444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa data center power market represents a critical infrastructure segment experiencing unprecedented growth driven by digital transformation initiatives across the continent. As organizations increasingly migrate to cloud-based solutions and embrace digital technologies, the demand for reliable, efficient data center power infrastructure has surged dramatically. South Africa’s strategic position as the gateway to African markets has positioned the country as a regional hub for data center development, creating substantial opportunities for power infrastructure providers.

Market dynamics indicate that the sector is experiencing robust expansion, with growth rates reaching 8.2% annually as enterprises prioritize digital infrastructure investments. The increasing adoption of artificial intelligence, machine learning, and Internet of Things applications has intensified power consumption requirements, driving demand for advanced power management solutions. Government initiatives supporting digital economy development and foreign investment in technology infrastructure have further accelerated market growth.

Regional market leadership in Africa positions South Africa as the dominant force in continental data center development, with approximately 65% market share in sub-Saharan Africa’s data center power infrastructure. The country’s relatively stable power grid, skilled workforce, and established telecommunications infrastructure provide competitive advantages for international data center operators seeking African market entry points.

The South Africa data center power market refers to the comprehensive ecosystem of power generation, distribution, management, and backup systems specifically designed to support data center operations throughout South Africa. This market encompasses uninterruptible power supply systems, backup generators, power distribution units, cooling systems, and energy management software solutions that ensure continuous, reliable power delivery to critical IT infrastructure.

Power infrastructure components within this market include primary power systems that connect data centers to the national electrical grid, secondary backup systems that provide emergency power during outages, and sophisticated monitoring systems that optimize energy consumption and ensure operational efficiency. The market also encompasses renewable energy integration solutions, battery storage systems, and smart grid technologies that enhance sustainability and reduce operational costs.

Market participants include power equipment manufacturers, system integrators, energy service providers, and technology companies specializing in data center infrastructure management. These stakeholders collaborate to deliver comprehensive power solutions that meet the stringent reliability, efficiency, and scalability requirements of modern data center operations.

South Africa’s data center power market demonstrates exceptional growth potential as the country establishes itself as the continental leader in digital infrastructure development. The market benefits from increasing enterprise digitalization, government support for technology investments, and growing demand from international cloud service providers seeking African market presence. Key growth drivers include the expansion of hyperscale data centers, increasing adoption of edge computing solutions, and rising demand for disaster recovery services.

Technology advancement in power management systems has enabled data centers to achieve higher efficiency levels while reducing environmental impact. The integration of artificial intelligence in power monitoring systems has improved predictive maintenance capabilities, reducing downtime risks and operational costs. Renewable energy adoption has accelerated, with solar power integration reaching 35% penetration among new data center developments.

Market consolidation trends indicate increasing collaboration between international technology companies and local infrastructure providers, creating opportunities for knowledge transfer and capacity building. The emergence of colocation services and managed hosting solutions has diversified market demand, requiring flexible, scalable power infrastructure solutions that can accommodate varying customer requirements and growth trajectories.

Strategic market positioning reveals several critical insights that define the South Africa data center power market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Market maturation is evident through the establishment of industry standards, professional certification programs, and specialized training initiatives that support sustainable market growth and technical excellence.

Digital transformation initiatives across South African enterprises represent the primary catalyst driving data center power market expansion. Organizations are investing heavily in cloud migration, digital analytics, and automation technologies that require robust, scalable data center infrastructure. Government digitalization programs and smart city initiatives have created additional demand for data processing capabilities, further accelerating market growth.

International investment in South African technology infrastructure has intensified as global companies recognize the country’s strategic importance as an African market gateway. Major cloud service providers are establishing regional data centers to serve continental markets, creating substantial demand for reliable power infrastructure. Hyperscale deployments require sophisticated power management systems capable of supporting massive computing workloads while maintaining operational efficiency.

Regulatory support for renewable energy adoption has encouraged data center operators to invest in sustainable power solutions. Government incentives for solar power installations and energy efficiency improvements have reduced the total cost of ownership for green data center power systems. Environmental consciousness among enterprises has driven demand for carbon-neutral data center operations, creating opportunities for renewable energy integration and energy storage solutions.

Telecommunications infrastructure development and submarine cable investments have positioned South Africa as a regional connectivity hub, attracting international data center investments that require world-class power infrastructure to support critical communications and data processing operations.

Power grid reliability challenges represent the most significant constraint affecting South Africa’s data center power market development. Periodic load shedding and grid instability have increased the complexity and cost of data center power systems, requiring extensive backup power capabilities and sophisticated monitoring systems. Infrastructure limitations in certain regions restrict data center development opportunities and increase deployment costs.

High capital investment requirements for advanced power infrastructure can limit market participation, particularly for smaller enterprises and local companies seeking to enter the data center market. The substantial upfront costs associated with redundant power systems, backup generators, and energy storage solutions create barriers to entry for emerging market participants.

Skills shortage in specialized data center power management and maintenance creates operational challenges and increases dependency on expensive foreign expertise. The limited availability of certified technicians and engineers with data center power systems experience constrains market growth and increases operational risks for data center operators.

Regulatory complexity surrounding power generation, environmental compliance, and building codes can delay project implementations and increase development costs. Navigating multiple regulatory frameworks and obtaining necessary permits for data center power infrastructure requires significant time and resources, potentially deterring international investment.

Renewable energy integration presents exceptional opportunities for market expansion as data center operators seek sustainable, cost-effective power solutions. The abundance of solar and wind resources in South Africa creates potential for innovative hybrid power systems that combine grid connectivity with renewable generation and battery storage. Energy independence through on-site renewable generation can reduce operational costs and improve power reliability.

Edge computing deployment across South Africa’s urban and rural areas creates demand for distributed data center power solutions. The need for low-latency computing capabilities in telecommunications, financial services, and industrial applications drives requirements for smaller, more efficient power systems that can operate reliably in diverse environments.

Regional expansion opportunities exist as South African companies leverage their experience to support data center development across sub-Saharan Africa. The country’s technical expertise and established supply chains position local companies to capture market share in neighboring countries experiencing digital transformation.

Technology innovation in power management systems, including artificial intelligence-driven optimization, predictive maintenance, and automated load balancing, creates opportunities for differentiation and value creation. Smart grid integration and demand response capabilities can provide additional revenue streams while improving overall system efficiency.

Supply chain evolution within the South Africa data center power market reflects increasing localization of manufacturing and assembly capabilities. International power equipment manufacturers are establishing regional facilities and partnerships to reduce costs and improve service delivery. Local content requirements and government procurement preferences are driving investment in domestic manufacturing capabilities.

Competitive intensity has increased as global technology companies compete for market share in South Africa’s growing data center sector. This competition has accelerated innovation in power management technologies and driven down equipment costs, benefiting end users while challenging traditional market participants to differentiate their offerings.

Customer requirements are evolving toward integrated solutions that combine power infrastructure with monitoring, maintenance, and optimization services. Data center operators increasingly prefer comprehensive service packages that reduce operational complexity and provide predictable cost structures. Service-oriented business models are gaining traction as customers seek to focus on core business activities rather than infrastructure management.

Technology convergence between power systems, cooling infrastructure, and IT equipment is creating opportunities for holistic optimization approaches that improve overall data center efficiency. MarkWide Research analysis indicates that integrated infrastructure solutions can achieve 25% efficiency improvements compared to traditional standalone systems.

Comprehensive market analysis for the South Africa data center power market employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included structured interviews with industry executives, technology vendors, data center operators, and government officials involved in digital infrastructure development. Survey methodologies captured quantitative data on market trends, technology adoption patterns, and investment priorities.

Secondary research encompassed analysis of industry reports, government publications, regulatory filings, and company financial statements to validate primary research findings and identify market trends. Technical documentation review provided insights into emerging technologies and their potential market impact. Market modeling techniques integrated multiple data sources to develop comprehensive market forecasts and scenario analyses.

Expert validation processes involved consultation with industry specialists, academic researchers, and technology consultants to ensure research findings accurately reflected market realities. Peer review mechanisms and cross-validation techniques enhanced the reliability and credibility of research conclusions.

Data triangulation methods combined quantitative and qualitative research findings to provide comprehensive market insights. Statistical analysis techniques identified correlations and trends within the data, while qualitative analysis provided context and explanation for observed market phenomena.

Gauteng Province dominates South Africa’s data center power market, accounting for approximately 55% of national capacity due to its concentration of financial services, telecommunications, and technology companies. Johannesburg and Pretoria serve as primary data center hubs, benefiting from established infrastructure, skilled workforce availability, and proximity to major enterprises. Power grid stability in urban areas provides advantages for large-scale data center deployments.

Western Cape represents the second-largest regional market, with Cape Town emerging as a significant data center location driven by its submarine cable landing points and growing technology sector. The region’s renewable energy resources and relatively stable power supply create attractive conditions for sustainable data center development. Government support for technology investments has accelerated market growth in the province.

KwaZulu-Natal shows promising growth potential, particularly in Durban, where port facilities and logistics infrastructure support data center development for regional and international markets. The province’s industrial base creates demand for edge computing solutions and distributed data processing capabilities.

Regional development initiatives across other provinces are creating opportunities for data center power infrastructure expansion, particularly in areas with abundant renewable energy resources and growing industrial activity. Government incentives for rural development and digital inclusion programs are driving distributed data center deployments that require specialized power solutions.

Market leadership in South Africa’s data center power sector is characterized by a mix of international technology companies and established local infrastructure providers. The competitive landscape reflects the market’s evolution from basic power supply solutions to comprehensive, intelligent power management systems.

Strategic partnerships between international vendors and local system integrators have become increasingly important for market success, combining global technology expertise with local market knowledge and service capabilities.

Technology segmentation within the South Africa data center power market reveals distinct categories based on power capacity, application requirements, and deployment models. Each segment demonstrates unique growth characteristics and customer requirements that influence market development strategies.

By Power Capacity:

By Component Type:

Uninterruptible Power Supply systems represent the largest category within the South Africa data center power market, driven by the critical need for power protection against grid instabilities. Advanced UPS technologies incorporating lithium-ion batteries and modular designs are gaining market share due to their improved efficiency and reduced maintenance requirements. Online double-conversion UPS systems dominate enterprise deployments, while line-interactive systems serve smaller applications.

Backup generator systems have experienced increased demand due to South Africa’s power supply challenges, with diesel generators remaining the primary technology choice for extended runtime requirements. Natural gas generators are gaining interest in areas with gas infrastructure availability, offering improved environmental performance and operational cost advantages.

Power distribution infrastructure is evolving toward intelligent systems that provide real-time monitoring, remote management, and predictive maintenance capabilities. Smart PDUs with network connectivity and environmental monitoring are becoming standard in modern data center deployments. Modular power distribution solutions offer flexibility for rapidly changing data center requirements.

Energy storage systems are emerging as a significant category, with battery technologies complementing traditional UPS systems and providing grid stabilization services. Lithium-ion battery adoption has reached 40% penetration in new data center installations, driven by improved energy density and lifecycle cost advantages.

Data center operators benefit from advanced power infrastructure through improved operational reliability, reduced downtime risks, and enhanced energy efficiency. Modern power management systems provide comprehensive monitoring and control capabilities that enable proactive maintenance and optimization strategies. Cost reduction opportunities through energy efficiency improvements and predictive maintenance can significantly impact operational profitability.

Enterprise customers gain access to reliable, scalable IT infrastructure that supports their digital transformation initiatives without requiring substantial capital investments in power infrastructure. Colocation and managed hosting services provide enterprise-grade power reliability and redundancy at shared costs. Service level agreements guarantee uptime performance and provide financial protection against power-related service disruptions.

Technology vendors benefit from growing market demand and opportunities for innovation in power management solutions. The expanding market creates revenue growth opportunities while driving investment in research and development activities. Local partnerships provide market access and enable technology transfer that supports long-term market development.

Government stakeholders benefit from increased foreign investment, job creation, and technology transfer associated with data center power infrastructure development. The growing sector contributes to economic diversification and supports the development of digital economy capabilities. Tax revenue generation and export opportunities create additional economic benefits for the country.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration in data center power management systems represents a transformative trend enabling predictive maintenance, automated optimization, and intelligent load balancing. AI-powered systems can anticipate equipment failures, optimize energy consumption patterns, and automatically adjust power distribution based on real-time demand. Machine learning algorithms continuously improve system performance through pattern recognition and predictive analytics.

Sustainability focus has intensified across the data center industry, driving adoption of renewable energy sources, energy-efficient equipment, and carbon-neutral operations. Green building certifications and environmental reporting requirements are influencing data center design and power system selection. Solar power integration and battery storage systems are becoming standard components of new data center developments.

Edge computing proliferation is creating demand for distributed data center power solutions that can operate reliably in diverse environments with varying power quality conditions. Micro data centers and containerized solutions require specialized power systems optimized for remote deployment and autonomous operation.

Modular infrastructure approaches are gaining popularity as data center operators seek flexible, scalable solutions that can adapt to changing requirements. Prefabricated power modules enable rapid deployment and standardized configurations that reduce complexity and improve reliability. According to MarkWide Research findings, modular power solutions demonstrate 30% faster deployment times compared to traditional construction methods.

Major infrastructure investments by international cloud service providers have accelerated data center power market development in South Africa. Recent announcements of hyperscale data center projects have created substantial demand for advanced power infrastructure and driven technology innovation in the sector. Public-private partnerships have facilitated large-scale infrastructure development while sharing investment risks and expertise.

Renewable energy projects specifically designed for data center power supply have emerged as a significant development trend. Solar farms and wind installations dedicated to data center operations provide cost-effective, sustainable power while reducing grid dependency. Power purchase agreements between data center operators and renewable energy developers have created new financing models and risk-sharing arrangements.

Technology partnerships between international vendors and local companies have accelerated market development and knowledge transfer. Joint ventures and licensing agreements have enabled local manufacturing capabilities while providing access to advanced technologies. Skills development programs and training initiatives have improved local technical capabilities and reduced dependency on foreign expertise.

Regulatory developments supporting renewable energy adoption and energy efficiency improvements have created favorable conditions for sustainable data center power solutions. Government incentives and tax benefits for green technology investments have improved project economics and accelerated adoption of advanced power management systems.

Investment prioritization should focus on technologies that address South Africa’s specific power infrastructure challenges while providing scalability for future growth. Data center operators should consider hybrid power solutions that combine grid connectivity, renewable generation, and energy storage to achieve optimal reliability and cost performance. Risk mitigation strategies must account for power grid instabilities and incorporate appropriate backup power capabilities.

Partnership strategies with local companies can provide market access, regulatory expertise, and cost advantages while supporting sustainable market development. International vendors should consider establishing local assembly or manufacturing capabilities to reduce costs and improve service delivery. Skills development investments in training and certification programs will create competitive advantages and support long-term market growth.

Technology roadmap planning should anticipate future requirements for artificial intelligence, edge computing, and sustainability compliance. Early adoption of intelligent power management systems and renewable energy integration will provide competitive advantages as market requirements evolve. Standardization efforts can reduce complexity and improve interoperability across different vendor solutions.

Market entry strategies should consider regional expansion opportunities across sub-Saharan Africa, leveraging South African experience and infrastructure as a platform for continental growth. MWR analysis suggests that companies establishing strong positions in South Africa can capture significant market share in neighboring countries experiencing similar digital transformation trends.

Long-term market prospects for South Africa’s data center power sector remain highly positive, driven by continued digital transformation, increasing cloud adoption, and growing demand for data processing capabilities across Africa. The market is expected to experience sustained growth as enterprises modernize their IT infrastructure and international companies establish regional operations. Technology evolution will continue driving demand for more efficient, intelligent power management solutions.

Renewable energy integration will accelerate as costs continue declining and environmental regulations become more stringent. Solar power adoption in data centers is projected to reach 60% penetration within the next five years, supported by improving battery storage technologies and favorable regulatory frameworks. Grid independence through on-site renewable generation will become increasingly attractive for large-scale data center operations.

Edge computing expansion will create new market segments requiring specialized power solutions optimized for distributed deployments. The proliferation of Internet of Things applications, autonomous vehicles, and real-time analytics will drive demand for low-latency computing capabilities supported by reliable, efficient power infrastructure.

Regional market leadership will strengthen as South African companies leverage their experience to support data center development across sub-Saharan Africa. The country’s established supply chains, technical expertise, and regulatory frameworks position it to capture significant market share in the broader African data center power market, which is expected to experience robust double-digit growth over the forecast period.

The South Africa data center power market represents a dynamic, rapidly evolving sector with exceptional growth potential driven by digital transformation, international investment, and regional market leadership. Despite challenges related to power grid reliability and high capital requirements, the market benefits from strong fundamentals including strategic geographic positioning, established infrastructure, and government support for digital economy development.

Technology innovation in power management systems, renewable energy integration, and artificial intelligence applications will continue driving market evolution and creating opportunities for differentiation. The increasing focus on sustainability and energy efficiency aligns with global trends while addressing local environmental concerns and regulatory requirements.

Future success in this market will depend on the ability to address South Africa’s unique power infrastructure challenges while providing scalable, cost-effective solutions that support the country’s digital transformation objectives. Companies that invest in local partnerships, skills development, and technology innovation will be best positioned to capture the substantial opportunities presented by this growing market and its regional expansion potential across the African continent.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, which house computer systems and associated components. This includes power distribution, backup systems, and energy efficiency measures.

What are the key players in the South Africa Data Center Power Market?

Key players in the South Africa Data Center Power Market include companies like Schneider Electric, Eaton, and Vertiv, which provide power management solutions and infrastructure for data centers, among others.

What are the main drivers of the South Africa Data Center Power Market?

The main drivers of the South Africa Data Center Power Market include the increasing demand for cloud computing services, the growth of digital transformation initiatives, and the rising need for data storage and processing capabilities across various industries.

What challenges does the South Africa Data Center Power Market face?

Challenges in the South Africa Data Center Power Market include high energy costs, the need for reliable power supply, and regulatory compliance related to energy efficiency and sustainability standards.

What opportunities exist in the South Africa Data Center Power Market?

Opportunities in the South Africa Data Center Power Market include advancements in renewable energy integration, the development of energy-efficient technologies, and the expansion of data center facilities to meet growing demand.

What trends are shaping the South Africa Data Center Power Market?

Trends shaping the South Africa Data Center Power Market include the adoption of modular data center designs, increased focus on sustainability practices, and the implementation of advanced cooling technologies to enhance energy efficiency.

South Africa Data Center Power Market

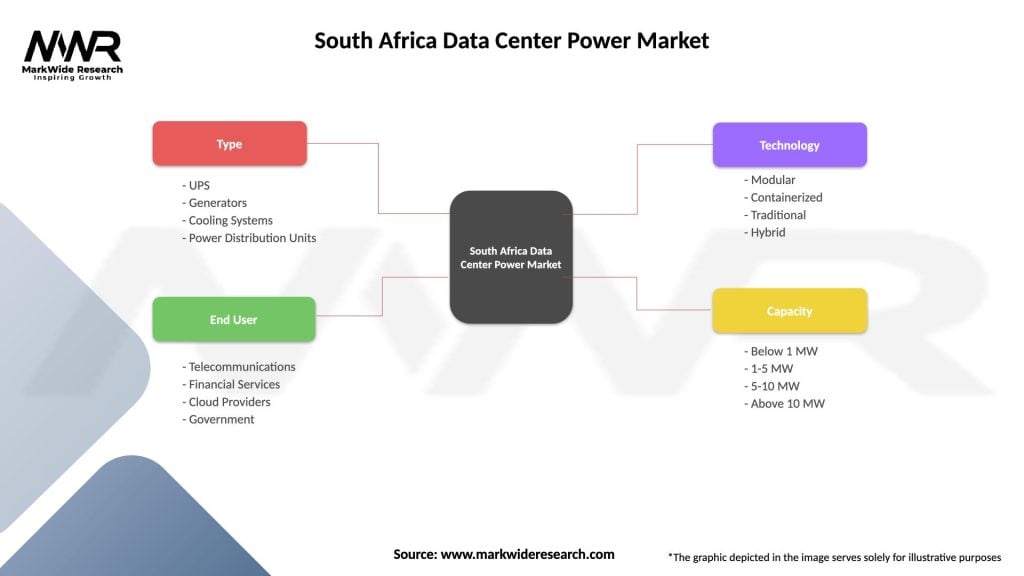

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Cooling Systems, Power Distribution Units |

| End User | Telecommunications, Financial Services, Cloud Providers, Government |

| Technology | Modular, Containerized, Traditional, Hybrid |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at