444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Software as a Medical Device (SaMD) market represents one of the most rapidly evolving sectors within the global healthcare technology landscape. This innovative segment encompasses software applications that perform medical functions independently of traditional hardware medical devices, revolutionizing how healthcare providers deliver patient care and manage medical data. SaMD solutions are transforming clinical workflows, diagnostic processes, and therapeutic interventions across hospitals, clinics, and remote healthcare settings worldwide.

Market dynamics indicate robust growth driven by increasing digitalization of healthcare systems, rising demand for remote patient monitoring, and the accelerated adoption of telemedicine solutions. The market is experiencing significant expansion with a projected CAGR of 8.2% through the forecast period, reflecting the growing recognition of software-based medical solutions’ potential to improve patient outcomes while reducing healthcare costs.

Regulatory frameworks continue to evolve to accommodate the unique characteristics of software-based medical devices, with agencies like the FDA and EMA establishing comprehensive guidelines for SaMD classification, validation, and market approval. This regulatory clarity is fostering increased investment and innovation in the sector, attracting both established medical device manufacturers and emerging technology companies.

The Software as a Medical Device market refers to the commercial ecosystem encompassing software applications designed to perform medical functions independently of hardware medical devices. SaMD solutions include diagnostic software, therapeutic applications, monitoring systems, and clinical decision support tools that directly impact patient care through data analysis, treatment recommendations, or medical interventions without requiring traditional medical device hardware.

Key characteristics of SaMD include standalone functionality, medical purpose, regulatory compliance, and the ability to operate across various computing platforms including mobile devices, cloud infrastructure, and integrated healthcare systems. These solutions range from simple wellness applications to sophisticated artificial intelligence-powered diagnostic tools that can analyze medical imaging, predict patient outcomes, and support complex clinical decision-making processes.

Classification systems for SaMD are based on risk levels and intended use, with categories ranging from low-risk informational tools to high-risk diagnostic and therapeutic applications that require rigorous clinical validation and regulatory oversight. This classification framework ensures appropriate safety standards while enabling innovation in digital health technologies.

Market expansion in the Software as a Medical Device sector is being driven by convergent trends in healthcare digitization, artificial intelligence advancement, and regulatory modernization. The industry is witnessing unprecedented growth as healthcare organizations increasingly recognize the value proposition of software-based medical solutions in improving clinical outcomes, operational efficiency, and patient accessibility to care.

Technology integration represents a critical success factor, with leading SaMD solutions incorporating machine learning algorithms, cloud computing capabilities, and interoperability standards to deliver comprehensive healthcare solutions. The market is characterized by rapid innovation cycles, with approximately 73% of healthcare organizations planning to increase their SaMD investments over the next three years.

Competitive landscape features a diverse mix of established healthcare technology companies, emerging startups, and traditional medical device manufacturers expanding into software solutions. Strategic partnerships between technology providers and healthcare institutions are becoming increasingly common, facilitating the development and deployment of specialized SaMD applications tailored to specific clinical needs and workflow requirements.

Market penetration analysis reveals significant opportunities across multiple healthcare segments, with diagnostic imaging, chronic disease management, and remote patient monitoring emerging as primary growth drivers. The following key insights shape the current market landscape:

Healthcare digitization serves as the primary catalyst for SaMD market growth, with healthcare organizations worldwide investing heavily in digital transformation initiatives. The COVID-19 pandemic accelerated this trend, demonstrating the critical importance of software-based medical solutions for maintaining continuity of care during challenging circumstances. Remote care capabilities have become essential components of modern healthcare delivery systems.

Cost reduction pressures are driving healthcare providers to seek innovative solutions that can improve operational efficiency while maintaining or enhancing care quality. SaMD solutions offer significant advantages in this regard, providing scalable, updateable medical capabilities without the substantial capital investments required for traditional medical devices. Healthcare organizations report average cost savings of 15-25% through strategic SaMD implementations.

Aging populations in developed markets are creating increased demand for chronic disease management solutions, remote monitoring capabilities, and accessible healthcare technologies. SaMD applications are particularly well-suited to address these demographic challenges, offering personalized care management tools that can adapt to individual patient needs and clinical conditions over time.

Technological advancement in artificial intelligence, machine learning, and cloud computing is enabling the development of increasingly sophisticated SaMD solutions. These technologies are making it possible to create medical software applications that can perform complex diagnostic tasks, predict patient outcomes, and support clinical decision-making with unprecedented accuracy and reliability.

Regulatory complexity remains a significant challenge for SaMD market participants, particularly for companies developing high-risk applications that require extensive clinical validation and regulatory approval processes. The evolving nature of regulatory frameworks creates uncertainty for developers and investors, potentially slowing innovation and market entry for new solutions.

Data privacy concerns and cybersecurity risks pose ongoing challenges for SaMD adoption, particularly in light of increasing cyber threats targeting healthcare organizations. Healthcare providers must balance the benefits of software-based medical solutions with the need to protect sensitive patient information and maintain system security against sophisticated attack vectors.

Integration challenges with existing healthcare IT infrastructure can create barriers to SaMD adoption, particularly in organizations with legacy systems or complex technical environments. Interoperability issues, data format incompatibilities, and workflow disruptions can significantly impact the success of SaMD implementations and limit their clinical effectiveness.

Reimbursement uncertainty for SaMD solutions creates financial barriers for both healthcare providers and patients, as insurance coverage policies for software-based medical devices continue to evolve. The lack of established reimbursement frameworks for many SaMD applications can limit market adoption and commercial viability for innovative solutions.

Emerging markets present substantial growth opportunities for SaMD solutions, particularly in regions with developing healthcare infrastructure where software-based medical devices can provide cost-effective alternatives to traditional medical equipment. These markets offer the potential for rapid adoption of innovative healthcare technologies without the constraints of legacy system integration.

Artificial intelligence integration represents a transformative opportunity for SaMD developers, enabling the creation of intelligent medical applications that can learn from clinical data, adapt to individual patient needs, and provide increasingly sophisticated diagnostic and therapeutic capabilities. AI-powered SaMD solutions are expected to capture approximately 42% market share by 2028.

Personalized medicine applications offer significant potential for SaMD innovation, with software solutions uniquely positioned to analyze complex genomic data, patient history, and real-time health metrics to deliver individualized treatment recommendations and care plans. This personalization capability represents a key differentiator for advanced SaMD platforms.

Remote patient monitoring continues to expand as healthcare systems recognize the value of continuous health data collection and analysis. SaMD solutions are essential enablers of comprehensive remote monitoring programs, providing the analytical capabilities needed to transform raw health data into actionable clinical insights and intervention recommendations.

Competitive dynamics in the SaMD market are characterized by rapid innovation cycles, strategic partnerships, and increasing consolidation as larger healthcare technology companies acquire specialized software developers. The market is experiencing a shift toward platform-based solutions that can support multiple medical applications and integrate with diverse healthcare ecosystems.

Technology evolution continues to reshape market dynamics, with cloud computing, edge processing, and mobile technologies enabling new deployment models and use cases for SaMD solutions. These technological advances are reducing barriers to entry for innovative companies while creating new competitive advantages for organizations that can effectively leverage emerging technologies.

Regulatory evolution is creating both opportunities and challenges for market participants, with streamlined approval processes for certain SaMD categories enabling faster market entry while increased scrutiny for high-risk applications requires more substantial clinical evidence and validation data. MarkWide Research analysis indicates that regulatory clarity is improving market confidence and investment levels.

Market consolidation trends are evident as established medical device companies expand their software capabilities through acquisitions and partnerships, while technology companies seek healthcare domain expertise to develop clinically relevant SaMD solutions. This convergence is creating more comprehensive solution portfolios and accelerating market maturation.

Primary research methodologies employed in analyzing the SaMD market include comprehensive surveys of healthcare technology decision-makers, in-depth interviews with industry executives, and focus groups with clinical end-users. These primary research activities provide valuable insights into market trends, adoption barriers, and future requirements for SaMD solutions across diverse healthcare settings.

Secondary research encompasses analysis of regulatory filings, patent databases, clinical trial registrations, and published medical literature to understand technology trends, competitive positioning, and clinical evidence supporting various SaMD applications. This research approach ensures comprehensive coverage of market developments and emerging opportunities.

Market modeling techniques incorporate multiple data sources and analytical frameworks to project market growth, segment performance, and regional trends. Statistical analysis methods are applied to identify correlations between market drivers and adoption patterns, enabling accurate forecasting of future market developments and opportunity areas.

Expert validation processes involve consultation with clinical specialists, regulatory experts, and technology leaders to verify research findings and ensure accuracy of market assessments. This validation approach helps maintain research quality and provides confidence in market projections and strategic recommendations.

North America maintains market leadership in SaMD adoption, driven by advanced healthcare infrastructure, supportive regulatory frameworks, and significant investment in healthcare technology innovation. The region accounts for approximately 45% of global SaMD adoption, with the United States leading in both development and deployment of sophisticated software-based medical devices across diverse clinical applications.

Europe represents a rapidly growing market for SaMD solutions, with the European Union’s Medical Device Regulation providing clear frameworks for software-based medical devices. Countries like Germany, the United Kingdom, and France are leading regional adoption efforts, with particular strength in diagnostic imaging and clinical decision support applications. European markets show 35% growth rates in SaMD implementations.

Asia-Pacific emerges as the fastest-growing regional market, driven by expanding healthcare infrastructure, increasing healthcare spending, and growing acceptance of digital health technologies. Countries including China, Japan, and India are investing heavily in healthcare digitization initiatives that create substantial opportunities for SaMD solutions, particularly in remote patient monitoring and telemedicine applications.

Latin America and other emerging markets present significant long-term opportunities for SaMD expansion, particularly in applications that can address healthcare access challenges and resource constraints. These regions are increasingly recognizing the potential of software-based medical devices to improve healthcare delivery efficiency and expand access to specialized medical capabilities.

Market leaders in the SaMD sector include a diverse mix of established healthcare technology companies, medical device manufacturers, and innovative software developers. The competitive landscape is characterized by rapid innovation, strategic partnerships, and increasing focus on comprehensive platform solutions that can address multiple clinical needs.

Competitive strategies focus on clinical validation, regulatory compliance, and integration capabilities that enable seamless deployment within existing healthcare workflows. Companies are increasingly investing in artificial intelligence capabilities, cloud-based architectures, and interoperability standards to differentiate their SaMD offerings in the competitive marketplace.

By Risk Classification:

By Application Area:

By Deployment Model:

By End User:

Diagnostic SaMD applications represent the largest market segment, driven by advances in artificial intelligence and machine learning that enable sophisticated medical image analysis, pattern recognition, and diagnostic support capabilities. These solutions are particularly valuable in radiology, pathology, and cardiology applications where software can augment clinical expertise and improve diagnostic accuracy.

Therapeutic SaMD solutions are experiencing rapid growth as digital therapeutics gain clinical acceptance and regulatory approval. These applications provide evidence-based interventions for conditions including mental health disorders, substance abuse, and chronic disease management, offering scalable alternatives to traditional therapeutic approaches.

Monitoring and analytics SaMD applications continue to expand as healthcare organizations seek to leverage growing volumes of patient data for clinical insights and operational optimization. These solutions enable continuous patient monitoring, predictive analytics, and population health management capabilities that support value-based care initiatives.

Clinical decision support systems are becoming increasingly sophisticated, incorporating real-time patient data, clinical guidelines, and evidence-based protocols to provide actionable recommendations for healthcare providers. These solutions help reduce clinical errors, improve care consistency, and support complex decision-making processes across diverse clinical scenarios.

Healthcare providers benefit from SaMD solutions through improved clinical efficiency, enhanced diagnostic capabilities, and reduced operational costs. These software-based medical devices enable healthcare organizations to extend their clinical capabilities without significant capital investments while providing scalable solutions that can adapt to changing patient needs and clinical requirements.

Patients gain access to more personalized, convenient, and accessible healthcare services through SaMD applications. Remote monitoring capabilities, mobile health applications, and AI-powered diagnostic tools enable patients to receive high-quality medical care regardless of geographic location or resource constraints, improving health outcomes and patient satisfaction.

Technology companies find substantial opportunities in the SaMD market to leverage their software development expertise in addressing critical healthcare challenges. The market offers attractive revenue potential, opportunities for recurring subscription models, and the ability to create positive social impact through innovative healthcare solutions.

Regulatory agencies benefit from SaMD solutions that can improve healthcare quality and safety while providing more efficient regulatory oversight through software-based monitoring and compliance capabilities. Digital medical devices offer enhanced traceability, updateability, and performance monitoring compared to traditional medical devices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the SaMD market, with machine learning algorithms enabling increasingly sophisticated medical applications. AI-powered SaMD solutions are demonstrating superior performance in diagnostic imaging, predictive analytics, and clinical decision support, driving widespread adoption across healthcare organizations seeking competitive advantages.

Cloud-native architectures are becoming the preferred deployment model for SaMD solutions, offering scalability, cost-effectiveness, and enhanced collaboration capabilities. Cloud-based SaMD applications enable healthcare organizations to access advanced medical software capabilities without substantial IT infrastructure investments while supporting remote access and multi-site deployments.

Interoperability standards are gaining critical importance as healthcare organizations seek SaMD solutions that can seamlessly integrate with existing electronic health records, medical devices, and clinical workflows. Standards-based integration capabilities are becoming essential requirements for successful SaMD adoption and long-term sustainability.

Real-world evidence collection and analysis are becoming integral components of SaMD development and validation processes. Companies are incorporating continuous monitoring and outcomes tracking capabilities into their solutions to demonstrate clinical effectiveness and support regulatory compliance while enabling ongoing product improvement based on actual usage data.

Regulatory milestone achievements include the FDA’s establishment of comprehensive SaMD guidance documents and the creation of streamlined approval pathways for certain categories of software-based medical devices. These regulatory developments are providing greater clarity for developers and accelerating market entry for innovative SaMD solutions.

Strategic partnerships between technology companies and healthcare organizations are becoming increasingly common, facilitating the development of clinically relevant SaMD applications that address specific workflow requirements and patient needs. These collaborations are essential for ensuring successful SaMD implementation and adoption in complex healthcare environments.

Investment activity in the SaMD sector continues to accelerate, with venture capital firms and strategic investors recognizing the substantial market potential for software-based medical devices. MWR data indicates that SaMD companies received record investment levels, reflecting growing confidence in the sector’s long-term growth prospects.

Clinical validation studies are demonstrating the effectiveness of SaMD solutions across diverse medical applications, providing the evidence base needed for regulatory approval and clinical adoption. These studies are particularly important for high-risk SaMD applications that require extensive clinical evidence to support their safety and efficacy claims.

Market participants should prioritize regulatory compliance and clinical validation as fundamental requirements for successful SaMD development and commercialization. Companies must invest in comprehensive quality management systems and clinical evidence generation to meet evolving regulatory requirements and gain healthcare provider confidence in their solutions.

Technology integration strategies should focus on interoperability, cybersecurity, and user experience optimization to ensure successful SaMD deployment in complex healthcare environments. Organizations should adopt standards-based development approaches and invest in robust security frameworks to address healthcare industry requirements and concerns.

Partnership development with healthcare organizations, clinical specialists, and technology integrators is essential for understanding market needs and developing clinically relevant SaMD solutions. These partnerships provide valuable insights into workflow requirements, clinical challenges, and implementation considerations that are critical for market success.

Global expansion strategies should consider regional regulatory differences, healthcare infrastructure variations, and local market dynamics when planning SaMD deployments in international markets. Companies should develop flexible solutions that can adapt to diverse regulatory requirements and healthcare delivery models across different regions.

Market evolution in the SaMD sector is expected to accelerate over the next decade, driven by continued advances in artificial intelligence, cloud computing, and mobile technologies. The market is projected to maintain strong growth momentum with an estimated CAGR of 8.5% through 2030, reflecting increasing healthcare digitization and growing acceptance of software-based medical solutions.

Technology advancement will continue to expand the capabilities and applications of SaMD solutions, with emerging technologies including quantum computing, advanced analytics, and augmented reality creating new possibilities for medical software applications. These technological developments will enable more sophisticated diagnostic and therapeutic capabilities while improving user experiences and clinical outcomes.

Regulatory harmonization efforts are expected to facilitate global SaMD market expansion by creating more consistent approval processes and standards across different regions. This harmonization will reduce development costs and time-to-market for SaMD solutions while enabling more efficient global commercialization strategies for innovative medical software applications.

Market maturation will likely result in increased consolidation as larger healthcare technology companies acquire specialized SaMD developers to build comprehensive solution portfolios. This consolidation trend will create opportunities for integrated platforms that can address multiple clinical needs while maintaining the innovation and agility that characterize successful SaMD solutions.

The Software as a Medical Device market represents a transformative force in healthcare technology, offering unprecedented opportunities to improve patient care, reduce costs, and expand access to medical expertise through innovative software solutions. The market’s strong growth trajectory reflects the fundamental shift toward digital healthcare delivery and the increasing recognition of software’s potential to address critical healthcare challenges.

Success factors for market participants include regulatory compliance, clinical validation, technology integration capabilities, and strategic partnerships with healthcare organizations. Companies that can effectively navigate the complex regulatory landscape while delivering clinically valuable solutions will be well-positioned to capture the substantial opportunities available in this rapidly expanding market.

Future prospects for the SaMD market remain highly positive, with continued technology advancement, regulatory evolution, and healthcare digitization driving sustained growth and innovation. The market’s evolution toward more sophisticated, AI-powered solutions will create new possibilities for improving healthcare outcomes while addressing the growing challenges of healthcare accessibility, cost management, and clinical efficiency in healthcare systems worldwide.

What is Software As A Medical Device?

Software As A Medical Device refers to software intended for medical purposes that performs functions such as diagnosis, prevention, monitoring, or treatment of diseases. This category includes applications that can analyze medical data, control medical devices, or provide clinical decision support.

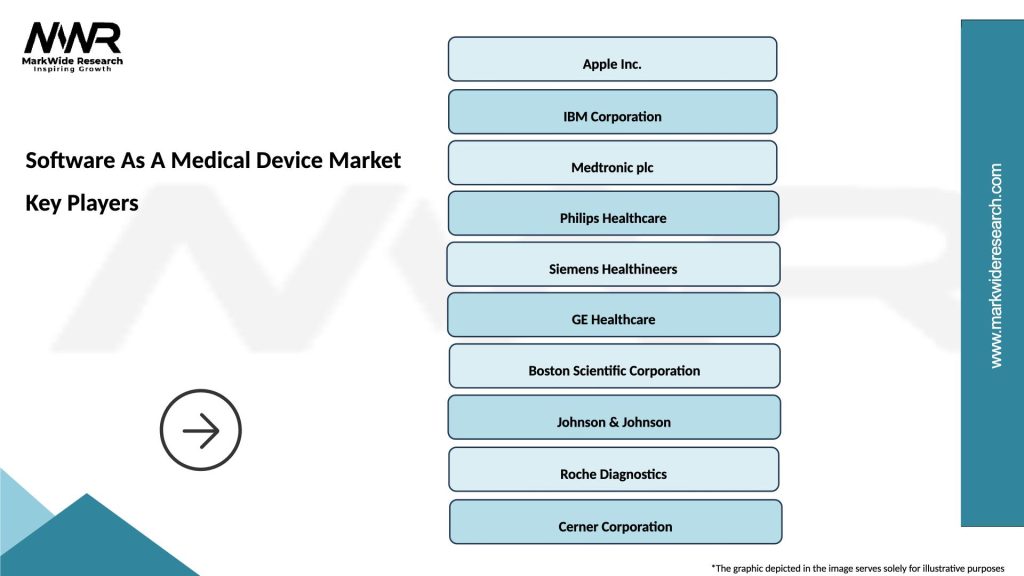

What are the key players in the Software As A Medical Device Market?

Key players in the Software As A Medical Device Market include companies like Philips Healthcare, Siemens Healthineers, and Medtronic, which develop innovative software solutions for healthcare applications. These companies focus on enhancing patient care through advanced technologies and data analytics, among others.

What are the growth factors driving the Software As A Medical Device Market?

The Software As A Medical Device Market is driven by factors such as the increasing adoption of digital health technologies, the rise in chronic diseases requiring continuous monitoring, and the demand for personalized medicine. Additionally, advancements in artificial intelligence and machine learning are enhancing software capabilities.

What challenges does the Software As A Medical Device Market face?

Challenges in the Software As A Medical Device Market include regulatory hurdles, data privacy concerns, and the need for interoperability among different healthcare systems. Ensuring compliance with stringent regulations can also slow down the development and deployment of new software solutions.

What opportunities exist in the Software As A Medical Device Market?

Opportunities in the Software As A Medical Device Market include the potential for telemedicine solutions, remote patient monitoring, and the integration of wearable devices. As healthcare continues to evolve, there is a growing demand for software that enhances patient engagement and improves health outcomes.

What trends are shaping the Software As A Medical Device Market?

Trends in the Software As A Medical Device Market include the increasing use of cloud-based solutions, the rise of mobile health applications, and the integration of big data analytics. These trends are transforming how healthcare providers deliver services and manage patient data.

Software As A Medical Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Software, Monitoring Software, Therapeutic Software, Imaging Software |

| End User | Hospitals, Clinics, Homecare Providers, Research Institutions |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

| Application | Chronic Disease Management, Surgical Planning, Patient Monitoring, Rehabilitation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Software As A Medical Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at