444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa facility management industry market represents a dynamic and rapidly evolving sector that encompasses comprehensive property and infrastructure management services across diverse commercial, industrial, and institutional environments. This market has experienced substantial growth driven by increasing urbanization, corporate expansion, and the growing recognition of facility management as a strategic business function rather than merely operational support.

Market dynamics indicate that South Africa’s facility management sector is witnessing significant transformation, with organizations increasingly outsourcing non-core functions to specialized service providers. The industry encompasses various service categories including maintenance management, security services, cleaning operations, catering services, space management, and energy optimization. Growth rates in the sector have been consistently positive, with the market expanding at approximately 6.2% CAGR over recent years.

Regional concentration shows that major metropolitan areas including Johannesburg, Cape Town, and Durban account for approximately 72% of market activity, reflecting the concentration of commercial and industrial facilities in these urban centers. The market demonstrates strong potential for continued expansion, particularly in emerging sectors such as healthcare facility management, educational institution services, and sustainable facility operations.

Technology integration has become increasingly important, with smart building solutions and IoT-enabled facility management systems gaining traction among forward-thinking organizations. This technological evolution is reshaping service delivery models and creating new opportunities for efficiency improvements and cost optimization across the facility management value chain.

The South Africa facility management industry market refers to the comprehensive ecosystem of professional services focused on maintaining, managing, and optimizing the functionality of built environments across commercial, industrial, residential, and institutional properties throughout South Africa. This market encompasses integrated service delivery models that combine hard services such as mechanical and electrical maintenance with soft services including cleaning, security, catering, and administrative support.

Facility management in the South African context involves strategic planning and execution of services that ensure optimal building performance, occupant comfort, safety compliance, and operational efficiency. The industry serves as a critical enabler for organizations seeking to focus on their core business activities while ensuring their physical infrastructure operates seamlessly and cost-effectively.

Service integration represents a key characteristic of modern facility management, where providers offer bundled solutions that address multiple operational requirements through single-point accountability. This approach has gained significant traction in South Africa as organizations seek to streamline vendor relationships and achieve greater operational coherence across their facility portfolios.

Market positioning analysis reveals that South Africa’s facility management industry has established itself as an essential component of the country’s commercial infrastructure ecosystem. The sector demonstrates robust growth characteristics driven by increasing corporate focus on operational efficiency, regulatory compliance requirements, and the strategic value of professional facility management services.

Key growth drivers include expanding commercial real estate development, increasing awareness of facility management benefits, and growing demand for specialized services in sectors such as healthcare, education, and manufacturing. The market benefits from approximately 68% of large corporations now utilizing some form of outsourced facility management services, representing significant growth from previous adoption levels.

Competitive dynamics show a market characterized by both international facility management companies and strong local service providers, creating a diverse ecosystem that serves various market segments effectively. The industry demonstrates particular strength in integrated service delivery, with many providers offering comprehensive solutions that span multiple facility management disciplines.

Future prospects indicate continued market expansion supported by urbanization trends, infrastructure development initiatives, and increasing recognition of facility management as a strategic business function. Technology adoption and sustainability focus are expected to drive service innovation and create new market opportunities throughout the forecast period.

Market segmentation reveals distinct service categories that collectively comprise the South African facility management landscape:

Client segmentation demonstrates diverse market participation across multiple sectors, with corporate offices, healthcare facilities, educational institutions, retail centers, and industrial complexes representing primary market segments. Each segment exhibits unique service requirements and growth characteristics that influence overall market dynamics.

Service delivery models have evolved to include single-service contracts, bundled service packages, and comprehensive integrated facility management solutions. The trend toward integrated service delivery has gained momentum, with approximately 45% of new contracts now incorporating multiple service categories under unified management structures.

Corporate focus on core business activities represents a fundamental driver of facility management market growth in South Africa. Organizations increasingly recognize that outsourcing facility management functions allows them to concentrate resources and expertise on revenue-generating activities while ensuring professional management of their physical infrastructure.

Regulatory compliance requirements have intensified across multiple sectors, particularly in healthcare, education, and industrial environments. These compliance demands require specialized expertise and systematic management approaches that many organizations find more effectively addressed through professional facility management services.

Cost optimization pressures drive organizations to seek more efficient facility operations through professional management services. Facility management providers offer economies of scale, specialized expertise, and systematic approaches that often deliver superior cost performance compared to in-house management alternatives.

Technology advancement creates opportunities for enhanced facility performance through smart building systems, predictive maintenance technologies, and integrated management platforms. Professional facility management providers are better positioned to implement and manage these technological solutions effectively.

Urbanization trends continue to drive commercial and residential development across South Africa’s major metropolitan areas, creating expanding demand for professional facility management services. This urban growth generates new facility portfolios that require comprehensive management solutions.

Sustainability focus has become increasingly important as organizations seek to reduce environmental impact and achieve sustainability objectives. Professional facility management providers offer specialized expertise in energy efficiency, waste management, and sustainable operations that support these organizational goals.

Economic volatility in South Africa creates periodic challenges for facility management market growth, as organizations may defer non-essential services or seek to reduce operational costs during economic downturns. This cyclical sensitivity can impact market expansion and service demand patterns.

Skills shortage in specialized facility management disciplines constrains market growth potential and service quality delivery. The industry requires technical expertise across multiple domains, and skills development has not always kept pace with market demand growth.

Price sensitivity among potential clients can limit market penetration, particularly in smaller organizations or price-conscious sectors. Some organizations remain focused primarily on cost considerations rather than value delivery, which can constrain service provider margins and growth opportunities.

Regulatory complexity across different sectors and jurisdictions can create operational challenges for facility management providers, particularly those serving multiple market segments. Compliance requirements vary significantly across sectors and can increase operational complexity and costs.

Technology adoption barriers exist in some market segments where organizations are hesitant to invest in advanced facility management technologies or lack the infrastructure to support sophisticated management systems. This can limit service innovation and efficiency improvements.

Competition intensity from both established providers and new market entrants can pressure margins and require continuous investment in service capabilities and differentiation strategies. The market’s attractiveness has drawn significant competitive participation, intensifying competitive dynamics.

Healthcare sector expansion presents significant opportunities for specialized facility management services, as healthcare facilities require sophisticated technical management, strict compliance adherence, and specialized operational expertise. The growing healthcare infrastructure in South Africa creates substantial market potential.

Smart building technology integration offers opportunities for facility management providers to deliver enhanced value through IoT systems, predictive maintenance, and data-driven optimization services. Organizations increasingly seek technology-enabled facility management solutions that improve efficiency and reduce costs.

Sustainability services represent a growing opportunity as organizations focus on environmental responsibility and energy efficiency. Facility management providers can develop specialized capabilities in green building management, energy optimization, and sustainability reporting services.

Industrial facility management presents opportunities in South Africa’s manufacturing and processing sectors, where specialized technical expertise and systematic maintenance approaches can deliver significant value. Industrial facilities often require comprehensive integrated management solutions.

Government sector outsourcing initiatives create potential opportunities for facility management providers as public sector organizations seek to improve operational efficiency and focus on core service delivery functions. Government facility portfolios represent substantial market potential.

Regional expansion opportunities exist in secondary cities and emerging commercial centers where facility management services are less established but growing commercial activity creates increasing demand for professional facility management solutions.

Supply-demand balance in South Africa’s facility management market demonstrates generally favorable conditions, with growing demand for professional services meeting expanding service provider capabilities. Market dynamics indicate healthy growth potential supported by fundamental economic and business trends.

Service evolution continues to shape market dynamics as providers develop more sophisticated and integrated service offerings. The trend toward comprehensive facility management solutions creates opportunities for providers to develop deeper client relationships and achieve greater service integration.

Technology disruption influences market dynamics through the introduction of smart building systems, mobile facility management platforms, and data analytics capabilities. These technological advances create both opportunities and challenges as providers must invest in new capabilities while maintaining traditional service excellence.

Client expectations continue to evolve toward higher service standards, greater transparency, and more strategic facility management partnerships. According to MarkWide Research analysis, approximately 78% of facility management clients now expect regular performance reporting and strategic consultation as part of service delivery.

Competitive intensity drives continuous service innovation and efficiency improvements as providers seek to differentiate their offerings and maintain market position. This competitive dynamic benefits clients through improved service quality and competitive pricing structures.

Regulatory evolution continues to influence market dynamics as new compliance requirements and industry standards shape service delivery requirements. Providers must maintain current expertise across multiple regulatory domains to serve diverse client portfolios effectively.

Primary research methodology incorporated comprehensive interviews with facility management service providers, client organizations, and industry experts across South Africa’s major metropolitan areas. This primary research provided direct insights into market conditions, service trends, and growth drivers from key market participants.

Secondary research analysis encompassed industry reports, regulatory filings, company financial statements, and trade association publications to develop comprehensive understanding of market structure, competitive dynamics, and growth patterns. This secondary research provided quantitative foundation for market analysis and trend identification.

Market segmentation analysis utilized both top-down and bottom-up approaches to identify and quantify distinct market segments by service type, client sector, and geographic region. This segmentation methodology enabled detailed analysis of market dynamics across different market categories.

Competitive analysis methodology included detailed evaluation of major market participants, service capabilities, geographic coverage, and strategic positioning. This competitive research provided insights into market structure and competitive dynamics affecting industry development.

Trend analysis incorporated historical market data, current market conditions, and forward-looking indicators to identify key trends and growth drivers shaping market evolution. This analytical approach supported development of market projections and strategic insights.

Data validation processes included cross-referencing multiple data sources, expert review of findings, and statistical analysis to ensure research accuracy and reliability. This validation methodology supports confidence in research conclusions and market insights.

Gauteng Province dominates South Africa’s facility management market, accounting for approximately 42% of total market activity. The province’s concentration of corporate headquarters, commercial developments, and industrial facilities in Johannesburg and Pretoria creates substantial demand for comprehensive facility management services across all service categories.

Western Cape represents the second-largest regional market, with Cape Town serving as a major commercial and tourism center requiring sophisticated facility management services. The region demonstrates particular strength in hospitality facility management, corporate office services, and healthcare facility management, contributing approximately 28% of national market activity.

KwaZulu-Natal shows strong market presence centered around Durban’s port and industrial activities, along with significant commercial and residential developments. The region’s diverse economic base creates demand for various facility management services, representing approximately 18% of market share.

Eastern Cape demonstrates emerging market potential with growing commercial development and industrial activity, particularly in automotive manufacturing and related sectors. The region shows increasing adoption of professional facility management services as commercial activity expands.

Regional development patterns indicate continued market concentration in major metropolitan areas while secondary cities show growing facility management service adoption. This geographic expansion creates opportunities for service providers to develop regional capabilities and serve emerging market segments.

Infrastructure development initiatives across various provinces support facility management market growth through new commercial, industrial, and institutional developments that require professional management services. These development projects create both immediate and long-term market opportunities.

Market leadership in South Africa’s facility management industry includes both international companies and strong domestic service providers, creating a diverse competitive environment that serves various market segments effectively.

Competitive differentiation strategies focus on service integration, technology capabilities, sector specialization, and geographic coverage. Leading providers invest continuously in service innovation, technology platforms, and staff development to maintain competitive advantages.

Market consolidation trends show ongoing merger and acquisition activity as providers seek to expand service capabilities, geographic coverage, and client portfolios. This consolidation activity creates larger, more capable service providers while maintaining competitive market dynamics.

New entrants continue to enter the market, particularly in specialized service niches and emerging technology areas. These new competitors bring innovation and specialized expertise while established providers leverage scale and experience advantages.

By Service Type:

By Client Sector:

By Contract Type:

By Geographic Region:

Hard Services Category demonstrates strong demand driven by technical complexity of modern buildings and regulatory compliance requirements. This category includes HVAC maintenance, electrical systems management, plumbing services, and structural maintenance. Growth in this segment reflects increasing building sophistication and the specialized expertise required for effective technical facility management.

Soft Services Category shows consistent growth across cleaning services, security, catering, and landscaping segments. These services directly impact occupant experience and satisfaction, making them essential components of comprehensive facility management programs. The category benefits from increasing quality standards and service expectations.

Integrated Services Category represents the fastest-growing segment as organizations seek simplified vendor relationships and coordinated service delivery. MWR data indicates that integrated facility management contracts have grown by approximately 35% annually over recent years, reflecting strong client preference for comprehensive solutions.

Technology-Enabled Services emerge as a distinct category incorporating smart building management, IoT systems, and data analytics capabilities. This category shows strong growth potential as organizations seek efficiency improvements and operational optimization through technology integration.

Sustainability Services develop as a specialized category addressing energy management, environmental compliance, and green building operations. Growing environmental awareness and regulatory requirements drive demand for specialized sustainability expertise in facility management.

Compliance Services represent a critical category encompassing health and safety management, regulatory compliance, and risk assessment services. This category shows steady growth driven by increasing regulatory complexity and organizational focus on risk management.

For Service Providers:

For Client Organizations:

For Technology Providers:

For Investors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation represents a fundamental trend reshaping facility management service delivery through IoT sensors, mobile platforms, and data analytics capabilities. Service providers increasingly utilize digital tools to enhance operational efficiency, improve service quality, and provide real-time performance visibility to clients.

Sustainability Integration has become a central trend as organizations focus on environmental responsibility and energy efficiency. Facility management providers develop specialized capabilities in green building management, energy optimization, waste reduction, and sustainability reporting to meet growing client demands.

Service Consolidation continues as organizations seek to simplify vendor relationships and achieve greater operational coordination through integrated facility management solutions. This trend drives service providers to expand capabilities and develop comprehensive service portfolios.

Predictive Maintenance adoption grows as organizations seek to reduce maintenance costs and improve equipment reliability through data-driven maintenance strategies. Technology platforms enable facility management providers to implement predictive maintenance programs that optimize maintenance timing and reduce unexpected failures.

Workplace Experience focus intensifies as organizations recognize the importance of facility quality in employee satisfaction and productivity. This trend drives demand for enhanced soft services, space optimization, and amenity management that improve occupant experience.

Compliance Automation emerges as a key trend addressing increasing regulatory complexity through systematic compliance management and automated reporting capabilities. Service providers develop specialized compliance management systems to ensure consistent regulatory adherence across client portfolios.

Technology Platform investments by major facility management providers focus on developing integrated management systems that combine multiple service disciplines under unified digital platforms. These investments enhance service delivery capabilities and provide competitive differentiation.

Strategic Acquisitions continue to reshape the competitive landscape as providers seek to expand service capabilities, geographic coverage, and specialized expertise. Recent acquisition activity demonstrates ongoing market consolidation and capability development initiatives.

Sustainability Certifications gain importance as facility management providers pursue green building certifications and environmental management standards to meet growing client sustainability requirements. These certifications enhance service credibility and market positioning.

Skills Development initiatives address industry skills shortages through training programs, certification courses, and partnerships with educational institutions. These development programs support industry growth and service quality improvement.

Government Partnerships develop as public sector organizations increasingly utilize private facility management services to improve operational efficiency and focus on core service delivery functions. These partnerships create new market opportunities and demonstrate facility management value.

Innovation Centers established by leading providers focus on developing new service delivery models, testing emerging technologies, and creating innovative solutions for evolving client requirements. These innovation initiatives support industry advancement and competitive differentiation.

Service Integration strategies should focus on developing comprehensive facility management capabilities that address multiple client requirements through coordinated service delivery. Providers should invest in systems and processes that enable seamless integration across service disciplines.

Technology Investment priorities should emphasize platforms that enhance operational efficiency, improve service quality, and provide client value through data analytics and performance optimization. Technology investments should align with client needs and market trends.

Sector Specialization opportunities exist in healthcare, education, and industrial facility management where specialized expertise creates competitive advantages and premium service positioning. Providers should consider developing sector-specific capabilities and service offerings.

Geographic Expansion strategies should evaluate opportunities in secondary cities and emerging commercial centers where facility management services are less established but commercial activity creates growing demand for professional services.

Sustainability Capabilities development should address growing client focus on environmental responsibility through specialized expertise in energy management, green building operations, and sustainability reporting services.

Partnership Strategies should consider collaborations with technology providers, specialized service companies, and industry organizations to enhance service capabilities and market reach while maintaining focus on core competencies.

Market expansion prospects remain positive supported by continued urbanization, commercial development, and increasing recognition of facility management as a strategic business function. MarkWide Research projects that the market will continue growing at approximately 7.1% CAGR over the next five years, driven by fundamental economic and business trends.

Technology integration will accelerate as smart building systems, IoT platforms, and data analytics become standard components of professional facility management services. This technology evolution will create new service opportunities while improving operational efficiency and client value delivery.

Service sophistication will increase as clients demand more strategic facility management partnerships that contribute to business objectives beyond basic operational support. This evolution will drive service providers to develop consulting capabilities and strategic advisory services.

Sustainability focus will intensify as environmental regulations strengthen and organizational sustainability commitments expand. Facility management providers will need to develop comprehensive sustainability capabilities to meet evolving client requirements and regulatory compliance needs.

Market consolidation will continue as providers seek scale advantages, expanded capabilities, and improved competitive positioning through strategic acquisitions and partnerships. This consolidation will create larger, more capable service providers while maintaining competitive market dynamics.

Regional development will expand facility management services beyond major metropolitan areas as commercial activity grows in secondary cities and emerging economic centers throughout South Africa. This geographic expansion will create new market opportunities and service delivery challenges.

South Africa’s facility management industry market demonstrates strong fundamentals and positive growth prospects driven by increasing outsourcing adoption, commercial development, and evolving client requirements for professional facility management services. The market has evolved from basic operational support to strategic business partnerships that contribute to organizational efficiency and effectiveness.

Key success factors for market participants include service integration capabilities, technology adoption, sector specialization, and the ability to deliver measurable value to client organizations. The industry’s future development will be shaped by digital transformation, sustainability focus, and the continued evolution of facility management from operational necessity to strategic advantage.

Market opportunities remain substantial across various segments, with particular potential in healthcare facility management, smart building services, sustainability solutions, and regional market expansion. Organizations that can effectively combine traditional facility management expertise with emerging technology capabilities and specialized sector knowledge will be best positioned for continued success in this dynamic and growing market.

What is Facility Management?

Facility Management refers to the integrated approach to maintaining and managing buildings and facilities, ensuring their functionality, safety, and efficiency. It encompasses various services such as maintenance, cleaning, security, and space management.

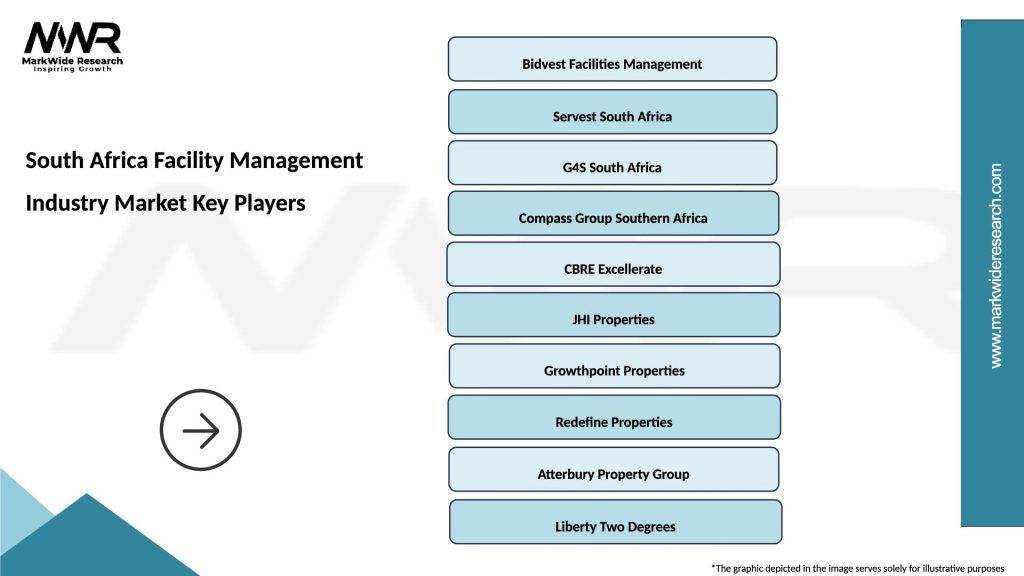

What are the key players in the South Africa Facility Management Industry Market?

Key players in the South Africa Facility Management Industry Market include companies like Bidvest Facilities Management, Servest, and Tsebo Solutions Group, which provide a range of services from cleaning to technical maintenance, among others.

What are the growth factors driving the South Africa Facility Management Industry Market?

The growth of the South Africa Facility Management Industry Market is driven by increasing urbanization, the need for efficient building management, and the rising demand for sustainable practices in facility operations.

What challenges does the South Africa Facility Management Industry Market face?

The South Africa Facility Management Industry Market faces challenges such as a shortage of skilled labor, fluctuating economic conditions, and the need for compliance with evolving regulations and standards.

What opportunities exist in the South Africa Facility Management Industry Market?

Opportunities in the South Africa Facility Management Industry Market include the adoption of smart building technologies, the growing emphasis on sustainability, and the potential for expansion into emerging markets.

What trends are shaping the South Africa Facility Management Industry Market?

Trends shaping the South Africa Facility Management Industry Market include the integration of technology for operational efficiency, a focus on health and safety in facility management, and the increasing importance of environmental sustainability in service delivery.

South Africa Facility Management Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Cleaning, Security, Maintenance, Landscaping |

| End User | Commercial, Residential, Educational, Healthcare |

| Technology | Building Automation, Energy Management, IoT Solutions, Smart Sensors |

| Application | Office Buildings, Retail Spaces, Industrial Facilities, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Facility Management Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at