444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The solar system in Kuwait market represents a transformative sector within the nation’s renewable energy landscape, driven by ambitious sustainability goals and increasing energy diversification initiatives. Kuwait’s solar energy sector has emerged as a critical component of the country’s Vision 2035 strategy, which aims to reduce dependency on fossil fuels and establish a more sustainable energy infrastructure. The market encompasses residential, commercial, and utility-scale solar installations, with photovoltaic systems dominating the technological landscape.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate of 12.5% over recent years. This expansion is primarily attributed to government incentives, declining solar technology costs, and increasing environmental awareness among consumers and businesses. The Kuwait solar market benefits from exceptional solar irradiation levels, with the country receiving approximately 2,200 kWh per square meter annually, making it one of the most favorable locations for solar energy generation in the Middle East region.

Government initiatives have played a pivotal role in market development, with the Kuwait Institute for Scientific Research leading various solar projects and research programs. The market structure includes both grid-tied and off-grid solutions, catering to diverse consumer needs and applications across residential, commercial, and industrial sectors.

The solar system in Kuwait market refers to the comprehensive ecosystem of solar energy technologies, services, and infrastructure deployed within Kuwait’s borders to harness solar radiation for electricity generation and other energy applications. This market encompasses the entire value chain from solar panel manufacturing and importation to system design, installation, maintenance, and energy storage solutions.

Solar systems in this context include photovoltaic panels, inverters, mounting structures, battery storage systems, and associated electrical components that convert sunlight into usable electricity. The market also includes supporting services such as system design, project financing, installation, monitoring, and maintenance services provided by specialized companies and contractors operating within Kuwait’s regulatory framework.

Market participants range from international solar technology manufacturers to local installation companies, engineering firms, and financial institutions providing solar project financing. The definition extends to include both distributed generation systems installed on rooftops and ground-mounted installations, as well as utility-scale solar farms contributing to the national grid.

Kuwait’s solar system market stands at a critical juncture, with significant momentum building toward large-scale adoption of solar energy technologies. The market has demonstrated remarkable resilience and growth potential, supported by favorable government policies and increasing private sector participation. Residential solar adoption has shown particularly strong growth, with installation rates increasing by 35% year-over-year as homeowners seek to reduce electricity costs and carbon footprints.

Commercial and industrial segments represent the largest market share, accounting for approximately 60% of total installations, driven by businesses seeking energy cost optimization and sustainability credentials. The utility-scale segment, while currently smaller, shows the highest growth potential with several major projects in development phases.

Technology trends favor high-efficiency photovoltaic systems, with monocrystalline silicon panels dominating the market due to their superior performance in high-temperature conditions typical of Kuwait’s climate. Energy storage integration is becoming increasingly important, with battery storage adoption rates growing by 28% annually as consumers seek energy independence and grid stability solutions.

Market challenges include regulatory complexities, grid integration requirements, and the need for skilled workforce development. However, these challenges are being addressed through government initiatives and private sector investments in training and infrastructure development.

Strategic market insights reveal several critical factors shaping the solar system landscape in Kuwait. The following key insights provide essential understanding of market dynamics and opportunities:

Market penetration varies significantly across different segments, with commercial installations leading adoption rates while residential markets show the highest growth potential. The insights indicate that system performance optimization and cost-effectiveness remain primary decision factors for consumers across all market segments.

Primary market drivers propelling the solar system market in Kuwait encompass economic, environmental, and policy-related factors that create favorable conditions for solar energy adoption. Government initiatives represent the most significant driver, with Kuwait’s National Renewable Energy Program establishing ambitious targets for renewable energy capacity expansion.

Economic incentives play a crucial role in market development, including feed-in tariffs, tax incentives, and subsidized financing programs that reduce the initial investment barriers for solar system adoption. The declining cost of solar technology has made solar installations increasingly competitive with traditional energy sources, with system costs decreasing by 40% over the past five years.

Energy security concerns drive government and private sector interest in diversifying energy sources and reducing dependence on fossil fuel imports. Environmental regulations and international climate commitments create additional pressure for clean energy adoption, with solar systems offering immediate carbon footprint reduction benefits.

Technological advancements in solar panel efficiency, energy storage systems, and smart grid technologies enhance the value proposition of solar installations. Rising electricity demand from population growth and economic development creates opportunities for distributed solar generation to supplement grid capacity.

Corporate sustainability initiatives increasingly drive commercial and industrial solar adoption as businesses seek to meet environmental, social, and governance objectives while reducing operational costs.

Market restraints present significant challenges that may limit the pace of solar system adoption in Kuwait despite favorable conditions. Regulatory complexities remain a primary constraint, with lengthy permitting processes and unclear interconnection standards creating barriers for potential solar system owners.

Grid integration challenges pose technical difficulties, particularly for large-scale installations that require substantial grid infrastructure upgrades to accommodate variable solar generation. Intermittency concerns related to solar energy production create reliability issues that require expensive backup systems or energy storage solutions.

High initial capital costs continue to deter some consumers despite declining technology prices, particularly in the residential segment where financing options may be limited. Lack of skilled workforce in solar installation and maintenance creates bottlenecks in market expansion and may compromise system quality and performance.

Cultural and aesthetic concerns in residential areas sometimes limit rooftop solar adoption, while land availability constraints restrict utility-scale project development in densely populated areas. Dust and sandstorm impacts on solar panel performance require additional maintenance costs and may reduce system efficiency.

Competition from subsidized conventional energy sources makes solar systems less economically attractive in some applications, while limited local manufacturing capabilities increase dependence on imported components and associated supply chain risks.

Significant market opportunities exist across multiple segments of Kuwait’s solar system market, driven by evolving energy needs and supportive policy environments. Utility-scale solar projects represent the largest opportunity, with the government planning several major solar farms that could transform the country’s energy mix and create substantial market value.

Residential market expansion offers considerable growth potential, particularly through innovative financing models such as solar leasing and power purchase agreements that eliminate upfront costs for homeowners. Commercial rooftop installations present opportunities for businesses to reduce energy costs while meeting sustainability objectives.

Energy storage integration creates new market segments and value propositions, with battery storage systems becoming increasingly important for grid stability and energy independence. Smart grid development opens opportunities for advanced solar system technologies including microinverters, power optimizers, and monitoring systems.

Industrial applications in oil and gas facilities, manufacturing plants, and water treatment facilities offer specialized market niches with high-value installations. Agrivoltaics combining solar generation with agricultural activities present innovative solutions for land use optimization.

Export opportunities may emerge as Kuwait develops local solar manufacturing capabilities and expertise that can be leveraged in regional markets. Research and development initiatives create opportunities for technology innovation and intellectual property development in solar applications suited to Middle Eastern conditions.

Market dynamics in Kuwait’s solar system sector reflect complex interactions between supply and demand factors, regulatory influences, and technological developments. Supply chain dynamics are characterized by heavy reliance on imported components, with most photovoltaic panels, inverters, and mounting systems sourced from international manufacturers in China, Germany, and other leading solar technology producing countries.

Demand patterns show strong seasonality, with installation activity typically peaking during cooler months when construction conditions are more favorable. Price dynamics reflect global solar technology trends, with component costs generally declining while installation and service costs remain relatively stable due to local labor and regulatory factors.

Competitive dynamics feature a mix of international companies establishing local presence and domestic firms developing solar expertise and capabilities. Technology adoption patterns favor proven, high-efficiency solutions over cutting-edge technologies, reflecting conservative approaches to long-term energy investments.

Financial dynamics are evolving rapidly, with traditional project financing models being supplemented by innovative approaches including green bonds, crowdfunding, and blockchain-based energy trading platforms. Regulatory dynamics continue to evolve as policymakers balance renewable energy promotion with grid stability and economic considerations.

Market maturation is evident in improving installation quality, standardized practices, and growing consumer awareness, with customer satisfaction rates reaching 85% for properly installed and maintained systems.

Comprehensive research methodology employed for analyzing Kuwait’s solar system market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with key market participants including solar installers, equipment suppliers, government officials, and end-users across residential, commercial, and industrial segments.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and academic studies related to solar energy development in Kuwait and the broader Middle East region. Market surveys conducted among potential and existing solar system owners provide insights into adoption drivers, barriers, and satisfaction levels.

Data validation processes include cross-referencing multiple sources, expert interviews, and statistical analysis to ensure information accuracy and consistency. Quantitative analysis employs statistical modeling techniques to identify trends, correlations, and growth patterns in market data.

Qualitative analysis includes thematic analysis of interview transcripts and document reviews to identify key themes and insights not captured in quantitative data. Market modeling incorporates scenario analysis and sensitivity testing to assess potential market developments under different conditions.

Continuous monitoring of market developments ensures research findings remain current and relevant, with regular updates to reflect changing market conditions and new developments in technology, policy, and market structure.

Regional analysis of Kuwait’s solar system market reveals distinct patterns and characteristics across different geographical areas and administrative regions. Kuwait City metropolitan area dominates market activity, accounting for approximately 45% of total installations due to high population density, commercial activity, and infrastructure development.

Hawalli Governorate shows strong residential solar adoption rates, with 25% market share driven by middle-class homeowners seeking energy cost reduction and environmental benefits. Ahmadi Governorate features significant industrial and commercial installations, particularly in oil and gas facilities and manufacturing plants.

Farwaniya Governorate demonstrates growing market penetration in both residential and commercial segments, while Mubarak Al-Kabeer Governorate shows emerging opportunities in new residential developments and commercial complexes. Jahra Governorate offers substantial potential for utility-scale solar projects due to available land and favorable solar conditions.

Coastal areas face unique challenges related to salt corrosion and humidity impacts on solar equipment, requiring specialized installation techniques and maintenance protocols. Desert regions provide optimal solar irradiation conditions but present challenges related to dust accumulation and extreme temperature variations.

Urban versus rural dynamics show distinct patterns, with urban areas favoring rooftop installations while rural areas offer opportunities for ground-mounted systems and agrivoltaic applications. Infrastructure availability varies significantly across regions, influencing grid connection feasibility and installation costs.

Competitive landscape in Kuwait’s solar system market features a diverse mix of international technology providers, regional integrators, and local installation companies. Market leadership is distributed among several key players, each bringing distinct capabilities and market positioning strategies.

Local companies are increasingly important in the competitive landscape, providing installation, maintenance, and system integration services while partnering with international technology providers. Competitive differentiation focuses on technology performance, warranty terms, local service capabilities, and project financing options.

Market consolidation trends are emerging as larger players acquire smaller regional companies to expand market presence and service capabilities.

Market segmentation analysis reveals distinct characteristics and growth patterns across various categories within Kuwait’s solar system market. By Application: The market divides into residential, commercial, industrial, and utility-scale segments, each with unique requirements and growth drivers.

By Technology: Segmentation includes monocrystalline silicon, polycrystalline silicon, and thin-film technologies, with monocrystalline systems dominating due to superior efficiency in high-temperature conditions. By System Type: Grid-tied systems represent the majority of installations, while off-grid and hybrid systems serve specialized applications.

By Capacity: Systems are categorized into small-scale residential installations (under 10 kW), medium-scale commercial systems (10-100 kW), large commercial and industrial installations (100 kW-1 MW), and utility-scale projects (above 1 MW). By Component: The market includes photovoltaic modules, inverters, mounting systems, monitoring equipment, and energy storage systems.

By End-User: Segmentation encompasses homeowners, small businesses, large corporations, government facilities, and utility companies. By Installation Type: Rooftop installations dominate in urban areas, while ground-mounted systems are preferred for larger commercial and utility projects.

By Service Type: The market includes system design, installation, maintenance, monitoring, and financing services, with integrated service providers gaining market share through comprehensive solution offerings.

Residential category demonstrates the highest growth potential, with homeowners increasingly recognizing the long-term economic benefits of solar installations. System sizes typically range from 3-8 kW, with average payback periods of 6-8 years depending on electricity consumption patterns and system configuration. Financing options are expanding, with solar loans and leasing programs making installations more accessible.

Commercial category shows strong adoption among retail establishments, office buildings, and small manufacturing facilities seeking to reduce operational costs and enhance sustainability credentials. System performance monitoring is particularly important in this segment, with businesses requiring detailed energy production and cost savings data.

Industrial category features large-scale installations at manufacturing facilities, oil and gas operations, and water treatment plants. Custom engineering solutions are often required to integrate solar systems with existing industrial processes and electrical infrastructure. Energy storage integration is becoming increasingly common in industrial applications to ensure power quality and reliability.

Utility-scale category represents the future growth engine of the market, with several major projects in development phases. Technology selection focuses on proven, bankable solutions with strong performance warranties and established track records in similar climate conditions.

Service categories are evolving rapidly, with operation and maintenance services becoming increasingly sophisticated and data-driven, while energy management services help customers optimize solar system performance and energy consumption patterns.

Industry participants in Kuwait’s solar system market enjoy numerous benefits from the sector’s growth and development. Equipment manufacturers benefit from expanding market demand, opportunities for local assembly operations, and potential for technology adaptation to regional climate conditions. Installation companies experience growing business opportunities, skill development, and potential for market expansion across the Gulf region.

Financial institutions benefit from new lending opportunities, green finance product development, and portfolio diversification into renewable energy assets. Government stakeholders achieve energy security objectives, environmental goals, and economic diversification benefits while creating employment opportunities in the renewable energy sector.

End-users realize significant benefits including reduced electricity costs, energy independence, environmental impact reduction, and potential property value increases. Residential customers typically achieve 20-30% reduction in electricity bills, while commercial users often realize even greater savings due to higher electricity consumption and favorable rate structures.

Utility companies benefit from distributed generation that reduces peak demand stress, defers infrastructure investments, and supports grid stability when properly managed. Environmental stakeholders benefit from reduced carbon emissions, improved air quality, and progress toward national climate commitments.

Research institutions gain opportunities for technology development, workforce training programs, and collaboration with international solar energy organizations. Local communities benefit from job creation, skill development, and improved energy access in remote areas through off-grid solar solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends are reshaping Kuwait’s solar system landscape, with energy storage integration becoming increasingly important as customers seek energy independence and grid stability. Smart solar systems incorporating advanced monitoring, predictive maintenance, and automated optimization capabilities are gaining traction among commercial and industrial users.

Digitalization trends include the adoption of artificial intelligence and machine learning for system performance optimization, predictive maintenance scheduling, and energy consumption forecasting. Blockchain technology is emerging as a potential solution for peer-to-peer energy trading and renewable energy certificate management.

Financing innovation continues to evolve, with solar-as-a-service models gaining popularity among customers seeking to avoid upfront capital investments. Green financing instruments including sustainability-linked loans and green bonds are becoming more prevalent in large-scale project financing.

Technology trends favor higher efficiency panels, with bifacial solar modules showing growing adoption due to their ability to generate electricity from both sides, increasing overall system output. Floating solar installations are being explored for water treatment facilities and reservoirs.

Sustainability trends extend beyond energy generation to include circular economy principles in solar panel recycling and end-of-life management. Agrivoltaics combining solar generation with agricultural activities represent an emerging trend for land use optimization.

Recent industry developments highlight the dynamic nature of Kuwait’s solar system market and its evolution toward greater sophistication and scale. Major project announcements include several utility-scale solar farms in development, with combined capacity representing a significant expansion of the country’s renewable energy infrastructure.

Regulatory developments include updated net metering regulations, streamlined permitting processes, and new safety standards for solar installations. MarkWide Research analysis indicates that these regulatory improvements have contributed to a 15% increase in installation permit applications over the past year.

Technology partnerships between international solar companies and local firms are expanding, with several joint ventures announced for manufacturing, installation, and maintenance services. Financial sector developments include new solar financing products from major banks and the launch of specialized green investment funds.

Infrastructure developments include grid modernization projects, smart metering deployments, and energy storage pilot programs that support increased solar integration. Educational initiatives encompass new training programs for solar technicians and engineering curricula focused on renewable energy technologies.

Research and development activities include collaborations between local universities and international research institutions on solar technology optimization for Middle Eastern conditions. Market expansion developments feature new market entrants, service offerings, and geographic coverage areas.

Strategic recommendations for market participants focus on capitalizing on growth opportunities while addressing key challenges in Kuwait’s solar system market. Technology providers should prioritize developing solutions specifically adapted to Kuwait’s harsh climate conditions, including enhanced dust resistance, temperature tolerance, and corrosion protection.

Installation companies should invest in workforce development and certification programs to address the skilled labor shortage while building long-term competitive advantages. Financing institutions should develop innovative solar financing products that address the diverse needs of residential, commercial, and industrial customers.

Government policymakers should continue streamlining regulatory processes while maintaining quality and safety standards, and consider additional incentives for energy storage integration and grid modernization. Utility companies should proactively plan for increased distributed generation through grid infrastructure upgrades and smart grid technologies.

Market entry strategies for new participants should focus on partnerships with established local companies, understanding of regulatory requirements, and adaptation to local market conditions. Customer education initiatives remain important for accelerating market adoption and ensuring realistic expectations about system performance and benefits.

Supply chain diversification strategies should be implemented to reduce dependence on single-source suppliers and mitigate potential disruption risks. Quality assurance programs should be strengthened to maintain market confidence and ensure long-term system performance.

Future market outlook for Kuwait’s solar system sector appears highly promising, with multiple factors converging to support sustained growth and market expansion. Government commitment to renewable energy targets and climate objectives provides a stable policy foundation for long-term market development, with MWR projections indicating continued policy support through 2030 and beyond.

Technology advancement will continue driving cost reductions and performance improvements, making solar systems increasingly attractive across all market segments. Energy storage costs are expected to decline by 50% over the next five years, significantly enhancing the value proposition of solar-plus-storage systems.

Market maturation will bring improved installation quality, standardized practices, and enhanced customer service capabilities. Utility-scale projects currently in development will transform Kuwait’s energy landscape and establish the country as a regional leader in solar energy deployment.

Digital transformation will enable more sophisticated system monitoring, predictive maintenance, and energy management capabilities, improving system performance and customer satisfaction. Regional integration opportunities may emerge as Kuwait develops expertise and capabilities that can be exported to neighboring markets.

Long-term projections suggest that solar energy could account for a significant portion of Kuwait’s electricity generation capacity within the next decade, supported by continued technology advancement, policy support, and economic competitiveness. Market diversification into specialized applications and emerging technologies will create additional growth opportunities and market segments.

Kuwait’s solar system market represents a compelling growth opportunity characterized by exceptional solar resources, supportive government policies, and increasing economic attractiveness of solar energy solutions. The market has demonstrated resilience and adaptability while evolving from early-stage development to a more mature and sophisticated sector with diverse participants and applications.

Key success factors for market development include continued policy support, workforce development, technology adaptation to local conditions, and innovative financing solutions that address diverse customer needs. The convergence of declining technology costs, improving system performance, and growing environmental awareness creates favorable conditions for sustained market expansion.

Strategic opportunities exist across all market segments, from residential rooftop installations to utility-scale solar farms, with energy storage integration and smart grid technologies offering additional value creation potential. The market’s evolution toward greater sophistication and scale positions Kuwait as an emerging leader in regional solar energy development.

Future success will depend on addressing current challenges including regulatory streamlining, workforce development, and grid infrastructure modernization while capitalizing on opportunities in technology innovation, market expansion, and regional leadership. The solar system in Kuwait market is well-positioned for continued growth and transformation, contributing significantly to the country’s energy security, environmental objectives, and economic diversification goals.

What is Solar System in Kuwait?

The Solar System in Kuwait refers to the utilization and implementation of solar energy technologies, including photovoltaic panels and solar thermal systems, to harness sunlight for electricity generation and heating applications in the region.

What are the key companies in the Solar System in Kuwait Market?

Key companies in the Solar System in Kuwait Market include First Solar, SunPower, and Kuwait Renewable Energy Company, among others.

What are the growth factors driving the Solar System in Kuwait Market?

The growth of the Solar System in Kuwait Market is driven by increasing energy demand, government initiatives promoting renewable energy, and the country’s abundant solar resources.

What challenges does the Solar System in Kuwait Market face?

Challenges in the Solar System in Kuwait Market include high initial investment costs, regulatory hurdles, and the need for skilled labor to install and maintain solar systems.

What future opportunities exist in the Solar System in Kuwait Market?

Future opportunities in the Solar System in Kuwait Market include advancements in solar technology, potential for large-scale solar farms, and increasing public awareness of renewable energy benefits.

What trends are shaping the Solar System in Kuwait Market?

Trends shaping the Solar System in Kuwait Market include the integration of energy storage solutions, the rise of smart grid technologies, and partnerships between private and public sectors to enhance solar energy adoption.

Solar System in Kuwait Market

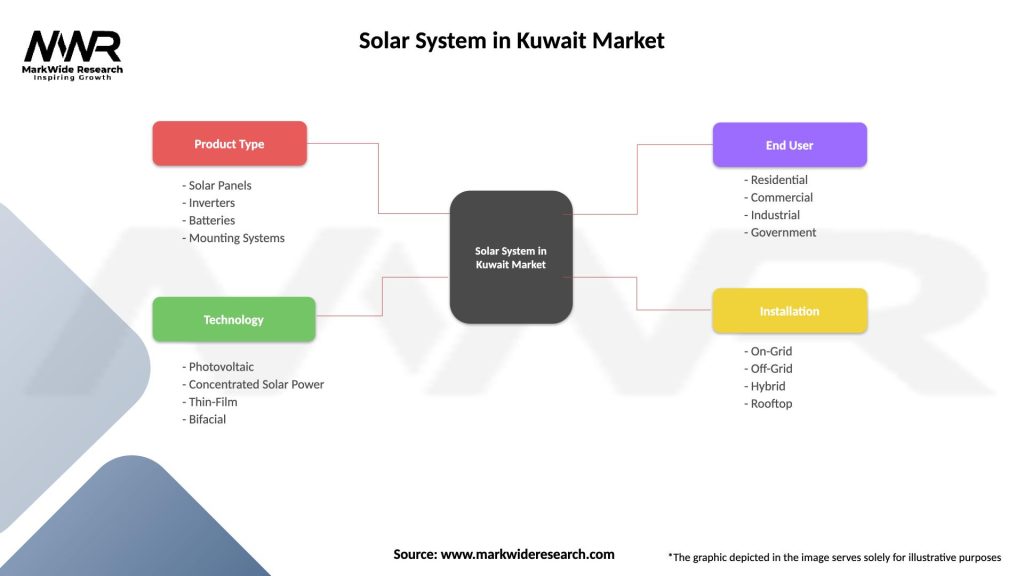

| Segmentation Details | Description |

|---|---|

| Product Type | Solar Panels, Inverters, Batteries, Mounting Systems |

| Technology | Photovoltaic, Concentrated Solar Power, Thin-Film, Bifacial |

| End User | Residential, Commercial, Industrial, Government |

| Installation | On-Grid, Off-Grid, Hybrid, Rooftop |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Solar System in Kuwait Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at