444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Africa agriculture market represents a cornerstone of the nation’s economy, contributing significantly to employment, food security, and export revenues. Agricultural activities span diverse sectors including crop production, livestock farming, and agribusiness operations across the country’s varied climatic zones. The market encompasses both commercial and subsistence farming, with commercial agriculture dominating export-oriented production while smallholder farming remains crucial for rural livelihoods.

Market dynamics indicate robust growth potential driven by technological adoption, sustainable farming practices, and increasing demand for agricultural products both domestically and internationally. The sector benefits from favorable climatic conditions in certain regions, advanced irrigation systems, and well-established supply chains. Recent developments show the market experiencing a compound annual growth rate of 4.2%, reflecting steady expansion despite challenges such as climate variability and land reform initiatives.

Key agricultural commodities include maize, wheat, sugarcane, citrus fruits, wine grapes, and various horticultural products. The livestock sector encompasses cattle, sheep, poultry, and dairy operations, contributing substantially to both domestic consumption and export markets. Geographic distribution varies significantly, with the Western Cape leading in fruit and wine production, KwaZulu-Natal dominating sugarcane cultivation, and the Free State serving as the primary grain-producing region.

The South Africa agriculture market refers to the comprehensive ecosystem of agricultural production, processing, distribution, and trade activities within the Republic of South Africa. This market encompasses all forms of crop cultivation, livestock farming, aquaculture, forestry, and related agribusiness operations that contribute to food production, raw material supply, and economic development across the nation’s nine provinces.

Agricultural market scope extends beyond primary production to include value-added processing, agricultural technology services, farm equipment supply, fertilizer and seed distribution, and agricultural finance. The market operates within a complex framework of commercial farming enterprises, smallholder operations, cooperative structures, and government support programs designed to enhance productivity and sustainability.

Market participants range from large-scale commercial producers and multinational agribusiness corporations to small-scale farmers and emerging agricultural entrepreneurs. The sector integrates traditional farming methods with modern agricultural technologies, creating a diverse landscape of production systems adapted to local conditions and market demands.

South Africa’s agricultural sector demonstrates remarkable resilience and adaptability, maintaining its position as a critical economic driver despite facing numerous challenges. The market exhibits strong fundamentals with agricultural exports accounting for approximately 8.5% of total national exports, highlighting the sector’s importance in foreign exchange earnings and trade balance maintenance.

Technological transformation emerges as a defining characteristic, with precision agriculture, drone technology, and digital farming solutions gaining traction among progressive farmers. The adoption of sustainable farming practices accelerates as environmental consciousness and regulatory requirements drive innovation in resource management and conservation techniques.

Market consolidation trends indicate increasing integration between production, processing, and distribution segments, creating more efficient value chains and improved market access for farmers. Government initiatives supporting land redistribution and emerging farmer development programs contribute to market restructuring while addressing historical inequalities in land ownership and agricultural participation.

Export performance remains robust, with South African agricultural products maintaining strong positions in international markets, particularly in citrus fruits, wine, and processed food products. Domestic market demand continues growing, driven by population expansion, urbanization, and rising consumer purchasing power across various income segments.

Agricultural productivity demonstrates significant regional variations, with commercial farming areas achieving yields comparable to international standards while smallholder sectors present substantial improvement opportunities. The market benefits from advanced research institutions and agricultural universities that contribute to innovation and knowledge transfer throughout the sector.

Population growth serves as a fundamental driver, creating sustained demand for agricultural products and food security solutions. South Africa’s growing population, combined with urbanization trends, generates increasing consumption requirements that stimulate agricultural production and market expansion across multiple commodity segments.

Export opportunities continue expanding as South African agricultural products gain recognition for quality and reliability in international markets. The country’s strategic location provides advantageous access to both African and global markets, while trade agreements and preferential market access arrangements facilitate export growth and revenue generation.

Technological advancement accelerates adoption of modern farming techniques, precision agriculture systems, and digital solutions that enhance productivity and operational efficiency. Innovation in agricultural machinery, biotechnology applications, and data-driven farming practices contribute to yield improvements and cost optimization across various agricultural enterprises.

Government support programs provide crucial backing through subsidies, research funding, infrastructure development, and policy frameworks that encourage agricultural investment and development. Land reform initiatives aim to increase participation in commercial agriculture while maintaining productive capacity and food security objectives.

Climate adaptation strategies drive investment in resilient agricultural systems, drought-resistant crop varieties, and sustainable farming practices that ensure long-term viability despite environmental challenges. Water resource management improvements and conservation technologies become increasingly important for maintaining agricultural productivity.

Climate variability presents ongoing challenges through irregular rainfall patterns, drought conditions, and extreme weather events that impact crop yields and livestock productivity. These environmental factors create uncertainty in production planning and require substantial investments in risk mitigation strategies and adaptive farming systems.

Land reform complexities generate uncertainty regarding property rights, investment security, and long-term planning capabilities for agricultural enterprises. The redistribution process sometimes results in temporary production disruptions and requires significant support systems to maintain agricultural productivity during transition periods.

Infrastructure limitations in rural areas constrain market access, increase transportation costs, and limit the adoption of modern agricultural technologies. Inadequate storage facilities, processing capacity, and logistics networks contribute to post-harvest losses and reduced profitability for farmers across various regions.

Skills shortages affect both technical agricultural expertise and business management capabilities, particularly among emerging farmers and in specialized agricultural sectors. Knowledge gaps in modern farming techniques, financial management, and market analysis limit productivity improvements and business sustainability.

Input cost inflation impacts profitability through rising prices for fertilizers, seeds, fuel, and agricultural equipment. Currency fluctuations affect both input costs and export revenues, creating additional financial pressures for agricultural enterprises operating in competitive markets.

Value-added processing presents significant opportunities for agricultural enterprises to capture higher margins through product transformation, packaging, and branding initiatives. Agro-processing development can create employment opportunities while reducing dependence on raw commodity exports and enhancing market positioning.

Organic agriculture emerges as a high-growth segment driven by consumer health consciousness and premium pricing opportunities in both domestic and export markets. Sustainable farming certifications enable access to specialized market segments and command price premiums that justify investment in environmentally responsible practices.

Technology adoption offers substantial productivity improvements through precision agriculture, automated systems, and data-driven decision making. Digital agriculture platforms can optimize resource utilization, reduce operational costs, and improve crop management effectiveness across various farming operations.

Regional market integration within Africa provides expanding opportunities for South African agricultural products and expertise. Continental trade agreements and regional economic partnerships facilitate market access and create platforms for agricultural investment and knowledge sharing initiatives.

Climate-smart agriculture development attracts international funding and support while addressing environmental challenges and sustainability requirements. Carbon credit opportunities and environmental service payments create additional revenue streams for farmers implementing conservation practices and sustainable land management systems.

Supply chain evolution reflects increasing integration between production, processing, and retail segments, creating more efficient market linkages and improved price transmission mechanisms. Vertical integration strategies enable better quality control, cost management, and market responsiveness across agricultural value chains.

Consumer preferences shift toward locally produced, sustainable, and traceable agricultural products, creating opportunities for farmers who can meet these evolving demands. Premium market segments reward quality, authenticity, and environmental responsibility with higher prices and loyal customer relationships.

International competitiveness requires continuous improvement in productivity, quality standards, and cost efficiency to maintain market positions against global competitors. Trade dynamics influence market access, pricing structures, and investment priorities across different agricultural sectors and geographic regions.

Policy environment shapes market conditions through regulations, support programs, and strategic initiatives that influence investment decisions and operational practices. Regulatory compliance requirements for food safety, environmental protection, and labor standards create both challenges and opportunities for market differentiation.

Financial market development improves access to credit, insurance, and investment capital for agricultural enterprises seeking to expand operations or adopt new technologies. Risk management tools become increasingly sophisticated, enabling better planning and financial stability for agricultural businesses.

Comprehensive data collection employs multiple sources including government statistics, industry associations, academic research institutions, and direct stakeholder engagement to ensure accuracy and completeness of market analysis. Primary research activities involve structured interviews with farmers, agribusiness executives, policy makers, and industry experts across different agricultural sectors and geographic regions.

Secondary research incorporates analysis of official agricultural statistics, trade data, policy documents, and academic publications to establish historical trends and market context. Data validation processes ensure consistency and reliability through cross-referencing multiple sources and expert verification of key findings and projections.

Market segmentation analysis examines different agricultural sectors, production systems, and geographic regions to identify specific trends, opportunities, and challenges affecting market dynamics. Quantitative analysis focuses on production volumes, yield trends, price movements, and trade flows to establish market patterns and growth trajectories.

Qualitative assessment captures stakeholder perspectives, policy implications, and emerging trends that influence market development and future prospects. Scenario analysis considers various factors including climate conditions, policy changes, and economic developments that could impact agricultural market performance and strategic planning requirements.

Western Cape province dominates fruit and wine production, accounting for approximately 65% of national fruit exports and maintaining strong positions in international markets. The region benefits from Mediterranean climate conditions, advanced irrigation infrastructure, and well-established export supply chains that support high-value agricultural production.

KwaZulu-Natal leads in sugarcane cultivation and subtropical fruit production, contributing significantly to both domestic consumption and export revenues. The province’s coastal location and favorable climate conditions support diverse agricultural activities including dairy farming, poultry production, and vegetable cultivation for urban markets.

Free State province serves as the primary grain production region, generating substantial portions of national maize and wheat output. The area’s extensive commercial farming operations utilize mechanized production systems and advanced agricultural technologies to achieve competitive yields and operational efficiency.

Gauteng province, despite limited agricultural land, plays a crucial role as a market hub and agribusiness center, hosting major food processing facilities, distribution networks, and agricultural service providers. The province’s urban markets create substantial demand for fresh produce and processed agricultural products.

Mpumalanga province contributes significantly to forestry, citrus production, and livestock farming, benefiting from diverse climatic conditions and established agricultural infrastructure. The region’s strategic location provides access to both domestic and export markets through efficient transportation networks.

Market structure encompasses a diverse range of participants from large-scale commercial enterprises to smallholder farmers, creating a complex competitive environment with varying capabilities, resources, and market strategies. Industry consolidation trends indicate increasing integration and strategic partnerships among major agricultural players.

Competitive strategies focus on operational efficiency, technology adoption, market diversification, and value chain integration to maintain profitability and market position. Innovation initiatives emphasize sustainable practices, product differentiation, and supply chain optimization to address evolving market demands and regulatory requirements.

By Product Type: The market segments into crop production, livestock farming, and mixed farming operations, each with distinct characteristics, requirements, and market dynamics. Crop production includes field crops, horticultural products, and specialty crops targeting different market segments and applications.

By Farm Size: Market segmentation reflects the dual agricultural economy with commercial farming operations and smallholder agriculture serving different market functions and requiring distinct support systems and development approaches.

By Technology Adoption: Segmentation based on mechanization levels, precision agriculture implementation, and digital technology utilization creates distinct market categories with varying productivity levels, input requirements, and market access capabilities.

Grain Production: Represents the largest agricultural category by volume, with maize cultivation dominating production across multiple provinces. Commercial grain farming achieves yields of approximately 5.2 tons per hectare on average, while smallholder operations typically produce lower yields due to resource constraints and technology limitations.

Fruit Production: Demonstrates strong export performance with citrus fruits, apples, and grapes generating substantial foreign exchange earnings. Quality standards and certification requirements drive continuous improvement in production practices and post-harvest handling systems to maintain international market access.

Livestock Sector: Contributes significantly to both domestic food security and export revenues through beef, poultry, and dairy products. Commercial livestock operations utilize advanced breeding programs, nutrition management, and health protocols to optimize productivity and product quality.

Vegetable Production: Serves primarily domestic markets with increasing focus on year-round production through protected cultivation and irrigation systems. Urban agriculture initiatives expand vegetable production closer to consumption centers, reducing transportation costs and improving freshness.

Wine Industry: Maintains international recognition for quality and diversity, with wine exports contributing substantially to agricultural export revenues. The sector emphasizes terroir expression, sustainable viticulture practices, and premium market positioning to compete effectively in global markets.

Economic Development: Agricultural activities generate employment opportunities across rural areas, supporting livelihoods and contributing to poverty reduction initiatives. Multiplier effects extend benefits to related industries including transportation, processing, and retail sectors that depend on agricultural production.

Food Security: Domestic agricultural production ensures reliable food supplies and reduces dependence on imports for essential commodities. Strategic food reserves and diversified production systems enhance national food security and price stability for consumers across different income levels.

Export Earnings: Agricultural exports generate foreign exchange revenues that support balance of payments and economic stability. Market diversification strategies reduce dependence on single markets while expanding opportunities for South African agricultural products globally.

Technology Transfer: Agricultural development facilitates knowledge sharing, innovation adoption, and capacity building that benefits the broader economy. Research collaboration between institutions, private sector, and international partners accelerates technological advancement and competitiveness improvements.

Environmental Services: Sustainable agricultural practices contribute to carbon sequestration, biodiversity conservation, and natural resource management. Ecosystem services provided by agricultural landscapes support environmental sustainability and climate change mitigation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Agriculture Revolution: Accelerating adoption of precision agriculture technologies, satellite monitoring, and data analytics platforms that optimize resource utilization and improve decision-making processes. Smart farming solutions integrate sensors, drones, and artificial intelligence to enhance productivity while reducing environmental impact.

Sustainable Farming Practices: Growing emphasis on conservation agriculture, organic production methods, and regenerative farming systems that balance productivity with environmental stewardship. Certification programs for sustainable agriculture gain traction as consumers and markets demand environmentally responsible products.

Value Chain Integration: Increasing vertical integration and strategic partnerships between producers, processors, and retailers to improve efficiency and market access. Contract farming arrangements provide stability for farmers while ensuring consistent supply for agribusiness operations.

Export Market Diversification: Expanding beyond traditional markets to explore opportunities in Asia, Middle East, and other African countries. Market development initiatives focus on building relationships and meeting specific requirements of emerging export destinations.

Youth Engagement: Growing interest among young entrepreneurs in agricultural ventures, supported by technology adoption and innovative business models. Agripreneurship programs encourage youth participation in agriculture through training, financing, and mentorship initiatives.

Technology Infrastructure: Major investments in agricultural technology platforms, including satellite-based monitoring systems and precision agriculture equipment, enhance productivity and sustainability across commercial farming operations. Digital transformation initiatives integrate farm management systems with market information and supply chain coordination.

Research Partnerships: Collaborative research programs between universities, government institutions, and private sector organizations accelerate innovation in crop varieties, farming techniques, and sustainable practices. International cooperation facilitates knowledge exchange and technology transfer from global agricultural leaders.

Infrastructure Development: Significant investments in rural infrastructure including irrigation systems, storage facilities, and transportation networks improve market access and reduce post-harvest losses. Logistics optimization projects enhance efficiency in agricultural supply chains and export operations.

Policy Reforms: Government initiatives to streamline regulations, improve land tenure security, and enhance support services for emerging farmers create more favorable conditions for agricultural investment and development. Regulatory modernization addresses food safety, environmental standards, and trade facilitation requirements.

Market Access Initiatives: Development of new export markets and trade agreements expand opportunities for South African agricultural products while reducing dependence on traditional markets. Trade promotion activities showcase product quality and build relationships with international buyers and distributors.

MarkWide Research analysis indicates that agricultural enterprises should prioritize technology adoption and sustainable practices to maintain competitiveness in evolving markets. Investment strategies should focus on water-efficient irrigation systems, precision agriculture tools, and renewable energy solutions that reduce operational costs while improving environmental performance.

Market positioning requires emphasis on quality, traceability, and sustainability credentials that differentiate South African products in competitive international markets. Brand development initiatives should highlight unique characteristics, production methods, and origin stories that resonate with conscious consumers and premium market segments.

Risk management strategies must address climate variability, market volatility, and policy uncertainty through diversification, insurance coverage, and flexible production systems. Financial planning should incorporate scenario analysis and contingency measures to maintain business continuity during challenging periods.

Collaboration opportunities exist in research partnerships, technology sharing, and market development initiatives that leverage collective resources and expertise. Industry associations and cooperative structures can facilitate knowledge transfer, bulk purchasing, and joint marketing efforts that benefit all participants.

Skills development investments in technical training, business management, and digital literacy are essential for maximizing productivity and profitability across agricultural enterprises. Capacity building programs should address both technical agricultural skills and business acumen required for successful market participation.

Growth projections indicate continued expansion of the South African agriculture market, driven by technology adoption, sustainable practices, and market diversification strategies. MWR forecasts suggest the sector will experience steady growth with a projected CAGR of 4.8% over the next five years, supported by improving productivity and expanding market opportunities.

Technology integration will accelerate across all agricultural sectors, with precision agriculture, automation, and digital platforms becoming standard practices rather than competitive advantages. Innovation adoption rates are expected to increase significantly as costs decrease and benefits become more apparent to farmers of all scales.

Sustainability requirements will intensify as environmental regulations strengthen and consumer preferences shift toward responsibly produced agricultural products. Carbon neutrality goals and biodiversity conservation requirements will drive investment in regenerative agriculture and ecosystem service programs.

Market integration within Africa will expand opportunities for South African agricultural products and expertise, with regional trade growth expected to reach 15% annually as continental trade agreements facilitate market access and reduce trade barriers.

Investment flows into agricultural technology, infrastructure, and processing facilities will increase as both domestic and international investors recognize the sector’s growth potential and strategic importance. Public-private partnerships will play crucial roles in financing major development initiatives and technology deployment programs.

The South Africa agriculture market demonstrates remarkable resilience and adaptability, positioning itself as a critical economic sector with substantial growth potential. Market fundamentals remain strong despite challenges, with technological advancement, sustainable practices, and market diversification driving continued development and competitiveness improvements.

Strategic opportunities abound in value-added processing, export market expansion, and technology adoption that can enhance productivity while addressing environmental and social objectives. Industry transformation toward more sustainable, efficient, and inclusive agricultural systems creates pathways for long-term growth and development that benefit all stakeholders.

Success factors include continued investment in research and development, infrastructure improvement, skills development, and policy support that creates enabling environments for agricultural innovation and growth. Collaborative approaches involving government, private sector, and civil society organizations will be essential for addressing complex challenges and maximizing market potential.

The future trajectory of South Africa’s agriculture market appears positive, with strong fundamentals, growing opportunities, and increasing recognition of the sector’s strategic importance for economic development, food security, and environmental sustainability. Continued evolution toward more productive, sustainable, and inclusive agricultural systems will ensure the market’s contribution to national prosperity and global food security objectives.

What is South Africa Agriculture?

South Africa Agriculture refers to the sector involved in the cultivation of crops, livestock farming, and related activities within the country. It plays a crucial role in the economy, providing food, employment, and raw materials for various industries.

What are the key companies in the South Africa Agriculture Market?

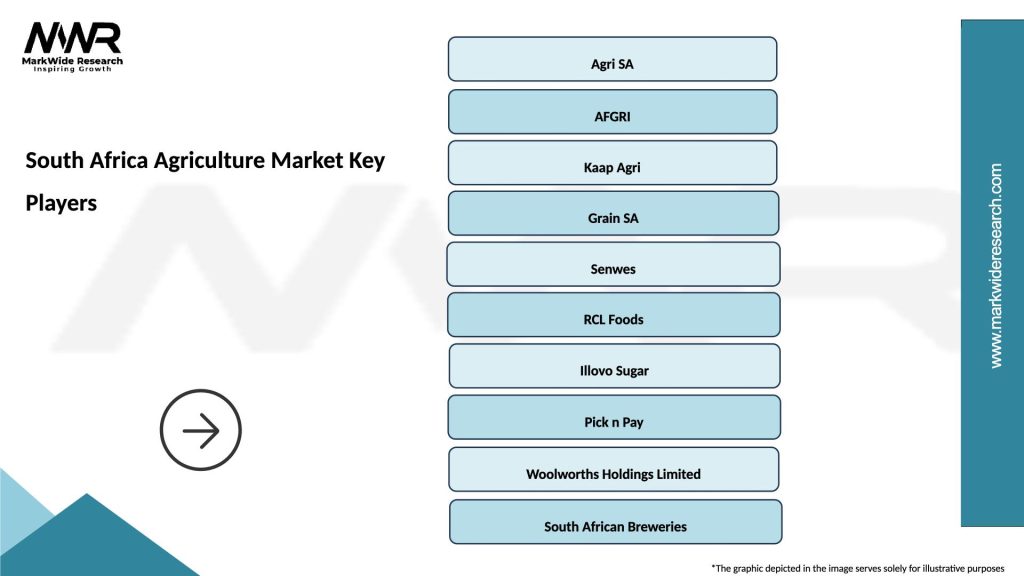

Key companies in the South Africa Agriculture Market include Afgri, Pioneer Foods, and Tongaat Hulett, which are involved in various agricultural activities such as crop production, food processing, and sugar manufacturing, among others.

What are the growth factors driving the South Africa Agriculture Market?

The South Africa Agriculture Market is driven by factors such as increasing food demand, advancements in agricultural technology, and government support for sustainable farming practices. Additionally, the rise in export opportunities for agricultural products contributes to market growth.

What challenges does the South Africa Agriculture Market face?

The South Africa Agriculture Market faces challenges such as climate change, water scarcity, and land reform issues. These factors can impact crop yields and overall agricultural productivity, posing risks to food security.

What opportunities exist in the South Africa Agriculture Market?

Opportunities in the South Africa Agriculture Market include the adoption of precision farming techniques, organic farming, and the development of agro-processing industries. These trends can enhance productivity and create value-added products for both local and international markets.

What trends are shaping the South Africa Agriculture Market?

Trends shaping the South Africa Agriculture Market include the increasing use of technology in farming, such as drones and data analytics, as well as a growing focus on sustainability and environmentally friendly practices. Additionally, there is a rising interest in local food production and supply chain transparency.

South Africa Agriculture Market

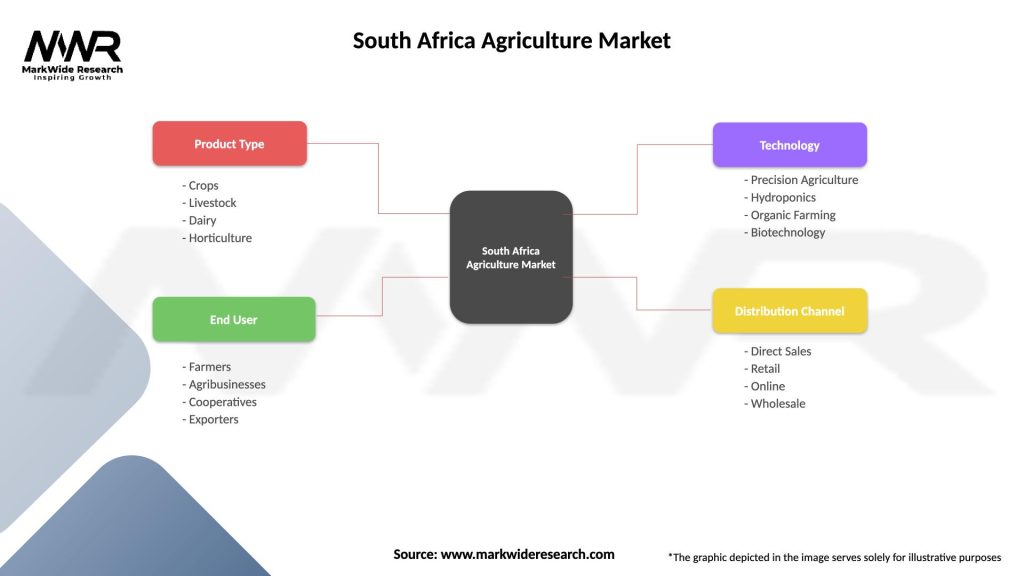

| Segmentation Details | Description |

|---|---|

| Product Type | Crops, Livestock, Dairy, Horticulture |

| End User | Farmers, Agribusinesses, Cooperatives, Exporters |

| Technology | Precision Agriculture, Hydroponics, Organic Farming, Biotechnology |

| Distribution Channel | Direct Sales, Retail, Online, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Africa Agriculture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at