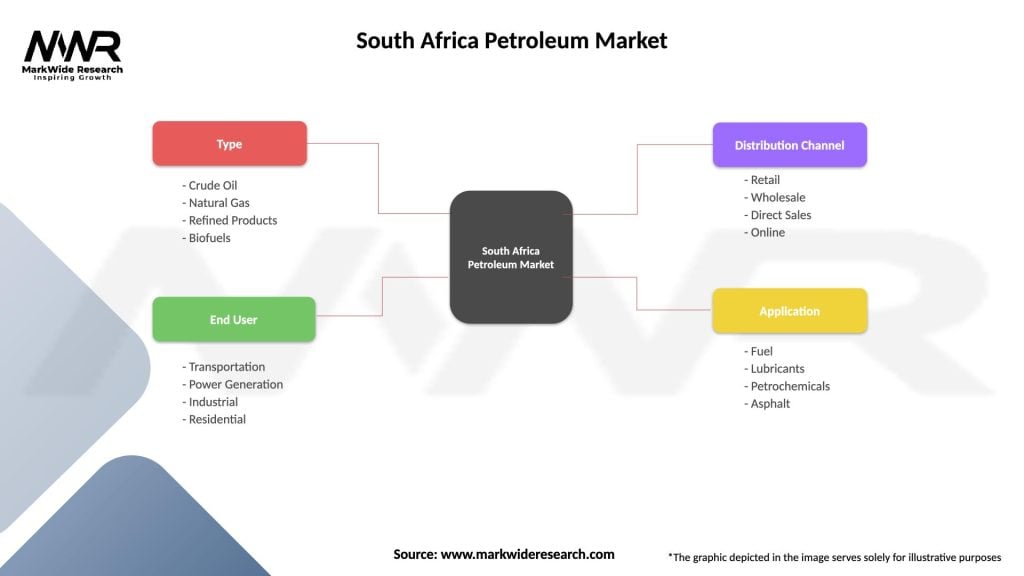

| Segmentation Details | Description |

|---|---|

| Type | Crude Oil, Natural Gas, Refined Products, Biofuels |

| End User | Transportation, Power Generation, Industrial, Residential |

| Distribution Channel | Retail, Wholesale, Direct Sales, Online |

| Application | Fuel, Lubricants, Petrochemicals, Asphalt |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Petroleum Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at