444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa data center construction market represents a rapidly expanding sector within the country’s digital infrastructure landscape, driven by increasing digitalization, cloud adoption, and growing demand for data storage solutions. South Africa’s position as the economic hub of the African continent has positioned it as a strategic location for data center investments, with major metropolitan areas like Johannesburg, Cape Town, and Durban emerging as key construction hotspots. The market is experiencing robust growth with an estimated compound annual growth rate of 8.2% CAGR over the forecast period, reflecting the nation’s commitment to digital transformation.

Infrastructure development in South Africa’s data center sector is being fueled by several key factors, including the expansion of hyperscale cloud providers, increasing enterprise digitalization, and the growing need for edge computing solutions. The market encompasses various construction types, from greenfield developments to brownfield conversions, with hyperscale facilities representing approximately 45% of new construction projects. Major international players are establishing significant presence in the region, while local construction companies are developing specialized expertise in data center infrastructure.

Government initiatives supporting digital infrastructure development, combined with favorable regulatory frameworks and strategic geographic positioning, continue to attract substantial investment in data center construction. The market benefits from South Africa’s relatively stable power grid, skilled workforce, and established telecommunications infrastructure, making it an attractive destination for both regional and international data center operators seeking to serve the broader African market.

The South Africa data center construction market refers to the comprehensive ecosystem of planning, designing, building, and commissioning specialized facilities designed to house computer systems, servers, networking equipment, and associated infrastructure components. Data center construction encompasses the development of purpose-built facilities that provide controlled environments with redundant power supplies, cooling systems, fire suppression, and security measures necessary for reliable IT operations.

Construction activities in this market include both new facility development and the expansion or modernization of existing data centers. The scope covers everything from initial site preparation and foundation work to the installation of sophisticated mechanical, electrical, and plumbing systems specifically designed for high-density computing environments. Modern data center construction in South Africa increasingly focuses on energy efficiency, sustainability, and scalability to meet evolving technological demands.

Market participants include general contractors, specialized data center construction firms, mechanical and electrical contractors, technology integrators, and various suppliers of critical infrastructure components. The construction process requires deep expertise in power distribution, cooling technologies, fire suppression systems, and security infrastructure, making it a highly specialized segment within the broader construction industry.

South Africa’s data center construction market is experiencing unprecedented growth driven by digital transformation initiatives, cloud migration trends, and increasing data generation across various industries. The market has evolved from primarily serving local enterprises to becoming a regional hub for international cloud service providers and hyperscale operators seeking to establish presence in the African continent. Construction activity is concentrated in major urban centers, with Johannesburg leading in terms of both existing capacity and new development projects.

Key market drivers include the rapid adoption of cloud services, which accounts for approximately 62% of new data center demand, growing e-commerce activities, and increasing digitalization across government and private sectors. The market is characterized by a shift toward larger, more efficient facilities, with hyperscale data centers representing the fastest-growing segment. International investment continues to flow into the market, with global operators recognizing South Africa’s strategic importance as a gateway to the broader African market.

Technological advancement is reshaping construction practices, with increased focus on energy efficiency, renewable energy integration, and advanced cooling technologies. The market faces challenges including power supply reliability concerns and skilled labor shortages, but these are being addressed through innovative solutions and workforce development programs. Future growth prospects remain strong, supported by continued digital transformation and the expansion of edge computing requirements across the region.

Market dynamics in South Africa’s data center construction sector reveal several critical insights that shape the industry’s trajectory. The following key insights provide a comprehensive understanding of market conditions:

Digital transformation initiatives across South African enterprises serve as the primary catalyst for data center construction growth. Organizations are increasingly migrating from legacy IT infrastructure to modern, scalable data center solutions that support cloud computing, artificial intelligence, and big data analytics. Government digitalization programs are also contributing significantly to market demand, with public sector entities requiring secure, compliant data storage and processing facilities.

Cloud service adoption represents another fundamental driver, with South African businesses rapidly embracing hybrid and multi-cloud strategies. This trend necessitates the construction of facilities capable of supporting diverse cloud architectures and providing seamless connectivity to major cloud platforms. Hyperscale cloud providers are establishing regional presence to serve both South African and broader African markets, driving demand for large-scale construction projects.

Regulatory compliance requirements are increasingly driving data center construction, particularly in sectors such as financial services, healthcare, and telecommunications. The Protection of Personal Information Act (POPIA) and other data protection regulations require organizations to maintain greater control over data storage and processing, often necessitating local data center infrastructure. Economic growth in various sectors, including fintech, e-commerce, and digital media, continues to generate substantial data center capacity requirements.

Connectivity improvements and submarine cable investments are enhancing South Africa’s position as a regional digital hub, attracting international operators seeking to serve the broader African market. The expansion of fiber optic networks and 5G infrastructure deployment creates additional demand for edge computing facilities and distributed data center architectures throughout the country.

Power supply challenges represent the most significant constraint facing South Africa’s data center construction market. Ongoing electricity supply issues, including load shedding and grid instability, create substantial operational risks for data center operators. Construction projects must incorporate expensive backup power systems and alternative energy sources, significantly increasing capital expenditure requirements and extending project timelines.

Skilled labor shortages pose another critical challenge, particularly in specialized trades required for data center construction such as electrical systems, cooling infrastructure, and fire suppression installation. The highly technical nature of data center construction requires workers with specific certifications and experience, creating bottlenecks in project execution. Training programs and workforce development initiatives are being implemented but require time to address the skills gap effectively.

High construction costs associated with importing specialized equipment and materials impact project feasibility and return on investment calculations. Many critical data center components must be imported, subjecting projects to currency fluctuations, supply chain disruptions, and extended lead times. Local manufacturing capabilities for data center infrastructure components remain limited, perpetuating dependence on international suppliers.

Regulatory complexity and lengthy approval processes can delay project commencement and increase development costs. Environmental impact assessments, building permits, and utility connections often require extensive documentation and coordination with multiple government agencies. Land availability in prime locations with adequate power and connectivity infrastructure is becoming increasingly scarce, forcing developers to consider less optimal sites or invest in additional infrastructure development.

Renewable energy integration presents significant opportunities for data center construction companies to differentiate their offerings and address power supply challenges. The development of on-site solar installations, wind power integration, and energy storage systems can provide competitive advantages while supporting sustainability objectives. Green building certifications and energy-efficient designs are increasingly valued by operators seeking to reduce operational costs and environmental impact.

Edge computing expansion creates opportunities for smaller, distributed data center construction projects throughout South Africa. As applications require lower latency and local data processing capabilities, demand for edge facilities in secondary cities and rural areas is expected to grow substantially. Modular construction approaches can enable rapid deployment of edge facilities while maintaining cost effectiveness and standardized quality.

Regional expansion opportunities exist as South African construction companies develop expertise that can be exported to other African markets. The experience gained in addressing power challenges, implementing alternative energy solutions, and working within emerging market constraints provides valuable capabilities for expansion into neighboring countries. Cross-border partnerships and joint ventures can facilitate market entry and knowledge transfer.

Technology innovation in construction methods, materials, and systems presents opportunities for companies that invest in research and development. Advanced cooling technologies, prefabricated construction techniques, and smart building systems can provide competitive advantages and improve project outcomes. Digital construction tools including building information modeling (BIM) and project management platforms can enhance efficiency and reduce costs.

Supply and demand dynamics in South Africa’s data center construction market are characterized by strong demand growth outpacing construction capacity, creating favorable conditions for established contractors and new market entrants. Demand drivers include accelerating digital transformation, cloud adoption, and regulatory compliance requirements, while supply constraints stem from skilled labor shortages and power infrastructure limitations.

Competitive dynamics are evolving as international construction firms establish local presence to serve growing demand from global data center operators. Local contractors are forming strategic partnerships with international firms to access specialized expertise and technology, while developing internal capabilities through training and certification programs. Price competition is intensifying as market capacity expands, but specialized expertise and proven track records continue to command premium pricing.

Technology adoption is reshaping construction practices, with increased use of prefabricated components, modular construction techniques, and advanced project management systems. Sustainability requirements are driving innovation in energy-efficient design, renewable energy integration, and waste reduction practices. Construction companies that successfully integrate these technologies gain competitive advantages in terms of project speed, quality, and cost effectiveness.

Regulatory dynamics continue to evolve as government agencies develop specialized frameworks for data center construction and operation. Policy support for digital infrastructure development creates favorable conditions for market growth, while environmental regulations drive adoption of sustainable construction practices and renewable energy solutions.

Comprehensive market analysis for the South Africa data center construction market employs a multi-faceted research approach combining primary and secondary research methodologies. Primary research includes extensive interviews with key industry stakeholders, including data center operators, construction contractors, equipment suppliers, and regulatory officials. These interviews provide insights into market trends, challenges, opportunities, and future outlook from industry participants actively engaged in market activities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. Data triangulation methods ensure accuracy and reliability of market insights by cross-referencing information from multiple sources and identifying consistent themes and trends across different data points.

Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market understanding. Bottom-up analysis examines individual project data, construction activity levels, and capacity additions to build aggregate market perspectives. Top-down analysis considers macroeconomic factors, digital transformation trends, and infrastructure investment patterns to validate market size estimates and growth projections.

Qualitative analysis focuses on understanding market dynamics, competitive landscapes, and strategic considerations that influence construction decisions. Quantitative analysis examines construction volumes, investment levels, and performance metrics to establish statistical foundations for market insights and projections.

Johannesburg metropolitan area dominates South Africa’s data center construction market, accounting for the majority of new development activity and existing capacity. The region benefits from established telecommunications infrastructure, proximity to major enterprises, and relatively stable power supply compared to other areas. Gauteng province as a whole represents approximately 60% of total construction activity, reflecting its position as the country’s economic center.

Cape Town emerges as the second-largest market for data center construction, driven by its role as a landing point for international submarine cables and growing technology sector presence. The city’s relatively stable power supply and skilled workforce make it attractive for both local and international operators. Western Cape province accounts for roughly 25% of construction projects, with particular strength in edge computing and smaller enterprise facilities.

Durban and KwaZulu-Natal represent emerging opportunities for data center construction, supported by the region’s manufacturing base and port activities. The area’s lower land costs and developing infrastructure create opportunities for cost-effective facility development. Secondary cities including Bloemfontein, Port Elizabeth, and Pretoria are experiencing increased interest for edge computing facilities and regional data centers.

Rural and semi-urban areas present growing opportunities as edge computing requirements expand and connectivity infrastructure improves. These locations offer advantages in terms of land availability, lower costs, and reduced environmental impact, though they face challenges related to power supply reliability and skilled workforce availability.

Market leadership in South Africa’s data center construction sector is shared among several key players, including both international firms and local specialists. The competitive landscape is characterized by strategic partnerships, technology innovation, and specialization in different market segments.

Competitive strategies focus on developing specialized expertise, forming strategic partnerships with international firms, and investing in workforce development. Companies are differentiating through sustainability initiatives, innovative construction methods, and comprehensive project delivery capabilities.

By Construction Type:

By Facility Size:

By End-User Industry:

Hyperscale Construction represents the fastest-growing segment, driven by international cloud providers establishing regional presence. These projects require specialized expertise in large-scale power distribution, advanced cooling systems, and high-density server environments. Construction timelines for hyperscale facilities typically range from 18-24 months, with emphasis on modular design and phased deployment capabilities.

Enterprise Data Centers focus on customized solutions meeting specific organizational requirements. These projects often incorporate enhanced security features, specialized compliance capabilities, and integration with existing IT infrastructure. Design considerations include flexibility for future expansion, energy efficiency, and operational cost optimization.

Colocation Facilities require versatile construction approaches accommodating diverse customer requirements within shared infrastructure environments. Multi-tenant design considerations include flexible power distribution, scalable cooling systems, and comprehensive security segregation. These facilities often incorporate retail-ready spaces and customer amenity areas.

Edge Computing Construction emphasizes rapid deployment, standardized designs, and remote management capabilities. Modular construction approaches are particularly well-suited for edge facilities, enabling consistent quality and faster time-to-market. These projects often face unique challenges related to site selection, power availability, and local permitting processes.

Construction Companies benefit from the specialized nature of data center construction, which commands premium pricing and creates opportunities for long-term customer relationships. Expertise development in data center construction provides competitive advantages and enables expansion into related infrastructure sectors. The growing market creates opportunities for workforce development and technology innovation.

Data Center Operators gain access to purpose-built facilities designed to meet specific operational requirements while benefiting from local construction expertise and cost efficiencies. Partnership opportunities with experienced local contractors can reduce project risks and accelerate deployment timelines. Local construction capabilities support ongoing maintenance and expansion requirements.

Equipment Suppliers benefit from growing demand for specialized data center infrastructure components, including power systems, cooling equipment, and fire suppression systems. Local partnerships with construction companies can provide market access and support customer relationship development. The expanding market creates opportunities for local assembly and manufacturing operations.

Government Stakeholders benefit from increased infrastructure investment, job creation, and enhanced digital capabilities supporting economic development. Tax revenue generation from construction activities and ongoing operations provides economic benefits, while improved digital infrastructure supports broader economic competitiveness and innovation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration is becoming increasingly important in data center construction, with operators demanding energy-efficient designs, renewable energy integration, and green building certifications. Construction companies are investing in sustainable construction practices, including waste reduction, water conservation, and environmentally friendly materials. This trend is driven by both operational cost considerations and corporate sustainability commitments.

Modular Construction Adoption is accelerating as operators seek faster deployment times and improved quality control. Prefabricated components and standardized designs enable more predictable project outcomes and reduced construction timelines. This approach is particularly valuable for edge computing facilities and standardized colocation environments.

Advanced Cooling Technologies are being integrated into new construction projects to improve energy efficiency and support higher density computing environments. Liquid cooling systems, free cooling approaches, and innovative air management solutions are becoming standard features in modern data center construction. These technologies require specialized installation expertise and ongoing maintenance capabilities.

Edge Computing Infrastructure is driving demand for distributed data center construction throughout South Africa. Smaller facilities located closer to end users require different construction approaches and present unique challenges related to site selection, power availability, and remote management capabilities. This trend is creating opportunities for standardized, repeatable construction solutions.

Major international operators have announced significant construction projects in South Africa, including hyperscale facilities and regional data centers. These developments demonstrate continued confidence in the South African market and create opportunities for local construction companies to develop specialized expertise. Investment announcements from global cloud providers indicate sustained demand for construction services over the coming years.

Government infrastructure initiatives are supporting data center construction through improved power infrastructure, streamlined permitting processes, and investment incentives. Policy developments including data localization requirements and digital transformation programs are creating additional demand for local data center capacity and construction services.

Technology partnerships between international and local construction companies are facilitating knowledge transfer and capability development. These collaborations enable local firms to access specialized expertise while providing international partners with local market knowledge and relationships. Joint ventures and strategic alliances are becoming increasingly common in major project pursuits.

Workforce development programs are being established to address skills shortages in specialized data center construction trades. Training initiatives supported by industry associations, educational institutions, and government agencies are working to develop the technical expertise required for continued market growth. These programs focus on electrical systems, cooling technologies, and project management capabilities.

MarkWide Research analysis indicates that construction companies should prioritize development of specialized data center expertise through training programs, strategic partnerships, and technology investments. Competitive differentiation will increasingly depend on demonstrated capability in energy-efficient design, sustainable construction practices, and advanced cooling technologies. Companies that invest early in these capabilities will be well-positioned for future growth opportunities.

Power infrastructure challenges require innovative solutions including on-site renewable energy generation, energy storage systems, and advanced power management technologies. Construction companies should develop expertise in integrating these solutions into data center projects to provide comprehensive value propositions to operators. Sustainability credentials will become increasingly important in project selection processes.

Regional expansion opportunities exist for South African construction companies that develop strong data center capabilities. The experience gained in addressing local challenges provides valuable expertise for expansion into other African markets facing similar infrastructure constraints. Strategic partnerships with international operators can facilitate regional expansion and provide access to larger project opportunities.

Technology adoption in construction processes, including building information modeling, project management systems, and quality control technologies, will become essential for maintaining competitiveness. Digital construction tools can improve project outcomes, reduce costs, and enhance customer satisfaction. Investment in these capabilities should be prioritized to support long-term market success.

Market growth prospects for South Africa’s data center construction sector remain strong, supported by continued digital transformation, cloud adoption, and regional expansion of international operators. MarkWide Research projects sustained demand growth over the next five years, with particular strength in hyperscale and edge computing segments. The market is expected to benefit from improved power infrastructure, workforce development initiatives, and supportive government policies.

Technology evolution will continue to reshape construction requirements, with increasing emphasis on energy efficiency, sustainability, and advanced cooling technologies. Construction companies that successfully adapt to these changing requirements will capture greater market share and command premium pricing. The integration of renewable energy and energy storage systems will become standard practice in new construction projects.

Regional integration opportunities will expand as South Africa’s position as a digital hub for the African continent strengthens. Cross-border data center projects and regional connectivity initiatives will create additional construction opportunities for companies with appropriate expertise and capabilities. The development of submarine cable infrastructure and terrestrial fiber networks will support continued market expansion.

Workforce development will remain critical for market growth, with continued investment in training programs and certification initiatives required to address skills shortages. Industry collaboration between construction companies, educational institutions, and government agencies will be essential for developing the specialized expertise required for continued market success. The establishment of local training centers and apprenticeship programs will support long-term capability development.

South Africa’s data center construction market represents a dynamic and rapidly growing sector with significant opportunities for specialized construction companies, equipment suppliers, and related service providers. The market benefits from strong demand drivers including digital transformation, cloud adoption, and regional expansion of international operators, while facing challenges related to power infrastructure and skilled workforce availability. Strategic positioning as a regional digital hub creates substantial long-term growth potential, supported by improving infrastructure and supportive government policies.

Success in this market requires specialized expertise, strategic partnerships, and continued investment in technology and workforce development. Construction companies that develop comprehensive capabilities in energy-efficient design, sustainable construction practices, and advanced data center technologies will be well-positioned to capitalize on growth opportunities. Market evolution toward larger, more efficient facilities and distributed edge computing infrastructure will create diverse opportunities for companies with appropriate expertise and capabilities.

Future market development will be shaped by technology innovation, regulatory evolution, and regional integration initiatives. The continued expansion of digital infrastructure throughout Africa will create additional opportunities for South African construction companies with proven data center expertise. Long-term success will depend on the industry’s ability to address current challenges while positioning for future growth opportunities in this critical infrastructure sector.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These centers are crucial for managing data and supporting cloud services, IT infrastructure, and digital operations.

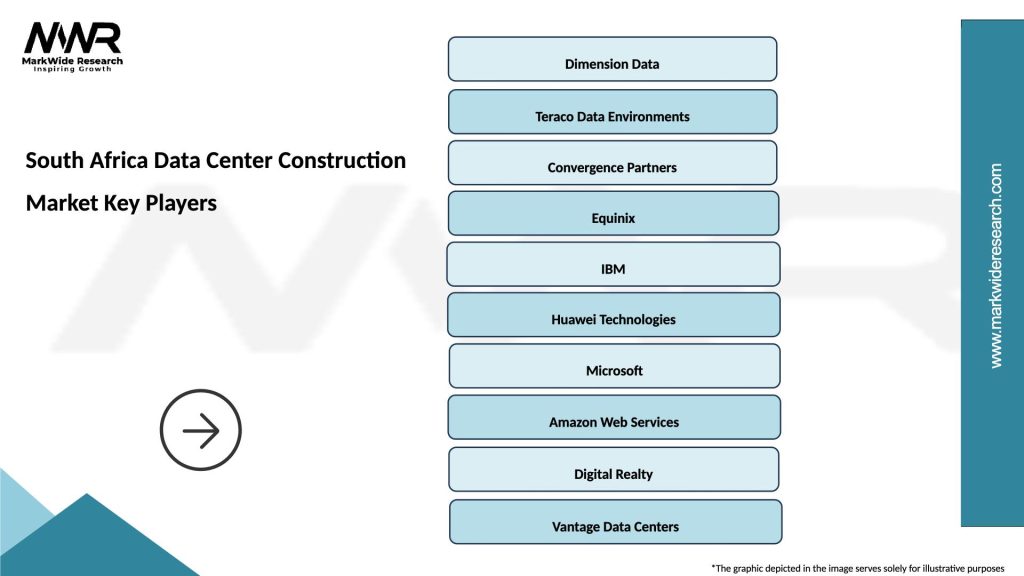

What are the key players in the South Africa Data Center Construction Market?

Key players in the South Africa Data Center Construction Market include companies like Teraco, Dimension Data, and NTT, which are involved in the design, construction, and operation of data centers. These companies focus on providing robust infrastructure to support growing data demands, among others.

What are the growth factors driving the South Africa Data Center Construction Market?

The South Africa Data Center Construction Market is driven by factors such as the increasing demand for cloud services, the rise of big data analytics, and the need for improved data security. Additionally, the expansion of internet connectivity and digital transformation initiatives contribute to market growth.

What challenges does the South Africa Data Center Construction Market face?

Challenges in the South Africa Data Center Construction Market include high construction costs, regulatory hurdles, and the need for sustainable energy solutions. Additionally, competition for skilled labor and the rapid pace of technological change can pose significant obstacles.

What opportunities exist in the South Africa Data Center Construction Market?

Opportunities in the South Africa Data Center Construction Market include the potential for investment in green data centers, the adoption of advanced cooling technologies, and the expansion of edge computing facilities. These trends can enhance operational efficiency and sustainability.

What trends are shaping the South Africa Data Center Construction Market?

Trends in the South Africa Data Center Construction Market include the increasing focus on energy efficiency, the integration of artificial intelligence for operational management, and the rise of modular data center designs. These innovations aim to improve performance and reduce environmental impact.

South Africa Data Center Construction Market

| Segmentation Details | Description |

|---|---|

| Type | Hyperscale, Colocation, Edge, Enterprise |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government |

| Capacity | Up to 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at