444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South Africa aesthetic devices market refers to the industry involved in the manufacturing and distribution of devices used in aesthetic treatments and procedures. These devices encompass a wide range of technologies, including laser, radiofrequency, ultrasound, and others, designed to enhance and improve the appearance of individuals. The market in South Africa has witnessed significant growth in recent years, driven by various factors such as increasing consumer demand for aesthetic treatments, advancements in technology, and rising disposable income.

Meaning

Aesthetic devices are specialized tools and equipment used by healthcare professionals and aesthetic practitioners to perform non-invasive or minimally invasive procedures aimed at improving the aesthetics of the human body. These procedures can include skin rejuvenation, body contouring, hair removal, tattoo removal, and anti-aging treatments. The aesthetic devices market plays a crucial role in meeting the growing demand for these procedures in South Africa.

Executive Summary

The South Africa aesthetic devices market has experienced substantial growth in recent years, driven by the increasing popularity of aesthetic treatments among individuals seeking to enhance their appearance. The market is characterized by the presence of both international and domestic manufacturers, offering a wide range of technologically advanced devices to meet the diverse needs of consumers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

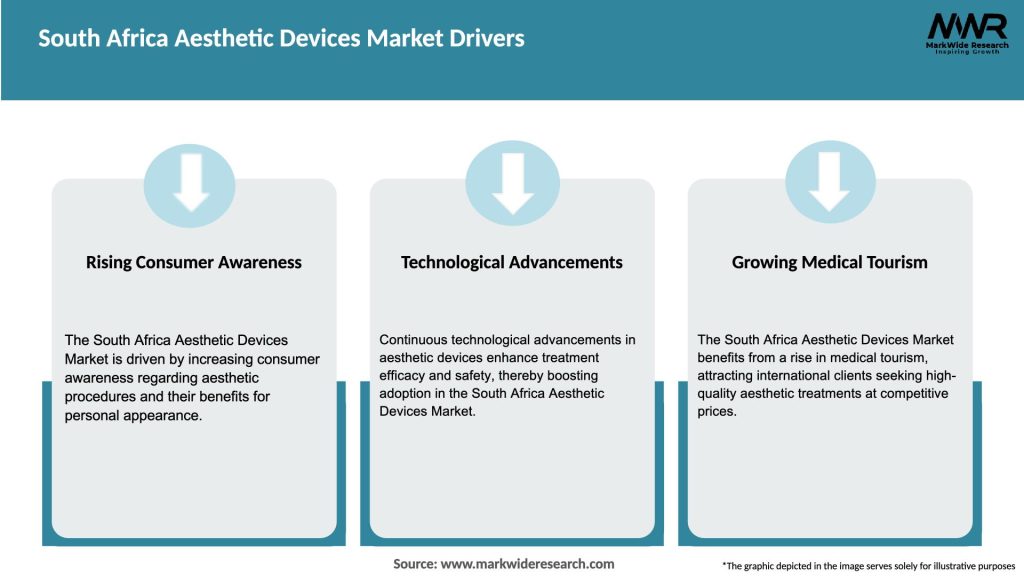

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The South Africa aesthetic devices market is characterized by intense competition among market players. Companies are constantly striving to introduce advanced technologies and innovative products to gain a competitive edge. Market dynamics are influenced by factors such as changing consumer preferences, technological advancements, and strategic collaborations between manufacturers and healthcare providers.

Regional Analysis

The South Africa aesthetic devices market is geographically segmented into major regions, including Gauteng, Western Cape, KwaZulu-Natal, Eastern Cape, and others. Gauteng holds the largest market share, primarily driven by the presence of major metropolitan areas and a high concentration of aesthetic clinics and facilities. The Western Cape and KwaZulu-Natal regions also contribute significantly to the market growth, owing to the presence of popular tourist destinations and the growing demand for aesthetic procedures.

Competitive Landscape

Leading Companies in the South Africa Aesthetic Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The South Africa aesthetic devices market can be segmented based on device type, technology, end-user, and geography. Device types include laser-based devices, radiofrequency devices, ultrasound devices, and others. Technology-based segmentation includes ablative and non-ablative technologies, while end-users comprise hospitals, clinics, medical spas, and beauty centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the South Africa aesthetic devices market. During the lockdown periods and restrictions on non-essential services, the market experienced a decline in demand. However, as the situation improved and restrictions eased, the market witnessed a gradual recovery. The pandemic highlighted the importance of safety measures and hygiene protocols in aesthetic clinics, leading to increased adoption of such practices.

Key Industry Developments

Analyst Suggestions

Future Outlook

The South Africa aesthetic devices market is expected to witness steady growth in the coming years. Factors such as increasing consumer awareness, advancements in technology, and rising disposable income are expected to drive market expansion. The adoption of non-invasive and minimally invasive procedures, as well as personalized and tailored treatments, will contribute to market growth. The industry will continue to evolve with the introduction of new devices and treatment options, focusing on safety, efficacy, and patient satisfaction.

Conclusion

The South Africa aesthetic devices market presents significant opportunities for manufacturers, healthcare providers, and industry stakeholders. With the growing demand for aesthetic procedures and advancements in technology, the market is poised for growth. By addressing challenges such as cost barriers, skilled workforce availability, and regulatory compliance, market players can capitalize on the market’s potential and contribute to the development of the aesthetic industry in South Africa.

What is Aesthetic Devices?

Aesthetic devices refer to a range of tools and technologies used in cosmetic procedures to enhance physical appearance. These devices include lasers, injectables, and other non-invasive treatments aimed at improving skin texture, reducing wrinkles, and contouring the body.

What are the key players in the South Africa Aesthetic Devices Market?

Key players in the South Africa Aesthetic Devices Market include companies like Allergan, Merz Pharmaceuticals, and Galderma, which are known for their innovative aesthetic solutions. These companies focus on various segments such as injectables, laser treatments, and skin rejuvenation technologies, among others.

What are the growth factors driving the South Africa Aesthetic Devices Market?

The South Africa Aesthetic Devices Market is driven by increasing consumer awareness about aesthetic procedures, a growing demand for non-invasive treatments, and advancements in technology. Additionally, the rise in disposable income and changing beauty standards contribute to market growth.

What challenges does the South Africa Aesthetic Devices Market face?

The South Africa Aesthetic Devices Market faces challenges such as regulatory hurdles, high costs of advanced devices, and competition from alternative treatments. Additionally, there is a need for skilled professionals to operate these devices effectively.

What opportunities exist in the South Africa Aesthetic Devices Market?

Opportunities in the South Africa Aesthetic Devices Market include the expansion of aesthetic clinics, increasing acceptance of aesthetic procedures among younger demographics, and the introduction of innovative technologies. These factors are likely to enhance market penetration and consumer engagement.

What trends are shaping the South Africa Aesthetic Devices Market?

Trends in the South Africa Aesthetic Devices Market include the rise of personalized treatments, the integration of artificial intelligence in aesthetic procedures, and a growing focus on minimally invasive techniques. These trends reflect changing consumer preferences and advancements in technology.

South Africa Aesthetic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Devices, Ultrasound Devices, Radiofrequency Devices, Light Therapy Devices |

| End User | Clinics, Hospitals, Beauty Salons, Dermatology Centers |

| Technology | Non-invasive, Minimally Invasive, Invasive, Hybrid |

| Application | Skin Rejuvenation, Hair Removal, Body Contouring, Acne Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the South Africa Aesthetic Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at