444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa data center market represents a rapidly expanding segment of the country’s digital infrastructure landscape, driven by increasing digitalization, cloud adoption, and growing demand for data storage solutions. South Africa has emerged as a strategic hub for data center operations across the African continent, benefiting from its advanced telecommunications infrastructure, stable political environment, and strategic geographic location. The market encompasses various types of data centers including enterprise data centers, colocation facilities, and cloud service provider facilities.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory is supported by increasing internet penetration rates, which have reached 68% of the population, and the government’s commitment to digital transformation initiatives. The market benefits from Cape Town and Johannesburg serving as primary data center hubs, with these metropolitan areas accounting for approximately 75% of total data center capacity in the country.

International investments have significantly contributed to market expansion, with global data center operators recognizing South Africa’s potential as a gateway to the broader African market. The presence of multiple submarine cable landing points along the South African coast has enhanced the country’s connectivity profile, making it an attractive destination for hyperscale data center deployments and regional data center operations.

The South Africa data center market refers to the comprehensive ecosystem of facilities, infrastructure, and services dedicated to housing, powering, cooling, and connecting computer servers and associated components for data processing, storage, and distribution across South Africa. This market encompasses various facility types ranging from small server rooms to large-scale hyperscale data centers, serving diverse customer segments including enterprises, government organizations, cloud service providers, and telecommunications companies.

Data centers in South Africa function as critical infrastructure supporting the country’s digital economy, providing essential services such as web hosting, cloud computing, disaster recovery, and business continuity solutions. These facilities are characterized by redundant power systems, advanced cooling technologies, robust security measures, and high-speed network connectivity to ensure 99.9% uptime reliability for mission-critical applications and services.

The market includes various service models including colocation services, where multiple organizations share data center space and infrastructure, managed hosting services providing comprehensive IT infrastructure management, and cloud services offering scalable computing resources on-demand. This diverse service portfolio addresses the varying needs of organizations across different industries and scales of operation.

South Africa’s data center market demonstrates exceptional growth momentum, positioning the country as the leading data center destination in Africa. The market’s expansion is fundamentally driven by accelerating digital transformation initiatives across both public and private sectors, with cloud adoption rates increasing by 12% annually among South African enterprises. This digital shift has created substantial demand for reliable, scalable data center infrastructure capable of supporting modern business operations.

Key market drivers include the proliferation of mobile devices, increasing internet usage, growing e-commerce activities, and the government’s commitment to establishing South Africa as a regional technology hub. The market benefits from significant infrastructure investments, with major international data center operators establishing operations in key metropolitan areas. Johannesburg and Cape Town continue to dominate the market landscape, collectively hosting approximately 80% of commercial data center capacity.

Technological advancement remains a critical factor shaping market evolution, with operators increasingly adopting energy-efficient technologies, advanced cooling systems, and automation solutions to optimize operational efficiency. The integration of artificial intelligence and machine learning technologies for predictive maintenance and resource optimization has become increasingly prevalent, contributing to improved service reliability and cost-effectiveness.

Market challenges include power supply reliability concerns, skilled workforce shortages, and regulatory compliance requirements. However, ongoing infrastructure development projects and government support for the ICT sector continue to create favorable conditions for sustained market growth and international investment attraction.

Strategic market insights reveal several critical trends shaping the South Africa data center landscape. The market demonstrates strong resilience and adaptability, with operators successfully navigating challenges while capitalizing on emerging opportunities in the digital economy.

Digital transformation acceleration serves as the primary driver of South Africa’s data center market growth. Organizations across various sectors are modernizing their IT infrastructure to support digital business models, creating substantial demand for reliable data center services. The COVID-19 pandemic has accelerated this transformation, with remote work adoption and digital service delivery becoming permanent features of the business landscape.

Cloud adoption momentum continues to drive market expansion, with South African enterprises increasingly migrating workloads to cloud platforms. This shift requires robust data center infrastructure to support Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings. The growing preference for hybrid cloud architectures is particularly driving demand for colocation services that enable seamless integration between on-premises and cloud resources.

Internet penetration growth represents another significant market driver, with mobile internet usage expanding rapidly across the country. The deployment of 5G networks is expected to further accelerate data consumption and create new requirements for low-latency data processing capabilities. This connectivity expansion is driving demand for both centralized and distributed data center infrastructure.

Government support initiatives play a crucial role in market development, with various policies and programs designed to promote ICT sector growth. The government’s commitment to establishing South Africa as a regional technology hub includes infrastructure development projects and regulatory frameworks that support data center investments. Additionally, data localization requirements in certain sectors are driving demand for domestic data center capacity.

Power supply challenges represent the most significant constraint facing South Africa’s data center market. The country’s electricity grid faces reliability issues, with load shedding events creating operational challenges for data center operators. These power interruptions necessitate substantial investments in backup power systems and alternative energy sources, increasing operational complexity and costs for data center facilities.

Skills shortage in the ICT sector poses another significant challenge, with limited availability of qualified professionals for data center design, construction, and operations. This shortage affects both the speed of market development and the operational efficiency of existing facilities. The specialized nature of data center operations requires specific technical expertise that is currently in limited supply within the local market.

Infrastructure limitations in secondary cities constrain market expansion beyond major metropolitan areas. While Johannesburg and Cape Town offer robust infrastructure support, other regions may lack the necessary power, connectivity, and support services required for large-scale data center operations. This geographic limitation affects the development of distributed data center networks and edge computing infrastructure.

Regulatory complexity can create challenges for international investors and operators seeking to establish data center operations in South Africa. Compliance with various regulations including Protection of Personal Information Act (POPIA) and sector-specific requirements requires careful navigation and ongoing monitoring. Additionally, foreign exchange controls and investment approval processes can impact the speed of international investment deployment.

Regional expansion potential presents significant opportunities for South Africa’s data center market, with the country positioned to serve as a hub for the broader African continent. The growing digital economy across Africa creates demand for reliable data center services, and South Africa’s advanced infrastructure makes it an ideal location for regional data center operations serving multiple African markets.

Edge computing deployment represents a substantial growth opportunity as organizations seek to reduce latency and improve application performance. The rollout of 5G networks and the increasing adoption of Internet of Things (IoT) applications create requirements for distributed computing infrastructure. This trend opens opportunities for data center operators to establish smaller facilities in secondary cities and industrial areas.

Renewable energy integration offers opportunities for sustainable data center development while addressing power supply challenges. The country’s abundant solar and wind resources provide potential for green data centers that can operate independently of the national grid during peak demand periods. This approach can differentiate operators in the market while addressing environmental concerns and operational cost optimization.

Government digitalization projects create substantial opportunities for data center service providers. The public sector’s digital transformation initiatives require secure, compliant data center infrastructure for hosting government applications and citizen services. These projects often involve long-term contracts and stable revenue streams, making them attractive opportunities for data center operators.

Competitive dynamics in South Africa’s data center market are characterized by a mix of local and international players, each bringing unique strengths and capabilities. International operators contribute advanced technologies, global expertise, and substantial capital investment, while local providers offer deep market knowledge, established customer relationships, and regulatory compliance expertise. This combination creates a dynamic competitive environment that drives innovation and service quality improvements.

Technology evolution significantly influences market dynamics, with operators continuously investing in advanced infrastructure to maintain competitive advantages. The adoption of software-defined infrastructure, artificial intelligence for operations optimization, and advanced cooling technologies represents key areas of technological advancement. These investments enable operators to improve power usage effectiveness (PUE) by up to 15% while enhancing service reliability and scalability.

Customer demand patterns are evolving toward more sophisticated service requirements, including hybrid cloud connectivity, disaster recovery services, and managed security solutions. This evolution drives operators to expand their service portfolios beyond basic colocation to comprehensive managed services that address complex customer requirements. The shift toward outcome-based pricing models is also changing traditional revenue structures in the market.

Investment flows into the market remain robust, with both domestic and international capital supporting expansion projects. Private equity and infrastructure funds are increasingly viewing data centers as attractive investment opportunities due to their stable cash flows and growth potential. This capital availability supports continued market expansion and technology upgrades across the sector.

Comprehensive market analysis for the South Africa data center market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data analysis, qualitative insights from industry stakeholders, and trend analysis to provide a complete market perspective.

Primary research activities include structured interviews with data center operators, enterprise customers, technology vendors, and industry experts. These interviews provide insights into market trends, customer requirements, competitive dynamics, and future growth prospects. Survey methodologies are employed to gather quantitative data on market sizing, customer preferences, and adoption patterns across different market segments.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and regulatory documents. This research provides historical market data, regulatory context, and competitive intelligence necessary for comprehensive market analysis. MarkWide Research utilizes proprietary databases and analytical tools to process and analyze large datasets for market trend identification and forecasting.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Market forecasting models incorporate various scenarios to account for potential market disruptions and changing economic conditions. The research methodology adheres to international standards for market research quality and reliability.

Gauteng Province dominates South Africa’s data center market, with Johannesburg serving as the primary hub for data center operations. The province accounts for approximately 60% of total data center capacity, benefiting from its status as the country’s economic center, excellent connectivity infrastructure, and concentration of enterprise customers. Major international and local data center operators have established significant operations in the region, creating a competitive ecosystem that drives innovation and service quality improvements.

Western Cape, anchored by Cape Town, represents the second-largest data center market in South Africa, accounting for roughly 20% of national capacity. The region benefits from its role as a major submarine cable landing point, providing excellent international connectivity for data center operations. Cape Town’s stable power supply, skilled workforce availability, and favorable business environment make it an attractive location for both domestic and international data center investments.

KwaZulu-Natal is emerging as a growing data center market, with Durban serving as the primary development center. The province’s strategic location, port facilities, and growing industrial base create opportunities for data center development, particularly for operators seeking to serve the eastern regions of South Africa and neighboring countries. The region currently accounts for approximately 8% of national data center capacity but shows strong growth potential.

Secondary markets across other provinces are beginning to attract data center investments, driven by edge computing requirements and regional development initiatives. Cities such as Port Elizabeth, Bloemfontein, and Polokwane are seeing increased interest from operators looking to establish distributed infrastructure networks. These markets collectively represent the remaining 12% of national capacity but offer significant expansion opportunities as digital adoption spreads across the country.

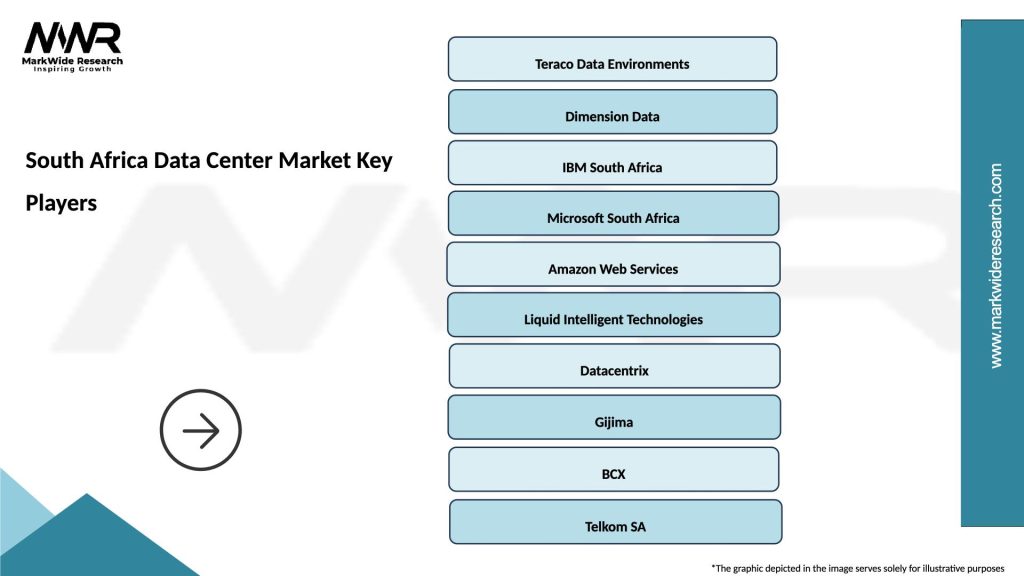

Market leadership in South Africa’s data center sector is shared among several key players, each contributing unique capabilities and serving different market segments. The competitive landscape combines international operators with strong global expertise and local providers with deep market knowledge and established customer relationships.

Competitive strategies focus on service differentiation, geographic expansion, and technology innovation. Operators are investing in renewable energy solutions, edge computing capabilities, and managed services portfolios to differentiate their offerings and capture market share in high-growth segments.

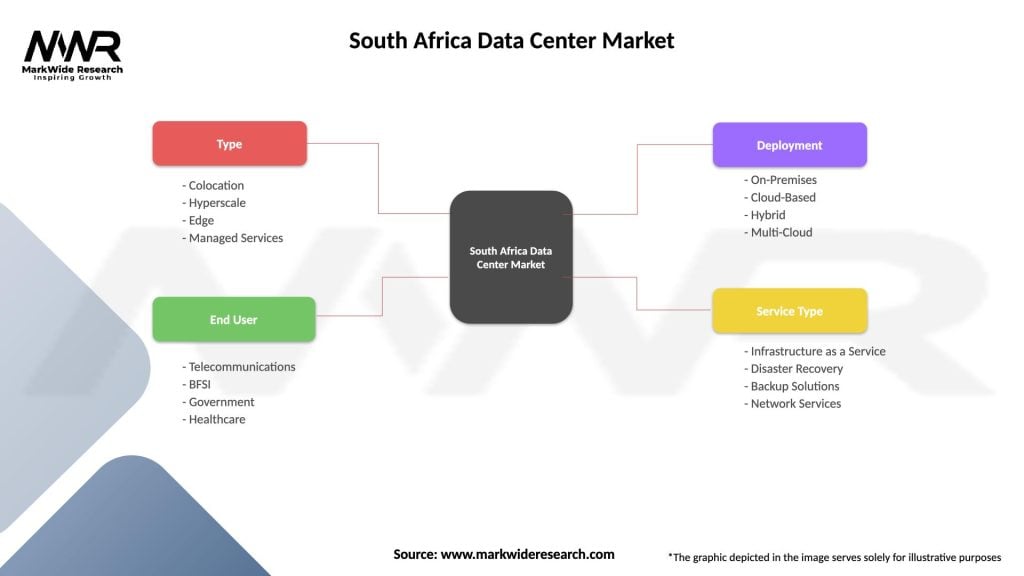

By Service Type: The South Africa data center market segments into several distinct service categories, each addressing specific customer requirements and use cases. Colocation services represent the largest segment, providing shared infrastructure for multiple customers seeking cost-effective data center solutions. Managed hosting services offer comprehensive IT infrastructure management, while cloud services provide scalable computing resources on-demand.

By Organization Size: Market segmentation by customer size reveals distinct patterns in service adoption and requirements. Large enterprises typically require dedicated infrastructure and comprehensive managed services, while small and medium enterprises (SMEs) often prefer shared colocation services and cloud-based solutions. Government organizations represent a specialized segment with specific security and compliance requirements.

By Industry Vertical: Different industries demonstrate varying data center requirements and adoption patterns. Financial services organizations require high-security, low-latency infrastructure for trading and banking applications. Healthcare providers need compliant infrastructure for patient data management. Manufacturing companies increasingly require edge computing capabilities for industrial IoT applications.

By Deployment Model: The market segments into various deployment approaches including traditional data centers, modular data centers, and edge computing facilities. Each model addresses specific requirements for scalability, deployment speed, and geographic distribution of computing resources.

Enterprise Data Centers continue to represent a significant portion of the market, with large organizations maintaining dedicated facilities for mission-critical applications. These facilities typically feature redundant infrastructure, advanced security measures, and direct connectivity to cloud service providers. Enterprise adoption of hybrid cloud strategies is driving demand for colocation services that enable seamless integration between on-premises and cloud resources.

Colocation Services demonstrate the strongest growth trajectory, driven by organizations seeking to outsource data center infrastructure while maintaining control over their IT equipment. This segment benefits from economies of scale, shared infrastructure costs, and access to carrier-neutral connectivity options. Colocation adoption rates have increased by 18% annually among South African enterprises seeking cost-effective data center solutions.

Cloud Data Centers are experiencing rapid expansion as hyperscale cloud providers establish regional presence in South Africa. These facilities support Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings for both domestic and regional customers. The segment benefits from increasing cloud adoption rates and the need for local data residency compliance.

Edge Computing Facilities represent an emerging category driven by requirements for low-latency computing and real-time data processing. These smaller, distributed facilities support Internet of Things (IoT) applications, autonomous vehicles, and augmented reality services. The segment is expected to grow significantly as 5G networks enable new applications requiring edge computing capabilities.

Data Center Operators benefit from strong market demand, stable revenue streams, and opportunities for geographic expansion across the African continent. The market offers attractive returns on investment due to growing digitalization trends and limited competition in certain segments. Operators can leverage South Africa’s strategic position to serve regional markets while benefiting from advanced local infrastructure and skilled workforce availability.

Enterprise Customers gain access to world-class data center infrastructure without the capital investment and operational complexity of building and managing their own facilities. Benefits include improved service reliability, enhanced security measures, and access to advanced technologies that would be cost-prohibitive for individual organizations. Cost savings of up to 30% compared to self-managed infrastructure represent a significant advantage for enterprise customers.

Cloud Service Providers benefit from established data center infrastructure that enables rapid market entry and service deployment. Access to carrier-neutral facilities provides connectivity options to multiple network providers, enhancing service quality and redundancy. The availability of compliant infrastructure supports cloud providers in meeting regulatory requirements and customer expectations for data security and privacy.

Government Organizations can leverage private sector data center investments to support digital transformation initiatives without substantial public infrastructure investments. Access to secure, compliant data center services enables government agencies to modernize citizen services while maintaining data sovereignty and security requirements. This approach allows for faster deployment of digital services and improved cost-effectiveness in government IT operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus has emerged as a dominant trend in South Africa’s data center market, with operators increasingly adopting renewable energy sources and energy-efficient technologies. This trend is driven by both environmental concerns and the need to address power supply challenges through alternative energy solutions. Data center operators are investing in solar power systems, battery storage, and advanced cooling technologies to reduce their environmental impact and operational costs.

Edge Computing Adoption is accelerating across various industries, driving demand for distributed data center infrastructure. The deployment of 5G networks and increasing adoption of Internet of Things (IoT) applications require low-latency computing capabilities that traditional centralized data centers cannot provide. This trend is creating opportunities for smaller, distributed facilities in secondary cities and industrial areas.

Hybrid Cloud Integration represents a significant trend as organizations adopt multi-cloud strategies that combine on-premises infrastructure with public cloud services. This approach requires data center facilities that provide seamless connectivity to multiple cloud providers while maintaining security and performance standards. Hybrid cloud adoption has increased by 22% among South African enterprises over the past two years.

Automation and AI Implementation is transforming data center operations through predictive maintenance, resource optimization, and automated management systems. These technologies enable operators to improve efficiency, reduce operational costs, and enhance service reliability. The integration of artificial intelligence for capacity planning and energy management is becoming standard practice among leading operators.

Major Infrastructure Investments continue to shape the South African data center landscape, with several significant expansion projects underway. Leading operators are investing in new facilities and capacity expansions to meet growing demand from both domestic and international customers. These investments include advanced cooling systems, renewable energy integration, and enhanced security measures that position South Africa as a premier data center destination.

Submarine Cable Developments are enhancing South Africa’s connectivity profile, with new cable systems providing additional international bandwidth and redundancy. Recent cable landings have improved connectivity to Europe, Asia, and other African countries, making South African data centers more attractive for regional and international customers. These developments support the country’s position as a connectivity hub for the African continent.

Regulatory Framework Evolution includes the implementation of the Protection of Personal Information Act (POPIA) and other data protection regulations that impact data center operations. These regulatory developments are driving demand for compliant data center infrastructure and services while creating opportunities for operators that can demonstrate regulatory compliance capabilities.

Technology Partnerships between local and international companies are accelerating innovation and knowledge transfer in the South African data center market. These partnerships enable local operators to access advanced technologies and global best practices while providing international companies with local market expertise and regulatory compliance support.

Infrastructure Resilience should be a primary focus for data center operators, particularly regarding power supply reliability and backup systems. MWR analysis suggests that operators investing in comprehensive backup power solutions and alternative energy sources will gain competitive advantages and customer confidence. The integration of renewable energy systems with battery storage can provide both operational cost benefits and marketing advantages in an increasingly sustainability-conscious market.

Geographic Diversification presents opportunities for market expansion beyond traditional metropolitan centers. Operators should consider establishing edge computing facilities in secondary cities to capture emerging demand for distributed computing services. This strategy can provide first-mover advantages in underserved markets while supporting the development of South Africa’s digital infrastructure across all regions.

Service Portfolio Expansion toward comprehensive managed services can differentiate operators in an increasingly competitive market. Customers are seeking partners that can provide end-to-end solutions rather than basic infrastructure services. Operators should invest in developing capabilities in cloud connectivity, cybersecurity, disaster recovery, and compliance management to capture higher-value customer relationships.

Skills Development Initiatives are essential for supporting sustainable market growth and operational excellence. Operators should invest in training programs and partnerships with educational institutions to develop the specialized workforce required for data center operations. This investment will support both individual company growth and the broader development of South Africa’s data center ecosystem.

Market growth prospects for South Africa’s data center sector remain highly positive, with continued expansion expected across all major segments. MarkWide Research projects sustained growth driven by accelerating digitalization, increasing cloud adoption, and South Africa’s emergence as a regional technology hub. The market is expected to benefit from ongoing infrastructure investments, regulatory support, and growing international recognition of South Africa’s data center capabilities.

Technology evolution will continue to shape market development, with edge computing, artificial intelligence, and 5G networks creating new requirements for data center infrastructure. Operators that successfully adapt to these technological changes while maintaining operational excellence will capture the greatest market opportunities. The integration of sustainable technologies will become increasingly important for competitive differentiation and regulatory compliance.

Regional expansion opportunities will drive market growth as South African operators leverage their expertise to serve broader African markets. The development of pan-African data center networks will create economies of scale and provide customers with comprehensive regional coverage. This expansion will position South Africa as the primary data center hub for the African continent.

Investment flows into the market are expected to remain robust, with both domestic and international capital supporting continued expansion. The stable regulatory environment, growing customer demand, and attractive investment returns will continue to attract private equity, infrastructure funds, and strategic investors to the South African data center market.

South Africa’s data center market represents one of the most dynamic and promising technology infrastructure sectors on the African continent. The market’s strong fundamentals, including advanced telecommunications infrastructure, strategic geographic position, and growing digital economy, provide a solid foundation for continued expansion and international investment attraction.

Market opportunities span multiple dimensions, from traditional enterprise colocation services to emerging edge computing applications and regional expansion initiatives. The successful operators will be those that can navigate challenges such as power supply reliability while capitalizing on trends including sustainability, automation, and hybrid cloud integration. The market’s evolution toward comprehensive managed services and technology-enabled solutions will create new revenue opportunities and competitive advantages.

Strategic positioning as Africa’s leading data center hub provides South Africa with significant advantages in capturing regional growth opportunities. The combination of established infrastructure, regulatory stability, and growing customer demand creates an attractive investment environment that will continue to draw both domestic and international capital. As digital transformation accelerates across Africa, South Africa’s data center market is well-positioned to serve as the foundation for the continent’s digital infrastructure development.

What is Data Center?

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It plays a crucial role in managing and storing data for various applications across industries.

What are the key players in the South Africa Data Center Market?

Key players in the South Africa Data Center Market include Teraco, NTT Ltd., and Dimension Data, among others. These companies provide a range of services including colocation, cloud services, and managed hosting.

What are the growth factors driving the South Africa Data Center Market?

The South Africa Data Center Market is driven by increasing demand for cloud services, the rise of big data analytics, and the growing need for data storage solutions. Additionally, the expansion of internet connectivity and digital transformation initiatives contribute to market growth.

What challenges does the South Africa Data Center Market face?

Challenges in the South Africa Data Center Market include high energy costs, regulatory compliance issues, and the need for skilled workforce. These factors can hinder the growth and efficiency of data center operations.

What opportunities exist in the South Africa Data Center Market?

Opportunities in the South Africa Data Center Market include the increasing adoption of edge computing, the expansion of renewable energy sources, and the growth of e-commerce. These trends present avenues for innovation and investment in data center infrastructure.

What trends are shaping the South Africa Data Center Market?

Trends in the South Africa Data Center Market include the rise of hybrid cloud solutions, advancements in cooling technologies, and a focus on sustainability. These trends are influencing how data centers are designed and operated to meet evolving customer needs.

South Africa Data Center Market

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Hyperscale, Edge, Managed Services |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Multi-Cloud |

| Service Type | Infrastructure as a Service, Disaster Recovery, Backup Solutions, Network Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Data Center Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at