444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South Africa Extra Neutral Alcohol (ENA) market is a vital segment of the country’s alcohol industry, serving as a key ingredient in various alcoholic beverages, pharmaceuticals, cosmetics, and industrial applications. ENA, also known as neutral spirit or rectified spirit, is a highly purified ethanol produced through distillation and rectification processes. It is characterized by its neutral odor and taste, making it an essential component in the production of spirits such as vodka, gin, and rum, as well as in the formulation of medicinal tinctures, perfumes, and solvents. The South Africa ENA market is influenced by factors such as consumer preferences, regulatory framework, raw material availability, economic conditions, and technological advancements, driving innovation, growth, and competitiveness in the industry.

Meaning

Extra Neutral Alcohol (ENA) refers to highly purified ethanol produced through distillation and rectification processes to remove impurities, flavors, and odors, resulting in a neutral-tasting and odorless alcohol. ENA is commonly used as a raw material in the production of alcoholic beverages, including vodka, gin, rum, and liqueurs, as well as in various non-beverage applications such as pharmaceuticals, cosmetics, personal care products, and industrial solvents. In South Africa, the ENA market plays a vital role in the country’s alcohol industry, catering to diverse customer needs and market demands across different sectors.

Executive Summary

The South Africa Extra Neutral alcohol (ENA) market is a dynamic and competitive segment of the country’s alcohol industry, driven by factors such as changing consumer preferences, regulatory developments, technological advancements, and economic conditions. The market offers significant opportunities for industry participants to innovate, diversify product offerings, expand market presence, and enhance competitiveness in both domestic and international markets. Understanding key market insights, trends, drivers, restraints, and opportunities is essential for stakeholders to navigate the competitive landscape, capitalize on growth prospects, and sustain long-term success in the South Africa ENA market.

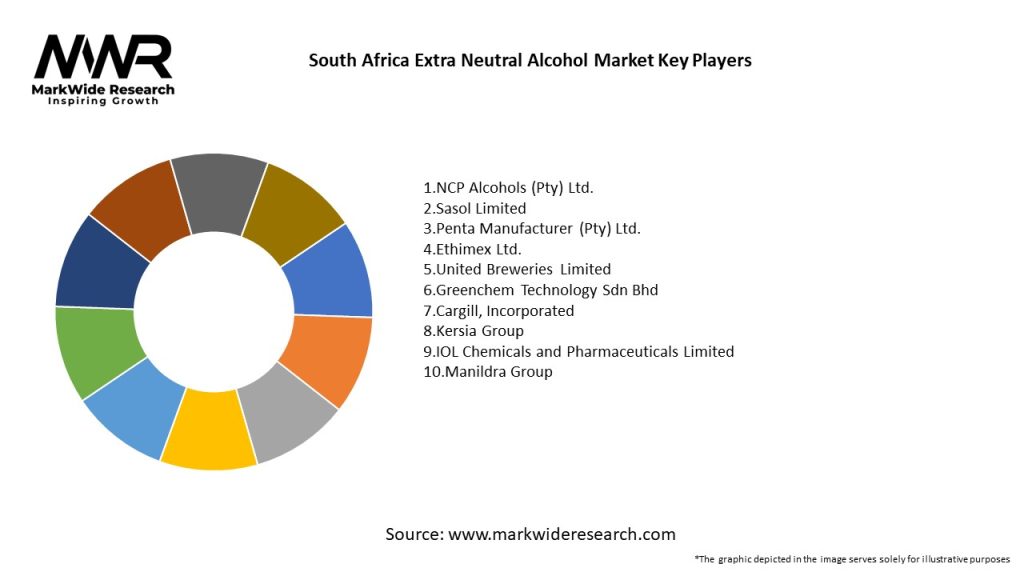

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The South Africa Extra Neutral Alcohol (ENA) market operates in a dynamic and competitive environment influenced by factors such as changing consumer preferences, regulatory framework, technological advancements, economic conditions, and market trends. Market dynamics such as product innovation, pricing strategies, distribution channels, and industry consolidation shape market competitiveness, growth, and sustainability, requiring stakeholders to adapt, innovate, and differentiate to capitalize on opportunities and mitigate risks effectively.

Key dynamics influencing the South Africa Extra Neutral Alcohol Market include:

Regional Analysis

The South Africa Extra Neutral Alcohol Market can be segmented by region, focusing on major urban centers such as:

Competitive Landscape

Leading Companies in the South Africa Extra Neutral Alcohol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The South Africa Extra Neutral Alcohol Market can be segmented based on:

Category-wise Insights

Each category of extra neutral alcohol offers distinct features and applications:

Key Benefits for Industry Participants and Stakeholders

The South Africa Extra Neutral Alcohol Market offers several advantages:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the South Africa Extra Neutral Alcohol Market include:

Covid-19 Impact

The COVID-19 pandemic significantly impacted the South African alcohol market, with initial disruptions in supply chains and production. However, as restrictions eased, there was a resurgence in consumer interest in alcoholic beverages, particularly premium and craft options. The pandemic underscored the importance of quality and safety in production, leading to increased consumer scrutiny of sourcing and production practices.

Key Industry Developments

Recent developments in the South Africa Extra Neutral Alcohol Market include:

Analyst Suggestions

Analysts recommend that companies in the South Africa Extra Neutral Alcohol Market focus on:

Future Outlook

The future outlook for the South Africa Extra Neutral Alcohol (ENA) market is positive, with continued growth and innovation driven by factors such as changing consumer preferences, regulatory reforms, technological advancements, and market trends. Despite challenges such as regulatory compliance, raw material availability, and competitive pressures, the South Africa ENA market presents significant opportunities for industry participants to innovate, diversify, and expand market presence in a dynamic and evolving industry landscape.

Conclusion

In conclusion, the South Africa Extra Neutral Alcohol (ENA) market is a vital segment of the country’s alcohol industry, serving diverse industries and end-user segments with high-purity ethanol for beverage production, pharmaceutical formulations, cosmetic formulations, and industrial applications. The market offers significant opportunities for industry participants to innovate, diversify product offerings, expand market presence, and enhance competitiveness in both domestic and international markets. Despite challenges such as regulatory compliance, raw material availability, and competitive pressures, the South Africa ENA market presents favorable prospects for sustainable growth, innovation, and market leadership in the years to come.

What is Extra Neutral Alcohol?

Extra Neutral Alcohol refers to a highly purified form of ethanol that is free from impurities and has a neutral taste. It is commonly used in the production of spirits, flavorings, and as a solvent in various industries.

What are the key players in the South Africa Extra Neutral Alcohol Market?

Key players in the South Africa Extra Neutral Alcohol Market include Distell Group Limited, South African Breweries, and KWV, among others. These companies are involved in the production and distribution of extra neutral alcohol for various applications.

What are the growth factors driving the South Africa Extra Neutral Alcohol Market?

The growth of the South Africa Extra Neutral Alcohol Market is driven by increasing demand for alcoholic beverages, the rise of craft distilleries, and the expanding use of extra neutral alcohol in food and beverage applications.

What challenges does the South Africa Extra Neutral Alcohol Market face?

The South Africa Extra Neutral Alcohol Market faces challenges such as regulatory restrictions on alcohol production, competition from alternative spirits, and fluctuations in raw material prices affecting production costs.

What opportunities exist in the South Africa Extra Neutral Alcohol Market?

Opportunities in the South Africa Extra Neutral Alcohol Market include the growing trend of premiumization in alcoholic beverages, increasing exports to international markets, and innovations in product formulations for health-conscious consumers.

What trends are shaping the South Africa Extra Neutral Alcohol Market?

Trends shaping the South Africa Extra Neutral Alcohol Market include the rise of sustainable production practices, the popularity of flavored spirits, and the increasing use of extra neutral alcohol in non-alcoholic beverages and mixers.

South Africa Extra Neutral Alcohol Market

| Segmentation Details | Description |

|---|---|

| Product Type | Grain, Sugarcane, Molasses, Potato |

| End User | Beverage Industry, Pharmaceutical, Cosmetics, Food Industry |

| Packaging Type | Bottles, Drums, Tankers, Bulk |

| Distribution Channel | Online, Retail, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the South Africa Extra Neutral Alcohol Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at