444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa automotive lubricant market represents a critical component of the nation’s automotive ecosystem, serving as the backbone for vehicle maintenance and performance optimization across diverse transportation sectors. Market dynamics indicate robust growth driven by expanding vehicle ownership, industrial development, and increasing awareness of preventive maintenance practices. The market encompasses engine oils, transmission fluids, brake fluids, gear oils, and specialty lubricants designed for passenger vehicles, commercial trucks, motorcycles, and industrial equipment.

Regional demand patterns reflect South Africa’s position as a major automotive hub in sub-Saharan Africa, with significant manufacturing capabilities and a growing consumer base. The market experiences steady expansion at approximately 6.2% CAGR, supported by urbanization trends, infrastructure development, and rising disposable incomes. Technological advancement in lubricant formulations continues to drive product innovation, with synthetic and semi-synthetic lubricants gaining substantial market traction among performance-conscious consumers.

Industry transformation encompasses the shift toward environmentally sustainable products, extended drain intervals, and enhanced fuel economy benefits. The market serves diverse applications ranging from passenger car maintenance to heavy-duty commercial vehicle operations, mining equipment, and agricultural machinery. Distribution networks span automotive dealerships, independent service centers, retail outlets, and industrial supply channels, ensuring comprehensive market coverage across urban and rural regions.

The South Africa automotive lubricant market refers to the comprehensive ecosystem of lubricating products specifically designed for automotive applications within the South African territory, encompassing engine oils, transmission fluids, hydraulic fluids, and specialty lubricants used in passenger vehicles, commercial transportation, and industrial automotive equipment to reduce friction, prevent wear, and optimize mechanical performance.

Market scope includes conventional mineral oils, synthetic lubricants, semi-synthetic formulations, and bio-based alternatives distributed through various channels to serve automotive manufacturers, service providers, fleet operators, and individual consumers. The market encompasses both original equipment manufacturer specifications and aftermarket products designed to meet diverse performance requirements across different vehicle categories and operating conditions.

Product categories within this market include passenger car motor oils, heavy-duty diesel engine oils, automatic transmission fluids, manual transmission oils, differential oils, brake fluids, power steering fluids, and specialized lubricants for motorcycles, marine applications, and off-road vehicles. The market serves as a vital component supporting South Africa’s transportation infrastructure and automotive industry development.

Market performance demonstrates consistent growth momentum driven by expanding vehicle parc, increasing maintenance awareness, and technological advancement in lubricant formulations. The South African automotive lubricant sector benefits from strong domestic automotive manufacturing, growing commercial vehicle operations, and rising consumer preference for premium lubricant products. Key growth drivers include urbanization trends contributing to 78% urban vehicle concentration, infrastructure development projects, and expanding mining operations requiring specialized lubricants.

Competitive landscape features established international brands alongside emerging local manufacturers, creating dynamic market conditions that foster innovation and competitive pricing. The market experiences significant demand from passenger vehicle segment representing approximately 65% market share, while commercial vehicle applications contribute substantial volume growth. Technology trends emphasize synthetic lubricant adoption, extended service intervals, and environmentally compliant formulations meeting stringent emission standards.

Regional distribution concentrates in major metropolitan areas including Johannesburg, Cape Town, and Durban, while rural markets present growth opportunities through expanding distribution networks. The market benefits from South Africa’s strategic position as a regional automotive hub, supporting export opportunities to neighboring countries and contributing to broader sub-Saharan African market development.

Strategic market insights reveal fundamental trends shaping the South African automotive lubricant landscape, providing essential understanding for industry stakeholders and market participants:

Primary growth drivers propelling the South African automotive lubricant market encompass diverse economic, technological, and social factors creating sustained demand expansion. Vehicle ownership growth represents the fundamental driver, with increasing disposable incomes enabling broader access to personal transportation and commercial vehicle investments. The expanding middle class demonstrates growing preference for vehicle ownership, directly translating to increased lubricant consumption across passenger and commercial segments.

Industrial development across mining, manufacturing, and logistics sectors generates substantial demand for specialized lubricants supporting heavy machinery, commercial vehicles, and industrial equipment operations. South Africa’s position as a regional economic hub drives commercial transportation growth, requiring high-performance lubricants for long-haul trucking, delivery services, and freight operations. Infrastructure investment in transportation networks, ports, and industrial facilities creates additional demand for construction equipment and commercial vehicle lubricants.

Technological advancement in automotive engineering necessitates sophisticated lubricant formulations meeting stringent performance specifications, emission standards, and fuel economy requirements. The shift toward turbocharged engines, direct injection systems, and advanced transmission technologies demands premium lubricants with enhanced protection capabilities. Maintenance awareness among consumers and fleet operators drives adoption of preventive maintenance practices, increasing lubricant consumption frequency and quality preferences.

Market challenges present significant obstacles to growth momentum, requiring strategic approaches from industry participants to maintain competitive positioning. Economic volatility affects consumer spending patterns and commercial investment decisions, potentially reducing demand for premium lubricant products and extending service intervals. Currency fluctuations impact import costs for base oils and additives, creating pricing pressures that affect market accessibility and profitability margins.

Regulatory complexity surrounding environmental standards, product specifications, and import requirements creates compliance challenges for manufacturers and distributors. The need to meet multiple international standards while maintaining cost competitiveness presents ongoing operational difficulties. Infrastructure limitations in rural areas restrict distribution efficiency and market penetration, limiting growth potential in underserved regions with expanding vehicle populations.

Competitive pricing pressure from low-cost alternatives and counterfeit products undermines premium product positioning and brand value propositions. The presence of informal market channels and unregulated products creates unfair competition affecting legitimate market participants. Extended drain intervals promoted by advanced lubricant technology, while beneficial for consumers, reduce overall consumption volumes and frequency of purchases, impacting market growth rates.

Emerging opportunities present substantial potential for market expansion and strategic development across multiple dimensions of the South African automotive lubricant sector. Synthetic lubricant adoption offers significant growth potential as consumers increasingly recognize the benefits of extended service intervals, improved fuel economy, and enhanced engine protection. The transition from conventional to synthetic products represents a major opportunity for value-added product positioning and margin improvement.

Regional expansion into neighboring African markets leverages South Africa’s established manufacturing capabilities and distribution networks. The growing automotive markets in countries such as Botswana, Namibia, and Mozambique present export opportunities for South African lubricant manufacturers. E-commerce development creates new distribution channels reaching previously underserved market segments and enabling direct-to-consumer sales models.

Fleet management services integration offers opportunities to provide comprehensive maintenance solutions combining lubricant supply with monitoring, analysis, and optimization services. The growing commercial vehicle sector presents opportunities for specialized product development and service packages. Sustainability initiatives drive demand for bio-based lubricants and recycled products, creating market niches for environmentally conscious consumers and corporate fleet operators seeking to reduce environmental impact.

Dynamic market forces shape the competitive landscape and growth trajectory of the South African automotive lubricant market through complex interactions between supply and demand factors. Supply chain optimization becomes increasingly critical as manufacturers seek to balance cost efficiency with product quality and availability. The integration of local production capabilities with imported raw materials creates opportunities for cost reduction while maintaining international quality standards.

Consumer behavior evolution reflects growing sophistication in lubricant selection, with increasing emphasis on performance benefits, environmental impact, and total cost of ownership. Fleet operators demonstrate growing adoption of condition-based maintenance programs, utilizing oil analysis and monitoring systems to optimize lubricant performance and replacement intervals. Digital transformation influences customer engagement through online platforms, mobile applications, and data-driven service offerings.

Competitive dynamics intensify as international brands compete with local manufacturers for market share across different price segments. The market experiences consolidation trends as smaller players seek partnerships or acquisition opportunities to achieve scale economies. Innovation cycles accelerate with continuous advancement in additive technology, base oil quality, and specialized formulations addressing specific application requirements and performance standards.

Comprehensive research approach employs multiple data collection and analysis methodologies to ensure accurate market assessment and reliable insights for stakeholders. Primary research encompasses structured interviews with industry executives, automotive service providers, fleet operators, and consumers to gather firsthand market intelligence and trend identification. Survey methodologies capture quantitative data regarding purchasing behavior, brand preferences, and market dynamics across different customer segments.

Secondary research utilizes industry publications, government statistics, trade association reports, and company financial statements to validate primary findings and provide comprehensive market context. Data triangulation ensures accuracy and reliability through cross-verification of information sources and analytical approaches. Market modeling incorporates statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts.

Expert consultation with industry specialists, technical experts, and regional market analysts provides additional validation and insight into market trends, competitive dynamics, and future opportunities. The research methodology ensures comprehensive coverage of market segments, geographic regions, and product categories while maintaining analytical rigor and objectivity in findings and conclusions.

Geographic distribution across South Africa reveals distinct regional patterns reflecting economic development, population density, and industrial activity concentration. Gauteng province dominates market consumption with approximately 42% regional market share, driven by Johannesburg and Pretoria metropolitan areas hosting significant automotive manufacturing, commercial transportation, and mining operations. The region benefits from high vehicle density, established distribution networks, and strong industrial demand for specialized lubricants.

Western Cape region represents the second-largest market segment with 23% market share, centered around Cape Town’s automotive manufacturing facilities, port operations, and growing commercial vehicle activity. The region demonstrates strong preference for premium lubricant products and environmental compliance, reflecting higher consumer awareness and regulatory enforcement. KwaZulu-Natal province contributes 18% market share through Durban’s industrial base, port facilities, and expanding logistics operations supporting regional trade activities.

Rural market development presents significant growth opportunities across provinces such as Limpopo, North West, and Eastern Cape, where expanding mining operations, agricultural mechanization, and improving transportation infrastructure drive lubricant demand. These regions experience growing vehicle ownership rates and increasing access to formal distribution channels. Regional distribution strategies focus on establishing service networks, dealer partnerships, and mobile service capabilities to reach underserved markets effectively.

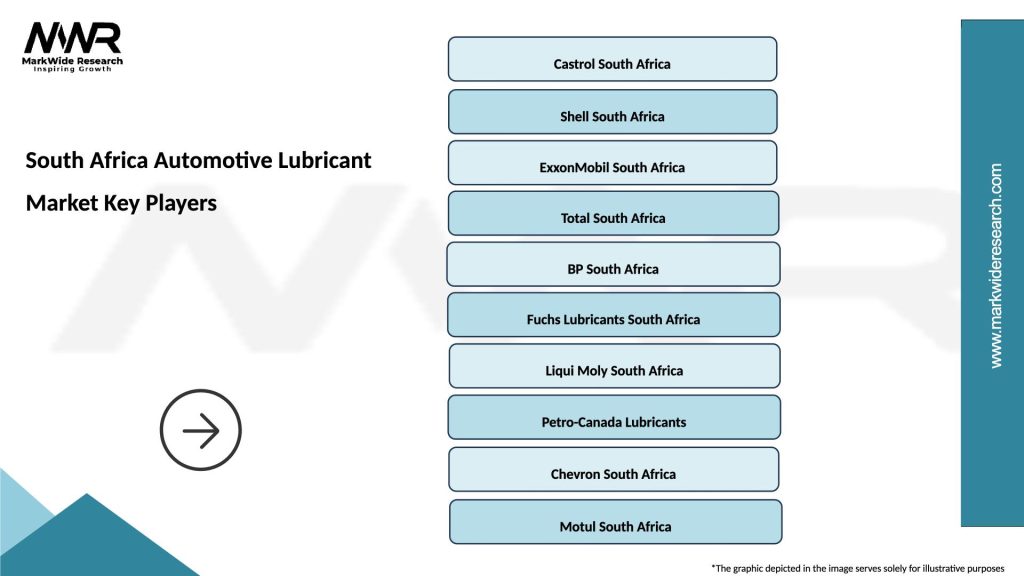

Market leadership encompasses established international brands and emerging local manufacturers competing across multiple product segments and price points. The competitive environment demonstrates dynamic positioning strategies, innovation focus, and distribution network development:

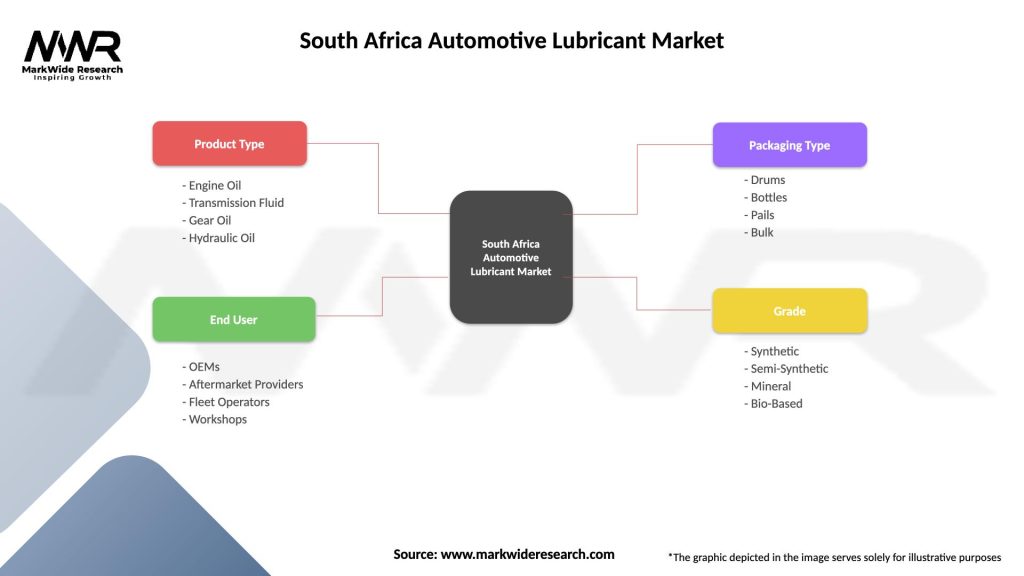

Market segmentation analysis reveals distinct categories based on product type, application, and distribution channels, enabling targeted strategies and market positioning approaches. Product-based segmentation encompasses engine oils representing the largest segment, transmission fluids, hydraulic oils, gear oils, and specialty lubricants for specific applications. Each segment demonstrates unique growth patterns, pricing dynamics, and competitive characteristics.

Application segmentation divides the market into passenger vehicles, light commercial vehicles, heavy-duty trucks, motorcycles, and industrial equipment categories. Passenger vehicle segment dominates volume consumption while commercial vehicle applications generate higher value per transaction. Technology segmentation distinguishes between conventional mineral oils, semi-synthetic blends, and full synthetic lubricants, with synthetic products showing the strongest growth momentum.

Distribution channel segmentation includes automotive dealerships, independent service centers, retail outlets, online platforms, and direct industrial sales. Each channel serves specific customer segments with varying service requirements, pricing expectations, and purchase behaviors. Geographic segmentation considers urban versus rural markets, provincial distribution, and proximity to industrial centers affecting product demand and distribution strategies.

Engine oil category represents the dominant market segment with diverse viscosity grades, performance specifications, and technology levels serving passenger and commercial vehicle applications. Passenger car motor oils demonstrate growing preference for synthetic and semi-synthetic formulations offering extended drain intervals and improved fuel economy. The segment benefits from increasing vehicle ownership and growing maintenance awareness among consumers seeking optimal engine protection.

Commercial vehicle lubricants encompass heavy-duty diesel engine oils, transmission fluids, and hydraulic oils designed for demanding operating conditions in trucking, mining, and construction applications. This category shows strong growth driven by expanding logistics operations and infrastructure development projects. Specialty lubricants include motorcycle oils, marine lubricants, and industrial applications requiring specific performance characteristics and regulatory compliance.

Transmission fluid category experiences growth through automatic transmission adoption in passenger vehicles and advanced transmission systems in commercial applications. Hydraulic fluid segment serves industrial equipment, construction machinery, and mobile hydraulic systems with specialized formulations meeting performance and environmental requirements. Each category demonstrates unique market dynamics, competitive positioning, and growth opportunities requiring tailored marketing and distribution strategies.

Manufacturers benefit from expanding market opportunities through product diversification, technology advancement, and regional market development. The growing demand for premium lubricants enables value-added positioning and improved profit margins while synthetic lubricant adoption creates differentiation opportunities. Local production capabilities provide cost advantages, supply chain control, and responsiveness to market demands while supporting export potential to regional markets.

Distributors and retailers gain from expanding customer base, diverse product portfolios, and service integration opportunities. The market growth supports network expansion, digital platform development, and value-added services enhancing customer relationships and revenue streams. Service providers benefit from increasing maintenance awareness, fleet management opportunities, and technical service demand requiring specialized expertise and equipment.

End users experience benefits through improved product availability, competitive pricing, and enhanced performance characteristics. Fleet operators gain from reduced maintenance costs, extended equipment life, and improved operational efficiency through advanced lubricant technology. Economic benefits include job creation in manufacturing, distribution, and service sectors while supporting broader automotive industry development and regional economic growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic lubricant adoption represents the most significant trend transforming the South African automotive lubricant market, with consumers increasingly recognizing the superior performance benefits, extended service intervals, and long-term cost advantages. This trend drives premium product positioning and enables manufacturers to differentiate their offerings while achieving improved profit margins. Technology advancement in synthetic base oils and additive packages continues to enhance product performance characteristics.

Digital transformation reshapes customer engagement and distribution strategies through e-commerce platforms, mobile applications, and digital marketing initiatives. Online retail channels provide convenient access to lubricant products while enabling direct-to-consumer relationships and data-driven marketing approaches. Fleet management integration combines lubricant supply with comprehensive maintenance services, oil analysis, and condition monitoring systems.

Environmental sustainability influences product development and consumer preferences, driving demand for bio-based lubricants, recycled products, and environmentally compliant formulations. The trend toward circular economy principles creates opportunities for used oil collection and reprocessing programs. Service integration trends emphasize comprehensive maintenance solutions combining product supply with technical support, training, and equipment services to enhance customer value propositions.

Manufacturing expansion initiatives by major lubricant companies demonstrate confidence in market growth potential and commitment to local production capabilities. Recent facility upgrades and capacity expansions enable improved product quality, cost efficiency, and market responsiveness. Technology partnerships between international lubricant manufacturers and local distributors create synergies combining global expertise with regional market knowledge.

Product innovation focuses on developing specialized formulations for South African operating conditions, including extreme temperatures, dusty environments, and diverse fuel qualities. Advanced additive technology enables extended drain intervals, improved fuel economy, and enhanced engine protection. Distribution network expansion includes new retail partnerships, service center affiliations, and mobile service capabilities reaching previously underserved markets.

Sustainability initiatives encompass used oil collection programs, packaging reduction efforts, and development of bio-based lubricant alternatives. Digital platform development includes customer portals, mobile applications, and e-commerce capabilities enhancing customer experience and operational efficiency. According to MarkWide Research analysis, these developments position the market for sustained growth and competitive advancement.

Strategic recommendations for market participants emphasize the importance of synthetic lubricant portfolio development to capture growing premium segment demand and achieve differentiated positioning. Companies should invest in technology advancement, product innovation, and performance testing capabilities to meet evolving customer requirements and regulatory standards. Distribution network optimization requires balanced approach combining traditional channels with digital platforms and direct-to-consumer capabilities.

Regional expansion strategies should leverage South Africa’s position as a regional hub to develop export opportunities in neighboring African markets. This approach requires understanding local market conditions, regulatory requirements, and distribution partnerships while maintaining quality standards and brand positioning. Service integration opportunities enable value-added offerings combining lubricant supply with maintenance services, technical support, and fleet management solutions.

Sustainability positioning becomes increasingly important as environmental awareness grows among consumers and corporate customers. Companies should develop eco-friendly product lines, implement circular economy practices, and communicate environmental benefits effectively. Digital transformation investments in e-commerce platforms, customer relationship management, and data analytics capabilities will enhance competitive positioning and customer engagement effectiveness.

Market trajectory indicates continued growth momentum driven by expanding vehicle ownership, industrial development, and increasing preference for premium lubricant products. The transition toward synthetic lubricants accelerates with projected adoption rates reaching 35% market penetration within the forecast period. Technology advancement continues to drive product innovation, performance improvement, and application-specific formulations meeting diverse customer requirements.

Regional market development presents significant opportunities as infrastructure investment, mining expansion, and commercial transportation growth create additional demand for specialized lubricants. The market benefits from South Africa’s strategic position supporting export potential to broader African markets experiencing economic development and automotive sector growth. MWR projections indicate sustained growth rates supported by favorable demographic trends and industrial expansion.

Industry evolution encompasses digital transformation, service integration, and sustainability initiatives reshaping competitive dynamics and customer relationships. The market experiences consolidation trends as companies seek scale economies and expanded capabilities through partnerships and acquisitions. Innovation cycles accelerate with continuous advancement in lubricant technology, additive development, and specialized applications addressing emerging automotive technologies and environmental requirements.

The South Africa automotive lubricant market demonstrates robust growth potential driven by expanding vehicle ownership, industrial development, and increasing preference for premium products. Market dynamics reflect the complex interplay between economic factors, technological advancement, and evolving consumer preferences creating opportunities for strategic positioning and competitive differentiation. The transition toward synthetic lubricants represents a fundamental shift enabling enhanced performance benefits and value-added positioning strategies.

Strategic success factors include technology innovation, distribution network optimization, and service integration capabilities that enhance customer value propositions and competitive positioning. Companies that effectively balance product quality, cost efficiency, and market responsiveness will capture the greatest share of growth opportunities. The market’s regional significance as an automotive hub creates additional potential for export development and broader African market participation.

Future market development will be shaped by digital transformation, sustainability initiatives, and continued technology advancement in lubricant formulations. Industry participants must adapt to evolving customer requirements, regulatory standards, and competitive dynamics while maintaining focus on operational excellence and strategic positioning. The South Africa automotive lubricant market presents compelling opportunities for sustained growth and value creation across the automotive ecosystem.

What is Automotive Lubricant?

Automotive lubricant refers to substances used to reduce friction between surfaces in automotive engines and machinery, enhancing performance and longevity. These lubricants include engine oils, transmission fluids, and greases, which are essential for the smooth operation of vehicles.

What are the key players in the South Africa Automotive Lubricant Market?

Key players in the South Africa Automotive Lubricant Market include companies like Castrol, TotalEnergies, and Sasol, which provide a range of automotive lubricants for various applications. These companies focus on innovation and quality to meet the demands of the automotive sector, among others.

What are the growth factors driving the South Africa Automotive Lubricant Market?

The growth of the South Africa Automotive Lubricant Market is driven by increasing vehicle production and sales, rising awareness of vehicle maintenance, and advancements in lubricant technology. Additionally, the growing trend towards synthetic lubricants is contributing to market expansion.

What challenges does the South Africa Automotive Lubricant Market face?

The South Africa Automotive Lubricant Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and the availability of certain lubricant types, affecting overall market dynamics.

What opportunities exist in the South Africa Automotive Lubricant Market?

Opportunities in the South Africa Automotive Lubricant Market include the increasing demand for eco-friendly lubricants and the expansion of electric vehicles, which require specialized lubricants. Additionally, the growth of the automotive aftermarket presents further avenues for market players.

What trends are shaping the South Africa Automotive Lubricant Market?

Trends shaping the South Africa Automotive Lubricant Market include the shift towards synthetic and bio-based lubricants, as well as the integration of advanced additives for improved performance. Furthermore, the rise of digital technologies in lubricant formulation and distribution is influencing market strategies.

South Africa Automotive Lubricant Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Gear Oil, Hydraulic Oil |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Workshops |

| Packaging Type | Drums, Bottles, Pails, Bulk |

| Grade | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Automotive Lubricant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at