444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The solar panel industry has experienced significant growth in recent years, driven by the increasing demand for renewable energy sources. Solar panels are widely used to harness solar energy and generate electricity. With the rising adoption of solar panels, the need for warranty insurance has emerged as a critical component in the solar industry. Solar panel warranty insurance provides coverage against potential damages, defects, and performance issues associated with solar panels. This market overview will delve into the meaning, key market insights, drivers, restraints, opportunities, and dynamics of the solar panel warranty insurance market.

Meaning

Solar panel warranty insurance refers to a specialized insurance product that offers financial protection to solar panel owners against potential damages, malfunctions, and underperformance of their solar panel systems. This insurance coverage typically extends beyond the manufacturer’s warranty, providing added security and peace of mind to solar panel owners. It helps mitigate the financial risks associated with repairs, replacements, and maintenance of solar panels.

Executive Summary

The solar panel warranty insurance market is witnessing steady growth due to the expanding solar panel market globally. As more individuals, businesses, and governments embrace solar energy, the need for comprehensive warranty insurance coverage becomes increasingly vital. This executive summary provides a concise overview of the key market insights, drivers, restraints, opportunities, and dynamics shaping the solar panel warranty insurance market.

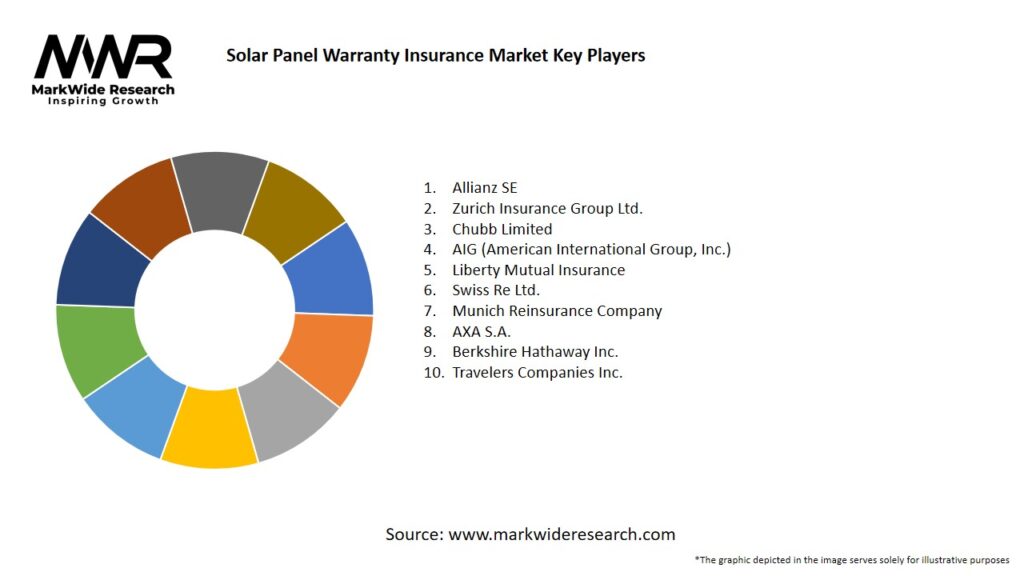

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The solar panel warranty insurance market is influenced by various dynamics, including the demand for solar panels, technological advancements, regulatory factors, and customer preferences. Understanding these dynamics is crucial for insurance providers, solar panel manufacturers, and other stakeholders operating in this market.

Regional Analysis

The solar panel warranty insurance market exhibits regional variations due to differences in solar panel installations, government policies, and market maturity. Analyzing regional trends can provide valuable insights into market opportunities and potential challenges for insurance providers.

Competitive Landscape

Leading Companies in the Solar Panel Warranty Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

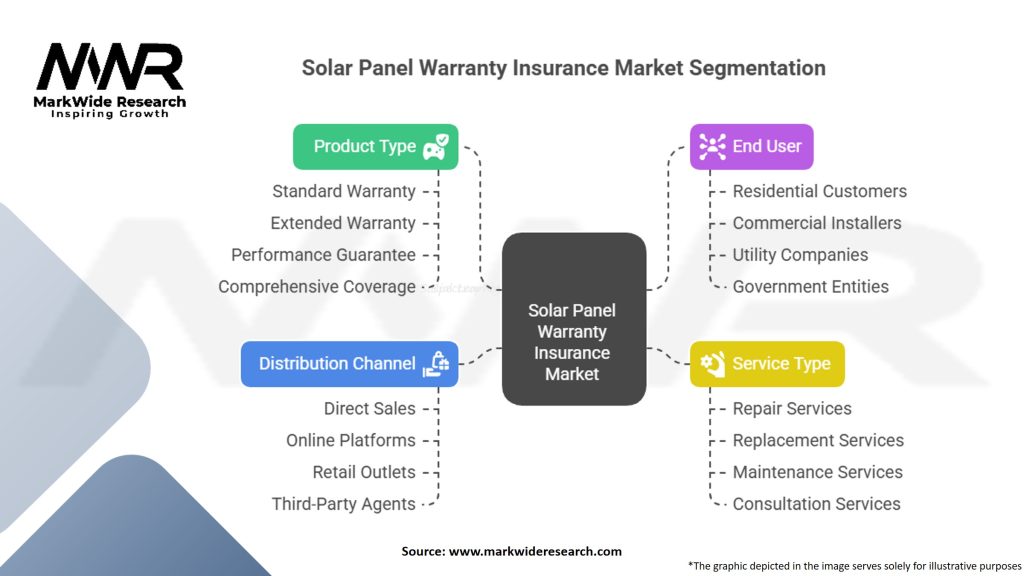

Segmentation

The solar panel warranty insurance market can be segmented based on various factors, including coverage type, warranty duration, end-user, and geography. Understanding the different segments can help insurance providers tailor their offerings to specific customer requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had mixed effects on the solar panel warranty insurance market. While the initial disruption in supply chains and project installations caused a temporary setback, the renewable energy sector rebounded quickly. The pandemic has also highlighted the importance of renewable energy sources, leading to increased investments in solar panel installations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the solar panel warranty insurance market appears promising. As the solar panel industry continues to grow and mature, the demand for comprehensive warranty coverage is expected to rise. Insurance providers should anticipate market trends, adapt to technological advancements, and forge strategic partnerships to capitalize on the expanding market opportunities.

Conclusion

The solar panel warranty insurance market plays a crucial role in providing financial protection and peace of mind to solar panel owners. As the solar industry grows, the demand for comprehensive warranty coverage is expected to increase. Insurance providers, solar panel manufacturers, and other stakeholders should focus on customer education, innovative solutions, and strategic collaborations to meet the evolving needs of the market. By addressing the challenges and leveraging the opportunities, the solar panel warranty insurance market can thrive and contribute to the sustainable growth of the solar energy sector.

What is Solar Panel Warranty Insurance?

Solar Panel Warranty Insurance is a type of coverage that protects consumers against defects and failures in solar panel systems. This insurance typically covers repairs, replacements, and maintenance costs associated with solar panels, ensuring long-term reliability and performance.

What are the key players in the Solar Panel Warranty Insurance Market?

Key players in the Solar Panel Warranty Insurance Market include companies like SunPower, LG Electronics, and Enphase Energy, which offer various warranty and insurance products for solar installations. These companies focus on enhancing customer confidence and ensuring the longevity of solar investments, among others.

What are the growth factors driving the Solar Panel Warranty Insurance Market?

The growth of the Solar Panel Warranty Insurance Market is driven by increasing adoption of solar energy, rising consumer awareness about the importance of warranties, and advancements in solar technology. Additionally, government incentives and policies promoting renewable energy contribute to market expansion.

What challenges does the Solar Panel Warranty Insurance Market face?

Challenges in the Solar Panel Warranty Insurance Market include the complexity of warranty terms, varying regulations across regions, and the potential for fraudulent claims. These factors can create uncertainty for both consumers and insurers, impacting market growth.

What opportunities exist in the Solar Panel Warranty Insurance Market?

Opportunities in the Solar Panel Warranty Insurance Market include the development of innovative insurance products tailored to specific consumer needs and the expansion into emerging markets where solar adoption is increasing. Additionally, partnerships with solar installation companies can enhance service offerings.

What trends are shaping the Solar Panel Warranty Insurance Market?

Trends in the Solar Panel Warranty Insurance Market include the integration of technology for better claims processing and customer service, as well as a growing emphasis on sustainability and eco-friendly practices. Insurers are also focusing on providing more comprehensive coverage options to meet diverse consumer demands.

Solar Panel Warranty Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Warranty, Extended Warranty, Performance Guarantee, Comprehensive Coverage |

| End User | Residential Customers, Commercial Installers, Utility Companies, Government Entities |

| Service Type | Repair Services, Replacement Services, Maintenance Services, Consultation Services |

| Distribution Channel | Direct Sales, Online Platforms, Retail Outlets, Third-Party Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Solar Panel Warranty Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at