444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa ophthalmic equipment market represents a dynamic and rapidly evolving sector within the country’s healthcare infrastructure. This specialized market encompasses a comprehensive range of diagnostic, surgical, and therapeutic devices designed to address various eye-related conditions and vision disorders. South Africa’s ophthalmic equipment market has experienced substantial growth driven by increasing prevalence of eye diseases, aging population demographics, and expanding healthcare accessibility across urban and rural regions.

Market dynamics indicate that the sector is experiencing robust expansion, with growth rates reaching approximately 8.2% annually as healthcare facilities modernize their ophthalmology departments. The market encompasses various equipment categories including diagnostic devices, surgical instruments, vision care products, and advanced laser systems. Healthcare infrastructure development across South Africa has created significant opportunities for ophthalmic equipment manufacturers and distributors.

Regional distribution shows that approximately 65% of market activity concentrates in major metropolitan areas including Johannesburg, Cape Town, and Durban, while rural healthcare initiatives are driving demand in previously underserved regions. The market benefits from government healthcare initiatives, private sector investments, and international partnerships that enhance equipment accessibility and affordability.

The South Africa ophthalmic equipment market refers to the comprehensive ecosystem of medical devices, instruments, and technologies specifically designed for the diagnosis, treatment, and management of eye-related conditions within South Africa’s healthcare system. This market encompasses all equipment used by ophthalmologists, optometrists, and eye care professionals to provide comprehensive vision care services.

Ophthalmic equipment includes diagnostic instruments such as optical coherence tomography systems, fundus cameras, and visual field analyzers, alongside surgical devices including phacoemulsification systems, vitrectomy machines, and laser therapy equipment. The market also covers consumable products, maintenance services, and technological upgrades that support ongoing eye care delivery across public and private healthcare facilities.

Market scope extends beyond traditional equipment sales to include training programs, technical support services, and integrated healthcare solutions that enhance overall eye care delivery efficiency. This comprehensive approach ensures that South African healthcare providers can deliver world-class ophthalmology services while addressing the unique challenges of the local healthcare environment.

South Africa’s ophthalmic equipment market demonstrates exceptional growth potential driven by demographic shifts, disease prevalence increases, and healthcare modernization initiatives. The market exhibits strong fundamentals with consistent demand growth across multiple equipment categories and geographic regions. Key market drivers include rising diabetes prevalence, which affects approximately 12.7% of the adult population, leading to increased diabetic retinopathy cases requiring specialized equipment.

Technology adoption rates show significant acceleration, with digital imaging systems experiencing 15.3% annual growth as healthcare facilities upgrade from analog to digital platforms. The market benefits from favorable government policies supporting healthcare infrastructure development and medical equipment procurement programs that enhance accessibility across diverse economic segments.

Competitive landscape features a mix of international manufacturers and local distributors, creating a dynamic environment that promotes innovation and competitive pricing. Market participants focus on providing comprehensive solutions that combine advanced technology with local support services, training programs, and flexible financing options tailored to South African healthcare requirements.

Future prospects remain highly positive, with projected growth driven by expanding healthcare coverage, increasing awareness of preventive eye care, and continued investment in medical infrastructure. The market is positioned to benefit from emerging technologies including artificial intelligence integration and telemedicine applications that enhance diagnostic capabilities and extend care reach to remote areas.

Market intelligence reveals several critical insights that shape the South African ophthalmic equipment landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling the South African ophthalmic equipment market include demographic shifts, disease prevalence increases, and healthcare infrastructure modernization. The aging population represents a fundamental driver, as age-related eye conditions require sophisticated diagnostic and treatment equipment. Population demographics show increasing life expectancy, creating sustained demand for comprehensive eye care services and supporting equipment.

Disease prevalence trends significantly impact market growth, particularly the rising incidence of diabetes mellitus and associated diabetic retinopathy. Healthcare statistics indicate that diabetic eye complications affect a substantial portion of the diabetic population, necessitating regular screening and monitoring equipment. Hypertensive retinopathy and other cardiovascular-related eye conditions also contribute to growing equipment demand.

Healthcare infrastructure development across South Africa creates opportunities for equipment suppliers as new facilities require comprehensive ophthalmology departments. Government initiatives supporting healthcare accessibility and quality improvements drive institutional purchases of advanced diagnostic and surgical equipment. Private healthcare expansion further accelerates market growth as private practices and clinics invest in state-of-the-art equipment to enhance service offerings.

Technology advancement serves as a crucial driver, with healthcare providers seeking equipment that offers improved diagnostic accuracy, enhanced patient comfort, and operational efficiency. Digital imaging systems, automated diagnostic tools, and minimally invasive surgical equipment represent key growth areas driven by technological innovation and clinical outcome improvements.

Market constraints affecting the South African ophthalmic equipment market include economic challenges, infrastructure limitations, and regulatory complexities. Economic factors such as currency fluctuations and import costs significantly impact equipment pricing and accessibility, particularly for advanced technology systems that require international procurement.

Healthcare budget constraints limit institutional purchasing power, especially in public healthcare facilities where budget allocations must cover diverse medical equipment needs. The high capital costs associated with advanced ophthalmic equipment create barriers for smaller practices and rural healthcare facilities seeking to upgrade their capabilities.

Infrastructure limitations in certain regions pose challenges for equipment deployment and maintenance. Reliable electricity supply, appropriate facility conditions, and technical support availability affect equipment performance and longevity. Skills shortages in specialized technical areas limit the effective utilization of advanced equipment, requiring additional investment in training and support services.

Regulatory compliance requirements add complexity and costs to market entry and equipment distribution. Import regulations, certification processes, and ongoing compliance monitoring create administrative burdens that can delay equipment availability and increase overall costs. Market fragmentation across different healthcare sectors and geographic regions complicates distribution strategies and market penetration efforts.

Significant opportunities exist within the South African ophthalmic equipment market, driven by unmet healthcare needs, technological advancement, and expanding market access. Rural healthcare expansion represents a substantial opportunity as government initiatives and private sector investments focus on extending quality eye care services to underserved populations.

Telemedicine integration creates opportunities for equipment manufacturers to develop solutions that enable remote diagnostics and consultation capabilities. This approach addresses geographic barriers and specialist shortages while expanding the effective reach of existing healthcare infrastructure. Mobile eye care units equipped with portable diagnostic equipment offer innovative solutions for community-based screening programs.

Technology partnerships with local healthcare institutions and universities present opportunities for equipment manufacturers to establish research collaborations, training programs, and market development initiatives. These partnerships can facilitate technology transfer, local adaptation, and sustainable market growth strategies.

Preventive care emphasis creates opportunities for diagnostic equipment suppliers as healthcare systems shift toward early detection and intervention strategies. School-based vision screening programs, workplace eye health initiatives, and community screening campaigns drive demand for portable and user-friendly diagnostic equipment. Insurance coverage expansion for eye care services further enhances market opportunities by improving patient access to advanced diagnostic and treatment options.

Market dynamics within the South African ophthalmic equipment sector reflect complex interactions between supply-side factors, demand drivers, and regulatory influences. Supply chain dynamics show increasing localization efforts as manufacturers establish regional distribution centers and service facilities to improve equipment availability and reduce costs.

Competitive dynamics feature intense competition among international manufacturers seeking market share, leading to improved product offerings, competitive pricing, and enhanced service packages. Local distributors play crucial roles in market dynamics by providing specialized knowledge, customer relationships, and after-sales support that international manufacturers require for successful market penetration.

Technology adoption cycles influence market dynamics as healthcare facilities balance the benefits of advanced equipment against budget constraints and operational requirements. The market demonstrates cyclical patterns related to equipment replacement schedules, technology upgrades, and institutional procurement cycles.

Regulatory dynamics continue evolving as authorities update standards, certification requirements, and import procedures to ensure equipment quality and safety. These changes affect market entry strategies, product development priorities, and compliance costs for market participants. Economic dynamics including exchange rate fluctuations, inflation rates, and healthcare spending patterns significantly influence market growth trajectories and investment decisions.

Research methodology for analyzing the South African ophthalmic equipment market employs comprehensive data collection and analysis techniques to ensure accurate market assessment. Primary research involves direct engagement with healthcare professionals, equipment distributors, and industry stakeholders through structured interviews, surveys, and focus group discussions.

Secondary research encompasses analysis of government healthcare statistics, industry reports, regulatory documentation, and academic publications related to ophthalmology and medical equipment markets. This approach provides historical context, trend analysis, and comparative benchmarking against regional and global markets.

Data validation processes include cross-referencing multiple sources, statistical analysis of quantitative data, and expert review of findings to ensure accuracy and reliability. Market sizing methodologies combine bottom-up analysis based on equipment categories and top-down analysis using healthcare spending data and market penetration rates.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive market understanding. Forecasting models utilize regression analysis, scenario planning, and expert judgment to project future market trends and growth trajectories. Quality assurance measures ensure that research findings meet professional standards for accuracy, objectivity, and practical applicability.

Regional market distribution across South Africa reveals distinct patterns influenced by population density, healthcare infrastructure, and economic development levels. Gauteng Province dominates market activity, accounting for approximately 42% of total market share, driven by the concentration of major hospitals, private practices, and medical schools in Johannesburg and Pretoria metropolitan areas.

Western Cape represents the second-largest regional market with approximately 28% market share, benefiting from Cape Town’s status as a medical hub and the presence of leading healthcare institutions. The region demonstrates strong demand for advanced diagnostic equipment and surgical systems, supported by both public and private healthcare investments.

KwaZulu-Natal accounts for approximately 18% of market activity, with Durban serving as the primary commercial center. The region shows growing demand for ophthalmic equipment driven by population growth, healthcare infrastructure development, and increasing awareness of eye health importance.

Rural provinces including Eastern Cape, Limpopo, and North West collectively represent emerging market opportunities as government healthcare initiatives and mobile clinic programs expand equipment deployment to previously underserved areas. These regions show particular demand for portable diagnostic equipment and cost-effective solutions that can operate in challenging infrastructure conditions.

Market access strategies vary significantly across regions, with urban areas favoring direct sales and comprehensive service packages, while rural markets require innovative distribution approaches including mobile service units and regional service centers.

Competitive landscape analysis reveals a diverse market structure featuring international manufacturers, regional distributors, and specialized service providers. Market leadership positions are held by established global companies that combine advanced technology offerings with comprehensive local support capabilities.

Competitive strategies focus on providing integrated solutions that combine equipment sales with training, maintenance, and financing services. Market participants emphasize local partnerships, technical support capabilities, and flexible commercial terms to differentiate their offerings in the competitive marketplace.

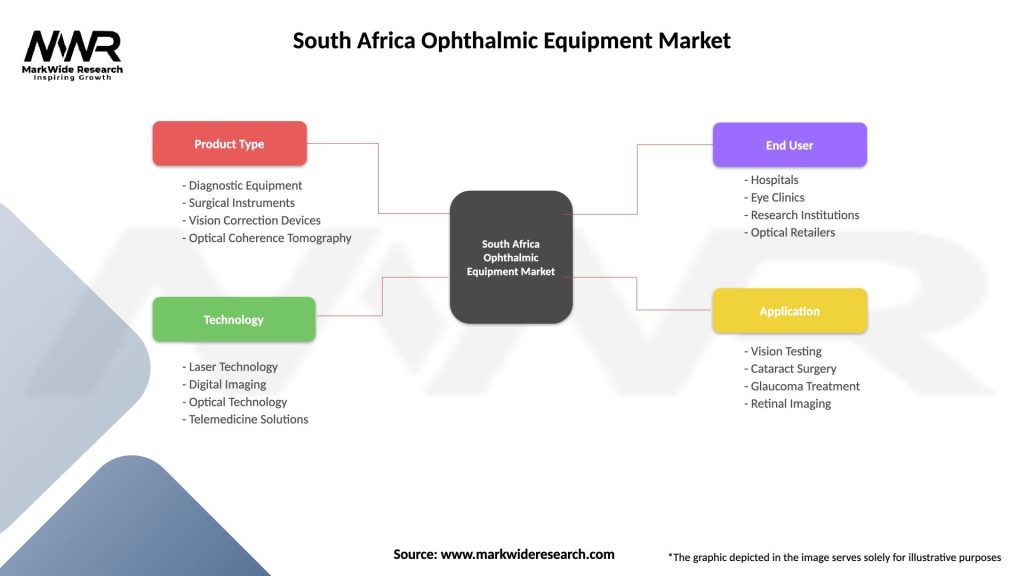

Market segmentation analysis provides detailed insights into the diverse categories and applications within the South African ophthalmic equipment market. Product-based segmentation reveals distinct market dynamics across different equipment categories, each with unique growth drivers and competitive characteristics.

By Product Type:

By End User:

By Application:

Diagnostic equipment category represents the largest market segment, driven by increasing emphasis on early detection and preventive eye care. Optical coherence tomography systems show particularly strong growth as healthcare providers recognize their value in detecting retinal diseases and monitoring treatment progress. This category benefits from technological advancement and growing clinical evidence supporting improved patient outcomes.

Surgical equipment segment demonstrates robust growth driven by increasing cataract surgery volumes and expanding refractive surgery adoption. Phacoemulsification systems represent a major component of this category, with healthcare facilities upgrading to newer systems that offer improved efficiency and patient safety features. Laser surgery equipment shows strong growth potential as refractive surgery becomes more accessible and affordable.

Vision care equipment category serves the broader optometry market and shows steady growth driven by increasing awareness of vision correction needs and expanding optometry practice networks. Autorefractors and keratometers represent essential equipment for comprehensive eye examinations and contact lens fitting procedures.

Consumables and accessories provide recurring revenue opportunities for market participants and show consistent growth patterns aligned with equipment utilization rates. This category includes surgical supplies, diagnostic consumables, and maintenance components that support ongoing equipment operation and clinical procedures.

Healthcare providers benefit significantly from advanced ophthalmic equipment through improved diagnostic capabilities, enhanced treatment outcomes, and operational efficiency gains. Diagnostic accuracy improvements enable earlier disease detection and more precise treatment planning, leading to better patient outcomes and reduced long-term healthcare costs.

Patients benefit from access to advanced diagnostic and treatment technologies that provide more comfortable procedures, faster recovery times, and improved visual outcomes. Modern equipment often features patient-friendly designs that reduce anxiety and improve the overall healthcare experience.

Equipment manufacturers gain access to a growing market with diverse opportunities across multiple product categories and customer segments. The South African market offers potential for long-term partnerships with healthcare providers and opportunities to establish regional service and distribution capabilities.

Healthcare systems benefit from improved efficiency and cost-effectiveness as advanced equipment enables more procedures to be performed with better outcomes. Training and education programs associated with equipment purchases enhance overall healthcare system capabilities and professional development opportunities.

Economic benefits extend to the broader healthcare sector through job creation, skills development, and technology transfer opportunities. Local partnerships and service capabilities contribute to economic development while ensuring sustainable equipment support and maintenance services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the South African ophthalmic equipment market. Healthcare facilities are rapidly adopting digital imaging systems, electronic health records integration, and cloud-based data management solutions. Artificial intelligence integration is emerging as a key trend, with AI-enhanced diagnostic systems showing 23% adoption growth among leading healthcare facilities.

Minimally invasive procedures continue gaining popularity, driving demand for advanced surgical equipment that enables smaller incisions, faster recovery times, and improved patient comfort. This trend particularly affects cataract surgery equipment and refractive surgery systems, where technological advancement enables better outcomes with reduced patient trauma.

Portable and mobile equipment trends address the need for healthcare delivery in diverse settings, including rural areas and community screening programs. Mobile diagnostic units and portable screening equipment show strong growth as healthcare systems seek to expand access and improve preventive care delivery.

Integrated healthcare solutions trend toward comprehensive packages that combine equipment, training, maintenance, and financing services. Healthcare providers increasingly prefer suppliers who can provide complete solutions rather than individual equipment purchases, driving market participants to develop integrated service offerings.

Sustainability focus influences equipment selection as healthcare facilities consider environmental impact, energy efficiency, and lifecycle costs. Equipment manufacturers respond by developing more sustainable products and offering equipment recycling and upgrade programs.

Recent industry developments highlight the dynamic nature of the South African ophthalmic equipment market and emerging opportunities for growth and innovation. Technology partnerships between international manufacturers and local healthcare institutions have accelerated, facilitating knowledge transfer and market-specific product development.

Government healthcare initiatives including the National Health Insurance implementation and rural healthcare infrastructure development programs create new opportunities for equipment suppliers. These initiatives emphasize accessible, quality healthcare delivery and support equipment procurement for previously underserved areas.

Training program expansion represents a significant development as equipment manufacturers invest in comprehensive education programs for healthcare professionals. These programs enhance equipment utilization, improve clinical outcomes, and strengthen customer relationships while addressing skills development needs in the healthcare sector.

Service network development shows major manufacturers establishing regional service centers and technical support capabilities to improve equipment maintenance and customer support. This development addresses previous concerns about equipment reliability and service availability, particularly in remote areas.

Financing innovation includes development of flexible payment options, leasing programs, and equipment-as-a-service models that improve equipment accessibility for healthcare providers with budget constraints. These financial innovations enable broader market penetration and support healthcare system modernization efforts.

Market entry strategies should prioritize local partnerships and comprehensive service capabilities to succeed in the South African ophthalmic equipment market. MarkWide Research analysis indicates that successful market participants combine advanced technology offerings with strong local support, training programs, and flexible commercial terms tailored to local market conditions.

Product development focus should emphasize solutions that address specific South African healthcare challenges, including equipment designed for diverse infrastructure conditions, portable solutions for rural healthcare delivery, and cost-effective systems that provide advanced capabilities at accessible price points.

Distribution strategy optimization requires multi-channel approaches that serve diverse market segments effectively. Urban markets benefit from direct sales and comprehensive service packages, while rural markets require innovative distribution models including mobile service units and regional partnerships with local healthcare organizations.

Investment priorities should focus on training and education programs that enhance equipment utilization and customer satisfaction. Healthcare professionals require ongoing education to maximize equipment benefits, creating opportunities for manufacturers to differentiate their offerings through comprehensive training support.

Technology integration strategies should consider telemedicine capabilities, AI enhancement, and digital health platform compatibility to align with broader healthcare digitalization trends. Equipment that integrates seamlessly with existing healthcare systems and supports remote consultation capabilities will gain competitive advantages.

Future market prospects for the South African ophthalmic equipment market remain highly positive, driven by demographic trends, healthcare infrastructure development, and technological advancement. Growth projections indicate sustained expansion with annual growth rates expected to reach 9.1% over the next five years, supported by increasing healthcare investments and expanding patient access to eye care services.

Technology evolution will continue reshaping the market as artificial intelligence, machine learning, and advanced imaging technologies become more prevalent in clinical practice. These technologies will enhance diagnostic accuracy, improve treatment outcomes, and enable more efficient healthcare delivery across diverse settings.

Market expansion into rural and underserved areas represents significant growth potential as government initiatives and private sector investments focus on healthcare accessibility improvements. Mobile healthcare units, telemedicine integration, and portable diagnostic equipment will play crucial roles in expanding market reach.

Regional integration opportunities may emerge as South Africa’s position as a regional healthcare hub enables equipment suppliers to serve broader African markets. This development could create economies of scale and support more comprehensive service networks across the region.

Sustainability initiatives will increasingly influence market development as healthcare systems prioritize environmental responsibility and lifecycle cost management. Equipment manufacturers will need to develop more sustainable products and services while maintaining clinical effectiveness and economic viability. MWR forecasts indicate that sustainability considerations will affect approximately 35% of equipment purchasing decisions within the next three years.

The South Africa ophthalmic equipment market presents exceptional opportunities for growth and development, driven by strong demographic trends, healthcare infrastructure modernization, and increasing awareness of eye health importance. Market fundamentals remain robust with consistent demand growth across multiple equipment categories and geographic regions, supported by both public and private healthcare investments.

Key success factors for market participants include developing comprehensive solutions that combine advanced technology with local support capabilities, flexible financing options, and extensive training programs. The market rewards suppliers who understand local healthcare challenges and provide tailored solutions that address specific needs while maintaining international quality standards.

Future growth potential remains substantial as the market benefits from expanding healthcare coverage, increasing disease prevalence, and continued technology advancement. Rural market expansion, telemedicine integration, and preventive care emphasis create additional growth opportunities that will sustain market development over the long term.

Strategic positioning in this dynamic market requires commitment to local partnerships, comprehensive service capabilities, and continuous innovation that addresses evolving healthcare needs. The South Africa ophthalmic equipment market offers significant potential for companies prepared to invest in long-term market development and customer relationship building while contributing to improved eye care accessibility and quality across the country.

What is Ophthalmic Equipment?

Ophthalmic Equipment refers to the tools and devices used in the diagnosis, treatment, and management of eye disorders. This includes instruments for eye examinations, surgical procedures, and vision correction.

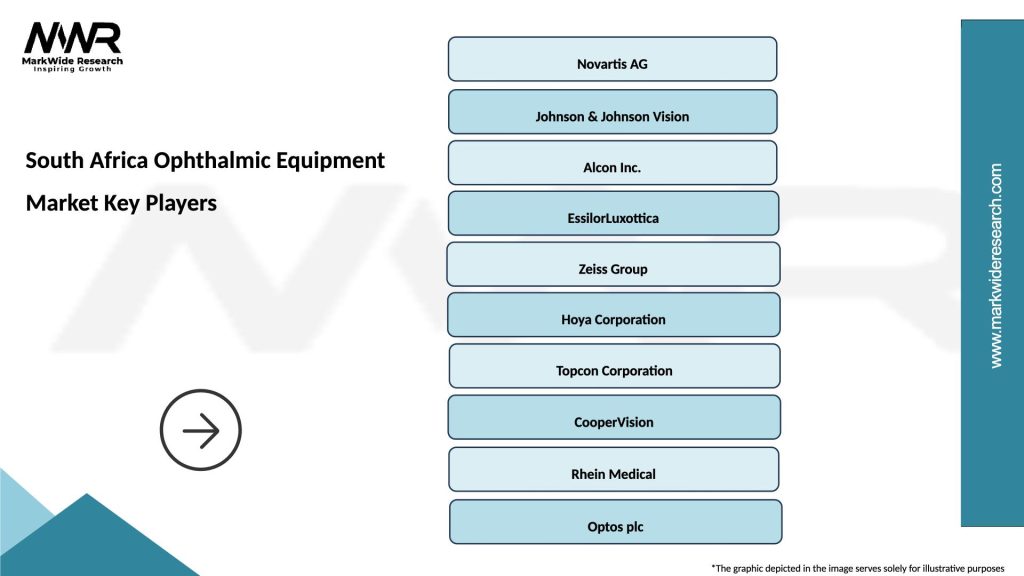

What are the key players in the South Africa Ophthalmic Equipment Market?

Key players in the South Africa Ophthalmic Equipment Market include Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss AG, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the South Africa Ophthalmic Equipment Market?

The main drivers of the South Africa Ophthalmic Equipment Market include the increasing prevalence of eye diseases, advancements in technology, and a growing aging population requiring vision care. Additionally, rising awareness about eye health contributes to market growth.

What challenges does the South Africa Ophthalmic Equipment Market face?

The South Africa Ophthalmic Equipment Market faces challenges such as high costs of advanced equipment, limited access to healthcare in rural areas, and regulatory hurdles. These factors can hinder the adoption of new technologies and equipment.

What opportunities exist in the South Africa Ophthalmic Equipment Market?

Opportunities in the South Africa Ophthalmic Equipment Market include the potential for telemedicine in eye care, increasing investments in healthcare infrastructure, and the development of affordable diagnostic tools. These factors can enhance access to eye care services.

What trends are shaping the South Africa Ophthalmic Equipment Market?

Trends shaping the South Africa Ophthalmic Equipment Market include the integration of artificial intelligence in diagnostic tools, the rise of minimally invasive surgical techniques, and the growing demand for personalized eye care solutions. These innovations are transforming the landscape of ophthalmic care.

South Africa Ophthalmic Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Equipment, Surgical Instruments, Vision Correction Devices, Optical Coherence Tomography |

| Technology | Laser Technology, Digital Imaging, Optical Technology, Telemedicine Solutions |

| End User | Hospitals, Eye Clinics, Research Institutions, Optical Retailers |

| Application | Vision Testing, Cataract Surgery, Glaucoma Treatment, Retinal Imaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Ophthalmic Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at