444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa flexible plastic packaging market represents a dynamic and rapidly evolving sector within the country’s manufacturing landscape. This market encompasses a wide range of packaging solutions including flexible films, pouches, bags, wraps, and specialized barrier materials designed to protect, preserve, and present various consumer and industrial products. Market growth has been driven by increasing consumer demand for convenient packaging solutions, expanding retail sectors, and growing awareness of product preservation requirements.

South Africa’s position as a regional economic hub has significantly influenced the flexible plastic packaging industry’s development. The market serves diverse sectors including food and beverages, pharmaceuticals, personal care, household products, and industrial applications. Recent trends indicate a shift toward sustainable packaging solutions, with manufacturers increasingly focusing on recyclable materials and reduced environmental impact. The industry has experienced robust expansion, with growth rates reaching 6.2% annually over recent years.

Regional dynamics play a crucial role in market development, with major metropolitan areas like Johannesburg, Cape Town, and Durban serving as primary manufacturing and distribution centers. The market benefits from established infrastructure, skilled workforce availability, and proximity to key raw material suppliers. Technology adoption has accelerated, with manufacturers investing in advanced production equipment and innovative material formulations to meet evolving customer requirements.

The South Africa flexible plastic packaging market refers to the comprehensive industry segment focused on manufacturing, distributing, and utilizing flexible plastic materials for packaging applications across various sectors. This market encompasses all forms of non-rigid plastic packaging solutions that can be easily shaped, folded, or compressed without losing their protective properties.

Flexible plastic packaging includes materials such as polyethylene films, polypropylene pouches, multilayer barrier films, shrink wraps, and specialty coated materials designed for specific applications. These packaging solutions offer superior protection against moisture, oxygen, light, and contamination while providing cost-effective alternatives to rigid packaging formats. Market participants include raw material suppliers, film manufacturers, converters, brand owners, and end-users across multiple industries.

The significance of this market extends beyond simple packaging functionality, encompassing aspects of product safety, shelf-life extension, brand presentation, and consumer convenience. Modern flexible packaging solutions incorporate advanced technologies including barrier coatings, antimicrobial treatments, and smart packaging features that enhance product integrity and user experience.

South Africa’s flexible plastic packaging market demonstrates remarkable resilience and growth potential, driven by expanding consumer markets, industrial development, and increasing adoption of modern packaging technologies. The market has established itself as a critical component of the country’s manufacturing ecosystem, supporting diverse industries from food processing to pharmaceutical production.

Key market drivers include rising disposable incomes, urbanization trends, and growing demand for packaged goods across all consumer segments. The food and beverage sector represents the largest application area, accounting for approximately 45% of total market demand. Pharmaceutical packaging has emerged as a high-growth segment, with increasing healthcare awareness and regulatory compliance requirements driving demand for specialized barrier materials.

Technological advancement remains a central theme, with manufacturers investing in state-of-the-art production facilities and developing innovative material formulations. Sustainability initiatives have gained momentum, with recycling rates improving by 18% over recent years. The market faces challenges including raw material price volatility and environmental regulations, but opportunities in export markets and value-added applications continue to drive expansion.

Regional distribution shows concentration in major industrial centers, with Gauteng province leading in production capacity and Western Cape showing strong growth in specialized applications. The market’s future outlook remains positive, supported by ongoing industrialization and increasing consumer sophistication.

Market analysis reveals several critical insights that define the South African flexible plastic packaging landscape. The industry has demonstrated consistent growth patterns, with demand driven by both domestic consumption and regional export opportunities.

Consumer behavior patterns indicate increasing preference for convenient, portable packaging formats that offer extended shelf life and product protection. Brand owners are prioritizing packaging solutions that enhance product visibility, provide tamper evidence, and support marketing objectives through high-quality graphics and functional features.

Economic growth serves as the primary driver for South Africa’s flexible plastic packaging market expansion. Rising GDP levels, increased consumer spending, and expanding middle-class demographics have created sustained demand for packaged goods across all categories. Urbanization trends continue to influence packaging requirements, with city dwellers showing strong preference for convenient, ready-to-use products that require effective protective packaging.

Food industry expansion represents a major growth catalyst, with increasing demand for processed foods, snacks, beverages, and ready-to-eat meals driving packaging requirements. The sector benefits from changing lifestyle patterns, dual-income households, and growing awareness of food safety standards. Retail sector development, including supermarket chains and convenience stores, has created additional demand for attractive, functional packaging solutions.

Pharmaceutical sector growth has emerged as a significant driver, with expanding healthcare infrastructure and increasing medication consumption requiring specialized packaging solutions. Regulatory compliance requirements for pharmaceutical packaging have driven demand for high-barrier materials and tamper-evident solutions. The personal care and cosmetics industry has also contributed to market growth through demand for premium packaging formats.

Export opportunities within the Southern African Development Community (SADC) region have provided additional growth impetus. South African manufacturers benefit from competitive production costs, established infrastructure, and proximity to regional markets. Technology advancement in packaging machinery and materials has enabled manufacturers to offer innovative solutions that meet evolving customer requirements.

Environmental concerns represent the most significant restraint facing the South African flexible plastic packaging market. Growing awareness of plastic pollution and its environmental impact has led to increased scrutiny from regulators, environmental groups, and consumers. Regulatory pressure for reduced plastic usage and improved recycling has created compliance challenges for manufacturers and increased operational costs.

Raw material price volatility poses ongoing challenges for market participants. Fluctuations in petroleum prices directly impact the cost of plastic resins, affecting profit margins and pricing strategies. Supply chain disruptions, particularly those affecting imported raw materials and additives, can significantly impact production schedules and cost structures.

Competition from alternative packaging materials including paper, glass, and metal containers has intensified, particularly in segments where environmental considerations are paramount. Consumer perception challenges regarding plastic packaging sustainability have influenced purchasing decisions and brand preferences, requiring manufacturers to invest in education and sustainable product development.

Infrastructure limitations in certain regions, including inadequate waste management systems and recycling facilities, have created operational challenges and limited market expansion opportunities. Skills shortage in specialized technical areas has constrained innovation and productivity improvements in some market segments.

Sustainable packaging development presents the most significant opportunity for market growth and differentiation. Manufacturers investing in biodegradable materials, recyclable formulations, and circular economy solutions are positioned to capture growing demand from environmentally conscious consumers and brands. Innovation in bio-based plastics and compostable materials offers potential for premium market segments.

Export market expansion within Africa and beyond represents substantial growth potential. South Africa’s established manufacturing capabilities, quality standards, and competitive cost structure provide advantages in regional markets. SADC trade agreements and improved regional infrastructure create opportunities for increased market penetration across neighboring countries.

Smart packaging technologies offer opportunities for value-added solutions including RFID integration, temperature indicators, and freshness sensors. These technologies appeal to premium brands seeking differentiation and enhanced consumer engagement. E-commerce growth has created demand for specialized packaging solutions designed for online retail and direct-to-consumer shipping.

Healthcare sector expansion continues to drive demand for specialized pharmaceutical and medical device packaging. Aging population demographics and increased healthcare spending support long-term growth in this segment. Food safety regulations and quality standards create opportunities for high-performance barrier materials and antimicrobial packaging solutions.

Supply and demand dynamics in the South African flexible plastic packaging market reflect complex interactions between raw material availability, production capacity, and end-user requirements. Demand patterns show seasonal variations, particularly in food packaging applications, with peak periods during harvest seasons and holiday periods driving increased production requirements.

Competitive dynamics have intensified with both local and international players vying for market share. Local manufacturers benefit from proximity to customers, reduced logistics costs, and better understanding of regional preferences. International companies bring advanced technologies, global best practices, and access to international markets. This competition has driven innovation and improved service levels across the industry.

Technology adoption rates have accelerated, with manufacturers investing in advanced production equipment to improve efficiency and product quality. Digital printing technologies have gained traction, enabling shorter run lengths and customized packaging solutions. Automation and Industry 4.0 concepts are being implemented to enhance productivity and reduce labor dependency.

Regulatory dynamics continue to evolve, with government policies addressing environmental concerns, food safety standards, and industry development initiatives. Extended Producer Responsibility regulations are being implemented, requiring manufacturers to take greater responsibility for packaging waste management. These regulatory changes are reshaping business models and investment priorities across the industry.

Comprehensive market research for the South African flexible plastic packaging market employs multiple methodologies to ensure accurate and reliable insights. Primary research involves direct engagement with industry participants including manufacturers, suppliers, distributors, and end-users through structured interviews, surveys, and focus group discussions.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements. Data triangulation methods are employed to validate findings across multiple sources and ensure consistency in market assessments. Industry databases and statistical sources provide quantitative foundations for market sizing and trend analysis.

Expert consultation with industry professionals, technology specialists, and market analysts provides qualitative insights into market dynamics, competitive landscapes, and future trends. Field research includes facility visits, trade show participation, and direct observation of market conditions to gather firsthand intelligence.

Analytical frameworks incorporate statistical modeling, trend analysis, and scenario planning to develop comprehensive market projections. Quality assurance processes ensure data accuracy, methodology consistency, and analytical rigor throughout the research process. Regular validation and updating of research findings maintain relevance and accuracy of market intelligence.

Gauteng Province dominates the South African flexible plastic packaging market, accounting for approximately 42% of total production capacity. The region benefits from concentrated industrial activity, proximity to major consumer markets, and well-developed infrastructure. Johannesburg and Pretoria serve as primary manufacturing hubs with numerous packaging facilities and supporting industries.

Western Cape represents the second-largest regional market, with Cape Town serving as a major center for food packaging applications. The region’s strong agricultural sector drives demand for fresh produce packaging, while the wine industry requires specialized flexible packaging solutions. Port access provides advantages for raw material imports and finished product exports.

KwaZulu-Natal shows strong growth potential, particularly in the Durban metropolitan area. The region’s strategic location provides access to both domestic and regional markets, with the port of Durban serving as a key logistics hub. Industrial development initiatives have attracted packaging manufacturers and supporting industries.

Eastern Cape and other provinces represent emerging opportunities, with government incentives supporting industrial development and job creation. Regional distribution strategies focus on serving local markets while building capacity for broader market participation. Infrastructure development and skills training programs support long-term growth in these regions.

Market leadership in South Africa’s flexible plastic packaging sector is characterized by a mix of established local companies and international players with local operations. The competitive environment has intensified with technological advancement and market expansion creating opportunities for both incumbents and new entrants.

Competitive strategies focus on technological differentiation, customer service excellence, and sustainable product development. Market consolidation trends have created opportunities for strategic partnerships and acquisitions. Companies are investing in research and development, production capacity expansion, and market diversification to maintain competitive advantages.

By Material Type: The market segments into various plastic resin categories, with polyethylene representing the largest segment due to its versatility and cost-effectiveness. Polypropylene applications have grown significantly in food packaging and industrial uses. Specialty materials including barrier films and biodegradable options serve niche applications with higher value propositions.

By Application: Food and beverage packaging dominates market demand, followed by pharmaceutical, personal care, and industrial applications. Food packaging includes fresh produce, processed foods, snacks, and beverages. Non-food applications encompass healthcare products, cosmetics, household goods, and industrial materials.

By Product Type: The market includes various packaging formats such as pouches, bags, films, wraps, and specialized containers. Stand-up pouches have gained popularity for their convenience and shelf appeal. Barrier films serve applications requiring extended shelf life and product protection.

By End-User Industry: Market segmentation reflects diverse industry requirements, with food processing companies representing the largest customer segment. Pharmaceutical companies require specialized packaging meeting regulatory standards. Retail chains drive demand for private label packaging solutions.

Food Packaging Category represents the most significant market segment, driven by South Africa’s expanding food processing industry and changing consumer preferences. Fresh produce packaging has evolved to include modified atmosphere packaging and extended shelf-life solutions. The category benefits from increasing demand for convenience foods and portion-controlled packaging formats.

Pharmaceutical Packaging demonstrates the highest growth rates, with regulatory compliance driving demand for specialized barrier materials and tamper-evident solutions. MarkWide Research indicates this segment has experienced growth rates of 8.5% annually, reflecting expanding healthcare infrastructure and medication consumption patterns.

Personal Care Packaging shows strong performance in premium segments, with brands seeking differentiation through innovative packaging formats and sustainable materials. Cosmetics packaging requires high-quality graphics and functional features that enhance user experience and brand perception.

Industrial Packaging serves diverse applications including agricultural products, chemicals, and manufactured goods. This category emphasizes durability, cost-effectiveness, and specialized performance characteristics. Export-oriented applications drive demand for packaging solutions meeting international standards and shipping requirements.

Manufacturers benefit from the flexible plastic packaging market through diversified revenue streams, technological advancement opportunities, and export market access. Production efficiency improvements through advanced manufacturing technologies have enhanced profitability and competitive positioning. The market provides opportunities for value-added services including design, printing, and logistics support.

Brand owners gain significant advantages through flexible packaging solutions that enhance product protection, extend shelf life, and improve consumer appeal. Marketing benefits include superior graphics capabilities, customization options, and packaging formats that support brand differentiation. Cost advantages compared to rigid packaging alternatives improve overall product economics.

Consumers benefit from improved product quality, convenience, and safety through advanced packaging technologies. Portion control and resealable packaging formats enhance user experience and reduce food waste. Lightweight packaging reduces transportation costs and environmental impact while maintaining product integrity.

Retailers advantage from flexible packaging through improved shelf utilization, reduced handling costs, and enhanced product presentation. Supply chain efficiency improvements include reduced storage requirements and simplified logistics. Private label opportunities enable retailers to develop branded packaging solutions that enhance customer loyalty.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the South African flexible plastic packaging market. Manufacturers are investing heavily in recyclable materials, biodegradable alternatives, and circular economy solutions. Consumer awareness of environmental issues has accelerated adoption of sustainable packaging options, with recycling rates improving by 22% over recent years.

Smart packaging integration has gained momentum with technologies including QR codes, NFC chips, and sensor integration becoming more common. These solutions provide enhanced consumer engagement, supply chain visibility, and product authentication capabilities. Digital printing technologies enable shorter run lengths and personalized packaging solutions.

E-commerce optimization has driven development of packaging solutions specifically designed for online retail and direct-to-consumer shipping. Protective packaging requirements for shipping have created opportunities for specialized materials and formats. The trend toward subscription services and meal kits has influenced packaging design and functionality requirements.

Health and safety focus has intensified following global health concerns, driving demand for antimicrobial packaging materials and enhanced barrier properties. Food safety regulations continue to evolve, requiring packaging solutions that meet stringent quality and traceability standards. Premium packaging formats that enhance product safety and consumer confidence have gained market traction.

Investment expansion has characterized recent industry developments, with major manufacturers announcing facility upgrades and capacity expansion projects. Technology partnerships between local companies and international technology providers have accelerated innovation and capability development. These collaborations focus on sustainable materials, advanced production processes, and smart packaging solutions.

Regulatory developments include implementation of Extended Producer Responsibility regulations and plastic waste management requirements. Government initiatives supporting industrial development and export promotion have created favorable conditions for market growth. Industry associations have strengthened advocacy efforts and sustainability programs.

Merger and acquisition activity has increased as companies seek to consolidate market positions and achieve operational synergies. Strategic partnerships between packaging manufacturers and brand owners have deepened, creating integrated supply chain solutions. International companies have increased their South African presence through acquisitions and joint ventures.

Innovation initiatives focus on developing next-generation packaging materials and technologies. Research and development investments have increased significantly, with companies collaborating with universities and research institutions. Pilot projects for biodegradable materials and smart packaging applications are advancing toward commercial implementation.

Strategic positioning recommendations emphasize the importance of sustainability leadership and technological differentiation. Companies should prioritize investments in recyclable materials and circular economy solutions to address environmental concerns and regulatory requirements. MWR analysis suggests that early adopters of sustainable technologies will achieve competitive advantages and premium market positioning.

Market diversification strategies should focus on expanding into high-growth segments including pharmaceuticals, e-commerce packaging, and export markets. Value-added services including design, logistics, and technical support can enhance customer relationships and improve profit margins. Companies should develop capabilities in smart packaging technologies to capture emerging opportunities.

Operational excellence initiatives should focus on improving production efficiency, quality consistency, and customer service levels. Supply chain optimization including raw material sourcing, inventory management, and distribution efficiency can enhance competitiveness. Investment in automation and digital technologies will improve productivity and reduce labor dependency.

Partnership strategies should emphasize collaboration with technology providers, research institutions, and international partners to accelerate innovation and market development. Customer collaboration programs can drive co-innovation and strengthen market relationships. Industry association participation and advocacy efforts support favorable regulatory and business environments.

Long-term growth prospects for the South African flexible plastic packaging market remain positive, supported by continued economic development, population growth, and increasing consumer sophistication. Market expansion is expected to continue at sustainable rates, with growth projections indicating 5.8% annual expansion over the next five years. Regional market opportunities and export potential provide additional growth drivers.

Technology evolution will continue to reshape the market landscape, with sustainable materials, smart packaging, and advanced manufacturing processes becoming standard industry practices. Digital transformation including automation, data analytics, and supply chain integration will enhance operational efficiency and customer service capabilities.

Regulatory environment changes will continue to influence market development, with environmental regulations driving innovation in sustainable packaging solutions. Industry adaptation to regulatory requirements will create opportunities for companies that proactively address environmental concerns and develop compliant solutions.

Competitive dynamics will intensify as market maturity increases and new technologies emerge. Market consolidation may accelerate as companies seek scale advantages and operational synergies. Success will depend on innovation capabilities, customer relationships, and operational excellence. MarkWide Research projects that companies investing in sustainability and technology will achieve superior long-term performance and market positioning.

The South Africa flexible plastic packaging market represents a dynamic and evolving industry with significant growth potential and strategic importance to the country’s manufacturing sector. Market fundamentals remain strong, supported by diverse end-user industries, established manufacturing capabilities, and favorable regional positioning. Sustainability transformation has emerged as the defining trend, creating both challenges and opportunities for market participants.

Industry resilience has been demonstrated through adaptation to changing market conditions, regulatory requirements, and consumer preferences. Companies that embrace innovation, prioritize sustainability, and maintain operational excellence are well-positioned for continued success. Technology adoption and strategic partnerships will be critical success factors in the evolving competitive landscape.

Future success in the South African flexible plastic packaging market will depend on balancing growth objectives with environmental responsibilities, maintaining competitive cost structures while investing in innovation, and serving diverse customer needs while building sustainable business models. The market’s evolution toward sustainability and technological sophistication positions it for continued relevance and growth in the global packaging industry.

What is Flexible Plastic Packaging?

Flexible Plastic Packaging refers to packaging made from flexible materials that can be easily shaped and molded. This type of packaging is widely used in various industries, including food, pharmaceuticals, and consumer goods, due to its lightweight and versatile nature.

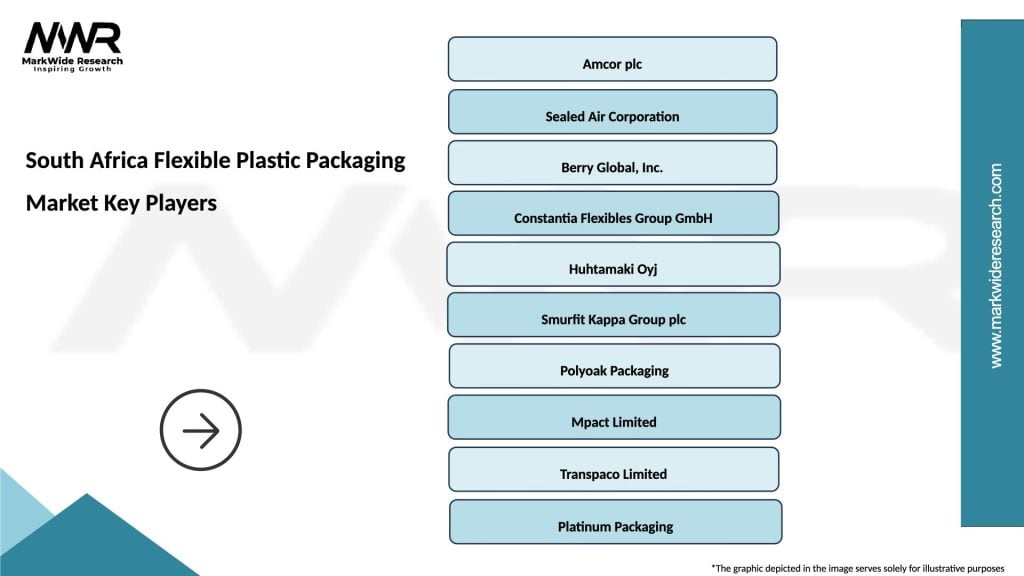

What are the key players in the South Africa Flexible Plastic Packaging Market?

Key players in the South Africa Flexible Plastic Packaging Market include companies like Amcor, Sealed Air Corporation, and Constantia Flexibles, which are known for their innovative packaging solutions and extensive product offerings in flexible materials, among others.

What are the growth factors driving the South Africa Flexible Plastic Packaging Market?

The South Africa Flexible Plastic Packaging Market is driven by factors such as the increasing demand for convenient packaging solutions, the growth of the food and beverage sector, and the rising trend of e-commerce, which requires efficient packaging for shipping.

What challenges does the South Africa Flexible Plastic Packaging Market face?

Challenges in the South Africa Flexible Plastic Packaging Market include environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging solutions, and competition from alternative packaging materials that may offer better recyclability.

What opportunities exist in the South Africa Flexible Plastic Packaging Market?

Opportunities in the South Africa Flexible Plastic Packaging Market include the development of biodegradable and recyclable packaging materials, innovations in packaging technology, and the potential for growth in sectors such as personal care and healthcare.

What trends are shaping the South Africa Flexible Plastic Packaging Market?

Trends in the South Africa Flexible Plastic Packaging Market include a shift towards sustainable packaging solutions, increased use of smart packaging technologies, and a growing focus on consumer preferences for eco-friendly products.

South Africa Flexible Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Shrink Films, Rigid Containers, Flexible Bags |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Flexible Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at