444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa out-of-home (OOH) and digital out-of-home (DOOH) market represents a dynamic and rapidly evolving advertising landscape that continues to transform how brands connect with consumers across the nation. This comprehensive market encompasses traditional billboard advertising, transit advertising, street furniture, and increasingly sophisticated digital displays that leverage cutting-edge technology to deliver targeted messaging. Market dynamics indicate substantial growth potential driven by urbanization, technological advancement, and changing consumer behavior patterns throughout South African metropolitan areas.

Digital transformation has become the cornerstone of market evolution, with DOOH solutions experiencing remarkable adoption rates of approximately 12.5% annually as advertisers seek more engaging and measurable advertising formats. The integration of programmatic advertising capabilities, real-time content management, and data-driven targeting has positioned South Africa as a leading market for innovative OOH solutions across the African continent. Urban centers including Johannesburg, Cape Town, and Durban serve as primary growth engines, accounting for nearly 75% of total market activity while secondary cities demonstrate increasing investment in modern advertising infrastructure.

Technological innovation continues to reshape market opportunities, with LED technology, interactive displays, and mobile integration creating new possibilities for advertiser engagement. The market benefits from South Africa’s relatively advanced telecommunications infrastructure, enabling sophisticated DOOH networks that can deliver dynamic content based on time of day, weather conditions, and audience demographics. Investment trends show increasing focus on sustainable advertising solutions and energy-efficient display technologies that align with corporate environmental responsibility initiatives.

The South Africa out-of-home and digital out-of-home market refers to the comprehensive ecosystem of advertising media and technologies deployed in public spaces to reach consumers outside their homes and workplaces. This market encompasses traditional static advertising formats such as billboards, posters, and transit advertising, alongside advanced digital displays that utilize LED technology, interactive capabilities, and programmatic advertising platforms to deliver dynamic, targeted messaging to specific audience segments.

OOH advertising represents any visual advertising media found outside the home environment, including roadside billboards, transit shelters, shopping mall displays, and airport advertising spaces. DOOH advertising specifically refers to digital formats that can display multiple advertisements, change content remotely, and incorporate interactive elements such as touch screens, QR codes, and mobile connectivity. These digital solutions enable real-time content updates, audience measurement, and sophisticated targeting capabilities that traditional static formats cannot provide.

Market definition extends beyond simple advertising placement to include comprehensive solutions involving content management systems, audience analytics, programmatic buying platforms, and integration with broader digital marketing ecosystems. The South African market specifically benefits from advanced telecommunications infrastructure that supports sophisticated DOOH networks capable of delivering personalized content based on demographic data, location intelligence, and real-time environmental factors.

Market leadership in South Africa’s OOH and DOOH sector reflects a mature advertising ecosystem that successfully balances traditional outdoor advertising strengths with innovative digital capabilities. The market demonstrates robust growth trajectory supported by increasing urbanization, rising consumer spending power, and advertiser demand for measurable, engaging advertising formats that can compete effectively with digital media channels.

Digital adoption has accelerated significantly, with DOOH formats now representing approximately 35% of total OOH advertising investment as brands recognize the superior engagement rates and measurement capabilities offered by digital platforms. This shift reflects broader global trends toward programmatic advertising, real-time optimization, and data-driven marketing strategies that require sophisticated technological infrastructure and analytics capabilities.

Competitive dynamics feature established media companies expanding digital capabilities alongside emerging technology providers specializing in DOOH solutions. The market benefits from increasing collaboration between traditional outdoor advertising companies and technology partners, creating comprehensive solutions that combine prime advertising locations with advanced digital capabilities and audience measurement tools.

Growth drivers include expanding retail environments, infrastructure development projects, and increasing focus on location-based marketing strategies that leverage South Africa’s growing smartphone penetration rates. MarkWide Research analysis indicates that integration with mobile marketing campaigns has become a critical success factor, with brands seeking omnichannel approaches that connect OOH messaging with digital engagement opportunities.

Strategic positioning within South Africa’s advertising landscape reveals several critical insights that define market opportunities and competitive dynamics:

Urbanization trends continue to fuel market expansion as South Africa’s metropolitan areas experience sustained population growth and infrastructure development. This demographic shift creates larger audiences for OOH advertising while concentrating consumer spending power in areas where outdoor advertising can achieve maximum impact. Urban development projects including shopping centers, transportation hubs, and mixed-use developments provide new opportunities for both traditional and digital advertising installations.

Digital transformation across all advertising channels has elevated expectations for OOH campaigns, driving demand for DOOH solutions that can deliver dynamic content, real-time updates, and measurable results. Advertisers increasingly require outdoor campaigns that integrate seamlessly with digital marketing strategies, social media campaigns, and mobile marketing initiatives. Programmatic capabilities enable automated buying processes that improve efficiency and targeting precision while reducing campaign management complexity.

Economic recovery following recent challenges has restored advertiser confidence and marketing budgets, with outdoor advertising benefiting from its ability to reach broad audiences cost-effectively. Retail sector growth particularly drives demand for location-based advertising that can influence purchase decisions at critical moments in the consumer journey. Shopping centers, retail parks, and commercial districts represent high-value environments where OOH advertising can directly impact sales performance.

Technology advancement in display technology, content management systems, and audience measurement tools has significantly improved the value proposition of DOOH investments. LED technology improvements offer better image quality, lower energy consumption, and longer operational life, making digital installations more economically viable for advertisers and media owners alike.

Economic volatility in South Africa creates periodic challenges for advertising spending, with outdoor media often experiencing budget cuts during economic uncertainty. Currency fluctuations affect the cost of imported technology and equipment, potentially impacting the pace of digital infrastructure development and upgrade cycles for existing installations.

Regulatory complexity surrounding outdoor advertising varies significantly across municipalities, creating compliance challenges for national campaigns and potentially limiting expansion opportunities in certain markets. Zoning restrictions and environmental regulations can constrain placement options for new installations, particularly in environmentally sensitive areas or heritage districts where visual impact concerns take precedence.

Infrastructure limitations in some regions affect the viability of sophisticated DOOH installations, particularly regarding reliable electricity supply and telecommunications connectivity required for advanced digital displays. Maintenance challenges in remote or high-crime areas can increase operational costs and reduce the attractiveness of certain locations for premium advertising investments.

Competition from digital media continues to pressure traditional advertising budgets, with online platforms offering detailed targeting and measurement capabilities that challenge OOH’s value proposition. Measurement standardization remains an ongoing challenge, with advertisers seeking more sophisticated audience verification and campaign effectiveness metrics comparable to digital advertising platforms.

Smart city initiatives across South African municipalities present significant opportunities for integrated DOOH networks that can serve both advertising and public information functions. These projects often include digital infrastructure development that can support advanced advertising capabilities while providing community benefits such as emergency communications, traffic information, and public service announcements.

Retail expansion in emerging markets and secondary cities creates new opportunities for OOH and DOOH installations as national retailers extend their geographic reach. Shopping center development particularly offers controlled environments where sophisticated digital advertising networks can be implemented with guaranteed audience flow and extended dwell times.

Event marketing and experiential campaigns represent growing opportunities as brands seek to create memorable interactions with consumers. Interactive DOOH installations can support augmented reality experiences, social media integration, and gamification elements that extend campaign reach beyond immediate viewers through social sharing and viral marketing effects.

Data integration opportunities enable DOOH networks to leverage location intelligence, weather data, traffic patterns, and demographic information to deliver highly relevant advertising content. Programmatic advertising platforms can automate campaign optimization based on real-time performance data, improving return on investment for advertisers while maximizing revenue for media owners.

Competitive intensity in South Africa’s OOH and DOOH market reflects a mature industry with established players investing heavily in digital transformation while new entrants focus on technology innovation and niche market segments. Market consolidation trends show larger media companies acquiring smaller operators to achieve scale economies and expand geographic coverage, creating more comprehensive national advertising networks.

Technology evolution drives continuous market transformation as display quality improvements, cost reductions, and new interactive capabilities create opportunities for enhanced advertiser value propositions. LED technology advancement has significantly reduced the total cost of ownership for digital displays while improving image quality and reliability, making DOOH installations viable in previously unsuitable locations.

Advertiser expectations continue to evolve toward greater accountability, measurement precision, and integration with broader marketing campaigns. Attribution modeling and audience verification technologies enable more sophisticated campaign evaluation, helping justify OOH investments within integrated marketing strategies that span multiple channels and touchpoints.

Regulatory environment shows increasing focus on digital advertising standards, environmental impact, and public safety considerations that influence installation requirements and operational procedures. Industry collaboration with regulatory authorities helps establish frameworks that balance commercial interests with community concerns about visual pollution and public space utilization.

Comprehensive analysis of South Africa’s OOH and DOOH market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, media buyers, technology providers, and regulatory officials to capture current market dynamics and future trend projections.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and market data from established sources to validate primary findings and provide historical context for market development patterns. Quantitative analysis includes statistical modeling of market trends, growth patterns, and competitive positioning based on available performance data and industry benchmarks.

Field research involves direct observation and documentation of OOH and DOOH installations across major South African markets to assess technology deployment, audience engagement, and competitive positioning. Technology assessment includes evaluation of current and emerging display technologies, content management systems, and audience measurement platforms that influence market development.

Stakeholder consultation with advertisers, agencies, media owners, and technology providers provides insights into market challenges, opportunities, and strategic priorities that shape investment decisions and competitive strategies. Regulatory analysis examines current and proposed legislation affecting outdoor advertising to assess potential market impacts and compliance requirements.

Gauteng Province dominates South Africa’s OOH and DOOH market, representing approximately 45% of total market activity driven by Johannesburg and Pretoria’s dense urban populations and high commercial activity levels. Economic hub status attracts national and international advertisers seeking maximum reach and frequency, while sophisticated infrastructure supports advanced DOOH installations with programmatic capabilities and real-time content management.

Western Cape accounts for roughly 25% of market share with Cape Town serving as the primary growth center supported by tourism, retail, and financial services sectors. Tourist destinations provide unique opportunities for seasonal campaigns and international brand exposure, while the region’s relatively affluent demographics attract premium advertisers seeking high-value audience segments.

KwaZulu-Natal represents approximately 15% of market activity centered around Durban’s port city economy and growing retail sector. Coastal development and industrial growth create opportunities for both traditional and digital advertising formats, while the region’s diverse population provides attractive demographic targeting opportunities for national campaigns.

Secondary markets including Eastern Cape, Free State, and other provinces collectively account for the remaining 15% of market share but demonstrate increasing investment in modern advertising infrastructure. Regional development initiatives and retail expansion into smaller cities create new opportunities for OOH and DOOH installations, though economic constraints may limit the pace of digital adoption in these markets.

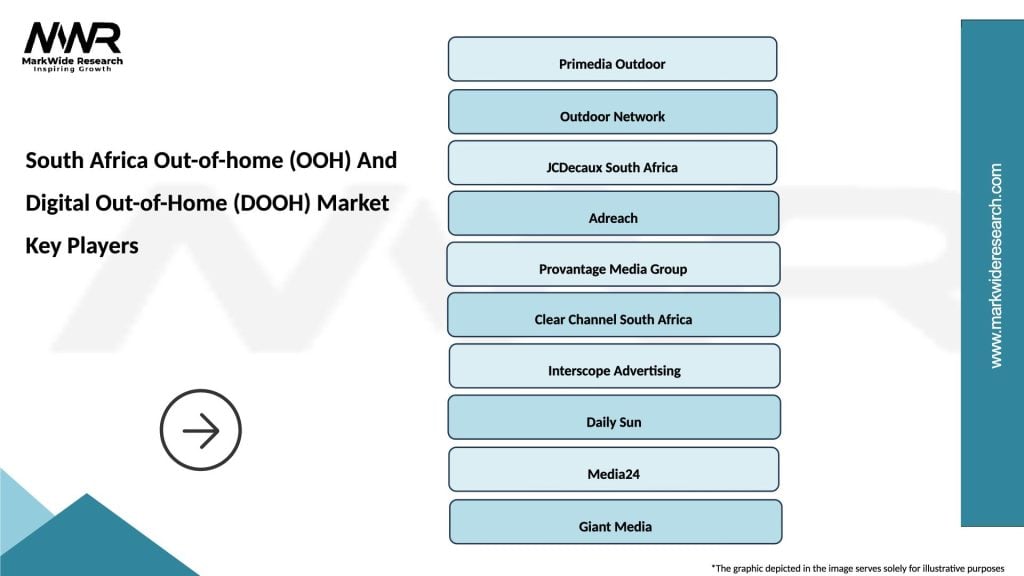

Market leadership in South Africa’s OOH and DOOH sector features several established companies that have successfully adapted to digital transformation while maintaining strong positions in traditional outdoor advertising:

Competitive strategies increasingly focus on technology integration, audience measurement capabilities, and comprehensive service offerings that span traditional and digital formats. Strategic partnerships between media companies and technology providers enable rapid deployment of advanced DOOH solutions while maintaining cost competitiveness and operational efficiency.

Market differentiation occurs through location quality, technology sophistication, audience measurement accuracy, and integration with broader digital marketing ecosystems. Innovation leadership becomes increasingly important as advertisers seek partners capable of delivering cutting-edge solutions that maximize campaign effectiveness and return on investment.

Format segmentation reveals distinct market categories with different growth trajectories and competitive dynamics:

By Format Type:

By Technology:

By Location:

Traditional billboard advertising maintains significant market presence despite digital transformation trends, particularly in locations where static displays offer cost-effective reach for long-term campaigns. Premium locations along major highways and urban arterials continue to command strong advertiser interest, especially for brand awareness campaigns that benefit from consistent, repeated exposure over extended periods.

Digital billboard networks demonstrate the strongest growth trajectory with 22% annual expansion as advertisers recognize the flexibility and measurement capabilities offered by LED technology. Programmatic integration enables automated campaign management and real-time optimization based on traffic patterns, weather conditions, and audience demographics, significantly improving campaign effectiveness and return on investment.

Transit advertising benefits from South Africa’s expanding public transportation infrastructure and increasing urban commuter populations. Bus rapid transit systems and modernized train networks provide controlled environments for sophisticated DOOH installations with guaranteed audience exposure and detailed ridership analytics for campaign planning and optimization.

Retail DOOH represents the fastest-growing category as shopping centers invest in digital infrastructure to enhance tenant value and advertising revenue. Shopper analytics enable precise targeting based on demographic profiles, shopping patterns, and purchase intent, creating premium advertising opportunities that command higher rates than traditional outdoor formats.

Interactive installations emerge as a specialized category offering unique engagement opportunities through touch screens, augmented reality, and mobile integration. Experiential campaigns leverage these capabilities to create memorable brand interactions that extend beyond immediate viewers through social media sharing and viral marketing effects.

Advertisers benefit from enhanced targeting capabilities, improved measurement accuracy, and greater campaign flexibility offered by modern OOH and DOOH solutions. Real-time optimization enables continuous campaign improvement based on performance data, weather conditions, and audience behavior patterns, maximizing return on advertising investment while reducing waste and inefficiency.

Media owners achieve higher revenue per installation through multiple advertiser rotation, premium pricing for digital formats, and operational efficiency improvements enabled by remote content management systems. Asset utilization increases significantly with digital displays that can serve multiple advertisers simultaneously while providing detailed performance analytics that justify premium pricing structures.

Technology providers find expanding opportunities in display manufacturing, content management systems, audience measurement platforms, and integration services that connect OOH campaigns with broader digital marketing ecosystems. Innovation leadership in areas such as interactive displays, programmatic platforms, and analytics tools creates competitive advantages and recurring revenue opportunities.

Urban planners and municipalities benefit from modern OOH installations that can serve dual purposes as advertising media and public information systems. Smart city integration enables digital displays to provide emergency communications, traffic updates, and community information while generating revenue through commercial advertising partnerships.

Consumers experience more relevant and engaging advertising content through improved targeting and creative capabilities enabled by digital technology. Interactive elements and mobile integration create opportunities for immediate engagement and response, transforming passive advertising exposure into active brand interaction and potential conversion opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising adoption accelerates across DOOH networks as advertisers seek automated buying processes that improve efficiency and targeting precision. Real-time bidding platforms enable dynamic pricing based on audience demographics, traffic patterns, and campaign performance metrics, optimizing revenue for media owners while improving cost-effectiveness for advertisers.

Interactive technology integration transforms traditional advertising displays into engagement platforms that support touch interaction, QR code campaigns, and augmented reality experiences. Mobile connectivity enables seamless transition from outdoor exposure to digital engagement, creating omnichannel marketing opportunities that extend campaign reach and effectiveness.

Sustainability initiatives drive adoption of energy-efficient LED technology, solar-powered installations, and environmentally responsible operational practices. Green advertising becomes increasingly important for corporate social responsibility programs while reducing operational costs and improving long-term investment returns for media owners.

Data integration enables sophisticated audience targeting based on location intelligence, demographic profiles, and behavioral patterns derived from mobile device data and traffic analytics. Privacy-compliant data utilization creates opportunities for personalized advertising content while respecting consumer privacy expectations and regulatory requirements.

Content personalization leverages real-time data to deliver relevant advertising messages based on time of day, weather conditions, traffic patterns, and audience characteristics. Dynamic content optimization improves campaign effectiveness while maximizing the value of each advertising impression through contextual relevance and timing optimization.

Technology partnerships between traditional media companies and digital platform providers accelerate DOOH network deployment and capability enhancement. Strategic alliances enable rapid scaling of programmatic advertising capabilities while maintaining operational efficiency and cost competitiveness in increasingly competitive markets.

Regulatory modernization efforts across South African municipalities aim to streamline approval processes for digital advertising installations while maintaining environmental and safety standards. Industry collaboration with regulatory authorities helps establish frameworks that balance commercial interests with community concerns about visual impact and public space utilization.

Investment expansion by international media companies demonstrates confidence in South Africa’s long-term growth potential and market sophistication. Foreign investment brings advanced technology capabilities and global best practices that enhance competitive dynamics and accelerate market development across all segments.

Measurement standardization initiatives work toward establishing industry-wide audience verification and campaign effectiveness metrics that provide advertisers with confidence comparable to digital media platforms. MWR analysis indicates that standardized measurement protocols will become critical for continued market growth and advertiser adoption.

Sustainability programs focus on reducing environmental impact through energy-efficient technology, responsible content management, and integration with renewable energy sources. Corporate responsibility initiatives align with broader environmental goals while reducing operational costs and improving long-term investment sustainability.

Investment priorities should focus on digital infrastructure development and programmatic platform integration to capture growing demand for automated, data-driven advertising solutions. Technology partnerships with leading platform providers can accelerate capability development while sharing implementation costs and technical risks associated with rapid technological change.

Market expansion opportunities exist in secondary cities and emerging retail developments where modern advertising infrastructure can provide competitive advantages and premium pricing opportunities. Strategic location acquisition in high-growth areas should prioritize sites with long-term development potential and infrastructure support for advanced DOOH installations.

Operational efficiency improvements through centralized content management, remote monitoring, and predictive maintenance can significantly reduce costs while improving service quality and reliability. Automation investments in campaign management and performance optimization enable better resource allocation and improved advertiser satisfaction.

Partnership strategies with retailers, municipalities, and transportation authorities can create new revenue opportunities while providing value-added services that strengthen competitive positioning. Collaborative approaches to smart city initiatives and public-private partnerships offer sustainable growth opportunities with reduced investment risk.

Measurement capabilities require continued investment in audience verification technology, analytics platforms, and integration with advertiser attribution systems. Data strategy development should prioritize privacy compliance while maximizing the value of audience insights for campaign optimization and advertiser reporting.

Market evolution toward fully integrated digital advertising ecosystems will accelerate over the next five years as programmatic platforms mature and audience measurement capabilities improve. Technology convergence between OOH, mobile, and online advertising creates opportunities for sophisticated omnichannel campaigns that maximize reach and frequency across all consumer touchpoints.

Growth projections indicate continued expansion at approximately 8.5% annually driven by digital transformation, urban development, and increasing advertiser confidence in OOH measurement capabilities. DOOH adoption will likely reach 60% of total market investment within five years as technology costs decline and operational advantages become more apparent to both advertisers and media owners.

Innovation trends point toward artificial intelligence integration for content optimization, 5G connectivity enabling real-time campaign management, and augmented reality capabilities creating immersive advertising experiences. Emerging technologies will continue to enhance the value proposition of outdoor advertising while creating new revenue opportunities and competitive differentiators.

Regulatory development will likely focus on standardizing digital advertising practices, environmental impact assessment, and data privacy protection while maintaining support for industry growth and innovation. Policy frameworks that balance commercial interests with community concerns will be essential for sustainable market development and continued investment attraction.

Competitive dynamics will increasingly favor companies that successfully integrate technology capabilities with premium location portfolios and comprehensive service offerings. MarkWide Research projects that market consolidation will continue as scale advantages become more important for technology investment and operational efficiency in an increasingly sophisticated marketplace.

The South Africa out-of-home and digital out-of-home market represents a dynamic and rapidly evolving sector that successfully balances traditional advertising strengths with innovative digital capabilities. Market fundamentals remain strong, supported by urbanization trends, technological advancement, and increasing advertiser demand for measurable, engaging advertising formats that can compete effectively with digital media channels.

Digital transformation continues to reshape market opportunities, with DOOH solutions demonstrating superior growth rates and revenue potential compared to traditional formats. The integration of programmatic advertising capabilities, real-time content management, and sophisticated audience measurement tools positions South Africa as a leading market for innovative outdoor advertising solutions across the African continent.

Strategic opportunities exist for companies that can successfully navigate the balance between technology investment and operational efficiency while maintaining strong relationships with advertisers and regulatory authorities. The market’s future success will depend on continued innovation in measurement capabilities, sustainable operational practices, and integration with broader digital marketing ecosystems that meet evolving advertiser expectations and consumer preferences.

What is Out-of-home (OOH) And Digital Out-of-Home (DOOH)?

Out-of-home (OOH) and Digital Out-of-Home (DOOH) refer to advertising formats that reach consumers while they are outside their homes. This includes billboards, transit ads, and digital screens in public spaces, which are designed to capture the attention of passersby in various locations.

What are the key players in the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market?

Key players in the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market include Primedia Outdoor, Clear Channel South Africa, and Outdoor Network, among others. These companies provide a range of advertising solutions across various platforms and locations.

What are the growth factors driving the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market?

The growth of the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market is driven by increasing urbanization, the rise of digital technology, and the effectiveness of targeted advertising. Additionally, the integration of data analytics enhances campaign performance and audience engagement.

What challenges does the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market face?

The South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market faces challenges such as regulatory restrictions, competition from digital media, and the need for continuous innovation. These factors can impact the effectiveness and reach of OOH advertising campaigns.

What opportunities exist in the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market?

Opportunities in the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market include the expansion of smart city initiatives, increased investment in digital signage, and the potential for interactive advertising experiences. These trends can enhance consumer engagement and brand visibility.

What trends are shaping the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market?

Trends shaping the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market include the growing use of programmatic advertising, the integration of augmented reality, and the focus on sustainability in advertising practices. These innovations are transforming how brands connect with consumers in public spaces.

South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Screens |

| End User | Retailers, Advertisers, Event Organizers, Corporations |

| Technology | LED, LCD, Projection, Interactive Displays |

| Distribution Channel | Direct Sales, Agencies, Online Platforms, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Out-of-home (OOH) And Digital Out-of-Home (DOOH) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at