444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa hotel industry market represents a cornerstone of the nation’s tourism and hospitality sector, demonstrating remarkable resilience and adaptability in the face of evolving travel patterns and economic dynamics. This comprehensive market encompasses a diverse range of accommodation facilities, from luxury safari lodges and boutique hotels to business-focused establishments and budget-friendly options that cater to both domestic and international travelers.

Market dynamics indicate that the South African hotel industry has experienced significant transformation, with the sector showing robust recovery patterns following global disruptions. The industry benefits from the country’s unique position as a gateway to African tourism, combining world-class infrastructure with diverse natural attractions and cultural experiences. Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 6.2%, driven by increasing domestic tourism, recovering international visitor numbers, and strategic infrastructure investments.

Regional distribution shows that approximately 35% of hotel capacity is concentrated in major metropolitan areas including Cape Town, Johannesburg, and Durban, while 28% of establishments are located in key tourist destinations such as the Western Cape wine regions and game reserve areas. The industry’s recovery trajectory has been supported by government initiatives promoting domestic tourism and strategic marketing campaigns targeting key international markets.

The South Africa hotel industry market refers to the comprehensive ecosystem of accommodation providers, hospitality services, and related infrastructure that serves both domestic and international travelers throughout the Republic of South Africa. This market encompasses various accommodation types, from luxury resorts and business hotels to boutique establishments and budget accommodations, all contributing to the nation’s tourism economy and hospitality sector growth.

Industry scope includes traditional hotels, resort properties, boutique accommodations, business hotels, airport hotels, and specialized lodging facilities such as safari lodges and wine estate accommodations. The market also encompasses ancillary services including conference facilities, dining establishments, spa services, and recreational amenities that enhance the overall guest experience and contribute to revenue generation.

Economic significance extends beyond direct accommodation services, as the hotel industry serves as a catalyst for job creation, skills development, and economic empowerment initiatives throughout South Africa. The sector plays a crucial role in supporting local communities, promoting cultural exchange, and showcasing the country’s diverse attractions to global audiences.

Strategic positioning of the South African hotel industry reflects the country’s status as a premier African tourism destination, combining exceptional natural beauty, rich cultural heritage, and modern hospitality infrastructure. The market has demonstrated remarkable adaptability, with operators implementing innovative service delivery models, enhanced health and safety protocols, and technology-driven guest experiences to meet evolving traveler expectations.

Performance indicators reveal that the industry has achieved occupancy rates of approximately 58% across major markets, with premium properties and unique destination hotels showing stronger performance metrics. The sector has benefited from increased domestic tourism, which now represents approximately 65% of total hotel bookings, providing stability and reducing dependence on international travel patterns.

Investment trends show renewed confidence in the market, with both local and international hospitality groups expanding their South African portfolios. The industry has attracted significant capital for property upgrades, technology implementations, and sustainability initiatives that align with global hospitality trends and environmental consciousness among travelers.

Future prospects indicate continued growth potential, supported by government tourism promotion initiatives, infrastructure development projects, and the country’s competitive positioning in the African hospitality market. The industry is well-positioned to capitalize on recovering international travel demand while maintaining strong domestic market foundations.

Market segmentation reveals distinct performance patterns across different hotel categories and geographic regions, with luxury and boutique properties showing resilience and premium pricing power. The industry has successfully diversified its revenue streams, incorporating conference and events business, extended stay options, and specialized tourism packages that cater to various traveler segments.

Tourism recovery serves as the primary catalyst for hotel industry growth, with both domestic and international travel showing positive momentum. The South African government’s tourism promotion initiatives, including marketing campaigns and infrastructure investments, have created favorable conditions for hospitality sector expansion and visitor attraction.

Economic factors supporting market growth include improved business confidence, increased corporate travel budgets, and rising disposable income among middle-class consumers. The country’s competitive exchange rate has made South Africa an attractive destination for international visitors, while domestic travelers are increasingly choosing local destinations for leisure and business purposes.

Infrastructure development continues to enhance the hotel industry’s operational environment, with improvements to transportation networks, airport facilities, and telecommunications infrastructure. These developments reduce operational costs and improve accessibility for both guests and hotel operators, creating opportunities for market expansion and service enhancement.

Digital transformation has accelerated adoption of technology solutions that improve operational efficiency and guest experiences. Hotels are leveraging data analytics, mobile applications, and automated systems to optimize revenue management, personalize services, and streamline operations while reducing costs and improving profitability.

Economic volatility remains a significant challenge for the South African hotel industry, with currency fluctuations, inflation pressures, and economic uncertainty affecting both operational costs and consumer spending patterns. These factors can impact hotel profitability and investment decisions, particularly for properties dependent on international markets.

Infrastructure limitations in certain regions continue to constrain market growth, including challenges related to reliable electricity supply, water availability, and transportation connectivity. These issues can increase operational costs and limit the development of hotel properties in potentially attractive destinations.

Skills shortages in the hospitality sector present ongoing challenges for hotel operators seeking to maintain service quality and operational efficiency. The industry requires continuous investment in training and development programs to address skill gaps and ensure adequate staffing levels across all operational areas.

Regulatory complexity and compliance requirements can create administrative burdens for hotel operators, particularly smaller properties with limited resources. Navigating various licensing requirements, health and safety regulations, and employment legislation requires significant management attention and financial resources.

Domestic tourism expansion presents substantial growth opportunities for hotel operators willing to adapt their offerings to local market preferences and price points. The growing middle class and increased awareness of domestic destinations create potential for year-round occupancy and reduced dependence on seasonal international travel patterns.

Niche market development offers opportunities for specialized hotel concepts, including wellness retreats, adventure tourism accommodations, cultural heritage hotels, and eco-friendly properties. These specialized offerings can command premium pricing while attracting specific traveler segments seeking unique experiences.

Technology adoption creates opportunities for operational efficiency improvements, cost reductions, and enhanced guest experiences. Hotels can leverage artificial intelligence, Internet of Things (IoT) devices, and data analytics to optimize operations, personalize services, and improve revenue management strategies.

Regional expansion within Africa presents growth opportunities for South African hotel operators with established expertise and operational capabilities. The country’s hospitality industry can serve as a platform for expansion into other African markets, leveraging experience and brand recognition to capture regional growth opportunities.

Competitive landscape in the South African hotel industry reflects a mix of international hotel chains, local hospitality groups, and independent operators, each bringing distinct strengths and market positioning strategies. This diversity creates a dynamic marketplace where innovation, service quality, and operational efficiency determine success and market share growth.

Consumer behavior has evolved significantly, with travelers increasingly seeking authentic experiences, sustainable accommodations, and value-driven offerings. Hotels must adapt their service delivery models to meet these changing expectations while maintaining operational efficiency and profitability in a competitive market environment.

Pricing strategies have become more sophisticated, with hotels utilizing dynamic pricing models, revenue management systems, and market intelligence to optimize room rates and maximize revenue per available room. This approach helps properties adapt to demand fluctuations and competitive pressures while maintaining profitability.

Operational efficiency has gained prominence as hotels seek to reduce costs while maintaining service quality. Properties are implementing energy-efficient systems, streamlining operations, and leveraging technology to improve productivity and reduce environmental impact, creating sustainable competitive advantages.

Comprehensive analysis of the South African hotel industry market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes surveys and interviews with hotel operators, industry executives, and hospitality professionals across various market segments and geographic regions.

Data collection encompasses both quantitative and qualitative research approaches, including occupancy statistics, revenue performance metrics, guest satisfaction surveys, and market trend analysis. Secondary research incorporates industry reports, government statistics, tourism board data, and economic indicators relevant to hospitality sector performance.

Market segmentation analysis examines performance across different hotel categories, price segments, and geographic regions to provide detailed insights into market dynamics and growth opportunities. This approach enables identification of trends, challenges, and opportunities specific to various market segments.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and statistical verification methods. The research methodology incorporates feedback from industry stakeholders to validate findings and ensure practical relevance for market participants and investors.

Western Cape dominates the South African hotel market, accounting for approximately 32% of total hotel capacity and generating the highest revenue per available room across the country. The region benefits from Cape Town’s international appeal, wine tourism attractions, and diverse accommodation options ranging from luxury resorts to boutique properties.

Gauteng province represents the largest business travel market, with Johannesburg and Pretoria hosting approximately 28% of business-focused hotel properties. The region’s economic significance and transportation hub status support consistent demand for corporate accommodations, conference facilities, and airport hotels.

KwaZulu-Natal combines coastal tourism with business travel, particularly in Durban and surrounding areas. The province’s diverse offerings include beach resorts, business hotels, and cultural tourism accommodations that serve both domestic and international travelers throughout the year.

Eastern Cape and other provinces contribute to market diversity through specialized tourism offerings, including game reserves, cultural heritage sites, and adventure tourism destinations. These regions provide opportunities for unique accommodation experiences and niche market development.

Rural and remote areas present emerging opportunities for eco-tourism, community-based tourism, and specialized accommodation concepts that showcase South Africa’s natural beauty and cultural diversity while supporting local economic development initiatives.

Market leadership in the South African hotel industry reflects a combination of international hospitality brands, established local operators, and innovative independent properties. The competitive environment encourages continuous improvement in service quality, operational efficiency, and guest experience delivery.

By Property Type: The South African hotel market encompasses diverse accommodation categories, each serving specific traveler segments and price points. Luxury hotels and resorts command premium positioning, while business hotels focus on corporate traveler needs, and budget accommodations serve price-conscious domestic and international visitors.

By Location: Geographic segmentation reveals distinct market characteristics, with urban hotels serving business travelers and city tourists, coastal properties focusing on leisure tourism, and rural accommodations specializing in nature-based and cultural tourism experiences.

By Target Market: Customer segmentation includes business travelers, leisure tourists, conference and events guests, and specialized segments such as adventure tourists, wine enthusiasts, and wildlife safari participants, each requiring tailored service offerings and amenities.

By Service Level: The market spans from luxury five-star properties offering comprehensive amenities and personalized services to budget accommodations providing essential services at competitive price points, with mid-market properties bridging these segments.

Luxury Hotels demonstrate strong performance in key destinations, with properties achieving average occupancy rates of 68% and commanding premium pricing through exceptional service delivery, unique amenities, and exclusive experiences. This segment benefits from international tourism recovery and high-value domestic travelers seeking premium accommodations.

Business Hotels serve the corporate travel market with functional amenities, meeting facilities, and convenient locations near business districts and transportation hubs. These properties focus on operational efficiency, consistent service standards, and technology integration to meet business traveler expectations.

Boutique Properties have gained market share through personalized service, unique design concepts, and authentic local experiences. These hotels often achieve higher guest satisfaction scores and repeat visitation rates by offering distinctive accommodations that reflect local culture and character.

Budget Accommodations serve price-sensitive travelers while maintaining essential service standards and cleanliness. This segment has grown through standardization of operations, technology adoption, and strategic location selection to provide value-driven accommodation options.

Resort Properties combine accommodation with recreational facilities, dining options, and entertainment amenities to create comprehensive destination experiences. These properties often achieve higher revenue per guest through ancillary services and extended length of stay.

Hotel Operators benefit from South Africa’s diverse tourism appeal, which supports year-round demand across multiple market segments. The country’s established tourism infrastructure, skilled workforce availability, and government support for hospitality sector development create favorable operating conditions for both local and international hotel companies.

Investors find attractive opportunities in the South African hotel market through property appreciation potential, steady cash flow generation, and portfolio diversification benefits. The market offers various investment options, from established properties in prime locations to development opportunities in emerging destinations.

Local Communities benefit from hotel industry growth through job creation, skills development, and economic multiplier effects. Hotels support local suppliers, service providers, and cultural attractions, creating broader economic benefits beyond direct employment in hospitality operations.

Government Stakeholders gain from increased tax revenue, foreign exchange earnings, and tourism promotion benefits. The hotel industry supports broader economic development objectives, including job creation, skills development, and regional development initiatives.

Guests and Travelers benefit from improved accommodation options, competitive pricing, enhanced service quality, and diverse experiences available throughout South Africa. The competitive market environment encourages continuous improvement in facilities, services, and value propositions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has become a defining trend in the South African hotel industry, with properties implementing comprehensive environmental programs including renewable energy adoption, water conservation systems, and waste reduction initiatives. MarkWide Research indicates that approximately 72% of hotels have implemented some form of sustainability program, responding to both regulatory requirements and guest preferences for environmentally responsible accommodations.

Technology Advancement continues to reshape hotel operations and guest experiences, with properties investing in mobile applications, contactless services, artificial intelligence, and data analytics. These technologies improve operational efficiency, enhance guest satisfaction, and provide competitive advantages in an increasingly digital marketplace.

Experiential Tourism has gained prominence as travelers seek authentic, immersive experiences that connect them with local culture, nature, and communities. Hotels are developing specialized programs, partnerships with local attractions, and unique amenities that create memorable experiences beyond traditional accommodation services.

Health and Wellness Focus has expanded beyond traditional spa services to encompass comprehensive wellness programs, healthy dining options, fitness facilities, and mental health considerations. This trend reflects growing consumer awareness of health and wellness priorities in travel decisions.

Flexible Accommodation Options have emerged as hotels adapt to changing travel patterns, including extended stay options, remote work facilities, and flexible booking policies. These adaptations respond to evolving traveler needs and create new revenue opportunities for hotel operators.

Infrastructure Investments have accelerated across the South African hotel industry, with major operators upgrading facilities, implementing technology systems, and enhancing sustainability features. These investments improve operational efficiency, guest satisfaction, and long-term competitiveness in the hospitality market.

Brand Expansions continue as both international and local hospitality companies expand their South African presence through new property developments, acquisitions, and management agreements. This expansion reflects confidence in the market’s growth potential and long-term prospects.

Partnership Development has increased between hotels and local tourism operators, cultural institutions, and experience providers. These partnerships create comprehensive destination offerings that enhance guest experiences while supporting local economic development and community engagement.

Skills Development Programs have been implemented across the industry to address workforce challenges and improve service quality. Hotels are investing in training initiatives, apprenticeship programs, and career development opportunities that benefit both employees and operational performance.

Digital Transformation initiatives have accelerated, with hotels implementing comprehensive technology solutions for operations management, guest services, and revenue optimization. These developments improve efficiency, reduce costs, and enhance competitive positioning in the digital marketplace.

Market Positioning strategies should focus on differentiation through unique value propositions, whether through luxury amenities, authentic local experiences, operational efficiency, or specialized services. Hotels must clearly define their target markets and develop offerings that meet specific traveler needs and preferences.

Technology Investment should prioritize solutions that improve both operational efficiency and guest experiences, including revenue management systems, mobile applications, and data analytics platforms. These investments can provide sustainable competitive advantages and improve long-term profitability.

Sustainability Programs should be integrated into core business strategies, addressing both environmental impact and guest expectations. Hotels should implement comprehensive sustainability initiatives that reduce costs, enhance brand reputation, and appeal to environmentally conscious travelers.

Staff Development requires ongoing investment in training, skills development, and career advancement opportunities. Quality service delivery depends on skilled, motivated employees who can create positive guest experiences and support operational excellence.

Revenue Diversification should extend beyond room revenue to include food and beverage, events, experiences, and ancillary services. This approach reduces dependence on occupancy rates and creates multiple revenue streams that improve financial stability.

Growth Projections for the South African hotel industry remain positive, with MWR analysis suggesting continued expansion driven by domestic tourism growth, international travel recovery, and infrastructure development. The market is expected to benefit from increased business confidence, improved economic conditions, and strategic tourism promotion initiatives.

Market Evolution will likely emphasize sustainability, technology integration, and experiential offerings as key differentiators. Hotels that successfully adapt to these trends while maintaining operational efficiency and service quality will achieve competitive advantages and superior financial performance.

Investment Opportunities are expected to emerge in niche markets, technology solutions, and sustainable development projects. The industry’s growth trajectory and diversification potential create attractive prospects for both local and international investors seeking exposure to South African hospitality markets.

Regional Development will likely expand beyond traditional tourism centers to include emerging destinations, rural tourism opportunities, and specialized accommodation concepts. This expansion will create new market segments and revenue opportunities while supporting broader economic development objectives.

Industry Consolidation may occur as larger operators acquire independent properties and smaller chains, creating economies of scale and operational efficiencies. This trend could improve overall industry professionalism and service standards while maintaining market diversity and competition.

The South African hotel industry market represents a dynamic and resilient sector that has successfully adapted to changing market conditions while maintaining its position as a key component of the country’s tourism economy. The industry’s diverse offerings, from luxury safari lodges to business hotels and boutique properties, provide comprehensive accommodation options that serve both domestic and international travelers.

Market fundamentals remain strong, supported by South Africa’s unique tourism appeal, established infrastructure, and government commitment to hospitality sector development. The industry has demonstrated remarkable adaptability, implementing innovative service delivery models, sustainability initiatives, and technology solutions that enhance operational efficiency and guest satisfaction.

Future prospects indicate continued growth potential, driven by domestic tourism expansion, international travel recovery, and strategic investments in property development and operational improvements. The market’s ability to serve diverse traveler segments while maintaining competitive pricing and service quality positions it well for sustained growth and development in the evolving global hospitality landscape.

What is South Africa Hotel Industry?

The South Africa Hotel Industry encompasses a range of accommodations, including hotels, lodges, and guesthouses, catering to both domestic and international travelers. It plays a crucial role in the tourism sector, contributing to the economy and providing various services such as dining, entertainment, and event hosting.

What are the key players in the South Africa Hotel Industry Market?

Key players in the South Africa Hotel Industry Market include major hotel chains such as Tsogo Sun, Protea Hotels, and Marriott International. These companies operate a variety of properties, from luxury hotels to budget accommodations, catering to diverse traveler needs, among others.

What are the growth factors driving the South Africa Hotel Industry Market?

The growth of the South Africa Hotel Industry Market is driven by increasing domestic tourism, international arrivals, and investments in infrastructure. Additionally, the rise of online booking platforms and the demand for unique travel experiences are contributing to market expansion.

What challenges does the South Africa Hotel Industry Market face?

The South Africa Hotel Industry Market faces challenges such as economic fluctuations, competition from alternative accommodations like Airbnb, and regulatory hurdles. These factors can impact occupancy rates and profitability for hotel operators.

What opportunities exist in the South Africa Hotel Industry Market?

Opportunities in the South Africa Hotel Industry Market include the growth of eco-tourism, the development of luxury and boutique hotels, and the potential for increased business travel. Additionally, leveraging technology for enhanced guest experiences presents a significant opportunity.

What trends are shaping the South Africa Hotel Industry Market?

Trends shaping the South Africa Hotel Industry Market include a focus on sustainability, the integration of smart technology in hotel operations, and the rise of experiential travel. These trends reflect changing consumer preferences and the industry’s response to environmental concerns.

South Africa Hotel Industry Market

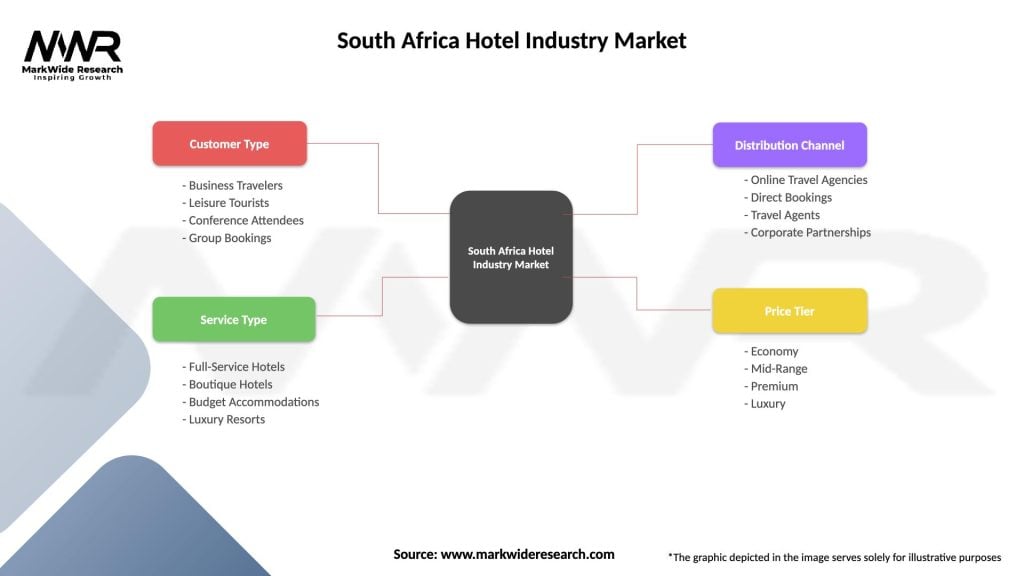

| Segmentation Details | Description |

|---|---|

| Customer Type | Business Travelers, Leisure Tourists, Conference Attendees, Group Bookings |

| Service Type | Full-Service Hotels, Boutique Hotels, Budget Accommodations, Luxury Resorts |

| Distribution Channel | Online Travel Agencies, Direct Bookings, Travel Agents, Corporate Partnerships |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Hotel Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at