444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa property and casualty insurance market represents a cornerstone of the nation’s financial services sector, providing essential risk management solutions across diverse economic segments. This dynamic market encompasses comprehensive coverage for property damage, liability protection, motor vehicle insurance, and specialized commercial lines that serve both individual consumers and corporate entities throughout the region.

Market dynamics in South Africa’s P&C insurance landscape reflect the country’s unique economic environment, characterized by evolving regulatory frameworks, technological advancement, and changing consumer expectations. The sector demonstrates resilience despite economic challenges, with insurers adapting their offerings to meet the diverse needs of South Africa’s heterogeneous population and business community.

Growth trajectories indicate sustained expansion driven by increasing urbanization, rising middle-class participation, and enhanced digital penetration. The market benefits from a well-established regulatory environment overseen by the Prudential Authority, which ensures stability while promoting innovation and competition among market participants.

Digital transformation initiatives are reshaping traditional insurance delivery models, with insurers investing heavily in technology platforms, mobile applications, and data analytics capabilities. This technological evolution enables more personalized product offerings, streamlined claims processing, and improved customer engagement across all market segments.

The South Africa P&C insurance market refers to the comprehensive ecosystem of insurance providers, intermediaries, and regulatory bodies that deliver property and casualty insurance products to consumers and businesses across South Africa. This market encompasses protection against property damage, liability risks, motor vehicle accidents, and various other non-life insurance exposures that individuals and organizations face in their daily operations.

Property insurance components include coverage for residential and commercial buildings, contents protection, and specialized property risks such as engineering insurance and construction coverage. These products protect policyholders against losses from fire, theft, natural disasters, and other perils that could damage or destroy physical assets.

Casualty insurance elements encompass liability protection, motor vehicle insurance, professional indemnity, and public liability coverage. These products provide financial protection against legal obligations arising from third-party claims, ensuring that policyholders can meet their legal and financial responsibilities when accidents or incidents occur.

South Africa’s P&C insurance market demonstrates remarkable resilience and adaptability within the broader African insurance landscape. The sector serves as a critical economic stabilizer, providing risk transfer mechanisms that enable business growth, individual wealth protection, and economic development across multiple sectors.

Key performance indicators reveal a market characterized by steady growth, increasing digitalization, and evolving customer preferences. The sector benefits from a sophisticated regulatory framework, established distribution networks, and growing awareness of insurance benefits among previously underserved populations.

Market concentration reflects a competitive landscape dominated by several major insurers while maintaining space for specialized providers and emerging insurtech companies. This balance promotes innovation while ensuring market stability and consumer protection through established industry practices and regulatory oversight.

Strategic priorities for market participants include digital transformation, product innovation, distribution channel optimization, and enhanced customer experience delivery. These focus areas align with broader economic trends and consumer expectations in South Africa’s evolving financial services environment.

Market penetration analysis reveals significant opportunities for expansion, particularly in underserved demographic segments and emerging economic sectors. The insurance industry continues to develop innovative approaches to reach previously excluded populations through microinsurance products, mobile-based solutions, and simplified application processes.

Critical success factors in the South African P&C insurance market include:

Economic development serves as a fundamental driver of P&C insurance demand in South Africa. As the economy expands and diversifies, businesses require comprehensive insurance protection for their assets, operations, and liability exposures. This economic growth creates opportunities for insurers to develop specialized products and services tailored to emerging industries and business models.

Regulatory evolution continues to shape market dynamics through initiatives such as the Insurance Act implementation, which modernizes the regulatory framework and promotes market development. These regulatory changes encourage innovation while maintaining consumer protection standards, creating an environment conducive to sustainable market growth.

Urbanization trends drive increased demand for property insurance as more South Africans acquire homes, vehicles, and personal property requiring protection. Urban populations typically demonstrate higher insurance awareness and purchasing power, contributing to market expansion and product sophistication.

Digital transformation enables insurers to reach new customer segments, streamline operations, and develop innovative products. Mobile technology penetration and internet connectivity improvements facilitate digital insurance distribution, claims processing, and customer service delivery across diverse geographic and demographic markets.

Climate change awareness increases demand for comprehensive property protection as extreme weather events become more frequent and severe. This environmental factor drives innovation in risk assessment, product design, and claims management processes throughout the insurance value chain.

Economic volatility presents ongoing challenges for the South African P&C insurance market, with currency fluctuations, inflation pressures, and economic uncertainty affecting consumer purchasing power and business investment decisions. These macroeconomic factors can constrain market growth and impact insurer profitability through reduced demand and increased claims costs.

Affordability constraints limit insurance penetration among lower-income populations, despite growing awareness of insurance benefits. Many South Africans struggle to prioritize insurance premiums amid competing financial obligations, creating barriers to market expansion and inclusive growth.

Fraud challenges impose significant costs on the insurance industry through fraudulent claims, staged accidents, and other criminal activities. These issues require substantial investment in fraud detection systems, investigation capabilities, and legal processes, ultimately increasing operational costs and premium levels.

Skills shortages in specialized areas such as actuarial science, underwriting, and claims management constrain industry growth and innovation. The limited availability of qualified professionals affects insurers’ ability to expand operations, develop new products, and maintain service quality standards.

Infrastructure limitations in certain regions affect insurance distribution, claims processing, and risk assessment capabilities. Poor road conditions, limited telecommunications infrastructure, and inadequate emergency services can impact both insurance demand and operational efficiency.

Digital insurance platforms present substantial opportunities for market expansion through improved accessibility, reduced distribution costs, and enhanced customer experience. Insurers can leverage mobile technology, artificial intelligence, and data analytics to create innovative products and services that meet evolving customer expectations.

Microinsurance development offers pathways to serve previously excluded populations through affordable, simplified insurance products. These initiatives can expand market penetration while contributing to financial inclusion and economic development objectives across South Africa’s diverse communities.

Commercial lines expansion provides growth opportunities as businesses increasingly recognize the importance of comprehensive risk management. Specialized products for emerging industries, cyber risks, and environmental liabilities represent areas of significant potential for insurers with appropriate expertise and capabilities.

Partnerships and collaborations with fintech companies, retailers, and other service providers can create new distribution channels and customer touchpoints. These strategic alliances enable insurers to reach broader audiences while leveraging complementary capabilities and market presence.

Data analytics advancement enables more sophisticated risk assessment, pricing optimization, and customer segmentation. Insurers can utilize big data, telematics, and predictive modeling to improve underwriting accuracy, reduce losses, and develop personalized insurance solutions.

Competitive intensity in the South African P&C insurance market drives continuous innovation and service improvement among market participants. Established insurers compete with emerging insurtech companies, creating a dynamic environment that benefits consumers through improved products, services, and pricing options.

Customer expectations continue to evolve, with policyholders demanding faster claims processing, digital service options, and personalized insurance solutions. These changing preferences require insurers to invest in technology, training, and process improvements to maintain competitive positioning and customer satisfaction.

Regulatory developments influence market structure, product offerings, and operational practices throughout the insurance value chain. The Prudential Authority’s ongoing initiatives promote market stability while encouraging innovation and competition among licensed insurers and intermediaries.

Technology adoption accelerates across all market segments, with insurers implementing advanced systems for underwriting, claims processing, customer service, and risk management. According to MarkWide Research analysis, digital transformation initiatives are driving operational efficiency improvements of approximately 25% across leading market participants.

Risk landscape evolution requires continuous adaptation of insurance products and services to address emerging threats such as cyber risks, climate change impacts, and new liability exposures. Insurers must balance innovation with prudent risk management to maintain profitability while meeting customer needs.

Comprehensive market analysis for the South African P&C insurance sector employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research framework combines quantitative data analysis with qualitative market intelligence to provide a complete understanding of market dynamics, trends, and opportunities.

Primary research activities include structured interviews with industry executives, regulatory officials, and market participants across different segments of the insurance value chain. These discussions provide firsthand insights into market challenges, opportunities, and strategic priorities that shape industry development.

Secondary research components encompass analysis of regulatory filings, industry reports, financial statements, and market data from authoritative sources. This information provides quantitative foundations for market sizing, trend analysis, and competitive assessment across different insurance lines and geographic regions.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and statistical analysis techniques. The methodology incorporates both historical data analysis and forward-looking projections to provide comprehensive market intelligence for strategic decision-making.

Market segmentation analysis examines the P&C insurance market across multiple dimensions including product lines, distribution channels, customer segments, and geographic regions. This detailed segmentation provides insights into growth opportunities, competitive dynamics, and market development potential.

Gauteng Province represents the largest regional market for P&C insurance in South Africa, driven by high population density, economic activity concentration, and elevated property values. This region accounts for approximately 45% of total market premium volume, reflecting its status as the country’s economic hub and center of commercial activity.

Western Cape demonstrates strong market development with sophisticated insurance penetration and diverse risk exposures including residential property, commercial enterprises, and specialized industries. The region benefits from relatively stable economic conditions and high insurance awareness among consumers and businesses.

KwaZulu-Natal presents significant growth opportunities through industrial development, port activities, and tourism-related businesses requiring comprehensive insurance protection. The region’s diverse economy creates demand for various P&C insurance products across different sectors and customer segments.

Eastern Cape and other provinces represent emerging markets with substantial potential for insurance expansion as economic development progresses and infrastructure improvements enhance accessibility. These regions offer opportunities for insurers willing to invest in distribution networks and customer education initiatives.

Rural market development remains a strategic priority for the insurance industry, with initiatives focused on improving accessibility, affordability, and relevance of insurance products for rural communities. Digital distribution channels and simplified products are key enablers for rural market penetration.

Market leadership in South Africa’s P&C insurance sector is characterized by several major insurers maintaining significant market share while competing with specialized providers and emerging insurtech companies. The competitive environment promotes innovation, service excellence, and customer-focused product development.

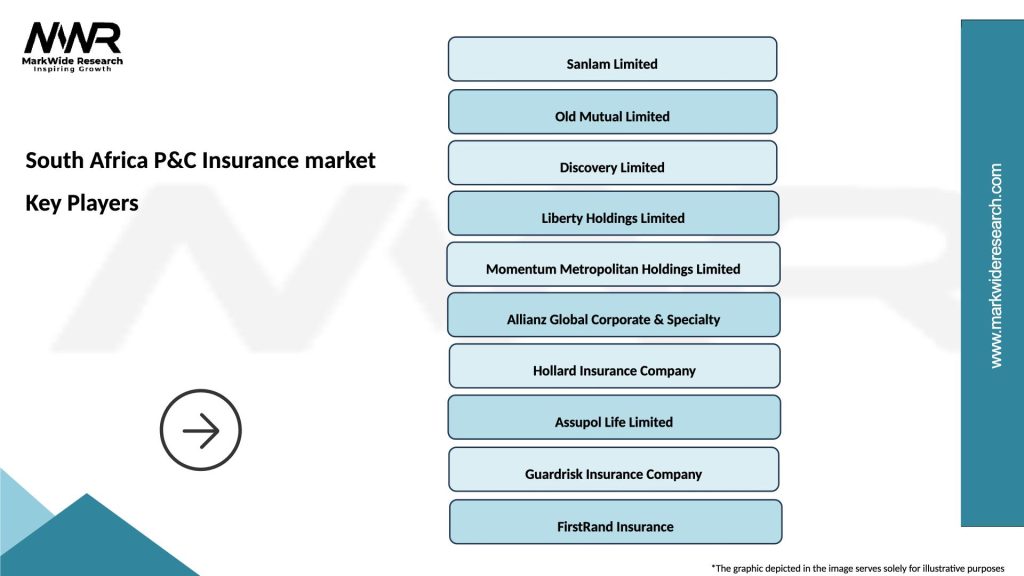

Leading market participants include:

Competitive strategies focus on digital transformation, customer experience enhancement, product innovation, and operational efficiency improvements. Market participants invest heavily in technology platforms, data analytics capabilities, and distribution channel optimization to maintain competitive advantages.

Product line segmentation reveals distinct market characteristics and growth patterns across different insurance categories within the South African P&C market. Each segment demonstrates unique dynamics, customer requirements, and competitive landscapes that influence strategic approaches and market development initiatives.

By Product Type:

By Distribution Channel:

Motor insurance dominance reflects South Africa’s high vehicle ownership rates and mandatory insurance requirements. This category benefits from stable demand drivers including new vehicle sales, economic activity levels, and regulatory compliance requirements. Insurers compete intensively on pricing, service quality, and claims handling efficiency.

Property insurance evolution demonstrates increasing sophistication as property values rise and customers demand comprehensive coverage options. Climate change impacts drive product innovation including flood coverage, severe weather protection, and risk mitigation services that help policyholders protect their assets.

Commercial lines expansion reflects growing business awareness of risk management importance and regulatory requirements for certain types of coverage. This segment offers higher margins and longer-term customer relationships, making it attractive for insurers seeking profitable growth opportunities.

Specialty insurance development addresses unique risks in sectors such as mining, agriculture, and technology. These specialized products require deep industry knowledge and sophisticated underwriting capabilities, creating opportunities for insurers with appropriate expertise and market positioning.

Microinsurance initiatives target previously underserved populations through simplified products, affordable premiums, and accessible distribution channels. These programs contribute to financial inclusion while creating new market opportunities for participating insurers.

Insurance companies benefit from diverse revenue streams, risk diversification opportunities, and potential for sustainable growth in an expanding market. The South African P&C insurance sector offers established regulatory frameworks, sophisticated infrastructure, and growing customer awareness that support business development and profitability.

Policyholders gain access to comprehensive risk protection, financial security, and peace of mind through professional insurance coverage. The competitive market environment ensures reasonable pricing, service quality improvements, and product innovation that meets evolving customer needs and preferences.

Intermediaries and brokers benefit from commission income, professional development opportunities, and the ability to provide valuable risk management advice to clients. The market supports various distribution models and compensation structures that enable intermediaries to build sustainable businesses.

Regulatory authorities achieve market stability, consumer protection, and economic development objectives through effective oversight of a well-functioning insurance market. The sector contributes to financial system stability and economic resilience through risk transfer mechanisms and capital accumulation.

Economic stakeholders benefit from reduced financial volatility, enhanced business confidence, and improved access to credit through insurance-backed risk management. The insurance sector supports economic growth by enabling business investment, individual wealth accumulation, and recovery from adverse events.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies are transforming how insurers interact with customers, process applications, and handle claims. Leading companies invest heavily in mobile applications, online platforms, and automated systems that provide seamless customer experiences while reducing operational costs and improving efficiency.

Personalization initiatives leverage data analytics and artificial intelligence to create customized insurance products and pricing models. Insurers utilize telematics, behavioral data, and predictive modeling to better understand customer needs and risk profiles, enabling more accurate pricing and targeted product development.

Sustainability focus drives product innovation and operational improvements as insurers respond to climate change impacts and environmental concerns. Green insurance products, sustainable business practices, and climate risk assessment capabilities become increasingly important for market competitiveness and regulatory compliance.

Insurtech collaboration accelerates innovation through partnerships between traditional insurers and technology companies. These collaborations enable rapid development of new products, services, and distribution models while leveraging complementary capabilities and market expertise.

Customer experience enhancement remains a critical differentiator as insurers compete for market share and customer loyalty. Companies invest in omnichannel service delivery, simplified processes, and proactive customer communication to meet rising expectations and improve satisfaction levels. MWR research indicates that customer experience improvements can drive retention rate increases of up to 15% in competitive markets.

Regulatory modernization continues through implementation of updated insurance legislation and supervisory frameworks. The Prudential Authority’s ongoing initiatives focus on market development, consumer protection, and international best practice adoption while maintaining market stability and competitive dynamics.

Technology investments accelerate across the industry as insurers upgrade core systems, implement advanced analytics platforms, and develop digital customer interfaces. These technology initiatives enable improved operational efficiency, better risk management, and enhanced customer service capabilities.

Market consolidation activities include mergers, acquisitions, and strategic partnerships that reshape competitive dynamics and market structure. These transactions often focus on achieving scale economies, expanding distribution capabilities, and accessing specialized expertise or technology platforms.

Product innovation addresses emerging risks and customer needs through development of cyber insurance, climate-related coverage, and usage-based insurance products. Insurers collaborate with technology providers and industry experts to create solutions for evolving risk landscapes and customer preferences.

Distribution evolution encompasses expansion of digital channels, development of new partnership models, and enhancement of traditional distribution networks. Insurers experiment with various approaches to reach different customer segments while optimizing cost structures and service quality.

Strategic priorities for South African P&C insurers should focus on digital transformation acceleration, customer experience enhancement, and market expansion initiatives. Companies must balance innovation investments with operational efficiency improvements to maintain competitiveness while achieving sustainable growth objectives.

Technology adoption recommendations include implementation of comprehensive digital platforms, advanced data analytics capabilities, and automated processing systems. These investments enable improved customer service, more accurate risk assessment, and operational cost reductions that support long-term profitability.

Market development strategies should emphasize underserved segment penetration through innovative products, accessible distribution channels, and affordable pricing models. Insurers can leverage partnerships, digital platforms, and simplified processes to reach previously excluded populations while maintaining prudent risk management practices.

Risk management enhancement requires continuous investment in fraud detection systems, catastrophe modeling capabilities, and emerging risk assessment tools. Companies must balance growth objectives with prudent underwriting practices to maintain profitability and financial stability in evolving risk environments.

Competitive positioning strategies should focus on differentiation through superior customer experience, innovative products, and operational excellence. Insurers must identify unique value propositions that resonate with target customers while building sustainable competitive advantages in increasingly competitive markets.

Growth projections for the South African P&C insurance market indicate continued expansion driven by economic development, increasing insurance awareness, and digital transformation initiatives. The market is expected to maintain steady growth momentum with projected annual growth rates of 6-8% over the medium term, supported by favorable demographic trends and regulatory developments.

Digital transformation will accelerate across all market segments, with insurers investing heavily in technology platforms, data analytics, and customer interface improvements. These initiatives will enable more efficient operations, better customer experiences, and innovative product offerings that meet evolving market needs and preferences.

Market expansion opportunities will emerge from increased penetration in underserved segments, development of new product categories, and geographic expansion initiatives. Insurers will focus on microinsurance, commercial lines growth, and specialized coverage areas to capture additional market opportunities while diversifying revenue streams.

Regulatory evolution will continue supporting market development through modernized frameworks, enhanced consumer protection measures, and innovation-friendly policies. According to MarkWide Research projections, regulatory initiatives are expected to contribute to market accessibility improvements of approximately 20% over the next five years.

Competitive dynamics will intensify as traditional insurers compete with insurtech companies and new market entrants. This competition will drive continued innovation, service improvements, and customer-focused strategies that benefit consumers while creating challenges and opportunities for market participants.

South Africa’s P&C insurance market represents a dynamic and evolving sector with substantial growth potential and significant opportunities for innovation and expansion. The market benefits from a well-established regulatory framework, sophisticated infrastructure, and increasing customer awareness that support sustainable development and competitive dynamics.

Key success factors for market participants include digital transformation capabilities, customer-centric strategies, operational efficiency, and prudent risk management practices. Companies that effectively balance innovation with stability while meeting evolving customer needs will be best positioned to capture growth opportunities and maintain competitive advantages.

Future prospects remain positive despite economic challenges and competitive pressures. The market’s resilience, combined with ongoing technological advancement and regulatory support, creates an environment conducive to continued growth and development across all segments of the P&C insurance value chain.

Strategic imperatives for industry stakeholders include embracing digital transformation, expanding market reach, enhancing customer experiences, and developing innovative solutions for emerging risks. Success in this evolving market requires continuous adaptation, investment in capabilities, and commitment to meeting the diverse needs of South Africa’s insurance consumers and businesses.

What is P&C Insurance?

P&C Insurance, or Property and Casualty Insurance, refers to a type of coverage that protects individuals and businesses from financial losses related to property damage and liability claims. This includes various policies such as auto, home, and commercial insurance.

What are the key players in the South Africa P&C Insurance market?

Key players in the South Africa P&C Insurance market include companies like Santam, Old Mutual Insure, and Mutual & Federal, which offer a range of insurance products to consumers and businesses. These companies compete on factors such as pricing, customer service, and product offerings among others.

What are the growth factors driving the South Africa P&C Insurance market?

The growth of the South Africa P&C Insurance market is driven by increasing urbanization, a growing middle class, and rising awareness of the importance of insurance. Additionally, the expansion of digital platforms for insurance services is enhancing accessibility for consumers.

What challenges does the South Africa P&C Insurance market face?

The South Africa P&C Insurance market faces challenges such as high levels of fraud, regulatory compliance issues, and economic instability. These factors can impact profitability and the ability to provide affordable coverage to consumers.

What opportunities exist in the South Africa P&C Insurance market?

Opportunities in the South Africa P&C Insurance market include the potential for innovative insurance products tailored to emerging risks, such as cyber insurance and climate-related coverage. Additionally, the adoption of technology in underwriting and claims processing presents avenues for growth.

What trends are shaping the South Africa P&C Insurance market?

Trends shaping the South Africa P&C Insurance market include the increasing use of artificial intelligence for risk assessment and claims management, as well as a shift towards more personalized insurance products. Sustainability and ESG considerations are also becoming more prominent in product development.

South Africa P&C Insurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Homeowners, Auto, Commercial, Liability |

| Customer Type | Individuals, Small Businesses, Corporates, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Third-Party, Fire, Theft |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa P&C Insurance market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at