444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa diagnostic imaging equipment market represents a critical component of the nation’s healthcare infrastructure, experiencing substantial growth driven by technological advancements and increasing healthcare demands. This dynamic market encompasses various imaging modalities including X-ray systems, computed tomography (CT) scanners, magnetic resonance imaging (MRI) machines, ultrasound equipment, and nuclear imaging devices. Healthcare providers across South Africa are increasingly investing in advanced diagnostic imaging technologies to enhance patient care and improve clinical outcomes.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 6.2% over the forecast period. The growing prevalence of chronic diseases, aging population demographics, and government initiatives to modernize healthcare facilities are primary catalysts driving market growth. Private healthcare facilities and public hospitals are both contributing to increased demand for sophisticated imaging equipment, creating opportunities for both domestic and international manufacturers.

Technological innovation continues to reshape the landscape, with artificial intelligence integration, portable imaging solutions, and enhanced image quality driving adoption rates. The market benefits from South Africa’s position as a regional healthcare hub, serving neighboring countries and establishing itself as a gateway for medical technology distribution across the African continent.

The South Africa diagnostic imaging equipment market refers to the comprehensive ecosystem of medical devices, technologies, and systems used for non-invasive visualization of internal body structures for diagnostic and therapeutic purposes. This market encompasses the manufacturing, distribution, sales, and servicing of various imaging modalities designed to assist healthcare professionals in accurate disease detection, treatment planning, and patient monitoring across South African healthcare facilities.

Diagnostic imaging equipment includes a broad spectrum of technologies ranging from traditional X-ray machines to advanced molecular imaging systems. These sophisticated devices enable healthcare providers to visualize anatomical structures, detect abnormalities, monitor disease progression, and guide therapeutic interventions. The market encompasses both hardware components such as scanners, detectors, and imaging systems, as well as associated software solutions for image processing, analysis, and management.

Healthcare transformation in South Africa has elevated the importance of diagnostic imaging as a cornerstone of modern medical practice. The market serves diverse healthcare settings including tertiary hospitals, specialized imaging centers, community clinics, and mobile healthcare units, addressing the varied diagnostic needs of South Africa’s diverse population across urban and rural areas.

Market expansion in South Africa’s diagnostic imaging equipment sector reflects the country’s commitment to healthcare modernization and improved patient outcomes. The market demonstrates strong growth momentum driven by increasing healthcare expenditure, technological advancements, and rising disease prevalence requiring advanced diagnostic capabilities. Key market segments including CT scanners, MRI systems, and ultrasound equipment are experiencing particularly robust demand from both public and private healthcare sectors.

Government initiatives supporting healthcare infrastructure development have created favorable conditions for market growth, with public sector procurement accounting for approximately 45% of total market demand. Private healthcare providers continue to invest in premium imaging technologies to maintain competitive advantages and attract patients seeking high-quality diagnostic services. The integration of digital health technologies and telemedicine capabilities is further enhancing the value proposition of modern imaging equipment.

Competitive dynamics feature a mix of international manufacturers and local distributors, with established global brands maintaining strong market positions while emerging players focus on cost-effective solutions tailored to local market needs. The market benefits from South Africa’s well-developed healthcare infrastructure, skilled medical professionals, and regulatory framework that supports the adoption of advanced medical technologies.

Strategic insights reveal several critical factors shaping the South Africa diagnostic imaging equipment market landscape:

Primary growth drivers propelling the South Africa diagnostic imaging equipment market include the increasing prevalence of chronic diseases requiring regular monitoring and diagnostic imaging. Cardiovascular diseases, cancer, and diabetes rates continue to rise, necessitating advanced imaging capabilities for early detection, treatment planning, and ongoing patient management. The aging population demographic is contributing to higher demand for diagnostic services, with elderly patients requiring more frequent imaging procedures.

Healthcare infrastructure development initiatives by both government and private sectors are creating substantial market opportunities. New hospital construction, facility upgrades, and equipment replacement programs are driving consistent demand for modern imaging systems. Medical tourism growth is encouraging healthcare facilities to invest in state-of-the-art imaging equipment to attract international patients seeking high-quality diagnostic services.

Technological advancements in imaging equipment are making procedures faster, more accurate, and less invasive, encouraging adoption by healthcare providers seeking to improve patient experience and clinical outcomes. The integration of artificial intelligence and automated analysis capabilities is enhancing diagnostic accuracy while reducing interpretation time. Government healthcare policies supporting universal healthcare access are expanding the patient base requiring diagnostic imaging services across the country.

Significant challenges facing the South Africa diagnostic imaging equipment market include high capital investment requirements for advanced imaging systems. Budget constraints in public healthcare facilities often limit the procurement of premium equipment, forcing institutions to prioritize essential over advanced technologies. The substantial costs associated with equipment installation, training, and ongoing maintenance create barriers for smaller healthcare providers seeking to upgrade their imaging capabilities.

Skills shortages in specialized technical areas pose operational challenges, with limited availability of qualified radiologic technologists and biomedical engineers affecting equipment utilization rates. Infrastructure limitations in rural areas, including unreliable power supply and inadequate facility space, restrict the deployment of sophisticated imaging equipment. The complex regulatory approval processes for medical devices can delay market entry for new technologies and increase compliance costs for manufacturers.

Economic volatility and currency fluctuations impact equipment pricing and procurement decisions, particularly affecting imported technologies that comprise the majority of the market. Maintenance costs and the need for specialized service support create ongoing financial burdens for healthcare facilities, especially those operating with limited budgets. Competition from refurbished equipment markets provides cost-effective alternatives but may limit demand for new systems.

Emerging opportunities in the South Africa diagnostic imaging equipment market include the growing demand for point-of-care imaging solutions that can be deployed in primary healthcare settings. Portable ultrasound systems and mobile X-ray units present significant potential for expanding diagnostic capabilities to underserved communities. The integration of telemedicine and remote diagnostic capabilities creates opportunities for equipment manufacturers to develop connected imaging solutions.

Artificial intelligence integration represents a transformative opportunity, with AI-powered imaging systems offering enhanced diagnostic accuracy and workflow efficiency. Preventive healthcare initiatives are driving demand for screening-focused imaging equipment, particularly in mammography and cardiac imaging segments. The expansion of private healthcare networks creates opportunities for premium imaging equipment sales and service contracts.

Regional expansion opportunities exist as South Africa serves as a hub for medical technology distribution across sub-Saharan Africa. Public-private partnerships in healthcare infrastructure development present collaborative opportunities for equipment suppliers and service providers. The growing focus on value-based healthcare is creating demand for imaging systems that demonstrate clear clinical and economic benefits, opening markets for innovative technologies that improve patient outcomes while reducing costs.

Dynamic market forces shaping the South Africa diagnostic imaging equipment landscape reflect the complex interplay between healthcare needs, technological innovation, and economic factors. Supply chain dynamics have evolved to accommodate both international equipment imports and local assembly operations, with manufacturers establishing regional distribution networks to serve the South African market effectively. The market demonstrates seasonal variations in procurement patterns, with budget cycles influencing purchasing decisions in public healthcare facilities.

Competitive intensity varies across different imaging modalities, with established international brands dominating premium segments while local distributors compete on service quality and cost-effectiveness. Technology adoption cycles show healthcare facilities increasingly prioritizing equipment with upgrade pathways and modular capabilities to extend useful life and adapt to evolving clinical needs. According to MarkWide Research analysis, the market shows strong resilience with consistent growth despite economic challenges.

Regulatory dynamics continue to evolve, with authorities implementing stricter quality standards and safety requirements that influence equipment selection and market entry strategies. Financing mechanisms including leasing programs and equipment-as-a-service models are gaining popularity, enabling healthcare facilities to access advanced imaging technologies without substantial upfront capital investments. The market benefits from South Africa’s stable regulatory environment and well-established healthcare quality standards.

Comprehensive research methodology employed for analyzing the South Africa diagnostic imaging equipment market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare administrators, radiologists, biomedical engineers, and equipment manufacturers to gather firsthand insights into market trends, challenges, and opportunities. Survey data from healthcare facilities across different provinces provides quantitative insights into equipment utilization, procurement patterns, and future investment plans.

Secondary research encompasses analysis of government healthcare statistics, industry reports, regulatory filings, and financial statements from key market participants. Market sizing methodologies utilize bottom-up and top-down approaches, cross-validating findings through multiple data sources to ensure accuracy. Trade association data, import/export statistics, and healthcare expenditure reports provide additional validation for market estimates and growth projections.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive benchmarking to evaluate market structure and competitive dynamics. Forecasting models incorporate historical trends, demographic projections, healthcare policy changes, and economic indicators to project future market development. Expert validation through industry advisory panels ensures research findings reflect current market realities and emerging trends accurately.

Gauteng Province dominates the South Africa diagnostic imaging equipment market, accounting for approximately 40% of total market demand due to its concentration of major healthcare facilities, medical schools, and private hospitals. Johannesburg and Pretoria serve as primary markets with numerous tertiary care centers and specialized imaging facilities driving equipment procurement. The province benefits from superior healthcare infrastructure, skilled medical professionals, and higher healthcare spending per capita.

Western Cape represents the second-largest regional market with Cape Town serving as a major healthcare hub and medical tourism destination. The province demonstrates strong demand for premium imaging equipment, with private healthcare facilities investing in advanced technologies to maintain competitive advantages. KwaZulu-Natal shows growing market potential, particularly in the Durban metropolitan area, with both public and private sectors expanding imaging capabilities.

Rural provinces including Eastern Cape, Limpopo, and Northern Cape present unique market dynamics characterized by greater reliance on mobile and portable imaging solutions. Government initiatives to improve rural healthcare access are driving demand for cost-effective, robust imaging equipment suitable for challenging operating environments. MWR data indicates that rural market segments are experiencing higher growth rates as healthcare infrastructure development programs expand diagnostic capabilities to underserved areas.

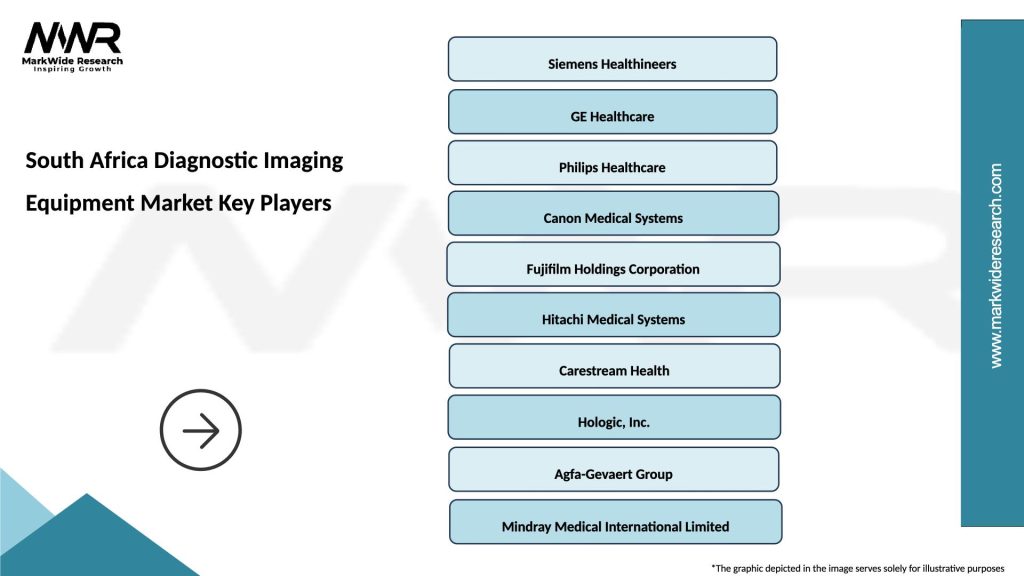

Market leadership in the South Africa diagnostic imaging equipment sector is characterized by strong competition among established international manufacturers and specialized local distributors. Key market participants include:

Competitive strategies focus on comprehensive service offerings, local technical support, and flexible financing options to address diverse customer needs across different healthcare segments.

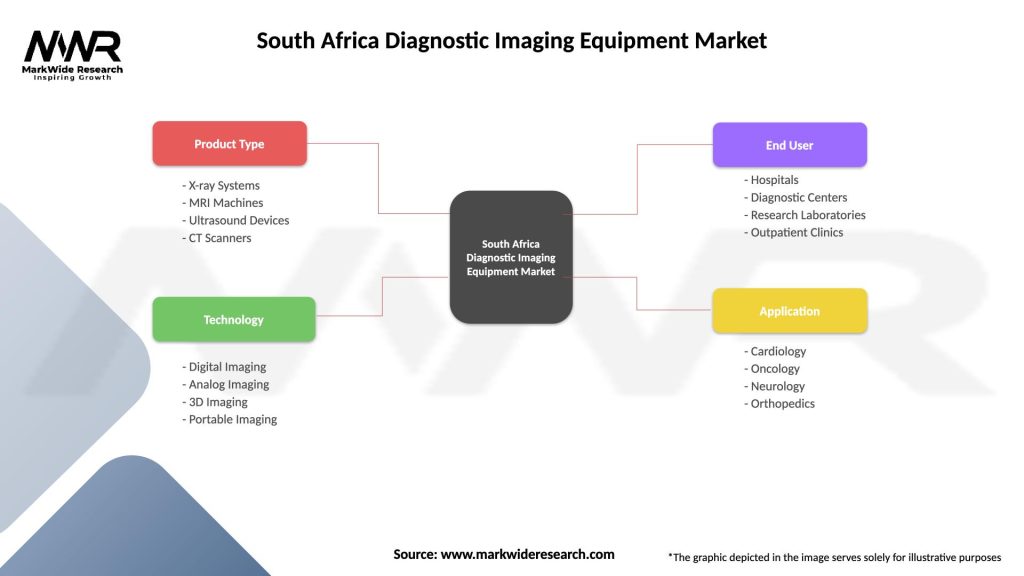

Market segmentation analysis reveals distinct patterns across multiple dimensions of the South Africa diagnostic imaging equipment market:

By Technology:

By End User:

X-ray systems maintain the largest market share due to their fundamental role in diagnostic imaging across all healthcare settings. Digital radiography adoption continues to accelerate, with healthcare facilities upgrading from analog systems to improve image quality and workflow efficiency. The segment benefits from relatively lower costs and versatile applications spanning emergency medicine, orthopedics, and routine diagnostic procedures.

Ultrasound equipment demonstrates strong growth momentum driven by portable system adoption and expanding clinical applications. Point-of-care ultrasound is gaining popularity among emergency departments and primary care facilities, while advanced systems serve specialized applications in cardiology, obstetrics, and interventional procedures. The segment shows adoption rates of 78% among private healthcare facilities for basic diagnostic capabilities.

CT scanners represent a high-value segment with growing demand for multi-slice systems offering enhanced imaging speed and quality. Advanced CT technologies including spectral imaging and AI-powered reconstruction are gaining traction among leading healthcare facilities. MRI systems show selective growth focused on high-field systems for specialized applications, with 1.5T and 3T systems comprising the majority of new installations in tertiary care centers.

Healthcare providers benefit from improved diagnostic accuracy and enhanced patient care capabilities through access to advanced imaging technologies. Clinical outcomes improve significantly with early disease detection, precise treatment planning, and ongoing monitoring capabilities enabled by sophisticated imaging equipment. Operational efficiency gains include reduced examination times, automated workflows, and integrated digital systems that streamline patient management processes.

Equipment manufacturers gain access to a growing market with diverse opportunities across different technology segments and customer categories. Service revenue streams provide ongoing income through maintenance contracts, training programs, and equipment upgrades. The market offers opportunities for innovation and differentiation through specialized solutions addressing local healthcare challenges and requirements.

Patients benefit from improved access to diagnostic services, reduced examination times, and enhanced comfort during imaging procedures. Healthcare outcomes improve through earlier disease detection, more accurate diagnoses, and personalized treatment approaches enabled by advanced imaging capabilities. Government stakeholders achieve healthcare policy objectives through expanded diagnostic capabilities and improved population health outcomes across urban and rural communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the South Africa diagnostic imaging equipment market. AI-powered systems are enhancing diagnostic accuracy, reducing interpretation time, and enabling automated analysis capabilities that support radiologists in clinical decision-making. Machine learning algorithms are being integrated into imaging equipment to improve image quality, optimize scanning protocols, and detect abnormalities with greater precision.

Digital transformation continues to reshape healthcare delivery with comprehensive Picture Archiving and Communication Systems (PACS) implementation across major healthcare facilities. Cloud-based solutions are gaining popularity for image storage, sharing, and remote access capabilities. Telemedicine integration is driving demand for imaging equipment with remote diagnostic capabilities, enabling specialist consultations and second opinions across geographical boundaries.

Portable and mobile imaging solutions are experiencing accelerated adoption driven by the need to expand diagnostic capabilities to underserved areas. Point-of-care ultrasound systems are becoming standard equipment in emergency departments and primary care settings. MarkWide Research indicates that mobile imaging adoption rates have increased by 35% over the past two years, reflecting the growing emphasis on accessible healthcare delivery.

Recent industry developments highlight the dynamic nature of the South Africa diagnostic imaging equipment market with several significant milestones shaping future growth trajectories. Government healthcare initiatives including the National Health Insurance (NHI) implementation are creating new opportunities for equipment procurement and healthcare infrastructure development. Major healthcare facilities are announcing substantial capital investment programs focused on imaging equipment upgrades and expansion.

Technology partnerships between international manufacturers and local distributors are strengthening market presence and service capabilities. Training programs launched by equipment manufacturers in collaboration with medical schools and healthcare institutions are addressing skills shortages and supporting technology adoption. New financing mechanisms including equipment leasing and pay-per-use models are making advanced imaging technologies more accessible to smaller healthcare providers.

Regulatory developments include updated medical device regulations and quality standards that are influencing equipment selection and procurement processes. Research collaborations between healthcare institutions and technology companies are driving innovation in imaging applications and clinical protocols. The establishment of regional service centers by major manufacturers is improving technical support and maintenance capabilities across the country.

Strategic recommendations for market participants include focusing on value-based solutions that demonstrate clear clinical and economic benefits to healthcare providers. Equipment manufacturers should prioritize local service capabilities and technical support to differentiate their offerings in the competitive market. Developing flexible financing options and equipment-as-a-service models can expand market access and reduce barriers to adoption for budget-constrained healthcare facilities.

Healthcare providers should consider comprehensive imaging strategies that integrate multiple modalities and leverage digital technologies for improved workflow efficiency. Investment priorities should focus on equipment with upgrade pathways and modular capabilities to extend useful life and adapt to evolving clinical needs. Establishing partnerships with equipment manufacturers for training and technical support can maximize return on investment and ensure optimal equipment utilization.

Government stakeholders should continue supporting healthcare infrastructure development while addressing regulatory frameworks that facilitate technology adoption. Public-private partnerships can leverage private sector expertise and resources to accelerate healthcare modernization initiatives. Investing in technical education and training programs will address skills shortages and support sustainable market growth across all healthcare segments.

Future market prospects for the South Africa diagnostic imaging equipment sector remain highly positive with sustained growth expected across all major segments. Technology advancement will continue driving market evolution with artificial intelligence, machine learning, and digital health integration becoming standard features in new imaging systems. The market is projected to maintain a compound annual growth rate of 6.8% over the next five years, supported by healthcare infrastructure development and increasing diagnostic imaging demand.

Emerging technologies including molecular imaging, hybrid systems, and advanced visualization capabilities will create new market opportunities and applications. Healthcare digitization initiatives will drive demand for connected imaging equipment with cloud integration and remote diagnostic capabilities. The growing emphasis on preventive healthcare and early disease detection will sustain demand for screening-focused imaging equipment across multiple clinical specialties.

Market expansion into underserved rural areas will accelerate through mobile imaging solutions and portable equipment deployment. Regional market development will position South Africa as a hub for medical technology distribution across sub-Saharan Africa, creating additional growth opportunities for equipment manufacturers and service providers. The integration of value-based healthcare models will favor imaging technologies that demonstrate measurable improvements in patient outcomes and operational efficiency.

The South Africa diagnostic imaging equipment market represents a dynamic and rapidly evolving sector characterized by strong growth potential, technological innovation, and diverse opportunities across multiple healthcare segments. Market fundamentals remain robust with increasing healthcare demand, government support for infrastructure development, and growing adoption of advanced imaging technologies driving sustained expansion. The market benefits from South Africa’s position as a regional healthcare hub and its well-established medical infrastructure.

Key success factors for market participants include focusing on value-based solutions, establishing strong local service capabilities, and developing flexible financing options that address diverse customer needs. Technology trends including artificial intelligence integration, digital transformation, and portable imaging solutions will continue shaping market development and creating new opportunities for innovation and differentiation.

Future growth prospects remain highly favorable with the market positioned to benefit from ongoing healthcare modernization initiatives, expanding diagnostic imaging applications, and South Africa’s strategic role in regional medical technology distribution. Stakeholder collaboration between government, healthcare providers, and equipment manufacturers will be essential for realizing the market’s full potential and ensuring sustainable growth that benefits all participants in the healthcare ecosystem.

What is Diagnostic Imaging Equipment?

Diagnostic Imaging Equipment refers to various technologies used to visualize the interior of the body for clinical analysis and medical intervention. This includes modalities such as X-rays, MRI, CT scans, and ultrasound, which are essential for diagnosing diseases and monitoring treatment progress.

What are the key players in the South Africa Diagnostic Imaging Equipment Market?

Key players in the South Africa Diagnostic Imaging Equipment Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others. These companies are known for their innovative imaging technologies and comprehensive healthcare solutions.

What are the growth factors driving the South Africa Diagnostic Imaging Equipment Market?

The growth of the South Africa Diagnostic Imaging Equipment Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technologies, and the rising demand for early diagnosis and preventive healthcare. Additionally, government initiatives to improve healthcare infrastructure contribute to market expansion.

What challenges does the South Africa Diagnostic Imaging Equipment Market face?

The South Africa Diagnostic Imaging Equipment Market faces challenges such as high costs of advanced imaging systems, limited access to healthcare facilities in rural areas, and regulatory hurdles. These factors can hinder the adoption of new technologies and limit market growth.

What opportunities exist in the South Africa Diagnostic Imaging Equipment Market?

Opportunities in the South Africa Diagnostic Imaging Equipment Market include the growing trend of telemedicine, which enhances access to diagnostic services, and the increasing focus on personalized medicine. Furthermore, partnerships between public and private sectors can lead to improved healthcare delivery.

What trends are shaping the South Africa Diagnostic Imaging Equipment Market?

Trends shaping the South Africa Diagnostic Imaging Equipment Market include the integration of artificial intelligence in imaging processes, the development of portable imaging devices, and the shift towards value-based healthcare. These innovations aim to enhance diagnostic accuracy and improve patient outcomes.

South Africa Diagnostic Imaging Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | X-ray Systems, MRI Machines, Ultrasound Devices, CT Scanners |

| Technology | Digital Imaging, Analog Imaging, 3D Imaging, Portable Imaging |

| End User | Hospitals, Diagnostic Centers, Research Laboratories, Outpatient Clinics |

| Application | Cardiology, Oncology, Neurology, Orthopedics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Diagnostic Imaging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at